What is the margin on an Iron Condor option strategy?

If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike.

Example:

10 SPY Dec19 160P

-10 SPY Dec19 170P

-10 SPY Dec19 180C

10 SPY Dec19 190C

The margin requirement is determined by taking the strike of the short put (170) and subtracting the strike of the long put (160)

170-160 = 10

Take the difference and multiply by the number of contracts (10) and the multiplier (100)

10*10*100 = 10,000

In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such.

What formulas do you use to calculate the margin on options?

There are many different formulas used to calculate the margin requirement on options. Which formula is used will depend on the option type or strategy determined by the system. There are a significant number of detailed formulas that are applied to various strategies. To find this information go to the IBKR home page at www.interactivebrokers.com. Go to the Trading menu and click on Margin. From the Margin Requirements page, click on the Options tab. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each.

The information above applies to equity options and index options. Options on futures employ an entirely different method known as SPAN margining. For information on SPAN margining, conduct a search on this page for “SPAN” or “Futures options margin”.

What happens to the USD equity option that I am long at expiration?

There are two scenarios which could occur if a long option is taken to expiration. If the option is out-of-the-money at expiration and you do not choose to exercise it, the option will expire worthless, and your losses will consist of the premium that was paid to acquire the option. If the option is in-the-money at expiration by 0.01 or more, it will be automatically exercised on your behalf (unless you previously chose to lapse the option) by the Options Clearing Corporation (OCC). The OCC processes monthly expiration options on the third Saturday of the month, or the day after Friday expiration. The resulting long or short position will be put into the account, effective on the Friday trade date. If the account has sufficient margin to satisfy the requirement on the resulting position, it will then be up to the account holder to decide what they want to do with the position. If the resulting position causes a margin deficit, the account will be subject to liquidation at a time which is defined by the holdings within the account. Please be aware that any positions could be liquidated as a result of the account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. For example, if the account holds currency, futures, future options positions or and non-USD product, the account may begin to liquidate to meet the margin deficit as soon as a corresponding market opens.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.

How can I exercise long options?

Account holders have the ability to exercise equity options they hold long in their account.

From Trader Workstation, go to the Trade menu and select Option Exercise.

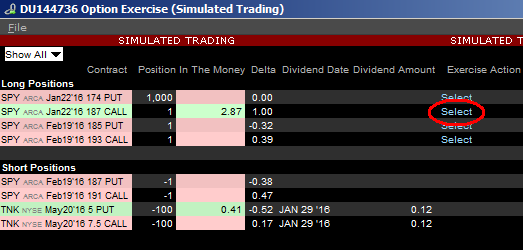

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To exercise one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

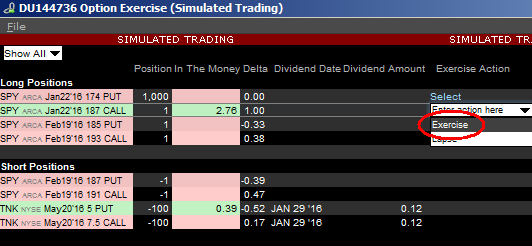

Select "Exercise" from the drop down menu.

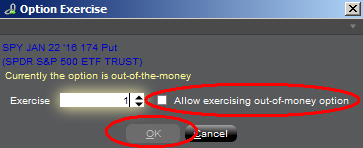

Your Exercise request will now show as an order line on your Trader Workstation until the clearinghouse processes the request. If the option is out-of-the-money, a warning message will appear. To submit the Exercise request, check the box to “Allow exercising out-of-money option” and click OK.

