有關向淨現金餘額為正的賬戶收取利息的說明

在以下情况下,儘管賬戶保持整體淨多頭或貸方現金餘額,但仍需支付利息:

1. 該賬戶持有特定幣種的空頭或借方餘額。

例如,某賬戶有相當于5,000美元的淨現金貸方餘額,這其中包括8,000美元的多頭餘額和相當于3,000美元的歐元空頭餘額,需要對歐元空頭餘額支付利息。 由于賬戶所持有的多頭美元餘額低于10,000美元的第一階梯水平,不會獲得利息,因此無法沖抵要支付的利息。

賬戶持有人應注意,如其買入的證券是以賬戶未持有的貨幣計價,則IBKR會創建相應幣種的貸款,以便與清算所結算交易。如希望避免此類貸款和相關利息費用,客戶需在進行交易前存入以該特定貨幣計價的資金,或通過Ideal Pro(餘額25,000美元或以上)或散股(餘額低于25,000美元)交易場所兌換現有的現金餘額。

2. 貸方餘額主要來自于賣空證券所得。

例如,某賬戶的淨現金餘額爲12,000美元,其中包括證券子賬戶中的6,000美元借方餘額(减去空頭股票持倉的市場價值)和18,000美元的股票空倉價值。賬戶需就第一階梯借記餘額6,000美元支付利息,同時,由于空頭股票貸記低于100,000美元的第一階梯水平,不會從空頭股票貸記中獲得利息。

3. 貸方餘額包含未結算的資金。

IBKR僅根據已結算資金决定要收取和支付利息。正如賬戶持有人在買入交易結算之前,無需對用來買入證券的借款支付利息一樣,在賣出交易結算之前(而清算所已向IBKR存入資金),賬戶持有人也不會就賣出證券所得資金獲得利息或借方餘額沖抵。

成為香港專業投資者

專業投資者(“PI”)是具有豐富的經驗和市場知識、從而有資格享受某些福利的高淨值投資者。

根據香港《證券及期貨條例》(“SFO”)的規定,專業投資者包括擁有總資産超過4000萬港幣的實體和擁有投資組合總價值超過800萬港幣的個人投資者。

爲什麽要成爲專業投資者?

專業投資者被認爲擁有充足的資本、經驗和淨資産,可以參與更高級的投資機會,包括外匯掉期、中國創業板(ChiNext)和虛擬資産等産品。

一般來說,專業投資者在短期內不會需要清算投資資産,幷且能够在不傷及其整體淨值的情况下經歷投資損失。

專業投資者可以交易哪些産品?

我們在不斷擴大爲客戶提供的投資選擇,幷定期增加專門針對專業投資者的新産品和服務。

目前有以下産品可供交易:

|

産品/市場 |

專業投資者資格要求 |

|

創業板(ChiNext) |

機構 – 僅限專業投資者 |

|

科創板(Star) |

機構 – 僅限專業投資者 |

|

外匯掉期 |

專業投資者 |

|

加密貨幣相關産品 |

專業投資者 |

|

共同基金 |

專業投資者 |

如何取得香港專業投資者資格?

要取得專業投資者資格,您必須達到或超過規定的門檻要求,不同客戶類別要求不同:

|

客戶類別 |

門檻/要求 |

|

個人 |

持有的現金和/或證券或由托管人持有的投資組合價值不低于800萬港幣(或等值外幣)的高淨值個人。 |

|

聯名* |

持有的現金和/或證券或由托管人持有的投資組合價值不低于800萬港幣(或等值外幣)的與配偶或子女開有聯名賬戶的高淨值個人。 |

|

法人團體/合夥企業 |

持有的現金和/或證券或由托管人持有的投資組合價值不低于800萬港幣(或等值外幣)或總資産不低于4000萬港幣(或等值外幣)的法人團體或合夥企業。 |

|

信托法團 |

作爲信托的受托人獲受托管理的總資産不低于4000萬港幣(或等值外幣)的信托法團。. 請注意,如果有一個以上的受托人,則必須所有受托人均達到專業投資者要求,信托才能取得專業投資者資格。 |

* 如果您是聯名賬戶持有人,則您必須向盈透證券(香港)有限公司(“IBHK”)聲明幷保證您與另一賬戶持有人爲配偶或親子關係,幷且您與另一帳戶持有人之間不存在約定您聯名投資組合各占份額的書面協議。如果您與另一賬戶持有人不是配偶或親子關係,或者如果存在約定您聯名投資組合各占份額的協議,則您必須立即通知IBHK。

成爲專業投資者有哪些風險?

專業投資者不能享受普通散戶投資者享有的某些保護。特別是,在向專業投資者提供服務時,IBHK無需遵守《操守準則》和其它香港法規的某些要求。這其中包括(但不限于)限制或禁止發布廣告、撥打未經請求的電話以及發送證券相關要約郵件的規則。

IBHK建議,如認爲必要,潜在專業投資者應就被視爲專業投資者的相關後果(包括《證券及期貨條例》和《操守準則》中列明的後果),尋求獨立的專業意見。

如何選擇不被歸類爲專業投資者?

