Como configurar a entrega e a notificação de mensagens de atendimento ao cliente

Para configurar suas preferências da Central de mensagens:

1. Inicie sessão no Portal do cliente.

2. Clique no menu Usuário (ícone de cabeça e ombros no canto superior direito) e em Central de mensagens seguras.

3. Clique em Preferências (ícone de engrenagem) ao lado do botão Compor.

4. A janela de Preferências de mensagens será exibida.

5. Selecione um Idioma principal e secundário para as mensagens usando os menus suspensos.

6. Selecione suas opções de entrega preferidas na seção Entrega de mensagens seguras.

7. Clique em SALVAR para salvar suas alterações.

Observe que, por motivos de segurança, não é possível receber a mensagem inteira por e-mail ou SMS/mensagem de texto. Só é possível receber um resumo da notificação por e-mail ou SMS/mensagem de texto.

Encontre mais informações sobre preferências da Central de mensagens no guia dos usuários do Portal do cliente.

How to Access Your Reports Using FTP on MacOS

This tutorial assumes you received reports via email or via FTP that were encrypted with the public key you sent to IBKR. If you need guidance to set up the encrypted statement delivery, please refer to this article, which is a prerequisite to the instructions below.

There are multiple methods to access the IBKR FTP server. FTP clients such as Filezilla can be used or you could as well use Finder. In this article we explain how to realize the connection to the IBKR FTP server using Finder.

Important Note: You will not be able to connect using your browser.

Once you are connected to the IBKR FTP Server, you will have both read and write access to your folder. The retention policy for the files is 100 days - IBKR will automatically purge files after that.

To access your reports using macOS Finder:

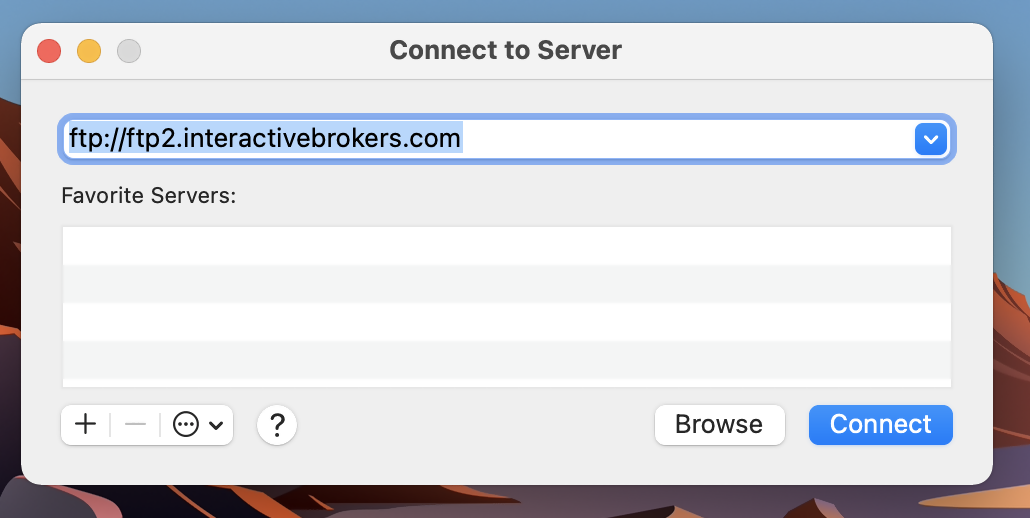

1. Open the Finder app. From the top menu Go, select Connect to Server... Alternatively, you can press Command + K on the keyboard while the Finder app is open.

2. Type the FTP address ftp://ftp2.interactivebrokers.com in to the Connect to Server field and click Connect.

3. A login dialog window will then appear. Select 'Registered User' for the Connect As field. Enter the FTP username and password IBKR provided you with in to the corresponding fields. Then press Connect.

.png)

