Corporate Actions

Voluntary Events

Tenders

A tender offer is a bid to purchase some or all of the shareholders' stock in a company. Tender offers are typically a public bid for stockholders to sell some or all their stock at a specific price within a particular time window.

Tender offers may carry certain conditions. Some conditions are limited to specific groups of shareholders, and some conditions may benefit any shareholder.

Rights Issues

A rights issue is an offer to existing shareholders to purchase newly-issued stock, the right to which they can usually exercise or sell on the open market.

SPAC

A SPAC (Special Purpose Acquisition Company) is a company without business activities that is formed strictly to raise capital through an initial public offering (IPO) with the intention to purchase all or part of a non-listed company in the relatively near term. As it is not clear which company SPACs are going to acquire in advance and do not have any business activities at the time of the IPO, they are also referred to as ‘shell companies’ or ‘blank cheque companies'.

Warrants

A warrant is a derivative issued by a company that gives the buyer the right, but not the obligation, to buy the company’s stock at a certain price before an expiration date.

Mandatory Events

Merger/Acquisition

A merger / acquisition involves the process of combining two companies into one. As a shareholder of a company which is set to be acquired, you are generally presented with a tender offer in which you can tender your shares to the acquiring company at a premium.

Spin Off

A spin-off occurs when a larger company wishes to create a new independent entity by either selling or distributing new shares of the new entity. As part of the spin-off, the parent company’s existing shareholders are given shares in the new independent company.

Split

Forward split: A corporate action in which a company issues additional shares to its shareholders, increasing the total by the specified ratio based on shares previously held.

Reverse Split: A corporate action which consolidates the number of existing shares into fewer, more expensive shares. Also dependent on the specified ratio.

非美国居民要缴纳预扣税吗?

纳税义务相关信息根据要求上报给您居住国家以及其它国家(如果交易的产品有地方预扣税要求)的税务机关。除非有税务机关明确要求,某则IBKR不会就证券交易收入扣缴税款。根据美国税法规定,我们对美国公司向外国人士支付的股息按30%的税率进行扣税。如果美国与您的所在国有税务协定,税率可能会有一定优惠。此外,投资利息收入没有美国预扣税。非美国人士和大多数实体的所有预扣税均将在每年年末通过表格1042-S申报。更多信息,请参见美国国税局901和/或咨询您的税务顾问。

有关IB自愿公司行动工具的信息

概况

工具的一般使用

有关做空优先认股权的重要信息

工具的一般使用

IB的自愿公司行动选择工具可供客户在公司行动开放选择的期间提交行动指令。

该工具的界面被分为5个部分。

第1部分 – 公司行动描述– 该部分位于界面的左上角,提供公司行动各项条款的详细信息。

第2部分 – 公司行动总结 –该部分会提供公司行动相关日期的快照。该部分位于界面的右上角,会提供公司行动类型、证券信息、公司行动的有效日期及为账户提交指令的截止时间。

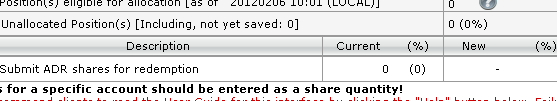

第3部分 – 持仓或价值 – 该部分会提供账户内当前可参与公司行动的持仓总览,以及目前未被分配参与公司行动的股票数量。 对于未在截止时间前分配的股票,IB将自动为其选择默认的选项。没有资格参与公司行动的账户将在本部分看到0。在查看股票购买计划(SPP)要约时,这部分会显示可买入的最大股票价值以及当前已分配参与要约的价值。

第4部分 – 选择表格– 该部分以表格的形式提供,会列出特定公司行动的选项,以及当前分配至某个选项的仓位。IB会在每一行提供以下信息:

a. 选项描述

b. 当前选择的持仓(价值)–报告之前提交了该选项的股票数量以及该数量占当前可用持仓的百分比。股票购买计划(SPP)要约会显示提交待买入的股票价值。

c. 新选择 –您可在框内输入您想提交至该选项的股票数量。除股票购买计划(SPP)的要约外,IB只接受以股数而非持有的股票百分比提交的指令。在股票购买计划下,选择必须以您想购买的股票价值为单位输入。