專業投資者可以隨時通過在客戶端的賬戶設置中將其PI分類更改爲“非專業投資者”來撤銷其同意。 更改後,PI相關的交易許可將被立即移除,相關的未平倉倉位將被實施“僅限平倉”限制。您可以繼續持有或平倉,但無法加倉或開倉。

如果您在IBHK的年度專業投資者審查中未采取任何行動驗證您的資格,您也會不再被列爲專業投資者。如果您的分類不符合專業投資者門檻要求,我們會向您發送通知郵件。

專業投資者身份取决于IBHK對您資産的驗證。投資金融産品和服務須符合IBHK的資格要求和適宜性標準。

How to Access Your Reports Using FTP on MacOS

This tutorial assumes you received reports via email or via FTP that were encrypted with the public key you sent to IBKR. If you need guidance to set up the encrypted statement delivery, please refer to this article, which is a prerequisite to the instructions below.

There are multiple methods to access the IBKR FTP server. FTP clients such as Filezilla can be used or you could as well use Finder. In this article we explain how to realize the connection to the IBKR FTP server using Finder.

Important Note: You will not be able to connect using your browser.

Once you are connected to the IBKR FTP Server, you will have both read and write access to your folder. The retention policy for the files is 100 days - IBKR will automatically purge files after that.

To access your reports using macOS Finder:

1. Open the Finder app. From the top menu Go, select Connect to Server... Alternatively, you can press Command + K on the keyboard while the Finder app is open.

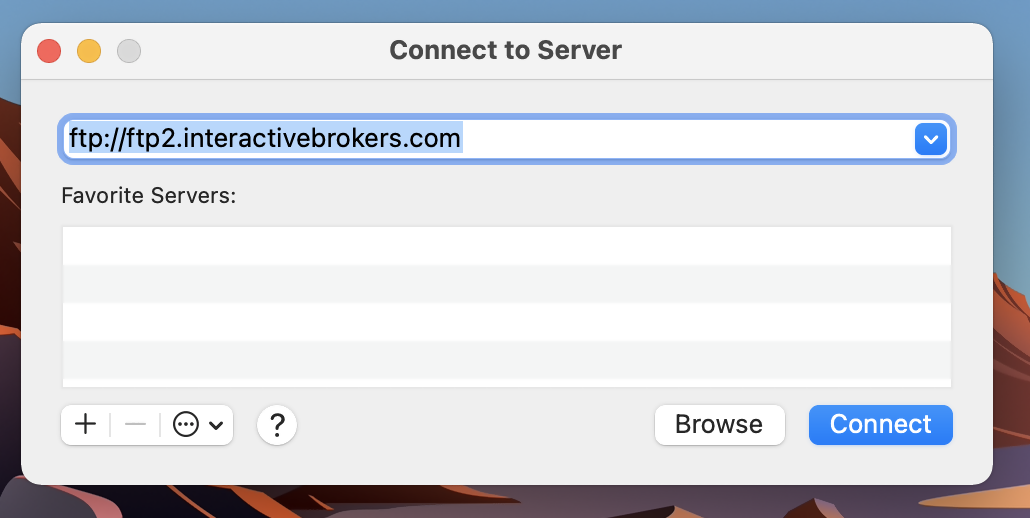

2. Type the FTP address ftp://ftp2.interactivebrokers.com in to the Connect to Server field and click Connect.

3. A login dialog window will then appear. Select 'Registered User' for the Connect As field. Enter the FTP username and password IBKR provided you with in to the corresponding fields. Then press Connect.

.png)

