Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

加密貨幣產品市場數據

股票/ETF

美國

GBTC @ PINK

- 非專業

- 一級:場外市場(非專業,一級)【OTC Markets (NP,L1)】

- 一級:美國證券快照與期貨數據組(非專業,一級)【US Securities Snapshot and Futures Value Bundle (NP,L1)】

- 二級:場外市場(非專業,二級)【OTC Markets (NP,L2)】

- 二級:全球場外交易和場外市場(非專業,二級)【Global OTC and OTC Markets (NP,L2)】

- 專業

- 一級:場外市場(專業,一級)【OTC Markets (P,L1)】

- 一級:專業美國證券快照數據組(專業,一級)【Professional US Securities Snapshot Bundle (P,L1)】

- 二級:場外市場(專業,二級)【Level 2: OTC Markets (P,L2)】

- 二級:全球場外交易和場外市場(專業,二級)【Global OTC and OTC Markets (P,L2)】

非美國

BITCOINXB @ SFB

- 非專業

- 一級:北歐股票(非專業,一級)【Nordic Equity (NP,L1)】

- 二級:北歐股票(非專業,二級)【Nordic Equity (NP,L2)】

- 專業

- 一級:北歐股票(專業,一級)【Nordic Equity (P,L1)】

- 二級:北歐股票(專業,二級)【Nordic Equity (P,L2)】

COINETH @ SFB

- 非專業

- 一級:北歐股票(非專業,一級)【Nordic Equity (NP,L1)】

- 二級:北歐股票(非專業,二級)【Nordic Equity (NP,L2)】

- 專業

- 一級:北歐股票(專業,一級)【Nordic Equity (P,L1)】

- 二級:北歐股票(專業,二級)【Nordic Equity (P,L2)】

COINETHE @ SFB

- 非專業

- 一級:北歐股票(非專業,一級)【Nordic Equity (NP,L1)】

- 二級:北歐股票(非專業,二級)【Nordic Equity (NP,L2)】

- 專業

- 一級:北歐股票(專業,一級)【Nordic Equity (P,L1)】

- 二級:北歐股票(專業,二級)【Nordic Equity (P,L2)】

指數

BRR/BRTI @ CME

- 非專業

- 芝商所實時非專業一級(CME Real-Time Non-Professional Level 1)

- 美國證券快照與期貨數據組(非專業,一級)【US Securities Snapshot and Futures Value Bundle (NP,L1)】

- 專業

- 芝商所實時專業二級(CME Real-Time Professional Level 2)(沒有芝商所專業一級産品)

NYXBT @ FWB/SWB

- 非專業

- FWB:現貨市場德國(法蘭克福/Xetra)(非專業,一級)【Spot Market Germany (Frankfurt/Xetra)(NP,L1)】

- SWB:斯圖加特交易所包含Euwax(SWB)(非專業,一級)【Stuttgart Boerse incl. Euwax (SWB) (NP,L1)】

- 專業

- FWB:現貨市場德國(法蘭克福/Xetra)(專業,一級)【Spot Market Germany (Frankfurt/Xetra)(P,L1)】

- SWB:斯圖加特交易所包含Euwax(SWB)(專業,一級)【Stuttgart Boerse incl. Euwax (SWB) (P,L1)】

期貨

BRR @ CME

ETHUSDRR @ CME

- 非專業

- 一級:芝商所實時非專業一級(CME Real-Time Non-Professional Level 1)

- 一級:美國證券快照與期貨數據組(非專業,一級)【US Securities Snapshot and Futures Value Bundle (NP,L1)】

- 二級:芝商所實時專業二級(CME Real-Time Professional Level 2)

- 二級:美國數據組增强版(非專業,二級【US Value Bundle PLUS (NP,L2)】

- 需要訂閱美國證券快照與期貨數據組

- 僅針對深度在册

- 專業

- 二級:芝商所實時專業二級(CME Real-Time Professional Level 2)(沒有芝商所專業一級産品)

BAKKT @ ICECRYPTO

- 非專業

- ICE Futures US (NP)

- Professional

- 洲際交易所期貨美國(專業)【ICE Futures US (P)】

返回目錄:IBKR的比特幣和其它加密貨幣産品

如何確定哪些市場數據訂閱適合某一指定證券?

IBKR爲賬戶持有人提供了市場數據助手,可幫助其選擇想要交易的證券(股票、期權或權證)所適用的訂閱服務。搜索結果會顯示産品進行交易的所有交易所、訂閱服務及其月費(專業客戶和非專業客戶)以及每種訂閱服務的市場深度數據。

要訪問市場數據助手:

- 登錄客戶端

- 點擊“幫助”菜單(右上角的問號圖標),然後點擊“支持中心”

- 向下滾動,選擇“市場數據助手”

- 輸入代碼或ISIN以及交易所

- 選擇篩選條件:專業/非專業訂戶狀態、幣種和資産

- 點擊“搜索”

- 查看搜索結果幷决定哪些訂閱最符合自己的需求。

更多信息請參見IBKR網站的市場數據選擇頁面。

訂閱美國市場數據(非專業)應該考慮的因素

在確定要提供的市場數據訂閱服務範疇時,IBKR力求能平衡廣大客戶的需求,既考慮交易産品的範疇,也要考慮數據使用的頻率。爲了幫助客戶節省美國數據的每月訂閱費用,我們提供了組合訂閱和分項訂閱兩種方式,同時還有實時數據、快照數據和延時數據這三種類型可供客戶自行選擇。請注意,根據監管要求,IBKR不再向Interactive Brokers LLC的客戶提供美國股票的延時報價信息。

您交易什麽美國産品?