第5部分 – 行动按钮 – 有以下4个按钮:

a. 帮助– 提供如何使用“自愿公司行动选择”工具的更多信息

b. 修改–点击后会显示相关公司行动的描述/条款的更改概况。该项目只有当修改对相关的公司行动适用时才会显示。

c. 保存–点击后将向IB提交进一步处理的指令

d. 关闭–点击后将不向IB提交进一步处理的指令,直接关闭界面

与荷兰式拍卖相关的信息

如股东希望以特定的买价参与荷兰式拍卖,则可通过IB的公司行动工具按以下步骤提交选择。

1. 找到您想以“买价”买入的股票对应的行

2. 点击最右边的“更改”链接

此时会出现一个新的界面,显示有关买价的规则和可参与竞拍的持仓。

3. 输入您想提交的数量及买价。请注意,我们不接受以持有的股数的百分比提交的委托,因此,请以股票数量为单位输入

4. 信息输入完毕后,您可选择

- “添加行”,这会添加一行新的选择行,以便您以第二个买价提交待买入的股票

- 如您已完成选择,可点击界面右下角的“完成”

5. 在买价选择界面选择了“完成”后,您将回到主界面,在那里您将看到您想提交的股票数量。如您希望检查您的选择或编辑买价,可再次选择“更改”。

6. 所有选择均完成后,阅读并勾选您同意“条款与条件”,然后选择“保存”以提交您的选择

.jpg)

常见问题

如何向自愿公司行动分配股票?

- 在“新选择”栏内输入您想分配至已有的选择的股数。

- 当“新选择”准确地反映了符合您意图的选择指令时,选择“保存”

- 阅读自愿公司行动协议,如您同意协议条款,则选“我同意”

- 在收到您提交的选择后的30秒内,IB会向IB消息中心发送确认。如未收到确认,则客户必须联系IB,因为未确认的选择不会被处理

注

向股票购买计划(SPP)提交选择时也可根据以上步骤操作;然而,请注意,选择必须以您想购买的股票的价值为单位提交。

如果我不选择会怎么样?

如未提交选择并经IB确认,则未选择的股票将以默认的分配方式处理。

我能否看到我的选择历史?

是的。选择一旦提交并经IB确认,客户可在消息中心内查看咨询单或点击选择界面(持仓信息旁)的“选择历史”链接来了解选择历史信息。向IB提交的选择的概况将被列出。

如果我没有收到IB的确认,我的选择会被处理吗?

不支持。如果IB没有就自愿公司行动提供电子确认,则客户必须联系IB以确认选择。. IB只会处理以电子方式确认过的选择。

我能否在截止时间以后提交选择?

超过要约的截止时间后将无法通过账户管理提交选择。在截止时间以后,客户可通过咨询单提交指令;然而,请注意,对所有以该方式提交的指令,我们都只能尽最大努力处理。IB不保证在截止时间以后提交的指令能成功被处理。

我拥有1,000股股票,界面为什么显示符合资格的持仓为0?

如果账户不符合参与公司行动的资格要求,选择界面就会显示可参与的持仓为0。视公司行动要约不同,参与资格可能有限制。如果显示账户不能参加,但账户持有人认为应该可以参加,请在消息中心创建咨询单联系IB。

我能否修改我的选择?

只要未超过选择的截止时间,客户仍可通过账户管理内的公司行动管理工具更新其选择。. 打开要约详情界面后,您可编辑如下

- 在“新选择”框内输入零,移除已提交的内容,或

- 如您是代表客户账户操作的主账户使用者,则选择“移除所有分配”

选择移除后,您可重新输入新的数量。

有关公司行动选择的重要提示

请知悉,如果提交参与自愿的公司行动的总股数超过了要约截止时间账户内持有的总股数,IB有权在不向客户发送通知的情况下按比例分配选择。请监控账户的持股数量,以确保提交参与行动的股数不超过账户持股总数。

按比例分配指令举例

情境

在第一次选择时,账户内有2000股ABC公司的股票。提交了以下选择:

