System requirements for FaceKom interviews

Interactive Brokers Central Europe ZRt ("IBCE") is required, by regulation, to confirm applicant's identity via video interview. Interviews are conducted using a regulatory compliant remote client identification system offered by FaceKom. The minimum system requirements necessary to participate in the IBCE video interview are as follows:

- PC, laptop or mobile devices: Android OS 4+ and Chrome or Android 5+ with built-in Chrome, iOS Safari 11+.

- Supported browsers from PC / laptop: Google Chrome v44 or later, Mozilla Firefox v39 or later, Opera (since 2018), Microsoft Edge 15+ Safari 11.

- Hardware requirements: Intel Core i3, i5, or i7 (AMD or equivalent), RAM: minimum 2GB. Camera: HD (720p) is recommended.

股票收益提升计划(SYEP)常见问题

股票收益提升计划推出的目的是什么?

股票收益提升计划可供客户通过允许IBKR将其账户内原本闲置的证券头寸(即全额支付和超额保证金证券)出借给第三方来赚取额外收益。参与此计划的客户会收到用以确保股票在借贷终止时顺利归还的抵押(美国国债或现金)。

什么是全额支付和超额保证金证券?

全额支付证券是客户账户中全款付清的证券。超额保证金证券是虽然没有全款付清但本身市场价值已超过保证金贷款余额的140%的证券。

客户股票收益提升计划的借出交易收益如何计算?

客户借出股票的收益取决于场外证券借贷市场的借贷利率。借出的股票不同,出借的日期不同,都会对借贷利率造成很大差异。通常,IBKR会按自己借出股票所得金额的大约50%向参与计划的客户支付利息。

借贷交易的抵押金额如何确定?

证券借贷的抵押(美国国债或现金)金额采用行业惯例确定,即用股票的收盘价乘以特定百分比(通常为102-105%),然后向上取整到最近的美元/分。每个币种的行业惯例不同。例如,借出100股收盘价为$59.24美元的美元计价股票,现金抵押应为$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表为各个币种的行业惯例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 欧元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英镑 | 105%;向上取整到最近的便士 |

| 港币 | 105%;向上取整到最近的分 |

更多信息,请参见KB1146。

股票收益提升计划下的抵押如何保管以及保管在何处?

对于IBLLC的客户,抵押将采用现金或美国国债的形式,并将转入IBLLC的联营公司IBKR Securities Services LLC (“IBKRSS”)进行保管。您在该计划下借出股票的抵押会由IBKRSS以您为受益人保管在一个账户中,您将享有第一优先级担保权益。如果IBLLC违约,您将可以直接从IBKRSS取得抵押,无需经过IBLLC。请参见 此处的《证券账户控制协议》了解更多信息。对于非IBLLC的客户,抵押将由账户所在实体保管。例如,IBIE的账户其抵押将由IBIE保管。例如,IBIE的账户其抵押将由IBIE保管。

退出IBKR股票收益提升计划或卖出/转账通过此计划借出的股票会对利息造成什么影响?

交易日的下一个工作日(T+1)停止计息。对于转账或退出计划,利息也会在发起转账或退出计划的下一个工作日停止计算。

参加IBKR股票收益提升计划有什么资格要求?

| 可参加股票收益提升计划的实体* |

| 盈透证券有限公司(IB LLC) |

| 盈透证券英国有限公司(IB UK)(SIPP账户除外) |

| 盈透证券爱尔兰有限公司(IB IE) |

| 盈透证券中欧有限公司(IB CE) |

| 盈透证券香港有限公司(IB HK) |

| 盈透证券加拿大有限公司(IB Canada)(RRSP/TFSA账户除外) |

| 盈透证券新加坡有限公司(IB Singapore) |

| 可参加股票收益提升计划的账户类型 |

| 现金账户(申请参加时账户资产超过$50,000美元) |

| 保证金账户 |

| 财务顾问客户账户* |

| 介绍经纪商客户账户:全披露和非披露* |

| 介绍经纪商综合账户 |

| 独立交易限制账户(STL) |

*参加的账户必须是保证金账户或满足上述现金账户最低资产要求的现金账户。

盈透证券日本、盈透证券卢森堡、盈透证券澳大利亚和盈透证券印度公司的客户不能参加此计划。账户开在IB LLC下的日本和印度客户可以参加。

此外,满足上方条件的财务顾问客户账户、全披露介绍经纪商客户和综合经纪商可以参加此计划。如果是财务顾问和全披露介绍经纪商,必须由客户自己签署协议。综合经纪商由经纪商签署协议。

IRA账户可以参加股票收益提升计划吗?

可以。

IRA账户由盈透证券资产管理公司(Interactive Brokers Asset Management)管理的账户分区可以参加股票收益提升计划吗?

不能。

英国SIPP账户可以参加股票收益提升计划吗?

不能。

如果参加计划的现金账户资产跌破最低资产要求$50,000美元会怎么样?

现金账户只有在申请参加计划当时必须满足这一最低资产要求。之后资产跌破此要求并不会对现有借贷造成任何影响,也不影响您继续借出股票。

如何申请参加IBKR股票收益提升计划?

要参加股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。然后,在账户设置内,寻找交易板块并点击股票收益提升计划以申请参加。 您将会看到参加该计划所需填写的表格和披露。阅读并签署表格后,您的申请便会提交处理。可能需要24到48小时才能完成激活。

如何终止股票收益提升计划?

要退出股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。在账户 设置板块内会找到交易,然后点击股票 收益 提升 计划,然后参照所需步骤。您的申请便会提交处理。 中止参加的请求通常会在当日结束时进行处理。

如果一个账户参加了计划然后又退出,那么该账户多久可以重新参加计划?

退出计划后,账户需要等待90天才能重新参加。

哪些证券头寸可以出借?

| 美国市场 | 欧洲市场 | 香港市场 | 加拿大市场 |

| 普通股(交易所挂牌、粉单和OTCBB) | 普通股(交易所挂牌) | 普通股(交易所挂牌) | 普通股(交易所挂牌) |

| ETF | ETF | ETF | ETF |

| 优先股 | 优先股 | 优先股 | 优先股 |

| 公司债券* |

*市政债券不适用。

借出IPO后在二级市场交易的股票有什么限制吗?

没有,只要账户本身没有就相应的证券受到限制就可以。

IBKR如何确定可以借出的股票数量?

第一步是确定IBKR有保证金扣押权从而可以在没有客户参与的情况下通过股票收益提升计划借出的证券的价值(如有)。根据规定,通过保证金贷款借钱给客户购买证券的经纪商可以将该客户的证券借出或用作抵押,金额最高不超过贷款金额的140%。例如,如果客户现金余额为$50,000美元,买入市场价值为$100,000美元的证券,则贷款金额为$50,000美元,那么经纪商对$70,000美元($50,000的140%)的证券享有扣押权。客户持有的证券超出这一金额的部分被称为超额保证金证券(此例子中为$30,000),需要记在隔离账户,除非客户授权IBKR通过股票收益提升计划将其借出。

计算贷款金额首先要将所有非美元计价的现金余额转换成美元,然后减去股票卖空所得(转换成美元)。如果结果为负数,则我们最高可抵押此数目的140%。此外,商品账户段中持有的现金余额和现货金属和差价合约相关现金不纳入考虑范围。 详细说明请参见此处。

例1: 客户在基础货币为美元的账户内持有100,000欧元,欧元兑美元汇率为1.40。客户买入价值$112,000美元(相当于80,000欧元)的美元计价股票。由于转换成美元后现金余额为正数,所有证券被视为全额支付。

| 项目 | 欧元 | 美元 | 基础货币(美元) |

| 现金 | 100,000 | (112,000) | $28,000 |

| 多头股票 | $112,000 | $112,000 | |

| 净清算价值 | $140,000 |

例2: 客户持有80,000美元、多头持有价值$100,000美元的美元计价股票并且做空了价值$100,000美元的美元计价股票。总计$28,000美元的多头证券被视为保证金证券,剩余的$72,000美元为超额保证金证券。计算方法是用现金余额减去卖空所得($80,000 - $100,000),所得贷款金额再乘以140% ($20,000 * 1.4 = $28,000)

| 项目 | 基础货币(美元) |

| 现金 | $80,000 |

| 多头股票 | $100,000 |

| 空头股票 | ($100,000) |

| 净清算价值 | $80,000 |

IBKR会把所有符合条件的股票都借出去吗?

