Veelgestelde vragen: Effecten onderworpen aan bijzondere vereisten

Wij zien een ongekende volatiliteit in GME, AMC, BB, EXPR, KOSS en een klein aantal andere Amerikaanse effecten, waardoor wij de eerder geboden hefboomwerking voor deze effecten moeten verminderen en de handel soms moeten beperken tot risicobeperkende transacties. Hieronder volgt een reeks veelgestelde vragen over deze acties.

V: Zijn er momenteel beperkingen op mijn handelsmogelijkheden in GME en andere Amerikaanse effecten die onderhevig zijn geweest aan de recente verhoogde volatiliteit?

A: IBKR verhindert klanten momenteel niet om te handelen in aandelen van AMC, GME, BB, EXPR, KOSS of de andere aandelen die het onderwerp waren van extreme marktvolatiliteit. Dat geldt ook voor orders om nieuwe posities te openen of bestaande posities te sluiten.

Zoals vele makelaars heeft IBKR gedurende een periode beperkingen opgelegd met betrekking tot het openen van nieuwe posities in bepaalde van deze effecten. Deze beperkingen zijn sindsdien opgeheven.

IBKR heeft klanten niet beperkt in hun mogelijkheden om bestaande posities te sluiten en is niet van plan dat te doen.

V: Kan ik marge gebruiken bij de handel in aandelen, opties of andere derivaten op deze producten via IBKR?

A: IBKR heeft de margevereisten verhoogd voor effecten in GME en de andere Amerikaanse effecten die onderhevig zijn aan de recente volatiliteit, waaronder tot 100% marge vereist voor lange posities en 300% marge voor korte. U kunt deze margevereisten zien in uw handelsplatform voordat u een order plaatst.

V: Waarom heeft IBKR de mogelijkheid om nieuwe posities in bepaalde effecten te openen voor mij beperkt?

A: IBKR heeft deze maatregelen genomen met het oog op risicobeheer, om de onderneming en klanten te beschermen tegen buitensporige verliezen als gevolg van enorme prijsschommelingen in een volatiele en onstabiele markt.

IBKR blijft bezorgd over het effect van deze onnatuurlijke volatiliteit op de clearinghouses, makelaars en marktdeelnemers.

V: Heeft IBKR of de gelieerde ondernemingen posities in deze producten die worden beschermd door deze beperkingen?

A: Nee. IBKR heeft zelf geen eigen posities in de effecten.

V: Waarom kon IBKR de beperkingen opleggen?

A: IBKR naar eigen inzicht een order van een klant weigeren op grond van de klantenovereenkomst.

IBKR heeft ook het recht om op elk moment naar eigen inzicht de margevereisten voor open of nieuwe posities te wijzigen. IBKR is immers degene die geld uitleent in een margetransactie.

V: Gelden de beperkingen voor alle of slechts enkele IBKR-klanten?

A: Alle beperkingen - alle restricties op het openen van nieuwe posities en margeverhogingen -waren van toepassing op alle IBKR-klanten. Ze werden opgelegd op basis van het effect, niet op basis van de klant.

V: Is mijn geld bij IBKR in gevaar? Heeft IBKR materiële verliezen geleden?

A: IBKR heeft geen grote verliezen geleden. Door een voorzichtig risicobeheer heeft IBKR deze marktvolatiliteit goed doorstaan. Bovendien heeft IBG LLC op geconsolideerde basis meer dan $9 miljard aan eigen vermogen, meer dan $6 miljard boven de wettelijke vereisten.

V: Wat gaat IBKR in de toekomst doen? Hoe komt ik dat te weten?

A: IBKR zal de ontwikkelingen op de markt blijven volgen en zal beslissingen nemen op basis van de marktomstandigheden. Voor actuele informatie kunt u onze website blijven bezoeken.

Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

FAQs: Securities subject to Special Requirements

We are seeing unprecedented volatility in GME, AMC, BB, EXPR, KOSS and a small number of other U.S. securities that has forced us reduce the leverage previously offered to these securities and, at times, limit trading to risk reducing transactions. Outlined below are a series of FAQs relating to these actions.