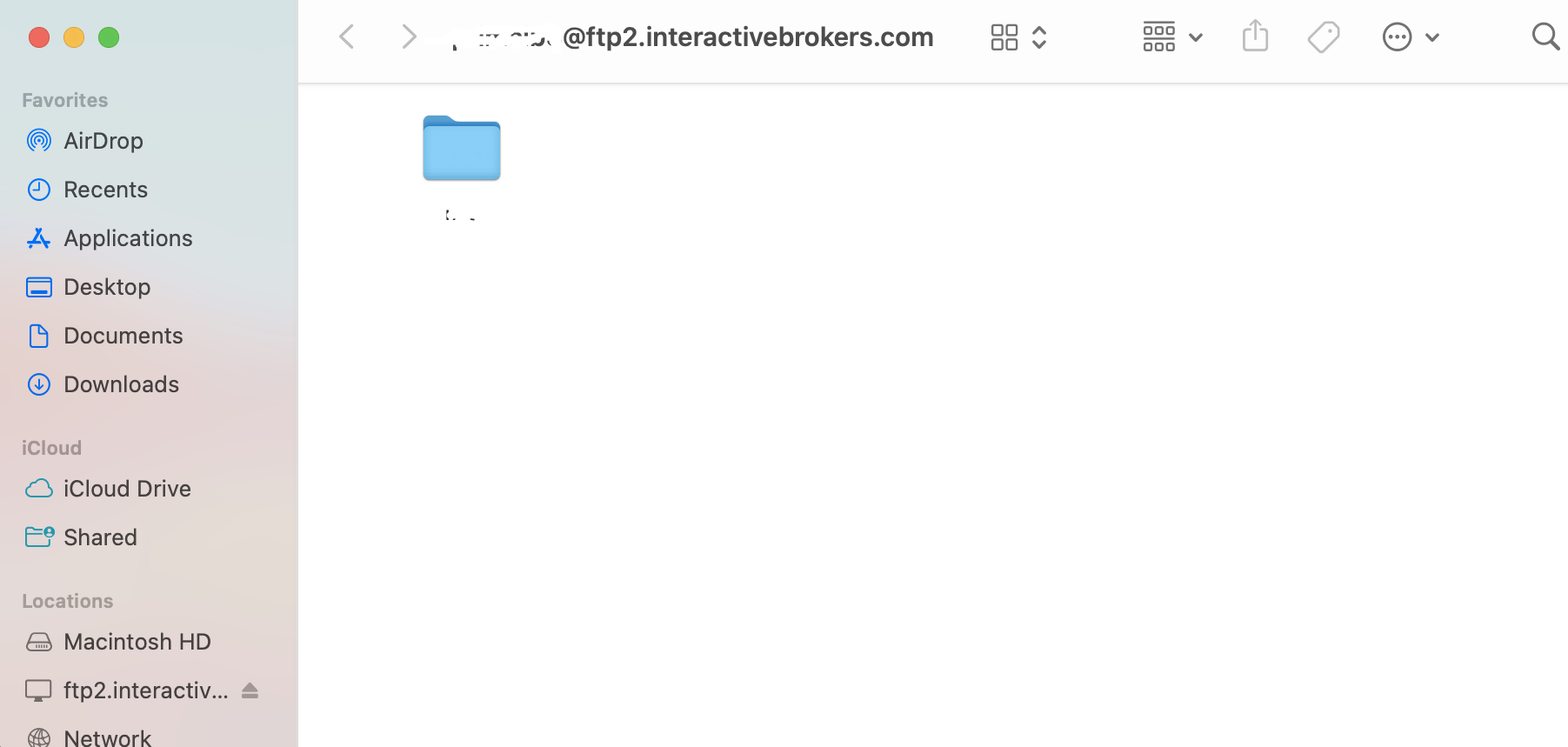

4. A Finder window will open and you will now have direct access to your FTP folder. Documents and files present there can now be decrypted using your PGP key, as explained in IBKB4210.

Common issues and solutions

Ensure the correct login details are being used to connect to the FTP server. The username and password you are entering should match the ones you have received from the Reporting Integration Team.

-

Enable the Passive (PASV) mode for FTP connections. Click on the Apple icon on the top left of your Desktop and choose System Preferences. Launch Network. Select your active network connection, then click on the button Advanced and select the Proxies tab. Activate the option Use Passive FTP mode (PASV). The passive mode is more firewall friendly then the active one, since all the connections are initiated from the Client side. If you are using a specific FTP Client, check its connection settings or advanced settings in order to find and enable the Passive (PASV) mode switch.

-

In case you have an antivirus or a security software installed on your machine, make sure it is not blocking the FTP connection attempt. Normally, security software allow to set up exceptions for specific connections in order to whitelist them.

-

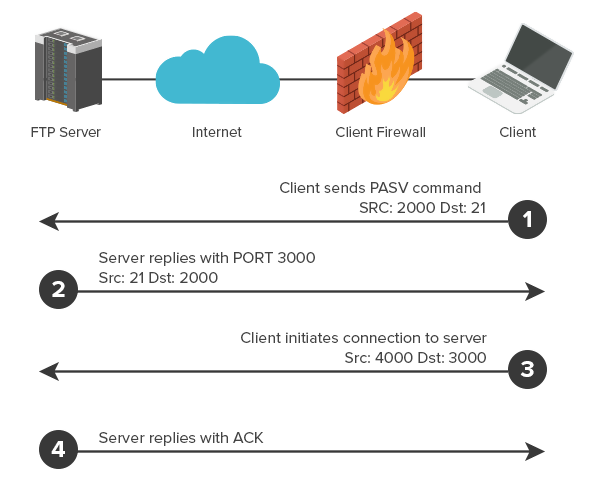

Should the above steps be unable to resolve the issue, ask your network administrator/s to confirm that your firewall allows traffic from/to ftp2.interactivebrokers.com. Note: Your network administrator should consider that every time your FTP Client attempts connecting to our FTP server with Passive mode, it establishes two connections: a command channel (outbound, from random TCP port above 1024 to TCP port 21) and a data channel (outbound, from a random TCP port above 1024 to the TCP port above 1024 which was negotiated through the command channel). Both connections are initiated by the Client side. In the picture below, you can find an example of this connections schema. Please notice that the ports 2000, 3000, 4000 are examples of randomly selected ports and may very well not correspond to the ones used within your specific FTP connection attempt.