选择1(默认)选1500股

选择2 选500股

如在选择截止时间前卖出了500股,则将按如下安排调整选择:

选择1(默认)选1125股

选择2 选375股

如在选择截止时间前买入了500股,则将按如下安排调整选择:

选择1(默认)选2000股

选择2 选500股

有关做空优先认股权的重要信息

如果某一账户在认股权发行的生效日期前一天做空了目标证券,则账户将根据发行条款规定的比率分配认股权对应证券的空头仓位。

如果认股权未挂牌交易

如果多头仓位持有者提交请求认购认股权,则做空认股权的客户需承担相应的交付义务。客户应注意,可能需要承担的交付义务包括所有或部分被认购的空头仓位以及分配到的超额认购份额。客户应密切关注账户,确保能正常交付需要交付的股票。

IB直到认股权发行结束后才会知道账户需要承担的交付义务。

如果认股权挂牌交易

做空认股权的客户会尝试通过IB的交易者工作站(TWS)或网络交易者(WebTrader)提交委托单平仓。如果无法通过下达委托单平仓,客户可通过电话联系IB交易服务台请求代其下达平仓交易。

IB会为认股权发行设定平仓截止时间。平仓截止时间通常(但并不一定)会按下方规则设定:

(外部处理截止时间) - (市场结算所需时间 + 1)个工作日

举例:

在美国,外部处理截止时间为周四的认股权发行,其平仓截止时间通常为:

周四 - (3个工作日 + 1) = 上一周周五

IB会尽最大努力对平仓截止日仍剩余的空头仓位进行平仓(按标准佣金收费)。但IB不能保证平仓交易的时间和价格,也不保证一定能执行平仓交易。如果IB无法平掉剩余的空头仓位,而多头仓位持有者请求认购认股权,则客户应承担相应的交付义务。

IB执行了剩余空头仓位的平仓交易后会向账户持有人发送通知,告知其平仓交易已处理。IB会尽快将平仓交易发布至账户。如果通知未及时发送,IB不承担任何责任。如果客户在未事先与IB确认平仓状态的情况下在IB平仓截止时间之后平仓空头仓位,可能会导致账户出现多头认股权仓位。

ASX股息和公司行动常见问题

盈透证券澳大利亚有限公司(“IBKR澳大利亚”)已指定法国巴黎证券服务公司(“BNP”)为第三方次保管银行为我们的客户保管澳大利亚证券交易所(“ASX”)挂牌的现金股票1。IBKR澳大利亚确保所有您名下取得的证券均以IBKR澳大利亚全资托管公司盈透证券澳大利亚托管有限公司(“IBA Nominees”)的名义登记在BNP的账簿和记录之中。IBKR澳大利亚对IBA Nominees的行为负责。

为了您的便利,我们收集了客户对于此安排的一些常见问题以及公司行动方面的一些常见问题,详情如下:

我可以在我自己的持有人身份识别号码(HIN)下持有证券吗?

不支持。IBKR澳大利亚不支持个人HIN注册。而是由IBA Nominees通过在BNP或对应次保管机构设立综合账户的方式持有所有客户仓位。因此,您不会直接从证券登记机构收到CHESS报表和信息,但您仍然有权享有股息并可参与公司发生的任何公司行动。

IBKR澳大利亚支持ASX的IPO吗?

IBKR澳大利亚不支持。

但您仍然可以参与IPO并请求证券登记机构以发行人直接发行的形式接收IPO股票。登记机构接收之后,您便可以通过客户端的消息中心提交转仓咨询单、提供股票代码/账户持有人姓名/邮寄地址和股数请求将证券转至您的IBKR账户, 我们会为您进行处理。

如何监控公司行动相关投资组合和重要信息?

根据我们的条款与条件,您有责任了解自己在账户中交易和持有的所有证券、衍生品和其它金融产品的相关条款。这包括公司行动的详细信息和条款条件。尽管IBKR尽力确保为您提供最新的准确的信息,但我们不能对此进行任何保证或担保。我们为您所提供之信息的准确性可能会受到诸多因素的影响,如证券市场的信息处理延迟,市场数据供应商的错误或您所持股票之发行人的操作等等。因此,您应确保自己充分了解所有会对您IBKR账户所持产品造成影响的公开信息。

IBKR澳大利亚支持ASX股息再投资计划吗?

