How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

1) To submit this information change request, first login to Account Management

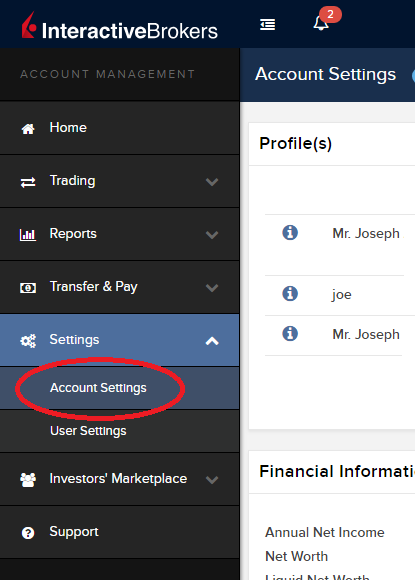

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

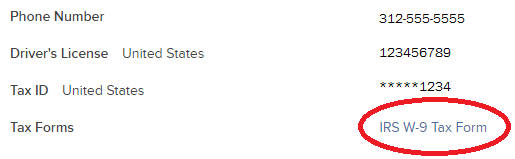

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

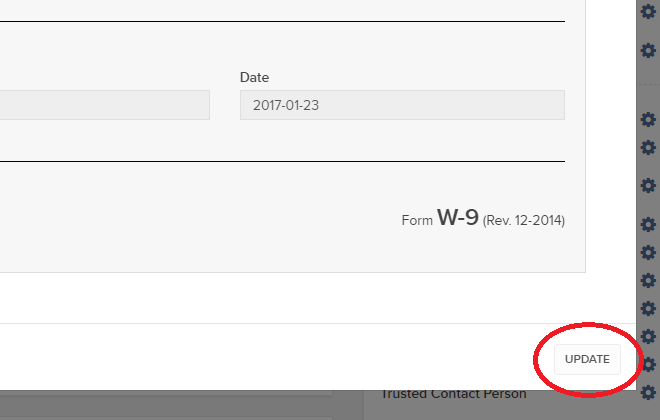

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

Changing Market Data Subscriber Status from Pro to Non-Pro

For purposes of determining available quote subscriptions and fees, IB is obligated to determine whether account holders fall under the exchange classifications as a Professional or Non-Professional subscriber (See KB2369 for definitions). In most instances, account holders are allowed to self-declare their subscriber status at the point of application or update via Client Portal thereafter, although these declarations are subject to review and account holders electing Non-Professional status are subject to having their status amended to Professional based upon the account information they've submitted.

Account holders who no longer meet the definition of a Professional may request a change in their status to Non-Professional by following the steps below:

Individual and Joint Accounts

- Log into Client Portal and select the User menu (head and shoulders icon in the top right corner) followed by User Settings, click on the Configure (gear) icon for Market Data Subscriptions on the Trading Platform panel, and then click on Configure (gear) icon next to Market Data Subscriber Status. You will be presented with a page through which you can select the option titled Non-Professional and agree to the permitted use and notification of future change in status requirements.

- Your request will then be subject to a review by IB to determine whether it can be accepted or denied based upon the account information of record or whether completion of the Non Professional Questionnaire is required. You will be notified via the Message Center if accepted or denied.

- If completion of the questionnaire is required, you will receive an email advising you to log into Client Portal at which point you will be prompted with the form. Once completed, the responses will be reviewed by IB and you will be notified as to whether or not your change request has been accepted. Please allow between 1 - 2 business days for this review process to complete.

- If your request to change status is approved, your Professional Subscriptions will be canceled immediately and, as exchanges do not provide for prorated subscriptions, you will be charged for the subscription as if you had use of it the entire month. If you wish to subscribe to replacement quote services as a Non-Professional, you may do so through Client Portal. Again, please note that mid-month subscriptions are charged at the full monthly rate. Accordingly, depending upon your decision to request a change of status and elect replacement subscriptions, you may be subject to both Professional and Non-Professional fees for a given month.

16.00 Normal 0 false false false EN-US X-NONE X-NONE

Family Advisors and Non-Professional Advisor Accounts

- Submit your request to complete the Non-Professional Questionnaire via the Message Center located in Client Portal.