KB3968 - Generate a key pair using GPG for Windows

KB4205 - Generate a key pair using GPG Suite on macOS

KB4108 - Decrypt your Reports using GPG for Windows

KB4210 - Decrypting Reports using your PGP Key pair on macOS

KB4407 - Generate RSA Key Pair on Windows

KB4409 - How to set up sFTP for using Certificate Authentication on Windows

KB4410 - How to set up sFTP for using Certificate Authentication on macOS

KB4411 - How to backup your public/private Key pair

KB4323 - How to transfer your public/private key pair from one computer to another

如何生成".har"文件

在解決重大的網站問題時,有時我們的客服團隊需要您提供有關您的瀏覽器的更多信息。我們可能會要求您錄製並提供.har文件。該文件包含有關您的瀏覽器發送及收到的網絡請求的更多信息。您的瀏覽器可在問題發生時記錄HTTP/HTPS請求和響應的內容、時間軸及狀態,從而生成此類文件。

我們將在本文中解釋如何生成.Har文件。請在下方點擊您正在使用的瀏覽器:

1. 打開Google Chrome並前往發生問題的頁面。

2. 點擊鍵盤上的 CRTL +SHIFT + I 。或者,點擊Chrome菜單圖標(瀏覽器窗口右上角的三個垂直點),然後選擇 “更多工具” > “開發者工具”

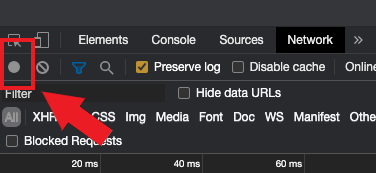

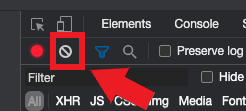

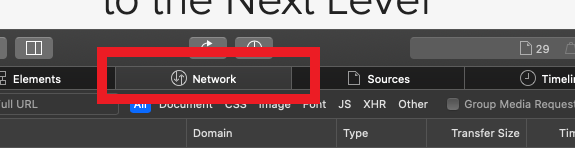

3. “開發者工具”會以停靠面板的形式在Chrome側面或底部打開。選擇 “網絡”選項卡(如圖1)

圖1

.png)

4. 在 “開發者工具” 工具欄左上角找到圓形的“錄製”按鈕並確保它是紅色的。如果它是灰色的,點擊一次開始錄製或點擊 CTRL+E (如圖2)

圖2

5. 激活 “保留日誌”選項框(如圖3)

圖3

.png)

6. 點擊 “清除” 按鈕清除已有的日誌。“清除” 按鈕顯示為停止圖標,位於 “錄製” 按鈕的右側 (如圖4)

圖4

7. 再現您遇到的問題並錄製網絡請求。

8. 當您完成問題再現後,右擊已記錄的網絡請求列表上的任意地方,選擇 “以HAR格式保存所有內容”, 並將文件保存在您計算機上任意您想保存的位置(如桌面)。

9. 在IBKR客戶端中, 前往消息中心並創建 一個新的網絡諮詢單(或使用已有的諮詢單)

10. 在網絡諮詢單內,將之前生成的.har文件作為附件添加。 如果IBKR客服向您提供過諮詢單號或客服代表的名字,請在諮詢單中加上這些信息。

11. 提交網絡諮詢單

1. 打開Firefox並前往發生問題的頁面

2. 點擊鍵盤上發 F12 。或者,點擊Firefox菜單按鈕(瀏覽器窗口右上角的三條平行線),然後選擇 Web 開發者工具 > 網絡

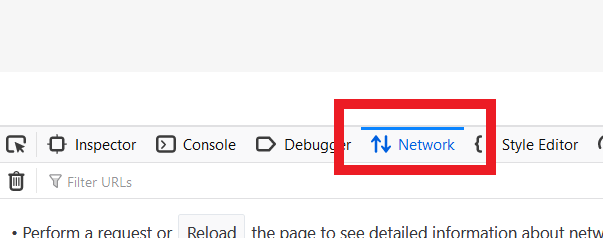

3. 開發者網絡工具會以停靠面板的形式在Firefox底部打開。選擇 “網絡”選項卡(如圖5)

圖5

4. 激活 “保存日誌”選項框(圖6)

圖6

5. 再現您遇到的問題。系統會自動開始錄製網絡請求。

6. 再現問題後,右擊已錄製的請求列表並選擇“所有內容另存為HAR”

