Entity and FATCA Classification for Non-Financial Entities

Introduction

Interactive Brokers (“IB”, “we” or “us”) is required to collect certain documentation from clients (“you”) to comply with U.S. Foreign Account Tax Compliance Act (“FATCA”) and other international exchange of information agreements.

This guide contains a series of flowcharts and accompanying notes that summarize IRS rules relating to:

1. The tax classification for purposes of determining which W-8 or W-9 tax form an entity is required to complete; and

2. The FATCA classification required of entities completing the W-8 tax form (Part I, Section 5).

![]() Note: The flowcharts and notes contained herein do not cover every possible scenario and other scenarios not presented here exist and may more closely align with your situation. You should consult a tax professional regarding your particular circumstances if you are still unsure of your U.S. entity and/or FATCA classification after reading this guide.

Note: The flowcharts and notes contained herein do not cover every possible scenario and other scenarios not presented here exist and may more closely align with your situation. You should consult a tax professional regarding your particular circumstances if you are still unsure of your U.S. entity and/or FATCA classification after reading this guide.

What is NOT Covered in this Guide

The guide is directed to non-U.S. entities that (i) are the beneficial owners of the payments made to the account and (ii) are not financial institutions. This guide does not apply to:

• Individuals (use W-9 or W-8BEN)

• U.S. entities (use W-9)

• Entities acting as an intermediary (such as a nominee, broker, custodian, investment advisor) on behalf of another person (use W-8IMY).

• Non-U.S. Tax-Exempt Organizations and Private Foundations

• Financial Institutions

![]() Note: The U.S. entered into bilateral agreements called Intergovernmental Agreements (IGAs) with many countries regarding the implementation of FATCA. In some cases, the provisions of an applicable IGA could modify the results described in this guide. Entities are covered by an IGA should refer to the IGA and/or consult a tax professional for their filing requirements.

Note: The U.S. entered into bilateral agreements called Intergovernmental Agreements (IGAs) with many countries regarding the implementation of FATCA. In some cases, the provisions of an applicable IGA could modify the results described in this guide. Entities are covered by an IGA should refer to the IGA and/or consult a tax professional for their filing requirements.

1. U.S. Tax Classification

Your U.S. income tax classification determines the tax form(s) required to document the account. The flow chart below may help you determine your tax classification and the tax form to be completed.

Important: The U.S. imposes income tax on its residents’ worldwide income. On the other hand, nonresidents are only subject to withholding tax on certain limited types of US source investment income (dividends from U.S. companies, etc.). Completion of a W-8 series tax form certifies you are NOT taxable as a U.S. resident. A W-8 form may also be used to claim a reduced rate of withholding tax under a U.S. income tax treaty.

Flowchart for Determining Tax Classification and Required Tax Form (Non-Trust Entities)

.png)

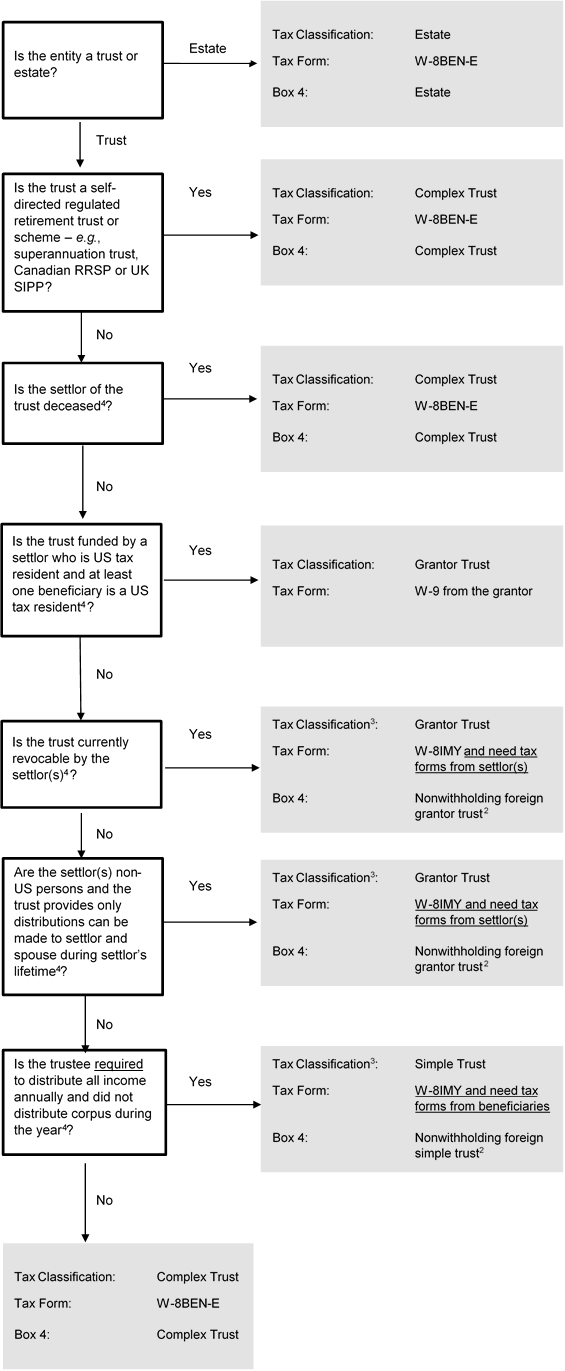

Flowchart for Determining Tax Classification and Required Tax Form (Trusts)