您需要查看實時報價的頻率如何?

您每月一般會産生多少傭金?

您交易哪些交易所的産品?

- 美國股票和期權擴展實時更新數據組(US Equity and Options Add-On Streaming Bundle)1:包括NYSE (Network A)、AMEX (Network B)、NASDAQ(Network C)和OPRA(美國期權)。適合交易所有四家交易所的證券幷且交易頻率較高的用戶。將取代美國證券快照和期貨數據組訂閱中提供的快照報價。

延時市場數據的延遲時間

市場數據供應商提供的交易所數據通常分爲兩類,即實時數據和延時數據。實時市場數據是只要信息一公開便會立刻發布。而延時市場數據則相對于實時報價會有一定延遲,通常會晚10到20分鐘。

某些交易所允許免費顯示延時數據,不收取任何市場數據訂閱費用。下方表格列出了我們可以無需正式請求(即在交易平臺輸入産品代碼便會顯示相應的延時數據)、免費提供延時數據的交易所。該表格還包含的對應的實時數據訂閱信息,詳細費用請參見IBKR的網站。

請注意:

- 根據監管要求,IBKR不再向Interactive Brokers LLC的客戶提供美國股票的延時報價信息。

- 延時報價應作爲指示參考使用,不一定可用于交易。延遲的時間可能會在無事先通知的情况下進一步延長。

美洲

| 外部交易所名稱 | IB交易所名稱 | 延遲時間 | 實時訂閱 |

| CBOT | CBOT | 10分鐘 | CBOT Real-Time |

| CBOE Futures Exchange | CFE | 10分鐘 | CFE Enhanced |

| Market Data Express (MDX) | CBOE | 10分鐘 | CBOE Market Data Express Indices |

| CME | CME | 10分鐘 | CME Real-Time |

| COMEX | COMEX | 10分鐘 | COMEX Real-Time |

| ICE US | NYBOT | 10分鐘 | ICE Futures U.S. (NYBOT) |

| Mexican Derivatives Exchange | MEXDER | 15分鐘 | Mexican Derivatives Exchange |

| Mexican Stock Exchange | MEXI | 20分鐘 | Mexican Stock Exchange |

| Montreal Exchange | CDE | 15分鐘 | Montreal Exchange |

| NYMEX | NYMEX | 10分鐘 | NYMEX Real-Time |

| NYSE GIF | NYSE | 15分鐘 | NYSE Global Index Feed |

| One Chicago | ONE | 10分鐘 | OneChicago |

| OPRA | OPRA | 15分鐘 | OPRA Top of Book (L1) (US Option Exchanges) |

| OTC Markets | PINK | 15分鐘 | OTC Markets |

| Toronto Stock Exchange | TSE | 15分鐘 | Toronto Stock Exchange |

| Venture Exchange | VENTURE | 15分鐘 | TSX Venture Exchange |

歐洲

| 外部交易所名稱 | IB交易所名稱 | 延遲時間 | 實時訂閱 |

| BATS Europe | BATE/CHIX | 15分鐘 | European (BATS/Chi-X) Equities |

| Boerse Stuttgart | SWB | 15分鐘 | Stuttgart Boerse incl. Euwax (SWB) |

| Bolsa de Madrid | BM | 15分鐘 | Bolsa de Madrid |

| Borsa Italiana | BVME/IDEM | 15分鐘 | Borsa Italiana (BVME stock / SEDEX / IDEM deriv) |

| Budapest Stock Exchange | BUX | 15分鐘 | Budapest Stock Exchange |

| Eurex | EUREX | 15分鐘 | Eurex Real-Time Information |

| Euronext | AEB/SBF/MATIF/BELFOX | 15分鐘 | Euronext Cash |

| Euronext | AEB/SBF/MATIF/BELFOX | 15分鐘 | Euronext Data Bundle |

| Frankfurt Stock Exchange and XETRA | FWB/IBIS/XETRA | 15分鐘 | Spot Market Germany (Frankfurt/Xetra) |

| ICE Futures Europe (Commodities) | IPE | 10分鐘 | ICE Futures E.U. - Commodities (IPE) |

| ICE Futures Europe (Financials) | ICEEU | 10分鐘 | ICE Futures E.U. – Financials (LIFFE) |

