Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

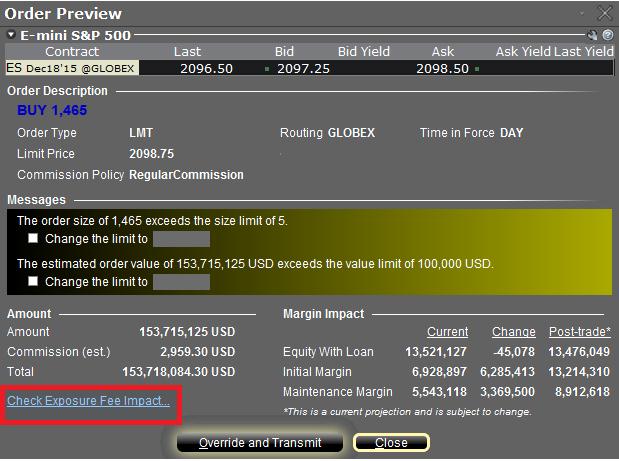

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

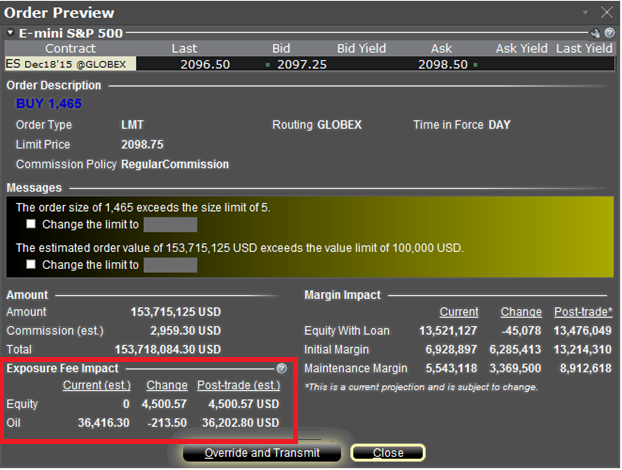

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days

Tools Provided to Monitor and Manage Margin

IB provides a variety of tools and information intended to provide account holders with real-time details as to their state of margin compliance so as to avoid forced liquidations. These include the following:

Trading on margin in an IRA account

IRA accounts, by definition, may not use borrowed funds to purchase securities and must pay for all long stock purchases in full, may not carry short stock positions and may not hold a debit cash balance (in any currency). IRA accounts are eligible to carry futures and option contracts. In addition, IB offers a specific form of IRA account referred to as a “Margin IRA” that allows the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations.

For additional information regarding trading permissions in an IRA account, refer to KB188.

How to determine if you are borrowing funds from IBKR

If the aggregate cash balance in a given account is a debit, or negative, then funds are being borrowed and the loan is subject to interest charges. A loan may still exist, however, even if the aggregate cash balance is a credit, or positive, as a result of balance netting or timing differences. The most common examples of this are as follows:

Overview of Margin Methodologies

Introduction

Where to Learn More

Tools provided to monitor and manage margin

How to determine if you are borrowing funds from IBKR

Why does IBKR calculate and report a margin requirement when I am not borrowing funds?

Determining Buying Power

Buying power serves as a measurement of the dollar value of securities that one may purchase in a securities account without depositing additional funds. In the case of a cash account where, by definition, securities may not be purchased using funds borrowed from the broker and must be paid for in full, buying power is equal to the amount of settled cash on hand. Here, for example, an account holding $10,000 in cash may purchase up to $10,000 in stock.

In a margin account, buying power is increased through the use of leverage provided by the broker using cash as well as the value of stocks already held in the account as collateral. The amount of leverage depends upon whether the account is approved for Reg. T margin or Portfolio Margin. Here, a Reg. T account holding $10,000 in cash may purchase and hold overnight $20,000 in securities as Reg. T imposes an initial margin requirement of 50%, which translates to buying power of 2:1 (i.e., 1/.50). Similarly, a Reg. T account holding $10,000 in cash may purchase and hold on an intra-day basis $40,000 in securities given IB’s default intra-day maintenance margin requirement of 25%, which translates to buying power of 4:1 (i.e., 1/.25).

