如何用手机向IBKR发送文件

即使您一时无法扫描文件,盈透证券也支持您给我们发送文件副本。您可以用手机将所需文件拍下来。

下方介绍了在不同手机操作系统下如何拍照并将照片通过电子邮件发送给盈透证券的详细步骤:

如果您已经知道如何拍照并通过电子邮件发送图片,请点击此处——电子邮件应该发送到哪里以及邮件主题应该写什么。

iOS

1. 从手机屏幕的底部向上滑,然后点击相机图标。

如果没找到相机图标,您可以从iPhone主屏幕点击相机应用程序图标。

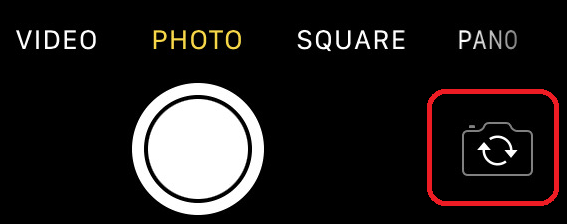

通常情况下打开的应该是后置摄像头。如果打开的是前置摄像头,请点击摄像头切换按钮。

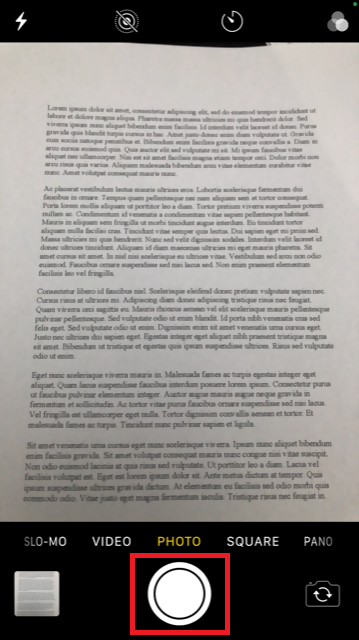

2. 将手机移到文件上方,镜头对准需要的位置或页面。

3. 确保光线均匀、充足,避免因为拿手机的姿势在文件上投下任何阴影。手机拿稳,防止抖动。点击拍照按钮拍照。

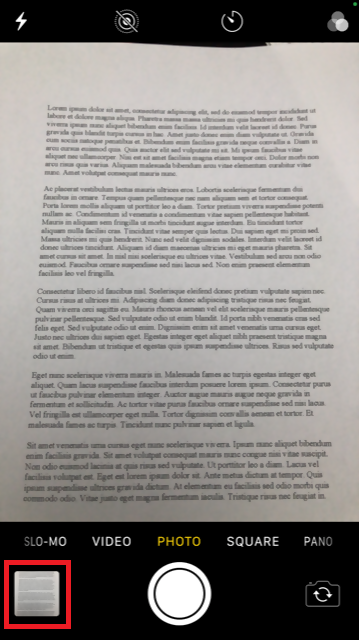

4. 点击左下角的缩略图查看您刚刚拍的照片。

5. 确保照片清晰,文件字迹清楚。您可以用两个手指在图片上划开来放大图片查看细节。

如果图片质量或亮度不好,请重复上述步骤重新拍照。

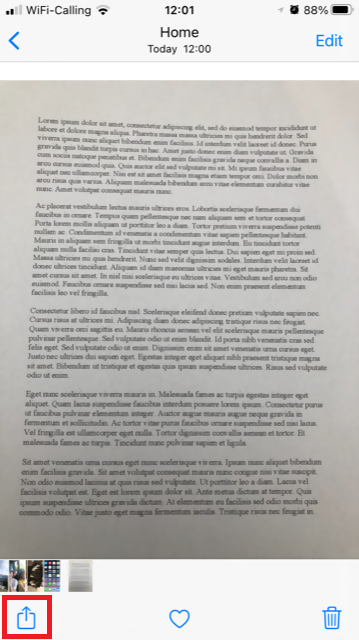

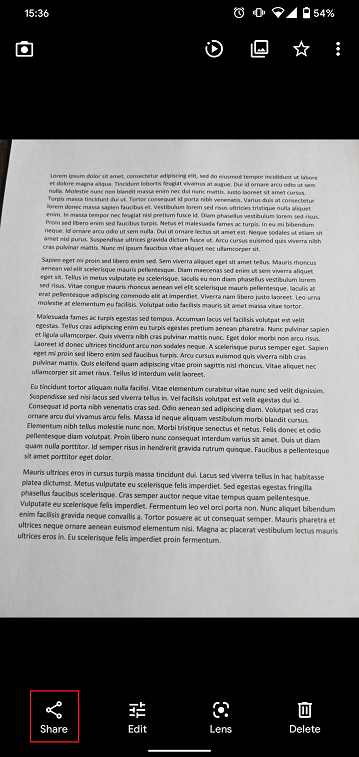

6. 点击屏幕左下角的分享图标。

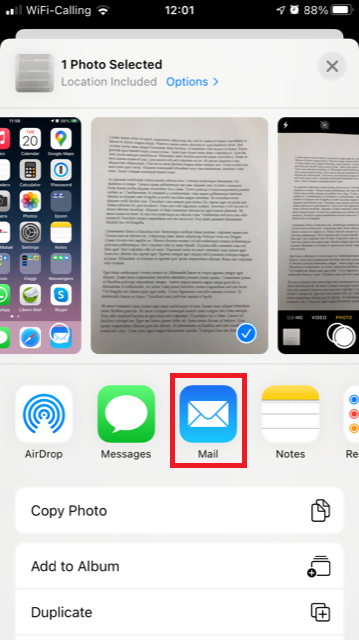

7. 点击电子邮件图标。

注意:要发送电子邮件,您的手机必须有相应配置。如果不知道如何配置,请联系您的电子邮件供应商。

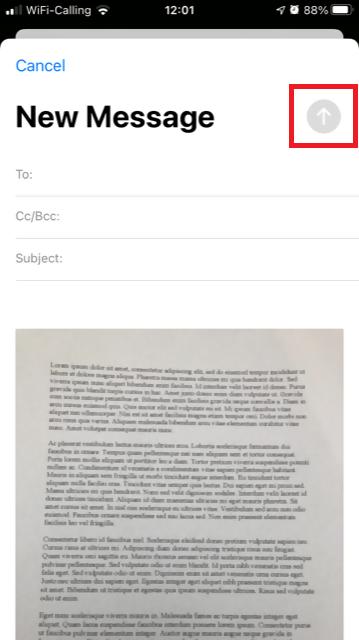

8. 请参见此处了解如何填写电子邮件收件人(To:)和主题(Subject:)。填写完毕后,点击右上方的向上箭头发送邮件。

安卓

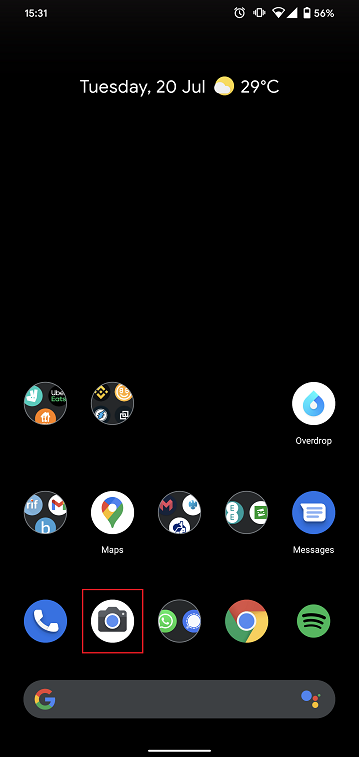