不支持。我们只支持现金派息。

对于涉及认购和购股计划的公司行动,提交选择的截止时间是什么时候?

由于IBKR澳大利亚指定了BNP作为我们的次保管机构保管ASX挂牌的现金股票,我们必须赶在市场截止时间(通常会在发行文件中说明)之前提交指令。如果您在登记日持有股票,我们会向您或您的经纪商/顾问发送电子邮件或通过消息中心通知提醒您或您的经纪商/顾问注意IBKR澳大利亚提交选择的截止时间(通常至少比市场截止时间提前4个工作日。如果错过了IBKR的提交截止时间但仍想提交请求,请在公司行动类别下提交一个咨询单。请注意,该等请求我们会尽最大努力处理,但并不保证一定会成功。如果我们成功提交了您的请求,则无论公司行动最后结果如何您都需按每笔请求100澳元的标准缴纳费用。所有的公司行动,发行人都有权自行决定是接受、削减还是拒绝您的请求。有关费用标准的更多信息,请参见此处链接。

在IBKR澳大利亚的截止时间之后我还能更改或取消我的选择吗?

一旦过了IBKR澳大利亚的截止时间,我们便只能是尽最大努力处理您的指令,不保证一定能将您的新请求提交上去。但是,如果我们成功提交了您的请求,则无论公司行动最后结果如何您都需按每笔请求100澳元的标准缴纳费用。所有的公司行动,发行人都有权自行决定是接受、削减还是拒绝您的请求。有关费用标准的更多信息,请参见此处链接。

IBKR澳大利亚支持机构配售吗?

不支持。通过IBKR澳大利亚提交的股票发行只面向散户投资者。如果同时有零售和机构发行,您无法同时两个都接受。如果证券登记机构或发行公司已就机构发行直接联系了您并且您也已经予以接受,则您不应再通过IBKR澳大利亚的平台参与零售发行。

IBKR澳大利亚会在付息日分配股票和退费(如有)吗?

一旦从BNP收到新股票并核对好所有参与客户的认购请求,IBKR澳大利亚便会尽最大努力及时分配股票。由于该过程通常有多方参与,IBKR澳大利亚无法保证您账户收到新股票和/或退费(如有)的确切时间。因此,通过IBKR澳大利亚提交公司行动请求即代表您确认,由于分配的证券和/或退费(如有)超出IBKR澳大利亚的控制,您账户收到证券和/或退费的时间可能会有延迟;并且您不会要求IBKR承担任何与此相关的损失或损害。

IBKR澳大利亚如何处理小数股权益?

现已不再支持向上取整权益的请求,包括小数股权益。所有选择均必须在客户端中按招股书或发行文件规定的有效股数提交,并且必须是整数股数。任何不符合要求的选择均会被拒绝或进行相应削减。

我作为外国投资者可以参加澳大利亚公司行动吗?

IBKR澳大利亚不提供法律、税务或投资建议,也不能决定您是否可以参加。通过在线客户端提交请求即代表您确认您已阅读并了解了招股书或发行文件,并且您并没有因为发行文件或招股书中所列的一条或多条限制(包括居住国家或地区相关限制)而无资格参加公司行动。证券登记机构将全权决定您是否具备参与资格并接受或拒绝您的请求。

对于需要付款的公司行动(如配股权发行和购股计划),资金什么时候扣除?

资金将于IBKR澳大利亚提交截止日从您的IBKR澳大利亚账户扣除。请确保您的IBKR澳大利亚账户届时有足够资金。如果没有足够资金,您的选择可能被拒,某些情况下,账户持仓会被强制清算。

通过IBKR澳大利亚提交ASX代理投票的截止时间是什么时候?

与提交公司行动选择类似,澳大利亚代理投票指令必须在大会前至少提交8个工作日提交。截止时间之后我们无法代您提交投票指令。

IBKR澳大利亚会提醒我即将进行的ASX代理投票吗?