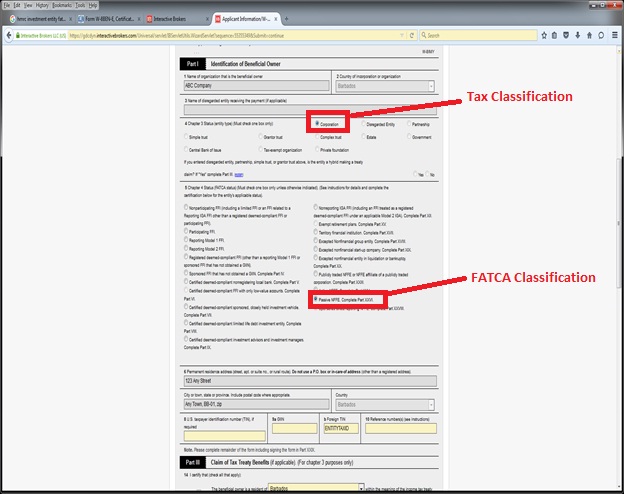

2. FATCA Classification

The W8 tax forms are also used to collect FATCA classifications. Many countries have executed “Intergovernmental Agreements (IGA)” with the U.S. requiring its local financial institutions to classify its customers for FATCA purposes. The classification rules under an IGA may not exactly match the classification rules established by the IRS. Other institutions have agreed with the IRS to become FATCA compliant and determine their customers’ FATCA classifications under the IRS rules. We are required to collect this information. The flowchart below applies the IRS default FATCA classification rules and is general in nature. The flowchart is accompanied by sample W-8BEN-E screenshots for a common account structure: a non-U.S. corporation classified for FATCA purposes as a Passive Non-Financial Foreign Entity (NFFE), which qualifies for treaty witholding rates.

![]() Note: It is important to recognize many organizations meet the qualifications for multiple FATCA types and you must select the most appropriate classification. Your specific situation may not fall within the general guidance. We recommend you seek your own independent advice as we are not in a position to make this determination for you and the rules are complex.

Note: It is important to recognize many organizations meet the qualifications for multiple FATCA types and you must select the most appropriate classification. Your specific situation may not fall within the general guidance. We recommend you seek your own independent advice as we are not in a position to make this determination for you and the rules are complex.

Flowchart for Determining FATCA Classification

.png)

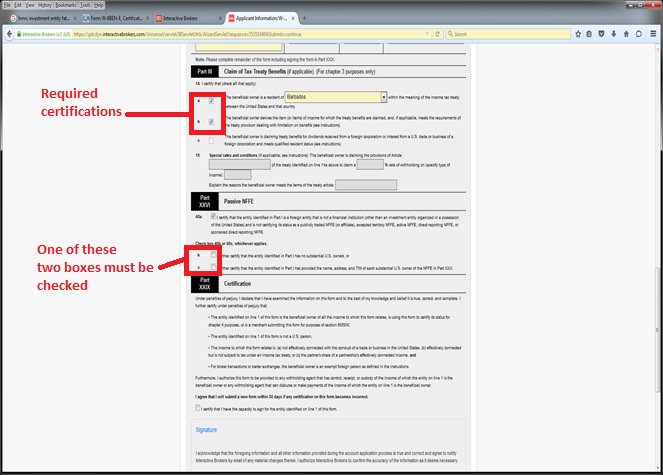

Example: A corporation is a common form of entity ownership, involving two or more owners with none having any personal liability for the debts of entity. As outlined in the Tax Classification flowchart above, an entity of this type would be required to complete the W-8BEN-E. Assuming the corporation is not classified as a Foreign Financial Entity (e.g. bank, broker, investment manager, hedge fund, mutual fund, insurance company) as discussed in footnote 5 below, then its FATCA classification would be Passive NFFE. Screenshots of the W-8BEN-E for this sample entity are provided below.

Sample Screenshots - W-8BEN-E (Passive NFFE)

Footnotes

1 The US Internal Revenue Service (IRS) established rules for determining the tax classification of entities formed outside the United States. These rules apply regardless of how the entity is classified in its country of organization or residency.

Generally corporate entities are treated as the beneficial owners of an account and should complete a W-8BEN-E and select “corporation” unless they elect otherwise (discussed below).