不保证账户内所有符合条件的股票都能通过股票收益提升计划借出去,因为某些证券可能没有利率有利的市场,或者IBKR无法接入有意愿的借用方所在的市场,也有可能IBKR不想借出您的股票。

通过股票收益提升计划借出股票是否都要以100为单位?

不能。只要是整股都可以,但是借给第三方的时候我们只以100为倍数借出。这样,如果有第三方需要借用100股,就可能发生我们从一个客户那里借出75股、从另一个客户那里借出25股的情况。

如果可供借出的股票超过借用需求,如何在多个客户之间分配借出份额?

如果我们股票收益提升计划的参与者可用以借出的股票数量大于借用需求,则借出份额将按比例分配。例如,可供借出XYZ数量为20,000股,而对于XYZ的需求只有10,000股的情况下,每个客户可以借出其所持股数的一半。

股票是只借给其它IBKR客户还是也会借给其它第三方?

股票可以借给IBKR客户和第三方。

股票收益提升计划的参与者可以自行决定哪些股票IBKR可以借出吗?

不能。此计划完全由IBKR管理,IBKR在确定了自己因保证金贷款扣押权可以借出的证券后,可自行决定哪些全额支付或超额保证金证券可以借出,并发起借贷。

通过股票收益提升计划借出去的证券其卖出是否会受到限制?

借出去的股票可随时卖出,没有任何限制。卖出交易的结算并不需要股票及时归还,卖出收益会按正常结算日记入客户的账户。此外,借贷会于证券卖出的下一个工作日开盘终止。

客户就通过股票收益提升计划借出去的股票沽出持保看张期权还能享受持保看涨期权保证金待遇吗?

可以。由于借出去的股票其盈亏风险仍然在借出方身上,借出股票不会对相关保证金要求造成任何影响。

借出去的股票由于看涨期权被行权或看跌期权行权被交付会怎么样?

借贷将于平仓或减仓操作(交易、被行权、行权)的T+1日终止。

借出去的股票被暂停交易会怎么样?

暂停交易对股票借出没有直接影响,只要IBKR能继续借出该等股票,则无论股票是否被暂停交易,借贷都可以继续进行。

借贷股票的抵押可以划至商品账户段冲抵保证金和/或应付行情变化吗?

不能。股票借贷的抵押不会对保证金或融资造成任何影响。

计划参与者发起保证金贷款或提高现有贷款金额会怎么样?

如果客户有全额支付的证券通过股票收益提升计划借出,之后又发起保证金贷款,则不属于超额保证金证券的部分将被终止借贷。同样,如果客户有超额保证金证券通过此计划借出,之后又要增加现有保证金贷款,则不属于超额保证金证券的部分也将被终止借贷。

什么情况下股票借贷会被终止?

发生以下情况(但不限于以下情况),股票借贷将被自动终止:

- 客户选择退出计划

- 转账股票

- 以股票作抵押借款

- 卖出股票

- 看涨期权被行权/看跌期权行权

- 账户关闭

股票收益提升计划的参与者是否会收到被借出股票的股息?

通过股票收益提升计划借出的股票通常会在除息日前召回以获取股息、避免股息替代支付。但是仍然有可能获得股息替代支付。

股票收益提升计划的参与者是否对被借出的股票保有投票权?

不能。如果登记日或投票、给予同意或采取其它行动的截止日期在贷款期内,则证券的借用者有权就证券相关事项进行投票或决断。

股票收益提升计划的参与者是否能就被借出的股票获得权利、权证和分拆股份?

可以。被借出股票分配的任何权利、权证和分拆股份都将属于证券的借出方。

股票借贷在活动报表中如何呈现?

借贷抵押、借出在外的股数、活动和收益在以下6个报表区域中反映:

1. 现金详情 – 详细列出了期初抵押(美国国债或现金)余额、借贷活动导致的净变化(如果发起新的借贷则为正;如果股票归还则为负)和期末现金抵押余额。

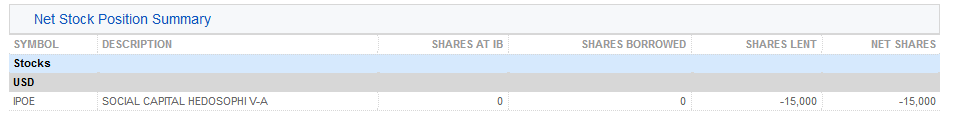

2. 净股票头寸总结 – 按股票详细列出了在IBKR持有的总股数、借入的股数、借出的股数和净股数(=在IBKR持有的总股数 + 借入的股数 - 借出的股数)。

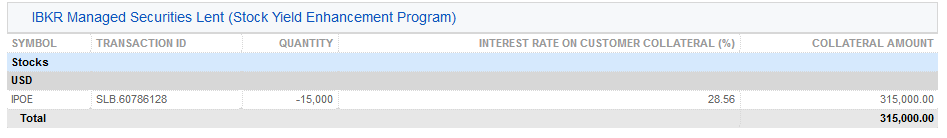

3. 借出的IBKR管理证券(股票收益提升计划) – 对通过股票收益提升计划借出的股票按股票列出了借出的股数以及利率(%)。

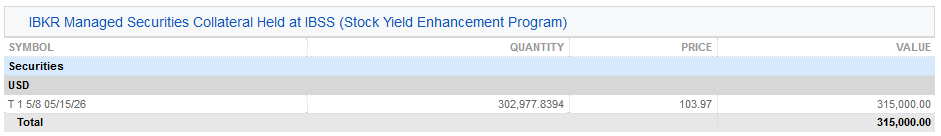

3a. 在IBSS保管的IBKR管理证券的抵押(股票收益提升计划)– IBLLC的客户会看到其报表中多出来一栏,显示作为抵押的美国国债以及抵押的数量、价格和总价值。