| LSE | LSE | 15分鐘 | LSE UK |

| LSEIOB | LSEIOB | 15分鐘 | LSE International |

| MEFF | MEFF | 15分鐘 | BME (MEFF) |

| NASDAQ OMX Nordic Derivatives | OMS | 15分鐘 | Nordic Derivatives |

| Prague Stock Exchange | PRA | 15分鐘 | Prague Stock Exchange Cash Market |

| SWISS Exchange | EBS/VIRTX | 15分鐘 | SIX Swiss Exchange |

| Tel Aviv Stock Exchange | TASE | 15分鐘 | Tel Aviv Stock Exchange |

| Turquoise ECN | TRQXCH/TRQXDE/TRQXEN | 15分鐘 | Turquoise ECNs |

| Warsaw Stock Exchange | WSE | 15分鐘 | Warsaw Stock Exchange |

亞洲

| 外部交易所名稱 | IB交易所名稱 | 延遲時間 | 實時訂閱 |

| Australian Stock Exchange | ASX | 20分鐘 | ASX Total |

| 恒生指數 | HKFE-IND | 15分鐘 | 恒生指數 |

| 香港期貨交易所 | HKFE | 15分鐘 | 香港衍生品(期貨&期權) |

| 香港聯合交易所 | SEHK | 15分鐘 | 香港證券交易所(股票、權證&債券) |

| Korea Stock Exchange | KSE | 20分鐘 | Korea Stock Exchange |

| National Stock Exchange of India | NSE | 15分鐘 | National Stock Exchange of India, Capital Market Segment |

| Osaka Securities Exchange | OSE.JPN | 20分鐘 | Osaka Exchange |

| SGX Derivatives | SGX | 10分鐘 | Singapore Exchange (SGX) - Derivatives |

| 上海證券交易所 | SEHKNTL | 15分鐘 | 上海證券交易所 |

| 上海證券交易所科創板 | SEHKSTAR | 15分鐘 | 上海證券交易所 |

| 深圳證券交易所 | SEHKSZSE | 15分鐘 | 深圳證券交易所 |

| Singapore Stock Exchange | SGX | 10分鐘 | Singapore Exchange (SGX) - Stocks |

| Sydney Futures Exchange | SNFE | 10分鐘 | ASX24 Commodities and Futures |

| Tokyo Stock Exchange | TSEJ | 20分鐘 | Tokyo Stock Exchange |

費用概覽

我們鼓勵客戶和潛在客戶訪問我們的網站瞭解詳細費用信息。

最常見的幾項費用有:

1. 傭金——取決於產品類型和掛牌交易所,以及您選擇的是打包式(一價全含)還是非打包式收費。例如,美國股票傭金為每股0.005美元,每筆交易最低傭金為1.00美元。

2. 利息——保證金貸款需繳納利息,IBKR採用國際公認的隔夜存款基準利率作為基礎來確定自己的利率。然後我們將分等級在基準利率基礎上應用一個浮動值(這樣餘額越大對應的利率就越有利)來確定實際利率。例如,對於美元計價的貸款,基準利率是聯邦基金利率,而10萬美元以內的餘額利率會在基準利率的基礎上加1.5%。此外,賣空股票的個人應注意,借用“難以借到”的股票還會有一筆特殊費用,以日息表示。

3. 交易所費用——取決於產品類型和交易所。例如,對於美國證券期權,某些交易所會對消耗流動性的委託單(市價委託單或適銷的限價委託單)收取費用、對添加流動性的委託單(限價委託單)給與補貼。此外,許多交易所還會對取消或修改的委託單收取費用。

4. 市場數據——您並非一定要訂閱市場數據,但是如果不訂閱市場數據,您可以會產生月費用,具體取決於供應交易所及其訂閱服務。我們提供市場數據助手工具,可根據您想交易的產品幫助您選擇適當的市場數據訂閱服務。要訪問該工具,請登錄客戶端,點擊支持然後打開市場數據助手鏈接。

5. 最低月活動費用——為迎合活躍客戶的需求,我們規定如果賬戶產生的月傭金能達到最低月傭金要求,則可免交月活動費用;而如果產生的月傭金未能達到最低月傭金要求,則需繳納差額作為活動費用。最低月傭金要求為10美元。

6. 雜費 - IBKR允許每月一次免費取款,後續取款將收取費用。此外,還會代收交易取消請求費用、期權和期貨行權&被行權費用以及ADR保管費用。

更多信息,請訪問我們的網站,從定價菜單中選擇查看。

VR(T) time decay and term adjusted Vega columns in Risk Navigator (SM)

Background

Risk Navigator (SM) has two Adjusted Vega columns that you can add to your report pages via menu Metrics → Position Risk...: "Adjusted Vega" and "Vega x T-1/2". A common question is what is our in-house time function that is used in the Adjusted Vega column and what is the aim of these columns. VR(T) is also generally used in our Stress Test or in the Risk Navigator custom scenario calculation of volatility index options (i.e VIX).

