Physical Delivery of US Spot Gold FAQs

Who is IB Global Investments (IBGI)?

IBGI is a wholly owned subsidiary of the IBKR Group that operates as a market maker, facilitating physical unallocated gold transactions on behalf of IBLLC for its clients. IBGI facilitates these transactions by taking delivery of gold warrants from exchange-listed futures contracts. Neither IBLLC nor IBGI engages in proprietary trading, and the inventory of warrants IBGI holds to facilitate client purchases are hedged with short futures contracts.

What does the term “unallocated” gold mean?

When you purchase unallocated gold, you own an undivided, fractional interest in the physical gold that IBGI has allocated to IBLLC. In other words, the warrants, which reference gold bars that are specifically identifiable by number, are held in the name of IBLLC who, in turn, records clients’ ownership interests on its books and records (similar to how stock is held in “street name”).

How does the gold get “allocated”?

The gold remains “unallocated” until the account holder takes physical possession of it via the delivery process.

What is the trading symbol for unallocated gold?

The symbol is USGOLD.

What is the minimum order size for unallocated gold?

The minimum order size is 1 ounce.

What is the minimum price increment for unallocated gold?

$0.001

What is the settlement time for an unallocated gold transaction?

Transactions settle in 2 business days.

Does IBGI or IB LLC add a mark up to physical gold transactions?

No. There is no markup or hidden price spreads added by IBGI to IBLLC or IBLLC to the client. IBLLC acts as a riskless principal, transacting with the client at the same price it transacts with IBGI, and charges the client a commission for the transaction, which is disclosed on our website.

Does IBKR allow short sales of unallocated gold?

No; only purchases are allowed. Clients seeking to profit from falling gold prices may obtain this exposure via futures contracts, options on futures contracts and/or short sales of various gold ETFs.

Does IBKR provide any loan value for unallocated gold positions?

No. Unallocated gold will be subject to a 100% margin requirement. This means that IBKR will not allow you to borrow money using unallocated gold as collateral. Similarly, your fully-paid unallocated gold positions cannot be used as collateral to purchase or maintain securities positions.

Is unallocated gold SIPC protected?

No. SIPC only offers protection for securities and cash held in a securities account.

In what forms of gold is delivery offered?

Clients may convert their unallocated gold and take physical delivery of one of the following products:

- Gold Bullion Bar (.999) 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin -1 oz

Delivery will be transacted through FideliTrade Incorporated, a full-service precious metals investment company that specializes in delivery and custody services. See https://www.fidelitrade.com/

Is partial delivery offered?

Yes, you may take delivery of only a portion of your unallocated gold position.

How do I request delivery?

Clients requesting physical delivery must submit their request via the Message Center using the topic "Physical Gold Delivery". The request should include the number of ounces and the form of delivery. IBKR will then confirm the cost and fees and, once approved by the client, instruct FideliTrade to deliver. Please note that delivery is only supported to the account holder’s address of record.

What is the cost of taking delivery (and do I pay a premium)?

The cost of physical delivery of US Spot Gold is the sum of:

- The differential between the spot price of gold and the cost of the physical product.

- Physical metals products are provided by Fidelitrade Inc. Estimated cost of the physical product can be found on their website.

- The cost of the product is the indicative ASK price displayed by FideliTrade.

- A $25 delivery fee

- A $500 IBKR processing fee

What trading permissions are required?

The exchange and permission bundle is United States Metals.

What are the eligibility requirements for obtaining IBMETAL trading permissions?

US Spot Gold is only available to legal residents of the United States. US Spot Gold is not available to legal residents of Arizona, Montana, New Hampshire, and Rhode Island.

Clients must also meet the following requirements

- Investment Objective: Trading, or Speculation, or Hedging, or Growth (Cash account)

- Financials: Must meet Futures financial requirements

- No minimum years trading experience

- No minimum trades

- Available in all account types (CASH, MRGN, PMRGN)

- Not available for UGMA/UTMA accounts

- Not available for IRA accounts

- FA/Broker Sub accounts: master account (FA or Broker) must be approved for Commodities trading

Physical Delivery of COMEX Precious Metals Futures

About Physical Delivery of COMEX Precious Metals Futures

Clients of IBLLC will be able to make and take delivery of COMEX Precious Metals Futures, specifically Gold (GC), Silver (SI) and the corresponding micro contracts for Gold (MGC) and Silver (SIL).

Physical delivery, in this context, is represented by the delivery-versus-payment of a registered electronic warrant or an Accumulated Certificate of Exchange (“ACE”) for each full size or E-micro futures contract.

About Gold and Silver Warrants

- Each Gold (GC) and Silver (SI) future will deliver one warrant representing deliverable grade gold or silver associated with the contract unit.

- Gold (GC): one hundred (100) troy ounces of gold with a weight tolerance of 5% either higher or lower with a minimum of 995 fineness. Additional information is available via COMEX Rulebook Chapter 113.

- Silver (SI): five thousand (5,000) troy ounces of silver with a weight tolerance of 10% either higher or lower with a minimum of 999 fineness. Additional information is available via COMEX Rulebook Chapter 112.

- Warrants are electronic documents that are issued by COMEX approved depositories.

- Each warrant is registered at COMEX and linked to specific deliverable grade bars with identifiable and unique warrant numbers traceable to each COMEX depository.

- Warrants will be registered to Interactive Brokers as the COMEX Clearing Member.

- Storage fees apply.

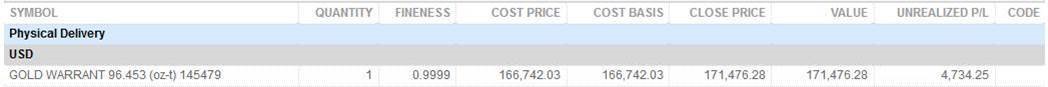

- Clients will see warrants in their "U" accounts:

- The symbol will contain the unique certificate number for the registered warrant.

- The quantity will always be 1.

- The net weight and fineness of the bars associated to the warrant will be visible. Below is an example of a client statement.

About Accumulated Certificate of Exchange (“ACE”)

- Micro Gold and Silver contracts deliver an Accumulated Certificate of Exchange (“ACE”), issued by the Clearing House.

- Micro Gold (MGC): An ACE represents a 10% ownership in a 100-troy ounce gold bar held in the form of a Warrant. Additional information is available via COMEX Rulebook Chapter 120.

- Micro Silver (SIL): An ACE represents a 20% ownership in a 5000-troy ounce silver bar held in the form of a Warrant. Additional information is available via COMEX Rulebook Chapter 121.

- Warrants can be converted to ACES.

- ACES can be redeemed for warrants once the correct multiples are accumulated (10 for gold and 5 for silver).

- Storage fees apply.

About Delivery Intents

In order to take or make delivery, an intent must be entered for the corresponding future. In the absence of an intent, futures positions will be subject to the relevant delivery period restrictions and positions may be liquidated. Refer to the delivery period liquidation schedule.

- Long Futures – Intent to Receive must be entered, for the corresponding number of long futures, a minimum of 2 business days prior to First Position Date of the corresponding delivery month. Clients can also enter Intents to Receive during the delivery period in order to place a buy order on a future in the current delivery month.

- Intent to Receive orders will be accepted only if the account has sufficient funds to take delivery of the declared amount of warrants. If there are insufficient funds, Intent to Receive orders will be rejected.

- Short Futures – Intent to Deliver must be entered for the corresponding number of short futures, a minimum 2 business days prior to the Last Trade Date of the corresponding delivery month. Clients can also enter Intents to Receive on the day preceding Last Trade Date, and Last Trade Date, in order to place a sell order on a future in the current delivery month.

- Intent to Deliver orders will be accepted only if the account has a sufficient number of warrant/ACE certificates to satisfy the delivery. If there are insufficient certificates, Intent to Deliver orders will be rejected.

Placing Delivery Intents

- To access the Physical Delivery tool from Trader Workstation (TWS):

- Right click on the eligible futures contract > Delivery OR

- Select Trade > Physical Delivery

- To access the Physical Delivery tool from Client Portal:

- Tap an eligible futures contract > Your Position > Row Action button (3 dots at end) > Delivery

- From the Positions page, tap the Row Action (3 dots at end) > Delivery

- IBKR Mobile App:

- Navigate to Main Menu > Trade > Delivery

- Tap an eligible futures contract to open the Contract Details > Positions > Delivery tool

To declare your intent for these precious metals you must follow one of the workflows below:

Intent to Receive

Submitting intent to receive not only indicates the desire to take delivery of the product at the end of the delivery window (in the form of a certified Warrant or ACE), it is also REQUIRED to open new Futures positions during the delivery window (i.e. it is not possible to open a physically deliverable futures position, during the delivery window, without first submitting the Intent to Receive for that Future).

Any Intents to Receive that do not have a corresponding Futures position at the end of the delivery window will be cancelled.

Intent to Deliver

Submitting intent to deliver indicates the desire to make delivery of a product (e.g. Warrant or ACE). It is also REQUIRED that the account is both short an eligible Future position and has the corresponding certificate to provide.

