Determining Tick Value

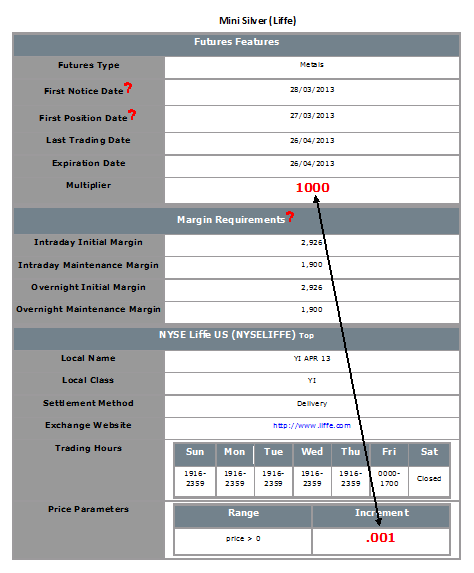

Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Tick values vary by instrument and are determined by the listing exchange. IB provides this information directly from the Contract Search tool on the website or via the Trader Workstation (TWS). To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. The contract specifications window for the instrument will then be displayed (Exhibit 1).

To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. As illustrated in the example below, the LIFFE Mini Silver futures contact has a tick value or minimum increment of .001 which, when multiplied by the contract multiplier of 1,000 ounces, results in a minimum tick value of $1.00 per contract. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

Exhibit 1

Compatibility between MetaTrader and Interactive Brokers

Interactive Brokers (IBKR) provides to its account holders a variety of proprietary trading platforms at no cost and therefore does not actively promote or offer the platforms or add-on software of other vendors. Nonetheless, as IBKR's principal trading platform, the TraderWorkstation (TWS), operates with an open API, there are numerous third-party vendors who create order entry, charting and various other analytical programs which operate in conjunction with the TWS for purposes of executing orders through IBKR. As these API specifications are made public, we are not necessarily aware of all vendors who create applications to integrate with the TWS but do offer a program referred to as the Investors Marketplace which operates as a self-service community bringing together third party vendors who have products and services to offer with IBKR customers seeking to fill a specific need.

While MetaQuotes Software is not a participant of IBKR's Investors Marketplace, they offer to Introducing Brokers the oneZero Hub Gateway so that MetaTrader 5 can be used to trade IBKR Accounts[1]. Clients interested would need to contact oneZero directly for additional assistance. Please refer to the Contact section from the following URL.

Note: Besides oneZero Hub Gateway, different vendors such as Trade-Commander, jTWSdata and PrimeXM also offer a software which they represent, acts as a bridge between MetaTrader 4/5 and the TWS. As is the case with other third-party software applications, IBKR is not in a position to provide information or recommendations as to the compatibility or operation of such software.

1: oneZero is not available for Individual Accounts, please click here for more information on Introducing Brokers.

Commodity Futures & Futures Options Position Limits

Regulators and exchanges typically impose limits on the number of commodity positions any customer may maintain with the intent of controlling excessive speculation, deterring market manipulation, ensuring sufficient market liquidity for bona fide hedgers and to prevent disruptions to the price discovery function of the underlying market. These limits are intended as strict caps, with no one account or group of related accounts allowed to aggregate or maintain a position in excess of the stated limit. Outlined below is an overview of the various limit types, calculation considerations, enforcement and links for finding additional information.

I. POSITION LIMIT TYPES

Position limits generally fall into one of the following 4 categories:

1. All Months Limit - apply to the account holder's positions summed across all delivery months for a given contract (e.g. positions in CBOT Oat futures contract for the Mar, May, Jul, Sep and Dec delivery months combined).

2. Single Month Limit - apply to the account holder's positions in any given futures delivery month (e.g. positions in CBOT Oat futures contract for any of the Mar, May, Jul, Sep and Dec delivery months). Note that in certain instances, the limit may vary by delivery month.

3. Spot Month Limit - apply to the account holder's positions in the contract month currently in delivery. For example, the March contract month for a product having delivery months of March, June, September and December, while considered a nearby month at the start of the year, does not become a spot month contract for position limit purposes until the date it actually enters delivery. Most spot month limits become effective at the close of trading on the day prior to the First Notice Date (e.g., if the First Notice Date for a Dec contract is the last trading date of the prior month, then the spot month limit would apply as of the close of business on Nov 29th). In other instances, the limit goes into effect or tightens during the last 3-10 days of trading.

