Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

Overview of ESMA CFD Rules Implementation at IBKR (UK) - Retail Investors Only

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The European Securities and Markets Authority (ESMA) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2018. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR (UK) has implemented the ESMA Decision.

1 Leverage Limits

1.1 ESMA Margins

Leverage limits were set by ESMA at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for non-major currency pairs and major indices;

- Non-major currency pairs are any combination that includes a currency not listed above, e.g. USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the ESMA Margins, IBKR (UK) establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by ESMA.

Details of applicable IB and ESMA margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement.

1.3 Funds Available for Initial Margin

You can only use cash to post initial margin to open a CFD position. Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

1.4 Automatic Funding of Initial Margin Requirements (F-segments)

IBKR (UK) automatically transfers funds from your main account to the F-segment of your account to fund initial margin requirements for CFDs.

Note however that no transfers are made to satisfy CFD maintenance margin requirements. Therefore if qualifying equity (defined below) becomes insufficient to meet margin requirements, a liquidation will occur even if you have ample funds in your main account. If you wish to avoid a liquidation you must transfer additional funds to the F-segment in Account Management.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

ESMA requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes cash in the F-segment (excluding cash in any other account segment) and unrealized CFD P&L (positive and negative).

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your CFD account. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

| Cash | Equity* | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Pre Trade | 2000 | 2000 | 2000 | |||||||

| Post Trade 1 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | No |

| Post Trade 2 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the ESMA rules IM and MM remain unchanged:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | Yes |

3 Negative Equity Protection

The ESMA Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g. shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore assets in the security and commodity segments of your main account, and non-CFD assets held in the F-segment, are not part of your capital at risk for CFD trading. However, all cash in the F-segment can be used to cover losses arising from CFD trading.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

4 Incentives Offered to trade CFDs

The ESMA Decision imposes a ban on monetary and certain types of non-monetary benefits related to CFD trading. IBKR does not offer any bonus or other incentives to trade CFDs.

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

Can I set a maximum dollar exposure for my account?

Unless an account holds solely long stock, bond, option or forex positions which have been paid for in full (i.e., no margin) and/or contains limited risk derivative positions such as option spreads, it is at risk of losing more than the original investment.

In the case of portfolios where the risk is indeterminable, there is no mechanism whereby the account holder can specify, at the portfolio level, a maximum dollar threshold of losses which, if reached, would limit their liability. IB does, however, provide a variety of tools and settings designed to assist account holders with managing and monitoring their exposure, including specialized order types, alerts and the Risk Navigator. A brief overview of each is provided below:

Order Types

Account holders may manage exposure on an individual trade level through several order types designed to limit risk. These order types include, but are not limited to: Stop, Adjustable Stop, Stop Limit, Trailing Stop and Trailing Stop Limit Orders. All of these order types allow you to specify an exit level for your individual positions based on your risk tolerance. For example, an account holder long 200 shares of hypothetical stock XYZ at an average price of $20.00 seeking to limit their loss to $500.00 could create a Stop Limit order having a Stop Price of $18.00 (the price at which a limit sell order is triggered) and a Limit Price of $17.50 (the lowest price at which the shares would be sold). It's important to note, however, that while a Stop Limit eliminates the price risk associated with a Stop order where the execution price is not guaranteed, it exposes the account holder to the risk that the order may never be filled even if the Stop Price is reached. For instructions on creating a Stop Limit order, click here.

Alerts

Alerts provide account holders the ability to specify events or conditions which, if met, trigger an action. The conditions can be based on time, trades that occur in the account, price levels, trade volume, or a margin cushion. For example, if the account holder wanted to be notified if their account was nearing a margin deficiency and forced liquidation, an alert could be set up to send an email if the margin cushion fell to some desired percentage, say 10% of equity. The action may consist of an email or text notification or the triggering of a risk reducing trade. For instructions on creating an Alert, click here.

Risk Navigator

The Risk Navigator is a real-time market risk management platform contained within the TraderWorkstation, which provides the account holder with the ability to create 'what-if' scenarios to measure exposure given user-defined changes to positions, prices, date and volatility variables which may impact their risk profile. For information on using an Risk Navigator, click here.