7. 將文件保存在計算機上的任意位置(如桌面)

8. 在IBKR客戶端中, 前往消息中心並創建 一個新的網絡諮詢單(或使用已有的諮詢單)

9. 在網絡諮詢單內,將之前生成的.har文件作為附件添加。 如果IBKR客服向您提供過諮詢單號或客服代表的名字,請在諮詢單中加上這些信息。

10. 提交網絡諮詢單

1. 打開Edge並前往發生問題的頁面。

2. 點擊鍵盤上發 F12 。或者點擊Edge菜單圖標(瀏覽器窗口右上角的三個平行點),然後選擇 “更多工具” > “開發者工具”

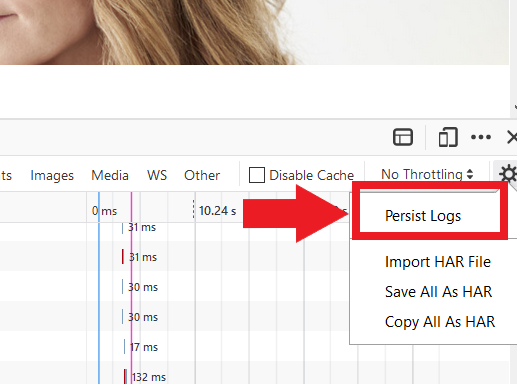

3. 點擊“網絡” 圖標 (如圖10)

圖10

.png)

4. 再現您遇到的問題並錄製網絡請求。

5. 完成後,點擊軟盤圖標(導出為HAR) 或按 CTRL+S (如圖11)

圖11

6. 為文件命名並將文件保存在您計算機上的任意位置(如桌面)。然後點擊 “保存” 按鈕

7. 在IBKR客戶端中,前往消息中心並創建一個新的網絡諮詢單(或使用已有的諮詢單)

8. 在網絡諮詢單內,將之前生成的.har文件作為附件添加。 如果IBKR客服向您提供過諮詢單號或客服代表的名字,請在諮詢單中加上這些信息。

9. 提交網絡諮詢單

注:在生成HAR文件前,請確保您可在Safari中看到 “開發者” 菜單。如果您看不到這個菜單,請點擊Safari瀏覽器,選擇 “偏好設置”, 前往 “高級” 選項卡並激活菜單欄 “顯示開發”菜單旁的選項框。

1. 打開 “開發” 菜單並選擇 “顯示網頁檢查器” 或點擊 CMD+ALT+I

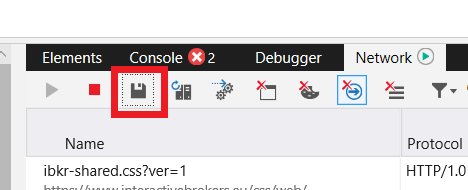

2. 點擊 “網絡” 選項卡 (如圖12)

圖12

3. 激活 “保留日誌”選項卡(圖13)

圖13

.png)

4. 點擊 “導出” 圖標(或按CMD+S), 為文件命名並將其保存在計算機上的任意位置(如桌面)並保存.har文件

5. 在IBKR客戶端中,前往消息中心並創建一個新的網絡諮詢單(或使用已有的諮詢單)

6. 在網絡諮詢單內,將之前生成的.har文件作為附件添加。 如果IBKR客服向您提供過諮詢單號或客服代表的名字,請在諮詢單中加上這些信息。

7. 提交網絡諮詢單

Overview of IBKR's Recurring Investment Feature

IBKR offers an automatic trading feature whereby account holders may set up a 'recurring investment' instruction with the cash amount, asset to invest into and the schedule when to invest (e.g. buy 500 USD of IBKR on the 2nd day of the month). Outlined below are a series of FAQs which describe the program and its operation.

1. How can I participate in the program?

Requests to participate are initiated online via Client Portal. Select the Trade menu option followed by Recurring Investments.

2. What accounts are eligible to use IBKR's recurring investment feature?

Recurring investment is available to any client that has fractional share trading enabled and is under IBLLC, IBUK, IBAU, IBCAN, IBCE, IBIE, IBHK, or IBSG.

3. Which securities are eligible for recurring investment?

The recurring investment feature is available for US, Canadian and European stocks/ETFs. Only stocks/ETFs which are tradable in fractions are eligible.

4. When does the investment occur?

The client is able to choose a date and select a schedule on which to invest (e.g. weekly, monthly, quarterly, etc.). Trades are executed soon after open on the start date and continue on future dates based upon the schedule selected. If the market is closed on the scheduled recurring investment date (e.g.: holiday, weekend) then the recurring investment will be scheduled for the next open market date. If the schedule of monthly, quarterly, or yearly is selected and the recurring investment date does not exist for the month (e.g.: February 29th) then the last date of the month will be used. Please note, there is no guarantee that modifying the recurring investment on the scheduled day of investment will be reflected in your trading activity for that day.