- Your request will then be subject to a review by IB to determine whether it can be accepted or denied based upon the account information of record or whether you are eligible to complete the Non Professional Questionnaire. You will be notified via the Message Center as to the decision.

- If eligible to complete the Non-Professional Questionnaire, you will receive an email advising you to log into Client Portal at which point you will be prompted with the form. Once completed, the responses will be reviewed by IB and you will be notified as to whether or not your change request has been accepted. Please allow between 1 - 2 business days for this review process to complete.

-

16.00

Normal

0

false

false

false

EN-US

X-NONE

X-NONE

Family Advisors and Non-Professional Advisor Accounts that are reclassified from Professional to Non-Professional are subject to the same market data cancellation, replacement and billing considerations as noted above for Individual accounts.

Organizations, Professional Advisor Accounts & Professional Trusts

- These types of accounts are classified as Professional by default per exchange rules and will not be considered for reclassification to Non Professional.

市場數據非專業客戶問卷

如何完成最新的非專業客戶問卷。

紐約證券交易所(NYSE)及大多數美國的交易所均要求供應商在允許客戶接收市場數據前確認每個客戶接收市場數據的身份。未來,我們將使用非專業客戶問卷來識別及確認所有訂閱用戶的市場數據身份。根據交易所的要求,在未明確客戶為非專業人士之前,將默認客戶的市場數據接收身份為專業人士。該流程能夠保證所有新訂閱用戶的數據訂閱身份是準確的。若要獲取有關非專業人士定義的簡要指南,請見ibkb.interactivebrokers.com/article/2369。

您必須回答問卷上的所有問題,方可被定義為非專業人士。鑑於交易所要求供應商明確獲得客戶為非專業人士的證明,若問卷回答不完整或不清晰,客戶將被界定為專業投資者,直至其身份得到確認。

如您的身份有所變更,請聯繫幫助台。

問題解釋:

1) 商業及業務用途

a) 您是否出於業務需要、或代表其他商業實體接收財經信息(包括關於證券、商品及其他金融產品的新聞或價格數據)?

解釋:除個人用途外,您是否代表公司或其他組織接收及使用本賬戶中的市場數據?

b) 您是否代表公司、合夥企業、專業信託機構、專業投資俱樂部或其他實體開展證券、商品或外匯交易?

解釋:您只代表個人交易,還是也代表機構(如,有限責任公司、有限責任企業、股份有限公司、公司、有限責任合夥企業等)交易?

c) 您是否就以下事項與其他實體或個人達成過協議:(a) 分享交易活動的盈利,或(b)獲取交易酬勞?

解釋:您是否通過交易獲得酬勞,或與第三方實體或個人分享交易活動的盈利?

d) 您是否通過交易換取辦公場所、設備或其他福利?或者,您是否擔任任意個人、企業或商業實體的財務顧問?

解釋:您是否以任意形式從第三方獲得交易的酬勞,該酬勞不一定以貨幣的形式支付。

2) 擔任職務

a) 目前您是否擔任任何投資顧問或經紀交易商的職務?

解釋:您是否通過管理第三方的資產或指導他人如何管理資產獲得酬勞?

b) 您是否擔任證券、商品或外匯方面的資產管理人?

解釋:您是否通過管理證券、商品或外匯資產獲得酬勞?

c) 目前您是否在工作中使用此類財經信息,或將其用於管理您的雇主或公司的資產?

解釋:您使用數據是否單純出於商業目的,即,用於管理您的雇主及/或公司的資產?

d) 您交易時是否使用了其他個人或實體的資金?

解釋:您的賬戶中除了您個人的資產,是否有其他實體的資產?

3) 向其他任意實體傳播、再發布或提供數據

a) 您是否以任意方式向任意第三方傳播、再傳播、發布或提供任何從服務中獲得的財經信息?

解釋:您是否以任意形式向其他實體發送您從我方獲得的任何數據?

4) 合資格的專業證券/期貨交易商

a) 目前,您是否為任意證券機構、商品或期貨市場的註冊或合資格的專業證券交易員,或為任意國家交易所、監管機構、專業協會或公認專業機構的投資顧問?i, ii

是☐ 否☐

i) 監管機構的例子包括但不限於:

- 美國證券交易委員會(SEC)

- 美國商品期貨交易委員會(CFTC)

- 英國金融服務局(FSA)

- 日本金融服務局(JFSA)

ii) 自律組織(SROs)的例子包括但不限於:

- 美國紐約證券交易所(NYSE)

- 美國金融業監管局(FINRA)

- 瑞士聯邦金融局(VQF)

盈透證券歡迎您

現在您的賬戶已完成入金并獲批,您可以開始交易了。以下信息可以幫助您入門。

- 您的資金

- 設置您的賬戶以進行交易

- 如何交易

- 在全球範圍進行交易

- 拓展您IB經驗的五個要點

1. 您的資金

存款&取款基本信息。所有轉賬都通過您的賬戶管理進行管理

存款

首先,通過您的賬戶管理 > 資金 > 資金轉賬 > 轉賬類型:“存款”創建一個存款通知(如何創建存款通知)。第二步,通知您的銀行進行電匯轉賬,在存款通知中提供詳細銀行信息。

取款

通過您的賬戶管理 > 資金 > 資金轉賬 > 轉賬類型:“取款”創建一個取款指令(如何創建取款指令)

如果您通知要進行超出取款限額的取款,則會被視為異常取款,我們因此將需要匹配銀行賬戶持有人和IB賬戶。如果目的地銀行賬戶已被用作存款,那麼取款將會被處理;否則,您必須聯繫客戶服務并提供所需文件。

錯誤排查

存款:我的銀行發出了資金,但我沒有看到資金記入我的IB賬戶。可能的原因:

a) 資金轉賬需要1至4個工作日。

b) 存款通知缺失。您必須通過賬戶管理創建存款通知并向客戶服務發送一條咨詢單。

c) 修改詳情缺失。轉賬詳情中缺失您的姓名和IB賬戶號碼。您必須聯繫您的銀行索取完整的修改詳情。

d) IB發起的ACH存款7個工作日內限額為10萬美元。如果您開立的是初始要求為11萬美元的投資組合保證金賬戶,最好選擇電匯存款以減少您第一筆交易的等待時間。如果選擇ACH,會需要等待近2周時間,或者可以選擇臨時升級至RegT。

取款:我已經請求了取款,但我沒有看到資金記入我的銀行賬戶。可能的原因:

a) 資金轉賬需要1至4個工作日。

b) 被拒。超出最大取款限額。請檢查您賬戶的現金餘額。注意,出於監管要求,存入資金時會有三天置存期,之後才可以被取出。

c) 您的銀行退回了資金。可能是因為接收銀行賬戶與匯款銀行賬戶名稱不匹配。

2. 設置您的賬戶以進行交易

現金與保證金賬戶的區別:如果您選擇快速申請,默認您的賬戶類型為配備美國股票許可的現金賬戶。如果您想使用槓桿并以保證金交易,參見此處如何升級為RegT保證金賬戶

交易許可

為了能夠交易特定國家的某一特定資產類別,您需要通過賬戶管理獲得該資產類別的交易許可。請注意,交易許可是免費的。但您可能需要簽署當地監管部門所要求的風險披露。如何請求交易許可

市場數據

如果想獲取某一特定產品/交易所的實時市場數據,您需要訂閱交易所收費的市場數據包。如何訂閱市場數據

市場數據助手會幫助您選擇正確的數據包。請觀看該視頻,其解釋了市場數據助手是如何工作的。

客戶可以通過從未訂閱的代碼行點擊免費延時數據按鈕選擇接收免費的延時市場數據。

顧問賬戶

請閱讀用戶指南顧問入門指南。在這裡,您可以看到如何向您的顧問賬戶創建其他使用者以及如何授予其訪問權限等等。

3. 如何交易

如果想學習如何使用我們的交易平台,您可以訪問交易者大學。在這裡您可以找到我們以10種語言提供的實時與錄製網研會以及有關交易平台的課程與文檔。

交易者工作站(TWS)

要求更高級交易工具的交易者可以使用我們做市商設計的交易者工作站(TWS)。TWS有著便於操作的電子表格式界面,可優化您的交易速度和效率,支持60多種定單類型,配備可適應任何交易風格的特定任務交易工具,并可實時監控賬戶餘額與活動。試試兩種不同模式:

魔方TWS:直觀可用性, 簡便的交易准入,定單管理,自選列表與圖表全部在一個窗口呈現。

標準模式TWS:為需要更高級工具與算法的交易者提供高級定單管理。

基本描述與信息 / 快速入門指南 / 用戶指南

互動課程:TWS基礎 / TWS設置 / 魔方TWS

如何下單交易:標準模式TWS視頻 / 魔方TWS視頻

交易工具:基本描述與信息 / 用戶指南

要求:如何安裝適用於Windows的Java / 如何安裝適用於MAC的Java / 需打開端口4000和4001

登錄TWS / 下載TWS

網絡交易者(WebTrader)

偏好乾淨簡潔界面的交易者可以使用我們基於HTML的網絡交易者。網絡交易者便於查看市場數據、提交定單以及監控您的賬戶與執行。從各瀏覽器使用最新版本網絡交易者

快速入門指南 / 網絡交易者用戶指南

簡介:網絡交易者視頻

如何下單交易:網絡交易者視頻

登錄網絡交易者

移動交易者(MobileTrader)

我們的移動解決方案可供您隨時隨地用您的IB賬戶進行交易。IB TWS iOS版和IB TWS BlackBerry版是為這些型號定制設計的,而通用的移動交易者支持大多數其他職能手機。

基本描述與信息

定單類型 可用定單類型與描述 / 視頻 / 課程 / 用戶指南

模擬交易 基本描述與信息 / 如何獲得模擬交易賬戶

一旦您的模擬交易賬戶創建成功,您便可用模擬交易賬戶分享您真實賬戶的市場數據:賬戶管理 > 管理賬戶 > 設置 > 模擬交易

4. 在全球範圍進行交易

IB賬戶為多幣種賬戶。您的賬戶可以同時持有不同的貨幣,可供您從一個賬戶交易全球範圍內的多種產品。

基礎貨幣

您的基礎貨幣決定了您報表的轉換貨幣以及用於確定保證金要求的貨幣。基礎貨幣在您開立賬戶時決定。客戶隨時可通過賬戶管理改變其基礎貨幣。

我們不會自動將貨幣轉換為您的基礎貨幣

貨幣轉換必須由客戶手動完成。在該視頻中,您可以學習如何進行貨幣轉換。

要開倉以您賬戶所不持有之貨幣計價的頭寸,您可以有以下兩種選擇:

A) 貨幣轉換。

B) IB保證金貸款。(對現金賬戶不可用)

請查看該課程,其解釋了外匯交易方法。

5. 拓展您IB經驗的五個要點

1. 合約搜索

在這裡,您會找到我們的所有產品、代碼與說明。

2. IB知識庫

IB知識庫包含了一系列術語、指導性文章、錯誤排查技巧以及指南,旨在幫助IB客戶管理其IB賬戶。只需在搜索按鈕輸入您想要了解的內容,您便會得到答案。

3. 賬戶管理

我們的交易平台可供您訪問市場,賬戶管理則可供您訪問自己的IB賬戶。使用賬戶管理可管理賬戶相關任務,如存入或取出資金、查看您的報表、修改市場數據與新聞訂閱、更改交易許可并驗證或更改您的個人信息。

登錄賬戶管理 / 賬戶管理快速入門指南 / 賬戶管理用戶指南

4. 安全登錄系統

為向您提供最高級別的在線安全,盈透證券推出了安全登錄系統(SLS),通過安全登錄系統訪問賬戶需要進行雙因素驗證。雙因素驗證旨在于登錄時採用兩項安全因素確認您的身份:1) 您的用戶名與密碼組合;和2) 生成隨機、一次性安全代碼的安全設備。因為登錄賬戶需要既知曉您的用戶名/密碼又持有實物安全設備,所以參加安全登錄系統基本上可以杜絕除您以外的其他任何人訪問您賬戶的可能性。

如何激活您的安全設備 / 如何獲取安全代碼卡 / 如何退還安全設備

如果忘記密碼或丟失安全代碼卡,請聯繫我們獲取即時幫助。

5. 報表與報告

我們的報表與報告方便查看和進行自定義,覆蓋了您盈透賬戶的方方面面。如何查看活動報表

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

取款請求旁邊“等待顧問處理”狀態的含義

在客戶端的轉賬曆史部分,請求可取款的客戶賬戶登錄進來可能會看到'等待顧問處理'這一狀態。

信息:

在顧問結構中,客戶帳戶可以像任何個人帳戶一樣登錄客戶端請求取款。一旦客戶帳戶發起取款請求,顧問必須同意該請求。如不同意,系統仍會處理取款請求,不過會有最多3個工作日的延遲。

顧問確認步驟:

一旦客戶帳戶提交取款請求,顧問便會收到一則電子郵件通知,告知有客戶請求取款。要同意取款請求,顧問必須登錄顧問端,選擇管理客戶 > 控制面板 > 待定項目標籤,然後點擊“同意”按鈕以加速待定取款請求的處理。

有關限制期的註釋:

為確保及時處理客戶發起的取款請求,當取款請求金額大於可供取款金額的80%時,款項會在顧問同意后或3日后(取較早者)發放。取款請求金額小於可供取款金額的80%時,款項會在顧問同意后或下一個工作日發放。

限制期的存在是爲了確保您的顧問意識到您的取款請求并留有足夠的時間備齊資金。

Financial Advisor How To: Linking Related Client Accounts

Account linkage provides account holders who maintain multiple accounts under a single advisor, the ability to group the accounts together under a single user name. The benefits of account linking include the following:

- The ability to log into all accounts via a single user name and password;

- Account accessed using a common security device;

- Activity fee minimums, when applicable, are determined based on commissions consolidated across the linked accounts;

- Consolidated reporting of accounts.

While linking may be performed by the client, this article outlines the steps by which an advisor may link accounts on behalf of the client

Steps:

1. Linkage begins by logging into Account Management at the master account level and selecting the Manage Clients, Accounts and then Link Client Accounts menu options.

.jpg)

2. You will then be provided with a drop down list of client which are eligible to be linked. While multiple clients may be linked in a given session, the linkage steps must be completed for a given client before proceeding to another.

.jpg)

3. After selecting the client to be linked, a list of all of the client's accounts that are eligible to be linked will be presented. Here, you will be prompted to specify which of the user names is to be retained for future account access. Once the linkage process has been completed, all other user names will be deactivated.

.jpg)

4. Next you will be presented with the Account Information page where confirmation of the client's personal information will be performed. In the event the client maintains information which differs among accounts (e.g., residential address), you will be prompted to select that which is accurate and is to be retained following completion of linkage.

.jpg)

5. Next, select any or all of the standing banking instructions which will be retained.

.jpg)

6. Confirmation of the linkage request is then provided.

.jpg)

IMPORTANT NOTES:

- You must select the client account with the highest level security device.

- Once the accounts are linked, the unique usernames and passwords for the accounts to be linked with this account will no longer function. The surviving username and password associated with the account will function for all linked accounts.

- Interactive Brokers will link these accounts on Fridays.

- Once the accounts are linked, the security devices for the accounts to be linked with this account will no longer function and the device associated with this account will function for all linked accounts. Those device do not need to be returned to IB, as per KB975

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

IRA: Required Minimum Distributions

IRA owners may be required to to withdraw funds beginning at age 73, and every year thereafter. Determining your Required Minimum Distribution (RMD) is significant while retaining an IRA, considering both your life expectancy and the IRA's fair market value.

The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Interactive Brokers LLC provides several information resources to understand and calculate your RMD, including access to the online FINRA RMD Calculator.

Requesting Your RMD Withdrawal

The Internal Revenue Service (IRS) requires the IRA plan custodian to notify IRA owners about the RMD requirements by January 31 each year. If you turn 73 this year, you are required to begin taking RMDs before April 1 of the following year.

Eligible IRA owners must begin receiving withdrawals by December 31 of the year they reach age 73. The first RMD withdrawal, however, may be delayed until April 1 of the following year.

If you elect to delay the withdrawal, then please observe the following considerations:

(1) Two RMD withdrawals will be required the following year, the undistributed initial RMD and the new RMD.

(2) The new RMD will be slightly larger due to the December 31 market value's inclusion of the undistributed initial RMD.

Subsequent RMD withdrawals from your IRA must be distributed by December 31 to avoid a penalty tax.

Note: Roth IRAs are exempt from the RMD rules during the IRA owner's lifetime.

Requesting Your RMD Withdrawal

You may request a withdrawal of funds through the Transfer & Pay and then Transfer Funds menu options within Client Portal. The IRS deadline for taking RMDs is December 31 each year. Keep in mind that the year end withdrawal cut off for processing withdrawals from your Interactive Brokers account may occur before December 31.

Please note that you can elect to transfer your funds to your bank account or to an Interactive Brokers non-IRA account. To transfer funds to an Interactive Brokers non-IRA account, log into Client Portal, select Transfer & Pay, Transfer Funds then select Transfer Funds Between Accounts.

Your RMD is determined by dividing the account balance on December 31 of last year by your life expectancy factor. Your life expectancy factor is taken from the Life Expectancy Tables contained in IRS Publication 590. Your IRA beneficiary election may play an important role in determining your RMD, as well.

You must calculate your RMD separately for each qualifying IRA custodied at Interactive Brokers and any other financial institution. The RMD, however, may be satisfied from any single one or combination of your IRAs. The IRA Required Minimum Distribution Worksheets may provide additional assistance with the calculation of your RMD.

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Rollover Rules & Conditions

This information is for general educational purposes only. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations.

Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The contribution to the second retirement plan is called a rollover contribution.

This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. Select from list below for details:

Eligible Rollover Transactions

Rules & Conditions

Prior to completing an IRA Rollover transaction, we recommend that you review the rules and conditions surrounding eligibility. Interactive Brokers can accept as a tax-free transaction an eligible rollover distribution as defined under the Internal Revenue Code. Included in this article is information about eligible transactions, as well as the Interactive Brokers IRA Rollover Certification form.

IRA Rollover Certification

Before accepting an IRA rollover transaction into an Interactive Brokers LLC IRA, we require that you review your eligibility for the rollover and certify your understanding of the rollover rules and conditions. The IRA Rollover Form includes the IRA Rollover Certification.

The Transfer Funds page within the Client Portal lets you notify IB of an IRA Rollover deposit of funds into your account. From the Transfer & Pay menu select Transfer Funds and then Make a Deposit. Select one of the saved deposit instructions and follow the prompts on the screen or create a new deposit instruction by selecting the Currency of the deposit from the drop-down menu. Click Connect or Get Instructions for the method you will use to transfer funds. And finally follow the remaining instructions provided to initiate the transfer with your bank.

Rollover Transactions

Two types of IRA rollover transactions exist with different guidelines and delivery methods:

- Direct Rollover - a transfer of assets from an employer-sponsored retirement plan directly to an eligible IRA. If you choose to receive the distribution first, then you may roll over the funds to the IRA within 60 days.

- Indirect Rollover - a distribution from an IRA paid to you, followed by a rollover into another IRA within 60 days. The IRS allows an indirect rollover of each IRA's funds once during a twelve-month period.

(Note: A distributions directly from one IRA trustee to another IRA trustee is a Trustee-to-Trustee transfer. It is not affected by the twelve-month waiting period.)

For additional information about rollovers, visit Understanding Rollovers. See also IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) for more specific guidelines on moving retirement plan assets.

Eligible Rollover Transactions

Almost any distribution from a qualified plan can be rolled over to an IRA. Your retirement account may be eligible for one of the following eligible rollover transactions.

Traditional IRA or SIMPLE IRA to Traditional IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

- Required Minimum Distribution satisfied (if over 73)

- For SIMPLE IRAs, after two years from the first contribution

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

Rollover or Direct Rollover from Qualified Plan into a Traditional IRA

- Eligible participant (participant, spouse beneficiary, or former spouse due to divorce)

- Funds or property deposited less than 60 days of receipt by the participant from the previous plan

- Funds received from an eligible qualified retirement plan

- Required Minimum Distribution satisfied (if over 73)

- Consists of funds, property, or proceeds from the sale of property distributed from the qualified plan

- All of the funds are eligible to be rolled over

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- Required Minimum Distribution satisfied (if over 73)

Ineligible Rollover Transactions

Some funds distributed from a retirement plan are not eligible for rollover into an IRA. The following transactions are not eligible rollover transactions.

- Any portion of a distribution from a retirement plan not rolled over

- Required Minimum Distributions

- Distribution of excess contributions and related earnings

- Retirement plan loan treated as a distribution

- Hardship distributions

- Distributions part of substantially equal payments (73-t)

- Dividends on employer securities

- Non-spousal death benefit distributions

- The cost of life insurance coverage

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.