Any Intents to Deliver that do not have corresponding Future positions at the end of the delivery window will be canceled.

Request to Deliver

Submitting a request to deliver is ONLY available during the delivery window and indicates a desire to deliver the product that day (instead of at the end of the delivery window, as with the intent to deliver). It is REQUIRED that to submit this request an account must have an existing, eligible product (e.g. Warrant or ACE) and corresponding short Future position (e.g. GC, MGC etc.).

Physical Delivery of US Spot Gold

Physical Delivery of US Spot Gold

Unallocated US Spot Gold (symbol: USGOLD) can be converted into any of the following products:

- Gold Bullion Bar (.999) - 1 kg

- Gold Bullion Bar ISO Accredited (.9999) - 1 oz

- Gold Bullion Bar ISO Accredited (.9999) - 10 oz

- Gold American Eagle Coin - 1 oz

- Gold American Buffalo Coin - 1 oz

- Gold Canadian Maple Leaf Coin - 1 oz

Requesting a Delivery

If you would like to convert your unallocated US Spot Gold position into a physical metal:

- Log in to Client Portal

- Navigate to the Message Center

- Click “Compose > New Ticket”

- Select “Physical Gold Delivery” as the Topic

Delivery Costs and Shipping

The cost of physical delivery of US Spot Gold is the sum of:

- The differential between the spot price of gold and the cost of the physical product.

- Physical metals products are provided by Fidelitrade Inc. Estimated cost of the physical product can be found on their website.

- The cost of the product is the indicative ASK price displayed by FideliTrade.1

- A $20 delivery fee plus an additional $2.50 per ounce delivered 2

- A $500 IBKR processing fee

FideliTrade Shipping Policy:

- Bullion is shipped via Federal Express, the US Postal Service or armored carrier.

- Bullion is insured to $100,000 per package when shipped via Federal Express or USPS and to higher levels when shipped via armored carrier.

- Bullion is shipped only to address on record for your IBKR Account to ensure the highest level of security.

- Individual shipments of bullion via Federal Express or USPS have a maximum value of $100,000. Deliveries for bullion values larger than $100,000 will be broken up into multiple deliveries. 2

Trading Permissions

To trade US Spot Gold you need US Metals trading permission on your account. You can request permission by:

- logging in to Portal

- selecting the Settings > Account Settings menu item from the bottom of the window

- clicking the “Configure” (gear) icon for Trading Experience & Permissions.

- Click the drop down menu for "Additional Products"

- Select "Metals"

- In the pop-up, select "United States" and click Save

- clicking Continue

US Spot Gold is only available to legal residents of the United States. US Spot Gold is not available to legal residents of Arizona, Montana, New Hampshire and Rhode Island.

U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

How Can I Lapse Long Options?

Account holders have the ability to lapse equity options (also known as providing contrary intentions) they hold long in their account.

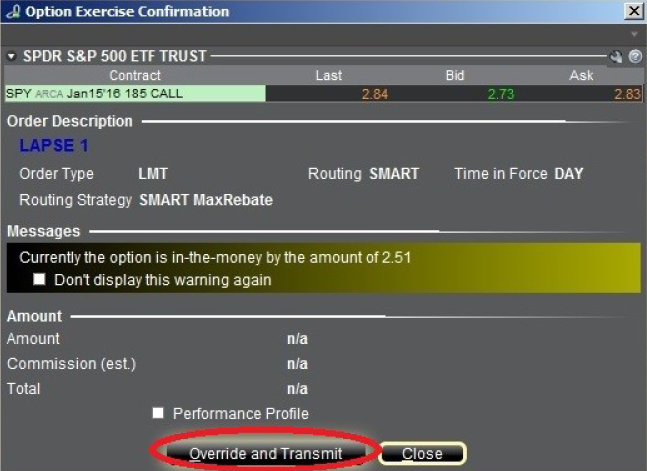

From Trader Workstation, go to the Trade menu and select Option Exercise.

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To lapse one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

.bmp)

Select “Lapse” from the drop down menu.

.bmp)

Review the request, and click the blue “ T” Transmit button to submit the lapse request.

.bmp)

The Option Exercise Confirmation window will appear and will show how much the option is in-the-money. If the option is out-of-the-money, a warning message will appear. To submit the Lapse request, click the Override and Transmit button.

Your Lapse request will now show as an order line on your Trader Workstation until the clearinghouse processes the request.

