Mikro-kapitalzációjú amerikai részvényekre („U.S. Microcap Stock”) vonatkozó korlátozások

Bevezetés

A nyilvántartásban nem szereplő értékpapírok értékesítésével kapcsolatos szabályozás betartása, illetve a nyilvánosan nem jegyzett részvények kereskedésével kapcsolatos manuális feldolgozási munka minimalizálása érdekében az IBKR bizonyos korlátozásokat alkalmaz a mikro-kapitalizációjú amerikai részvényekre. Az alábbiakban ismertetjük ezen korlátozások listáját, valamint a témába vágó gyakran ismételt egyéb kérdéseket.

Mikro-kapitalizációjú részvényekre vonatkozó korlátozások

- Az IBKR-hez kizárólag az erre jogosult ügyfelektől fogad el mikro-kapitalizációjú amerikai részvénycsomagok átutalását. A jogosult ügyfelek közé azok a számlatípusok tartoznak, amelyek: (1) legalább 5 millió USD tőkével rendelkeznek (az átutalás előtt vagy után), vagy olyan pénzügyi tanácsadók ügyfelei, akiknek az összes kezelt vagyona legalább 20 millió USD; és (2) tőkéjének kevesebb mint a felét teszik ki a mikro-kapitalizációjú amerikai részvények.

- Az IBKR kizárólag akkor fogadja el a mikro-kapitalizációjú amerikai részvénycsomagok átutalását1, ha a jogosult ügyfél igazolni tudja, hogy a részvényeket a nyílt piacon vásárolta, vagy azokat a SEC nyilvántartásba vette;

- Az IBKR semmilyen ügyféltől nem fogadja el a mikro-kapitalizációjú amerikai részvénycsomagok átutalását1 vagy az azokra vonatkozó megbízások benyújtását, amennyiben a részvényeket az OTC a „Caveat Emptor” (vevői óvatosság ajánlott) illetve „Grey Market” (szürke piac) kategóriába sorolja. Az ilyen részvényekben már meglévő pozícióval rendelkező ügyfelek lezárhatják a kérdéses pozíciókat;

- Az IBKR nem fogadja el mikro-kapitalizációjú amerikai részvénycsomagok átutalását; amennyiben annak célja az IBKR-nél létrehozott short pozíció fedezése;

- A „csak végrehajtás” szerződéssel rendelkező ügyfelek (azaz akik esetében az ügyletkötés az IBKR-nél, az elszámolás azonban máshol történik) nem kereskedhetnek mikro-kapitalizációjú amerikai részvényekkel az IBKR számlájukon. (Az IBKR kivételt tehet az Amerikai Egyesült Államokban bejegyzett brókerek esetén);

Mikro-kapitalizációjú részvények GYIK

Mi minősül mikro-kapitalizációjú amerikai részvénynek?

A „mikro-kapitalizációjú részvény” kifejezés, (1) a tőzsdén kívül kereskedett, vagy (2) a Nasdaq és a NYSE amerikai tőzsdéken jegyzett, 50 millió és 300 millió USD közötti piaci kapitalizációjú, 5 USD árfolyam alatt kereskedett részvényekre vonatkozik. A jelen szabályzat értelmében a mikro-kapitalizációjú részvény kifejezés az 50 millió USD vagy kisebb piaci kapitalizációval rendelkező, tőzsdén jegyzett amerikai vállalatok részvényeire is kiterjed, amelyeket néha a „nano-kapitalizációjú részvény” névvel illetnek, és amelyekkel általában a mikro-kapitalizációjú részvények piacain kereskednek.

Azon helyzetek elkerülése érdekében, ahol egy részvény árfolyamában bekövetkező kisebb, rövid távú kilengések többszöri átsorolást eredményeznének, a mikro-kapitalizációjú amerikai részvényként besorolt részvények besorolása nem változik meg mindaddig, amíg a piaci kapitalizáció illetve a részvény árfolyama egy összefüggő 30 naptári napos időszakban nem haladja meg rendre a 300 millió USD-t, illetve az 5 USD-t.

Mivel a mikro-kapitalizációjú részvények árfolyama gyakran alacsony, ezekre általában „filléres részvényként” szokás hivatkozni. Az IBKR kivételt tehet, többek között a jelenleg alacsony árfolyamon kereskedett, de a közelmúltban még magasabb piaci kapitalizációval rendelkező részvényekkel. Továbbá a nem amerikai vállalatokra vonatkozó ADR-eket az IBKR nem tekinti mikro-kapitalizációjú részvénynek.

Hol lehet kereskedni mikro-kapitalizációjú részvényekkel?

Mikro-kapitalizációjú részvényekkel általában nem a nemzeti értéktőzsdéken, hanem az OTC piacon lehet kereskedni. Ezeket a papírokat az árjegyzők gyakran elektronikus úton, az OTC rendszereken jegyzik, például az OTC Bulletin Board (OTCBB) rendszeren, illetve az OTC Markets Group által kezelt piacokon (pl. OTCQX, OTCQB & Pink). Ide tartoznak a nyilvánosan nem jegyzett, „Caveat Emptor” (vevői óvatosság ajánlott), „Other OTC” (egyéb OTC) vagy „Grey Market” (szürke piac) kategóriába sorolt részvények is.

Emellett az amerikai szabályozó hatóságok a Nasdaq és a NYSE amerikai tőzsdéken jegyzett, 5 USD árfolyamon vagy az alatt kereskedett, 300 millió USD vagy kisebb piaci kapitalizációjú részvényeket is a mikro-kapitalizációjú részvények kategóriába sorolják.

Mi történik olyankor, ha egy jogosult ügyfél átutalást indít az IBKR-hez, és egy vagy több érintett pozíció a mikro-kapitalizációjú részvény kategóriába tartozik?

Ha az IBKR-hez egy mikro-kapitalizációjú részvénycsomagot tartalmazó átutalás érkezik be, az IBKR fenntartja a jogot, hogy korlátozza az átutalás részét képező bármely mikro-kapitalizációjú pozíció(k) eladását, hacsak a jogosult ügyfél nem mutat be megfelelő dokumentációt, ami igazolja, hogy a részvényeket a nyílt piacon (azaz egy nyilvános tőzsdén, egy másik bróker igénybe vételével) szerezte be, vagy azokat a SEC – S-1 vagy ahhoz hasonló regisztrációs űrlap alapján – nyilvántartásba vette.

A jogosult ügyfelek úgy tudják bizonyítani, hogy a részvényeket a nyílt piacon szerezték be, hogy bemutatnak egy jó hírnévnek örvendő bróker által kiállított brókeri nyilatkozatot vagy ügyletkötési igazolást, amely bizonyítja, hogy a részvényeket egy nyilvános tőzsdén vásárolták. A jogosult ügyfelek a részvények SEC általi nyilvántartásba vételét úgy tudják bizonyítani, hogy benyújtják azt az SEC (Edgar rendszer) által generált ügyszámot, amelyen a részvények nyilvántartásba vételre kerültek (illetve bármely olyan további dokumentumot, amely szükséges annak igazolásához, hogy a részvényei megegyeznek a nyilvántartásba vételi nyilatkozaton feltüntetett részvényekkel).

MEGYJEGYZÉS: Minden ügyfél bármikor szabadon rendelkezhet a korlátozásaink alá eső részvényei bármelyikével.

Milyen korlátozásokat alkalmaz az IBKR a prémium számlák esetén?

Azok az ügyfelek, akik a tevékenységeik alapján prémium szolgáltatásokra jogosultak, kizárólag azon ügyleteik tekintetében minősülnek jogosult ügyfélnek, amelyeket az IBKR a végrehajtó brókerein keresztül befogadott. Bár előfordulhat, hogy a prémium számlák az IBKR-nél végzik a mikro-kapitalizációjú amerikai részvényeik elszámolását, a részvények mindaddig korlátozás alá fognak esni, amíg az IBKR nem erősíti meg, hogy a részvények a fent ismertetett eljárások alkalmazásával újraértékesíthetők.

A nyílt piacon beszerzett részvényekre vonatkozó korlátozások feloldása érdekében kérjük, szerezzen be a végrehajtó brókertől egy céges fejléccel ellátott papírra kinyomtatott és aláírt nyilatkozatot, vagy egy hivatalos számlakimutatást, amely bizonyítja, hogy a részvények beszerzésére a nyílt piacon került sor. A nyilatkozatnak vagy kimutatásnak az alábbi felsorolt kritériumoknak is meg kell felelnie. Amennyiben a részvények beszerzésére kibocsátás keretében került sor, a nyilatkozatnak vagy kimutatásnak tartalmaznia kell további dokumentumokat vagy linkeket is a releváns nyilvántartásba vételi igazoláshoz, amelyek igazolják, hogy a részvények annak részét képezték.

A brókeri nyilatkozat kötelező elemei:

1) IBKR számlaszám

2) IBKR számlanév

3) Kötés napja

4) Elszámolás napja

5) Ticker kód

6) Oldal

7) Árfolyam

8) Mennyiség

9) Végrehajtás időpontja

10) Tőzsde

11) Aláírás

12) A cég hivatalos fejléce

Összefoglalva: a long eladási ügyleteket akkor fogadjuk el, ha a long pozíció már nem esik korlátozás alá. A short eladási ügyleteket minden esetben elfogadjuk. A long vételi ügyleteket elfogadjuk, ám a pozíció korlátozás alá esik mindaddig, amíg a Compliance osztály nem kap elégséges információkat a korlátozás feloldásához. A fedezeti vételi ügyleteket és a napon belüli oda-vissza („round trip”) ügyleteket nem fogadjuk el.

Mi történik, ha egy Ön által megvásárolt részvény átsorolásra kerül a „Grey Market” vagy a „Caveat Emptor” kategóriába?

Amennyiben olyan részvényt vásárol az IBKR számláján, ami később átsorolásra kerül a „Caveat Emptor” vagy a „Grey Market” kategóriába, Önnek lehetősége lesz fenntartani, lezárni vagy átutalni a pozícióját, ugyanakkor nem lesz lehetősége tovább növelni a pozícióját.

Milyen okokból korlátozható a mikro-kapitalizációjú részvények kereskedése a számlámon?

Két fő ok van, ami miatt korlátozhatjuk a mikro-kapitalizációjú részvényekkel folytatott kereskedést a számláján:

- Potenciális kapcsolt viszony a kibocsátóval: az Amerikai Egyesült Államok Értékpapír és Tőzsdebizottsága („U.S. Securities and Exchange Commission”, „SEC”) 144-es szabálya bizonyos korlátozásokat léptetett életbe a kibocsátóval „kapcsolt viszonyban” lévő személyek által folytatott részvénykereskedésre (ideértve a mikro-kapitalizációjú részvényeket is). Amennyiben az IBKR olyan kereskedési aktivitást vagy pozíciót észlel mikro-kapitalizációjú részvényekben, amely megközelíti a 144-es szabály szerinti kereskedési volumen küszöbértékeket („144-es szabály szerinti küszöbértékek”), akkor a vonatkozó megfelelőségi felülvizsgálat lezárultáig korlátozhatja az ügyfél mikro-kapitalizációjú részvényekkel folytatott kereskedését.

- Mikro-kapitalizációjú részvény átutalása: ha az ügyfél a közelmúltban utalt át mikro-kapitalizációjú részvényeket az IBKR számlájára, az IBKR a vonatkozó megfelelőségi felülvizsgálat lezárultáig korlátozhatja az ügyfél kereskedési tevékenységét az adott értékpapírral.

Ha a fenti okok valamelyike fennáll, korlátozni fogjuk a kérdéses értékpapírral folytatott kereskedést, és értesítést fogunk küldeni az Ügyfélportálon található üzenetközpontba. Az értesítés tartalmazza a korlátozás okát, és azokat az intézkedéseket, amelyek az ügyfél részéről szükségesek ahhoz, hogy az IBKR megfontolja a korlátozás feloldásának lehetőségét.

Miért tekint engem az IBKR a mikro-kapitalizációjú részvény kibocsátójával potenciálisan kapcsolt viszonyban lévő személynek?

A „kapcsolt” személy olyan személy (például felső vezető, igazgató vagy nagy részvényes), aki ellenőrzési viszonyban áll a kibocsátóval.

A 144-es szabály minden értékpapírra, így a mikro-kapitalizációjú részvényekre is vonatkozik. Ugyanakkor, tekintettel a mikro-kapitalizációjú részvényekkel kapcsolatos fokozott kockázatokra, ha az ügyfél mikro-kapitalizációjú részvénnyel folytatott kereskedési tevékenysége és/vagy ilyen részvényben tartott pozíciója megközelíti a 144-es szabály szerinti küszöbértékeket, az IBKR korlátozni fogja az ügyfél adott mikro-kapitalizációjú részvénnyel folytatott kereskedési tevékenységét. Ez a korlátozás az ügyfél esetleges kapcsolt státuszára irányuló megfelelőségi felülvizsgálat lezárultáig hatályban marad.

Miért szükséges kéthetente megismételni a potenciális kapcsolt viszonyra irányuló megfelelőségi felülvizsgálatot?

Az ügyfél kapcsolt státusza röviddel azt követően is megváltozhat, hogy az IBKR lezárja a fent említett potenciális kapcsolt viszonyra irányuló vizsgálatot. Ezért az IBKR megítélése szerint indokolt kéthetente frissíteni a potenciális kapcsolt viszonyra irányuló vizsgálatot, amennyiben az ügyfél adott mikro-kapitalizációjú részvénnyel folytatott kereskedési tevékenysége és/vagy az abban fennálló pozíciói folytatólagosan megközelítik a 144-es szabály szerinti küszöbértékeket.

Hol találhatom meg az IBKR által mikro-kapitalizációjú amerikai részvénynek minősített részvények listáját?

Az IBKR által mikro-kapitalizációjú amerikai részvénynek minősített részvények listája elérhető a következő linken: www.ibkr.com/download/us_microcaps.csv

Felhívjuk a figyelmét, hogy ezt a listát naponta frissítjük.

Hol találhatok további információkat a mikro-kapitalizációjú részvényekről?

A mikro-kapitalizációjú részvényekre vonatkozó további információk, ideértve az ilyen részvényekkel kapcsolatos kockázatokat is, elérhetők az SEC weboldalán: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1Ebbe beleértendők a bármilyen módszerrel történő átutalások (pl. ACATS, DWAC, FOP), a kanadai jegyzések konverziói az amerikai egyesült államokbeli megfelelőjükre „Déli irányú” átutalás útján, a meglévő short pozíciók fedezését szolgáló átutalások, a végrehajtást más brókereknél, viszont az elszámolást az IBKR-nél végző prémium ügyfelek stb.

Számlaszám módosítása függőben lévő ACAT vagy ATON utalás esetén

Annak érdekében, hogy ACAT vagy ATON utalás sikeresen teljesüljön, az Ön brókerének hitelesítenie szükséges a kérelemben megadott számlaszámot. Amennyiben a számlaszám érvénytelen, a bróker elutasítja a kérelmet. Az elutasítás elkerülése érdekében az IBKR késleltetheti az ACATS/ATON utalási kérelmét, amennyiben a megadott számlaszám nem azonos a választott bróker számlaszámával. Abban az esetben, ha számlaszáma ellenőrzése és javítása szükséges, az IBKR értesítést küld Önnek.

Az alábbiakban a számlaszám frissítésére vonatkozó részletes tájékoztatás olvasható.

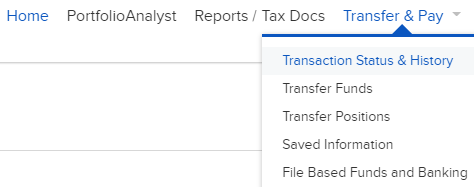

- Az Ügyfélportál „Utalások, be- és kifizetések” (Transfer & Pay) menüpontjában válassza a „Tranzakcióelőzmények” (Transactions Status & History) lehetőséget.

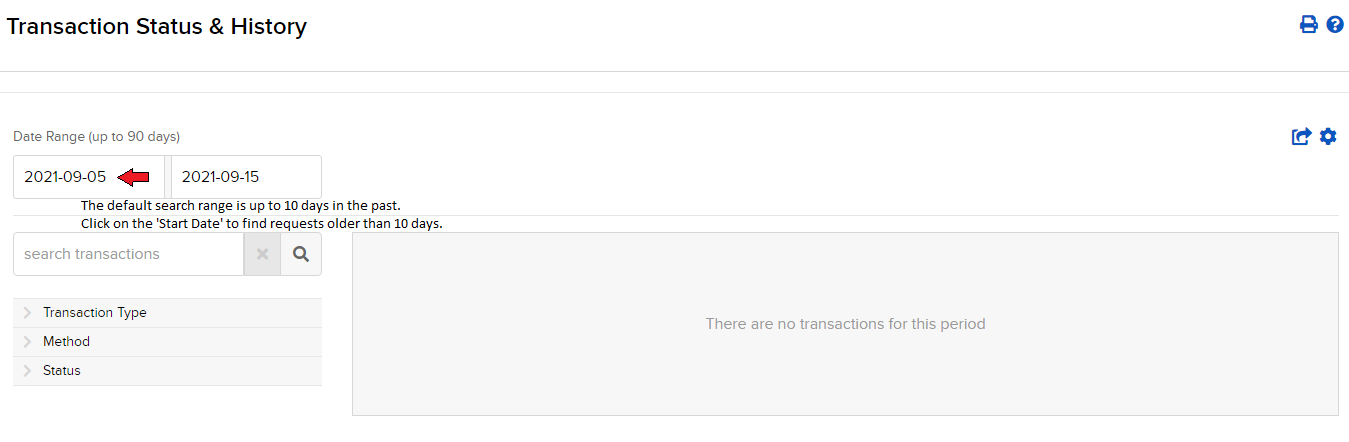

- Keresse meg az utalási kérelmet a „Függőben” (Pending) besorolású elemek között és kattintson rá. Az alapértelmezett keresési tartomány 10 napra visszamenőleg keres találatokat; szükség esetén módosítsa a kezdődátumot.

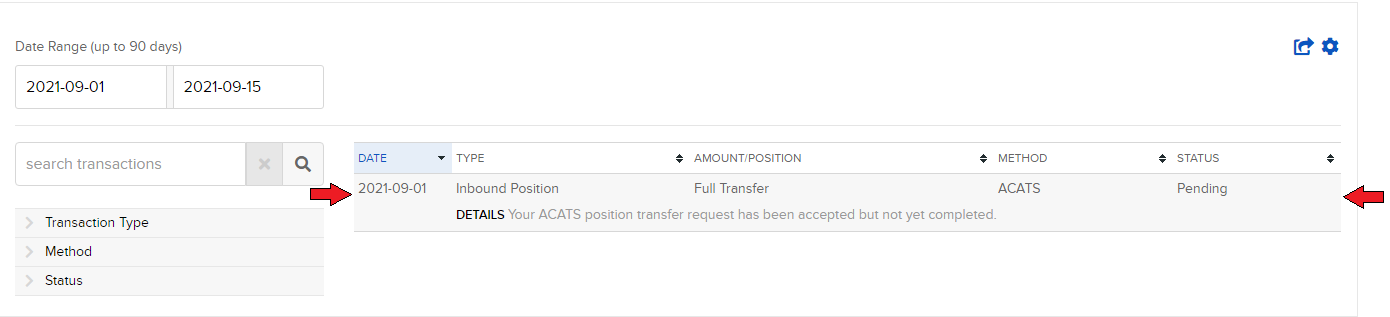

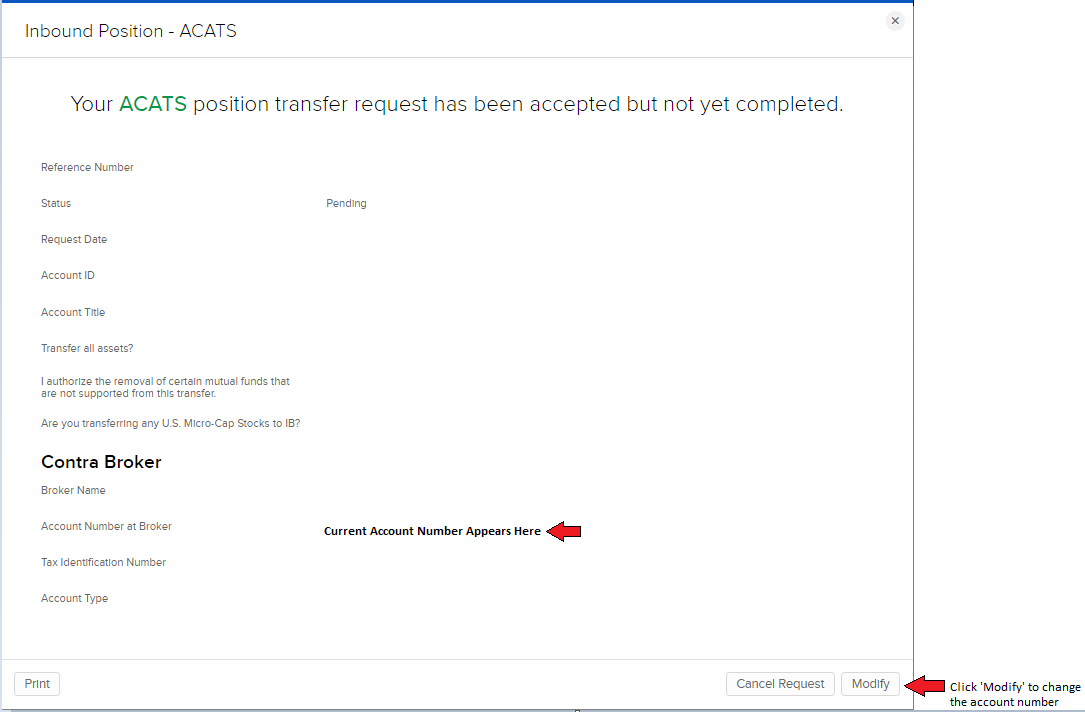

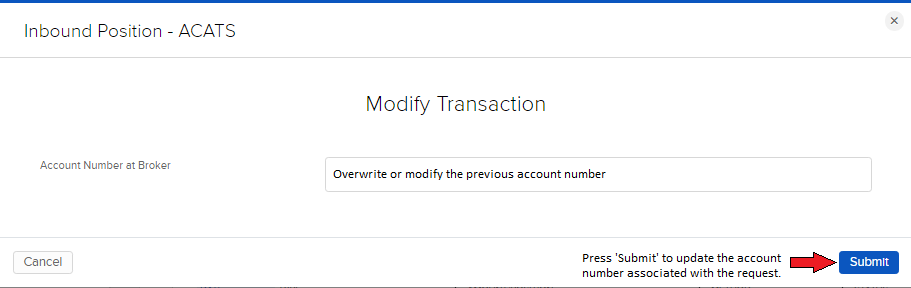

- A függőben lévő kérelem adatait összefoglaló előugró ablak jelenik meg. Az előugró ablak jobb alsó sarkában válassza a „Módosítás” lehetőséget.

- Új előugró ablak jelenik meg, amely a kérelemhez jelenleg tartozó számlaszámot tartalmazza. Módosítsa a számlaszámot.

- Amikor elkészült, válassza a „Benyújtás” (Submit) lehetőséget.

- Az összefoglaló előugró ablak ismét látható lesz, amelyen megtalálja a frissített „Brókernél vezetett számla számlaszáma” értéket.

- Bezárhatja az ablakot a jobb felső sarokban található „x” elemre kattintva.

Sikeres számlaszámfrissítés esetén az utalási kérelem továbbításra kerül a végrehajtó bróker felé. Sikertelen számlaszámfrissítés esetén az utalási kérelem nem kerül továbbításra, a sikertelen számlaszámfrissítést követő napon újabb számlaszámfrissítési kérelmet küldünk e-mail üzenetben.

Amennyiben úgy gondolja, hogy a kérelem indokolatlanul kerül visszatartásra, kérjük, hozzon létre egy webes hibajegyet.

Számlaszám azonosítása ACATS utalások esetén

Annak érdekében, hogy ACAT vagy ATON utalás sikeresen teljesüljön, az Ön brókerének hitelesítenie szükséges a kérelemben megadott számlaszámot. Amennyiben a számlaszám érvénytelen, a bróker elutasítja a kérelmet. Az IBKR javasolja ügyfeleinek, hogy a brókerszámla-kivonaton ellenőrizzék a számlaszámot. A tájékozódás elősegítéséhez a legnépszerűbb brókerek brókerszámla-kivonatairól készült mintákat mellékeltünk, kiemelve a dokumentumokon a számlaszámot.

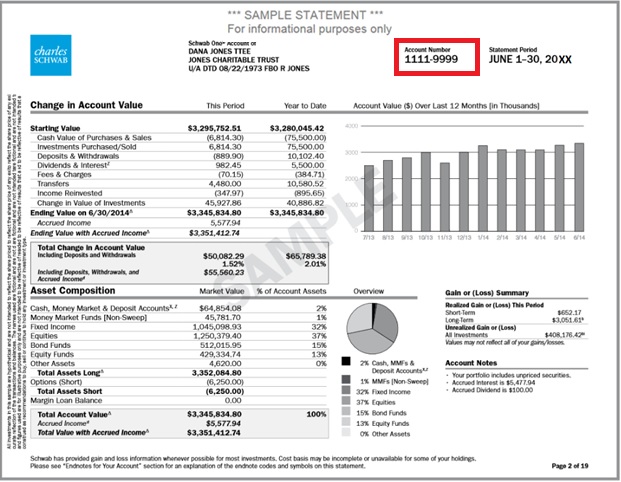

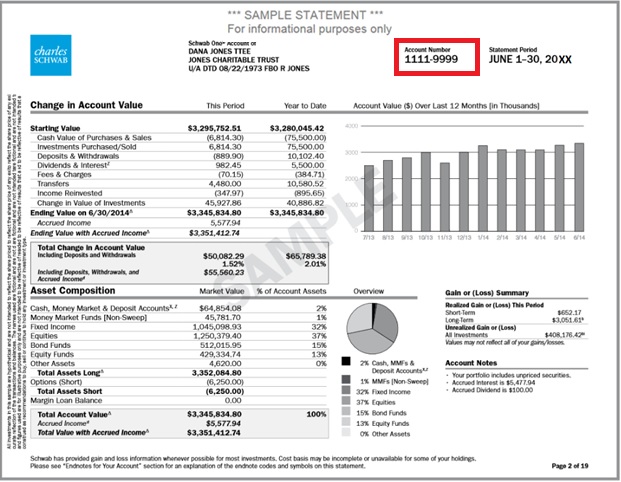

Charles Schwab - brókerszám: 0164. A számlaszám 8 karakterből áll, amely kizárólag számjegyekből tevődik össze.

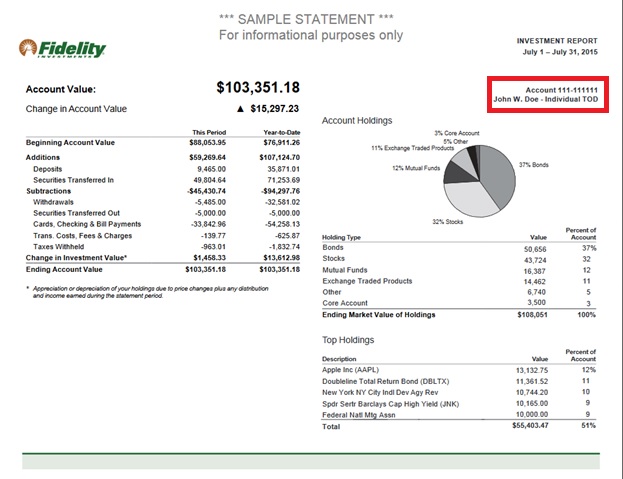

Fidelity Investments - National Financial Services, brókerszám: 0226. A számlaszám 9 karakterből áll, amelyből az első három betűből, az utolsó hat pedig számjegyből áll.

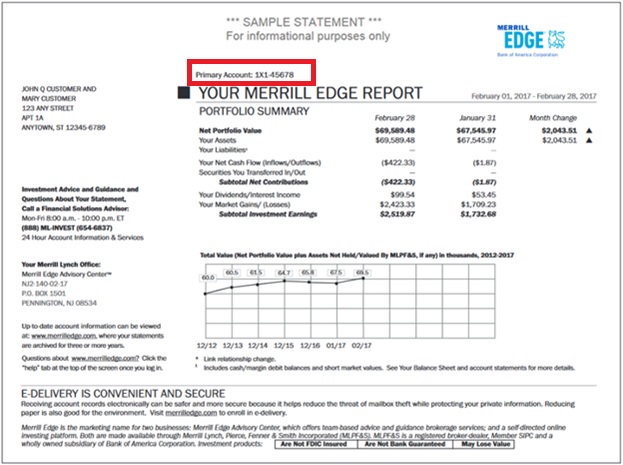

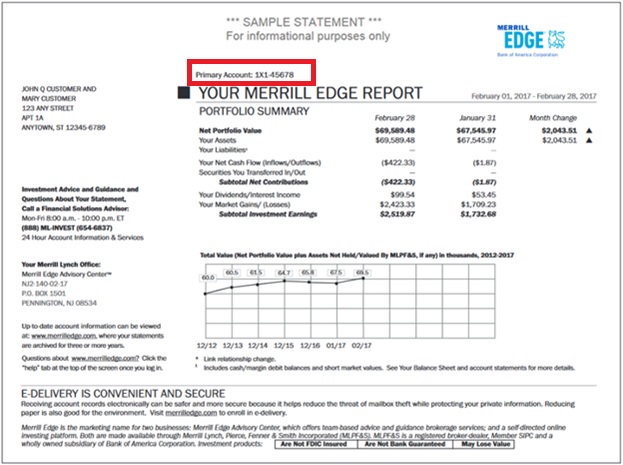

Merrill Edge - brókerszám: 0671. A számlaszám 8 karakterből áll, amely betűk és számjegyek kombinációja.

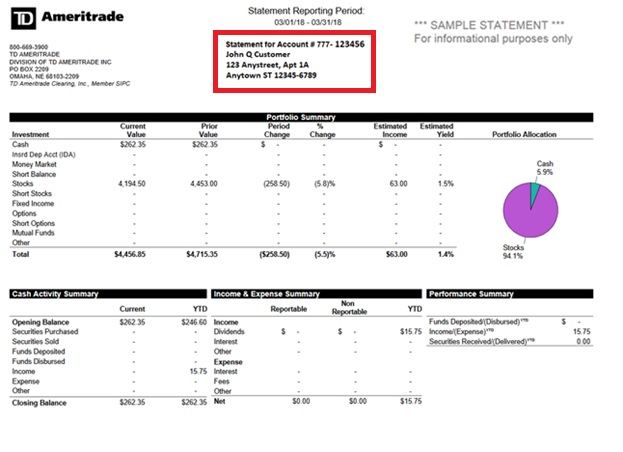

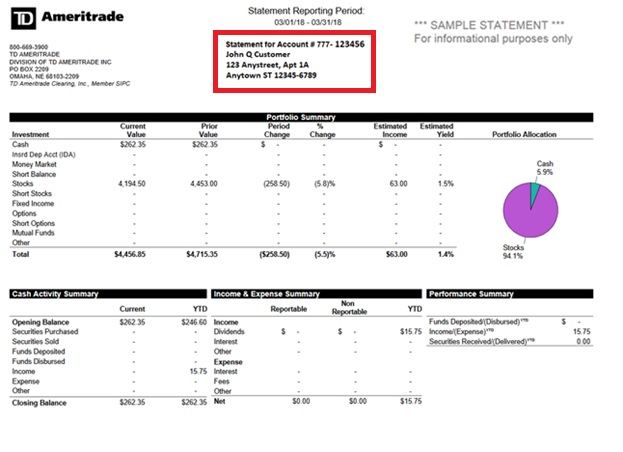

TD Ameritrade - brókerszám: 0188 A számlaszám 9 karakterből áll, amely kizárólag számjegyekből tevődik össze.

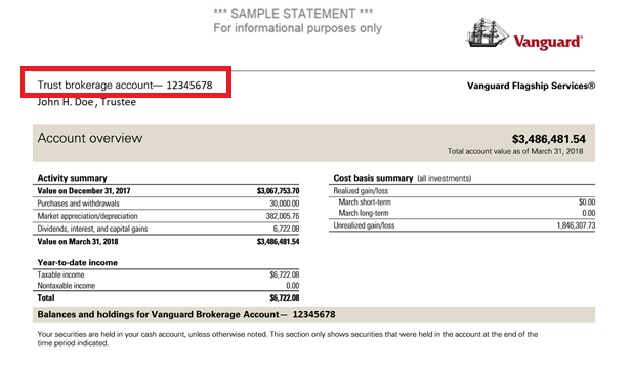

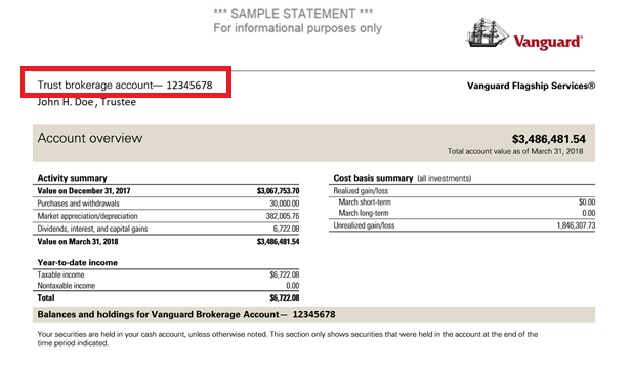

Vanguard- brókerszám: 0062. A számlaszám 8 karakterből áll, amely kizárólag számjegyekből tevődik össze.

Megjegyzés: A cikkben található brókerszámla-kivonatok képei kizárólag szemléltetés célját szolgálják, és a képeken látható logók a brókercégek tulajdonát képezik.

Modifying the account number for a pending ACAT or ATON transfer

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. To avoid such rejects, IBKR may delay the transmission of your ACATS/ATON request if the account number you have provided does not match the alpha-numeric pattern used by the selected broker. IBKR will send a notification for you to review and correct your account number.

Details for updating the account number are below.

- In Client Portal under the ‘Transfer & Pay’ menu, select “Transaction Status & History”.

- Locate the transfer request with a status of Pending and click on it. The default search range starts 10 days in the past; update the start date as necessary.

- A pop-up will appear with the summary details of the pending request. On the bottom right of the pop-up window, select the “Modify” button.

- A new pop-up will be presented that displays the current account number associated with the request. Modify the account number as appropriate.

- When done, select ‘Submit’.

- The summary detail pop-up will be re-displayed and you will now see the updated ‘Account Number at Broker’ value.

- You may close this will by clicking the ‘x’ at the top right.

An update to a valid account number will prompt the transmission of your request to the delivering broker. An update to an invalid account will not be transmitted and you will receive a new email alert the following day requesting additional account number updates.

If you determine the request is being held up for review incorrectly, please create a web ticket for further review by Interactive Brokers.

HK Stock Physical Certificate Deposit FAQ

HK Stock Physical Certificate Deposit FAQ

⦁ Does IBKR support HK stock physical certificate deposit?

Yes, we support stock physical certificate deposits for stocks trading on HKEX and available to trade at Interactive Brokers. We do not support physical withdrawals and reserve the right to reject any deposit.

⦁ Does Interactive Brokers Hong Kong charge any fees?

| Certificate Size | Processing Fee |

| HKD 500,000 or above (Full Service) | Free |

| Less than HKD 500,000 (Full Service) |

HKD 300.00/first stock certificate per day HKD 100.00/each additional certificate per day |

| Less than HKD 500,000 (Self Service) |

HKD 200.00/first stock certificate per day HKD 20.00/each additional certificate per day |

*A rejection fee of HKD 1,000 will be charged for any transaction rejected by the share registry. Additional fees may be imposed for submitting large volumes that are time consuming to process. Please contact Client Services via a web ticket for more information.

In addition to the above, there is also a fee of HKD 5 stamp tax per transfer form. Cash cannot be accepted. Please prepare a cheque for HKD 5 per transfer form payable to “The Stock Exchange of Hong Kong Limited”.

If a total of five certificates are to be deposited for stock A and stock B, a breakdown of the fees would be illustrated by the below examples:

Scenario (Full Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 300 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 100 HKD

Scenario (Self Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 200 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 20 HKD

⦁ How do I initiate a request?

Please compose a web ticket from the Client Portal under the category Funds & Banking > Position Transfer with all of the following information to avoid delays:

- Full Service or Self Service

- Company name/ stock ticker symbol

- Approximate value

- Number of certificates

Full Service

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ You will receive a receipt from IBKR within one business day.

Self Service

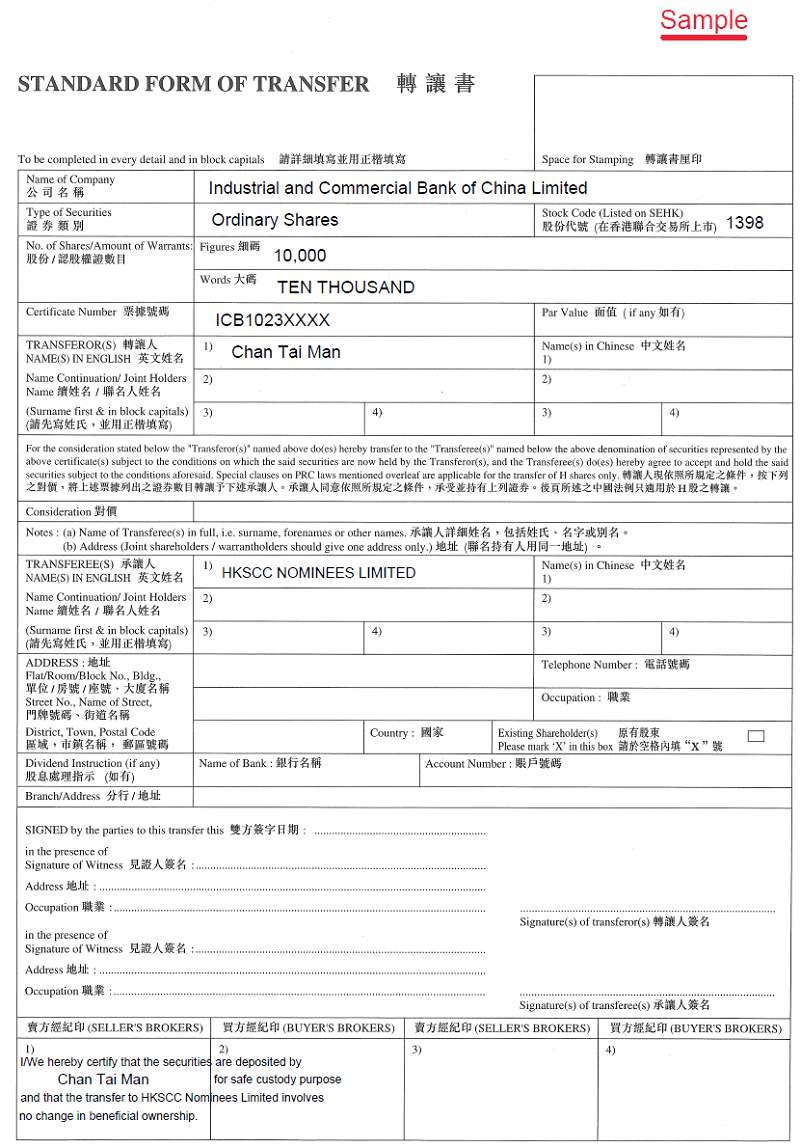

⦁ Our Client Service team will contact you by email and provide a “Standard Form of Transfer”;

⦁ Complete the “Standard Form of Transfer” by following below guidance.

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR (Additional courier fees, to be quoted, will be passed on to client)

⦁ IBKR will counter sign the form and return to you for the delivery of all of the below documents to HKSCC. Address – 1/F, One & Two Exchange Square, Central, Hong Kong SAR.

⦁ The countersigned Standard Form of Transfer

⦁ CCASS Stock Deposit Form (Prepared by IBKR)

⦁ The physical certificate(s)

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ Provide a scanned copy of the receipt to IBKR.

⦁ When will the shares be credited to my IBKR account?

Typically, the shares will be reflected on your IBKR account within 3-4 business days. However, as the share registry has the right to reject deposits, IBKR will apply a 12 business day hold on the shares during which time you will not be able to sell nor withdraw the shares deposited.

⦁ Instruction and Sample – Standard Form of Transfer

.png)

How to Submit an Inbound or Outbound Position Transfer via DWAC

You can initiate a DWAC transfer request in Client Portal:

- DWAC fees are USD 100.00 per DWAC. The account must also ensure enough funds are available to absorb the fees prior to setting up a DWAC request.

- The IBKR cutoff time for transmitting a DWAC transfer is 3:15 PM EST

FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

Locating your account number for ACATS transfers

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. IBKR recommends that clients review a copy of their brokerage statement to confirm their account number and has provided statement samples below from some of the more common brokers highlighting where this information can be found.

Charles Schwab - Broker #0164. Account Number convention is 8 characters, all numeric.

Fidelity Investments - Delivers through National Financial Services, Broker #0226. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric.

Merrill Edge - Broker #0671. Account Number convention is 8 characters, combination of alpha and numeric.

TD Ameritrade - Broker #0188. Account Number convention is 9 characters, all numeric.

Vanguard- Broker #0062. Account Number convention is 8 characters, all numeric.

Note: This article contains images of sample broker statements which are for illustrative purposes only and which may contain logos that remain the property of each of those brokers.

U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.