Q: Are there any current restrictions on my ability to trade GME and the other US securities that have been subject to the recent heightened volatility?

A: IBKR is currently not restricting customers from trading shares of AMC, GME, BB, EXPR, KOSS or the other stocks that have been the subject of extreme market volatility. That includes orders to open new positions or close existing ones.

Like many brokers, IBKR placed limits on opening new positions in certain of these securities for a period of time. Those restrictions have since been lifted.

IBKR has not restricted customers’ ability to close existing positions and does not plan to do so.

Q: Can I use margin in trading stocks, options or other derivatives on these products through IBKR?

A: IBKR has increased its margin requirements for securities in GME and the other US securities subject to the recent volatility, including up to 100% margin required for long positions and 300% margin on the short side. You can see these margin requirements in your trading platform prior to submitting an order.

Q: Why did IBKR place these restrictions on my ability to open new positions in certain securities?

A: IBKR took these actions for risk management purposes, to protect the firm and its customers from incurring outsized losses due to wild swings in prices in a volatile and unstable marketplace.

IBKR remains concerned about the effect of this unnatural volatility on the clearinghouses, brokers and market participants.

Q: Does IBKR or its affiliates have positions in these products that it was protecting by placing these restrictions?

A: No. IBKR itself has no proprietary positions in any of the securities.

Q: What allowed IBKR to place those restrictions?

A: Pursuant to its customer agreement, IBKR may decline to accept any customer’s order at IBKR’s discretion.

IBKR also has the right to modify margin requirements for any open or new positions at any time, in its sole discretion. After all, IBKR is the one whose money is being loaned in a margin trade.

Q: Did those restrictions apply to all or just some of IBKR’s customers?

A: All restrictions – all limits on opening new positions and margin increases – applied to all IBKR customers. They were placed based on the security, not based on the customer.

Q: Is my money at IBKR at risk? Has IBKR suffered material losses?

A: IBKR did not incur substantial losses. Through its prudent risk management, IBKR has navigated this market volatility well. In any event, on a consolidated basis, IBG LLC exceeds $9 billion in equity capital, over $6 billion in excess of regulatory requirements.

Q: What will IBKR do going forward? How will I know?

A: IBKR will continue to monitor developments in the market, and will make decisions based on market conditions. For current information, please continue to visit our website.

Bonus Certificates Tutorial

Introduction

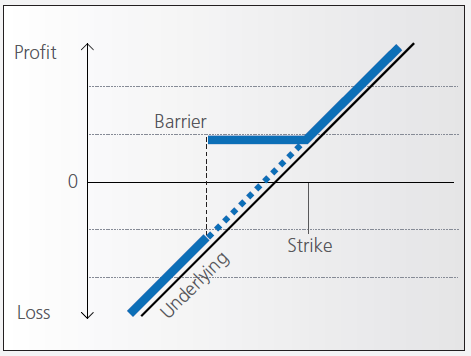

Bonus certificates are designed to provide a predictable return in sideways markets, and market returns in rising markets.

At the time they’re issued, bonus certificates normally have a term to maturity of two to four years. You will receive a specified cash pay-out (“bonus level” or “Strike”) if at maturity the price of the underlying is below or at the strike, as long as the underlying instrument has not touched or fallen below an established price level (“safety threshold” or “barrier”) during the term of the certificate.

Unless the certificate has a cap, you continue to participate in the price gains if the underlying instrument rises above the bonus level. In this case you either receive the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

However, if the barrier is breached, you will no longer be entitled to the bonus payment. The value of the certificate then corresponds to the value of the underlying (times the ratio). In other words, once the barrier has been touched the certificate effectively converts to an index certificate. You will receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Although there is no structured leverage, the presence of the barrier creates effective leverage. When the price of the underlying instrument approaches the barrier the probability of a breach increases, affecting the price of the certificate disproportionately.