Unless the lapse request is final it is still considered a position in the credit system and subject to the expiration exposure calculations. The Orders page of Global Configuration provides a selection box where you can specify that an option exercise request be final, and therefore cannot be canceled or editable until the cutoff time (default), which varies by clearing house. To specify this parameter, from the Mosaic File menu or Classic Edit menu, select Global Configuration and go to Orders followed by Settings from the configuration tree on the left side. Make your selection using the “Option exercise requests are” drop down menu. Please note that some contracts will not follow this rule and will remain revocable up until the clearing house deadline.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

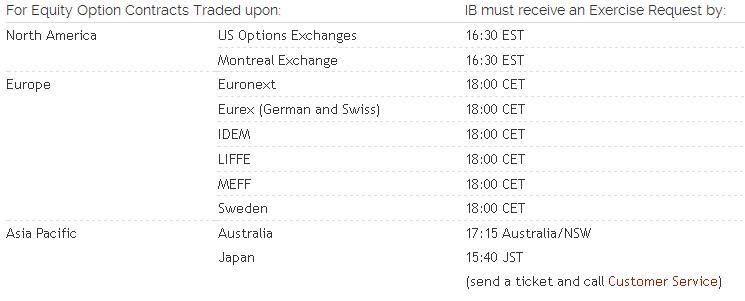

Option Lapse Requests (whether received through the TWS Option Exercise window or by a ticket sent via Account Management/Message Center) must be submitted as follows:

Note: "Contrary intentions" are handled on a best efforts basis.

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

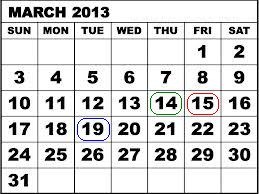

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

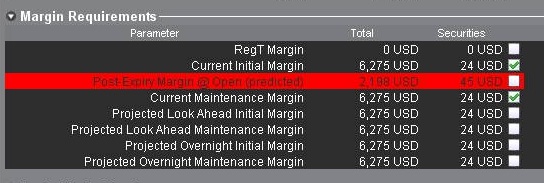

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

Overview of SEC Fees

Under Section 31 of the Securities Exchange Act of 1934, U.S. national securities exchanges are obligated to pay transaction fees to the SEC based on the volume of securities that are sold on their markets. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to their customers.

This fee is intended to allow the SEC to recover costs associated with its supervision and regulation of the U.S. securities markets and securities professionals. It applies to stocks, options and single stock futures (on a round turn basis); however, IB does not pass on the fee in the case of single stock futures trades. Note that this fee is assessed only to the sale side of security transactions, thereby applying to the grantor of an option (fee based upon the option premium received at time of sale) and the exerciser of a put or call assignee (fee based upon option strike price).

For the fiscal year 2016 the fee was assessed at a rate of $0.0000218 per $1.00 of sales proceeds, however, the rate is subject to annual and,in some cases, mid-year adjustments should realized transaction volume generate fees sufficiently below or in excess of targeted funding levels.1

Examples of the transactions impacted by this fee and sample calculations are outlined in the table below.

|

Transaction |

Subject to Fee? |

Example |

Calculation |

|

Stock Purchase |

No |

N/A |

N/A |

|

Stock Sale (cost plus commission option) |

Yes |

Sell 1,000 shares MSFT@ $25.87 |

$0.0000218 * $25.87 * 1,000 = $0.563966 |

|

Call Purchase |

No |

N/A |

N/A |

|

Put Purchase |

No |

N/A |

N/A |

|

Call Sale |

Yes |

Sell 10 MSFT June ’11 $25 calls @ $1.17 |

$0.0000218 * $1.17 * 100 * 10 = $0.025506 |

|

Put Sale |

Yes |

Sell 10 MSFT June ’11 $25 puts @ $0.41 |

$0.0000218 * $0.41 * 100 * 10 = $0.008938 |

|

Call Exercise |

No |

N/A |

N/A |

|

Put Exercise |

Yes |

Exercise of 10 MSFT June ’11 $25 puts |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Call Assignment |

Yes |

Assignment of 10 MSFT June ’11 $25 calls |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Put Assignment |

No |

N/A |

N/A |

1Information regarding current Section 31 fees may be found on the SEC's Frequently Requested Documents page located at: http://www.sec.gov/divisions/marketreg/mrfreqreq.shtml#feerate

FAQs - U.S. Securities Option Expiration

The following page has been created in attempt to assist traders by providing answers to frequently asked questions related to US security option expiration, exercise, and assignment. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer.

Click on a question in the table of contents to jump to the question in this document.

Table Of Contents:

How do I provide exercise instructions?

Do I have to notify IBKR if I want my long option exercised?

What if I have a long option which I do not want exercised?

What can I do to prevent the assignment of a short option?

Is it possible for a short option which is in-the-money not to be assigned?

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Am I charged a commission for exercise or assignments?

Q&A:

How do I provide exercise instructions?

Instructions are to be entered through the TWS Option Exercise window. Procedures for exercising an option using the IBKR Trader Workstation can be found in the TWS User's Guide.

![]() Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Do I have to notify IBKR if I want my long option exercised?

In the case of exchange listed U.S. securities options, the clearinghouse (OCC) will automatically exercise all cash and physically settled options which are in-the-money by at least $0.01 at expiration (e.g., a call option having a strike price of $25.00 will be automatically exercised if the stock price is $25.01 or more and a put option having a strike price of $25.00 will be automatically exercised if the stock price is $24.99 or less). In accordance with this process, referred to as exercise by exception, account holders are not required to provide IBKR with instructions to exercise any long options which are in-the-money by at least $0.01 at expiration.

![]() Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

What if I have a long option which I do not want exercised?

If a long option is not in-the-money by at least $0.01 at expiration it will not be automatically exercised by OCC. If it is in-the-money by at least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to let the option lapse. These instructions would need to be entered through the TWS Option Exercise window prior to the deadline as stated on the IBKR website.

What can I do to prevent the assignment of a short option?

The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day (for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes). When you sell an option, you provided the purchaser with the right to exercise which they generally will do if the option is in-the-money at expiration.

Is it possible for a short option which is in-the-money not to be assigned?

While is unlikely that holders of in-the-money long options will elect to let the option lapse without exercising them, certain holders may do so due to transaction costs or risk considerations. In conjunction with its expiration processing, OCC will assign option exercises to short position holders via a random lottery process which, in turn, is applied by brokers to their customer accounts. It is possible through these random processes that short positions in your account be part of those which were not assigned.

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Spread positions can have unique expiration risks associated with them. For example, an expiring spread where the long option is in-the-money by less than $0.01 and the short leg is in-the-money more than $0.01 may expire unhedged. Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money.

Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned?

No. There is no provision for issuing conditional exercise instructions to OCC. OCC determines the assignment of options based upon a random process which is initiated only after the deadline for submitting all exercise instructions has ended. In order to avoid the delivery of a long or short underlying stock position when only the short leg of an option spread is in-the-money at expiration, the account holder would need to either close out that short position or consider exercising an at-the-money long option.

What happens to my long stock position if a short option which is part of a covered write is assigned?

If the short call leg of a covered write position is assigned, the long stock position will be applied to satisfy the stock delivery obligation on the short call. The price at which that long stock position will be closed out is equal to the short call option strike price.

Am I charged a commission for exercise or assignments?

There is no commissions charged as the result of the delivery of a long or short position resulting from option exercise or assignment of a U.S. security option (note that this is not always the case for non-U.S. options).

What happens if I am unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment?

You should review your positions prior to expiration to determine whether you have adequate equity in your account to exercise your options. You should also determine whether you have adequate equity in the account if an in-the-money short option position is assigned to your account. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money.

If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account to meet the anticipated post-delivery margin requirement.

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either:

- Liquidate options prior to expiration. Please note: While IBKR retains the right to liquidate at any time in such situations, liquidations involving US security positions will typically begin at approximately 9:40 AM ET as of the business day following expiration;

- Allow the options to lapse; and/or

- Allow delivery and liquidate the underlying at any time.

In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

For more information, please see Expiration & Corporate Action Related Liquidations

Overview of Fees

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail.

An overview of the most common fees is provided below:

1. Commissions - vary by product type and listing exchange and whether you elect a bundled (all in) or unbundled plan. In the case of US stocks, for example, we charge $0.005 per share with a minimum per trade of $1.00.

2. Interest - interest is charged on margin debit balances and IBKR uses internationally recognized benchmarks on overnight deposits as a basis for determining interest rates. We then apply a spread around the benchmark interest rate (“BM”) in tiers, such that larger cash balances receive increasingly better rates, to determine an effective rate. For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1.5% is added to the benchmark for balances up to $100,000. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'.

3. Exchange Fees - again vary by product type and exchange. For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity (market order or marketable limit order) and provide payments for orders which add liquidity (limit order). In addition, many exchanges charge fees for orders which are canceled or modified.

4. Market Data - you are not required to subscribe to market data, but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. To access, log in to Portal click on the Support section and then the Market Data Assistant link.

5. Minimum Monthly Activity Fee - there is no monthly minimum activity requirement or inactivity fee in your IBKR account.

6. Miscellaneous - IBKR allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. In addition, there are certain pass-through fees for trade bust requests, options and futures exercise & assignments and ADR custodian fees.

For additional information, we recommend visiting our website and selecting any of the options from the Pricing menu option.