In the case of a Portfolio Margin account, greater leverage is available although, as the name suggests, the amount is highly dependent upon the make-up of the portfolio. Here, the requirement on individual stocks (initial = maintenance) generally ranges from 15% - 30%, translating to buying power of between 6.67 – 3.33:1. As the margin rate under this methodology can change daily as it considers risk factors such as the observed volatility of each stock and concentration, portfolios comprised of low-volatility stocks and which are diversified in nature tend to receive the most favorable margin treatment (e.g., higher buying power).

In addition to the cash examples above, buying power may be provided to securities held in the margin account, with the leverage dependent upon the loan value of the securities and the amount of funds, if any, borrowed to purchase them. Take, for example, an account which holds $10,000 in securities which are fully paid (i.e., no margin loan). Using the Reg. T initial margin requirement of 50%, these securities would have a loan value of $5,000 (= $10,000 * (1 - 0.50)) which, using that same initial requirement providing buying power of 2:1, could be applied to purchase and hold overnight an additional $10,000 of securities. Similarly, an account holding $10,000 in securities and a $1,000 margin loan (i.e., net liquidating equity of $9,000), has a remaining equity loan value of $4,000 which could be applied to purchase and hold overnight an additional $8,000 of securities. The same principles would hold true in a Portfolio Margin account, albeit with a potentially different level of buying power.

Finally, while the concept of buying power applies to the purchase of assets such as stocks, bonds, funds and forex, it does not translate in the same manner to derivatives. Most securities derivatives (e.g., short options and single stock futures) are not assets but rather contingent liabilities and long options, while an asset, are short-term in nature, considered a wasting asset and therefore generally have no loan value. The margin requirement on short options, therefore, is not based upon a percentage of the option premium value, but rather determined on the underlying stock as if the option were assigned (under Reg. T) or by estimating the cost to repurchase the option given adverse market changes (under Portfolio Margining).

Margin Treatment for Foreign Stocks Carried by a U.S. Broker

As a U.S. broker-dealer registered with the Securities & Exchange Commission (SEC) for the purpose of facilitating customer securities transactions, IB LLC is subject to various regulations relating to the extension of credit and margining of those transactions. In the case of foreign equity securities (i.e., non-U.S. issuer), Reg T. allows a U.S. broker to extend margin credit to those which either appear on the Federal Reserve Board's periodically published List of Foreign Margin Stocks, or are deemed to have a have a "ready market" under SEC Rule 15c3-1 or SEC no-action letter.

Prior to November 2012, "ready market" was deemed to include equity securities of a foreign issuer that are listed on what is now known as the FTSE World Index. This definition was based upon a 1993 SEC no-action letter and was premised upon the fact that, while there may not have been a ready market for such securities within the U.S., the securities could be readily resold in the applicable foreign market. In November of 2012, the SEC issued a follow-up no-action letter (www.sec.gov/divisions/marketreg/mr-noaction/2012/finra-112812.pdf) which expanded the population of foreign equity securities deemed to have a ready market to also include those not listed on the FTSE World Index provided that the following four conditions are met:

1. The security is listed on a foreign exchange located within a FTSE World Index recognized country, where the security has been trading on the exchange for at least 90 days;

2. Daily bid, ask and last quotations for the security as provided by the foreign listing exchange are made continuously available to the U.S. broker through an electronic quote system;

3. The median daily trading volume calculated over the preceding 20 business day period of the security on its listing exchange is either at least 100,000 shares or $500,000 (excluding shares purchased by the computing broker);

4. The aggregate unrestricted market capitalization in shares of the security exceed $500 million over each of the preceding 10 business days.

Note: if a security previously meeting the above conditions no longer does so, the broker is provided with a 5 business day window after which time the security will no longer be deemed readily marketable and must be treated as non-marginable.