Pay-out Profile

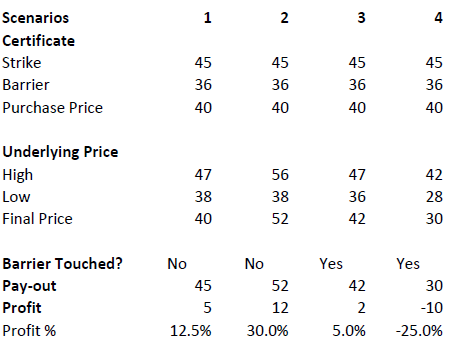

Example

Assume a bonus certificate on ABC share. The certificate has a strike of EUR 45.00 and a barrier set at EUR 36.00. The table below shows scenarios depending on the trading range of the underlying, the final price of the underlying and whether the barrier has been touched or not.

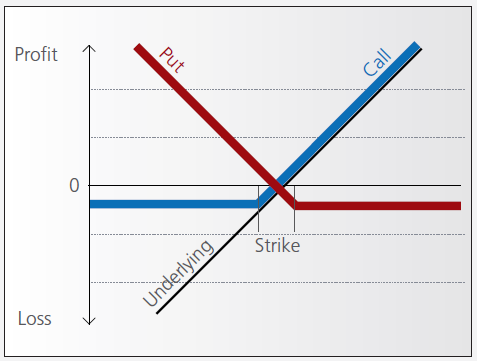

Warrant Tutorial

Introduction

A warrant confers the right to buy (call-warrant) or sell (put-warrant) a specific quantity of a specific underlying instrument at a specific price over a specific period of time.

Pay-out Profile

With some warrants, the option right can only be exercised on the expiration date. These are referred to as “European-style” warrants. With “American-style” warrants, the option right can be exercised at any time prior to expiration. The vast majority of listed warrants are cash-exercised, meaning that you cannot exercise the warrant to obtain the underlying physical share. The exception to this rule is Switzerland, where physically settled warrants are widely available.

Factors that influence pricing

Not only do changes in the price of the underlying instrument influence the value of a warrant, a number of other factors are also involved. Of particular importance to investors in this regard are changes in volatility, i.e. the degree to which the price of the underlying instrument fluctuates. In addition, changes in interest rates and the anticipated dividend payments on the underlying instrument also play a role.

However, changes in implied volatility - as well as interest rates and dividends - only affect the time value of a warrant. The primary driver - intrinsic value - is solely determined by the difference between the price of the underlying instrument and the specified exercise price.

Historical and implied volatility

In addressing this topic, a differentiation has to be made between historical and implied volatility. Implied volatility reflects the volatility market participants expect to see in the financial instrument in the days and months ahead. If implied volatility for the underlying instrument increases, so does the price of the warrant.

This is because the probability of profiting from a warrant during a particular time-frame increases if the price of the underlying instrument is highly volatile. The warrant is therefore more valuable.

Conversely, if implied volatility decreases, that leads to a decline in the value of warrants and hence occasionally to nasty surprises for warrant investors who aren’t familiar with the concept and influence of volatility.

Interest rates and dividends

Issuers hedge themselves against price changes in the warrant through purchases and sales of the underlying instrument. Due to the leverage afforded by warrants, the issuer needs considerably more capital to hedge its exposure than you require to buy the warrants. The issuer’s interest expense associated with that capital is included in the price of the warrant. The amount of embedded interest reduces over time and at expiration is zero.

In the case of puts, the situation is exactly the opposite. Here, the issuer sells the underlying instrument

short to establish the necessary hedge, and in so doing receives capital that can earn interest. Thus interest reduces the price of the warrant by an amount that decreases over time.

As the issuer owns shares as a part of its hedging operations, it is entitled to receive the related dividend

payments. That additional income reduces the price of call warrants and increases the price for puts. But if the dividend expectations change, that will have an influence on the price of the warrants. Unanticipated special dividends on the underlying instrument can lead to a price decline in the related warrants.

Key valuation factors

Let’s assume the following warrant:

Warrant Type: Call

Term to expiration: 2 years

Underlying : ABC Share

Share price: EUR 30.00

Strike: EUR 30.00

Exercise ratio: 0.1

Warrant’s price: EUR 0.30

Intrinsic value

Intrinsic value represents the amount you could receive if you exercised the warrant immediately and then bought (in the case of a call) or sold (put) the underlying instrument in the open market.