Abstract

Implied volatilities of two different options on the same underlying can change independently of each other. Most of the time the changes will have the same sign but not necessarily the same magnitude. In order to realistically aggregate volatility risk across multiple options into a single number, we need an assumption about relationship between implied volatility changes. In Risk Navigator, we always assume that within a single maturity, all implied volatility changes have the same sign and magnitude (i.e. a parallel shift of volatility curve). Across expiration dates, however, it is empirically known that short term volatility exhibits a higher variability than long term volatility, so the parallel shift is a poor assumption. This document outlines our approach based on volatility returns function (VR(T)). We also describe an alternative method developed to accommodate different requests.

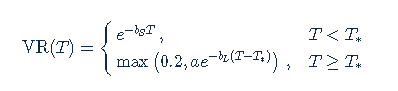

VR(T) time decay

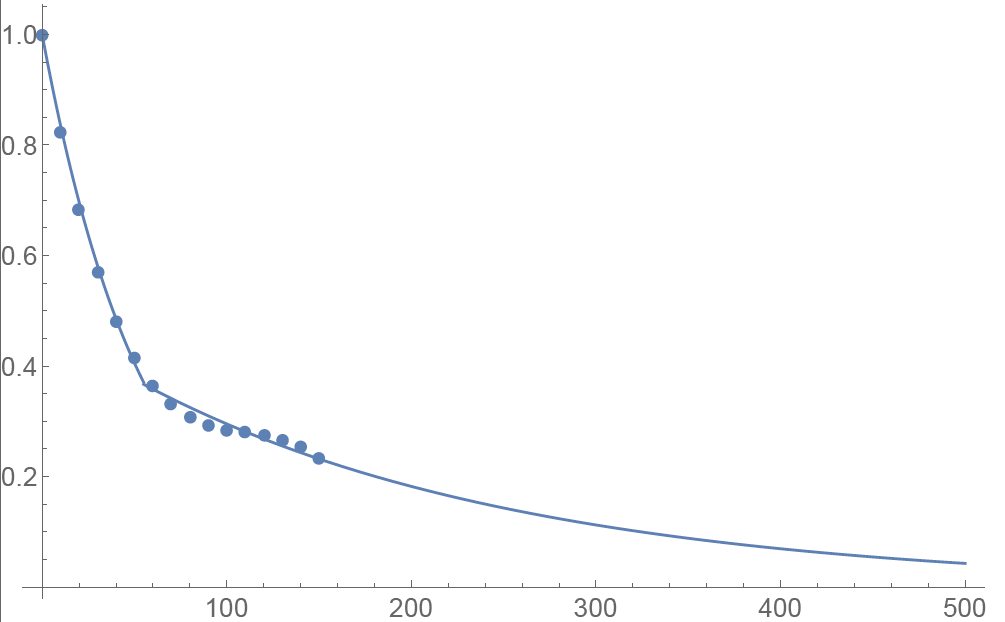

We applied the principal component analysis to study daily percentage changes of volatility as a function of time to maturity. In that study we found that the primary eigen-mode explains approximately 90% of the variance of the system (with second and third components explaining most of the remaining variance being the slope change and twist). The largest amplitude of change for the primary eigenvector occurs at very short maturities, and the amplitude monotonically decreases as time to expiration increase. The following graph shows the main eigenvector as a function of time (measured in calendar days). To smooth the numerically obtained curve, we parameterize it as a piecewise exponential function.

Functional Form: Amplitude vs. Calendar Days

To prevent the parametric function from becoming vanishingly small at long maturities, we apply a floor to the longer term exponential so the final implementation of this function is:

where bS=0.0180611, a=0.365678, bL=0.00482976, and T*=55.7 are obtained by fitting the main eigenvector to the parametric formula.

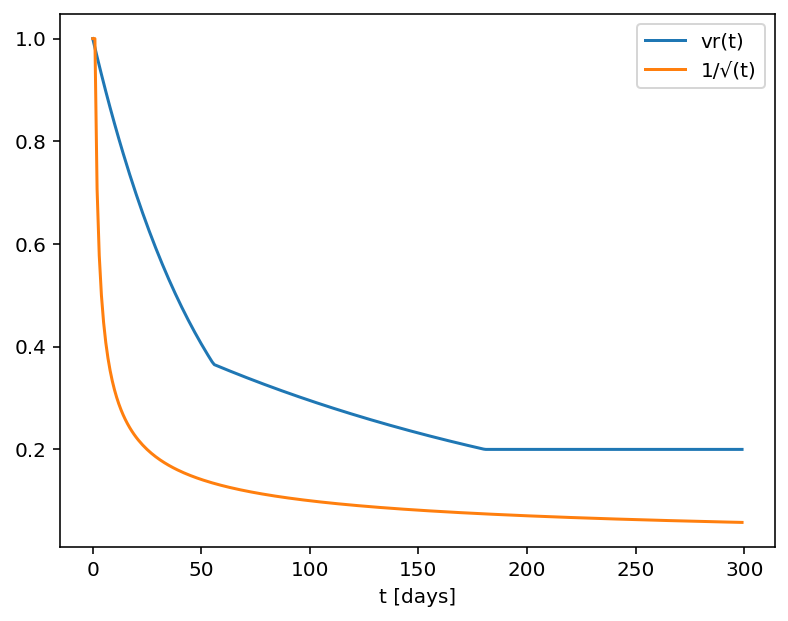

Inverse square root time decay

Another common approach to standardize volatility moves across maturities uses the factor 1/√T. As shown in the graph below, our house VR(T) function has a bigger volatility changes than this simplified model.