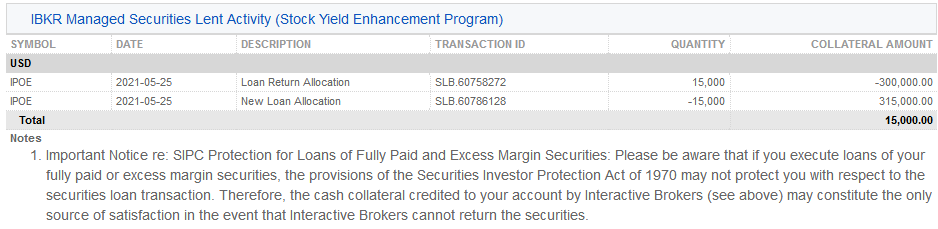

4. IBKR管理证券借出活动 (股票收益提升计划)– 详细列出了各证券的借贷活动,包括归还份额分配(即终止的借贷);新借出份额分配(即新发起的借贷);股数;净利率(%);客户抵押金额及其利率(%)。

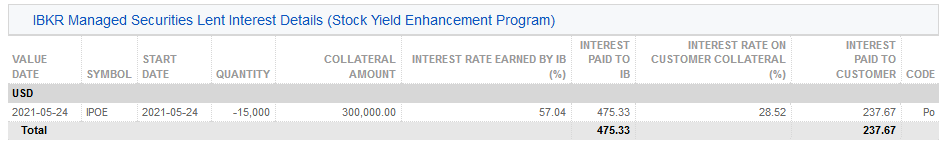

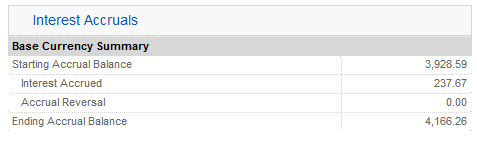

5. IBKR管理的证券借出活动利息详情 (股票收益提升计划)– 按每笔借出活动详细列出了IBKR赚取的利率(%);IBKR赚取的收益(为IBKR从该笔借出活动赚取的总收益,等于{抵押金额 * 利率}/360);客户抵押的利率(为IBKR从该笔借出活动赚取的收益的一半)以及支付给客户的利息(为客户的现金抵押赚取的利息收入)

注:此部分只有在报表期内客户赚取的应计利息超过1美元的情况下才会显示。

6. 应计利息 – 此处利息收入列为应计利息,与任何其它应计利息一样处理(累积计算,但只有超过$1美元才会显示并按月过账到现金)。年末申报时,该笔利息收入将上报表格1099(美国纳税人)。

如何使用语音回呼接收登录验证代码

如果启用了短信验证作为双因素验证方式,您可使用语音回呼来接收登录验证代码。本文详述了登录平台时使用语音回呼的具体步骤。

客户端

2. 从两个选项中选择"语音"然后等待回呼。

3. 选择语音后,您会在一分钟内接到回呼。请等待回呼,准备好记下回呼将提供给您的代码。

TWS

2. 从两个选项中选择"语音"然后点击确定,等待回呼。

3. 选择语音后,您会在一分钟内接到回呼。请等待回呼,准备好记下回呼将提供给您的代码。

注:TWS的语音回呼功能只适用于最新版和BETA版。

移动IBKR - iOS版

2. 从两个选项中选择"语音"然后等待回呼。

3. 选择语音后,您会在一分钟内接到回呼。请等待回呼,准备好记下回呼将提供给您的代码。

移动IBKR - 安卓版

2. 从两个选项中选择"语音"然后等待回呼。

3. 选择语音后,您会在一分钟内接到回呼。请等待回呼,准备好记下回呼将提供给您的代码。

参考:

FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

IB LLC Document Considerations for Individual Applicants

IB LLC is required to verify the identity and address of each applicant and, where we are unable to do so via electronic means, will instruct the applicant to submit copies of official documents as evidence (e.g., passport, driver’s license, national ID, bank statement utility statement). In most instances the applicant will need to submit two separate documents, one as proof of address and the other as proof of identity, even when a single document contains both. Individuals residing in certain countries, however, are eligible to submit a single qualifying document as proof of both their identity and address. A list of countries whose residents are eligible to submit a single qualifying document as proof of both their identity and address is listed below1.

| Country Name |

| United States |

| American Samoa |

| Anguilla |

| Antarctica |

| Aruba |

| Bahrain |

| Barbados |

| Bermuda |

| Bhutan |

| Bonaire, Sint Eustatius and Saba |

| British Indian Ocean Territory |

| Brunei Darussalam |

| Chile |

| China |

| Cook Islands |

| Curacao |

| East Timor |

| Faeroe Islands |

| Falkland Islands (Malvinas) |

| Fiji |

| French Polynesia |

| Greenland |

| Guam |

| Israel |

| Kiribati |

| Malawi |

| Marshall Islands |

| Martinique |

| Mauritius |

| Mayotte |

| Micronesia, Federated States of |

| New Caledonia |

| Norfolk Island |

| Northern Mariana Islands |

| Oman |

| Pitcairn |

| Puerto Rico |

| Qatar |

| Republic of Korea |

| Rwanda |

| Saint Barthelemy |

| Saint Helena |

| Saint Lucia |

| Saint Martin |

| Saint Vincent and the Grenadines |

| Samoa |

| Senegal |

| Singapore |

| Sint Maarten |

| Solomon Islands |

| South Africa |

| Svalbard and Jan Mayen Islands |

| Swaziland |

| Taiwain, ROC |

| Tokelau |

| Tonga |

| Turks and Caicos Islands |

| Tuvalu |

| United States Virgin Islands |

| Australia |

| French Guiana |

| Guadeloupe |

| New Zealand |

| Reunion |

| Saint Pierre and Miquelon |

1 Note that this list is subject to change and may not yet reflect the most recent updates.

How to use Voice callback for receiving login authentication codes

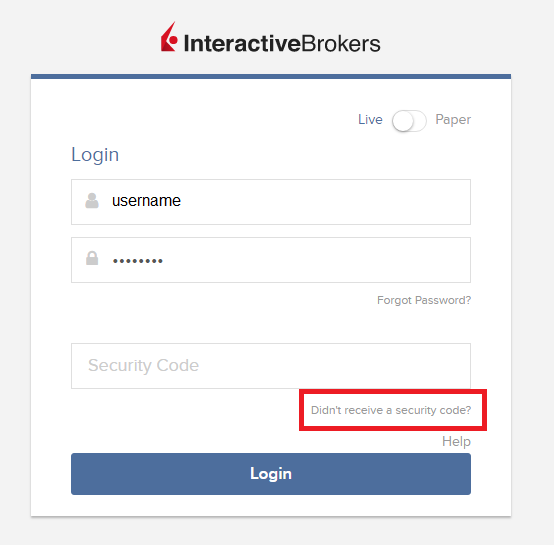

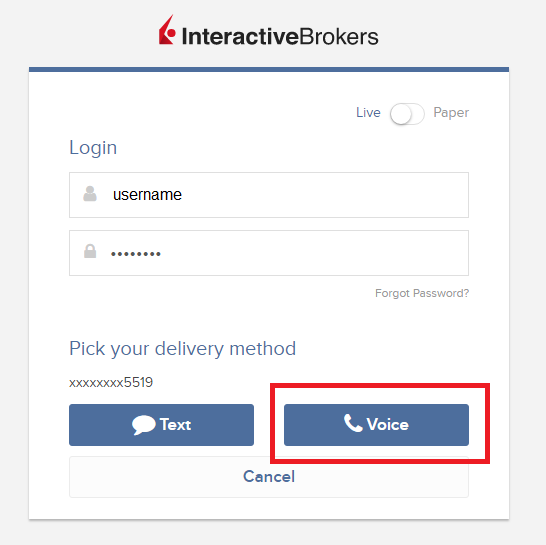

If you have SMS enabled as two-factor authentication method, you may use Voice callback to receive your login authentication codes. This article will provide you steps on how to select voice callback when logging in to our platforms.

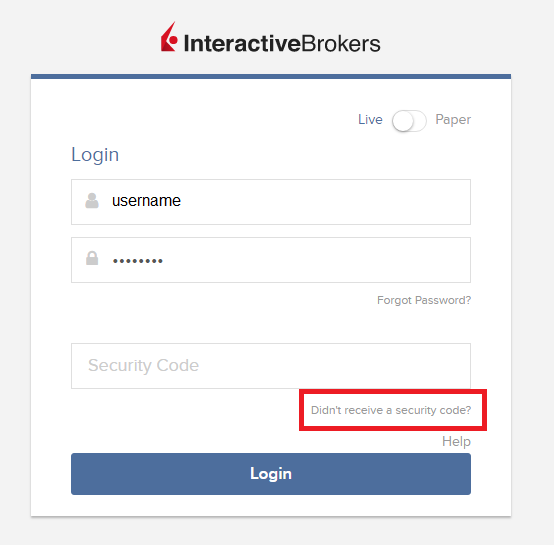

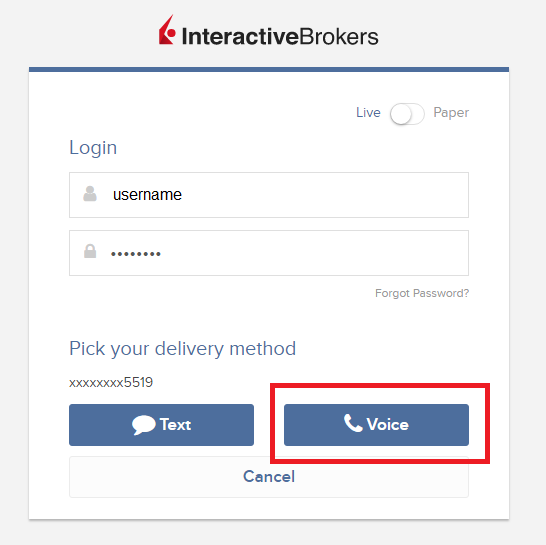

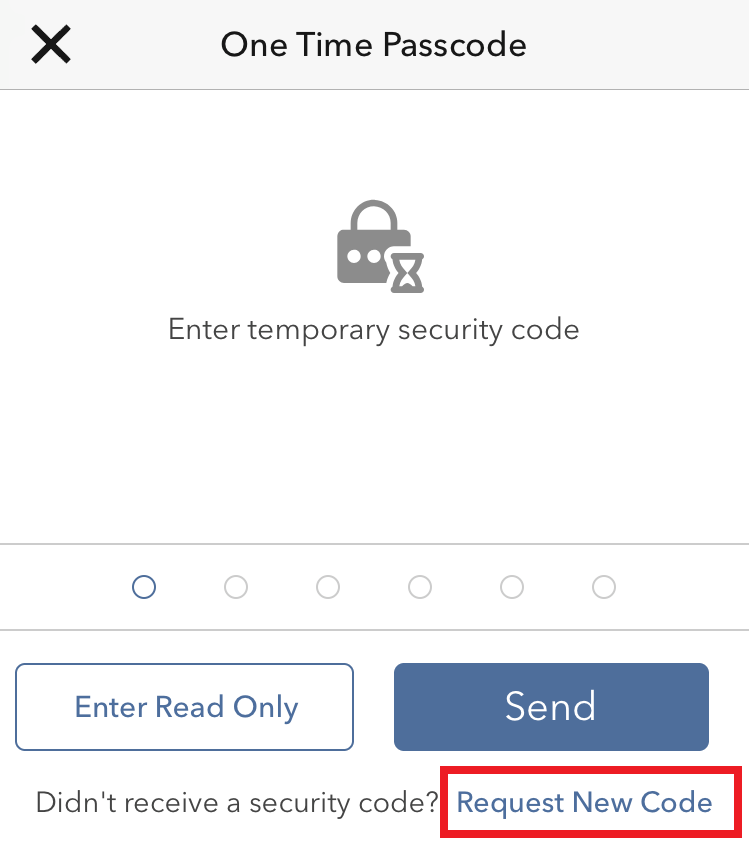

Client Portal

1. Click on "Didn't receive a security code?"

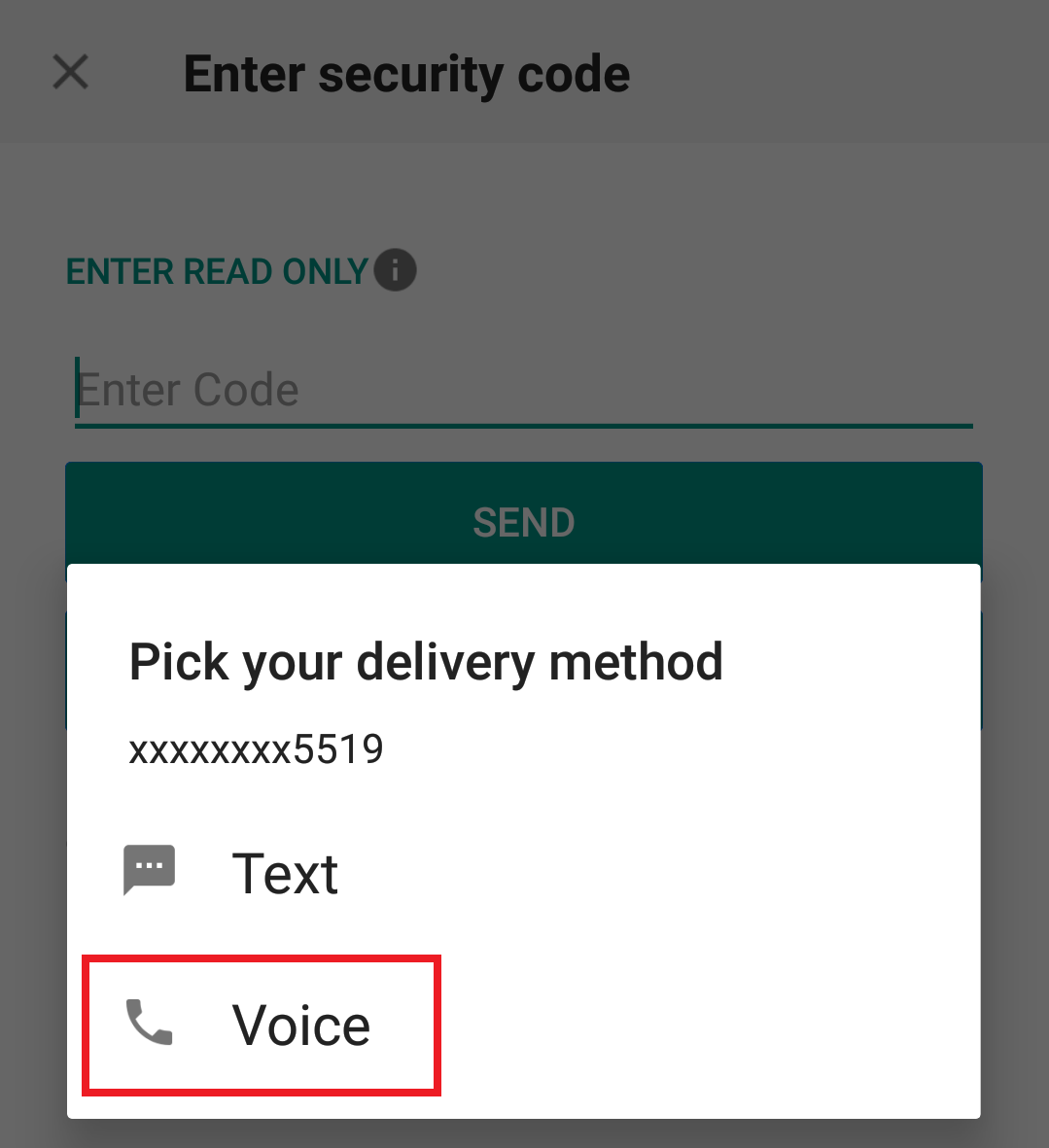

2. From the two options, select "Voice" and wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

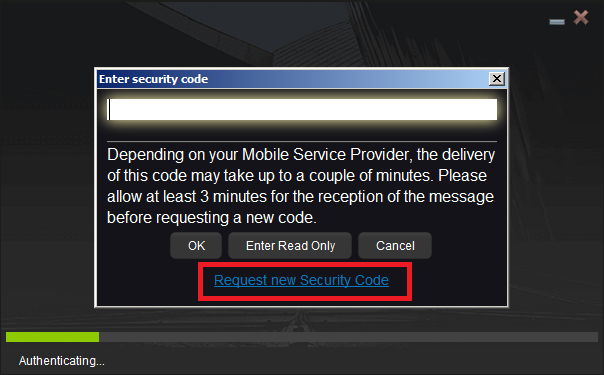

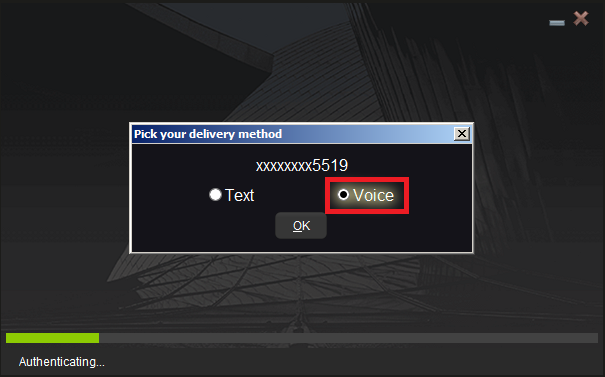

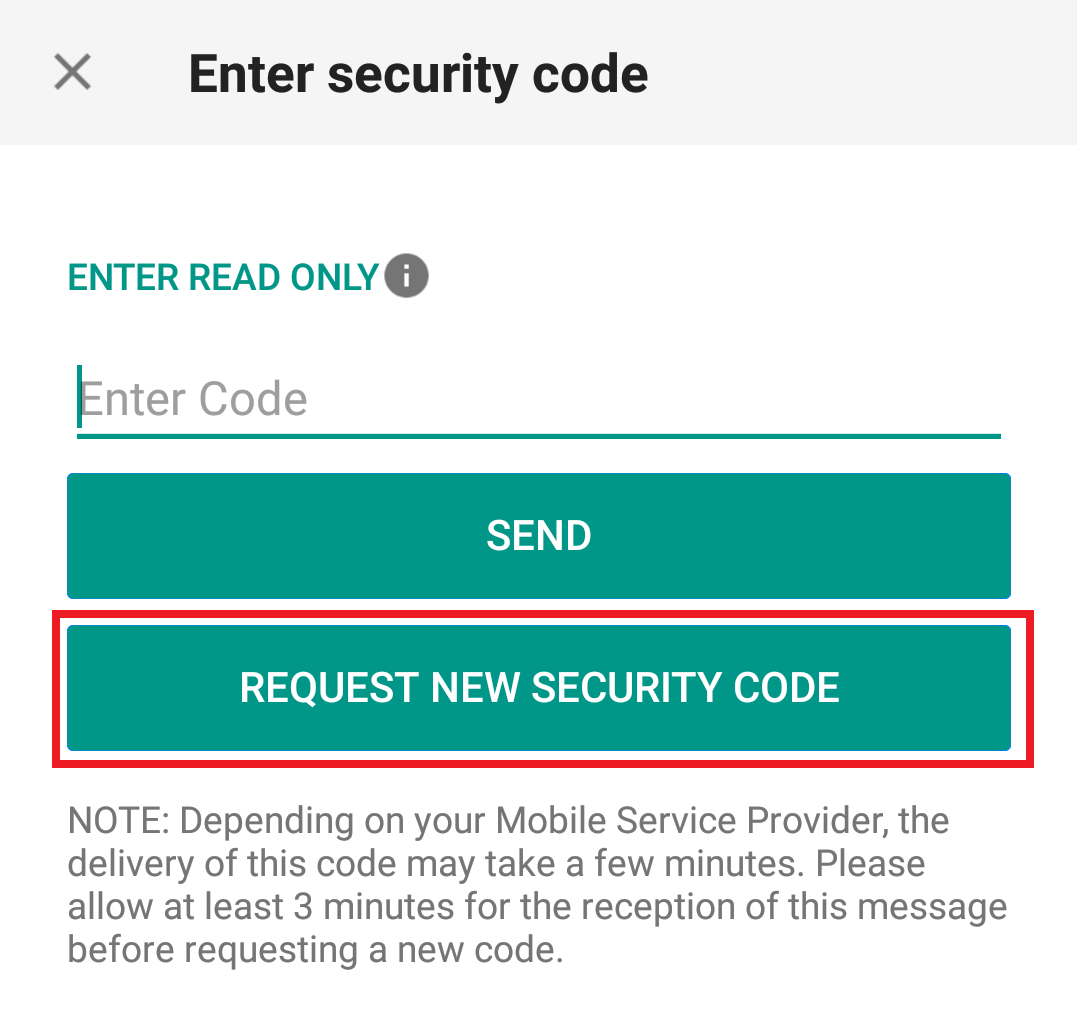

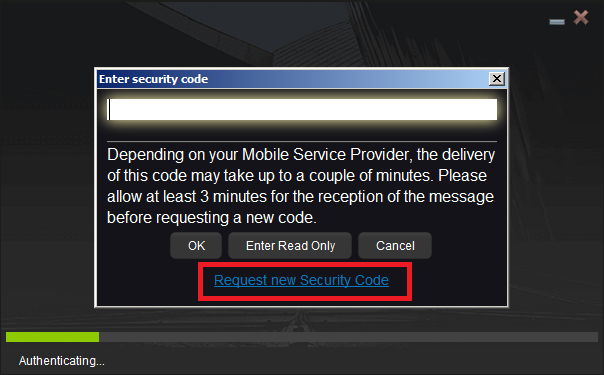

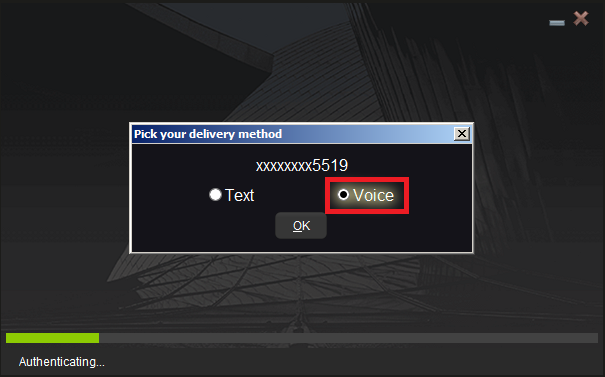

TWS

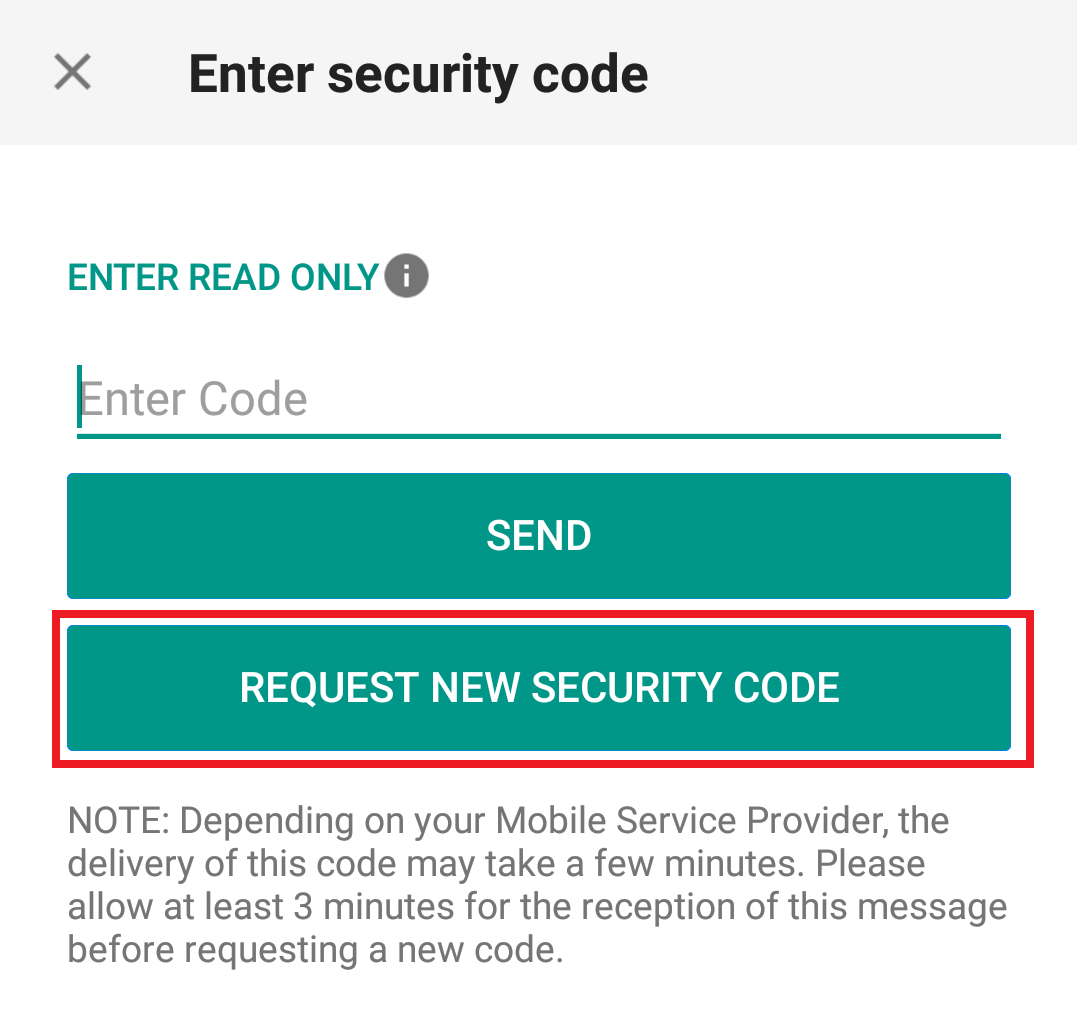

1. Click on "Request new Security Code"

2. From the two options, select "Voice" and click on OK. Then wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

Note: Voice callback for the TWS is only available in the LATEST and BETA version.

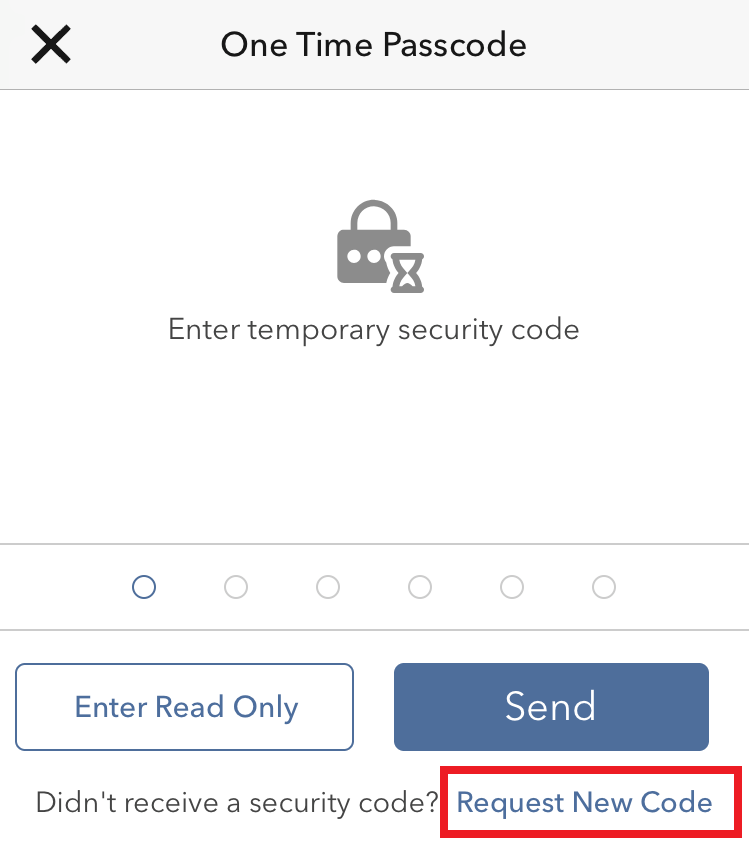

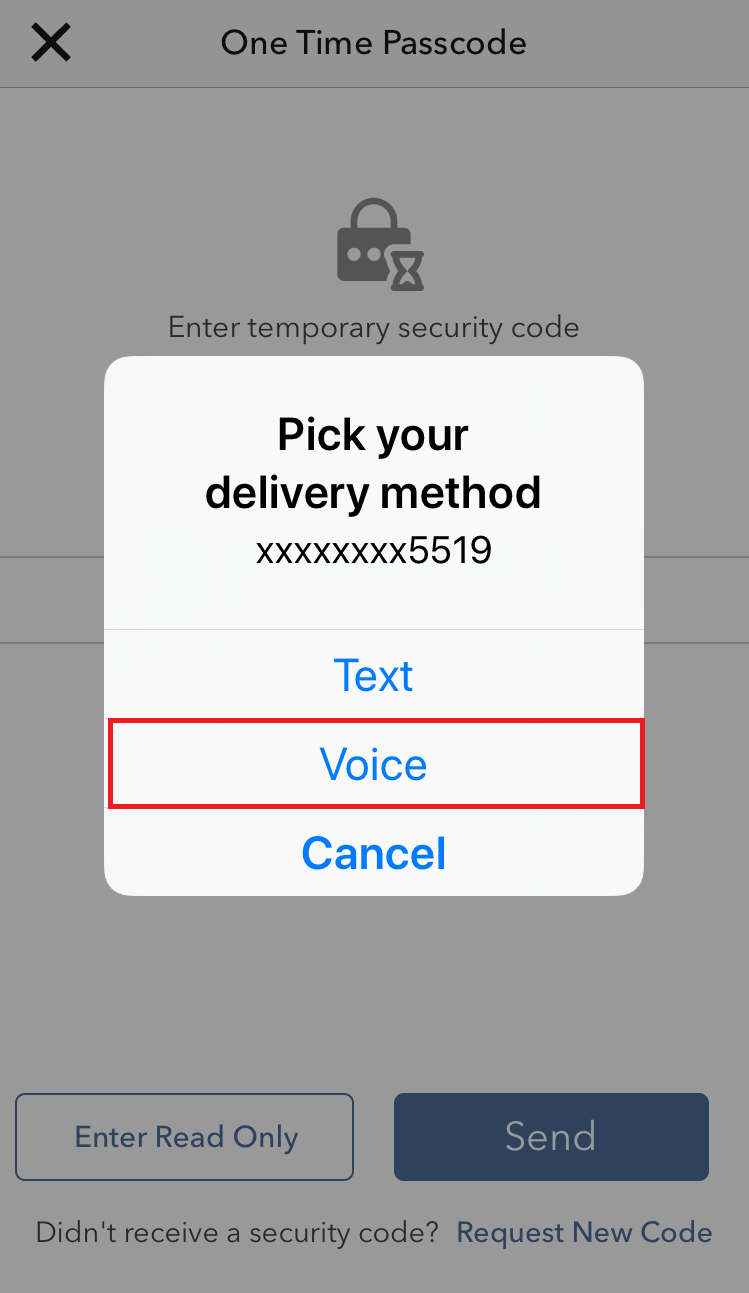

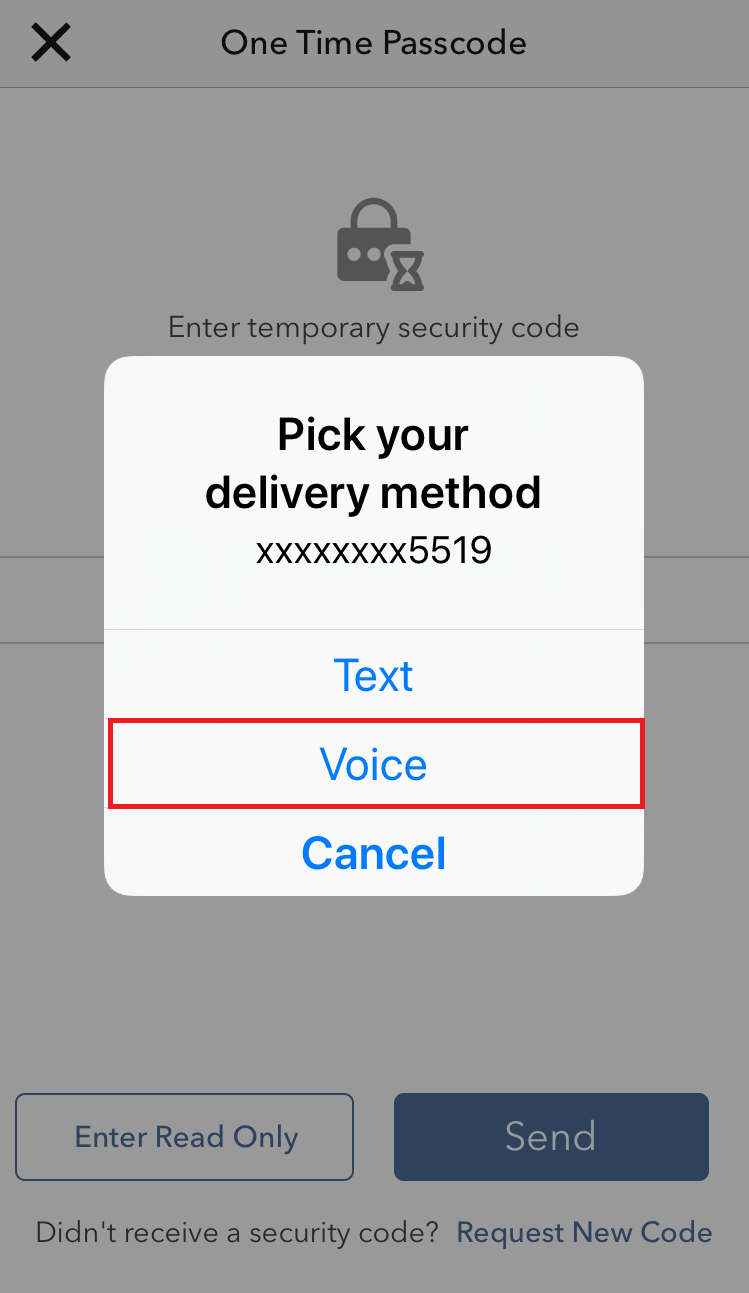

IBKR Mobile - iOS

1. Click on "Request New Code"

2. From the two options, select "Voice" and wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

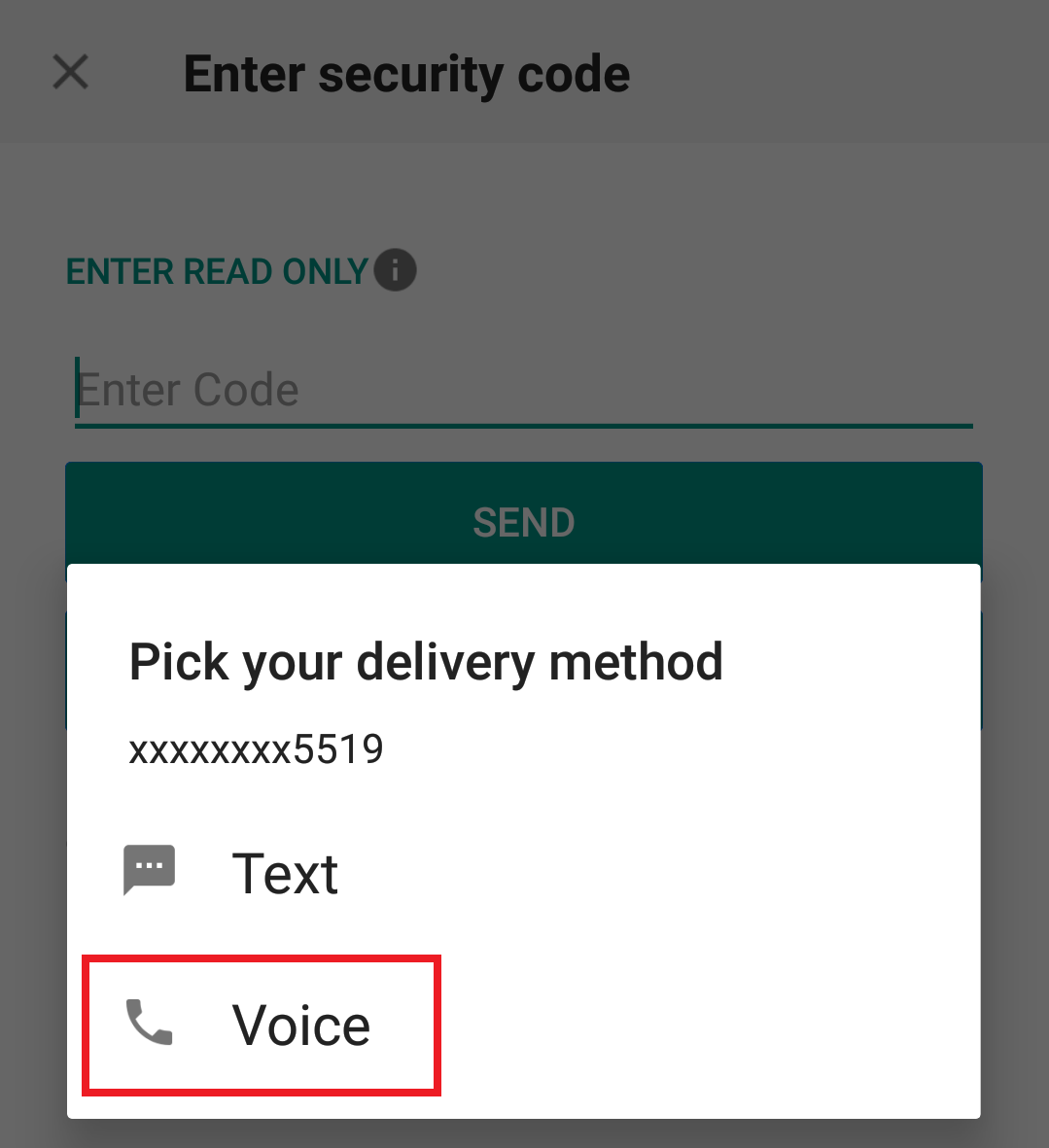

IBKR Mobile - Android

1. Click on "Request New Security Code"

2. From the two options, select "Voice" and wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

References:

- How to login using SMS authentication

- Overview of Secure Login System

- Information and procedures related to Security Devices

- IBKR Mobile Authentication

Converting From an Individual to Limited Liability Company Account

The process of converting from an individual account to a Limited Liability Company (LLC) account is outlined below:

1. As the LLC account structure differs from that of the individual in terms of account holder information required, legal agreements and, in certain cases, taxpayer status, direct conversion is not supported and a new LLC account application must be completed online.

The online LLC application may be initiated by visiting www.ibkr.com and clicking the "Open Account" button. Be sure to request trading permissions and, if necessary, margin status, sufficient to maintain the positions currently carried in your individual account. Note that if your account is managed by a financial advisor or you are a client of an introducing broker, please contact your advisor or broker to initiate the new application (you may need to make arrangements with your advisor or broker for fees that have accrued but not yet paid when the individual account closes).

2. The LLC account application requires Compliance review and approval and documentation evidencing the creation of the LLC as well as the identity and address of each member may be required. If this is the case, notice as to the required documents and how to submit will be provided at the conclusion of the online application.

3. Once you have received an email confirming approval of the LLC account application, send a request from your Message Center authorizing IB to manually transfer positions from your Individual to LLC account. Prior to submitting the request, you should make sure to close all open orders in the individual account to ensure that no executions take place following the transfer.

Due to the manual steps and scheduling required, you should allow a minimum of one week after LLC account approval and submitting your request for the transfer to take effect.

IMPORTANT NOTES

1. Note that exchange regulations preclude ownership transfer of derivative contracts such as futures and options. If you are holding such positions you would either need to close them prior to the transfer taking place or request that they remain in your individual account.

2. Prior to processing the transfer, you should make sure to close all open orders in the individual account to ensure that no executions take place following the transfer.

3. The SMA (Special Memorandum Account) balance in your individual account will not transfer to the LLC account. In certain instances, this may impact your ability to open new positions in the LLC account on the first day after the transfer is completed.

4. Elective options such as market data subscriptions and participation in IB's Yield Enhancement Program will not be carried over to the LLC account and must be re-initiated to continue. Note that LLC’s are classified as Professionals for market data subscription purposes which generally implies higher subscription rates than that for Non-Professionals.

5. The cost basis of transferred positions as reported in the activity statements will remain unchanged for tax purposes. The cost basis as reported in your trading platform (which is not used for tax reporting purposes) will not transfer over to the LLC account but may be manually adjusted.

6. Once the transfer has been completed and assuming all positions have been transferred your individual account will be designated for automatic closure. Note that certain balances such as dividend accruals can’t be transferred until paid, after which they will then be transferred and your individual account closed.

7. You'll receive any applicable tax forms for the reportable activity transacted in each of your individual and LLC accounts at year end. Access to Account Management for your individual account will remain after it has been closed for the purpose of reviewing and printing activity statements and tax forms.

8. IBKR does not provide tax advice or investment guidance and recommends that account holder consult with qualified professionals to determine any legal, tax or estate planning consequences associated with individual to LLC transfer requests.

I am not receiving text messages (SMS) from IBKR on my mobile phone

Once your mobile phone number has been verified in the Client Portal, you should immediately be able to receive text messages (SMS) from IBKR directly to your mobile phone. This article will provide you with basic troubleshooting steps in case you are unable to receive such messages.

1. Activate the IBKR Mobile Authentication (IB Key) as 2-Factor security device

In order to be independent of wireless/phone carrier-related issues and have a steady delivery of all IBKR messages we recommend to activate the IBKR Mobile Authentication (IB Key) on your smartphone.

The smartphone authentication with IB Key provided by our IBKR Mobile app serves as a 2-Factor security device, thereby eliminating the need to receive authentication codes via SMS when logging in to your IBKR account.

Our IBKR Mobile app is currently supported on smartphones running either Android or iOS operating system. The installation, activation, and operating instructions can be found here:

2. Restart your phone:

Power your device down completely and turn it back on. Usually this should be sufficient for text messages to start coming through.

Please note that in some cases, such as roaming outside of your carrier's coverage (when abroad) you might not receive all messages.

3. Use Voice callback

If you do not receive your login authentication code after restarting your phone, you may select 'Voice' instead. You will then receive your login authentication code via an automated callback. Further instructions on how to use Voice callback can be found in IBKB 3396.

4. Check whether your phone carrier is blocking the SMS from IBKR

Some phone carriers automatically block IBKR text messages, as they are wrongly recognized as spam or undesirable content. According to your region, those are the services you can contact to check if a SMS filter is in place for your phone number:

In the US:

- All carriers: Federal Trade Commission Registry

- T-Mobile: Message Blocking settings are available on T-Mobile web site or directly on the T-Mobile app

In India:

- All carriers: Telecom Regulatory Authority of India

In China:

- Call your phone carrier directly to check whether they are blocking IBKR messages

References:

- How to login using SMS authentication

- Overview of Secure Login System

- Information and procedures related to Security Devices

- IBKR Mobile Authentication

How do I convert my individual or joint account to a grantor trust?

The process of converting an individual or joint account to grantor trust account is outlined below:

- As the trust account structure differs from that of the joint account in terms of account holder information required, legal agreements and, in certain cases, taxpayer reporting, direct conversion is not supported and a new trust account application must be completed online and the account balances transferred therafter. The application is available on our website at: https://www.interactivebrokers.com/inv/en/main.php#open-account. Be sure to request trading permissions and, if necessary, margin status, sufficient to maintain the positions currently carried in your individual account. Note that if your account is managed by a financial advisor or you are a client of an introducing broker, please contact your advisor or broker to initiate the new application (you may need to make arrangements with your advisor or broker for fees that have accrued but not yet paid if the individual account closes). The trust account application requires Compliance review and approval and documentation including Trustee Certification Form, proof of identity and address for trustees and grantors. A list of required documents and document submission instructions will be provided at the conclusion of the online application.

- Once you have received an email confirming approval of the joint account application, send a request from your Message Center authorizing IB to manually transfer positions from your individual or joint account to the trust account. Prior to submitting the request you should make sure to close all open orders in the individual account to ensure that no executions take place following the transfer.

Due to the manual steps and scheduling required, you should allow a minimum of one week after trust account approval and submitting your request for the transfer to take effect.

IMPORTANT NOTES

- Note that exchange regulations preclude ownership transfer of derivative contracts such as futures and options. If your trust results in a change in ultimate beneficial ownership and your individual or joint account is holding such positions, you would either need to close them prior to the transfer taking place or request that they remain in your individual or joint account.

- Prior to processing the transfer, you should make sure to close all open orders in the individual or joint account to ensure that no executions take place following the transfer.

- The SMA (Special Memorandum Account) balance in your individual or joint account will not transfer to the trust account. In certain cases this may impact your ability to open new positions in the trust account on the first day after the transfer is completed.

- Elective options such as market data subscriptions and participation in IB's Yield Enhancement Program will not be carried over to the trust account and must be reinitiated to continue.

- The cost basis of transferred positions as reported in the activity statements will remain unchanged for tax purposes. The cost basis as reported in your trading platform (which is not used for tax reporting purposes) will not transfer over to the trust account but may be manually adjusted.

- Once the transfer has been completed and assuming all positions have been transferred, your individual or joint account will be designated for automatic closure. Note that certain balances such as dividend accruals can’t be transferred until paid, after which they will then be transferred and your individual or joint account closed.

- You'll receive any applicable tax forms for the reportable activity transacted in each of your individual or joint and trust accounts at year end. Access to Account Management for you individual or joint account will remain after it has been closed for the purpose of reviewing and printing activity statements and tax forms.

- IBKR does not provide tax advice or investment guidance and recommends that account holders consult with qualified professionals to determine any legal, tax or estate planning consequences associated with account transfer requests.