Comparison of U.S. Segregation Models

INTRODUCTION

The regulation of securities and commodities products and brokers1 in the U.S. is administered by two distinct federal agencies, the Securities and Exchange Commission (SEC) for securities including stocks, ETFs, bonds, options and mutual funds and the Commodities Futures Trading Commission (CFTC) for commodities including futures and options on futures.2 While both agencies seek to safeguard customer assets by restricting their use and “segregating” them from assets of the broker, the regulations and manner in which they accomplish this differs. The following article provides a basic overview of two segregation models and additional considerations relating to IB accounts.

OVERVIEW

Differences between the CFTC and SEC segregation models originate largely from the products themselves, whose characteristics are fundamentally unique. Commodity products, by nature, do not involve an extension of credit by the broker to the customer as a futures contract is not an asset but rather a contingent liability which is marked-to-market and a long futures option, while an asset, must be paid for in-full. Consequently, non-option assets in a commodities account are generally comprised of funds deposited as margin to secure performance on the contracts therein. Since the broker may not use the funds of one customer to margin or guarantee the transactions of another, the commodities segregation requirement (CFTC Rules 1.20 – 1.30) is equal to the gross assets of all customers and the broker needs to add its own funds to segregation to cover customers whose net equity is in deficit.

A securities margin account, in contrast, can facilitate the extension of credit for the purpose of long securities (e.g., stocks, bonds) purchases or short securities sales on a secured basis. The segregation or reserve requirement rules recognize this through special provisions for the protection of each of the cash and securities components, further distinguishing fully-paid securities from those whose purchase the broker has financed and maintains a lien upon. Here, the broker must deposit into a separate bank account the net amount of customer cash balances3, in accordance with a formula set forth in SEC Rule 15c3-3. In addition, the broker must identify and segregate in a good control location (e.g., depository, bank) customer securities which meet the definition of “fully paid” or “excess margin”.

The table below provides a comparison of the main principals of each model.

| COMPARISON OF CFTC & SEC SEGREGATION MODELS | ||

| PRINCIPAL | CFTC | SEC |

|

Separation of Customer Balances

|

Commodity customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts.

Funds used for trading on non-US commodity exchanges must be kept separate from those used for trading on U.S. exchanges (even for the same customer). Commodity customer balances must also be maintained separate from securities customer balances (even for the same customer). |

Securities customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts. Securities customer balances must also be maintained separate from commodity customer balances (even for the same customer).

|

|

Priority in the Event of Broker Default

|

Commodity customers maintain priority and equal claim over assets in each of their respective U.S. segregated and non-U.S. secured pools.

No claim on assets in a commodity pool in which one is not a participant and no claim on securities customer assets. If commodity segregated assets are insufficient to meet claims and broker is insolvent, customers share equally in shortfall and become general creditors for residual claims. |

Securities customers maintain priority and equal claim over assets.4

No claim on commodity segregated assets. If securities segregated assets are insufficient to meet claims, broker is insolvent and claims exceed SPIC coverage, customers share equally in shortfall and become general creditors for residual claims.

|

| Segregation Style |

Gross – the broker may not use the funds of one customer to margin or guarantee the transactions of another and must segregate assets in an amount at least equal to the sum of all customer credit balances. |

Net – broker may use customer cash credit balances to finance, on a secured basis, margin loans to other customers and may lend or pledge a portion of customer securities purchased on margin to other customers selling short.

|

| Investment of Cash Balances |

Broker is allowed to reinvest commodity customer’s cash balances and retain an interest in the income generated. Permissible investments include: U.S. government securities, municipal securities, government sponsored enterprise securities, bank CDs, corporate obligations (commercial paper, notes and bonds) fully guaranteed as to principal and interest by the U.S. under the Temporary Liquidity Guarantee Program and money market mutual funds. Securities which are the subject of reinvestment must be maintained in a segregated account. |

Broker is allowed to reinvest securities customer’s cash balances and retain an interest in the income generated. Permissible investments limited to “qualified securities” defined as securities which are guaranteed as to both interest and principal by the U.S. government. Securities which are the subject of reinvestment must be held in Special Reserve Bank Account (i.e., segregated). |

| Computation Frequency | Daily | Weekly |

| Insurance | None | Securities Investor Protection Corporation (SIPC) provides insurance of up to USD 500,000 with a cash sublimit of USD 250,000. |

ADDITIONAL CONSIDERATIONS

In addition to the safeguards afforded through segregation, IB employs a number of policies and practices which serve to enhance the safety and security of accounts beyond that outlined above. These include the following:

- IB computes its securities segregation or reserve requirement on a daily rather than weekly basis as allowed by regulation, thereby ensuring timely determination as to the amount required to be reserved and the deposit of funds necessary to satisfy the requirement.