4. Expiration Month Limit - expiration month limits apply to the account holder's positions in the contract currently in its last month of trading. Most expiration month limits become effective at the open of trading on the first business day of the last trading month. If the contract ceases trading before delivery begins, then the expiration month may precede the delivery month. (e.g., if the last trade date for a Dec contract is Nov 30th, then the expiration month limit would apply as Nov 1st). In other instances, the limit goes into effect or tightens during the last 3-10 days of trading.

II. CALCULATION CONSIDERATIONS

- Position limits are determined by aggregating option and futures contracts. In the case of option contracts, the position is converted to an equivalent futures position based upon the delta calculations provided by the exchange.

- Positions in contracts with non-standard notional values (e.g. mini-sized contracts) are normalized prior to aggregation.

- Most limits are applied on a net position basis (long - short) although certain are applied on a gross position basis (long + short). For purposes of determining the net or gross position, long calls and short puts are considered equivalent to long futures positions (subject to the delta adjustment) and short calls and long puts equivalent to short futures positions.

- Limits are imposed on both an intra-day and end of day basis.

III. ENFORCING LIMITS

IB acts to prevent account holders from entering into transactions which would result in a position limit violation. This process includes monitoring account activity, sending a series of notifications intended to allow the account holder to self-manage exposure and placing trading restrictions upon accounts approaching a limit. Examples of notifications which are sent via email, TWS bulletin and Message Center are as follows:

1. Information Level - sent when the position exceeds 50% of the limit. Intended to inform as to the existence of the position limit and its level.

2. Warning Level - sent when the position exceeds 70% of the limit. Intended to provide advance warning that account will be subject to trading restrictions should exposure increase to 90%.

3. Restriction Level - sent when the position exceeds 90% of the limit. Provides notice that account is restricted to closing transactions until exposure has been reduced to 85%.

IV. ADDITIONAL INFORMATION

For additional information, including various exchange rules position limit thresholds by contract and limit type, please refer to the following website links:

CFE ( Rule 412) - http://cfe.cboe.com/publish/CFERuleBook/CFERuleBook.pdf

CME (Rule 559) - http://www.cmegroup.com/rulebook/CME/index.html

CME (CBOT Rule 559) - http://www.cmegroup.com/rulebook/CBOT/index.html

CME (NYMEX Rule 559) - http://www.cmegroup.com/rulebook/NYMEX/index.html

ELX Futures (Rule IV-11) - http://www.elxfutures.com/PDFs/Rulebooks/ELX-FUTURES-RULEBOOK.aspx

ICE US / NYBOT (Rules 6.26 to 6.28) - https://www.theice.com/publicdocs/rulebooks/futures_us/6_Regulatory.pdf

NYSE LIFFE (Rule 420) - http://www.nyseliffeus.com/rulebook

OneChicago (Rule 414) - http://www.onechicago.com/wp-content/uploads/rules/OneChicago_Current_Rulebook.pdf

Overview of the OneChicago NoDiv Contract

The OneChicago NoDiv single stock futures contract (OCX.NoDivRisk) differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions (e.g., dividends, capital gains, etc.). Whereas the traditional contract is not adjusted for such ordinary distributions (the discounted expectations are reflected in the price), the NoDiv contract is intended to remove the risk of dividend expectations through a price adjustment made by the clearinghouse. The adjustment is made on the morning of the ex-date to ensure that the effect of the distribution is removed from the daily mark-to-market or cash variation pay/collect.

For example, assume a NoDiv contract which closes at $50.00 on the business day prior the ex-date at which stockholders of a $1.00 dividend are to be determined. On the ex-date OCC will adjust that prior day's final settlement price from $50.00 downward by the amount of the dividend to $49.00. The effect of this adjustment will be to ensure that the dividend has no impact upon the cash variation pay/collect as of ex-date close (i.e., short position holder does not receive the $1.00 variation collect and the long holder incur the $1.00 payment).

