Converting From a Single to Joint Account

The process of adding a second owner to an existing single account for purposes of converting to a joint account is outlined below:

Designation of Eligible Contract Participant

Account holders may designate their status as an Eligible Contract Participant (ECP) by completing an online questionnaire provided via Client Portal. In the case where the account holder has provided information via the application process which suggests that they meet the ECP financial and/or organizational qualifications (see the IBKR Knowledge Base), the questionnaire is posted online in Client Portal. If the information submitted at the point of application does not support ECP qualification, the account holder may update their information online to obtain the questionnaire. Outlined below are the steps necessary to access the questionnaire.

Step 1. Determine if the ECP questionnaire has been posted to your account:

For individual accounts, log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Manage Account and Investor Category. If you reported net worth in excess of the minimum qualifying threshold, you will be provided with the ECP questionnaire. Note that account holders reporting net worth below the ECP qualifying threshold may be provided with questionnaires for different investor categories (i.e., Accredited Investor).

For organization accounts, log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Manage Account and Investor Category. If your organization is of a specified category (e.g., registered broker dealer, FCM) or reported net worth in excess of the minimum qualifying threshold, you will be provided with the ECP questionnaire. Note that organizations reporting net worth below the ECP qualifying threshold may be provided with questionnaires for different investor categories (i.e., Qualified Purchaser).

If the ECP questionnaire has been posted to your account, complete and acknowledge the document via electronic signature. If the questionnaire has not been posted to your account, follow Step 2 below.

Step 2. Update your account information:

For individual and organization accounts, if your net worth exceeds the minimum qualifying threshold of $10 million, you may log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Manage Account and Financial Information. Included on that page will be a section where account holders can update and confirm their financial information. Note that updates to this information are subject to review by our Compliance Department prior to taking effect. Once changes have taken effect and, assuming those changes meet the qualifying threshold, the ECP questionnaire will be made available as noted in Step 1 above.

Eligible Contract Participant - Definition

IMPORTANT: Note that regulations are subject to change and clients are responsible for determining whether or not they qualify as an ECP. Please refer to "7 U.S. Code § 1a – Definitions" to ensure you are reviewing the most current definition of an ECP.

Account holders should take note of the below excerpt from the definition which is likely to be the most relevant.

(xi) an individual who has amounts invested on a discretionary basis, the aggregate of which is in excess of—

(I) $10,000,000; or

(II) $5,000,000 and who enters into the agreement, contract, or transaction in order to manage the risk associated with an asset owned or liability incurred, or reasonably likely to be owned or incurred, by the individual;

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

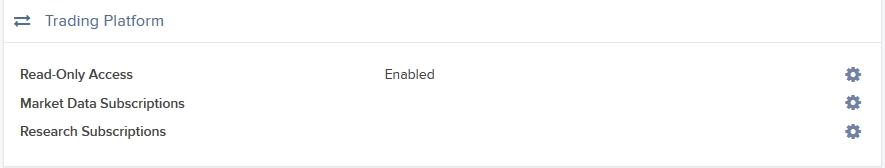

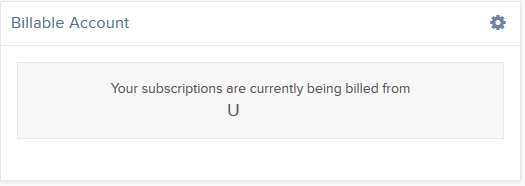

Change Your Billable Account

If you have additional linked, duplicate or consolidated accounts, the Billable Account section appears on the Market Data Subscriptions screen. Use the Billable Accounts panel to change the account that is currently being billed for market data.

To change your billable account

1. Click Settings > User Settings

2. In the Trading Platform panel, click the Configure (gear) icon for Market Data Subscriptions.

The Market Data Subscription screen opens.

3. Click the Configure (gear) icon in the Billable Account panel.

4. Select the account you want to be billed for market data, then click Save.

Beginning with the next billing cycle, your market data subscriptions will be billed to the account you selected.

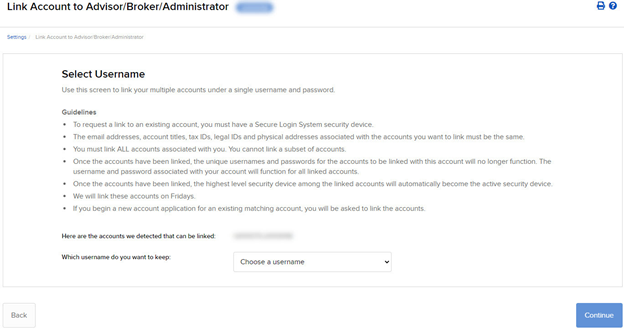

Linking Accounts

Account linkage allows for individual account holders maintaining multiple existing accounts or seeking to open a new account the ability to group those accounts together. In the case of a new account, linkage affords the opportunity to open the account without having to complete a full application, with the account holder providing solely that additional information which is specific to the new account. New account linkages are initiated either from the Client Portal of the existing account (via the User menu (head and shoulders icon in the top right corner) > Settings > Account Settings > Trading > Open an Additional Account) or automatically when initiating a new application from the website. The following article outlines the steps for linking one or more existing accounts.

1. Log into Client Portal and click the User menu (head and shoulders icon in the top right corner) followed by Settings > Trading > Link Account to Advisor/Broker/Administrator.

.png)

2. Select the radio button next to Link All of My Existing Account Under a Single Username and Password, and then click CONTINUE.

The Select Username screen opens.

3. The screen shows all of your accounts that can be linked under a single username and password. Select which username you want to keep. Once your accounts are linked, you will use the selected username to log in to any of the linked accounts.

4. The screen updates to display the security device for the selected username. Click CONTINUE.

5. A series of pages appears to prompt you to enter the username and password for each account to be linked, followed by additional authentication using your Secure Login device.

6. Enter the username, password and authentication values for each account to be linked on the next screens, clicking CONTINUE to advance to the next screen.

7. We aggregate the financial information and trading experience info for all accounts to be linked. Verify your financial information and trading experience for the accounts to be linked, and then click CONTINUE.

8. Verify your account information and click CONTINUE.

9. If you need to update your financial information, trading experience or account information, wait for those updates to be approved and then restart this linking procedure.

10. Verify any saved bank information you may have and click CONTINUE.

11. Click CONTINUE.

12. Click Ok.

For information on how to cancel a linkage request, see Canceling a Pending Link Request.

IMPORTANT NOTES

* Once linked, account access to Client Portal and the trading platform is accomplished using a single user name and password each of which will contain a drop-down window for selecting the account that the owner wishes to act upon.

* As market data subscriptions are billed at a session level (i.e., user name) and only a single TWS session can be open for any one user at a given time, account holders previously maintaining subscriptions for multiple users have the opportunity to consolidate subscriptions to a single user. Account holders wishing to view multiple TWS sessions simultaneously may add additional users (subject to separate market data subscriptions). In addition, only those market data subscriptions already associated with the surviving user name will remain in effect following consolidation. Account holders maintaining different subscriptions across multiple users are advised to review those subscriptions subject to cancellation in order to determine which they wish to resubscribe to under the surviving user name. Also note that the market data subscriptions either terminated or initiated mid-month are subject to billing as if they were provided for the entire month (i.e., fees are not prorated).

Non-Objecting Beneficial Owner (NOBO)

A NOBO refers to an account holder who provides its carry broker (i.e., IB) permission to release their name and address to the companies or issuers of securities they hold. These companies or issuers request this information in the event they need to contact shareholders regarding important shareholder communications such as proxies, circulars for rights offerings and annual/quarterly reports. IB, by default, classifies clients as a NOBO but allows client to have their classification changed to that of an Objecting Beneficial Owner (OBO). To do so, clients are required to provide formal notice of their request to be classified as an OBO through a Message Center ticket available via Account Management.

Tax Treaty Benefits

Income payments (dividends and payment in lieu) from U.S. sources into your IB account may have U.S. tax withheld. Generally, a 30% rate is applied to non-U.S. accounts. Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the U.S. Complete the applicable Form W-8 to find out your status.

Tax Treaties*

U.S. tax treaties with some countries have different benefits. Legal tax residents of the following countries may be eligible for the treaty benefits. Below is a list of the tax treaty countries. Benefits vary by country.

| Australia | Czech Republic | India | Lithuania | Sweden |

| Austria | Denmark | Indonesia | Poland | Switzerland |

| Bangladesh | Egypt | Ireland | Portugal | Thailand |

| Barbados | Estonia | Israel | Romania | Trinidad & Tobago |

| Belgium | Finland | Italy | Russia | Tunisia |

| Bulgaria | France | Jamaica | Slovak Republic | Turkey |

| Canada | Germany | Japan | Slovenia | Ukraine |

| China, People's Rep. Of | Greece | Kazakhstan | South Africa | United Kingdom |

| Commonwealth of Ind. States | Hungary | Korea, Rep. of | Spain | Venezuela |

| Cyprus | Iceland | Latvia | Sri Lanka |

*Country list as of April 2009

Refer to IRS Publication 901 for details on withholding rates for your tax residence country and your eligible benefits.

Why am I required to provide a W-8 if I am not a US citizen or resident?

As IB LLC is a carrying broker domiciled in the U.S., it is required to report information and, in certain instances, make payment of withholding taxes to the U.S. tax authority, the Internal Revenue Service for all account holders. To certify oneself as a non-U.S. person, a Form W-8 is requested at the time of application and is required to be re-certified every three years thereafter. If IB does not receive the W-8 or the account holder fails to re-certify the W-8 in a timely manner, then the account holder is presumed to be a US person and, absent a W-9, may then be subject to back-up withholding taxes on interest, dividends and substitute payments in lieu, as well as gross proceeds.

By certifying yourself as a non-U.S. person through a properly completed W-8, your U.S. withholding is limited to dividends issued by US corporations. Note that virtually all countries apply withholding taxes when local companies seek to distribute dividends to externally based shareholders (whether those shareholders are corporate or not). The rate at which IB is obligated to withhold for a given payment depends largely upon whether there is a tax treaty in place between the country where the dividend paying country is based and the country of residence of the dividend recipient.

SIPP Overview

What is a SIPP?

A SIPP account is a pension account that allows customers to control their retirement savings and where they are invested. SIPPs provide customers with more flexibility and self control over their savings, and are available to all UK residents between the ages of 18 and 75. Customers who are employed or self-employed may contribute up to 100% of their earnings (up to £235,000) in any one tax year. Further they allow retired and unemployed customers to invest up to £3,600 per year. You can trade financial products, property and other items in a SIPP.

- Long Stock (no shorting)

- Long Call or a Long Put

- Covered Calls

- Short Naked Put: only if covered by cash

- Call Spread: Only European style cash settled

- Put Spread: Only European style cash settled

- Long Butterfly: Only European style cash settled

- Iron Condor: Only European style cash settled

- Long Call and Put (long straddle)

Can I trade my ISA through Interactive Brokers?