- IB’s does not avail itself of the generally more permissive rules with respect to the investment of commodity customer cash balances. These balances are instead invested in a manner similar to that of securities cash balances (i.e., U.S. government securities) with the exception of an occasional investment in money market funds.

- All customer securities positions are held in the securities segment of the Universal Account as opposed to the commodities (commodities margin met with cash and/or futures options), thereby limiting their hypothecation to the more restrictive rules of the SEC.

- In addition to SIPC coverage, IB maintains an excess SIPC policy with Lloyd's of London which, in aggregate with SIPC, offers insurance totaling $30 million (with a cash sublimit of $900,000), subject to an aggregate firm limit of $150 million.

- IB offers account holders the ability to sweep cash balances in excess of that required for margin purposes in either the securities or commodities segment to the other segment. Details as to this feature may be found in KB1851.

- For additional information regarding IB strength and security, please review the following website page.

Other Relevant Knowledge Base Articles:

Information Regarding SIPC Coverage

Footnotes:

1The term broker as used in this article is intended to refer to an organization registered with both the SEC as a Broker-Dealer and the CFTC as a Futures Commission Merchant for the purpose of conducting customer transactions

2Single stock futures are a hybrid product jointly regulated by the SEC and CFTC and allowed to be carried in either account type.

3Including cash obtained through the use of customer securities such bank pledges or stock loans less cash required to finance customer transactions (e.g., stock borrows, customer fails to deliver of securities, or margin deposited for short option positions with OCC).

4Assets, or customer property, which securities customers share in proportion to their net equity claim, include cash, margin securities and fully-paid securities held in “street name”. IB does not hold securities in the customer’s name which are not considered bulk customer property.

W8 Re-certification

If you are not a U.S. citizen or entity formed within the U.S. and have an account with Interactive Brokers, you are requested to declare your citizenship or country of formation with the US tax authority (IRS). This declaration can be done online by correctly filling out the W-8BEN form. Filling out this form is an easy process that only takes a few minutes. In the short movie below, we show you where to find the W-8BEN in your IB account management and how to fill it out.

If you fail to declare your foreign citizenship or country of formation, and IB does not have a valid W-8BEN form on file, you are presumed to be a US person/entity without a proper tax certification. As a US person/entity, you will be subject to backup withholding at a rate of 28% on interest, dividends, and substitute payments in lieu; as well as gross proceeds.

Every 3 years the IRS requires a re-certification of the W-8BEN form. IB will ask the beneficial account owner to re-certify their foreign status by re-signing the W8-BEN in order to continue their status as a foreign person and claim the tax treaty benefits. If you experience any problems or have questions regarding the W-8BEN form or how IB handles Non-US persons and entities, select this Tax Information and Reporting link and choose the tab Non-US Persons and Entities or consult the following IRS information page for more details: www.irs.gov/instructions/iw8/ch02.html

How to obtain an Online Security Code Card

The Online Security Code Card provides you temporary access to your account and trading platform for a duration of 21 days. This is an ad-interim solution usually needed in those cases:

A. You are temporarily away from your permanent security device and you are waiting to regain access to it.

B. You have lost your permanent security device and you want to either request a replacement or maintain access to your account while waiting for the delivery to happen.