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

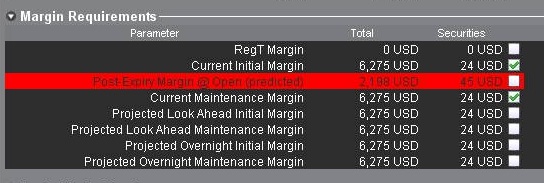

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

Equity & Index Option Position Limits

Equity option exchanges define position limits for designated equity options classes. These limits define position quantity limitations in terms of the equivalent number of underlying shares (described below) which cannot be exceeded at any time on either the bullish or bearish side of the market. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

Position limits are defined on regulatory websites and may change periodically. Some contracts also have near-term limit requirements (near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued). Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. The following information defines how position limits are calculated;

Option position limits are determined as follows:

- Bullish market direction -- long call & short put positions are aggregated and quantified in terms of equivalent shares of stock.

- Bearish market direction -- long put & short call positions are aggregated and quantified in terms of equivalent shares of stock.

The following examples, using the 25,000 option contract limit, illustrate the operation of position limits:

- Customer A, who is long 25,000 XYZ calls, may at the same time be short 25,000 XYZ calls, since long and short positions in the same class of options (i.e., in calls only or in puts only) are on opposite sides of the market and are not aggregated

- Customer B, who is long 25,000 XYZ calls, may at the same time be long 25,000 XYZ puts. Rule 4.11 does not require the aggregation of long call and long put (or short call and short put) positions, since they are on opposite sides of the market.

- Customer C, who is long 20,000 XYZ calls, may not at the same time be short more than 5,000 XYZ puts, since the 25,000 contract limit applies to the aggregate position of long calls and short puts in options covering the same underlying security. Similarly, if Customer C is also short 20,000 XYZ calls, he may not at the same time have a long position of more than 5,000 XYZ puts, since the 25,000 contract limit applies separately to the aggregation of short call and long put positions in options covering the same underlying security.

Notifications and restrictions:

IB will send notifications to customers regarding the option position limits at the following times:

- When a client exceeds 85% of the allowed limit IB will send a notification indicating this threshold has been exceeded

- When a client exceeds 95% of the allowed limit IB will place the account in closing only. This state will be maintained until the account falls below 85% of the allowed limit. New orders placed that would increase the position will be rejected.

Notes:

Position limits are set on the long and short side of the market separately (and not netted out).

Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side (index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge).

Position information is aggregated across related accounts and accounts under common control.

Definition of related accounts:

IB considers related accounts to be any account in which an individual may be viewed as having influence over trading decisions. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account (and accounts under common control), joint accounts with individual accounts for the joint parties and organization accounts (where an individual is listed as an officer or trader) with other accounts for that individual.

Position limit exceptions:

Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. In general the hedges permitted by the US regulators that are recognized in the IB system include outright stock position hedges, conversions, reverse conversions and box spreads. Currently collar and reverse collar strategies are not supported hedges in the IB system. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

OCC posts position limits defined by the option exchanges. They can be found here.

http://www.optionsclearing.com/webapps/position-limits

Do liquidation trades executed by IBKR count as day trades?

Yes, if a position that is opened is subsequently closed in the same trading session (day), it is defined as a Pattern Day Trade. If an IBKR liquidation results in the closing of a position that was opened in that same session/day, it would be counted towards the Pattern Day Trade total. This could also result in the account being flagged as a Pattern Day Trade account.

Will IBKR delay liquidation while I deposit funds in my account?

IBKR's margin compliance policy does not allow for transfers or other deposits if there is a margin violation/deficit in the account. In the case of a margin violation/deficit, the account in deficit is immediately subject to liquidation. Automated liquidations are accomplished with market orders, and any/all positions in the account can be liquidated. There are cases where, due to specific market conditions, a deficit is better addressed via a manual liquidation.

Funds deposited or wired into the account are not taken into consideration from a risk standpoint until those funds have cleared all the appropriate funds and banking channels and are officially in the account. The liquidation system is automated and programmed to act immediately if there is a margin violation/deficit.