IRS regulations assign a default classification to each entity type. This default classification may be overridden by making a filing with the IRS and obtaining an US employer identification number. Certain entities cannot change their classification and are treated as corporations in all events (e.g., Sociedad Anonima, Public Limited Company and Aktiengesellschaft). A complete list may be found at US Treasury Regulation Section 301.7701-2(b)(8).

The IRS default classification usually depends on (i) the number of owners and (ii) whether any owner is personally liable for the debts of the entity based on the organizing statute (i.e., bank guarantees or other contractual agreements by owners are ignored). The following table summarizes the default rules:

|

|

Number of Owners

|

Owners have Limited Liability?

|

|

|||

|

|

Yes?

|

No?

|

|

|||

|

|

1 Owner

|

Corporation

|

Disregarded Entity

|

|

||

|

|

2+ Owners

|

Corporation

|

Partnership

|

|

||

|

|

|

|

||||

Note: Since the entity tax classification of a disregarded entity is determined by its owner, a US disregarded entity may find the flowchart helpful if the owner is a non-US entity.

A fiscally transparent entity (such as a partnership, simple trust or grantor trust) using IRS Form W-8IMY must provide IRS tax forms for all of its beneficial owners (partners in a partnership, beneficiaries for a simple trust and settlors for a grantor trust) for the account to be documented for US tax purposes.

Certain unit investment trusts (generally where there is an ability to vary the investments) are not considered trusts for US tax purposes. These investment trusts are treated in the same manner as a traditional business entity under the rules discussed above (i.e., corporation, partnership or disregarded entity).

Finally, a trust (other than a unit investment trust treated as a business entity) is considered a non-US trust for US tax purposes if (1) a court outside the United States is able to exercise primary supervision over the administration of the trust, and (2) any non-US person has the ability to control (or veto) any “substantial decision” of the trust.

The flowchart assumes that the default entity classification rules apply and the entity is not a per se corporation.

2 A partnership or simple or grantor trust may enter into a withholding agreement with the IRS pursuant to which the partnership or simple or grantor trust agrees to withhold US taxes on the account. The flowchart assumes no withholding agreement was executed.

3 In general, US tax treaty benefits are granted to the beneficial owner of the income determined under US tax principles. For fiscally transparent entities (such as partnerships, simple or grantor trusts or disregarded entities), this means the owners of the entity, NOT THE ENTITY ITSELF, claim US tax treaty benefits. These benefits are claimed on the beneficial owners’ W8 tax forms. However in certain limited cases, an entity may be considered fiscally transparent for US tax purposes but not fiscally transparent by the country with which the US has an income tax treaty. This type of an entity is called a “hybrid entity.” In certain cases, a hybrid entity, not the owners, may claim US tax treaty benefits if the hybrid entity meets the so-called qualified resident test under the applicable tax treaty. A qualifying “hybrid entity” claims the benefits of a US tax treaty by providing a Form W-8BEN-E, in addition to the form required by the flowchart. Importantly, electing hybrid status does not eliminate the need to document all beneficial owners. We note it is unusual for a hybrid entity to claim treaty benefits. The more common scenario is the beneficial owners claim treaty benefits on their tax forms.

4 The rules for classifying trusts are difficult and complex. The flowchart applies generalized rules only. There are many nuances to be considered when classifying a trust which are not addressed in the flowchart. For example, simple trusts cannot have charitable beneficiaries.

5 What is a foreign financial institution for FATCA purpose?

The various FATCA classifications can be broken down into two major categories: foreign financial institutions (FFI) and non-financial foreign (NFFE). Very generally, a financial institution is an entity that is a:

• Depository Institution

• Custodial Institution

• Investment Entity

• Insurance Company that issues certain cash value insurance or annuity contracts.

An FFI typically is required to register with the IRS, obtain a Global Intermediary Identification Number and report on its customers / owners to the appropriate tax authorities. If the entity does not meet the definition of a Financial Institution, it is considered an NFFE and covered by this guide book.

Subject to variations under IRS regulations and intergovernmental agreements:

• a Depository Institution is an institution that accepts deposits in the ordinary course of a banking or similar business. This includes banks and credit unions.

• a Custodial Institution is an institution which holds financial assets for the account of others as a substantial portion of its business. This includes brokers, custodial banks, trust companies, clearing organizations, etc.

• an Investment Entity is any entity if either

(i) the entity generates 50%+ of its gross income from (i) trading in money market instruments, foreign currency, transferrable securities, interest rates, futures, etc.; (ii) portfolio management or (iii) otherwise investing, administering or managing funds or financial assets on behalf of other persons (generally, broker-dealers and investment managers);

or

(ii) 50%+ of the entity gross income is attributable to investing, reinvesting, or trading in financial assets AND it is managed by a Financial Institution (mutual funds, hedge funds, and collective investment vehicles are examples);

or

(iii) the entity holds itself out as an entity created to invest, reinvest, or trade invest in financial assets (mutual funds, hedge funds, and collective investment vehicles are examples).