Time function comparison: Amplitude vs. Calendar Days

Adjusted Vega columns

Risk Navigator (SM) reports a computed Vega for each position; by convention, this is the p/l change per 1% increase in the volatility used for pricing. Aggregating these Vega values thus provides the portfolio p/l change for a 1% across-the-board increase in all volatilities – a parallel shift of volatility.

However, as described above a change in market volatilities might not take the form of a parallel shift. Empirically, we observe that the implied volatility of short-dated options tends to fluctuate more than that of longer-dated options. This differing sensitivity is similar to the "beta" parameter of the Capital Asset Pricing Model. We refer to this effect as term structure of volatility response.

By multiplying the Vega of an option position with an expiry-dependent quantity, we can compute a term-adjusted Vega intended to allow more accurate comparison of volatility exposures across expiries. Naturally the hoped-for increase in accuracy can only come about if the adjustment we choose turns out to accurately model the change in market implied volatility.

We offer two parametrized functions of expiry which can be used to compute this Vega adjustment to better represent the volatility sensitivity characteristics of the options as a function of time to maturity. Note that these are also referred as 'time weighted' or 'normalized' Vega.

Adjusted Vega

A column titled "Vega Adjusted" multiplies the Vega by our in-house VR(T) term structure function. This is available any option that is not a derivative of a Volatility Product ETP. Examples are SPX, IBM, VIX but not VXX.

Vega x T-1/2

A column for the same set of products as above titled "Vega x T-1/2" multiplies the Vega by the inverse square root of T (i.e. 1/√T) where T is the number of calendar days to expiry.

Aggregations

Cross over underlying aggregations are calculated in the usual fashion given the new values. Based on the selected Vega aggregation method we support None, Straight Add (SA) and Same Percentage Move (SPM). In SPM mode we summarize individual Vega values multiplied by implied volatility. All aggregation methods convert the values into the base currency of the portfolio.

Custom scenario calculation of volatility index options

Implied Volatility Indices are indexes that are computed real-time basis throughout each trading day just as a regular equity index, but they are measuring volatility and not price. Among the most important ones is CBOE's Marker Volatility Index (VIX). It measures the market's expectation of 30-day volatility implied by S&P 500 Index (SPX) option prices. The calculation estimates expected volatility by averaging the weighted prices of SPX puts and calls over a wide range of strike prices.

The pricing for volatility index options have some differences from the pricing for equity and stock index options. The underlying for such options is the expected, or forward, value of the index at expiration, rather than the current, or "spot" index value. Volatility index option prices should reflect the forward value of the volatility index (which is typically not as volatile as the spot index). Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different, albeit related, volatility estimates.

For volatility index options like VIX the custom scenario editor of Risk Navigator offers custom adjustment of the VIX spot price and it estimates the scenario forward prices based on the current forward and VR(T) adjusted shock of the scenario adjusted index on the following way.

- Let S0 be the current spot index price, and

- S1 be the adjusted scenario index price.

- If F0 is the current real time forward price for the given option expiry, then

- F1 scenario forward price is F1 = F0 + (S1 - S0) x VR(T), where T is the number of calendar days to expiry.

VOLUME – Calculation of Shares Traded

At first glance, the number of shares executed in a given time period would seem to be a straightforward calculation. The simplest definition of volume is the number of shares traded from one point in time to another point in time. However, several variables affect the calculation.

Market conditions may cause a calculation of volume to differ among data providers. For example, the two plans that manage the US Consolidated equities market have different number of, and definition for, trade reporting codes. In addition, data distributors often include variables such as odd lots, corrections, cash trades, or pre-/post-market trades in the volume calculation.

Numbers can become more visible in light volume or over time. For example, what was volume as of 09:37?

| Time | Symbol | Quantity | Price |

| 9:35 | XYZ | 1000 | 19.90 |

| 9:36 | XYZ | -1000 | 19.90 |

| 9:37 | XYZ | 1000 | 19.80 |

Depending on the distributor, the volume at 09:37 could be:

- 1000 shares if the distributor corrects the volume for corrections

- 2000 shares if the distributor only counts positive numbers

- 3000 shares if the distributor reflects the total of all prints expressed as a positive number

This may be a simplified example, but understanding how a distributor calculates volume will help the volume calculation serve as an indicator of market direction.

Alternative Streaming Quotes for US Equities

The SEC Vendor Display Rule requires that brokers give clients access to the NBBO at the point of order entry. In order to provide users with free live streaming market data, we cannot display this free stream when entering an order without the client subscribing to the paid NBBO. Please note, this does not apply to non-IBLLC clients.

