Ex-Ante Costs and Charges Disclosures

What is this Disclosure?

MIFID II rules require that Interactive Brokers in Europe and the UK provide its retail clients with a reasonable estimate of the costs and charges related to products and services offered.

Retail clients of Interactive Brokers in Europe can view a per-transaction costs and charges disclosure at the time of the order entry (‘ex-ante’). The disclosure is personalized and corresponds to the conditions applicable to the client account.

While clients have the option to view the disclosure, it is not a mandatory step before the order submission.

The disclosure content and format are largely prescribed by the rules to enable retail clients to compare costs and charges across providers. This article aims to clarify the meaning of these standardized terms.

In addition to Interactive Brokers costs and charges, the disclosure must show implicit costs and costs embedded in the product price itself (and not charged by Interactive Brokers separately).

A per transaction costs and charges disclosure is required for:

- All futures and options globally, including futures options

- ETFs of all types

- Funds, including closed-end funds

- CFDs

- Warrants and structured products

A disclosure is not required for other products such as vanilla stocks and bonds.

Where to Find the Per-transaction Costs and Charges Disclosure?

Access to the disclosure is via a link embedded in the primary order-entry dialog.

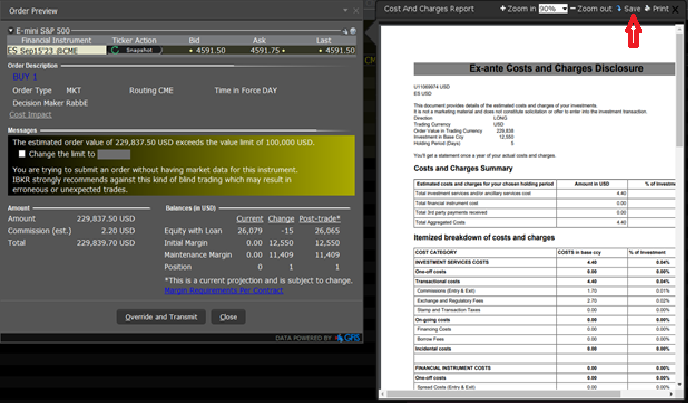

TWS Classic:

.png)

The presence of the link does not interrupt the standard order entry workflow if a client chooses not to click it. A client can click the transmit button in the usual way and skip viewing the disclosure.

Clicking the “Cost Impact” link brings up a pop-up with the ex-ante per transaction costs and charges disclosure, with the option to download it as a PDF:

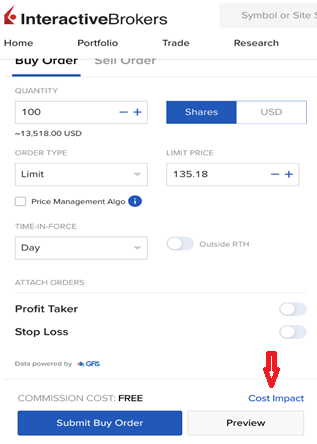

Other Trading Applications:

The other order entry interfaces such as Mosaic, Client Portal and Mobile likewise include a link to the costs and charges disclosure, again without interrupting the standard workflow unless a client expressly wants to see the disclosure.

Below is an example of the order ticket in the Client Portal. Order tickets in TWS Mosaic and Mobile are similar.

The Disclosure Content and Structure

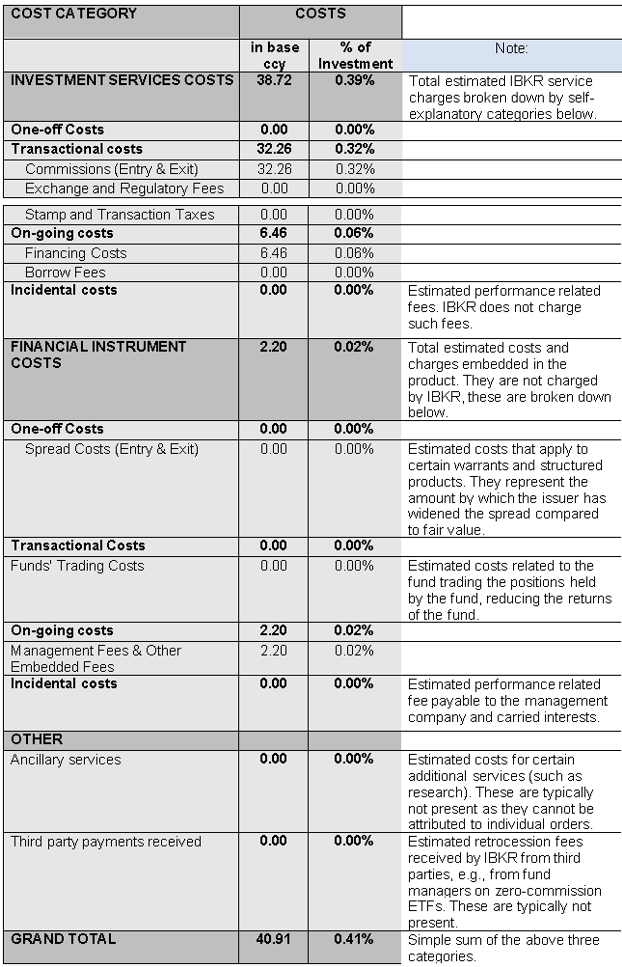

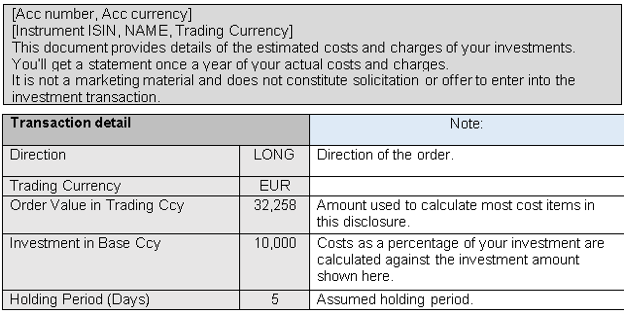

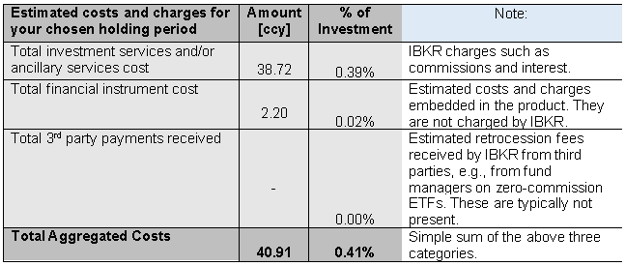

The per transaction costs and charges disclosure includes a summary-section followed by an itemized costs and charges breakdown. The various cost items are presented using headings and terms that are mandated by the regulation to make the disclosures comparable across investment service providers. The example below illustrates the statement structure and contains explanatory notes.

Ex-ante Costs and Charges Disclosure - Illustrative Example

(1) Account detail

(2) Costs and Charges Summary

Please note that the “Financial Instrument Cost” is embedded in the product, and not a cost charged by Interactive Brokers. We are required to source or estimate such costs so you could better understand all of the costs that are associated with some of your securities.

(3) Itemized Breakdown of Costs and Charges