It’s very easy to calculate the intrinsic value of a warrant. In our example the intrinsic value is EUR 00.00

and is calculated as follows:

(price of underlying instrument – strike price) x exercise ratio

= (EUR 30.00 – EUR 30.00) x 0.1

= EUR 00.00

If the price of the ABC share increases by EUR 1, the intrinsic value becomes

= (EUR 31.00 – EUR 30.00) x 0.1

= EUR 00.10

The intrinsic value of a put warrant is calculated with this formula:

(strike price – price of underlying instrument) x exercise ratio

It’s important to note that the intrinsic value of a warrant can never be negative. By way of explanation:

if the price of the underlying instrument is at or below the exercise price, the intrinsic value of a call equals zero. In this instance, the price of the warrant consists only of “time value”. On the flipside, the intrinsic value of a put is equal to zero if the price of the underlying instrument is at or above the exercise price.

Time value

Once you’ve calculated the intrinsic value of a warrant, it’s also easy to figure out what the time value of that warrant is. You simply deduct the intrinsic value from the current market price of the warrant. In our example, the time value is equal to EUR 1.30 as you can see from the following calculation:

(warrant price – intrinsic value)

= (EUR 0.30 EUR – EUR 0.00)

= EUR 0.30

Time value gradually erodes during the term of a warrant and ultimately ends up at zero upon expiration. At that point, warrants with no intrinsic value expire worthless. Otherwise you can expect to receive payment of the intrinsic value. Take note, though: a warrant’s loss of time value accelerates during the final months of its term.

Premium

The premium indicates how much more expensive a purchase/sale of the underlying instrument would be via the purchase of a warrant and the immediate exercise of the option right as opposed to simply buying/selling the underlying instrument in the open market.

Hence the premium is a measure of how expensive a warrant actually is. It follows that, when given a choice between warrants with similar features, you should always buy the one with the lowest premium. By calculating the premium as an annualized percentage, warrants with different terms to expiry can be compared with each other.

The percentage premium for the call warrant in our example can be calculated as follows:

(strike price + warrant price / exercise ratio – share price) / share price * 100

= (EUR 30.00 + EUR 0.30 / 0.1 – EUR 30.00) / EUR 30.00 x 100

= 10 percent

Leverage

The amount of leverage is the price of the share * ratio divided by the price of the warrant. In our example 30.00*0.1/0.3 = 10. So when the price of ABC increases by 1% the value of the warrant increases by 10%.

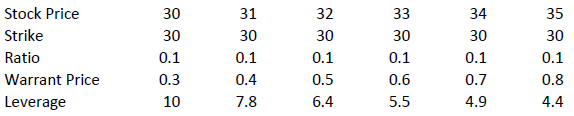

The amount of leverage is not constant however; it varies as intrinsic and time value changes, and is particularly sensitive to changes in intrinsic value. As a rule of thumb, the higher the intrinsic value of the warrant, the lower the leverage. For example (assuming constant time value):

Knock-out (Turbo) Tutorial

Introduction

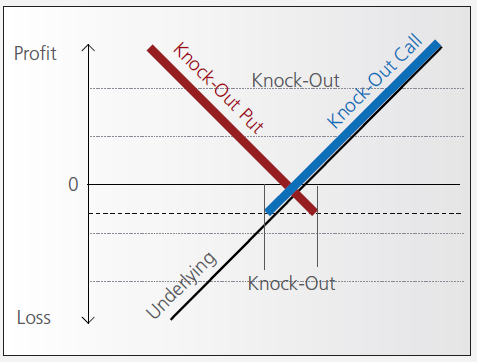

Knock-out warrants (turbos), like vanilla warrants, derive their value from the difference between the price of the underlying and the strike. They differ significantly however from vanilla warrants in many important respects:

- They can expire (knock-out) prematurely if the price of the underlying instrument touches or falls below (in the case of knock-out calls) or exceeds (in the case of knockout puts) a predetermined barrier-level. It expires worthless if the barrier equals the strike, or it may have a residual stop-loss value if the barrier is set higher than the strike (in the case of a call).