ASX代理投票只是出于礼节提供的服务,我们不支持就即将举办的股东大会提供通知提醒。

针对ASX股票提交代理投票有哪些步骤?

要参加ASX上市公司的股东大会,您需要通过消息中心提交咨询单并表明您对决议的回应以及您此次投票想提交的股数。请在大会前至少提前8个工作日提供您的指令以便IBKR澳大利亚和我们的代理机构能有足够时间处理。 请注意,任何在提交截止时间之后收到的请求我们都只会尽最大努力处理,不保证一定能成功。 请不要直接联系BNP。

请确保您是在消息中心的代理投票类别下创建咨询单,并在咨询单中提供下方所有信息以避免发生延误:

- 咨询单标题:ASX (股票代码) Proxy Vote Submission

- 大会日期:

- 确认要投票的IBKR澳大利亚账户号码:

- 投票的股数:

- 每个决议项的指示(赞成/反对/弃权):

- 同意该咨询单提交为最终决定且不可撤销,并且股票在大会前不会卖出。

1. 关于IBA为ASX证券指定的次保管机构的详细信息,请参见此链接

有关IB如何处理认股权空头仓位的信息

如果某一账户在认股权发行的生效日期前一天做空了目标证券,则账户将根据发行条款规定的比率分配认股权对应证券的空头仓位。

如果认股权未挂牌交易

如果多头仓位持有者提交请求认购认股权,则做空认股权的客户需承担相应的交付义务。客户应注意,可能需要承担的交付义务包括所有或部分被认购的空头仓位以及分配到的超额认购份额。客户应密切关注账户,确保能正常交付需要交付的股票。

IB直到认股权发行结束后才会知道账户需要承担的交付义务。

如果认股权挂牌交易

做空认股权的客户会尝试通过IB的交易者工作站(TWS)或网络交易者(WebTrader)提交委托单平仓。如果无法通过下达委托单平仓,客户可通过电话联系IB交易服务台请求代其下达平仓交易。

IB会为认股权发行设定平仓截止时间。平仓截止时间通常(但并不一定)会按下方规则设定:

(外部处理截止时间) - (市场结算所需时间 + 1)个工作日

举例:

在美国,外部处理截止时间为周四的认股权发行,其平仓截止时间通常为:

周四 - (3个工作日 + 1) = 上一周周五

IB会尽最大努力对平仓截止日仍剩余的空头仓位进行平仓(按标准佣金收费)。但IB不能保证平仓交易的时间和价格,也不保证一定能执行平仓交易。如果IB无法平掉剩余的空头仓位,而多头仓位持有者请求认购认股权,则客户应承担相应的交付义务。

IB执行了剩余空头仓位的平仓交易后会向账户持有人发送通知,告知其平仓交易已处理。IB会尽快将平仓交易发布至账户。如果通知未及时发送,IB不承担任何责任。如果客户在未事先与IB确认平仓状态的情况下在IB平仓截止时间之后平仓空头仓位,可能会导致账户出现多头认股权仓位。

如何配置客户服务消息传递和通知方式

自愿公司行动限制相关信息

自愿公司行动可能会在持股人参与自愿邀约的资格方面有一定限制。该等限制包括,但不限于:

居住地限制 - 根据自愿要约文件的规定,该等限制会指定某些国家的居民可以参与或不能参与要约。居住地限制的详细信息会在要约文件中列明,并可通过公司的投资者关系部门进行核实。

国籍限制 - 与居住地限制类似;但这一限制是基于账户持有人的国籍,而非当前居住地。

合格投资者限制 - 公司可能只能向合格投资者发起要约。这类限制会在要求文件中列明,并可通过公司的投资者关系部门进行核实。在将指令提交给存管机构或过户代理之前,IB不会对合格投资者身份进行核验。如果确实存在这一限制,则客户有责任确认其有资格参与该等要约。

通知限制 - 有时候,盈透证券有限公司(Interactive Brokers LLC)可能会受到限制,无法告知客户完整的要约信息。这种情况下,客户有责任通过第三方搜索即将发生的自愿公司行动信息。任何有关该等要约的选择都必须通过在IB账户管理的消息中心创建咨询单的方式提交给IB。通过这种方式提交的指令将在尽最大努力的基础上处理。

澳大利亚认股权限制:IB不支持对小数配股进行向上取整。在计算客户配股时,IB会采用以下规则对小数配股进行向下取整:小于1的,取0;大于1的,向下取最近的整数。例如,在1:10的配股比例下,如果客户持有股数低于10股,则IB在决定客户配股时会向下取整到0;而如果客户持有股数在10到19之间,则会向下取整到1。要参与配股,选择必须通过账户管理的选择工具提交。

如果账户无法查看某一公司行动的完整信息,但认为要约应该对账户开放,则请通过在IB账户管理的消息中心创建咨询单联系IB。在咨询单中,请详细说明要约以及账户为什么应该能参与此要约的原因,IB会进行相应调查。

ASX Dividend and Corporate Action FAQ

Interactive Brokers Australia Pty Ltd (“IBKR Australia”) has appointed a third party sub-custodian: BNP Paribas Security Services (“BNP”), to hold ASX listed cash equities for the benefit of our clients1. IBKR Australia ensures that securities acquired on your behalf are recorded in the books and records of BNP in the name of IBKR Australia’s wholly owned nominee company, Interactive Brokers Australia Nominees Pty Ltd (“IBA Nominees”). IBKR Australia is responsible for the conduct of IBA Nominees.

For your convenience, we have consolidated some common queries from clients regarding this arrangement, as well as some common queries regarding corporate actions in general.

Can I hold my securities on my own individual HIN (Holder Identification Number)?

No. IBKR Australia does not support individual HIN registration. Instead, IBA Nominees holds all client positions on an omnibus basis with BNP or the applicable sub-custodian. Accordingly, you will not receive CHESS statement and information directly from the registry, but you are still entitled to dividends and to participate in any corporate actions that the company offers.

Does IBKR Australia support ASX IPO’s?

No, this is not supported via IBKR Australia.

However, you can still participate in IPOs and request the IPO shares to be received at the registry in issuer sponsored form. Once received at the registry, you can raise a position transfer ticket via the client portal message center and request to transfer these securities to your IBKR account by providing the stock ticker / account holder’s name / mailing address and the number of shares, and we will assist further.

How to monitor your portfolio and important information about corporate actions?

Under our T&Cs , you are responsible for understanding the terms of all securities, derivatives or other financial products that you trade and hold in your account. This includes the details, terms and conditions associated with corporate actions. Whilst IBKR tries to ensure that the information which it provides to you is correct and up to date, we do not warrant or guarantee that this is the case. The accuracy and correctness of information which we pass on to you may be impacted by, amongst other things, delays in processing of information by the underlying market, failure of a market data vendor or the actions of the issuers of shares in your portfolio. As a result, you should ensure you are fully aware of any information that is publicly available that affects the products you hold in your IBKR account.

Does IBKR Australia support ASX dividend reinvestment plan?

No. We only support the cash payment method.

What is the deadline to submit elective corporate actions including subscriptions and share purchase plans?

As IBKR Australia uses BNP as our sub-custodian for holding ASX listed cash equities, we must submit our instructions earlier than the market deadlines (that are typically announced within the offer documents). If you are holding the shares at the record date, an email or message center notification will be sent to you or your broker / advisor to notify you of the IBKR Australia submission deadline, which is typically at least 4 business days prior to the market deadline. If you have missed the IBKR submission deadline but still wish to submit the request, please submit a ticket request under the Corporate Action category. Note that such requests are not guaranteed to be processed and are worked on best effort basis only. If we do submit your request, you will be charged a fee of AUD 100 for each request, regardless of the outcome of the corporate action. As with all corporate actions, the issuer has the sole discretion to accept, reduce or reject your request. For more information about the fees, please refer to this link here.

Can I change or cancel my election after the IBKR Australia deadline?

Once the IBKR Australia deadline has passed, your instruction can only be worked on best effort basis. There is no guarantee that IBKR can submit your new request. However, if we do submit your request, you will be charged a fee of AUD 100 for each request, regardless of the outcome of the corporate action. As with all corporate actions, the issuer has the sole discretion to accept, reduce or reject your request. For more information about the fees, please refer to this link here.

Does IBKR Australia support Institutional Offers where applicable?

No. The offer submitted through IBKR Australia is only for retail offers. Where there is both a retail and institutional offer, you cannot accept both the Institutional and Retail at the same time. If you have been contacted directly by the registry or the issuing company regarding an institutional offer and you have accepted it, then you should not participate in the Retail Offer via IBKR Australia platform.

Does IBKR Australia allocate shares and refund (if applicable) on the payment date?

IBKR Australia will, on a best efforts basis, promptly allocate the new shares once we have received them from the BNP and have reconciled the subscription requests from all participating clients with the allocation we have received. As this process often involves multiple parties, IBKR Australia cannot guarantee the exact timing when the new shares and/ or the cash refund (if applicable) will be received in your account. As a result, by submitting the corporate action request via IBKR Australia, you acknowledge that there may be a delay in receiving the allocated securities and/or refunds (if applicable) that is outside the control of IBKR Australia and as a result you will not hold IBKR for any harm or loss associated therewith.

How does IBKR Australia handle fractional entitlements?

Requests to round up entitlements are no longer supported, including fractional entitlements. All elections must be submitted via the client portal tool with a valid lot size as set forth in the terms and conditions of the prospectus or offering documents and must only be for a whole right entitlement. Any election submitted which does not meet the criteria may be rejected or reduced accordingly.

Am I eligible to participate in any Australian Corporate Action as a foreign investor?

IBKR Australia does not provide legal, tax or investment advice and determine your eligibility. By submitting your request through the online portal, you acknowledge that you have read and understood the prospectus or offer documents and that you are not ineligible to participate in the corporate action due to one or more of the restrictions set forth in the offering documents or prospectus, as applicable, including any restriction related residency. The registry, in its sole discretion, will determine your eligibility and whether to accept or reject your submission.

When will my funds be deducted for corporate actions requiring payment such as rights issue and shares purchase plan?

Funds will be deducted from your IBKR Australia account on the stated IBKR Australia deadline. Please ensure that there are sufficient funds available in the IBKR Australia account at that time. Failure to ensure that you have sufficient funding may result in a rejection of your election, and in some circumstances, forced liquidations to occur in your account.

When is the deadline to submit ASX Proxy Votes via IBKR Australia?

Similar to the circumstances of submitting elective corporate actions, Australian Proxy Vote instructions must be submitted at least 8 business days prior to the meeting day. We are unable to pass on voting instructions after this deadline has passed.

Will IBKR Australia notify me of upcoming ASX Proxy Votes?

ASX Proxy voting is provided as a courtesy service only and we do not support the provision of notifications for upcoming shareholder meetings, as such.

What are the steps to submit a proxy vote for ASX stock?

In order to participate in shareholder meetings for ASX listed companies, you will need to submit a ticket via Message Center and indicate your responses to the resolutions and the number of shares you would like to submit as part of the vote. Please provide your instructions at least 8 business days prior to the meeting for IBKR Australia and our agent to have sufficient time for processing. Note that any requests received after this submission deadline are not guaranteed to be processed and are worked on best effort basis only. Please do not contact BNP directly.

Please ensure you create a ticket under the category Proxy Voting on the Message Center with all of the following information to avoid any delays:

- Ticket Subject ASX (Stock Ticker) Proxy Vote Submission

- Meeting date:

- Confirm the IBKR Australia account number to vote:

- Number of shares to vote:

- EACH resolution item vote direction (FOR/AGAINST/ABSTAIN):

- Agree this ticket submission is final and irrevocable and the shares will not be sold prior to the meeting date.

1. For complete details of the sub-custodians that IBA has appointed for ASX securities, please refer to this link

ADR转换程序

美国存托凭证(ADR)是用以证明对美国存托股票(ADS)拥有所有权的实物凭证 。ADS是一种在非美国公司拥有的美元计价股权所有权。ADS代表公司存放在其所在国托管银行的外国股票,承载着外国股票的企业和经济权利,受ADR凭证的规定条款限制。

底层普通股的持有者可请求将这些股票转换成ADR。同样,ADR的持有者也可请求将其转换成底层普通股。

对此处列出的股票,IB可提供ADR转换。

提交股票进行转换

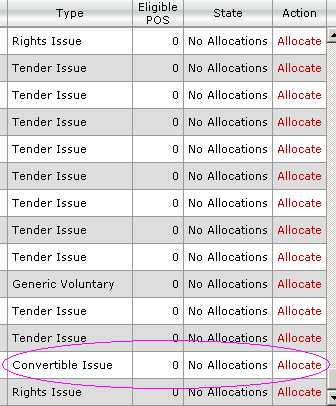

账户持有人可使用IB的自愿选择工具来请求进行转换(底层股票到ADR或ADR到底层股票)。要访问该工具,账户持有人

- 可登录账户管理

- 从账户管理的左手边选择“工具”图标,或打开“支持”并选择“工具”

- 从“工具”菜单选择“公司行动”;从公司行动类型标签中选择“转换”。

.bmp)

4. 在表格中找到您想操作的证券,并从表格右侧选择“分配”

一经选择便会出现一个新的页面,其将提供有关转换条款的信息。阅读条款后,您便可提交选择。

请注意:ADR转换将会被收取一定费用。尽管概述部分会给出预估费用,但最终账户需缴纳的费用取决于操作当时代理机构收取的手续费,因此预估费用会发生变化。

常见问题

转换是否有最低值要求?

IB对ADR或底层股票的转换没有设置最低值要求。

我在可转换头寸列表中并没有看到我的ADR/普通股。

如果证券未在表格中列出,客户可提交一个咨询单。在咨询单中,请注明您想要转换的证券以及股数。收到咨询单后,IB会审核请求并告知您是否可进行该操作。

提交了转换请求后,我的新股票会如何处理?

一旦所选股票在账户中完成结算,请求便会转至处理代理机构。尽管许多请求都会在1至2个工作日内完成,但因为处理过程取决于不同地区的独立第三方代理机构,所以这只是预估,实际有可能会需要更多时间。收到新股票后,头寸将会被分配至账户。

提交选择后会发生什么?

一旦提交了选择,请求便会转至处理代理机构。提交转换的股票将会被移至账户中的备抵区域,无法使用保证金贷款,也无法进行交易。转换完成之前,股票都将保持在该区域。账户持有人应对账户进行检查,确保账户在这一过程中始终满足保证金要求。

我怎样才能知道转换相关的费用?

最初,转换概述部分会提供每股预估费用。账户持有人将需要根据该信息自行计算费用。所有转换都将被收取500美元IB佣金外加外部费用(代收)。

我已经就转换同ADR发行机构协商好了费率。怎样确保这就是我将被收取的费用呢?

如果账户持有人已经协商好了某一特定费率,请提交一个咨询单,注明费率详情以及联系人名称和电话号码。IB将对信息进行审核,一旦确认,便会确保从您的账户扣除相应费用。

我能转换未结算股票吗?

不能。只有已结算股票才能提交至代理机构进行转换。

Dividend Accruals

If you are a shareholder of record as of the close of business on a dividend Record Date (see KB47), you are entitled to receive the dividend on its Payment Date. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. This information can be confirmed via the Daily Activity Statement posted to Account Management. The details of the accrual will be reflected in the statement section titled "Change in Dividend Accruals" and the net amount in a line item titled "Dividend Accruals" under the "Net Asset Value" section. If you wish to see information regarding dividends that you held through the Ex Date but which have not yet been paid out, choose "Legacy Full" from the Statements drop down when launching your statement. This will include an additional section called "Open Dividend Accruals" which will give you information on any pending dividends.

Note that dividend accruals may be either a debit (if short and borrowing the stock on the Record Date) or a credit (if long the stock on the Record date). In terms of account valuation, the dividend accrual is included in Equity with Loan Value as well as equity for purposes of determining compliance with the Pattern day Trading rules. A dividend credit accrual does not increase Available Funds and can therefore not be withdrawn until paid. A dividend accrual which is a debit does reduce Available Funds to ensure that funds are available to meet the obligation when payment is due.