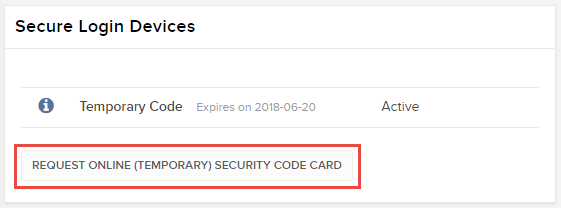

For the cases mentioned above, we assume you have already notified IBKR Client Services and obtained a Temporary Code, as explained in KB70. You can now extend the duration of your temporary access as follows:

Activation procedure

1. Open your browser and go to the web page ibkr.com

2. Click on Login

.png)

.png)

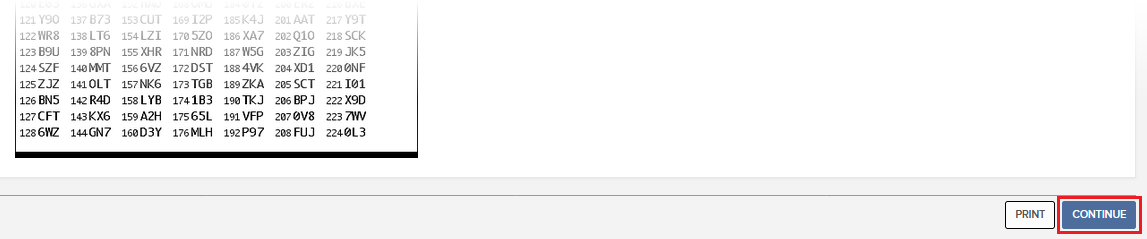

6. Your Online Security Card will be displayed. Click on Print2

(1).png)

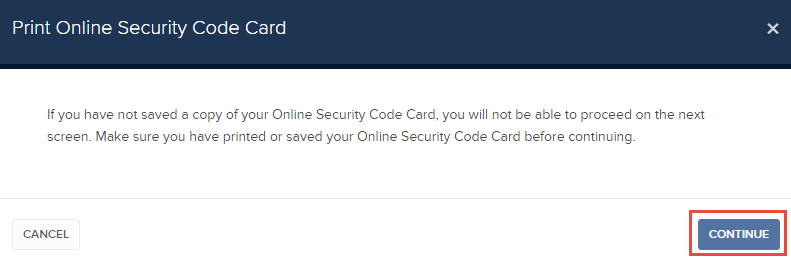

7. Please make sure the card has been printed correctly in all its parts and it is clearly readable. Then click on Continue

8. Two index numbers will appear on the activation screen. Locate the first index number on your card and enter the correspondent three digits code into the Card Values field. Then repeat the same operation for the second index number, leaving no spaces between the codes. Then click on Continue

9. You will see a confirmation message stating the expiration date of the card. Click on OK to finalize the procedure.png)

Notes

1. If you use the Classic Account Management, click on the top menu Manage Account > Security > Secure Login System > Security Device

References

- See KB1131 for an overview of the Secure Login System

- See KB1943 for instructions on requesting a replacement Digital Security Card+

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple Two-Factor Authentication System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

- See KB69 for information about Temporary passcode validity

How to Request Trading Permissions for IB U.K. CFD's

How to request trading permissions for IB U.K. Contracts for Difference (CFD's)

Account Linkage FAQs

Q: Which accounts are eligible for linkage?

A: Eligible accounts include Independent individual and IRA accounts which have matching country and state of legal residence and account title.

Q: What are the benefits of linkage?

A: The principal benefits of linkage are ease of access and potential savings in market data subscription fees. Following linkage, all accounts will be accessed via a single User Name, password and SLS device. After login to the trading platform or Client Portal Management you will be provided with a drop-down window for selecting the account you wish to trade or perform administrative tasks thereby eliminating the need to memorize multiple login information or maintain additional security devices.

In addition, as market data subscriptions are billed at a session level (i.e., User Name) and only a single TWS session can be viewed for any one user at a given time, account holders previously maintaining duplicate market data subscriptions for multiple accounts have the opportunity to consolidate those following linkage.

Q: If I link two accounts enrolled in SLS, are there any restrictions with respect to the security device which will remain following linkage?

A: Yes. In the case of a linkage request where the two accounts are SLS enrolled but maintain different devices, IBKR requires that the account holder retain the device having the highest protection rating as noted at the time of your request.

Q: What do I do with security devices which no longer are operable following linkage?

A: In the case of Security Code Cards, you may discard of the device once the linkage has been processed. For all other devices, you will need to return the device to IBKR to ensure that your account is not assessed a lost device fee. Click here for additional information regarding returning your device.

Q: Can I maintain multiple groups of linked accounts?

A: No. Once an account linkage has been requested and processed, all subsequent requests must be linked to that original grouping

Q: Can I unlink accounts which have already been linked?

A: No. Once a link has been established it is permanent and cannot be undone.

Q: Why has the linkage request which I submitted not been processed?

A: Linkage requests are automatically processed as of the close of business on the day submitted when accounts are SLS enrolled and the individual information on record identical (e.g. mailing address, telephone numbers, email address, etc.). If any of these conditions are not met, the linkage request will not be processed until SLS enrollment is complete and/or Compliance review of the information changes and any supporting documentation necessary to evidence the change has been received.

Q: Once linked, from which account will market data subscription fees be deducted?

A: Account holders are allowed to designate a billing account from which all market data fees may be deducted. We recommend that you select the account which generates the greatest level of commission activity if your subscription provides for fee waiver should your monthly commissions reach a minimum threshold (e.g., U.S. Securities & Commodities Market Data Bundle). IBKR will only look to the activity conducted in the billing account to determine waiver eligibility rather than aggregating the commission activity across all linked accounts. In selecting the billing account, consideration should also be given to selecting an account having the greatest level of equity as well as cash. This will minimize situations where the account has insufficient cash and the billing serves to increase the margin debit balance or where the account does not have margin permissions or maintains insufficient equity with loan value which, in both cases, will result in the liquidation of positions to cover the fees. IBKR will not act to automatically transfer cash across linked accounts to meet subscription obligations.

Q: If I link two accounts, will I have any restrictions on short sales?

A: Accounts owned by the same beneficial owner are considered in a consolidated manner when determining the ability to sell a stock short. If account A is long 100 shares and account B is short 100 shares, a new order to sell shares in either account A or account B will be considered a short sale, as overall the accounts hold a 0 position. The new sell order would be subject to any applicable locate requirements.

Cost Basis Reporting

1099 Reporting

Statement and Year End Reporting for US persons and entities comprises the following:

1. Cost Basis: While the required reporting schedule was staggered, the primary cost basis that will be reported to the IRS includes equities bought and sold after December 31, 2010. This includes the adjusted cost basis resulting from wash sales and corporate actions.

The future phase-in period for broker reporting includes the assets sold on or after the following dates:

--- Mutual Funds and ETFS - 1/1/2012

--- Simple debt instruments (i.e. treasuries, fixed-rate bonds & municipal bonds) and options, - 1/1/2014

--- Other debt instruments - 1/1/2016

2. Tax Basis Method: Brokers are required to use the method first in, first out (FIFO), unless given other instructions by an investor. Changes to your tax basis method may be submitted through the Tax Optimizer. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades.

IB offers multiple tax basis methods, including three basic options:

● First In, First Out (FIFO) - This is the default option. FIFO assumes that the oldest security in inventory is matched to the most recently sold security.

● Last In, First Out (LIFO) - LIFO assumes that the newest security acquired is sold first.

● Specific Lot - Lets you see all of your tax lots and closing trades, then manually match lots to trades. Specific Lot is not available as the Account Default Match Method.

Tax Optimizer also lets you select the following additional derivatives of the specific identification method.

● Highest Cost (HC), Maximize Long-Term Gain (MLTG), Maximize Long-Term Loss (MLTG), Maximize Short-Term Gain (MSTG), and Maximize Short-Term Loss(MSTL).

For complete instructions on using the Tax Optimizer and details on the lot-matching algorithms for each method, see the Tax Optimizer Users Guide.

Note: Changing your tax basis is effective immediately. The basis selected will be applied to all subsequent trades on the account statements and tax reports. Updates will not affect previously closed trades nor the TWS profit and loss data displayed.

3. Gain & Loss Categories: An additional requirement to the cost basis reporting is the capital gain or loss category. The gain or loss category of equities is determined by the length of time in which the security was held, known as the "holding period."

● Short-Term - Holding periods of one year or less are categorized as "short-term."

● Long-Term - Holding periods over one year are categorized as "long-term."

Year End Reports

The following statements and reports display cost basis information that will be reported on Form 1099-B for eligible accounts.

- Monthly Account Statements

- Annual Account Statements

- Worksheet for Form 8949

For a complete review of the tax information and year end reporting available, click here.

Note: Unlike the Account Statements, the Gain & Loss Worksheet for Form 8949 may consolidate sell trades. The cost basis will be adjusted, as required for 1099-B reporting.

Asset Transfers

U.S. legislation from 2008 included new guidelines for tax reporting by U.S. financial institutions. Effective January 2011, U.S. Brokers are required to report cost basis on sold assets, whether or not a gain/loss is short-term (held one year or less) or long-term (held more than one year). U.S. brokerage firms, Interactive Brokers LLC (IB) included, implemented changes to comply with the legislation.

For more information on cost basis with asset transfers, see Cost Basis & Asset Transfers.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

Linking Accounts

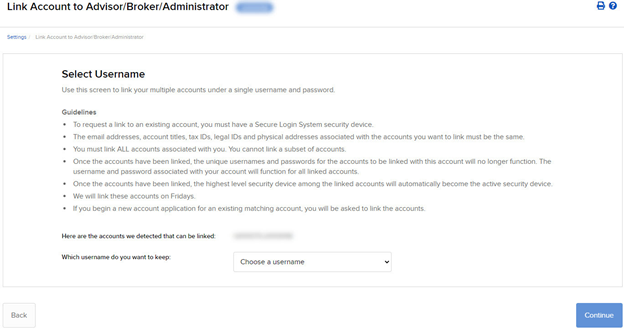

Account linkage allows for individual account holders maintaining multiple existing accounts or seeking to open a new account the ability to group those accounts together. In the case of a new account, linkage affords the opportunity to open the account without having to complete a full application, with the account holder providing solely that additional information which is specific to the new account. New account linkages are initiated either from the Client Portal of the existing account (via the User menu (head and shoulders icon in the top right corner) > Settings > Account Settings > Trading > Open an Additional Account) or automatically when initiating a new application from the website. The following article outlines the steps for linking one or more existing accounts.

1. Log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Settings > Trading > Link Account to Advisor/Broker/Administrator.

.png)

2. Select the radio button next to Link All of My Existing Account Under a Single Username and Password, and then click CONTINUE.

The Select Username screen opens.

3. The screen shows all of your accounts that can be linked under a single username and password. Select which username you want to keep. Once your accounts are linked, you will use the selected username to log in to any of the linked accounts.

4. The screen updates to display the security device for the selected username. Click CONTINUE.

5. A series of pages appears to prompt you to enter the username and password for each account to be linked, followed by additional authentication using your Secure Login device.

6. Enter the username, password and authentication values for each account to be linked on the next screens, clicking CONTINUE to advance to the next screen.

7. We aggregate the financial information and trading experience info for all accounts to be linked. Verify your financial information and trading experience for the accounts to be linked, and then click CONTINUE.

8. Verify your account information and click CONTINUE.

9. If you need to update your financial information, trading experience or account information, wait for those updates to be approved and then restart this linking procedure.

10. Verify any saved bank information you may have and click CONTINUE.

11. Click CONTINUE.

12. Click Ok.

For information on how to cancel a linkage request, see Canceling a Pending Link Request.

IMPORTANT NOTES

* Once linked, account access to Client Portal and the trading platform is accomplished using a single user name and password each of which will contain a drop-down window for selecting the account that the owner wishes to act upon.

* As market data subscriptions are billed at a session level (i.e., user name) and only a single TWS session can be open for any one user at a given time, account holders previously maintaining subscriptions for multiple users have the opportunity to consolidate subscriptions to a single user. Account holders wishing to view multiple TWS sessions simultaneously may add additional users (subject to separate market data subscriptions). In addition, only those market data subscriptions already associated with the surviving user name will remain in effect following consolidation. Account holders maintaining different subscriptions across multiple users are advised to review those subscriptions subject to cancellation in order to determine which they wish to resubscribe to under the surviving user name. Also note that the market data subscriptions either terminated or initiated mid-month are subject to billing as if they were provided for the entire month (i.e., fees are not prorated).

Message Center User Guide

- every inquiry is assigned a case number ("ticket"). This reference number can be used to efficiently track the progress of the inquiry.

- the real-time status of an inquiry is always available via an overview screen. You will know if the issue has been picked up by an IB service expert, which expert is handling your issue, and whether it is being addressed by our main help team or by a specialty team.

- both customers and IB staff can refine or add information to the ticket, permitting easy clarifications or follow up to the original inquiry. In addition, customers can cancel or close tickets once the issue has been addressed giving them greater control.

- History Overview of both open and completed inquiries

- Fast Response: Tickets will be assigned to an IB representative usually within a few minutes and always within 2 hours during European and North American trading hours. During Asian trading hours, response times may be longer.

- Open tickets are presented in the default view with date/time of submission, a brief description of the question, the most recent response from IB staff, the name of the IB Expert handling the inquiry, and a status indicator.

- A second tab shows closed or resolved inquiries going back 1 month. This allows customers to refer to the solutions or information provided by IB and save them on their computers in a document system of their choice (simple cut-and-paste). Status indicators allow customers to know at a glance where their inquiry is in the process. A key for the meanings of the various states are provided at the bottom of the overview screen. Action buttons (edit/view, close, cancel) permit customers to manage their inquiries directly.

- Resolve/Close

: use this when you are satisfied with the response provided by the IB service expert. This will move the ticket onto the "Closed" tab. Please note that IB staff may also close a ticket if they feel the inquiry has been completely addressed.

: use this when you are satisfied with the response provided by the IB service expert. This will move the ticket onto the "Closed" tab. Please note that IB staff may also close a ticket if they feel the inquiry has been completely addressed. - Cancel Ticket

: allows customers to retract an inquiry even if it has not yet been fully addressed.

: allows customers to retract an inquiry even if it has not yet been fully addressed. - Edit/View: customers can add additional information to an inquiry or respond back to an IB Expert's request for more detail.

- Click New Ticket in the menu bar. This will open a new window (you must allow pop-ups on your browser).

- Select the main Category and a SubCategory for the inquiry. The category will allow us to route your inquiry to the IB Expert who is specialized or is most experienced for your issue. We recommend choosing the category accurately to get the highest quality and speed of response.

- Enter a brief summary of the question. This is the text you will see in the overview screen.

- Enter details about the problem as needed. Please be as specific and complete as possible (for example, exact dates/times, TWS version, etc) , as this will allow us to accurately research your inquiry to give you the best / fastest response.

- Click "Next". This will take you to a confirmation screen that will allow you to review and submit your inquiry

- You will get a confirmation of receipt along with a ticket reference number. Note this reference number (it is also viewable on the Overview Screen) and please use it in any follow up to your inquiry (for example, over chat or by phone).

- The inquiry will show in the Overview Screen with the status=New.

- On the Overview Screen, select the open ticket you wish to update, and click on the Edit icon at the end of the row.

- A new window will open showing the history of the "conversation" to date, along with a text entry box for the new information to be added.

- Click "Send" to submit. After some seconds, you will get a confirmation from IB that the update has been received by our system.

- On the Overview Screen, select the open ticket you wish to update, and click on the paperclip

icon.

icon. - A new window will open showing the history of the "conversation" to date, along with a text entry box to add information about the attachment(s). Below the text box there is a section called "Attach Files" with the possibility of adding 3 attachments. Click "Browse" to find the file to be attached. Please note the max upload size is 2Mb per file with a 6Mb cap for all files.

- Click "Send" to submit. After some seconds you will be fowarded to the preview ticket mode where the attached file(s) name will be visible in the comment section.

- Use this when your inquiry has been resolved outside of the IB CIMS environment (for example, an exchange access problem that has already been fixed). This will move the ticket to a "Closed" state (CLS) immediately and will inform IB staff that there is no further need to investigate the issue.

- Just click on the Cancel

icon on the appropriate ticket row. A confirmation page will be provided.

icon on the appropriate ticket row. A confirmation page will be provided.

- Use this when you have received a satisfactory answer to your inquiry. This will change the ticket state to "Closed" (CLS). We request that you close tickets as soon as possible once you are satisfied. IB Customer Service managers may close tickets in cases where the ticket appears to be fully answered but has not been closed by the customer.

- Just click on the Close icon on the appropriate ticket row. A confirmation page will be provided.

- The IB-Expert might close a ticket after responding if he/she believes the inquiry was fully and satisfactorily resolved. It may be the case thaat the Client does not agree that the question was properly answered so we provide a way to reopen recently closed tickets. Just click on the Re-Open link on the appropriate line of the overview page. The ticket status should show LV1 and the IB-Expert who handled the ticket will be notified.

- Just click on the "Reopen" link on the appropriate ticket row. A confirmation page will be provided.