An individual cannot be an FFI. Thus, an organization managed by a professional individual investment advisor (as opposed to an employee of an organization) would not be considered an Investment Entity under (ii) above because it is not managed by a financial institution.

Trusts, family investment companies and funds may fall within the definition of an Investment Entity when they are professionally managed by a financial institution – i.e. where a financial institution handles the day-to-day functions of the entity or has discretionary authority over the fund.

Example: Individual created a non-US Trust A and appoints X, a non-US bank or other financial institution, as the trustee. X, as trustee, is responsible for the management and administration of Trust A. Trust A is an Investment Entity and a Foreign Financial Institution because it is managed by a Foreign Financial Institution.

Example: Individual created a non-US Trust A and appoints Y, an individual professional manager, as the trustee. Y, as trustee, is responsible for the management and administration of Trust A. Trust A is not an Investment Entity or a Foreign Financial Institution because it is not managed by a Foreign Financial Institution. Individuals cannot be financial institutions.

6 The IRS has a list of countries with which it has executed intergovernmental agreements (IGAs) to authorize the implementation of FATCA in that jurisdiction. The list of IGAs can be found at https://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA....

7 See #4 for the definition of Financial Institution. An organization that is not considered a financial institution is considered a non-financial foreign entity (NFFE). There are 3 types of NFFEs; Excepted, Active and Passive. An Active NFFE is an operating business where less than 50% of (i) its gross income is considered passive income and (ii) its average assets are held for the production of passive income. Any NFFE that is not Excepted or Active is a Passive NFFE and must provide us with a certification of its substantial US owners (if any) – generally 10%+ direct or indirect ownership. Some IGAs modify the means of substantial US owners and refer to them as Controlling Persons.

8 Other possible choices include nonfinancial group entity, excepted nonfinancial start-up company, excepted non-financial entity in liquidation or bankruptcy, publicly traded NFFE or sponsored NFFE. See the instructions to the W-8 for further information.

Disclaimer

This guide does not constitute tax or legal advice and Interactive Brokers cannot advise you on how to complete IRS Forms W-8. Examples included in this guide are for illustration only and do not address all possible scenarios. Please consult your tax professional if you are unsure how to complete IRS Forms W-8.

FATCA FAQs - Issues Involving Mismatch Between Tax Treaty Country and Address

FATCA related FAQs involving mismatches between tax treaty country and address. See KB2601 for other FATCA related FAQ topics.

Q1: I claimed treaty benefits in one country but have an address outside that treaty country. Why did I receive an email asking for additional documentation?

A1: We are required to verify your connection with the treaty country since you also have an address outside that country. We can process your claim for treaty benefits if you provide one document from Category (A) AND one document from Category (B) below.

|

Category (A)

|

AND

|

Category (B)

|

|

ANY OF the following unexpired documents issued by the treaty country:

|

ANY OF the following documents that match your address in the treaty country:

|

|

|

· Driver’s license

|

· Driver’s license

|

|

|

· Passport

|

· Bank or brokerage statement*

|

|

|

· National identity card

|

· Utility bill*

|

*Bank or brokerage statements and utility bills must be less than 12 months old. Alternatively, if you cannot provide documents from both categories, please provide a written explanation as to why you are entitled to treaty benefits together with any supporting documentation. Note: we may request further information or documentation from you depending on the explanation provided.

Q2: I submitted a proof of address and I received an email that the document submission did not resolve the issue. Why?

A2: Please confirm that the proof of identity you submitted was issued by the treaty country and that the proof of address relates to your address in the treaty country. A proof of address document alone is not sufficient to resolve the matter. Sometimes, customers inadvertently submit documentation for the other address. Please check the date of the proof of address document. We can only accept documents dated less than 12 months old. Also confirm you submitted a proof of identity document from the treaty country.

Q3: I live in Hong Kong and chose China as my tax treaty country on my Form W-8BEN. I received a notification saying the proof of address and proof of identity I submitted was not sufficient to claim benefits under the U.S.-China tax treaty. Hong Kong is a Special Administrative Region of the People’s Republic of China, so the U.S.-China tax treaty applies to it, correct?

A3: No. According to the US Internal Revenue Service, the U.S.-People’s Republic of China tax treaty does NOT apply to Hong Kong. Unless you can provide a proof of address and identity in the People’s Republic of China or provide other evidence that you are a tax resident of People’s Republic of China, you may not claim Chinese tax treaty benefits.

Q4: I live in Macau and chose China as my tax treaty country on my Form W-8BEN. I received an e-mail saying that the proof of address I submitted for my Macau address was not sufficient to claim benefits under the U.S.-China tax treaty. Macau is a Special Administrative Region of the People’s Republic of China, so the U.S.-China tax treaty applies to it, correct?

A4: No. According to the U.S. Internal Revenue Service, the U.S.- People’s Republic of China tax treaty does NOT apply to Macau. Unless you can provide a proof of address and identity in the People’s Republic of China or provide other evidence that you are a tax resident of People’s Republic of China, you may not claim Chinese tax treaty benefits.

Q5: I live in Taiwan, ROC and chose China as my tax treaty country on my Form W-8BEN. I received an e-mail saying that the proof of address I submitted for my address in Taiwan, ROC was not sufficient to claim benefits under the U.S.-China tax treaty. Taiwan, ROC is formally known as the Republic of China, so the U.S.-China tax treaty applies to it, correct?

A5: No. According to the US Internal Revenue Service, the U.S.- People’s Republic of China tax treaty does NOT apply to Taiwan, ROC. Unless you can provide a proof of address in People’s Republic of China or provide other evidence that you are a tax resident of People’s Republic of China, you may not claim Chinese tax treaty benefits.

Q6: The information you have in your master file is out-of-date. I moved so that the address you identified as outside the treaty country is incorrect. What should I do?

A6: The fastest and most effective way to remedy the situation is to provide the requested information (see FAQ#1 above) so that our records are complete. You should also log into Account Management and make any required changes to your personal information.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Address or Telephone Number

FATCA related FAQs involving U.S. address or telephone number. See KB2601 for other FATCA related FAQ topics.

Q1: I received a notification that a review of my file indicated a U.S. address or telephone and additional information is required. What additional information do I need to provide?

A1: You need to provide one document from Category (A) AND one document from Category (B) from the table below AND a written explanation explaining the U.S. address.

|

Category (A)

|

AND

|

Category (B)

|

AND

|

Category (C)

|

|

ANY OF the following documents issued by a non-US country:

|

ANY OF the following documents that match your foreign address:

|

A reasonable written explanation supporting your claim of non-US status.

|

||

|

· Driver’s license

|

· Driver’s license

|

|||

|

· Passport

|

· Bank or brokerage statement*

|

|||

|

· National identity card

|

· Utility bill*

|

*Bank or brokerage statements and utility bills must be less than 12 months old.

Q2: The day count table on the account application says I am a U.S. tax resident and will not let me complete IRS Form W-8. What should I do?

A2: The US Internal Revenue Service generally considers individuals who spend a significant number of days in the United States each year to be U.S. taxpayers. The table flags customers who exceed those IRS rules for U.S. income tax residency and requires a W-9. Alternatively, it may be possible for you to satisfy the “closer connection test” or utilize a U.S. tax treaty to avoid U.S. tax residency. Please refer to IRS Publication 519 for details or consult a tax professional regarding IRS rules for counting days, the closer connection test and U.S. tax treaties.

Q3: I am a studying in the U.S. and present on an F-1 visa. I responded to your email and provided a copy of my F-1 visa. I received an email saying my response was insufficient to resolve the issue. Why?

A3: Please check the expiration date of your visa. If your visa has expired, please provide other evidence of your status, such as an Optional Practical Training (OPT) card, a copy of Form I-20 endorsed by the DSO for your school or another Employment Authorization Document (EAD). Also confirm you submitted the necessary proof of identify and address documentation.

Q4: I use my daughter’s address to receive all mail. She lives in the United States. What should I do?

A4: In this case, you can probably satisfy the substantial presence test noted in the notification you've received . Please provide the number of days you spent or plan to spend in the U.S. in the current and prior two years (e.g., 2015, 2014 and 2013). Also refer to the documentation requirements outlined in FAQ#1 above.

Q5: The address or telephone you noted in your email is out-of-date. I have since moved out of the United States. What should I do?

A5: The fastest and most effective way to remedy the situation is to provide the information as requested in the notification you've received (see FAQ#1 above), so that our records are complete. You should also log into Account Management and make any required changes to your personal information of record.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

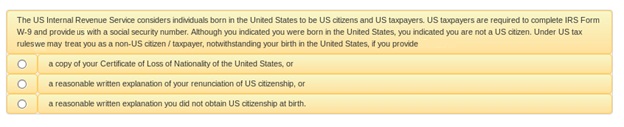

FATCA FAQs - Issues Involving U.S. Passport or Other Evidence of U.S. Citizenship

FATCA related FAQs involving U.S. passport or other evidence of U.S. citizenship . See KB2601 for other FATCA related FAQ topics.

Q1: I received a notification saying a review of my file indicated I am a U.S. citizen. I am being asked to complete IRS Form W-9 and provide a U.S. Social Security Number. I am not a U.S. citizen. What should I do?

A1: In most cases you received this message because our review of your file indicated you had U.S. citizenship or a U.S. place of birth, which likely infers automatic U.S. citizenship and U.S. taxpayer status even if you do not live in the U.S. or hold a U.S. passport. US citizens are required to provide us with IRS Form W-9 and a valid social security number. Nevertheless, we may accept IRS Form W-8 from you to establish your status as a non-U.S. taxpayer if you provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport evidencing citizenship in another country. Alternatively, you may provide us with a written explanation of why you are not a U.S. citizen (for instance, you were born in the United States to parents who were fully-accredited foreign diplomats). We may request further information from you depending on the explanation provided.

Q2: I gave up my U.S. citizenship. What should I do?

A2: Please provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport from another country.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Green Card Holders

FATCA related FAQs involving U.S. Green Card Holders. See KB2601 for other FATCA related FAQ topics.

Q1: I have a U.S. Green Card but am not a U.S. taxpayer. What additional information or documentation do I need to provide to ensure you can accept my Form W-8BEN?

A1: In general, all U.S. Green Card holders are U.S. taxpayers, even if they do not live in the United States (and even if their Green Card has expired or is otherwise invalid). In general, a U.S. Green Card holder cannot provide Form W-8BEN, and must provide Form W-9 instead. If you are a former U.S. Green Card holder who gave up your U.S. Green Card, you will need to provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status.

Q2: I used to have a U.S. Green Card but gave it up. What additional information or documentation do I need to provide to ensure you can accept my Form W-8BEN?

A2: You will need to provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status).

Q3: I have a U.S. Green Card but it expired. I received notification asking me provide a reasonable written explanation as to why I am a non-U.S. taxpayer despite having a Green Card. I responded that my Green Card is expired but received an email saying my response was insufficient to resolve the issue. Why?

A3: Even if your Green Card has expired for immigration purposes (that is, you cannot use it to enter the United States), tax rules, generally, provide you remain a U.S. taxpayer until you formally renounce your U.S. Green Card. Generally, a U.S. Green Card holder cannot provide Form W-8BEN, and must provide Form W-9 instead. If you did formally renounce your US Green Card, please provide a copy of your Form I-407 (Record of Abandonment of Lawful Permanent Resident Status).

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - Issues Involving U.S. Place of Birth

FATCA related FAQs involving U.S. Place of Birth. See KB2601 for other FATCA related FAQ topics.

Q1: I was born in the United States but I do not have a U.S. passport and am not a U.S. taxpayer. Why am I being asked for additional documentation?

A1: In most cases, you automatically acquired U.S. citizenship when you were born in the United States even if you have never applied for a passport. U.S. tax rules designate all U.S. citizens as U.S. taxpayers, even those that did not live in the U.S. or receive a U.S. passport. U.S. citizens are required to provide us with IRS Form W-9 and a valid taxpayer ID (e.g. Social Security Number). Nevertheless, we may accept IRS Form W-8 from you to establish your status as a non-U.S. taxpayer if you provide us with a copy of your Certificate of Loss of Nationality of the United States (Form DS-4083) and a copy of your passport evidencing citizenship in another country.

Alternatively, you may provide us with a written explanation of why you are not a U.S. citizen (for instance, you were born in the United States to parents who were fully-accredited foreign diplomats). We may request further information from you depending on the explanation provided.

Q2: I was born in the United States but I am not a U.S. taxpayer. I do not have a Certificate of Loss of Nationality of the United States (Form DS-4083). What should I do?

A2: In general, you are a U.S. citizen and U.S. taxpayer if you were born in the United States. Unlike many jurisdictions, the U.S. taxes its citizens regardless of where they live (or even if they have never lived in the United States). We cannot accept IRS Form W-8 from a U.S. citizen, and must receive a Form W-9 instead. If you are a former U.S. citizen who gave up your citizenship, please refer to the FAQ above for the additional information and documentation you may need to provide to establish your status as a former U.S. citizen.

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

FATCA FAQs - General

General FAQs involving FATCA . See KB2601 for other FATCA related FAQ topics.

Index of FATCA Related FAQs

Outlined below are links to a series of FATCA related FAQs organized by topic. For a general overview of FATCA, please see KB1986.

1. General (See KB2602)

2. Issues Involving U.S. Place of Birth (See KB2603)

3. Issues Involving U.S. Green Card Holders (See KB2604)

4. Issues Involving U.S. Passport or Other Evidence of U.S. Citizenship (See KB2605)

5. Issues Involving U.S. Address or Telephone Number (See KB2606)

6. Issues Involving Mismatch Between Tax Treaty Country and Address (See KB2607)

We do not provide tax advice. Please consult your tax advisor for advice in completing tax forms and determining your taxpayer status.

