Do liquidation trades executed by IBKR count as day trades?

Yes, if a position that is opened is subsequently closed in the same trading session (day), it is defined as a Pattern Day Trade. If an IBKR liquidation results in the closing of a position that was opened in that same session/day, it would be counted towards the Pattern Day Trade total. This could also result in the account being flagged as a Pattern Day Trade account.

Why is my account classified as a Pattern Day Trader account, and what can I do about it?

A day trade is defined as a purchase and sale of a security (US and Non-US) within the same trading day. The FINRA and NYSE instituted regulations intended to limit the amount of trading that can be done in accounts with small amounts of capital, specifically accounts with less than 25,000 USD Net Liquidation Value. A Pattern Day Trader is someone who effects 4 or more day trades within a 5 business day period. You have violated these rules and are therefore subject to PDT restrictions.

How to see if an account is restricted?

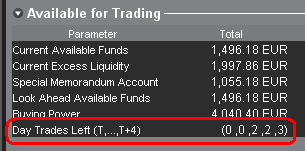

In the Account Window, the third section titled Available for Trading displays a line titled Day Trades Left (T...,T+4).

In the example above, we will assume that today is Monday. The account will have 0 day trades available Monday and Tuesday. On Wednesday and Thursday, 2 day trades will be available. If those two trades are not used, the account will have all 3 day trades available on Friday.

What options are available if the account is restricted?

According to the governing bodies, you are now disallowed to initiate any new positions (though you can always close out preexisting positions) for a period of 90 days. You do have options which are:

A. Deposit funds into the account which bring the account value greater than USD 25,000. Accounts valued greater than USD 25,000 are allowed unlimited day trades.

B. Request a PDT Reset through Client Portal. This can be done by going to the Support section of Client Portal followed by Message Center and selecting “Pattern Day Trader Request” from the “Compose” drop down menu. The Pattern Day Trader Request tool will launch and the system will check to see if the account is eligible for a PDT Reset.

Additional information can be found on the Day Trading tab on this page.