1. 打开应用程序列表,启动相机应用程序。或者直接从手机主屏幕启动相机。取决于您的手机型号、制造商或设置,相机应用程序的叫法可能有所不同。

通常情况下打开的应该是后置摄像头。如果打开的是前置摄像头,请点击摄像头切换按钮。

2. 将手机移到文件上方,镜头对准需要的位置或页面。

3. 确保光线均匀、充足,避免因为拿手机的姿势在文件上投下任何阴影。手机拿稳,防止抖动。点击拍照按钮拍照。

4. 确保照片清晰,文件字迹清楚。您可以用两个手指在图片上划开来放大图片查看细节。

如果图片质量或亮度不好,请重复上述步骤重新拍照。

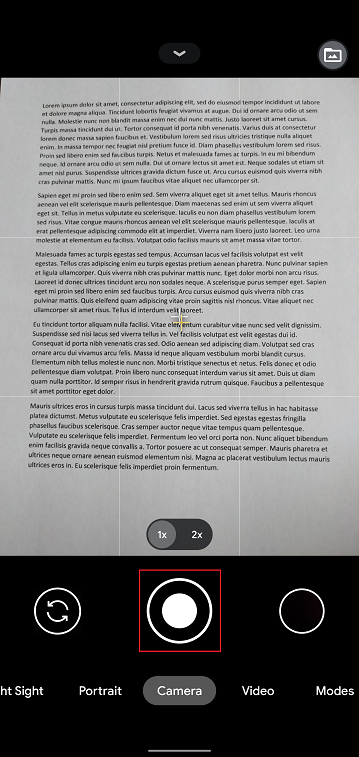

5. 点击屏幕右下角的空白圈圈图标。

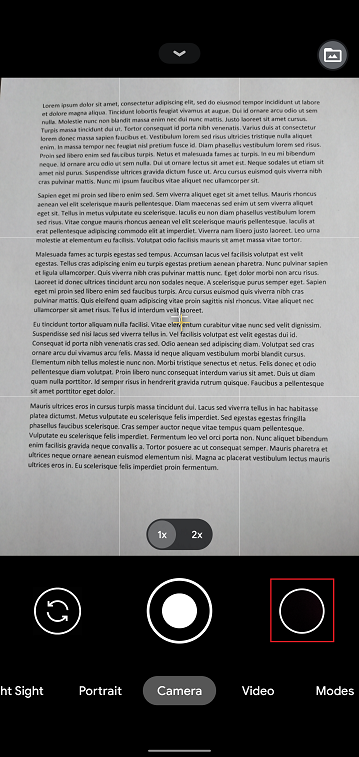

6. 点击屏幕左下角的分享图标。

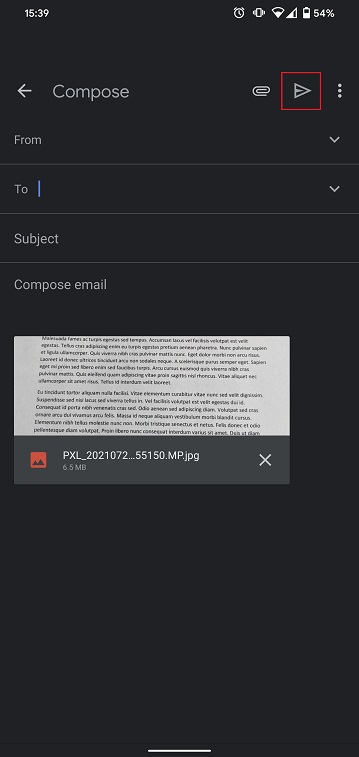

7. 在显示的分享菜单中点击手机上安装好的电子邮件客户端的图标。下图显示的是Gmail,但手机设置不同,电子邮件程序也会不同。

.png)

注意:要发送电子邮件,您的手机必须有相应配置。如果不知道如何配置,请联系您的电子邮件供应商。

8. 请参见此处了解如何填写电子邮件收件人(To:)和主题(Subject:)。填写完毕后,点击右上方的飞机图标发送邮件。

电子邮件应该发送到哪里以及邮件主题应该写什么

应按照以下说明发送邮件:

1. 在收件人(To:)字段,输入:

- newaccounts@interactivebrokers.com(如果您是非欧洲国家居民)

- newaccounts.uk@interactivebrokers.co.uk(如果您是欧洲国家居民)

2. 主题(Subject:)字段必须注明所有以下信息:

- 您的账户号码(通常格式为Uxxxxxxx,其中x是数字)或您的用户名

- 发送文件的目的。请采用以下惯例:

- 居住地证明请写PoRes

- 身份证明请写PID

手机收不到IBKR的短信(SMS)