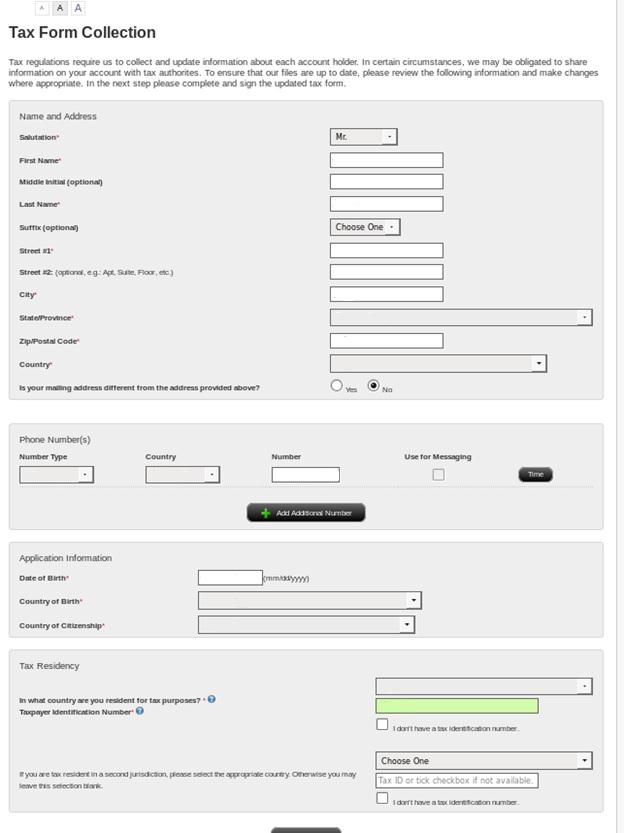

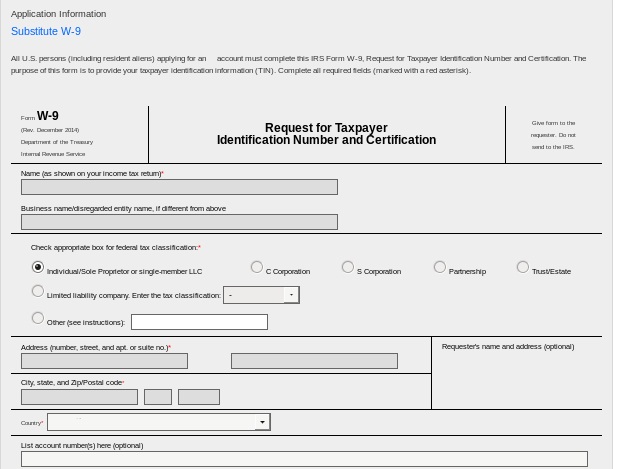

IB Tax Form Users Guide

Introduction

Client should hit “Submit” button after all personal information is completed. Assuming no entry errors have been made, the client will be directed to Page 2 (tax form).

Screen 1

Important: To change the pre-populated information on the W-9, the client MUST hit the back button and change the relevant information on the prior page for the tax form to be updated.

Important: The first 3 boxes on the W-9 under certification must be checked to avoid having the client subject to back up withholding.

.jpg)

Next, the client will need to provide an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen and select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

.jpg)

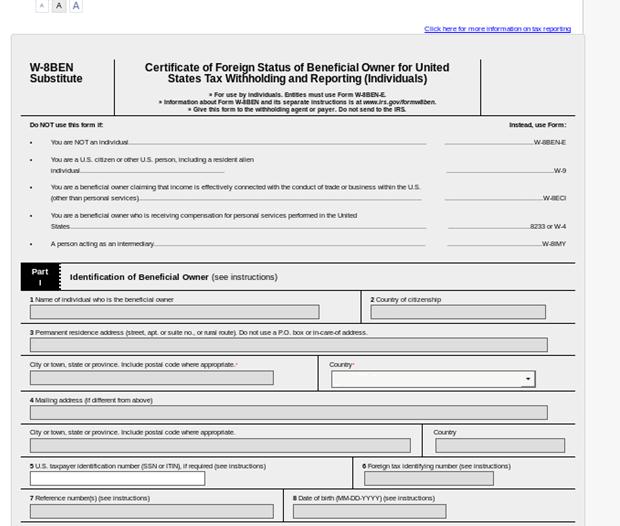

On Part II of the W-8BEN the client will be prompted to specify whether they are a resident of a country which maintains a tax treaty with the U.S. Only those countries with which the U.S. maintains a treaty will be shown on the drop-down list and if the client does not see his or her treaty country, the client should select “N/A” or “I am not resident in a treaty country.”

.jpg)

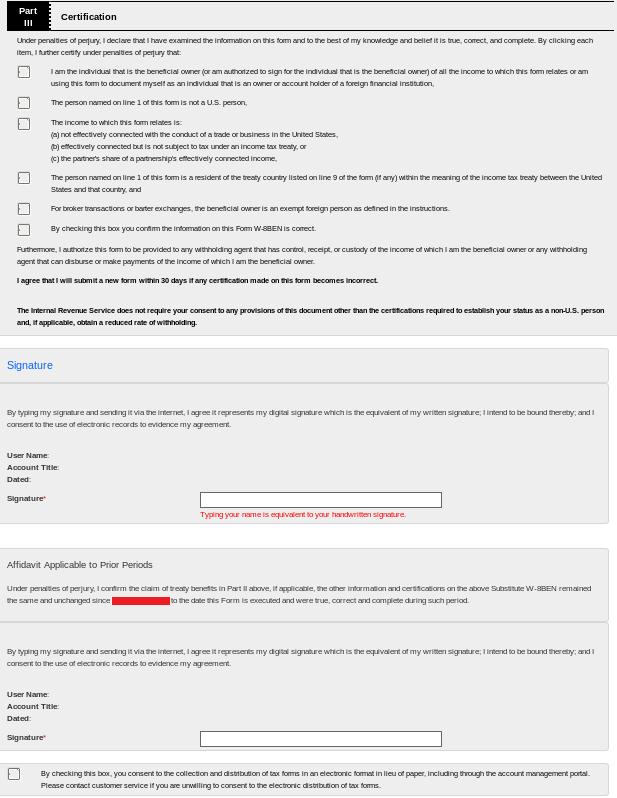

On Part III of the W-8BEN the client will be prompted to certify that the information provided on the form is accurate by checking the boxes and providing an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen.

The client will then be prompted to check the box through which they consent to electronic collection and delivery of tax forms and then select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

Final Review & Document Request

Once the form has been completed, it is subject to review by IB for purposes of verifying the client’s stated tax residency. This review may generate discrepancies in one of the following three areas: U.S. Connection, Treaty Claim or U.K. Crown Connection. If a client account is flagged for any discrepancy, you will need to contact them and request documents to resolve. The steps for resolving each of these is as follows:

IB will send a periodic report listing clients who have tasks which need to be completed so that you may contact them to act. This will include those accounts who have not logged into Account Management to complete the Tax Form or who have completed the form but need to send in documentation.

EXHIBIT 1 – Tax Form Prompt – U.S.

Confirming your information is essential to ensure that you will not become subject to backup withholding, including withholding on trade proceeds.

We appreciate your prompt attention to this matter.

Confirming your information is essential to ensure that (a) we can give you the most favorable rate on normal dividend and interest withholding as defined by standard international tax treaties; and (b) you will not become subject to any exceptional U.S. tax withholding.

We appreciate your prompt attention to this matter.

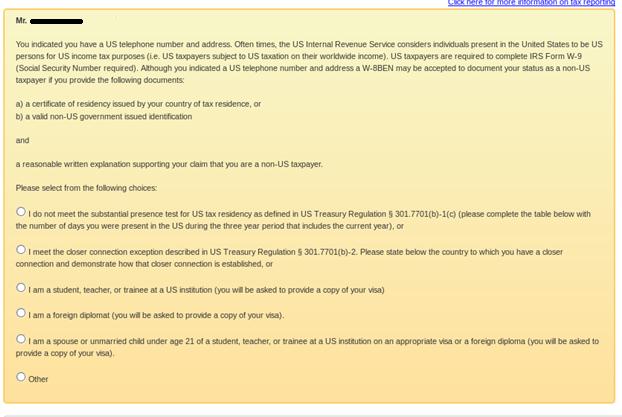

Documenting Taxpayer Status - Non U.S. Persons with U.S. Addresses

The U.S. Internal Revenue Service generally considers individuals with certain U.S. connections to be U.S. resident taxpayers who are required to complete IRS Form W-9 and provide IB with a U.S. taxpayer ID (e.g., social security number).

One common indicator of a U.S. connection for individuals is the presence of a U.S. residential or mailing address. In these cases, the individual is assumed to be a U.S. taxpayer and required to submit Form W-9 unless they can demonstrate that the address falls under one of the permissible explanations for a U.S. connection. These include:

(A) You do not meet the “substantial presence test” for U.S. tax residency as found in U.S. Treasury Regulation 301.7701(b)-1(c) and the address in the U.S. is

(B) You meet the closer connection exception described in US Treasury Regulation § 301.7701(b)-2 and the address in the United States is

(C) You are present in the United States as a student, teacher or trainee at a US institution. Here you will need to provide a copy of your F, J, M or Q visa from U.S. Immigration and Customs Enforcement.

(D) You are present in the United States as a foreign diplomat. Here you will need to provide a copy of your A or G visa (other than A-3 or G-3 visa) from U.S. Immigration and Customs Enforcement.

(E) You are present in the United States and are a spouse or unmarried child under the age of 21 of a person described in (C) or (D) above. Here you will need to provide a copy of your visa.

Note: the examples above are not the only permissible explanations for US connections. If none of the examples apply to your situation but you still believe you are a non-US taxpayer, you will need to provide a written explanation supporting your claim of non-US status