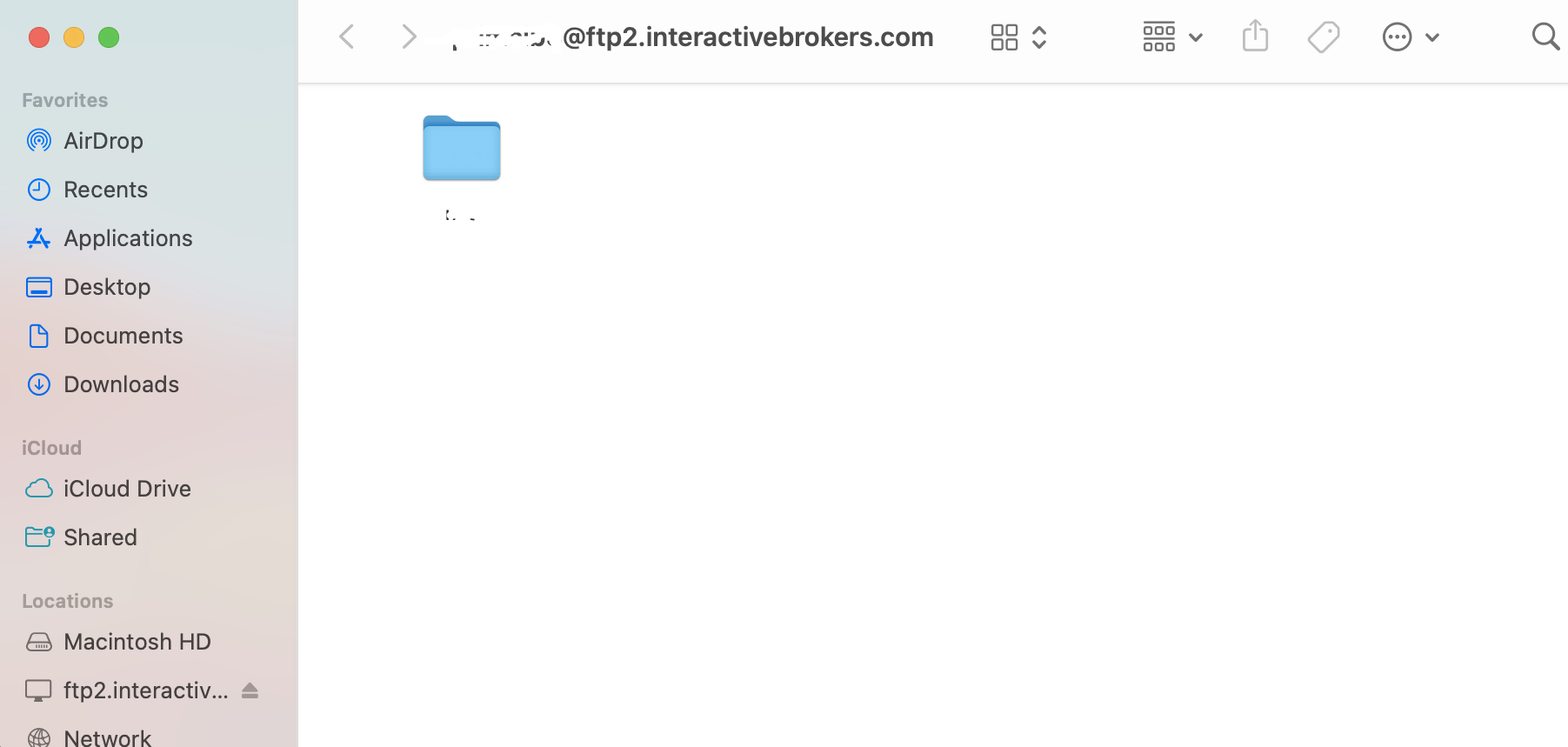

4. A Finder window will open and you will now have direct access to your FTP folder. Documents and files present there can now be decrypted using your PGP key, as explained in IBKB4210.

Common issues and solutions

Ensure the correct login details are being used to connect to the FTP server. The username and password you are entering should match the ones you have received from the Reporting Integration Team.

-

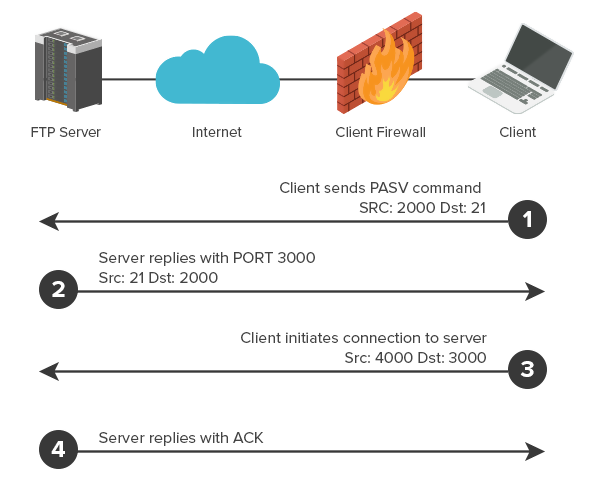

Enable the Passive (PASV) mode for FTP connections. Click on the Apple icon on the top left of your Desktop and choose System Preferences. Launch Network. Select your active network connection, then click on the button Advanced and select the Proxies tab. Activate the option Use Passive FTP mode (PASV). The passive mode is more firewall friendly then the active one, since all the connections are initiated from the Client side. If you are using a specific FTP Client, check its connection settings or advanced settings in order to find and enable the Passive (PASV) mode switch.

-

In case you have an antivirus or a security software installed on your machine, make sure it is not blocking the FTP connection attempt. Normally, security software allow to set up exceptions for specific connections in order to whitelist them.

-

Should the above steps be unable to resolve the issue, ask your network administrator/s to confirm that your firewall allows traffic from/to ftp2.interactivebrokers.com. Note: Your network administrator should consider that every time your FTP Client attempts connecting to our FTP server with Passive mode, it establishes two connections: a command channel (outbound, from random TCP port above 1024 to TCP port 21) and a data channel (outbound, from a random TCP port above 1024 to the TCP port above 1024 which was negotiated through the command channel). Both connections are initiated by the Client side. In the picture below, you can find an example of this connections schema. Please notice that the ports 2000, 3000, 4000 are examples of randomly selected ports and may very well not correspond to the ones used within your specific FTP connection attempt.

KB3968 - Generate a key pair using GPG for Windows

KB4205 - Generate a key pair using GPG Suite on macOS

KB4108 - Decrypt your Reports using GPG for Windows

KB4210 - Decrypting Reports using your PGP Key pair on macOS

KB4407 - Generate RSA Key Pair on Windows

KB4409 - How to set up sFTP for using Certificate Authentication on Windows

KB4410 - How to set up sFTP for using Certificate Authentication on macOS

KB4411 - How to backup your public/private Key pair

KB4323 - How to transfer your public/private key pair from one computer to another

Overview of IBKR's Recurring Investment Feature

IBKR offers an automatic trading feature whereby account holders may set up a 'recurring investment' instruction with the cash amount, asset to invest into and the schedule when to invest (e.g. buy 500 USD of IBKR on the 2nd day of the month). Outlined below are a series of FAQs which describe the program and its operation.

1. How can I participate in the program?

Requests to participate are initiated online via Client Portal. Select the Trade menu option followed by Recurring Investments.

2. What accounts are eligible to use IBKR's recurring investment feature?

Recurring investment is available to any client that has fractional share trading enabled and is under IBLLC, IBUK, IBAU, IBCAN, IBCE, IBIE, IBHK, or IBSG.

3. Which securities are eligible for recurring investment?

The recurring investment feature is available for US, Canadian and European stocks/ETFs. Only stocks/ETFs which are tradable in fractions are eligible.

4. When does the investment occur?

The client is able to choose a date and select a schedule on which to invest (e.g. weekly, monthly, quarterly, etc.). Trades are executed soon after open on the start date and continue on future dates based upon the schedule selected. If the market is closed on the scheduled recurring investment date (e.g.: holiday, weekend) then the recurring investment will be scheduled for the next open market date. If the schedule of monthly, quarterly, or yearly is selected and the recurring investment date does not exist for the month (e.g.: February 29th) then the last date of the month will be used. Please note, there is no guarantee that modifying the recurring investment on the scheduled day of investment will be reflected in your trading activity for that day.