Please note, you have the option of selecting whether you would like your option exercise request to be final and unable to be cancelled, or editable until cutoff time (varies by clearing house). If you select "final and cannot be cancelled", some contracts will not follow this rule and will remain revocable up until the clearing house deadline. You can make this selection in Trader Workstation by going to Edit followed by Global Configuration and selecting Orders from the configuration tree on the left side.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Client Portal window. In the Client Portal window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Option Exercise Requests (whether received through the TWS Option Exercise window or by a ticket sent via Client Portal / Message Center) must be submitted as follows:

| For Equity Option Contracts Traded Upon: | IBKR must receive an Exercise Request by: | ||||||

| North America | US Options Exchanges | 17:25 EST | |||||

| Montreal Exchange | 16:30 EST | ||||||

| Europe | Euronext | 17h50 CET | |||||

| Eurex (German and Swiss) | 17h50 CET | ||||||

| IDEM | 17h50 CET | ||||||

| LIFFE | 17h50 CET | ||||||

| MEFF | 17h50 CET | ||||||

| Sweden | 17h50 CET | ||||||

| Asia Pacific | Australia | 16:25 Australia/NSW | |||||

| Japan | 15:30 JST | ||||||

| (Send a ticket and call Client Services) | |||||||

Trading permissions in an IRA account

IBKR offers Traditional, Roth and SEP IRAs any of which may be designated as a 'Cash' or 'Margin' type. The following article outlines the trading permissions provided under each type as well as restrictions which account holders should familiarize themselves with.

CASH TYPE PERMISSIONS

- Long stock, bond, mutual fund

- Long call and put options

- Short calls if covered by underlying stock (which is then restricted)

- Short puts if strike price is fully covered by cash (which is then restricted)

- Option spreads where exercise style is European and long leg expires simultaneously or after short leg

- Long or short futures contracts (subject to a margin requirement which is generally 2x that of the requirement for non-retirement accounts)

Restrictions:

- Must have sufficient (unrestricted) cash available to support all outstanding orders

- Cash proceeds from sales not available for withdrawal or trading until settlement (generally 2 business days for stocks and Forex and 1 for options)

- No short stock

- No negative or debit cash balance (subject to immediate position liquidation in an amount sufficient to restore cash to non-negative balance)

- Not allowed to hold a cash balance or position denominated in a currency different from the Base Currency of the account.

- If the exercise or assignment of an option results in the delivery of either a long stock position for which the account does not have sufficient cash to purchase (e.g., call exercise) or any short stock position (e.g. put exercise) the account will be subject to liquidation.

- IBKR does not allow trading or holdings of securities such as Master Limited Partnerships (MLPs) in retirement accounts that have the potential to generate UBTI (Unrelated Business Taxable Income) as this type of income has the potential to trigger taxes and tax reporting in an otherwise tax-deferred account type.

MARGIN TYPE ACCOUNT

- Long stock, bond, mutual fund

- Long call and put options

- Short calls if covered by underlying stock (which is then restricted)

- Short puts if strike price is fully covered by cash (which is then restricted)

- Option spreads where long leg expires simultaneously or after short leg (no exercise style restriction)

- Long balance in non-Base Currency

- Long or short futures contracts (subject to a margin requirement which is generally 2x that of the requirement for non-retirement accounts)

Restrictions:

- Reg T margin rules enforced (including Pattern day Trading rules)

- Cash proceeds from sales not available for withdrawal until settlement (generally 2 business days for stocks and Forex and 1 for options). Unsettled funds may be used for trading

- Cash proceeds from unsettled sales are available for trading as long as the subsequent purchase order does not settle prior to the sale order

- No short stock

- No negative or debit cash balance (subject to immediate position liquidation in an amount sufficient to restore cash to non-negative balance)

- If purchasing a security or trading a product denominated in a currency different from the Base Currency of the account, a currency conversion must first be executed

- If the exercise or assignment of an option results in the delivery of either a long stock position for which the account does not have sufficient cash to purchase (e.g., call exercise) or any short stock position (e.g. put exercise) the account will be subject to liquidation

- IBKR does not allow trading or holdings of securities such as Master Limited Partnerships (MLPs) in retirement accounts that have the potential to generate UBTI (Unrelated Business Taxable Income) as this type of income has the potential to trigger taxes and tax reporting in an otherwise tax-deferred account type.

- Not eligible for Portfolio Margining

- Not allowed for clients of IBKR Canada

See KB280 or click here for instructions on upgrading an account from Cash to Margin type.