Under the Rule 603(c) of Regulation NMS (Vendor Display Rule), when a broker is providing quotation information to clients that can be used to assess the current market or the quality of trade execution, reliance on non-consolidated market information as the source of that quotation would not be consistent with the Vendor Display Rule.

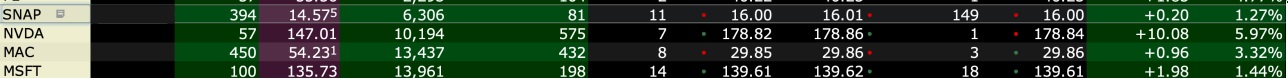

All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, we cannot show this quote when entering parameters for a US stock quote. Therefore and according to FINRA's enforcement of the SEC rule, IBKR provides IBLLC US clients a free default snapshot service, “US Snapshots VDR Required”. If clients do not sign up for an NBBO US equity data service and they are an IBLLC client, they will have access to free real-time snapshots when making trading decisions on US stocks. Order routing will not change based on what is shown on the screen. If one is subscribed to NBBO quotes or not, by default the trade will still take place with the assistance of the SMART order router designed to provide the best price for the order.

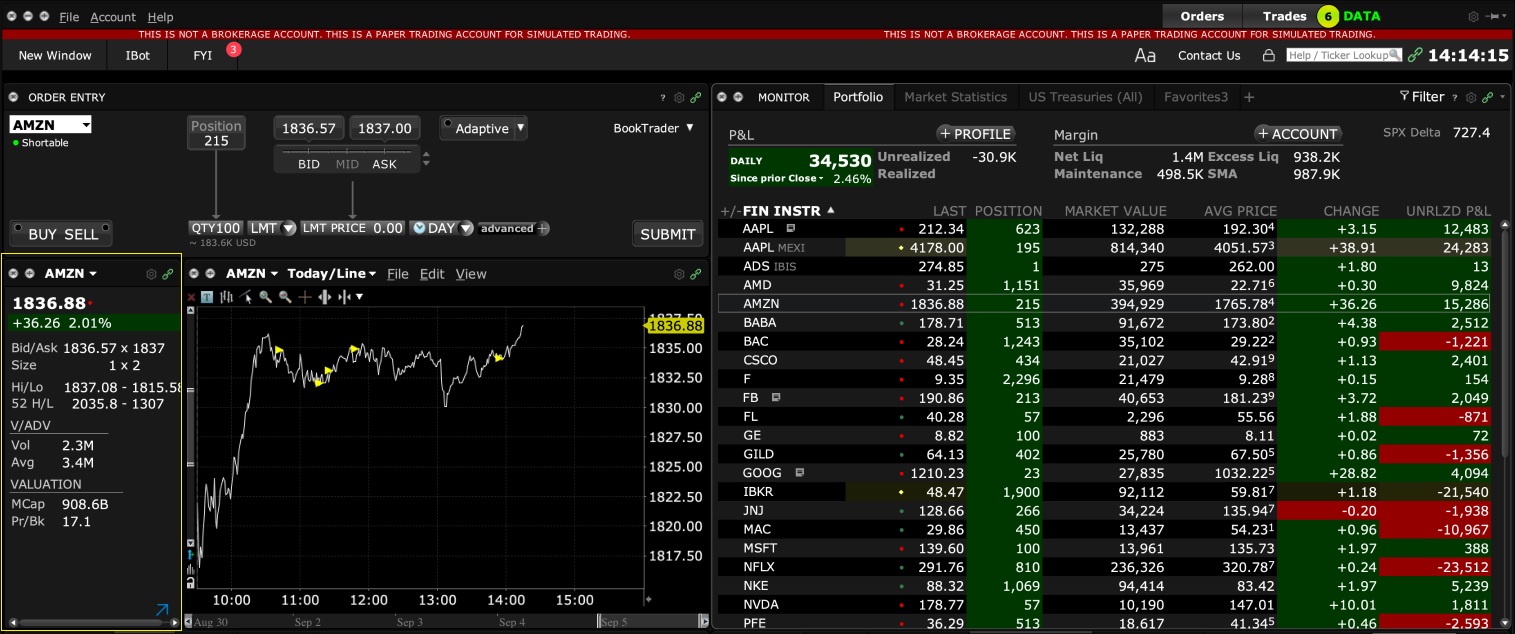

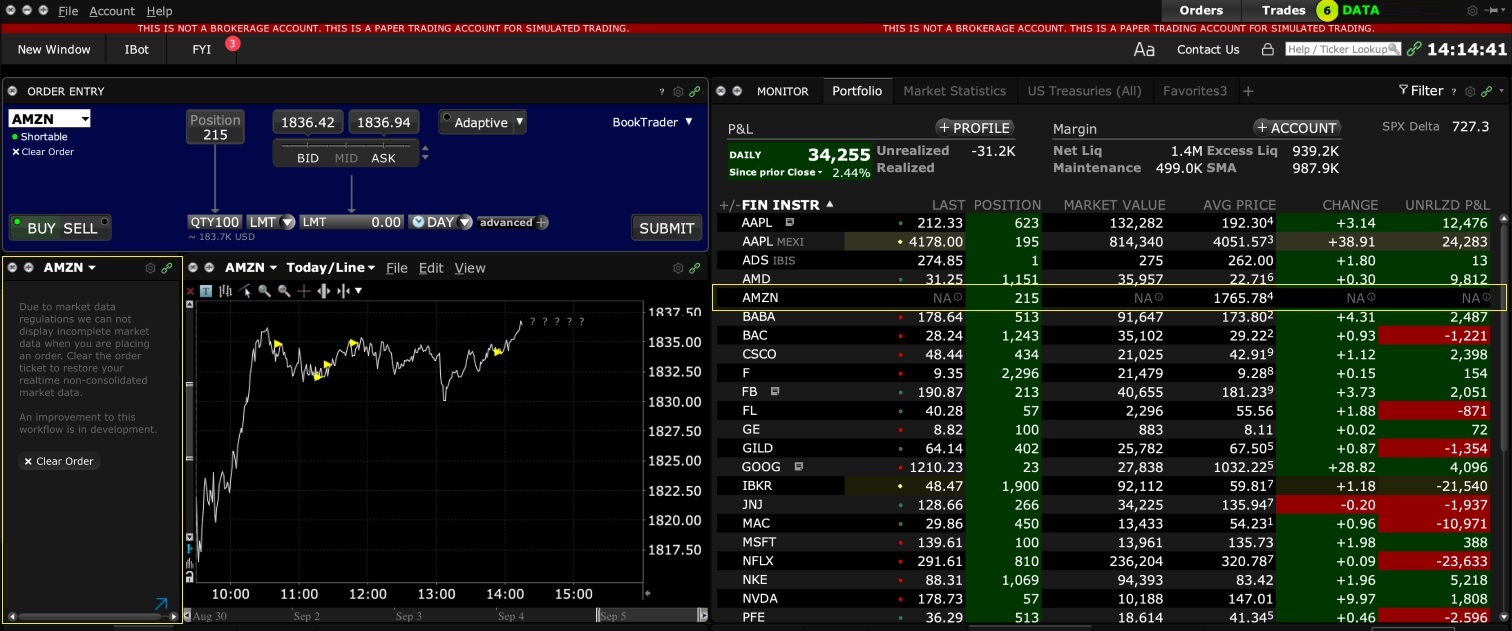

Please see the sample screenshots below from TWS Classic and TWS Mosaic for what occurs when placing an order without the NBBO streaming subscription for US equities.

TWS Classic:

1. Screenshot of quotes showing without order entry line item

2. Screenshot of quote going blank when putting in the order entry line item

TWS Mosaic:

1. Screenshot of quotes showing without order entry line item

2. Screenshot of quote going blank when putting in the order entry line item

快照市場數據

背景

符合一定要求的IBKR客戶可選擇提交單次請求,要求接收某個金融産品的實時報價。該服務被稱爲“快照報價”。傳統報價服務會持續更新實時報價,而快照報價不會,這是它與傳統報價服務的不同之處。對于不經常交易且不希望根據延時報價1下單的客戶,快照報價的價格更有競爭力。有關該報價服務的更多信息如下。

報價項目

快照報價包括以下數據:

- 最後價

- 最後價交易數量

- 最後價交易所

- 當前買價-賣價

- 當前買價-賣價的交易數量

- 當前買價-賣價的交易所

可用服務

| 服務 | 限制 | 每條報價請求的價格(美元)2 |

|---|---|---|

| AMEX(B/CTA網絡) | $0.01 | |

| ASX Total | 不支持ASX24 僅限非專業訂閱用戶 |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| 加拿大交易所集團(TSX/TSXV) | 僅限不是IB加拿大客戶的非專業訂閱用戶 | $0.03 |