在客户端中验证了手机号之后,您应该马上就能收到IBKR向您手机发送的短信(SMS)。本文阐述了在无法收到短信的情况下您可以采取的解决方法。

1. 激活移动IBKR验证(IB Key)作为双因素验证设备

为免受无线/手机运营商相关问题影响、稳定接收所有IBKR消息,我们建议您在手机上激活移动IBKR验证(IB Key)。

我们的手机验证以移动IBKR程序自带的IB Key作为双因素安全设备,因此在登录IBKR账户时无需通过SMS获取验证码。

移动IBKR程序目前支持在Android和iOS手机上使用。下方为安装、激活和操作说明:

2. 重启手机:

关机然后再重新开机。通常这样就能收到短信。

请注意,某些情况下,如漫游出运营商服务的范围时(在国外),您可能无法收到所有消息。

3. 使用语音回呼

如果重启手机后还是没能收到登录验证码,请可以选择“语音”。然后您会接到自动的语音回呼,告知您登录验证码。有关如何使用语音回呼的详细说明,请参见IBKB 3396。

4. 检查看是否您的手机运营商阻断了来自IBKR的SMS

某些手机运营商误将IBKR的短信识别为垃圾短信或不良内容,会自动对其进行阻断。您可以联系相应地区的相应部门检查您的手机号码是否有短信过滤:

美国:

- 所有运营商:Federal Trade Commission Registry

- T-Mobile:消息阻断设置请参见T-Mobile网站或直接在T-Mobile应用程序中查看

印度:

中国:

- 直接致电运营商询问其是否在阻断IBKR的消息

参考文章:

如何配置客户服务消息传递和通知方式

Changes to the Interactive Brokers Canada Inc. Client Agreement

Overview:

To address changes in our business, technology, services, markets, and other factors, Interactive Brokers Canada Inc. has revised the terms of our standard client agreement (Form 3206) ("Amended IB CAN Client Agreement").

For IB CAN accounts opened prior to June 9, 2021, the Amended IB CAN Agreement will be effective as of June 25, 2021. Continuing to maintain an IBKR account after June 25, 2021 shall constitute acceptance of the Amended IB CAN Client Agreement.*

The full text of the Amended IB CAN Client Agreement can be reviewed here:

https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

Sections or subsections (indicated in parentheses) of the Amended IB CAN Client Agreement that are new include, but are not limited to:

• Notice Requirements and Amendment of Terms (3)

• Special Risks of Algorithmic Orders (5 B)

• Payment for Orders and Rebates (6)

• Order Execution (8 C on pre-trade filters)

• Designation of Trusted Contact Person (12)

• U.S. Residents (14)

• Margin (15 B iii, iv and v)

• Closing Rights Positions Prior to Expiration (17)

• Mutual Funds (18)

• Worthless and Non-Transferable Securities (19)

• Position Limits (20)

• Unclaimed Property (29)

• Commissions and Fees, Interest Charges, Funds (33 C, D and E)

• Exposure Fees (34 B)

• Risks Regarding Political and Governmental Actions (36)

• Fractional shares (37 B)

• Indemnification (41)

• Fast and Volatile Markets (43)

• Physically Deliverable Futures (Schedule A / referenced in 32) *

Sections or subsections of the Amended Client Agreement that are not entirely new but have been substantively amended include, but are not limited to:

• Client Agreement (1)

• No Advice Regarding Investment, Tax, Trading or Account Type (2)

• Responsibility for Client Orders/Trades (4)

• Order Routing (5 A)

• Order Execution (8 A and B)

• Confirmations and Reporting Errors (9)

• Proprietary Trading – Display of Customer Orders (10)

• Client Qualification (11)

• Margin (15 B i and ii)

• Liquidation of Positions and Offsetting Transactions (16 all subsections)

• Universal Accounts (22)

• Short Sales (23)

• IBKR's Right to Loan/Pledge Assets (24)

• Security Interest (25)

• Event of Default (27)

• Suspicious Activity (28)

• Multi-Currency Function in IBKR Accounts (30 all subsections)

• Commodity Options and Futures Not Settled in Cash (32 all subsections)

• Commissions and Fees, Interest Charges, Funds (33 A and B)

• Account Deficits (34 A)

• Limitation of Liability (40 A)

• Client Must Maintain Alternative Trading Arrangements (42)

• Equity Options (57)

• Futures and Futures Options (58)

*Client's indication of an intent to make or take delivery on any Covered Contract as defined in Schedule A of the Amended Client Agreement shall constitute acceptance of the Amended Client Agreement as of the date of Client's indication of such intent, even if prior to June 25, 2021.

盈透证券有限公司客户协议(表格3203)修订

为应对业务、技术、服务、市场和其它方面的变化调整,盈透证券有限公司(Interactive Brokers LLC)对标准客户协议(表格3203)的条款进行了全面修订(“修订版客户协议”)。

对于2021年4月16日之前开立的盈透证券有限公司账户,修订版客户协议将于2021年6月11日正式生效。2021年6月11日后继续持有IBKR账户即代表客户接受此修订版客户协议。*

点击以下链接查看完整的修订版客户协议: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

修订版客户协议新增加的章节或子章节(在括号中注明)包括但不限于:

- 通知要求和条款修订(3)

- 算法定单的特殊风险(5 B)

- 定单报酬和返点(6)

- 定单执行(8 C:交易前筛选)

- 执行受信任联系人(12)

- 保管账户(14)

- 保证金(15 B iii、iv和v)

- 到期前平仓权利头寸(17)

- 共同基金(18)

- 无价值和不可转让证券(19)

- 头寸限制(20)

- 无人认领财产(29)

- 佣金与费用、利息、资金(33 C、D和E)

- 风险费用(34 B)

- 政治与政府行动相关风险(36)

- 小数股(37 B)

- 赔偿(41)

- 快速多变的市场(43)

- 实物交割期货(安排A / 32)*

修订版客户协议中不是新增但有重大修改的章节或子章节包括但不限于:

- 客户协议(1)

- 不提供投资、税务、交易和账户类型建议(2)

- 客户定单/交易的责任(4)

- 定单传递(5 A)

- 定单执行(8 A和B)