Foreign equity securities which do not meet the above conditions, will be treated as non-marginable and will therefore have no loan value. Note that for purposes of this no-action letter foreign equity securities do not include options.

Low Capitalization Stocks

| Symbol | Description |

| CQC | CUESTA COAL LTD |

| UNS | UNILIFE CORP-CDI |

| GHC | GENERATION HEALTHCARE REIT D |

| CDG | CLEVELAND MINING CO LTD |

| THR | THOR MINING PLC-CDI |

| CXX | CRADLE RESOURCES LTD |

| MGN | MAGELLAN PETROLEUM CORP-CDI |

| MXQ | MAX TRUST |

| PXS | PHARMAXIS LTD |

| EGG | ENERO GROUP LTD |

| AFR | AFRICAN ENERGY RESOURCES-CDI |

| TTI | TRAFFIC TECHNOLOGIES LTD |

| GID | GI DYNAMICS INC-CDI |

| MLX | METALS X LTD |

| IRI | INTEGRATED RESEARCH LIMITED |

| RCU | REAL ESTATE CAPITAL PARTNERS |

| PAA | PHARMAUST LTD |

| AVQ | AXIOM MINING LTD |

| SUM | SUMATRA COPPER & GOLD-CDI |

| SHC | SUNSHINE HEART INC-CDI |

| MNZ | MNEMON LTD |

| FRC | FORTE CONSOLIDATED LTD |

| RVA | REVA MEDICAL INC - CDI |

| SCD | SCANTECH LIMITED |

| PGI | PANTERRA GOLD LTD |

| AKP | AUDIO PIXELS HOLDINGS LTD |

| KPR | KUPANG RESOURCES LTD |

| WCB | WARRNAMBOOL CHEESE & BUTTER |

| 307 | UP ENERGY DEVELOPMENT GROUP |

| 8096 | RUIFENG PETROLEUM CHEMICAL |

| 3777 | CHINA FIBER OPTIC NETWORK SY |

| 396 | HING LEE HK HOLDINGS LTD |

| 8372 | RUIFENG PETROLEUM CHEMICAL |

| 8376 | GLOBAL ENERGY RESOURCES INT |

| 702 | SINO OIL AND GAS HOLDINGS LT |

| 8286 | SHANXI CHANGCHENG MICROLIG-H |

| 3300 | CHINA GLASS HOLDINGS LTD |

| 355 | CENTURY CITY INTL |

| 399 | UNITED GENE HIGH-TECH GROUP |

| STRTECH | STERLITE TECHNOLOGIES LTD |

| INGERRAND | INGERSOLL-RAND INDIA LTD |

| KALPATPOW | KALPATARU POWER TRANSMISSION |

| IBSEC | INDIABULLS SECURITIES LTD |

| RELMEDIA | RELIANCE MEDIAWORKS LTD |

| KENNAMET | KENNAMETAL INDIA LIMITED |

| TBZ | TRIBHOVANDAS BHIMJI ZAVERI L |

| MAHINDFOR | MAHINDRA FORGINGS LTD |

| IVRCLINFR | IVRCL LTD |

| GOLDLEG | GOLDEN LEGAND LEASING & FIN |

| 8068 | RYOYO ELECTRO CORP |

| 2749 | JP-HOLDINGS INC |

| 2169 | CDS CO LTD |

| 3278 | KENEDIX RESIDENTIAL INVESTME |

| 1934 | YURTEC CORP |

| 3433 | TOCALO CO LTD |

| 4109 | STELLA CHEMIFA CORP |

| 1720 | TOKYU CONSTRUCTION CO LTD |

| 4775 | SOGO MEDICAL CO LTD |

| 6801 | TOKO INC |

Low Capitalization Stocks

| SYMBOL | DESCRIPTION |

| AFAB.B | ACANDO AB |

| ALPA | ALPCOT AGRO AB |

| AOILSDBPR | ALLIANCE OIL CO LTD-PREF |

| ARCM | ARCAM AB |

| EOS | EOS RUSSIA |

| GDWN | GOODWIN PLC |

| IMS1 | IMMSI SPA |

| KDEV | KAROLINSKA DEVELOPMENT-B |

| MSAB.B | MICRO SYSTEMATION AB-B |

| NETI.B | NET INSIGHT AB-B |

| NOMI | NORDIC MINES AB |

| PARE | PA RESOURCES AB. |

| PGD | PATAGONIA GOLD PLC |

| REG | RARE EARTHS GLOBAL LTD |

| RPO | RUSPETRO PLC |

| SHELB | SHELTON PETROLEUM AB |

| SWOL.B | SWEDOL AB-B |

| TAGR | TRIGON AGRI A/S |

| VPP | VALIANT PETROLEUM PLC |

Low Capitalization Stocks

Please be advised that IB has increased the initial margin rates to 100% on low capitalization stocks (currently defined as companies with less than$250 million in market capitalization). The maintenance margin increases will occur in stages starting with an increase to 50% beginning after the EU market close on Friday, January 25th, 2013 and will be implemented as follows:

Monday January 28th, 2013: Maintenance Margin - 50%

Thursday January 31st,2013: Maintenance Margin - 75%

Tuesday February 2nd, 2013: Maintenance Margin - 100%

The list of stocks which are subject to this margin increase can be found on the following page:

Upon implementation, any of the incremental margin increases may result in a margin deficit in the account. A margin deficit implies that an account becomes subject to automated liquidation. Please carefully review the current positions within your account and adjust the portfolio accordingly.

Interactive Brokers Customer Service

| SYMBOL | DESCRIPTION |

| 02P | PEARL GOLD AG |

| 1PL | POWERLAND AG |

| 5MC | MOTRICITY INC |

| A2O | ALTONA MINING LTD |

| AAH3 | AHLERS AG PFD |

| ABL | ABLON GROUP |

| ABO | ABO INVEST AG |

| ACAN | ACANTHE DEVELOPPEMENT SA |

| ACD | ACENCIA DEBT STRATEGIES LTD |

| ADD | ADLER MODEMARKTE AG |

| ADI | AUDIKA GROUPE |

| AGX | AGENNIX AG |

| AJAX | AFC AJAX |

| ALC | A123 SYSTEMS INC |

| ALGLD | GOLD BY GOLD |

| ALS30 | SOLUTIONS 30 |

| AMC | AMUR MINERALS CORP |

| AMS | ADVANCED MEDICAL SOLUTIONS |

| APEF | ABERDEEN PRIVATE EQUITY FUND |

| AQU | GIGASET AG |

| ARG | ARGAN |

| ARN | ALERION CLEANPOWER |

| ATEB | ATENOR GROUP |

| AV.A | AVIVA PLC 8.75% PFD |

| BABE | BLUECREST ALLBLUE FUND LTD |

| BBN | BELLEVUE GROUP AG |

| BCRA | BACCARAT |

| BHGLE | BH GLOBAL LTD-EURO SHRS |

| BHUE | BLACKROCK HEDGE-UK EMERGING |

| BMP | BMP PHARMA TRADING AG |

| BMS | BRAEMAR SHIPPING SERVICES PL |

| BPC | BAHAMAS PETROLEUM CO PLC |

| BWB | BAADER BANK AG |

| CAMK | CAMKIDS GROUP PLC |

| CAML | CENTRAL ASIA METALS PLC |

| CARDG | LIFEWATCH AG-REG |

| CBAV | CLINICA BAVIERA SA |

| CEN | GROUPE CRIT |

| CGD | CEGID GROUP |

| CIB | TECNOCOM TELECOM Y ENERGIA |

| CIC | CONYGAR INVESTMENT CO PLC |

| CIRC | CIRCLE HOLDINGS LTD |

| CLIG | CITY OF LONDON INVESTMENT GR |

| CMBT | ATEVIA AG |

| CN9 | CIRCLE OIL PLC |

| CNP1 | CONAFI PRESTITO SPA |

| CRM | CARRS MILLING INDUSTRIES PL |

| CTH | CARETECH HOLDINGS PLC |

| CTN | CENTROTHERM PHOTOVOLTAICS AG |

| CU21 | CERUS CORP |

| DECB | DECEUNINCK NV |

| DES | DESIRE PETROLEUM PLC |

| DEVO | DEVOTEAM SA |

| DPT | S.T. DUPONT |

| DTL | DEXION TRADING LTD |

| EN6 | ECHELON CORP |

| ETG | ENVITEC BIOGAS AG |

| ETV | CONSTANTIN MEDIEN AG |

| EUCA | EUROMICRON AG |

| EXC1 | EXCEET GROUP SE |

| F2P | GLU MOBILE INC |

| FFY | FYFFES PLC |

| FFY | FYFFES PLC |

| FLO | GROUPE FLO |

| FM | FIERA MILANO SPA |

| FORE | LA FORESTIERE EQUATORIALE |

| FTON | FEINTOOL INTL HOLDING-REG |

| G6S | GENCO SHIPPING & TRADING LTD |

| GAL1S | 3W POWER SA |

| GBMN | GOLDBACH GROUP AG |

| GBO | GLOBO PLC |

| GDL | GREKA DRILLING LTD-DI |

| GDMS | GRANDS MOULINS DE STRASBOURG |

| GDWN | GOODWIN PLC |

| GEM | GEMFIELDS PLC |

| GFI | GFI INFORMATIQUE |

| GMC | GLOBAL MARKET GROUP LTD |

| GPX | GULFSANDS PETROLEUM PLC |

| GUR | GURIT HOLDING AG-BR |

| GYQ | FIRST DERIVATIVES PLC |

| HAMO | HAMON SA |

| HAT | H&T GROUP PLC |

| HEAD | HEAD N.V. |

| HIM | HI-MEDIA SA |

| HINS | HENDERSON INTERNATIONAL INCO |

| HNT | HUNTSWORTH PLC |

| HUE | HUEGLI HOLDING AG-BR |

| IBAB | ION BEAM APPLICATIONS |

| IBG | IBERPAPEL GESTION SA |

| ICLL | INTERCELL AG |

| IDH | IMMUNODIAGNOSTIC SYSTEMS HLD |

| IDIP | IDI |

| IFD | SCHRODER REAL ESTATE INVESTM |

| IFL | INTERNATIONAL FERRO METALS |

| IML | AFFINE |

| IMMO | IMMOBEL |

| IN0 | INPHI CORP |

| INM | INDEPENDENT NEWS & MEDIA PLC |

| INSD | INSIDE SECURE SA |

| IPEL | IMPELLAM GROUP PLC |

| ITMR | ITALMOBILIARE SPA-RSP |

| IUR | KAP-BETEILIGUNGS-AG |

| IX4 | IRIDEX CORP |

| JWB | JK WOHNBAU AG |

| KA | KAS BANK NV -CVA |

| KARN | KARDEX AG-REG |

| KMU | KLEMURS |

| LAC | LACIE SA |

| LBR | CUSTODIA HOLDING AG |

| LD | LOCINDUS |

| LKI | SEDO HOLDING AG |

| LLPE | LLOYDS BANKING GROUP PLC 6.475% NON-CUM |

| LN4 | LINEDATA SERVICES |

| LNA | LE NOBLE AGE |

| LSS | LECTRA |

| M5Z | MANZ AG |

| MBH3 | MASCH BERTHOLD HERMLE AG-VOR |

| MEO3 | METRO AG-VORZ |

| MF6 | MAGFORCE AG |

| MIRL | MINERA IRL LTD |

| MJT | MAJESTIC GOLD CORP. |

| MKEA | MAUNA KEA TECHNOLOGIES |

| MLD | MIRLAND DEVELOPMENT CORP |

| MOL | GRUPPO MUTUIONLINE SPA |

| MRB | MR BRICOLAGE |

| MSZN | COLTENE HOLDING AG-REG |

| MUB | MUEHLBAUER HOLDING AG & CO |

| MYRN | MYRIAD GROUP AG |

| NOP | NORTHERN PETROLEUM PLC |

| OFN | ORELL FUESSLI HOLDING AG-REG |

| ORANW | ORANJEWOUD NV |

| ORDN | ORDINA NV |

| OVXA | OVOCA GOLD PLC |

| PARP | GROUPE PARTOUCHE |

| PLAZ | PLAZA CENTERS NV |

| PMO | PRIME OFFICE REIT-AG |

| PNX | PHOENIX IT GROUP LTD |

| POL | POLO RESOURCES LTD |

| PRA | PRAKTIKER AG |

| PRS | PRELIOS SPA |

| PRT | ESPRINET SPA |

| PRW | PROMETHEAN WORLD PLC |

| PYT | POLYTEC HOLDING AG |

| RE. | R.E.A. HOLDINGS PLC |

| REA | REALDOLMEN |

| RECT | RECTICEL |

| REP | REPOWER AG-PC |

| RM. | RM PLC |

| RPT | REGAL PETROLEUM PLC |

| RSAB | RSA INSURANCE GROUP PLC 7 3/8% CUM IRRD PRF #1 |

| RSL1 | R STAHL AG |

| RWA | ROBERT WALTERS PLC |

| SAB | SABAF SPA |

| SBLM | SABLE MINING AFRICA LTD |

| SEPU | SEPURA LTD |

| SESL | STORE ELECTRONIC |

| SEY | STERLING ENERGY PLC |

| SFR | SEVERFIELD-ROWEN PLC |

| SHPN | SHAPE CAPITAL AG-REG |

| SII | SOCIETE POUR L'INFORMATIQUE |

| SIOE | SIOEN INDUSTRIES NV |

| SIV | ST.IVES PLC |

| SK1 | SKW STAHL-METALLURGIE HOLDIN |

| SMH | SUESS MICROTEC AG |

| SNBN | SCHWEIZERISCH NATIONALBA-REG |

| SNC3 | SANACORP PHARMAHOLDING-PFD |

| SNG | SINGULUS TECHNOLOGIES |

| SPI1 | SPIR COMMUNICATION |

| STAC | STANDARD CHARTERED PLC 8.25% NON-CUM PREF |

| STNT | STENTYS |

| STRN | STERN GROEP NV |

| SW1 | SHW AG |

| SWP | SWORD GROUP |

| TAM | ETAM DEVELOPPEMENT SA |

| TAN | TANFIELD GROUP PLC |

| TGH | LOGWIN AG |

| TGT | TELEGATE AG |

| TPET | TANGIERS PETROLEUM LTD |

| TPL | TETHYS PETROLEUM LTD |

| TPOE | THIRD POINT OFFSHORE INVESTM |

| TPOG | THIRD POINT OFFSHORE INVESTM |

| TPT | TOPPS TILES PLC |

| TRB | TRIBAL GROUP PLC |

| TV0 | TRAVEL VIVA AG |

| U6Z | URANIUM ENERGY CORP |

| UCC1 | URANIUM RESOURCES INC |

| UPL | ADVEO GROUP INTERNATIONAL SA |

| UTV | UTV MEDIA PLC |

| VBK | VERBIO AG |

| VCH | CHARLES VOEGELE HOLDING A-BR |

| VGAS | VOLGA GAS PLC |

| VIZ | VI[Z]RT LTD |

| VLS | VIVALIS SA |

| WFT | WENG FINE ART AG |

| WIMO | WITTE MOLEN NV |

| WMF3 | WMF- WUERTTEMBERG METAL- PRF |

| WSU | WASHTEC AG |

| ZAM | ZAMBEEF PRODUCTS PLC |