| CBOT實時 | $0.03 | |

| CME實時 | $0.03 | |

| COMEX實時 | $0.03 | |

| Eurex Core | 僅限非專業訂閱用戶 | $0.03 |

| Euronext基礎版 | 僅限非專業訂閱用戶 包括Euronext股票、指數、股票衍生品及指數衍生品 |

$0.03 |

| 德國ETF和指數 | 僅限非專業訂閱用戶 | $0.03 |

| 香港(HKFE)衍生品 | $0.03 | |

| 香港證券交易所(股票、權證、債券) | $0.03 | |

| 約翰內斯堡證券交易所 | $0.03 | |

| 蒙特利爾衍生品 | 僅限非專業訂閱用戶 | $0.03 |

| NASDAQ(C/UTP網絡) | $0.01 | |

| Nordic衍生品 | $0.03 | |

| Nordic股票 | $0.03 | |

| NYMEX實時 | $0.03 | |

| NYSE(A/CTA網絡) | $0.01 | |

| OPRA(美國期權交易所) | $0.03 | |

| 上交所5秒快照(通過HKEx) | $0.03 | |

| 深交所5秒快照(通過HKEx) | $0.03 | |

| SIX瑞士交易所 | 僅限非專業訂閱用戶 | $0.03 |

| 即期市場德國(Frankfurt/Xetra) | 僅限非專業訂閱用戶 | $0.03 |

| STOXX指數實時數據 | 僅限非專業訂閱用戶 | $0.03 |

| 多倫多證券交易所 | 僅限IB加拿大客戶中的非專業訂閱用戶 | $0.03 |

| 多倫多證券交易所創業板 | 僅限IB加拿大客戶中的非專業訂閱用戶 | $0.03 |

| 英國倫敦證券交易所(IOB)股票 | $0.03 | |

| 英國倫敦證券交易所股票 | $0.03 |

1根據監管要求,IBKR不再向Interactive Brokers LLC的客戶提供美國股票的延時報價信息。

2費用按每筆快照報價請求計算,如果不是美元計費,則將按賬戶基礎貨幣收取。

資格要求

- 賬戶必須達到市場數據訂閱的最低和維持資産要求才能使用快照報價服務。

- 用戶必須運行TWS 976.0或以上版本才能使用快照報價功能。

定價詳情

- 每月客戶可免費接收$1.00美元的快照報價。免費快照可能會用于美國或非美國報價請求,而一旦免費額度用完,便會直接開始收費,不再另行通知。客戶可在客戶端中查看其每日的快照使用情况。

- 報價采用後付費模式,通常在提供快照服務次月的第一周收取。賬戶現金或含貸款價值的淨資産如不足以支付月費的,賬戶持倉將面臨清算。

- 快照數據的月費用不得超過相關實時數據的月費。如果當月快照報價合計費用達到了相關實時數據的價格,則該月剩餘時間用戶無需支付額外費用便可使用實時數據服務。系統將在用戶達到快照數據費用上限下一個工作日的美東時間18:30左右切換爲實時報價。月末,實時報價服務會自動終止,次月快照費用則重新開始累計。每項服務的費用均單獨累計,一項服務的報價請求不得與另一項服務合幷來應用上限。詳情請見以下表格。

| 服務 | 每條報價請求的價格(美元) | 非專業訂閱用戶上限(請求次數/總費用)2 | 專業訂閱用戶上限(請求次數/總費用)3 |

|---|---|---|---|

| AMEX(B/CTA網絡) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ(C/UTP網絡) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE(A/CTA網絡) | $0.01 | 150/$1.50 | 4,500/$45.00 |

請求快照報價

桌面版交易——標準模式TWS:

如您已能看到延時數據且啓用了快照報價,則您可在“代碼行動”欄下看到“快照”按鈕:

點擊“快照”按鈕後會出現報價詳情窗口。一旦系統收到了該産品的NBBO(全國最佳買賣價)報價,報價詳情窗口會即刻生成一個時間戳幷顯示NBBO信息:

在報價詳情窗口中點擊刷新鏈接會更新NBBO報價。

舉例:

在上例中,GOOG是一家在納斯達克(C/UTP 網絡)上市的公司。每請求一次報價(一次快照)的費用爲0.01美元。

- 非專業用戶最多可再請求149條GOOG或任意其它在納斯達克(C/UTP 網絡)挂牌的股票的快照數據,超過149條將切換爲實時報價。

- 專業用戶最多可再請求2449條GOOG或任意其它在納斯達克(C/UTP 網絡)上市的股票的快照數據,超過2449條將切換爲實時報價。

您請求快照數據産生的費用不會超過上限。一旦達到上限,該月剩餘時間將不會産生新的費用,且您將收到該産品的實時數據。

桌面版交易——TWS魔方:

如您已能看到延時數據且啓用了快照報價,選擇監控標簽下的某一行後,“定單輸入”窗口會顯示請求快照數據的選項。

點擊+快照鏈接後會出現報價詳情窗口。一旦系統收到了該産品的NBBO報價,報價詳情窗口會即刻生成一個時間戳幷顯示NBBO信息:

在報價詳情窗口中點擊刷新鏈接會更新NBBO報價。

客戶端:

如您已能看到延時數據且啓用了快照報價,在買價/賣價下的“定單委托單”窗口內,您將看到快照鏈接:

點擊快照鏈接後會出現報價詳情窗口。一旦系統收到了該産品的NBBO報價,報價詳情窗口會即刻生成一個時間戳:

在報價詳情窗口中點擊刷新鏈接會更新NBBO報價。

網絡交易——網絡交易者(WebTrader):

如您已能看到延時數據且啓用了快照報價,在“市場”標簽下的“其它數據”欄上您將看到“快照”數據:

點擊“快照”按鈕後會出現報價詳情窗口。一旦系統收到了該産品的NBBO報價,報價詳情窗口會即刻生成一個時間戳:

移動交易——移動IBKR應用:

在報價界面點擊任意産品代碼會擴展報價框。如您已能看到延時數據且啓用了快照報價,您將看到“快照”鏈接:

點擊“快照”鏈接後會出現報價詳情窗口。一旦系統收到了該産品的NBBO(全國最佳買賣價)報價,報價詳情窗口會即刻生成一個時間戳幷顯示NBBO信息: