Verplichte extra aflossing (cash sweep)

Deze regelgeving vereist dat alle effectentransacties worden uitgevoerd en marge ontvangen in het effectensegment van het universele account, terwijl grondstoffentransacties moeten worden uitgevoerd in het grondstoffensegment.1 Hoewel de regelgeving de bewaring van volgestorte effectenposities in het grondstoffensegment als margeonderpand toestaat, doet IB dit niet, waardoor de hypothecaire zekerheid ervan wordt beperkt tot de restrictievere regels van de SEC. Gezien de regelgeving en het beleid die de beslissing om posities aan te houden in het ene segment versus het andere bepalen, blijft contant geld het enige activum dat tussen de twee kan worden overgedragen en waarover de klant kan beslissen.

Hieronder volgt een bespreking van de aangeboden opties voor verplichte extra aflossing, de procedure voor het selecteren van een optie en de selectieoverwegingen.

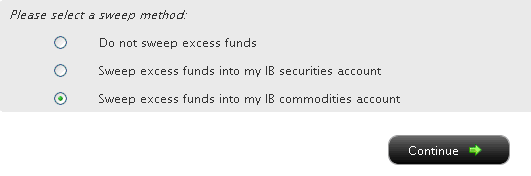

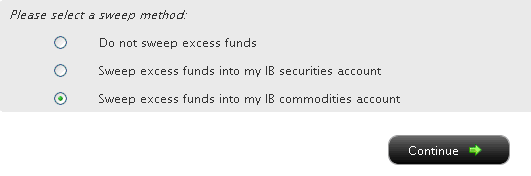

U kunt vervolgens het keuzerondje naast de optie van uw keuze selecteren en op de knop Doorgaan klikken. Uw keuze wordt van kracht vanaf de eerstvolgende werkdag en blijft van kracht totdat een andere optie is gekozen. Met inachtneming van de hierboven vermelde instellingen voor handelsrechten is er geen beperking op wanneer of hoe vaak u uw veegmethode mag wijzigen.

A Comparison of U.S. Segregation Model (Een vergelijking van Amerikaanse segregatiemodellen)

Key Information Documents (KID)

IBKR is required to provide EEA and UK retail customers with Key Information Documents (KID) for certain financial instruments.

Relevant products include ETFs, Futures, Options, Warrants, Structured Products, CFDs and other OTC products. Funds include both UCITS and non-UCITS funds available to retail investors.

Generally KIDs must be provided in an official language of the country in which a client is resident.

However, clients of IBKR have agreed to receive communications in English, and therefore if a KID is available in English all EEA and UK clients can trade the product regardless of their country of residence.

In cases where a KID is not available in English, IBKR additionally supports other languages as follows:

| Language | Can be traded by residents or citizens* of |

| German | Germany, Austria, Belgium, Luxembourg and Liechtenstein |

| French | France, Belgium and Luxembourg |

| Dutch | the Netherlands and Belgium |

| Italian | Italy |

| Spanish | Spain |

*regardless of country of residence

Are CDs purchased through IBKR FDIC insured?

Certificates of Deposit (CDs) offered by IBKR are not FDIC insured and are subject to the credit risk of the issuing bank.

Information Regarding SIPC Coverage

1. Interactive Brokers LLC is a member of SIPC.

2. SIPC protects cash and securities held with Interactive Brokers.

3. SIPC does not generally cover commodity futures or options on futures.

4. SIPC protects cash, including US dollars and foreign currency, to the extent that the cash was "deposited with Interactive Brokers for the purpose of purchasing securities."

5. SIPC does not generally cover cash or foreign currency that is not "deposited with Interactive Brokers for the purpose of purchasing securities." For example, SIPC does not generally cover cash in commodity futures trading accounts.

6. Interactive Brokers is not able to make any statements or representations about how cash deposited into a securities account in connection with forex trading or swept from a commodities account would be treated by SIPC. SIPC protection would depend in part on whether the cash was considered to be "deposited with Interactive Brokers for the purpose of purchasing securities." Interactive Brokers expects that at least one factor in deciding this would be whether and the extent to which the customer engages in securities trading in addition to or in conjunction with forex or commodities trading.

Account holders seeking further information should refer such inquiries to their own legal counsel or SIPC.

Excess Margin Securities

The term "excess margin securities" refers to margin securities carried for the account of a customer having a market value in excess of 140 percent of the total debit balance in the customer's account. These securities are in excess of the securities held in a customer's margin account that are pledged by the customer as collateral for the margin loan and can be used to support the purchase of additional securities on margin

Example:

A customer whose account equity consists solely of a cash balance of USD 10,000 on Day 1 purchases 400 shares of stock ABC at USD 50 per share on Day 2.

| Account Balance | Day 1 | Day 2 |

| Cash | $10,000 | ($10,000) |

| Stock | $0 | $20,000 |

| Total | $10,000 | $10,000 |

On Day 2, the customer's excess margin securities total USD 6,000. This is calculated by subtracting 140% of the margin debit or loan balance from the market value of the stock position ($6,000 = $20,000 - {1.4 * $10,000}).

The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are deemed excess margin securities. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers without specific written permission from the customer. The portion of the securities classified as margin securities ($20,000 - $6,000 or $14,000 in this example) are subject to a lien and may be pledged or loaned by the broker to others to assist in financing the loan made to the customer.

Note that securities which were excess margin at the date of acquisition may later be reclassified as margin securities based upon the customer's subsequent trade and/or margin borrowing activity. For example, if the loan value of excess margin securities is subsequently used to acquire additional securities on margin, a portion of securities will then be reclassified as margin securities and subject to a lien. If the customer subsequently deposits cash or sells securities to reduce or eliminate the margin loan, the securities will be reclassified as excess margin or fully paid and are required to be segregated.

See also "fully paid securities".

Fully Paid Securities

The term "fully paid securities" refers to securities held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin. The term is relevant from a regulatory perspective as the SEC requires that U.S. broker dealers segregate and maintain in a good control location (e.g., DTC or bank) all customer securities which are fully paid. Such securities cannot be pledged or loaned to finance the activities of the firm or other customers.

Note that securities which were fully paid at the date of acquisition may later be reclassified as margin or excess margin securities based upon the customer's subsequent trade and/or borrowing activity. For example, if the loan value of fully paid securities is subsequently used to acquire additional securities on credit, a portion of securities will then be classified as margin securities and subject to a lien and potential pledge or hypothecation by the broker.

See also "excess margin securities".

Comparison of U.S. Segregation Models

INTRODUCTION

The regulation of securities and commodities products and brokers1 in the U.S. is administered by two distinct federal agencies, the Securities and Exchange Commission (SEC) for securities including stocks, ETFs, bonds, options and mutual funds and the Commodities Futures Trading Commission (CFTC) for commodities including futures and options on futures.2 While both agencies seek to safeguard customer assets by restricting their use and “segregating” them from assets of the broker, the regulations and manner in which they accomplish this differs. The following article provides a basic overview of two segregation models and additional considerations relating to IB accounts.

OVERVIEW

Differences between the CFTC and SEC segregation models originate largely from the products themselves, whose characteristics are fundamentally unique. Commodity products, by nature, do not involve an extension of credit by the broker to the customer as a futures contract is not an asset but rather a contingent liability which is marked-to-market and a long futures option, while an asset, must be paid for in-full. Consequently, non-option assets in a commodities account are generally comprised of funds deposited as margin to secure performance on the contracts therein. Since the broker may not use the funds of one customer to margin or guarantee the transactions of another, the commodities segregation requirement (CFTC Rules 1.20 – 1.30) is equal to the gross assets of all customers and the broker needs to add its own funds to segregation to cover customers whose net equity is in deficit.

A securities margin account, in contrast, can facilitate the extension of credit for the purpose of long securities (e.g., stocks, bonds) purchases or short securities sales on a secured basis. The segregation or reserve requirement rules recognize this through special provisions for the protection of each of the cash and securities components, further distinguishing fully-paid securities from those whose purchase the broker has financed and maintains a lien upon. Here, the broker must deposit into a separate bank account the net amount of customer cash balances3, in accordance with a formula set forth in SEC Rule 15c3-3. In addition, the broker must identify and segregate in a good control location (e.g., depository, bank) customer securities which meet the definition of “fully paid” or “excess margin”.

The table below provides a comparison of the main principals of each model.

| COMPARISON OF CFTC & SEC SEGREGATION MODELS | ||

| PRINCIPAL | CFTC | SEC |

|

Separation of Customer Balances

|

Commodity customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts.

Funds used for trading on non-US commodity exchanges must be kept separate from those used for trading on U.S. exchanges (even for the same customer). Commodity customer balances must also be maintained separate from securities customer balances (even for the same customer). |

Securities customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts. Securities customer balances must also be maintained separate from commodity customer balances (even for the same customer).

|

|

Priority in the Event of Broker Default

|

Commodity customers maintain priority and equal claim over assets in each of their respective U.S. segregated and non-U.S. secured pools.