- Changes in implied volatility have little or no impact on knock-out products, therefore their pricing is easier for investors to comprehend than that of warrants.

- They have little or no time value (because of the presence of the knock-out barrier), and therefore have a higher degree of leverage than a warrant with the same strike. This is because the absence of time value makes the instrument “cheaper”.

Pay-out Profile

Leverage

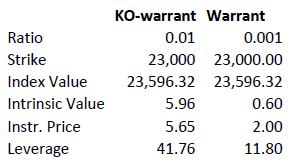

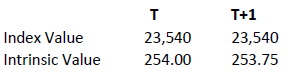

As discussed above, knock-out warrants exhibit high degrees of leverage, particularly as the price of the underlying nears the strike/barrier. Consider the following example of a long turbo on the Dow Jones Index, compared to a vanilla warrant:

Intrinsic value = (index value – strike) x ratio

Leverage = Index Value x Ratio / Instrument Price

A vanilla warrant retains significant time value even as the underlying price approaches the strike, sharply reducing its leverage compared to a knock-out warrant.

Product types

As discussed above, the barrier may either equal the strike, or be set above (calls) or below (puts). In the latter cases a small residual value remains after knock-out, corresponding to the difference between the barrier (the stop-loss level) and the strike.

Moreover, knock-out products may either have an expiration date or may be open-ended. This makes a difference in the way interest is accounted for. If the contract has an expiration date interest is included in the premium, the amount of which reduces over time and is zero on expiration. This is analogous to a standard vanilla warrant.

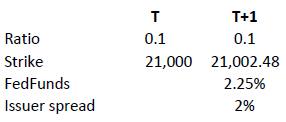

in relation to an expiration date. The price of the contract therefore corresponds exactly to its intrinsic value. Interest however must be accounted for. This is done by a daily adjustment of the barrier and strike. The following example shows the daily adjustment for a long open-end turbo on the Dow Jones Index:

The adjustment = Strike T x (1+ FedFunds/360 + Issuer Spread/360).

The intrinsic value of the instrument is correspondingly reduced as follows, assuming no change in the value of the DJ Index):

Intrinsic value = (index value – strike) x ratio

Discount Certificates Tutorial

Introduction

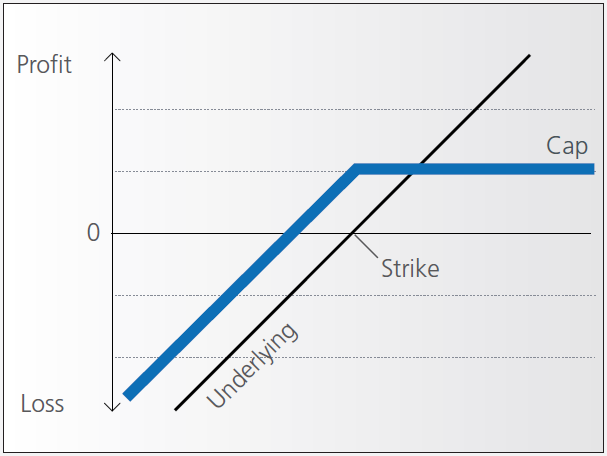

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

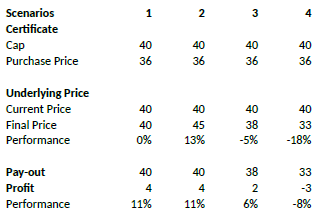

Example

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

Daily Leverage

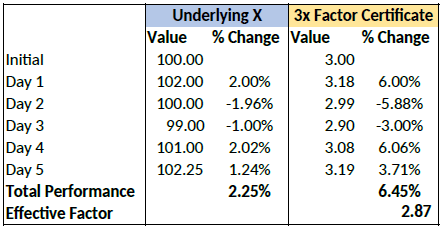

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

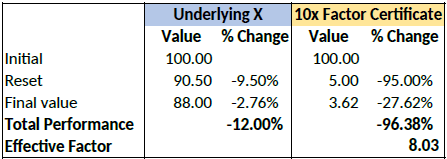

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

Intraday Reset

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows: