- Information Regarding IB's Voluntary Corporate Action Tool

- How to configure Client Services message delivery and notification

- Information Regarding IB's Corporate Action Notification Process

- If a dividend or split is declared on a stock I have a position in, will IBKR automatically adjust my working stop orders accordingly?

- The average price shown for one of my positions in the Trader Workstation is incorrect.

ADR Conversion Process

An American Depository Receipt (ADR) is a physical certificate evidencing ownership of American Depository Shares (ADS). An ADS is a US dollar denominated form of equity ownership in a non-US company. The ADS represents the foreign shares of the company held on deposit by a custodian bank in the company's home country and carries the corporate and economic rights of the foreign shares, subject to the terms specified on the ADR certificate.

Holders of the underlying ordinary shares may request to convert these shares into an ADR. Similarly, holders of an ADR may request to convert to the underlying ordinary shares.

Interactive Brokers will offer this conversion for the shares listed here.

Submitting Shares for Conversion

In order to request a conversion, either underlying to ADR or ADR to underlying, account holders may utilize IBKR's Voluntary Election Tool.

To access the tool, an individual account holder may:

- Log in to Portal

- Click Help to the right of the Welcome avatar in the top right corner and click Support Center.

- Scroll down to the Information & Tools section and select Corporate Actions Manager.

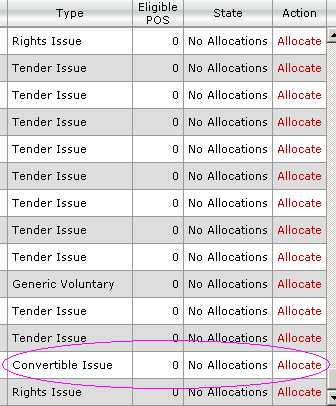

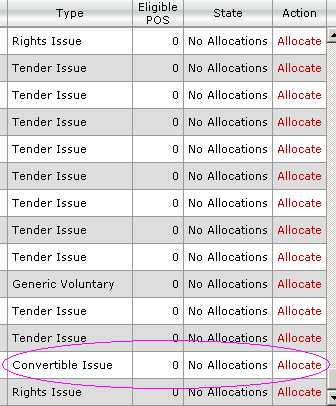

- Select the Conversions tab from the table of corporate action types.

- From the table, locate the security you wish to act upon and select Allocate from the far right of the table

To access the tool, an institutional account holder may:

- Log in to Portal

- Click Help > Support > Corporate Actions Manager.

- Select the Conversions tab from the table of corporate action types.

- From the table, locate the security you wish to act upon and select Allocate from the far right of the table

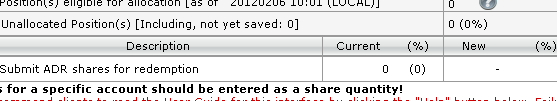

Once selected, a new screen will launch which will provide information on the terms of the conversion offer. Once you have reviewed the terms, you may submit an election.

Please note: Fees will be assessed for an ADR conversion request. While the overview description will provide an estimate of the fees, the final amount the account will be charged is dependent on the processing fee assessed by the agent at the time of the action and therefore the estimate is subject to change.

Frequently Asked Questions

Is there a minimum value required for conversion?

IBKR does not require a minimum value of ADRs or underlying shares to proceed with a conversion.

I do not see my ADR/common shares in the list of positions available for conversion.

In the event the security is not listed within the table, clients may submit an Inquiry Ticket. Within the ticket, please indicate the security you wish to convert and the number of shares. Upon receipt, IBKR will review the request and provide information on whether the action will be made available.

When can I expect my new shares after I submit my conversion request?

Once the elected shares are settled in the account, a request will be forwarded to the processing agent. While many requests will be completed within 1 to 2 business days, as the processing is dependent third party agents in various regions this is an estimate only and a given conversion may take additional time. Upon receipt of the new shares, the position will be allocated to the account.

What will happen once I submit my election?

Once the election has been submitted, a request will be forwarded to the processing agent. The shares submitted for conversion will be moved to a contra-symbol in the account which is non-marginable and non-tradeable. The shares will remain in this location until the conversion has been completed. Account holders should review their accounts to ensure the account will remain in margin compliance during the processing.

How will I know the fee associated with the conversion?

Initially the estimated fee per share will be provided in the description of the conversion. Account holders will be responsible for calculating the fee themselves based on this information. All voluntary conversions will be charged a commission of USD 500, plus a pass thru of external costs. Conversions on programs that are terminating will be charged a commission of USD 500 plus a pass through of external costs up to the delisting date. For 30 days following delisting, the commission is USD 0 plus a pass through of external costs. The commission returns to USD 500 plus a pass through of external costs more than 30 days following a delisting.

I have negotiated a rate with the ADR issuer for conversion. How can I ensure that this is the fee I am charged?

In the event an account holder has negotiated a specific rate, please supply the details of the rate as well as a contact name and phone number within an Inquiry Ticket. IBKR will review the details and once confirmed, ensure that the applicable fee is deducted from the account.

Can I convert unsettled shares?

No. Only settled shares may be submitted to the processing agent for conversion.