No claim on assets in a commodity pool in which one is not a participant and no claim on securities customer assets. If commodity segregated assets are insufficient to meet claims and broker is insolvent, customers share equally in shortfall and become general creditors for residual claims. |

Securities customers maintain priority and equal claim over assets.4

No claim on commodity segregated assets. If securities segregated assets are insufficient to meet claims, broker is insolvent and claims exceed SPIC coverage, customers share equally in shortfall and become general creditors for residual claims.

|

| Segregation Style |

Gross – the broker may not use the funds of one customer to margin or guarantee the transactions of another and must segregate assets in an amount at least equal to the sum of all customer credit balances. |

Net – broker may use customer cash credit balances to finance, on a secured basis, margin loans to other customers and may lend or pledge a portion of customer securities purchased on margin to other customers selling short.

|

| Investment of Cash Balances |

Broker is allowed to reinvest commodity customer’s cash balances and retain an interest in the income generated. Permissible investments include: U.S. government securities, municipal securities, government sponsored enterprise securities, bank CDs, corporate obligations (commercial paper, notes and bonds) fully guaranteed as to principal and interest by the U.S. under the Temporary Liquidity Guarantee Program and money market mutual funds. Securities which are the subject of reinvestment must be maintained in a segregated account. |

Broker is allowed to reinvest securities customer’s cash balances and retain an interest in the income generated. Permissible investments limited to “qualified securities” defined as securities which are guaranteed as to both interest and principal by the U.S. government. Securities which are the subject of reinvestment must be held in Special Reserve Bank Account (i.e., segregated). |

| Computation Frequency | Daily | Weekly |

| Insurance | None | Securities Investor Protection Corporation (SIPC) provides insurance of up to USD 500,000 with a cash sublimit of USD 250,000. |

ADDITIONAL CONSIDERATIONS

In addition to the safeguards afforded through segregation, IB employs a number of policies and practices which serve to enhance the safety and security of accounts beyond that outlined above. These include the following:

- IB computes its securities segregation or reserve requirement on a daily rather than weekly basis as allowed by regulation, thereby ensuring timely determination as to the amount required to be reserved and the deposit of funds necessary to satisfy the requirement.

- IB’s does not avail itself of the generally more permissive rules with respect to the investment of commodity customer cash balances. These balances are instead invested in a manner similar to that of securities cash balances (i.e., U.S. government securities) with the exception of an occasional investment in money market funds.

- All customer securities positions are held in the securities segment of the Universal Account as opposed to the commodities (commodities margin met with cash and/or futures options), thereby limiting their hypothecation to the more restrictive rules of the SEC.

- In addition to SIPC coverage, IB maintains an excess SIPC policy with Lloyd's of London which, in aggregate with SIPC, offers insurance totaling $30 million (with a cash sublimit of $900,000), subject to an aggregate firm limit of $150 million.

- IB offers account holders the ability to sweep cash balances in excess of that required for margin purposes in either the securities or commodities segment to the other segment. Details as to this feature may be found in KB1851.

- For additional information regarding IB strength and security, please review the following website page.

Other Relevant Knowledge Base Articles:

Information Regarding SIPC Coverage

Footnotes:

1The term broker as used in this article is intended to refer to an organization registered with both the SEC as a Broker-Dealer and the CFTC as a Futures Commission Merchant for the purpose of conducting customer transactions

2Single stock futures are a hybrid product jointly regulated by the SEC and CFTC and allowed to be carried in either account type.

3Including cash obtained through the use of customer securities such bank pledges or stock loans less cash required to finance customer transactions (e.g., stock borrows, customer fails to deliver of securities, or margin deposited for short option positions with OCC).

4Assets, or customer property, which securities customers share in proportion to their net equity claim, include cash, margin securities and fully-paid securities held in “street name”. IB does not hold securities in the customer’s name which are not considered bulk customer property.

How to request a Digital Security Card+ (DSC+) replacement

The below steps are required in order to:

- Replace a Digital Security Card+ which has been lost, stolen or has become inoperable

- Request a Digital Security Card+ alongside your current security device (if you are a new or existing Client with equity above $1,000,000, or equivalent)

1. Notify IBKR Client Services- Contact IBKR Client Services to obtain a temporary account access. This service can only be provided via telephone and requires the identity of the account holder to be verified, as detailed in the IBKR Knowledge Base.

2. Obtain an Online Security Code Card - Activate an Online Security Code Card, which offers enhanced protection and full Client Portal functionality for an extended period of 21 days. Please consult the IBKR Knowledge Base should you need guidance for this specific step.

3. Request the DSC+ replacement - Once you have completed the Online Security Code Card activation, please remain in the Secure Login System section of the Client Portal and order your replacement DSC.