Considerations for Optimizing Order Efficiency

Account holders are encouraged to routinely monitor their order submissions with the objective of optimizing efficiency and minimizing 'wasted' or non-executed orders. As inefficient orders have the potential to consume a disproportionate amount of system resources. IB measures the effectiveness of client orders through the Order Efficiency Ratio (OER). This ratio compares aggregate daily order activity relative to that portion of activity which results in an execution and is determined as follows:

OER = (Order Submissions + Order Revisions + Order Cancellations) / (Executed Orders + 1)

Outlined below is a list of considerations which can assist with optimizing (reducing) one's OER:

1. Cancellation of Day Orders - strategies which use 'Day' as the Time in Force setting and are restricted to Regular Trading Hours should not initiate order cancellations after 16:00 ET, but rather rely upon IB processes which automatically act to cancel such orders. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not.

2. Modification vs. Cancellation - logic which acts to cancel and subsequently replace orders should be substituted with logic which simply modifies the existing orders. This will serve to reduce the process from two order actions to a single order action, thereby improving the OER.

3. Conditional Orders - when utilizing strategies which involve the pricing of one product relative to another, consideration should be given to minimizing unnecessary price and quantity order modifications. As an example, an order modification based upon a price change should only be triggered if the prior price is no longer competitive and the new suggested price is competitive.

4. Meaningful Revisions – logic which serves to modify existing orders without substantially increasing the likelihood of the modified order interacting with the NBBO should be avoided. An example of this would be the modification of a buy order from $30.50 to $30.55 on a stock having a bid-ask of $31.25 - $31.26.

5. RTH Orders – logic which modifies orders set to execute solely during Regular Trading Hours based upon price changes taking place outside those hours should be optimized to only make such modifications during or just prior to the time at which the orders are activated.

6. Order Stacking - Any strategy that incorporates and transmits the stacking of orders on the same side of a particular underlying should minimize transmitting those that are not immediately marketable until the orders which have a greater likelihood of interacting with the NBBO have executed.

7. Use of IB Order Types - as the revision logic embedded within IB-supported order types is not considered an order action for the purposes of the OER, consideration should be given to using IB order types, whenever practical, as opposed to replicating such logic within the client order management logic. Logic which is commonly initiated by clients and whose behavior can be readily replicated by IB order types include: the dynamic management of orders expressed in terms of an options implied volatility (Volatility Orders), orders to set a stop price at a fixed amount relative to the market price (Trailing Stop Orders), and orders designed to automatically maintain a limit price relative to the NBBO (Pegged-to-Market Orders).

The above is not intended to be an exhaustive list of steps for optimizing one's orders but rather those which address the most frequently observed inefficiencies in client order management logic, are relatively simple to implement and which provide the opportunity for substantive and enduring improvements. For further information or questions, please contact the Customer Service Technical Assistance Center.

Why am I subject to a commodity account trading limit of 1 contract?

Clients who are unable to trade more than one futures contract per order should first check their order presets to ensure that they have not established an order size limit in the precautionary settings. If this is not the case, then the restriction has likely been imposed by IBKR due to the client's failure to accept the Arbitration Agreement which automatically imposes a trading limit of one contract per order. Clients decline to accept the agreement when presented through the application process but who subsequently wish to accept need to login to Client Portal and execute the Arbitration Agreement.

I receive a rejection on my futures option orders for DAX which says "No Trading Regulation", why?

U.S. residents are unable to trade options on futures for most foreign indicies, such as the DAX.

Overview of Accumulate / Distribute Algorithm

Accumulate/Distribute is a sophisticated trading algorithm which allows one to buy or sell large orders by splitting the trade into multiple orders with the goal of reducing visibility and market impact.

- Total Quantity – defines the aggregate order size (e.g., shares, contracts);

- Trade Increment – defines the unit (e.g., shares, contracts) size for each component order;

- Time Increment – defines the period of time (seconds, minutes or hours) between the submission of a component order and the submission of the following order;

- Order Type – may select from market, limit or relative. A market order will be executed at the ask price and should only be used where, for example, a stock is highly liquid with significant bid-ask sizes. Limit and Relative order types require that the trader specify additional order relationships and the choices are numerous. The execution price, for example, may be specified as being relative to a fixed value, bid, ask or last price, VWAP, moving average or last trade. These choices may be increased or decreased by an offset factor and multiple conditions may be established. For example, one may wish to create a relative order type to match the bid price plus an offset factor of $0.01 and to ensure that they don’t lift the ask if the spread is $0.01, add a condition that the bid be no less that $0.02 beneath the ask price.