- 确认和报告错误(9)

- 自营交易——客户定单显示(10)

- 客户资质(11)

- 保证金(15 B i和ii)

- 头寸平仓清算和抵消交易(16所有子章节)

- 全能账户(22)

- 卖空(23)

- IBKR借出/抵押资产的权利(24)

- 担保权益(25)

- 违约事项(27)

- 可疑活动(28)

- IBKR账户的多币种功能(30所有子章节)

- 不以现金结算的商品期权和期货(32所有子章节)

- 佣金与费用、利息、资金(33 A和B)

- 账户资金不足(34 A)

- 责任限度(40 A)

- 客户必须有备用交易安排(42)

*客户表明要就修订版客户协议安排A中所定义的持保合约发起或接受交割即代表客户自表明该等意图之日起接受此修订版客户协议,即使该日期在2021年6月11日之前。

Changes to the Interactive Brokers LLC Client Agreement (Form 3203)

To address changes in our business, technology, services, markets, and other factors, Interactive Brokers LLC has revised the terms of our standard client agreement (Form 3203) ("Amended IB LLC Client Agreement").

For IB LLC accounts opened prior to April 16, 2021, the Amended IB LLC Agreement will be effective as of June 11, 2021. Continuing to maintain an IBKR account after June 11, 2021 shall constitute acceptance of the Amended IB LLC Client Agreement.*

The full text of the Amended IB LLC Client Agreement can be reviewed here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

Sections or subsections (indicated in parentheses) of the Amended IB LLC Client Agreement that are new include, but are not limited to:

- Notice Requirements and Amendment of Terms (3)

- Special Risks of Algorithmic Orders (5 B)

- Payment for Orders and Rebates (6)

- Order Execution (8 C on pre-trade filters)

- Designation of Trusted Contact Person (12)

- Custodial Accounts (14)

- Margin (15 B iii, iv and v)

- Closing Rights Positions Prior to Expiration (17)

- Mutual Funds (18)

- Worthless and Non-Transferable Securities (19)

- Position Limits (20)

- Unclaimed Property (29)

- Commissions and Fees, Interest Charges, Funds (33 C, D and E)

- Exposure Fees (34 B)

- Risks Regarding Political and Governmental Actions (36)

- Fractional shares (37 B)

- Indemnification (41)

- Fast and Volatile Markets (43)

- Physically Deliverable Futures (Schedule A / referenced in 32)*

Sections or subsections of the Amended Client Agreement that are not entirely new but have been substantively amended include, but are not limited to:

- Client Agreement (1)

- No Advice Regarding Investment, Tax, Trading or Account Type (2)

- Responsibility for Client Orders/Trades (4)

- Order Routing (5 A)

- Order Execution (8 A and B)

- Confirmations and Reporting Errors (9)

- Proprietary Trading – Display of Customer Orders (10)

- Client Qualification (11)

- Margin (15 B i and ii)

- Liquidation of Positions and Offsetting Transactions (16 all subsections)

- Universal Accounts (22)

- Short Sales (23)

- IBKR’s Right to Loan/Pledge Assets (24)

- Security Interest (25)

- Event of Default (27)

- Suspicious Activity (28)

- Multi-Currency Function in IBKR Accounts (30 all subsections)

- Commodity Options and Futures Not Settled in Cash (32 all subsections)

- Commissions and Fees, Interest Charges, Funds (33 A and B)

- Account Deficits (34 A)

- Limitation of Liability (40 A)

- Client Must Maintain Alternative Trading Arrangements (42)

*Client’s indication of an intent to make or take delivery on any Covered Contract as defined in Schedule A of the Amended Client Agreement shall constitute acceptance of the Amended Client Agreement as of the date of Client's indication of such intent, even if prior to June 11, 2021.

IBKR Notes FAQs

What are IBKR Notes?

IBKR notes are short term debt securities issued periodically by IBG LLC. Interactive Brokers LLC (IB), a broker-dealer affiliate of IBG LLC is the sole placement agent for the Notes. The U.S. dollar denominated Notes are issued at face value in $1,000 increments and the minimum subscription is $10,000. The Notes mature no later than the 30th day following issuance but may be redeemed sooner. The Notes pay a fixed rate of interest, which is set by adding a spread to the effective Federal Funds rate as reported by the New York Federal Reserve Bank on the morning of the date the Notes are sold to the purchaser. The minimum Rate is 0.50% per annum, and all interest is due and payable upon the earlier of the date of redemption or maturity of the Notes.

Who is eligible to invest in IBKR Notes?

Clients who are Accredited Investors are eligible to subscribe to IBKR Notes. If you are interested in further information about this private placement, you may confirm your Accredited Investor status and access the restricted IBKR Notes Program section of the Client Portal, which contains the confidential Offering Memorandum, Subscription Agreement and other information about the IBKR Notes Program.

Only US persons will be able to participate at this time.

Additional Information

Where can I sign up for IBKR Notes?

Qualified clients can use the button above or follow the below procedure to request to participate in the IBKR Notes program:

- Log in to Client Portal

- Select Settings followed by Account Settings

- In the Configuration section, next to Invest in IBKR Notes, you can see your account’s enrollment status in the program.

- If you are not enrolled, you can sign up by clicking the Configure (gear) icon next to Invest in IBKR Notes.

- You must read the agreement, sign your name, and click Submit to enroll.

How are the rates determined for IBKR Notes?

The issuer sets the interest rate for each Notes issuance at its discretion. The minimum interest rate for a Notes issuance is 0.50%. When there is a new Notes issuance, IBG LLC announces a Spread rate at least two days in advance. The Interest Rate on the Note is the Spread Rate plus the Benchmark Rate, which is the Federal Funds Rate on the morning of the new issuance.

Can I choose which IBKR Notes to invest in?

Yes. So long as you are enrolled in the IBKR Notes Program and have indicated via the Client Portal your intention to participate in future Notes Program issuances, you have a standing order to automatically purchase Notes from the Issuer, if and when offered by the Issuer, with free credit balances in your IBKR account (the “Free Cash Balance” is generally defined as cash in your IBKR account in excess of margin requirements and short stock value). IBKR provides controls to allow you to place parameters on your standing order, including, a maximum amount of Notes to purchase (in dollars) and a minimum Free Cash Balance to leave in your account after purchasing the Notes.