Request a DSC+

1. Click on the button Request Physical Device.

.png)

.png)

3. Enter a four-digit Soft PIN1 for your DSC+. Please make sure to remember the PIN you are typing since it will be necessary to activate and to operate your device. When applicable and desired, you may change the account on which the 20 USD deposit will be kept on hold2. Complete this step by clicking on Continue..png)

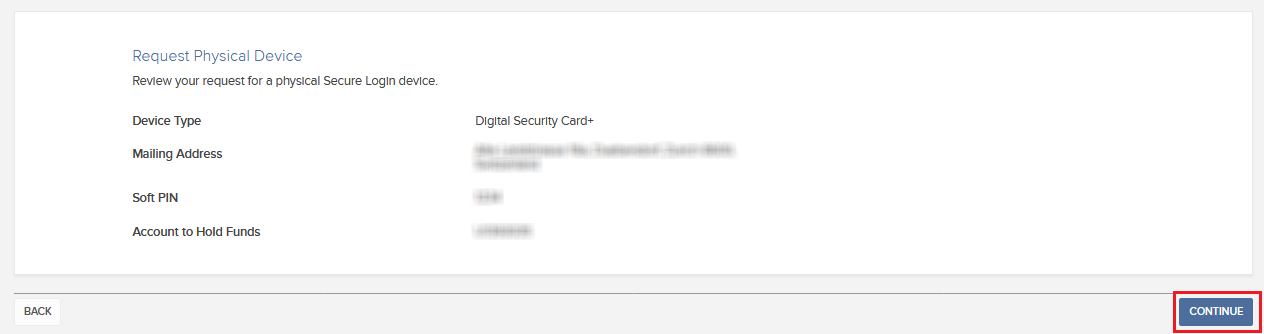

4. The system will show you a summary of your selection. Please make sure the information displayed is correct. Should you need to perform changes, click on the white Back button under the information field (not your browser back button), otherwise submit the request by clicking on Continue.

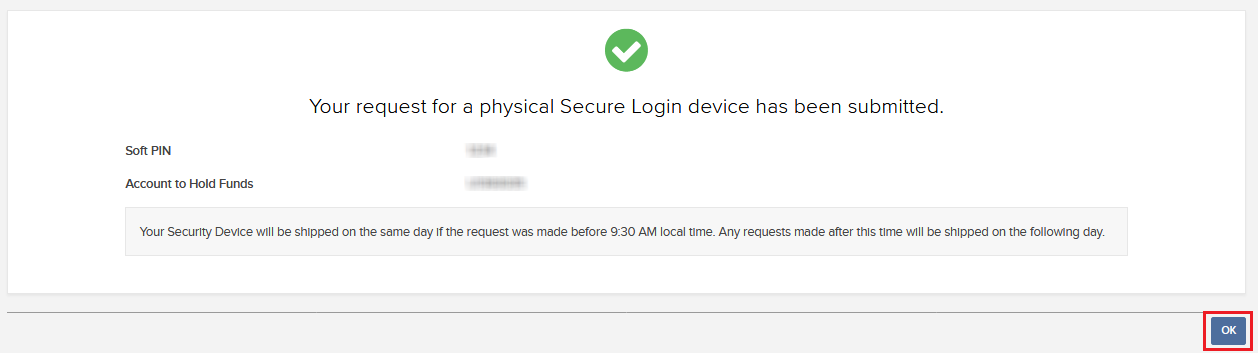

5. You will receive a final confirmation containing the estimated shipment date3. Click on Ok to finalize the procedure.

1. For PIN guidelines, please consult the IBKR Knowledge Base.

2. The Security token and the shipment are both free of charge. Nevertheless, when you order your device, we will freeze a small amount of your funds (20 USD). If your device is lost, intentionally damaged, stolen or if you close your account without returning it to IBKR, we will use that amount as a compensation for the loss of the hardware. In any other case, the hold will be released once your device has been returned to IBKR. More details on the IBKR Knowledge Base.

3. For security reasons, the replacement device is set to auto-activate within three weeks from the shipment date. IBKR will notify you when the auto-activation is approaching and when it is imminent.

IBKR Knowledge Base References

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

- See KB69 for information about Temporary passcode validity

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Securities Account Protection for Interactive Brokers India Customers

Customer accounts domiciled under Interactive Brokers India Pvt. Limited,(IBI) are awarded different account protection services than our IB-LLC and IB-UK clients. There are two major exchanges, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE), each one has established their own guidelines for investor grievances against exchange members and/or sub –brokers.

National Stock Exchange of India (NSE)

The NSE has established an Investor Protection Fund with the objective of compensating investors in the event of defaulters' assets not being sufficient to meet the admitted claims of investors, promoting investor education, awareness and research. The Investor Protection Fund is administered by way of registered Trust created for the purpose. The Investor Protection Fund Trust is managed by Trustees comprising of Public representative, investor association representative, Board Members and Senior officials of the Exchange.

The Investor Protection Fund Trust, based on the recommendations of the Defaulters' Committee, compensates the investors to the extent of funds found insufficient in Defaulters' account to meet the admitted value of claim, subject to a maximum limit of Rs. 11 lakhs (1.1 million USD) per investor per defaulter/expelled member.

Bombay Stock Exchange (BSE)

Currently trading is not offered on the BSE by Interactive Brokers.