- How to Operate – if the trader does not check the box titled “Wait for current order to fill before submitting next order” then orders which do not meet the price conditions will continue to accumulate in accordance with the established time increment, the unexecuted orders will be aggregated into one or more potentially sizable orders at the exchange. If this box is checked, then the more restrictive the buying conditions, the greater the likelihood that the algorithm will fall behind its schedule of buying or selling at every ‘X’ interval. If this box is checked the trader may then check the box titled “Catch up in time”. When that box has been checked and should the algorithm fall behind, the next orders will be placed immediately after their predecessor fills until such time the algorithm has caught up.

- Randomization – check boxes are provided to allow for a +/- 20% randomization in the time increment and a +/- 55% randomization in the trade increment. Accordingly, in the case of a 30 second time increment, this would allow for randomization of between 24 and 36 seconds between orders and in the case of a 500 share trade increment, this would allow for randomization of between 200 and 800 shares (rounded to the nearest round lot) per order. Randomization serves to minimize the likelihood of others detecting your order.

- RTH – a check box is provided which will allow the order to be filled outside of regular trading hours.

- Take up Offer Size – if a limit or relative order type is selected, the trader may input an order size which if bid (in the case of a sell order) or offered (in the case of a buy order) the trader would be willing to take in its entirety, up to the remaining portion of the total order quantity (satisfies the price conditions).

- Price Range - traders may specify a price range outside of which they do not want to buy the stock;

- News – the trader may stop the algorithm for some period of time if there is news on the stock, for example;

- Position - traders may stop the algorithm based upon their position in the stock; For example, a trader running multiple algorithms one to buy the stock and another to sell in an attempt to trade the stock back and forth for a profit may decide to suspend one side if the position becomes substantially imbalanced;

- Stock Path – a trader, for example, may wish to suspend the algorithm if a given moving average, say the 10-minute VWAP is not at least as high as another average, say the 50-day moving average. This feature enables you to set up algorithms to trade chart points even when you are not looking at the chart at that moment;

- Stock Path for Multiple Symbols – this condition is similar to the last except that it calls for two symbols. Here you can put in any symbol and compare some data point regarding that symbol (e.g., 10-minute VWAP, etc.) to the same or a different data point regarding the second symbol. These comparative conditions can apply to different symbols or to the same symbol. For example, you could specify that you want to buy a certain stock only if it has been in a continuous uptrend. So in addition to the 10-minute VWAP being higher than the 50-day moving average, you would also like the 10-day moving average to be higher than the 30-day moving average on this stock.

- Products – any product offered by IB (stocks, options, ETFs, bonds, futures, Forex) other than mutual funds;

- Order Type – market, limit or relative.

IMPORTANT NOTE

This algo will only operate when the trader is logged into the TWS. If the trader has been logged out prior to the algo completing (either by user action or by the automated nightly restart), a message will appear upon the next log in which will allow for re-activation of the algo.

Overview of the Scale Trader Algorithm

The ScaleTrader is a sophisticated trading algorithm which allows one to enter a large quantity order that is executed in a series of increments or components, with each component being executed at a progressively better price.

- Total Order Size (TOS) – the total number of shares the trader is willing to purchase (sell) as the price falls (increases);

- Initial Component Size (ICS) – the number of shares to be purchased (sold) at the Starting Price;

- Subsequent Component Size (SCS) – the additional number of shares to be purchased (sold) at each Price Increment (at successively lower prices in the case of a purchase and higher in the case of a sale). If a SCS is not entered, the ICS will be used for all component orders.

- Starting Price (SP) – the price at which you are willing to purchase (sell) the Initial Component Size

- Price Increment (PI) – in the case of a purchase (sale), this is the decrease (increase) in price at which each successive component order is to be executed.

- TP = (((ICS/SCS) -1) * PI) + SP

- BP = SP – (((TOS - ICS)/SCS) * PI

- TOS = 4,000;

- ICS = 1,000;

- SCS = 500;

- SP = $20.00

- PI = $0.05

- Profit taking orders – the Scale Trader may be set to send an offsetting order to take advantage of periodic price surges or if the trader has reached a specified profit objective. This feature may be enabled by checking the box titled “Create profit taking order” and specifying the Profit Offset. Using the example above and a Profit Offset of $1.00, once the ICS was filled at $20.00 and an SCS submitted at $19.95, two profit orders would also be submitted, one for 500 shares at $21.00 and another for 500 shares at $21.05. It should be noted that profit orders are scaled to the SCS regardless of the size of the ICS and that if the ICS > SCS then the profit order price is determined using the PI along with the Profit Offset.