Note for Prime Clients: Executing away is not a means to resolve real time deficits as away trades will not be taken into consideration for beneficial margin purposes until 9 pm ET on Trade Date or when the trades have been reported and matched with external confirms, whichever is later. Trading away for expiring options, on expiration day, is also discouraged due to the potential for late or inaccurate reporting which can lead to erroneous margin calculations or incorrect exercise and assignment activity. Clients who wish to trade expiring options on expiration day and away from IB, must load their FTP file no later than 2:50 pm ET, and do so at their own risk.

I want my liquidated position to be reinstated.

IBKR employs a proprietary algorithm which identifies positions for liquidation. This is a complicated formula which seeks always to make the best possible liquidation. There are numerous factors involved in the liquidation algorithm which are taken into account prior to the creation of a liquidation trade.

Your liquidated securities, if part of a valid liquidation, will not be taken back, or reinstated. Going forward, I want to point you towards a feature that might be of help. In the Account Window, under Portfolio, you will have your positions listed. You can highlight a position that you would prefer not be liquidated prior to others in the account in the event of a liquidation, by left-clicking it. Once this position is highlighted, right-click on the line. In the box which appears choose “Set Liquidate Last”. This feature allows you to mark those positions which you would prefer to hold over others. IBKR will try to honor those requests, but this is merely a request and we cannot guarantee that the chosen position won’t be liquidated.

Options Assignment Prior to Expiration

An American-Style option seller (writer) may be assigned an exercise at any time until the option expires. This means that the option writer is subject to being assigned at any time after he or she has written the option until the option expires or until the option contract writer closes out his or her position by buying it back to close. Early exercise happens when the owner of a call or put invokes his or her rights before expiration. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Generally, assignment risk becomes greater closer to expiration, however even with that being said, assignment can still happen at any time when trading American-Style Options.

Short Put

When selling a put, the seller has the obligation to buy the underlying stock or asset at a given price (Strike Price) within a specified window of time (Expiration date). If the strike price of the option is below the current market price of the stock, the option holder does not gain value putting the stock to the seller because the market value is greater than the strike price. Conversely, If the strike price of the option is above the current market price of the stock, the option seller will be at assignment risk.

Short Call

Selling a call gives the right to the call owner to buy or “call” stock away from the seller within a given time frame. If the market price of the stock is below the strike price of the option, the call holder has no advantage to call stock away at higher than market value. If the market value of the stock is greater than the strike price, the option holder can call away the stock at a lower than market value price. Short calls are at assignment risk when they are in the money or if there is a dividend coming up and the extrinsic value of the short call is less than the dividend.

What happens to these options?

If a short call is assigned, the short call holder will be assigned short shares of stock. For example, if the stock of ABC company is trading at $55 and a short call at the $50 strike is assigned, the short call would be converted to short shares of stock at $50. The account holder could then decide to close the short position by purchasing the stock back at the market price of $55. The net loss would be $500 for the 100 shares, less credit received from selling the call initially.

If a short put is assigned, the short put holder would now be long shares of stock at the put strike price. For example, with the stock of XYZ trading at $90, the short put seller is assigned shares of stock at the strike of $96. The put seller is responsible for buying shares of stock above the market price at their strike of $96. Assuming, the account holder closes the long stock position at $90, the net loss would be $600 for 100 shares, less credit received from selling the put originally.

Margin Deficit from the option assignment

If the assignment takes place prior to expiration and the stock position results in a margin deficit, then consistent with our margin policy accounts are subject to automated liquidation in order to bring the account into margin compliance. Liquidations are not confined to only shares that resulted from the option position.

Additionally, for accounts that are assigned on the short leg of an option spread, IBKR will NOT act to exercise a long option held in the account. IBKR cannot presume the intentions of the long option holder, and the exercise of the long option prior to expiration will forfeit the time value of the option, which could be realized via the sale of the option.

Post Expiration Exposure, Corporate Action and Ex-Dividend Events

Interactive Brokers has proactive steps to mitigate risk, based upon certain expiration or corporate action related events. For more information about our expiration policy, please review the Knowledge Base Article "Expiration & Corporate Action Related Liquidations".

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at the OCC's web site.