HK Stock Physical Certificate Deposit FAQ

HK Stock Physical Certificate Deposit FAQ

⦁ Does IBKR support HK stock physical certificate deposit?

Yes, we support stock physical certificate deposits for stocks trading on HKEX and available to trade at Interactive Brokers. We do not support physical withdrawals and reserve the right to reject any deposit.

⦁ Does Interactive Brokers Hong Kong charge any fees?

| Certificate Size | Processing Fee |

| HKD 500,000 or above (Full Service) | Free |

| Less than HKD 500,000 (Full Service) |

HKD 300.00/first stock certificate per day HKD 100.00/each additional certificate per day |

| Less than HKD 500,000 (Self Service) |

HKD 200.00/first stock certificate per day HKD 20.00/each additional certificate per day |

*A rejection fee of HKD 1,000 will be charged for any transaction rejected by the share registry. Additional fees may be imposed for submitting large volumes that are time consuming to process. Please contact Client Services via a web ticket for more information.

In addition to the above, there is also a fee of HKD 5 stamp tax per transfer form. Cash cannot be accepted. Please prepare a cheque for HKD 5 per transfer form payable to “The Stock Exchange of Hong Kong Limited”.

If a total of five certificates are to be deposited for stock A and stock B, a breakdown of the fees would be illustrated by the below examples:

Scenario (Full Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 300 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 100 HKD

Scenario (Self Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 200 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 20 HKD

⦁ How do I initiate a request?

Please compose a web ticket from the Client Portal under the category Funds & Banking > Position Transfer with all of the following information to avoid delays:

- Full Service or Self Service

- Company name/ stock ticker symbol

- Approximate value

- Number of certificates

Full Service

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ You will receive a receipt from IBKR within one business day.

Self Service

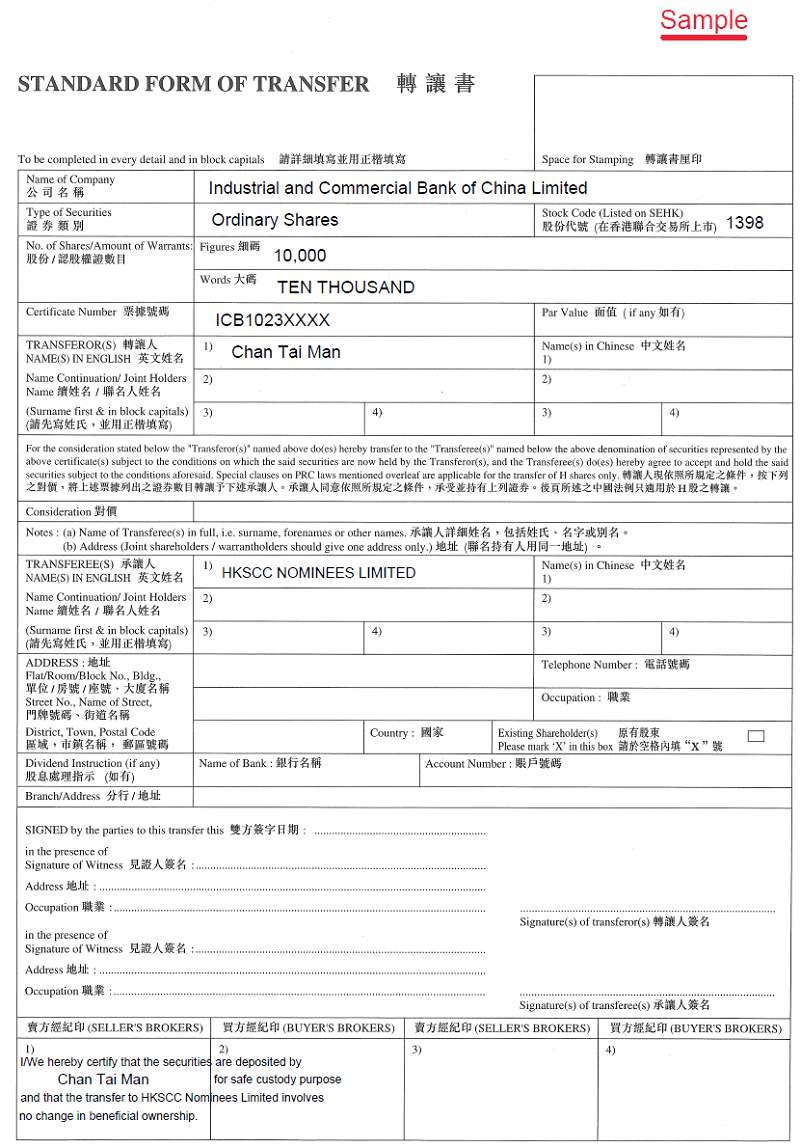

⦁ Our Client Service team will contact you by email and provide a “Standard Form of Transfer”;

⦁ Complete the “Standard Form of Transfer” by following below guidance.

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR (Additional courier fees, to be quoted, will be passed on to client)

⦁ IBKR will counter sign the form and return to you for the delivery of all of the below documents to HKSCC. Address – 1/F, One & Two Exchange Square, Central, Hong Kong SAR.

⦁ The countersigned Standard Form of Transfer

⦁ CCASS Stock Deposit Form (Prepared by IBKR)

⦁ The physical certificate(s)

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ Provide a scanned copy of the receipt to IBKR.

⦁ When will the shares be credited to my IBKR account?

Typically, the shares will be reflected on your IBKR account within 3-4 business days. However, as the share registry has the right to reject deposits, IBKR will apply a 12 business day hold on the shares during which time you will not be able to sell nor withdraw the shares deposited.

⦁ Instruction and Sample – Standard Form of Transfer

.png)