What are the minimum and maximum investment sizes for IBKR Notes?

Investors must purchase a minimum of $10,000 in aggregate principal amount of Notes and may not purchase more than $25,000,000 in aggregate principal amount. Notes are issued only in book-entry form, in denominations of $1,000 and integral multiples of $1,000.

Can IBKR Notes be redeemed early?

The Notes are redeemable prior to maturity only at the option of the Issuer. If the Issuer redeems the Notes prior to maturity, you will receive a notice of redemption. The principal and accrued and unpaid interest to and excluding the date of redemption will be credited to your IBKR account. Notes holders do not have the option to redeem their Notes holdings early.

Can I change my investment preferences in IBKR Notes?

Yes, you may change your Maximum Investment Amount and Minimum Uninvested Cash amount at any time by notifying us through Client Portal. You may also temporarily or permanently suspend your participation by setting the “Invest in All Upcoming Notes” preference to Off.

If you suspend your participation in the Notes Program, IBKR will not sell you Notes during any future issuances, but you will continue to hold existing Notes in your account until the earlier of their maturity or redemption. You may re-activate your participation in the Notes Program though the Client Portal at any time by setting the “Invest in All Upcoming Notes” preference to On.

Can I terminate my participation in the IBKR Notes program?

You may terminate your participation in the IBKR Notes Program at any time by notifying us through the Client Portal. IBKR may also terminate your participation in the Notes Program at any time and for any reason, including if you no longer meet the eligibility requirements or if you do not reaffirm that you meet such requirements upon our request. If your participation in the program is terminated, IBKR will not sell you Notes in any future issuance, but you will continue to hold existing Notes in your account until the earlier of their maturity or redemption. In addition, you will not be permitted to re-activate your participation in the Notes program without re-enrollment.

How are IBKR Notes reported on my Activity Statement?

IBKR Notes will be reported like a Bond on your Activity Statement. You will see Bond activity in various sections of your statement including the Performance Summary, Open Positions, Trades, and Financial Instrument Information sections. During the holding period, accrued interest is not reflected on the statement. Interest payments will be reflected upon redemption or maturity.

What happens if an IBKR Notes offering is oversubscribed?

In the event that an IBKR Notes offering is oversubscribed, IBKR will allocate notes to potential investors at its sole discretion. There is no guarantee that any potential investor, including you, will be allocated Notes.

Will the returns for IBKR Notes be included in Portfolio Analyst?

Yes, returns for IBKR Notes will be included in your Portfolio Analyst reports.

Are Notes Transferable?

No. Notes cannot be transferred between accounts at IBKR or to an external account. Notes must remain in the account they were initially allocated to until they mature (unless redeemed early by IBKR).

What happens if I close my account before my IBKR Note matures?

Clients must hold the Notes until they mature (unless redeemed early by IBKR). If you would like to close your account while you hold Notes, you may submit a close account request and request a transfer of your assets. However, Notes are non-transferrable, and the account will remain open until the Notes have matured and all assets have been transferred out of your account. During this period, account fees and charges may continue to apply. Please contact Customer Service should your account closure request be pending due to an existing Notes position before processing.

Can an advisor invest in IBKR Notes on behalf of their clients?

Yes. Advisors with trading discretion over their client accounts can invest in IBKR Notes on behalf of eligible clients through the IBKR CRM.

Are IBKR Notes included in the Net Liquidation Value calculation for fee-based advisor clients?

Yes. The value of the IBKR Notes in an IBKR account will be included in the calculation of Net Liquidation Value (NLV) fees. Interest will also be included in the calculation.

If I place a trade that uses the minimum required spare cash to invest in IBKR Notes, will my notes be liquidated?

The minimum spare cash requirement to invest in IBKR Notes is checked only when placing the initial Notes investment. It is not required to be maintained while the Note is outstanding.

Are IBKR Notes included in my Equity with Loan Value?

Yes, IBKR Notes are included in calculating your Equity with Loan Value.

If my account is in a margin deficit, will IBKR liquidate IBKR Notes?

If your account is in a margin deficit, IBKR will not liquidate your investment in IBKR Notes.

Additional Information

Where can I find the IBKR Notes Offering Memorandum?

The IBKR Notes Offering Memorandum is available at the time of enrollment as well as within the IBKR Notes page in the Client Portal. You may access this page by selecting Settings followed by Account Settings and Invest in IBKR Notes within the configuration section, and clicking the download Offering Memorandum link.

Are IBKR Notes marginable?

No. IBKR Notes are non-marginable and are ineligible for use as margin collateral. Additionally, the Initial Purchase will be capped to the USD cash balance in an account. An investment in IBKR Notes is not allowed if the purchase causes a USD debit balance.

Does the interest rate on an IBKR Note vary by amount invested?

No. All holders of a specific Note receive the same interest rate regardless of their individual investment amount.

How liquid are IBKR Notes?

The Notes are illiquid. No public market exists for the Notes. They are non-transferable and cannot be traded.

Are IBKR Notes “cash equivalents”?

No. IBKR Notes are illiquid short term debt investments. Cash equivalents generally are highly liquid instruments which are readily convertible into known amounts of cash.

How often are IBKR Notes issued?

Notes are issued at the discretion of the issuer.

What is the notice period for new IBKR Notes issuances?

There is a two-day notice period prior to newly issued Notes being allocated to your account. For example, if a new issuance notification is sent on Monday, the Note will post to your account on Wednesday evening. Interest begins accruing on settlement date (T+1), which would be Thursday.

How is interest calculated for IBKR Notes?

IBKR conforms to international standards for day-counting when calculating the interest paid on IBKR Notes.

IBKR utilizes the 30/360-day count convention, which means that interest income is determined based on a 360-day year. The actual number of calendar days each Note will be outstanding for is 30. But the number of days which accrue interest may be greater or lesser than 30 based on the specific time period Notes are issued, redeemed or mature.

Are Notes insured by SIPC, FDIC or any other entity?

No, the Notes are not insured by SIPC, FDIC or any other entity.

Any information provided about the IBKR Notes Program by Interactive Brokers LLC should not be construed as a solicitation or recommendation of any investment product. Each investor should review and determine independently whether or not IBKR Notes is suitable for them to invest in. In addition, all investors interested in IBKR Notes should review the details and associated risks found within the offering memorandum, accessible through the Client Portal.

中国证券相关交易禁令

美国宣布自2021年2月1日、3月9日和3月15日起分批对更多中国证券实施交易禁令。本轮交易禁令是对2021年1月11日实施的交易禁令的扩展。此外,美国近期宣布延迟实施针对某些中国证券的交易禁令,生效时间从2021年1月28日推迟至2021年5月27日。

该等交易禁令禁止“美国人士”购买具有中国军方背景的公开交易证券(“CCMC证券”),包括期权和其它衍生品。由于您至少持有一种被美国政府列为制裁对象的证券(自2021年3月9日生效),特此向您发送本通知。

禁令涉及哪些人?

目前,禁令只针对“美国人士”。美国人士包括“任意美国公民、永久居留的外国人、根据美国法律或美国境内任意司法辖域的法律设立的实体(包括外国分支机构),或任意在美人士。”对IBKR客户而言,美国人士的定义包括美国居民、美国公民、在美国成立或由美国人拥有的实体。

属于“美国人士”的IBKR客户会面临哪些限制?

自禁令生效日——2月1日、3月9日或3月15日起美国人士不得购买任意被制裁的证券,除非该等购买是为了平仓已有的空头头寸。在挂牌交易所开放交易且清算所提供交易清算的前提下,客户可在禁令生效后10个月内(即截至12月1日、1月9日或1月15日)平仓此类证券的头寸。但自禁令生效起将不再接受任何受制裁证券开仓定单和头寸转入。

该禁令覆盖哪些证券类型?

该禁令覆盖所有证券类型,包括股票、债券、权证、期权及ADR等其它类型的衍生品。它也包括包含CCMC证券的ETF、指数基金或共同基金。

该禁令具体涉及哪些证券?

如上方提到的,第一批CCMC证券禁令已于2021年1月11日实施生效。以下是我们列出的CCMC证券清单以及各证券将被限制交易的日期。

CCMC证券

|

公司名称

|

生效日期

|

|

Advanced Micro-Fabrication Equipment Inc. (AMEC)

|

3/15/2021

|

|

Aero Engine Corporation of China

|

1/11/2021

|

|

AECC Aviation Power

|

5/27/2021

|

|

Aviation Industry Corporation of China (AVIC)

|

1/11/2021

|

|

Beijing Zhongguancun Development Investment Center

|

3/15/2021

|

|

China Academy of Launch Vehicle Technology (CALT)

|

1/11/2021

|

|

China Aerospace Science and Industry Corporation (CASIC)

|

1/11/2021

|

|

China Aerospace Science and Technology Corporation (CASC)

|

1/11/2021

|

|

China Communications Construction Company (CCCC)

|

1/11/2021

|

|

China Construction Technology Co. Ltd. (CCTC)

|

2/1/2021

|

|

China Electronics Corporation (CEC)

|

1/11/2021

|

|

China Electronics Technology Group Corporation (CETC)

|

1/11/2021

|

|

China General Nuclear Power Corp.

|

1/11/2021

|

|

CGN Power Co. Ltd.

|

5/27/2021

|

|

China International Engineering Consulting Corp. (CIECC)

|

2/1/2021

|

|

China Mobile Communications Group

|

1/11/2021

|

|

China Mobile LTD.

|

3/9/2021

|

|

China National Aviation holding Co. Ltd. (CNAH)

|

3/15/2021

|

|

China National Chemical Corporation (ChemChina)

|

1/11/2021

|

|

China National Chemical Engineering Co. Ltd.

|

5/27/2021

|

|

China National Chemical Engineering Group Co., Ltd. (CNCEC)

|

1/11/2021

|

|

China National Nuclear Corp.

|

1/11/2021

|

|

China National Nuclear Power Co. Ltd.

|

5/27/2021

|

|

China National Offshore Oil Corp. (CNOOC)

|

2/1/2021

|

|

CNOOC Limited

|

3/9/2021

|

|

China North Industries Group Corporation (Norinco Group)

|

1/11/2021

|

|

China North Industries Corp.

|

5/27/2021

|

|

Norinco International Corporation Ltd.

|

5/27/2021

|

|

China Nuclear Engineering & Construction Corporation (CNECC)

|

1/11/2021

|

|

China Railway Construction Corporation (CRCC)

|

1/11/2021

|

|

China Shipbuilding Industry Corporation (CSIC)

|

1/11/2021

|

|

China Shipbuilding Industry Group Power Co. Ltd.

|

5/27/2021

|

|

China South Industries Group Corporation (CSGC)

|

1/11/2021

|

|

China Spacesat

|

1/11/2021

|

|

China State Construction Group Co., Ltd.

|

1/11/2021

|

|

China State Construction Engineering Corp. Ltd.

|

5/27/2021

|

|

China State Shipbuilding Corporation (CSSC)

|

1/11/2021

|

|

China Telecommunications Corp.

|

1/11/2021

|

|

China Telecom Corp. Ltd.

|

3/9/2021

|

|

China Three Gorges Corporation Limited

|

1/11/2021

|

|

China United Network Communications Group Co. Ltd.

|

1/11/2021

|

|

China United Network Communications Corp. Ltd.

|

5/27/2021

|

|

China UNICOM Hong Kong Ltd.

|

3/9/2021

|

|

Commercial Aircraft Corporation of China, Ltd. (COMAC)

|

3/15/2021

|

|

CRRC Corp.

|

1/11/2021

|

|

Dawning Information Industry Co (Sugon)

|

1/11/2021

|

|

Global Tone Communication Technology Co. Ltd. (GTCOM)

|

3/15/2021

|

|

GOWIN Semiconductor Corp.

|

3/15/2021

|

|

Grand China Air Co. Ltd. (GCAC)

|

3/15/2021

|

|

Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision)

|

1/11/2021

|

|

Huawei

|

1/11/2021

|

|

Inspur Group

|

1/11/2021

|

|

Inspur International Ltd.

|

5/27/2021

|

|

Luokong Technology Corporation (LKCO)

|

3/15/2021

|

|

Offshore Oil Engineering Co. Ltd

|

5/27/2021

|

|

Panda Electronics Group

|

1/11/2021

|

|

Semiconductor Manufacturing International Corp. (SMIC)

|

2/1/2021

|

|

Sinochem Corp.

|

5/27/2021

|

|

Sinochem Group Co. Ltd.

|

1/11/2021

|

|

Sinochem International Corp.

|

5/27/2021

|

|

Xiaomi Corporation

|

3/15/2021

|

如果美国政府发布新的指引,我们会向您提供最新的消息。点此可查看与本次制裁相关的美国行政令。目前可获得的指引请见此处。

Sanctions Related to Certain Chinese Securities

The U.S. announced additional sanctions related to certain Chinese securities scheduled to go into effect on February 1, March 9, and March 15, 2021. These are an extension of the sanctions regarding other Chinese companies that went into effect on January 11. The U.S. has also recently announced that the application of sanctions against certain Chinese securities will be delayed from January 28 to May 27, 2021.

These sanctions prohibit U.S. persons from purchasing publicly traded securities, including options and other derivatives, of certain companies affiliated with the military of the People's Republic of China. We sent you this notice because you hold a position in at least one of the securities the U.S. has stated will be subject to the sanctions effective March 9, 2021.

Who will the sanctions apply to?

Currently, the sanctions only apply to "U.S. persons." A U.S. person includes, "any United States citizen, permanent resident alien, entity organized under the laws of the United States or any jurisdiction within the United States (including foreign branches), or any person in the United States." The definition of U.S. Persons includes IBKR clients who are resident in, citizens of or incorporated in the U.S, or owned by U.S. persons.

What restrictions will the sanctions place on IBKR Customers who are U.S. Persons?

U.S. Persons may not buy any of the sanctioned securities after the effective date of the sanctions-February 1, March 9, or March 15 as listed below-unless the purchase is to close an existing short position. They may close existing positions in these securities up until June 2, 2022 assuming the listing exchanges offer trading and the clearinghouse will settle the trades. In recognition of these actions, opening orders and inbound transfers of sanctioned securities will not be accepted, effective immediately.

What types of securities do the sanctions cover?

The sanctions cover all securities, including stocks, bonds, warrants, options and other derivatives such as ADRs. The sanctions also cover ETFs, index funds and mutual funds that include the CCMC securities.

What individual securities are subject to the sanctions?

As we noted above, sanctions on the first wave of CCMC securities went into effect on January 11, 2021. We have listed below all of the CCMC issuers whose securities are subject to sanctions and the effective date of those sanctions.

CCMC Securities

|

Name of Company

|

Effective Date

|

|

Advanced Micro-Fabrication Equipment Inc. (AMEC)

|

3/15/2021

|

|

Aero Engine Corporation of China

|

1/11/2021

|

|

AECC Aviation Power

|

5/27/2021

|

|

Aviation Industry Corporation of China (AVIC)

|

1/11/2021

|

|

Beijing Zhongguancun Development Investment Center

|

3/15/2021

|

|

China Academy of Launch Vehicle Technology (CALT)

|

1/11/2021

|

|

China Aerospace Science and Industry Corporation (CASIC)

|

1/11/2021

|

|

China Aerospace Science and Technology Corporation (CASC)

|

1/11/2021

|

|

China Communications Construction Company (CCCC)

|

1/11/2021

|

|

China Construction Technology Co. Ltd. (CCTC)

|

2/1/2021

|

|

China Electronics Corporation (CEC)

|

1/11/2021

|

|

China Electronics Technology Group Corporation (CETC)

|

1/11/2021

|

|

China General Nuclear Power Corp.

|

1/11/2021

|

|

CGN Power Co. Ltd.

|

5/27/2021

|

|

China International Engineering Consulting Corp. (CIECC)

|

2/1/2021

|

|

China Mobile Communications Group

|

1/11/2021

|

|

China Mobile LTD.

|

3/9/2021

|

|

China National Aviation holding Co. Ltd. (CNAH)

|

3/15/2021

|

|

China National Chemical Corporation (ChemChina)

|

1/11/2021

|

|

China National Chemical Engineering Co. Ltd.

|

5/27/2021

|

|

China National Chemical Engineering Group Co., Ltd. (CNCEC)

|

1/11/2021

|

|

China National Nuclear Corp.

|

1/11/2021

|

|

China National Nuclear Power Co. Ltd.

|

5/27/2021

|

|

China National Offshore Oil Corp. (CNOOC)

|

2/1/2021

|

|

CNOOC Limited

|

3/9/2021

|

|

China North Industries Group Corporation (Norinco Group)

|

1/11/2021

|

|

China North Industries Corp.

|

5/27/2021

|

|

Norinco International Corporation Ltd.

|

5/27/2021

|

|

China Nuclear Engineering & Construction Corporation (CNECC)

|

1/11/2021

|

|

China Railway Construction Corporation (CRCC)

|

1/11/2021

|

|

China Shipbuilding Industry Corporation (CSIC)

|

1/11/2021

|

|

China Shipbuilding Industry Group Power Co. Ltd.

|

5/27/2021

|

|

China South Industries Group Corporation (CSGC)

|

1/11/2021

|

|

China Spacesat

|

1/11/2021

|

|

China State Construction Group Co., Ltd.

|

1/11/2021

|

|

China State Construction Engineering Corp. Ltd.

|

5/27/2021

|

|

China State Shipbuilding Corporation (CSSC)

|

1/11/2021

|

|

China Telecommunications Corp.

|

1/11/2021

|

|

China Telecom Corp. Ltd.

|

3/9/2021

|

|

China Three Gorges Corporation Limited

|

1/11/2021

|

|

China United Network Communications Group Co. Ltd.

|

1/11/2021

|

|

China United Network Communications Corp. Ltd.

|

5/27/2021

|

|

China UNICOM Hong Kong Ltd.

|

3/9/2021

|

|

Commercial Aircraft Corporation of China, Ltd. (COMAC)

|

3/15/2021

|

|

CRRC Corp.

|

1/11/2021

|

|

Dawning Information Industry Co (Sugon)

|

1/11/2021

|

|

Global Tone Communication Technology Co. Ltd. (GTCOM)

|

3/15/2021

|

|

GOWIN Semiconductor Corp.

|

3/15/2021

|

|

Grand China Air Co. Ltd. (GCAC)

|

3/15/2021

|

|

Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision)

|

1/11/2021

|

|

Huawei

|

1/11/2021

|

|

Inspur Group

|

1/11/2021

|

|

Inspur International Ltd.

|

5/27/2021

|

|

Luokong Technology Corporation (LKCO)

|

3/15/2021

|

|

Offshore Oil Engineering Co. Ltd

|

5/27/2021

|

|

Panda Electronics Group

|

1/11/2021

|

|

Semiconductor Manufacturing International Corp. (SMIC)

|

2/1/2021

|

|

Sinochem Corp.

|

5/27/2021

|

|

Sinochem Group Co. Ltd.

|

1/11/2021

|

|

Sinochem International Corp.

|

5/27/2021

|

|

Xiaomi Corporation

|

3/15/2021

|

We will provide you with an update if the U.S. government issues additional guidance. For reference, the U.S. Executive Order announcing the sanctions is available here and guidance provided to date is available here.

客户端登录失败故障排除

- 收到“无效的用户名密码组合”信息

- 输入安全设备值时收到“登录失败”信息

- 我忘记了用户名及/或密码

- 安全设备暂时不在我身边

- 我的安全设备遗失或损坏了

- 我获得的临时密码已过期

- 我获得的在线安全卡已过期

- 我还在等待实体安全设备配送,但现在无法登录账户

- 我可以使用临时密码登录客户端,但无法登录交易平台

- 我已拿到了安全设备,想要激活

- 输入我的用户名后收到了“坏字符”信息

重要提示:如您无法通过以上信息解决账户登录的问题,请联系您当地的客户服务中心。需注意的是,出于安全考虑,所有协助登录的请求必须通过电话发起,因为协助登录账户要求事先验证账户持有人的身份。您可通过以下链接了解客服中心列表、电话号码及服务时间:ibkr.com/support

请确保未使用“大写锁定”键,因为用户名需区分大小写且须以小写格式输入。

重要安全提示:如果账户在24小时内连续10次登录客户端失败,账户将被锁定,不论之后是否使用了正确的用户名和密码组合尝试登录。锁定账户是为了防止黑客随机尝试以猜测密码的一种安全措施,在最后一次尝试登录失败后的24小时账户都将处于锁定状态。

如果您觉得您的账户由于连续登录失败已被锁定或即将被锁定,则您需通过电话联系您所在区域的客服中心获取帮助。请注意,有关账户登录方面的问题必须通过电话联系客服,待账户持有人的身份验证通过后方能向您提供协助。

a. 如您使用的是临时密码,请注意字母区分大小写且必须以大写格式输入

b. 如您使用的是安全卡或电子密码设备,请注意字符之间无空格

出于安全考虑,所有与用户名及/或密码相关的请求必须通过电话发起,且须事先验证账户持有人的身份。应向所在区域的客服中心发起请求。

4. 安全设备暂时不在我身边

如您的安全设备暂时不在身边,您可通过电话联系您所在地区的客服中心,在验证您的身份后,我们会向您提供一个临时密码,供您临时访问账户。

临时密码是一个静态的包含字母与数字的代码,能代替通过您的安全设备随机生成的代码,可供您在2天内完整登录客户端或交易平台。如您需更长时间的临时访问权限,以及提高账户的安全保障,我们建议您使用临时密码登录客户端,然后将在线安全卡打印出来——在线安全卡最长可在3周内代替您的安全设备。

如果临时密码或在线安全卡过期了,或您重新拿到了您的安全设备,那么您需要登录客户端并选择菜单选项来重新激活您的安全设备。

5. 我的安全设备遗失或损坏了

如果您的安全设备遗失或损坏了,您将需要联系我们的客服中心请求更换安全设备或申请临时访问权限。视您居住的国家/地区不同,运输替换设备需要3-14天,因此我们会通过在线安全卡向您提供临时访问权限。拿到临时密码访问客户端后,您可将在线安全卡打印出来或作为图片保存至您的电脑桌面上。

6. 我获得的临时密码已过期

临时密码可供客户在2天时间内完整登录客户端或交易平台。2天后,您将无法使用临时密码登录交易平台,但仍可在10天内使用该密码登录客户端。然而,登录客户端后只能打印或保存在线安全卡而无法进行其它操作。

如您仍可使用临时密码登录客户端,您可打印或保存在线安全卡,然后在之后的21天内通过该卡完整登录客户端或交易平台。如您无法登录客户端,请联系您所在地区的客服中心寻求帮助。

7. 我获得的在线安全卡已过期

使用在线安全卡完整登录客户端及交易平台的有效期为21天。尽管时间有限,但这段时间应足够账户持有人重新拿到之前不在身边的安全设备或申请拿到替换设备。

如您无法使用在线安全卡登录,请联系您所在地区的客服中心寻求帮助或了解您永久安全设备的状态信息。

对于美国居民,实体安全设备会在2天内寄送至您账户登记的地址,其它地区的账户则需要2周。请注意,如账户持有人未手动激活永久设备,则设备在一定的时间后将自动激活。如果是这种情况且您在登录账户时遇到了困难,请致电1-877-442-2757联系我们的技术协助部门。

如果您仍可使用临时密码登录客户端,则您可打印或保存在线安全卡并通过该卡在21天内完整登录客户端及交易平台。

如您无法登录客户端,请联系您所在地区的客服中心寻求帮助。

10. 我已拿到了安全设备,想要激活

要激活替换设备或激活暂时不在身边而需申请临时密码的设备,您需要登录客户端并选择重新激活安全设备菜单选项。重新激活后,临时密码及在线安全卡都将失效。

重新输入您的用户名并确保您未输入空格或字母和数字以外的字符(如!@#$%^&*(.,”:...等)。