5. What is the minimum amount required to invest when setting up a recurring investment?

The minimum investment amount for a recurring investment is 10 for all currencies except SEK which has a minimum of 100. The minimum investment amount will be displayed to clients in Client Portal if the amount they enter is less than the required minimum.

6. At what price does reinvestment take place?

As shares are purchased in the open market, the price cannot be determined until the total number of shares for all program participants have been purchased using combined funds. Each aggregate order will result in one or more market orders. In the event that the purchase is executed in multiple smaller trades at varying prices, participants will receive the weighted-average price of such shares (i.e., each participant receives the same price).

Recurring investments are filled through Volume-Weighted Average Price (VWAP) orders submitted on a best-effort basis at market open on each scheduled purchase date. The time in force suspends the same day at the close of the market. All customers with recurring investments in the same security on the same date receive the same average price on their investment. If markets are closed on a scheduled recurring investment date, due to a weekend or holiday, recurring investment orders will be placed the next trading day. If there is a partial fill, clients will receive shares valued at less than the requested amount and the next scheduled purchase date will be increased by the instructed frequency. If no fill occurs (IBKR is unable to purchase shares on that trading day) the client experience will be the same as if the markets are closed: recurring investment orders will be placed the next trading day without increasing the next scheduled purchase date.

7. Is the recurring investment program subject to a commission charge?

Yes, Standard Commissions as listed on the IBKR website are applied for the purchase. Commissions are charged based on the Currency and the Region the security is traded on. Please note that the minimum commission charge is the lesser of the stated minimums (USD 1 for the Fixed structure) or 1% of the trade value.

8. What happens if my account is subject to a margin deficiency when the recurring investment occurs?

If your account is in a margin deficit and cannot initiate new positions, the recurring investment will not occur, even if you have the feature enabled. A Deposit Hold can cause a recurring investment to be rejected. The trade will only occur if free cash is available. Clients that are borrowing on margin cannot use the recurring investment feature until they have free cash. Please note that recurring investment orders are credit-checked at the time of entry. Should an account go into margin deficiency at any time after that, including as a result of the end-of-day SMA check and the end-of-day Soft Edge Margin, the account will become subject to automated liquidation.

9. What happens if my account does not have enough funds at the time of the recurring investment?

The system will check the account 3 business days prior to the next occurrence of the recurring investment and if the account is lacking funds then a notification will be sent to the client. If on the occurrence date the account still lacks the funds, the occurrence date will be incremented by the frequency (e.g.: if monthly, update to next month). If on the next occurrence date the account again lacks funds then the instruction will be canceled.

10. Will I receive whole shares or fractional shares?

When using the Recurring Investment program you will receive fractional shares equivalent to the cash amount specified.

11. What are the tax considerations associated with recurring investment?

The purchase of a shares via recurring investment is similar to that of any other share purchase for purposes of tax reporting.

12. Where can I see the recurring investments I have set up?

The "Recurring Investments" screen in Client Portal will display a grid with your current active recurring investment plans.

Please note that open recurring investment instructions are not visible on the Trader Workstation (TWS) or IBKR Mobile order screens. Submitting orders from these platforms will increase your exposure beyond that scheduled for your recurring investment. Your open recurring investment orders are visible in Client Portal from both the Portfolio and Trade > Orders & Trades menus.

13. What happens if I don't hold the currency the stock is denominated in?

If you don't hold the currency the stock is denominated in, IBKR will auto-convert currencies to complete the trade.

14. What happens if my recurring investment involves a security that is no longer available?

Your recurring investment will be cancelled. When a pending order involves a security that is the subject of a reverse split or merger, or a security that is delisted, the order will be cancelled.

15. How do I cancel a Recurring Investment order?

To "Cancel" an open Recurring Investment, login to the Client Portal and select the Trade menu option followed by Recurring Investments. Find the line with the security of the recurring investment you want to cancel and on the right side of the row click on the "X". Then in the next pop up, click on the button to "Confirm Cancel" of the recurring investment.

Becoming a Professional Investor in Hong Kong

A Professional Investor (“PI”) is a high-net-worth investor who is considered to have a depth of experience and market knowledge that makes them eligible for certain benefits.

As per the Securities and Futures Ordinance (“SFO”), a PI includes entities and individual investors holding over HK$40 million in assets or an HK$8 million portfolio value, respectively.

Why become a Professional Investor?

Professional Investors are considered as having sufficient capital, experience and a net worth that lets them engage in more advanced types of investment opportunities, including products such as FX Swaps, ChiNext, or virtual assets.

Generally, Professional Investors do not need to liquidate investment assets in the short term and can experience a loss of their investment without damaging their overall net worth.

Which products are available to Professional Investors?

We are constantly expanding the selection of investments available to clients and periodically adding new products and services that are only available to Professional Investors.

The following products are currently available:

|

Product/ Market |

Professional Investor eligibility |

|

ChiNext |

Institutional - Professional Investor only |

|

Star |

Institutional - Professional Investor only |

|

FX Swap |

Professional Investor |

|

Crypto related products |

Professional Investor |

|

Mutual Funds |

Professional Investor |

How do I qualify as a Professional Investor in Hong Kong?

To qualify as a Professional Investor, you must meet or exceed prescribed financial thresholds, which vary by client category:

|

Client Category |

Financial Threshold / Requirement |

|

Individual |

A High Net Worth Individual in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent). |

|

Joint* |

A High Net Worth Individual, with either his or her spouse or children in a joint account, in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent). |

|

Corporation/ Partnership |

A corporation or partnership in possession of cash and/or securities or have a portfolio held by a custodian of not less than HK$8 million (or its foreign currency equivalent) or total assets of not less than HK$40 million (or its foreign currency equivalent). |

|

Trust Corporations |

A trust corporation that has been entrusted under the trust(s) of which it acts as trustee with total assets of not less than HK$40 million (or its foreign currency equivalent). Please note that all trustees, if more than one, must qualify as Professional Investors in order for the trust to qualify. |

* If you are a joint account holder, you must represent and warrant to Interactive Brokers Hong Kong (IBHK) that you and the other account holder are married or parent/ child and that there is no written agreement between you and the other account holder which governs the sharing of your joint portfolio. If you and the other account holder are not married or parent/ child, or if an agreement exists which governs the sharing of your joint portfolio, you must immediately notify IBHK.

What are the risks of becoming a Professional Investor?

Professional Investors are not afforded some of the protections given to general retail investors. In particular, IBHK is not required to fulfill certain requirements under the Code of Conduct and other Hong Kong regulations when providing services to Professional Investors. These include, but aren’t limited to, rules restricting or prohibiting the issuance of advertisements, the making of unsolicited calls and the communication of an offer in relation to securities.

IBHK recommends that prospective Professional Investors obtain independent professional advice, if deemed necessary, in relation to the consequences of being treated as a professional investor (including those set forth in the SFO and the Code of Conduct).

How can I opt out of being classified as Professional Investors?

Professional Investors have the flexibility to withdraw their consent at any point in time by changing their PI classification to “Non Professional Investor” via the Account Settings in Portal Once changed, PI-related trading permissions will be immediately removed and existing open positions will be set to “Closing- Only”. You may continue to hold or close existing position of these exclusive products but cannot expand or open new positions.

You may also cease to be classified as Professional Investor if you take no action to validate your eligibility during IBHK’s annual Professional Investor review. A notification email will be sent to you if your classification is not aligned to the PI financial threshold.

Professional Investor status is subject to IBHK’s validation of your assets. Investing in financial products and services is subject to IBHK’s eligibility and suitability criteria.

Changes to the Interactive Brokers Canada Inc. Client Agreement

Overview:

To address changes in our business, technology, services, markets, and other factors, Interactive Brokers Canada Inc. has revised the terms of our standard client agreement (Form 3206) ("Amended IB CAN Client Agreement").

For IB CAN accounts opened prior to June 9, 2021, the Amended IB CAN Agreement will be effective as of June 25, 2021. Continuing to maintain an IBKR account after June 25, 2021 shall constitute acceptance of the Amended IB CAN Client Agreement.*

The full text of the Amended IB CAN Client Agreement can be reviewed here:

https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

Sections or subsections (indicated in parentheses) of the Amended IB CAN Client Agreement that are new include, but are not limited to:

• Notice Requirements and Amendment of Terms (3)

• Special Risks of Algorithmic Orders (5 B)

• Payment for Orders and Rebates (6)

• Order Execution (8 C on pre-trade filters)

• Designation of Trusted Contact Person (12)

• U.S. Residents (14)

• Margin (15 B iii, iv and v)

• Closing Rights Positions Prior to Expiration (17)

• Mutual Funds (18)

• Worthless and Non-Transferable Securities (19)

• Position Limits (20)

• Unclaimed Property (29)

• Commissions and Fees, Interest Charges, Funds (33 C, D and E)

• Exposure Fees (34 B)

• Risks Regarding Political and Governmental Actions (36)

• Fractional shares (37 B)

• Indemnification (41)

• Fast and Volatile Markets (43)

• Physically Deliverable Futures (Schedule A / referenced in 32) *

Sections or subsections of the Amended Client Agreement that are not entirely new but have been substantively amended include, but are not limited to:

• Client Agreement (1)

• No Advice Regarding Investment, Tax, Trading or Account Type (2)

• Responsibility for Client Orders/Trades (4)

• Order Routing (5 A)

• Order Execution (8 A and B)

• Confirmations and Reporting Errors (9)

• Proprietary Trading – Display of Customer Orders (10)

• Client Qualification (11)

• Margin (15 B i and ii)

• Liquidation of Positions and Offsetting Transactions (16 all subsections)

• Universal Accounts (22)

• Short Sales (23)

• IBKR's Right to Loan/Pledge Assets (24)

• Security Interest (25)

• Event of Default (27)

• Suspicious Activity (28)

• Multi-Currency Function in IBKR Accounts (30 all subsections)

• Commodity Options and Futures Not Settled in Cash (32 all subsections)

• Commissions and Fees, Interest Charges, Funds (33 A and B)

• Account Deficits (34 A)

• Limitation of Liability (40 A)

• Client Must Maintain Alternative Trading Arrangements (42)

• Equity Options (57)

• Futures and Futures Options (58)

*Client's indication of an intent to make or take delivery on any Covered Contract as defined in Schedule A of the Amended Client Agreement shall constitute acceptance of the Amended Client Agreement as of the date of Client's indication of such intent, even if prior to June 25, 2021.

Changes to the Interactive Brokers LLC Client Agreement (Form 3203)

To address changes in our business, technology, services, markets, and other factors, Interactive Brokers LLC has revised the terms of our standard client agreement (Form 3203) ("Amended IB LLC Client Agreement").

For IB LLC accounts opened prior to April 16, 2021, the Amended IB LLC Agreement will be effective as of June 11, 2021. Continuing to maintain an IBKR account after June 11, 2021 shall constitute acceptance of the Amended IB LLC Client Agreement.*

The full text of the Amended IB LLC Client Agreement can be reviewed here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2....

Sections or subsections (indicated in parentheses) of the Amended IB LLC Client Agreement that are new include, but are not limited to:

- Notice Requirements and Amendment of Terms (3)

- Special Risks of Algorithmic Orders (5 B)

- Payment for Orders and Rebates (6)

- Order Execution (8 C on pre-trade filters)

- Designation of Trusted Contact Person (12)

- Custodial Accounts (14)

- Margin (15 B iii, iv and v)

- Closing Rights Positions Prior to Expiration (17)

- Mutual Funds (18)

- Worthless and Non-Transferable Securities (19)

- Position Limits (20)

- Unclaimed Property (29)

- Commissions and Fees, Interest Charges, Funds (33 C, D and E)

- Exposure Fees (34 B)

- Risks Regarding Political and Governmental Actions (36)

- Fractional shares (37 B)

- Indemnification (41)

- Fast and Volatile Markets (43)

- Physically Deliverable Futures (Schedule A / referenced in 32)*

Sections or subsections of the Amended Client Agreement that are not entirely new but have been substantively amended include, but are not limited to:

- Client Agreement (1)

- No Advice Regarding Investment, Tax, Trading or Account Type (2)

- Responsibility for Client Orders/Trades (4)

- Order Routing (5 A)

- Order Execution (8 A and B)

- Confirmations and Reporting Errors (9)

- Proprietary Trading – Display of Customer Orders (10)

- Client Qualification (11)

- Margin (15 B i and ii)

- Liquidation of Positions and Offsetting Transactions (16 all subsections)

- Universal Accounts (22)

- Short Sales (23)

- IBKR’s Right to Loan/Pledge Assets (24)

- Security Interest (25)

- Event of Default (27)

- Suspicious Activity (28)

- Multi-Currency Function in IBKR Accounts (30 all subsections)

- Commodity Options and Futures Not Settled in Cash (32 all subsections)

- Commissions and Fees, Interest Charges, Funds (33 A and B)

- Account Deficits (34 A)

- Limitation of Liability (40 A)

- Client Must Maintain Alternative Trading Arrangements (42)

*Client’s indication of an intent to make or take delivery on any Covered Contract as defined in Schedule A of the Amended Client Agreement shall constitute acceptance of the Amended Client Agreement as of the date of Client's indication of such intent, even if prior to June 11, 2021.

IBKR Notes FAQs

What are IBKR Notes?

IBKR notes are short term debt securities issued periodically by IBG LLC. Interactive Brokers LLC (IB), a broker-dealer affiliate of IBG LLC is the sole placement agent for the Notes. The U.S. dollar denominated Notes are issued at face value in $1,000 increments and the minimum subscription is $10,000. The Notes mature no later than the 30th day following issuance but may be redeemed sooner. The Notes pay a fixed rate of interest, which is set by adding a spread to the effective Federal Funds rate as reported by the New York Federal Reserve Bank on the morning of the date the Notes are sold to the purchaser. The minimum Rate is 0.50% per annum, and all interest is due and payable upon the earlier of the date of redemption or maturity of the Notes.

Who is eligible to invest in IBKR Notes?

Clients who are Accredited Investors are eligible to subscribe to IBKR Notes. If you are interested in further information about this private placement, you may confirm your Accredited Investor status and access the restricted IBKR Notes Program section of the Client Portal, which contains the confidential Offering Memorandum, Subscription Agreement and other information about the IBKR Notes Program.

Only US persons will be able to participate at this time.

Additional Information

Where can I sign up for IBKR Notes?

Qualified clients can use the button above or follow the below procedure to request to participate in the IBKR Notes program:

- Log in to Client Portal

- Select Settings followed by Account Settings

- In the Configuration section, next to Invest in IBKR Notes, you can see your account’s enrollment status in the program.

- If you are not enrolled, you can sign up by clicking the Configure (gear) icon next to Invest in IBKR Notes.

- You must read the agreement, sign your name, and click Submit to enroll.

How are the rates determined for IBKR Notes?

The issuer sets the interest rate for each Notes issuance at its discretion. The minimum interest rate for a Notes issuance is 0.50%. When there is a new Notes issuance, IBG LLC announces a Spread rate at least two days in advance. The Interest Rate on the Note is the Spread Rate plus the Benchmark Rate, which is the Federal Funds Rate on the morning of the new issuance.

Can I choose which IBKR Notes to invest in?

Yes. So long as you are enrolled in the IBKR Notes Program and have indicated via the Client Portal your intention to participate in future Notes Program issuances, you have a standing order to automatically purchase Notes from the Issuer, if and when offered by the Issuer, with free credit balances in your IBKR account (the “Free Cash Balance” is generally defined as cash in your IBKR account in excess of margin requirements and short stock value). IBKR provides controls to allow you to place parameters on your standing order, including, a maximum amount of Notes to purchase (in dollars) and a minimum Free Cash Balance to leave in your account after purchasing the Notes.

What are the minimum and maximum investment sizes for IBKR Notes?

Investors must purchase a minimum of $10,000 in aggregate principal amount of Notes and may not purchase more than $25,000,000 in aggregate principal amount. Notes are issued only in book-entry form, in denominations of $1,000 and integral multiples of $1,000.

Can IBKR Notes be redeemed early?

The Notes are redeemable prior to maturity only at the option of the Issuer. If the Issuer redeems the Notes prior to maturity, you will receive a notice of redemption. The principal and accrued and unpaid interest to and excluding the date of redemption will be credited to your IBKR account. Notes holders do not have the option to redeem their Notes holdings early.

Can I change my investment preferences in IBKR Notes?

Yes, you may change your Maximum Investment Amount and Minimum Uninvested Cash amount at any time by notifying us through Client Portal. You may also temporarily or permanently suspend your participation by setting the “Invest in All Upcoming Notes” preference to Off.

If you suspend your participation in the Notes Program, IBKR will not sell you Notes during any future issuances, but you will continue to hold existing Notes in your account until the earlier of their maturity or redemption. You may re-activate your participation in the Notes Program though the Client Portal at any time by setting the “Invest in All Upcoming Notes” preference to On.

Can I terminate my participation in the IBKR Notes program?

You may terminate your participation in the IBKR Notes Program at any time by notifying us through the Client Portal. IBKR may also terminate your participation in the Notes Program at any time and for any reason, including if you no longer meet the eligibility requirements or if you do not reaffirm that you meet such requirements upon our request. If your participation in the program is terminated, IBKR will not sell you Notes in any future issuance, but you will continue to hold existing Notes in your account until the earlier of their maturity or redemption. In addition, you will not be permitted to re-activate your participation in the Notes program without re-enrollment.

How are IBKR Notes reported on my Activity Statement?

IBKR Notes will be reported like a Bond on your Activity Statement. You will see Bond activity in various sections of your statement including the Performance Summary, Open Positions, Trades, and Financial Instrument Information sections. During the holding period, accrued interest is not reflected on the statement. Interest payments will be reflected upon redemption or maturity.

What happens if an IBKR Notes offering is oversubscribed?

In the event that an IBKR Notes offering is oversubscribed, IBKR will allocate notes to potential investors at its sole discretion. There is no guarantee that any potential investor, including you, will be allocated Notes.

Will the returns for IBKR Notes be included in Portfolio Analyst?

Yes, returns for IBKR Notes will be included in your Portfolio Analyst reports.

Are Notes Transferable?

No. Notes cannot be transferred between accounts at IBKR or to an external account. Notes must remain in the account they were initially allocated to until they mature (unless redeemed early by IBKR).

What happens if I close my account before my IBKR Note matures?

Clients must hold the Notes until they mature (unless redeemed early by IBKR). If you would like to close your account while you hold Notes, you may submit a close account request and request a transfer of your assets. However, Notes are non-transferrable, and the account will remain open until the Notes have matured and all assets have been transferred out of your account. During this period, account fees and charges may continue to apply. Please contact Customer Service should your account closure request be pending due to an existing Notes position before processing.

Can an advisor invest in IBKR Notes on behalf of their clients?

Yes. Advisors with trading discretion over their client accounts can invest in IBKR Notes on behalf of eligible clients through the IBKR CRM.

Are IBKR Notes included in the Net Liquidation Value calculation for fee-based advisor clients?

Yes. The value of the IBKR Notes in an IBKR account will be included in the calculation of Net Liquidation Value (NLV) fees. Interest will also be included in the calculation.

If I place a trade that uses the minimum required spare cash to invest in IBKR Notes, will my notes be liquidated?

The minimum spare cash requirement to invest in IBKR Notes is checked only when placing the initial Notes investment. It is not required to be maintained while the Note is outstanding.

Are IBKR Notes included in my Equity with Loan Value?

Yes, IBKR Notes are included in calculating your Equity with Loan Value.

If my account is in a margin deficit, will IBKR liquidate IBKR Notes?

If your account is in a margin deficit, IBKR will not liquidate your investment in IBKR Notes.

Additional Information

Where can I find the IBKR Notes Offering Memorandum?

The IBKR Notes Offering Memorandum is available at the time of enrollment as well as within the IBKR Notes page in the Client Portal. You may access this page by selecting Settings followed by Account Settings and Invest in IBKR Notes within the configuration section, and clicking the download Offering Memorandum link.

Are IBKR Notes marginable?

No. IBKR Notes are non-marginable and are ineligible for use as margin collateral. Additionally, the Initial Purchase will be capped to the USD cash balance in an account. An investment in IBKR Notes is not allowed if the purchase causes a USD debit balance.

Does the interest rate on an IBKR Note vary by amount invested?

No. All holders of a specific Note receive the same interest rate regardless of their individual investment amount.

How liquid are IBKR Notes?

The Notes are illiquid. No public market exists for the Notes. They are non-transferable and cannot be traded.

Are IBKR Notes “cash equivalents”?

No. IBKR Notes are illiquid short term debt investments. Cash equivalents generally are highly liquid instruments which are readily convertible into known amounts of cash.

How often are IBKR Notes issued?

Notes are issued at the discretion of the issuer.

What is the notice period for new IBKR Notes issuances?

There is a two-day notice period prior to newly issued Notes being allocated to your account. For example, if a new issuance notification is sent on Monday, the Note will post to your account on Wednesday evening. Interest begins accruing on settlement date (T+1), which would be Thursday.

How is interest calculated for IBKR Notes?

IBKR conforms to international standards for day-counting when calculating the interest paid on IBKR Notes.

IBKR utilizes the 30/360-day count convention, which means that interest income is determined based on a 360-day year. The actual number of calendar days each Note will be outstanding for is 30. But the number of days which accrue interest may be greater or lesser than 30 based on the specific time period Notes are issued, redeemed or mature.

Are Notes insured by SIPC, FDIC or any other entity?

No, the Notes are not insured by SIPC, FDIC or any other entity.

Any information provided about the IBKR Notes Program by Interactive Brokers LLC should not be construed as a solicitation or recommendation of any investment product. Each investor should review and determine independently whether or not IBKR Notes is suitable for them to invest in. In addition, all investors interested in IBKR Notes should review the details and associated risks found within the offering memorandum, accessible through the Client Portal.

Sanctions Related to Certain Chinese Securities

The U.S. announced additional sanctions related to certain Chinese securities scheduled to go into effect on February 1, March 9, and March 15, 2021. These are an extension of the sanctions regarding other Chinese companies that went into effect on January 11. The U.S. has also recently announced that the application of sanctions against certain Chinese securities will be delayed from January 28 to May 27, 2021.

These sanctions prohibit U.S. persons from purchasing publicly traded securities, including options and other derivatives, of certain companies affiliated with the military of the People's Republic of China. We sent you this notice because you hold a position in at least one of the securities the U.S. has stated will be subject to the sanctions effective March 9, 2021.

Who will the sanctions apply to?

Currently, the sanctions only apply to "U.S. persons." A U.S. person includes, "any United States citizen, permanent resident alien, entity organized under the laws of the United States or any jurisdiction within the United States (including foreign branches), or any person in the United States." The definition of U.S. Persons includes IBKR clients who are resident in, citizens of or incorporated in the U.S, or owned by U.S. persons.

What restrictions will the sanctions place on IBKR Customers who are U.S. Persons?

U.S. Persons may not buy any of the sanctioned securities after the effective date of the sanctions-February 1, March 9, or March 15 as listed below-unless the purchase is to close an existing short position. They may close existing positions in these securities up until June 2, 2022 assuming the listing exchanges offer trading and the clearinghouse will settle the trades. In recognition of these actions, opening orders and inbound transfers of sanctioned securities will not be accepted, effective immediately.

What types of securities do the sanctions cover?

The sanctions cover all securities, including stocks, bonds, warrants, options and other derivatives such as ADRs. The sanctions also cover ETFs, index funds and mutual funds that include the CCMC securities.

What individual securities are subject to the sanctions?

As we noted above, sanctions on the first wave of CCMC securities went into effect on January 11, 2021. We have listed below all of the CCMC issuers whose securities are subject to sanctions and the effective date of those sanctions.

CCMC Securities

|

Name of Company

|

Effective Date

|

|

Advanced Micro-Fabrication Equipment Inc. (AMEC)

|

3/15/2021

|

|

Aero Engine Corporation of China

|

1/11/2021

|

|

AECC Aviation Power

|

5/27/2021

|

|

Aviation Industry Corporation of China (AVIC)

|

1/11/2021

|

|

Beijing Zhongguancun Development Investment Center

|

3/15/2021

|

|

China Academy of Launch Vehicle Technology (CALT)

|

1/11/2021

|

|

China Aerospace Science and Industry Corporation (CASIC)

|

1/11/2021

|

|

China Aerospace Science and Technology Corporation (CASC)

|

1/11/2021

|

|

China Communications Construction Company (CCCC)

|

1/11/2021

|

|

China Construction Technology Co. Ltd. (CCTC)

|

2/1/2021

|

|

China Electronics Corporation (CEC)

|

1/11/2021

|

|

China Electronics Technology Group Corporation (CETC)

|

1/11/2021

|

|

China General Nuclear Power Corp.

|

1/11/2021

|

|

CGN Power Co. Ltd.

|

5/27/2021

|

|

China International Engineering Consulting Corp. (CIECC)

|

2/1/2021

|

|

China Mobile Communications Group

|

1/11/2021

|

|

China Mobile LTD.

|

3/9/2021

|

|

China National Aviation holding Co. Ltd. (CNAH)

|

3/15/2021

|

|

China National Chemical Corporation (ChemChina)

|

1/11/2021

|

|

China National Chemical Engineering Co. Ltd.

|

5/27/2021

|

|

China National Chemical Engineering Group Co., Ltd. (CNCEC)

|

1/11/2021

|

|

China National Nuclear Corp.

|

1/11/2021

|

|

China National Nuclear Power Co. Ltd.

|

5/27/2021

|

|

China National Offshore Oil Corp. (CNOOC)

|

2/1/2021

|

|

CNOOC Limited

|

3/9/2021

|

|

China North Industries Group Corporation (Norinco Group)

|

1/11/2021

|

|

China North Industries Corp.

|

5/27/2021

|

|

Norinco International Corporation Ltd.

|

5/27/2021

|

|

China Nuclear Engineering & Construction Corporation (CNECC)

|

1/11/2021

|

|

China Railway Construction Corporation (CRCC)

|

1/11/2021

|

|

China Shipbuilding Industry Corporation (CSIC)

|

1/11/2021

|

|

China Shipbuilding Industry Group Power Co. Ltd.

|

5/27/2021

|

|

China South Industries Group Corporation (CSGC)

|

1/11/2021

|

|

China Spacesat

|

1/11/2021

|

|

China State Construction Group Co., Ltd.

|

1/11/2021

|

|

China State Construction Engineering Corp. Ltd.

|

5/27/2021

|

|

China State Shipbuilding Corporation (CSSC)

|

1/11/2021

|

|

China Telecommunications Corp.

|

1/11/2021

|

|

China Telecom Corp. Ltd.

|

3/9/2021

|

|

China Three Gorges Corporation Limited

|

1/11/2021

|

|

China United Network Communications Group Co. Ltd.

|

1/11/2021

|

|

China United Network Communications Corp. Ltd.

|

5/27/2021

|

|

China UNICOM Hong Kong Ltd.

|

3/9/2021

|

|

Commercial Aircraft Corporation of China, Ltd. (COMAC)

|

3/15/2021

|

|

CRRC Corp.

|

1/11/2021

|

|

Dawning Information Industry Co (Sugon)

|

1/11/2021

|

|

Global Tone Communication Technology Co. Ltd. (GTCOM)

|

3/15/2021

|

|

GOWIN Semiconductor Corp.

|

3/15/2021

|

|

Grand China Air Co. Ltd. (GCAC)

|

3/15/2021

|

|

Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision)

|

1/11/2021

|

|

Huawei

|

1/11/2021

|

|

Inspur Group

|

1/11/2021

|

|

Inspur International Ltd.

|

5/27/2021

|

|

Luokong Technology Corporation (LKCO)

|

3/15/2021

|

|

Offshore Oil Engineering Co. Ltd

|

5/27/2021

|

|

Panda Electronics Group

|

1/11/2021

|

|

Semiconductor Manufacturing International Corp. (SMIC)

|

2/1/2021

|

|

Sinochem Corp.

|

5/27/2021

|

|

Sinochem Group Co. Ltd.

|

1/11/2021

|

|

Sinochem International Corp.

|

5/27/2021

|

|

Xiaomi Corporation

|

3/15/2021

|

We will provide you with an update if the U.S. government issues additional guidance. For reference, the U.S. Executive Order announcing the sanctions is available here and guidance provided to date is available here.

FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

How to generate a ".har" file

When troubleshooting a non-trivial website issue, it is sometimes necessary for our Client Services team to obtain additional information about your browser communication. You may be asked record and provide a .har file. This file contains additional information about the network requests that are sent and received by your browser. Your browser can generate such file by recording content, timeline and status of HTTP/HTTPS requests and responses while the issue occurs.

In this article we explain how to generate a .har file. Please click on the browser that you use in the list below:

To generate the HAR file for Google Chrome:

1. Open Google Chrome and go to the page where the issue is occurring.

2. Press CRTL +SHIFT + I on your keyboard. Alternatively, click on the Chrome menu icon (three vertical dots at the top-right of your browser window) and select More Tools > Developer Tools

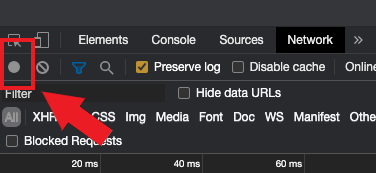

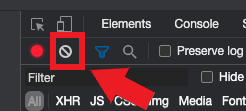

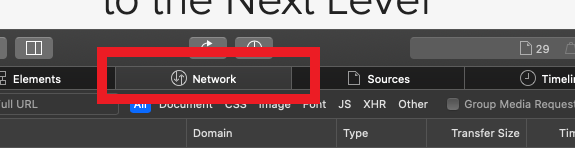

3. The Developers Tools opens as a docked panel at the side or bottom of Chrome. Select the tab Network (Figure 1.)

Figure 1.

.png)

4. Look for a round Record button in the upper left corner of the Developer Tools toolbar and make sure it is red. If it is grey, click it once to start recording or just press CTRL+E (Figure 2.)

Figure 2.

5. Activate the checkbox Preserve log (Figure 3.)

Figure 3.

.png)

6. Click the Clear button to clear out any existing logs. The Clear button has a stop icon and is located on the right of the Record button (Figure 4.)

Figure 4.

7. Reproduce the issue you are experiencing while the network requests are being recorded.

8. Once you have reproduced the issue, right-click anywhere on the list of recorded network requests, select Save all as HAR with Content, and save the file to a location of your preference on your computer (e.g. on your Desktop).

9. From the IBKR Client Portal, go to the Message Center and create a new Web Ticket (or use an existing one when applicable)

10. Within the Web Ticket, attach the .har file previously generated. In case the IBKR Client Services has provided you with a reference ticker number or representative name, please add this information to the ticket body.

11. Submit the Web Ticket

To generate the HAR file for Firefox:

1. Open Firefox and go to the page where the issue is occurring

2. Press F12 on your keyboard. Alternatively click the Firefox menu icon (three horizontal parallel lines at the top-right of your browser window), then select Web Developer > Network

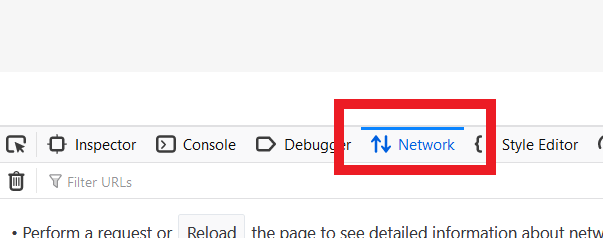

3. The Developers Network Tools opens as a docked panel at the side or bottom of Firefox. Select the tab Network (Figure 5.)

Figure 5.

4. Activate the checkbox Persists logs (Figure 6.)

Figure 6.

5. Reproduce the issue you are experiencing. The recording of the network request starts automatically.

6. Once you have reproduced the issue, right-click anywhere on the list of recorded requests and select Save All As HAR

7. Save the file to a location of your preference on your computer (e.g. on your Desktop)

8. From the IBKR Client Portal, go to the Message Center and create a Web Ticket (or use an existing one when applicable)

9. Within the Web Ticket, attach the .har file previously generated. In case the IBKR Client Services has provided you with a reference ticker number or representative name, please add this information to the ticket body

10. Submit the Web Ticket

To generate the HAR file for Microsoft Edge:

1. Open Edge and go to the page where the issue is occurring.

2. Press F12 on your keyboard. Alternatively click the Edge menu icon (three horizontal dots at the top-right of your browser window), then select More Tools > Developers Tools

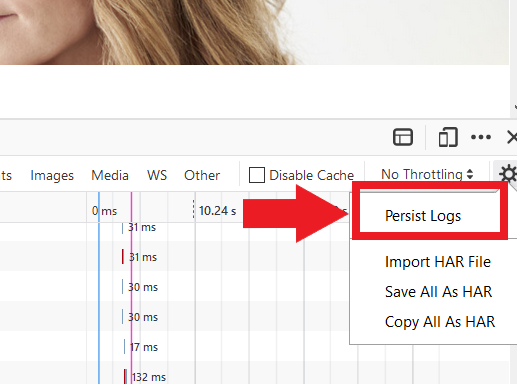

3. Click the Network tab (Figure 10.)

Figure 10.

.png)

4. Reproduce the issue that you were experiencing before, while the network requests are being recorded.

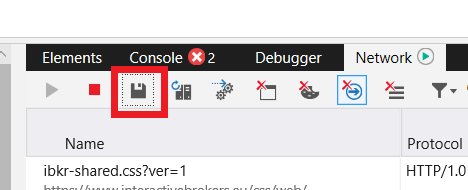

5. Once done click the floppy disk icon (Export as HAR) or press CTRL+S (Figure 11.)

Figure 11.

6. Provide a filename and a location of your preference on your computer (e.g. on the Desktop). Then click the Save button

7. From the IBKR Client Portal, go to the "Message Center" and create a Web Ticket (or use an existing one when applicable)

8. Within the Web Ticket, attach the .har file previously generated. In case the IBKR Client Services has provided you with a reference ticker number or representative name, please add this information to the ticket body.

9. Submit the Web Ticket

To generate the HAR file for Safari:

Note: Before generating the HAR file, make sure you can see the Develop menu in Safari. If you do not see this menu, click on the menu Safari, choose Preferences, go to the tab Advanced and activate the checkbox next to Show Develop menu in menu bar

1. Open the Develop menu and select Show Web Inspector or press CMD+ALT+I

2. Click the Network tab (Figure 12.)

Figure 12.

3. Activate the checkbox Preserve log (Figure 13.)

Figure 13.

.png)

4. Click on the icon Export (or press CMD+S), provide a filename and a location of your preference on your computer (e.g. on the Desktop) and save the .har file

5. From the IBKR Client Portal, go to the "Message Center" and create a Web Ticket (or use an existing one when applicable)

6. Within the Web Ticket, attach the web archive file previously generated. In case the IBKR Client Services has provided you with a reference ticker number or representative name, please add this information to the ticket body.

7. Submit the Web Ticket