5. What is the minimum amount required to invest when setting up a recurring investment?

The minimum investment amount for a recurring investment is 10 for all currencies except SEK which has a minimum of 100. The minimum investment amount will be displayed to clients in Client Portal if the amount they enter is less than the required minimum.

6. At what price does reinvestment take place?

As shares are purchased in the open market, the price cannot be determined until the total number of shares for all program participants have been purchased using combined funds. Each aggregate order will result in one or more market orders. In the event that the purchase is executed in multiple smaller trades at varying prices, participants will receive the weighted-average price of such shares (i.e., each participant receives the same price).

Recurring investments are filled through Volume-Weighted Average Price (VWAP) orders submitted on a best-effort basis at market open on each scheduled purchase date. The time in force suspends the same day at the close of the market. All customers with recurring investments in the same security on the same date receive the same average price on their investment. If markets are closed on a scheduled recurring investment date, due to a weekend or holiday, recurring investment orders will be placed the next trading day. If there is a partial fill, clients will receive shares valued at less than the requested amount and the next scheduled purchase date will be increased by the instructed frequency. If no fill occurs (IBKR is unable to purchase shares on that trading day) the client experience will be the same as if the markets are closed: recurring investment orders will be placed the next trading day without increasing the next scheduled purchase date.

7. Is the recurring investment program subject to a commission charge?

Yes, Standard Commissions as listed on the IBKR website are applied for the purchase. Commissions are charged based on the Currency and the Region the security is traded on. Please note that the minimum commission charge is the lesser of the stated minimums (USD 1 for the Fixed structure) or 1% of the trade value.

8. What happens if my account is subject to a margin deficiency when the recurring investment occurs?

If your account is in a margin deficit and cannot initiate new positions, the recurring investment will not occur, even if you have the feature enabled. A Deposit Hold can cause a recurring investment to be rejected. The trade will only occur if free cash is available. Clients that are borrowing on margin cannot use the recurring investment feature until they have free cash. Please note that recurring investment orders are credit-checked at the time of entry. Should an account go into margin deficiency at any time after that, including as a result of the end-of-day SMA check and the end-of-day Soft Edge Margin, the account will become subject to automated liquidation.

9. What happens if my account does not have enough funds at the time of the recurring investment?

The system will check the account 3 business days prior to the next occurrence of the recurring investment and if the account is lacking funds then a notification will be sent to the client. If on the occurrence date the account still lacks the funds, the occurrence date will be incremented by the frequency (e.g.: if monthly, update to next month). If on the next occurrence date the account again lacks funds then the instruction will be canceled.

10. Will I receive whole shares or fractional shares?

When using the Recurring Investment program you will receive fractional shares equivalent to the cash amount specified.

11. What are the tax considerations associated with recurring investment?

The purchase of a shares via recurring investment is similar to that of any other share purchase for purposes of tax reporting.

12. Where can I see the recurring investments I have set up?

The "Recurring Investments" screen in Client Portal will display a grid with your current active recurring investment plans.

Please note that open recurring investment instructions are not visible on the Trader Workstation (TWS) or IBKR Mobile order screens. Submitting orders from these platforms will increase your exposure beyond that scheduled for your recurring investment. Your open recurring investment orders are visible in Client Portal from both the Portfolio and Trade > Orders & Trades menus.

13. What happens if I don't hold the currency the stock is denominated in?

If you don't hold the currency the stock is denominated in, IBKR will auto-convert currencies to complete the trade.

14. What happens if my recurring investment involves a security that is no longer available?

Your recurring investment will be cancelled. When a pending order involves a security that is the subject of a reverse split or merger, or a security that is delisted, the order will be cancelled.

15. How do I cancel a Recurring Investment order?

To "Cancel" an open Recurring Investment, login to the Client Portal and select the Trade menu option followed by Recurring Investments. Find the line with the security of the recurring investment you want to cancel and on the right side of the row click on the "X". Then in the next pop up, click on the button to "Confirm Cancel" of the recurring investment.

IBKR證券集體訴訟返還

證券集體訴訟返還解决方案是一項自動化的服務,能免除客戶參加集體訴訟的行政性負擔。使用該服務無前期費用,但所有追回的金額將被收取20%的或有費用,詳情見條件與條款。

哪些人可使用IBKR的證券集體訴訟返還服務?

如果IBLLC的客戶有資格交易美國或加拿大的股票或債券,持有IBKR個人、聯名或獨立交易限制(STL)賬戶,或爲全披露介紹經紀商(IBroker)或財務顧問的客戶,則其可使用該服務。

符合資格要求的客戶可隨時登錄客戶端幷依此點擊“使用者”菜單(右上角的頭肩圖標)和“管理賬戶”來方便、快速地報名使用或不再使用該服務。點擊證券集體訴訟返還旁的“配置”按鈕查看條款與條件後即可訂閱或取消訂閱該服務。

報名參加後,如果您買賣的證券捲入了集體訴訟,則IBKR會通知您幷告知您提出索賠的日期。您的索賠收到的任意貨幣補償將以電子化的方式存入您的IBKR賬戶。請注意,從提出索賠到收到補償,中間可能會經過很長時間。

報名使用該服務無前期費用。然而,所有追回的金額將被收取20%的或有費用,費用將從追回的金額中扣除。詳情請見服務的條款與條件。

只要您與涉訴證券有關的活動和持倉在您退出項目前已傳送至了我們的服務供應商,您就有資格獲得和解補償金。如您取消IBKR的服務後使用了第三方供應商,則可能導致重複索賠。要避免索賠由于重複提交被拒,請發送郵件至proserve@ibkr.com告知我們您想使用哪一家供應商來發起索賠申請。

Becoming a Professional Investor in Hong Kong

A Professional Investor (“PI”) is a high-net-worth investor who is considered to have a depth of experience and market knowledge that makes them eligible for certain benefits.

As per the Securities and Futures Ordinance (“SFO”), a PI includes entities and individual investors holding over HK$40 million in assets or an HK$8 million portfolio value, respectively.

Why become a Professional Investor?

Professional Investors are considered as having sufficient capital, experience and a net worth that lets them engage in more advanced types of investment opportunities, including products such as FX Swaps, ChiNext, or virtual assets.

Generally, Professional Investors do not need to liquidate investment assets in the short term and can experience a loss of their investment without damaging their overall net worth.

Which products are available to Professional Investors?

We are constantly expanding the selection of investments available to clients and periodically adding new products and services that are only available to Professional Investors.

The following products are currently available:

|

Product/ Market |

Professional Investor eligibility |

|

ChiNext |

Institutional - Professional Investor only |

|

Star |

Institutional - Professional Investor only |

|

FX Swap |

Professional Investor |

|

Crypto related products |

Professional Investor |

|

Mutual Funds |

Professional Investor |

How do I qualify as a Professional Investor in Hong Kong?

To qualify as a Professional Investor, you must meet or exceed prescribed financial thresholds, which vary by client category:

|

Client Category |

Financial Threshold / Requirement |

|

Individual |

A High Net Worth Individual in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent). |

|

Joint* |

A High Net Worth Individual, with either his or her spouse or children in a joint account, in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent). |

|

Corporation/ Partnership |

A corporation or partnership in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent) or total assets of not less than HK$40 million (or its foreign currency equivalent). |

|

Trust Corporations |

A trust corporation that has been entrusted under the trust(s) of which it acts as trustee with total assets of not less than HK$40 million (or its foreign currency equivalent). Please note that all trustees, if more than one, must qualify as Professional Investors in order for the trust to qualify. |

* If you are a joint account holder, you must represent and warrant to Interactive Brokers Hong Kong (IBHK) that you and the other account holder are married or parent/ child and that there is no written agreement between you and the other account holder which governs the sharing of your joint portfolio. If you and the other account holder are not married or parent/ child, or if an agreement exists which governs the sharing of your joint portfolio, you must immediately notify IBHK.

What are the risks of becoming a Professional Investor?

Professional Investors are not afforded some of the protections given to general retail investors. In particular, IBHK is not required to fulfill certain requirements under the Code of Conduct and other Hong Kong regulations when providing services to Professional Investors. These include, but aren’t limited to, rules restricting or prohibiting the issuance of advertisements, the making of unsolicited calls and the communication of an offer in relation to securities.

IBHK recommends that prospective Professional Investors obtain independent professional advice, if deemed necessary, in relation to the consequences of being treated as a professional investor (including those set forth in the SFO and the Code of Conduct).

How can I opt out of being classified as Professional Investors?

Professional Investors have the flexibility to withdraw their consent at any point in time by changing their PI classification to “Non Professional Investor” via the Account Settings in Portal Once changed, PI-related trading permissions will be immediately removed and existing open positions will be set to “Closing- Only”. You may continue to hold or close existing position of these exclusive products but cannot expand or open new positions.

You may also cease to be classified as Professional Investor if you take no action to validate your eligibility during IBHK’s annual Professional Investor review. A notification email will be sent to you if your classification is not aligned to the PI financial threshold.

Professional Investor status is subject to IBHK’s validation of your assets. Investing in financial products and services is subject to IBHK’s eligibility and suitability criteria.

如何確定哪些市場數據訂閱適合某一指定證券?

IBKR爲賬戶持有人提供了市場數據助手,可幫助其選擇想要交易的證券(股票、期權或權證)所適用的訂閱服務。搜索結果會顯示産品進行交易的所有交易所、訂閱服務及其月費(專業客戶和非專業客戶)以及每種訂閱服務的市場深度數據。

要訪問市場數據助手:

- 登錄客戶端

- 點擊“幫助”菜單(右上角的問號圖標),然後點擊“支持中心”

- 向下滾動,選擇“市場數據助手”

- 輸入代碼或ISIN以及交易所

- 選擇篩選條件:專業/非專業訂戶狀態、幣種和資産

- 點擊“搜索”

- 查看搜索結果幷决定哪些訂閱最符合自己的需求。

更多信息請參見IBKR網站的市場數據選擇頁面。

爲個人賬戶添加(非雇員)使用者

個人賬戶持有人可以爲其IBKR賬戶添加多個使用者。賬戶持有人會想要在自己名下添加第二使用者以便能同時打開兩個TWS會話(一個是普通訪問,一個是通過API連接)。根據有限委托授權協議,賬戶持有人最多可向5名(非雇員)個人(如家庭成員)提供訪問權限。每名個人都可以訪問第二使用者。

每種情况下,第二使用者都會有唯一的用戶名,登錄客戶端和交易平臺時需要用到。下方爲添加(非雇員)個人使用者的步驟說明(爲個人賬戶持有人添加第二使用者的步驟說明,請參見KB1004)。

添加非雇員使用者步驟如下:

- 登錄客戶端。

- 點擊使用者菜單(右上角的小人圖標),然後點擊管理賬戶。

- 使用者和訪問權限面板將顯示在配置數據欄右側,列出您賬戶已經添加好的所有使用者。

- 點擊配置(齒輪)圖標打開使用者和訪問權限界面。

- 此處有兩個面板:使用者面板顯示的是您賬戶已添加的個人,以及其與主要賬戶持有人的關係;使用者角色面板顯示的是您已創建的所有使用者角色。

- 使用右側的圖標添加、編輯或删除使用者。

- 添加使用者和分配訪問權限分幾個界面進行。完成一個界面後,點擊繼續以進入下一個界面。如果想對上一個界面進行調整,點擊返回。

- 在第一個界面,輸入使用者相關的信息,包括用戶名、密碼、姓名、與主要賬戶持有人的關係以及電郵地址。

- 在下一個界面,選擇使用者角色(如有已保存的角色)。使用者角色會自動將先前配置好的一系列訪問權限應用到新的使用者身上。如果是這樣,您可以跳過剩下的界面,直接進入檢查確認界面。

- 後面的每個界面都會讓您授予新使用者訪問某組特定功能的權利。在每個界面點擊對應框授予使用者訪問相應功能的權利。

- 最後一個界面可供您檢查新使用者的所有相關信息,包括訪問權限。新使用者分配的權限將是已勾選狀態,顯示爲綠色;而沒有分配到的權限將是被劃掉狀態。如果沒有問題,點擊繼續。如還需要更改,點擊返回。

- 如果沒有參與安全登錄系統使用雙因素驗證,您將收到一封包含確認碼的電子郵件。輸入通過電郵發送給您的確認碼,然後點擊繼續。如果沒有收到確認碼,點擊請求確認碼以讓系統重新向您的郵箱發送確認碼。

- 點擊確定保存新的使用者,該使用者將顯示在使用者和訪問權限面板。

重要注意事項:

1. 根據市場數據供應商要求,市場數據服務是特定于使用者的,因此所有訂閱的用戶名均會被收取市場數據訂閱費用。

2. 賬戶持有人可以在使用者和訪問權限下點擊用戶名旁邊的删除鏈接删除使用者。

爲個人賬戶持有人添加第二使用者

添加第二使用者步驟如下:

- 登錄客戶端。

- 點擊使用者菜單(右上角的小人圖標),然後點擊管理賬戶。

- 使用者和訪問權限面板將顯示在配置數據欄右側,列出您賬戶已經添加好的所有使用者。

- 點擊配置(齒輪)圖標打開使用者和訪問權限界面。

- 點擊使用者旁的添加“+”圖標。然後您將看到添加使用者頁面,您需要在該頁面設置新的用戶名及其對應密碼。

- 因爲您創建此使用者是作爲第二用戶名,因此在是否爲第二使用者處選擇是。

- 點擊繼續按鈕。

- 檢查詳細信息,然後點擊繼續按鈕。

- 如果沒有參與安全登錄系統使用雙因素驗證,您將收到一封包含確認碼的電子郵件。輸入通過電郵發送給您的確認碼,然後點擊繼續。如果沒有收到確認碼,點擊請求確認碼以讓系統重新向您的郵箱發送確認碼。

- 點擊確定保存新的使用者,主要賬戶持有人現在就可以用其作爲第二用戶名了。

重要注意事項:

1. 根據市場數據供應商要求,市場數據服務是特定于使用者的,因此所有訂閱的用戶名均會被收取市場數據訂閱費用。

2. 賬戶持有人可以在使用者和訪問權限下點擊使用者旁邊的删除鏈接删除第二使用者賬戶。