- Restore size after taking profit – if using the profit taking orders feature, the trader can enable the repurchase of shares sold at a profit at the price they were originally bought at by checking the box titled “Restore size after taking profit”. This feature remains active whenever the price is within the range of TP + Profit Offset and BP. Using the example above, if order to sell 500 shares at $21.00 was executed this fill quantity would be put back into the original order at $20.00 and the order submitted at $19.95 would be cancelled.

- Restart Scale Trader & Restart Scale Trader with Filled Component Size – these features allow traders using the profit taking order and restore size features to restart the algorithm if stopped, helping to resume the order starting from the point at which the scaled sequence left off.

- Auto Price Adjustment – selecting this check box allows for an increase or decrease in the starting price automatically at stated time intervals (e.g., increase $0.01 every hour)

- Scale Trader Page – provides a view of the real-time status of scale orders, including filled and total quantity, filled, remaining, and total value, and the percent filled for each scale. Accessible via the Page and then Create Scale Trader Page menu options.

- View Scale Progress - right-click on the scale order line and select View Scale Progress. This will open a window displaying the complete scale price ladder, the Open/Filled component list for the parent scale order, and the Open/Filled component list for the child profit orders.

- Products – any product offered by IB other than mutual funds (e.g., stocks, options, ETFs, bonds, futures, Forex);

- Order Type - limit or relative (relative not offered for combination orders)

- Time in Force – Day, Good-til-Cancel or Day-til-Cancel. May also specify if order is allowed to be filled outside of regular trading hours, if executions may be routed and executed during pre-open session and whether to ignore opening auction.

Special risk relating to offsets between options and futures

Account holders hedging or offsetting the risk of futures contracts with option contracts are encouraged to pay particular attention to a potential scenario whereby a change in the underlying price may subject the account to a forced liquidation even if the account remains in margin compliance. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. options contracts coupled with IB's requirement that the commodity segment of one's account maintain a positive cash balance at all times.

Gains and losses in a futures contract, by design, are settled in cash and IB updates the account holder's cash balance through the TWS on a real-time basis for any changes in the futures contract price. An option contract is also marked-to-the-market on a real-time basis but this change in value represents an unrealized (i.e., non-cash) profit or loss with the actual cash proceeds not reflected in the account until such time the contract is either sold, exercised or expires.

To illustrate this scenario, assume, for example, at time 'X' a hypothetical portfolio consisting of a credit cash balance of $6,850, 2 short Sep ES futures contracts, 2 Long Sep ES $1,000 strike call options on the futures contract marked at $31.50 each, with the cash index at $1,006. Also assume that at time 'X+1' the cash index increases by 100 points or approximately 10%. A snapshot of the account equity and margin balances for each date is reflected in the table below.

| Portfolio | Time 'X' | Time 'X+1' | Change |

| Cash | $6,850 | ($3,150) | ($10,000) |

| 2 Long Sep ES $1,000 Calls* | $3,150 | $10,300 | $7,150 |

| 2 Short Sep ES Futures* | - | - | - |

| Total Equity | $10,000 | $7,150 | ($2,850) |

| Margin Requirement | $2,712 | $666 | ($2,046) |

| Margin Excess | $7,288 | $6,484 | ($804) |

*Note: the contract multiplier for the ES future and option is 50.

As reflected in the table above, the projected effect of this market move would be to decrease the cash balance to a deficit level based upon the mark-to-market or variation on the futures contracts of $10,000 (100 * 50 * 2). While the effect of this upon equity would be largely offset by a $7,150 increase in the market value of the long calls, the unrealized gain on the options has no effect upon cash until such time they are either sold, exercised or expire. In this instance, IB would act to liquidate positions in an amount sufficient to eliminate the cash deficit while maintaining margin compliance and attempting to preserve the greatest level of account equity.

While hypothetical in nature, this sample portfolio is intended to be illustrative of the liquidity risk associated with any portfolio containing futures and long options where the funding of any variation on the futures position must be supported by available cash or buying power from the securities segment of the account and not unrealized option gains.