Afetação de fundos excedentes (cash sweep)

Essas regulamentações exigem que todas as transações de valores mobiliários sejam realizadas e recebam margem no segmento de valores mobiliários da conta universal, enquanto as transações de commodities devem ser realizadas no segmento de commodities.1 Enquanto as regulamentações permitem que a custódia das posições de valores mobiliários pagos integralmente no segmento de commodities seja considerada garantia de margem, a IB não permite essa configuração, limitando a constituição de garantia às regras mais restritivas da SEC. Tendo em vista as regulamentações e as políticas que regem a decisão de manter posições em um determinado segmento, o valor disponível em dinheiro permanece sendo o único ativo que pode ser transferido entre as duas contas e para o qual a discricionariedade do cliente é oferecida.

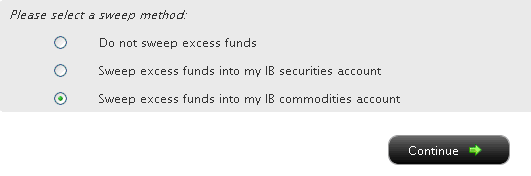

Veja a seguir uma descrição das opções oferecidas de afetação de fundos excedentes (cash sweep), o processo para selecionar uma opção, além das considerações de seleção.

Selecione a opção de sua preferência e clique no botão Continue (Continuar). Sua opção entrará em vigor no próximo dia útil e permanecerá ativada até que uma opção diferente seja selecionada. Observe que, de acordo com as configurações de permissão de negociações indicadas acima, não há restrições sobre quando ou com que frequência é possível alterar seu método de afetação de fundos excedentes.

Comparação de modelos de segregação dos EUA

Perguntas frequentes: valores mobiliários sujeitos a requisitos especiais

Como está ocorrendo uma variação sem precedentes no nível de volatilidade de GME, AMC, BB, EXPR, KOSS e de um pequeno número de valores mobiliários dos EUA, somos forçados a reduzir a alavancagem oferecida anteriormente para esses títulos e, ocasionalmente, as negociações serão limitadas para reduzir os riscos das transações. Veja a seguir uma série de Perguntas frequentes relacionadas a essas operações.

P: A minha capacidade de operar GME e outros valores mobiliários dos EUA sujeitos ao recente aumento de volatilidade sofrerá alguma restrição atual?

R: No momento, a IBKR não está restringindo a negociação de ações de AMC, GME, BB, EXPR, KOSS ou outras ações que estejam sujeitas à extrema volatilidade do mercado. Isso inclui ordens para abrir novas posições ou fechar posições existentes.

Como muitas corretoras, a IBKR estabelecia limites para a abertura de novas posições de determinados valores mobiliários por um período. Essas restrições foram suspensas.

A IBKR não restringiu a capacidade dos clientes de fechar posições existentes e não planeja colocar isso em prática.

P: Posso usar margem na negociação de ações, opções ou outros derivativos desses produtos por meio da IBKR?

R: A IBKR aumentou os requisitos de margem para ações de GME e outros valores mobiliários dos EUA sujeitos à recente volatilidade, incluindo uma margem de até 100% necessária para posições long e uma margem de 300% para posições short. Você pode ver esses requisitos de margem na sua plataforma de negociações antes de enviar uma ordem.

P: Por que a IBKR estabeleceu essas restrições na minha capacidade de abrir novas posições de determinados valores mobiliários?

R: A IBKR tomou essas medidas para finalidades de gerenciamento de riscos e para proteger a empresa e seus clientes contra perdas muito grandes devido às variações de preços em um mercado volátil e instável.

A IBKR permanece atenta aos efeitos dessa volatilidade anormal em câmaras de compensação, corretoras de valores e participantes do mercado.

P: A IBKR ou suas afiliadas têm posições nesses produtos que serão protegidas pelo estabelecimento dessas restrições?

R: Não. A IBKR não tem posições nesses títulos.

P: O que confere à IBKR a permissão de estabelecer essas restrições?

R: De acordo com o contrato do cliente, a IBKR pode recusar ou aceitar qualquer ordem do cliente a seu próprio critério.

A IBKR também tem o direito de modificar os requisitos de margem para qualquer posição nova ou aberta a qualquer momento, a seu exclusivo critério. Afinal, é a IBKR que empresta o dinheiro para as negociações em margem.

P: Essas restrições se aplicam a todos ou a apenas alguns clientes da IBKR?

R: Todas as restrições (todos os limites de abertura de novas posições e aumentos de margem) aplicam-se a todos os clientes da IBKR. Elas foram estabelecidas com base nos valores mobiliários, e não com base nos clientes.

P: Meu dinheiro aplicado na IBKR corre algum tipo de risco? A IBKR sofreu perdas significativas?

R: A IBKR não sofreu perdas significativas. Por meio de um prudente gerenciamento de riscos, a IBKR tem reagido bem a essa volatilidade do mercado. De qualquer maneira e com uma base consolidada, a IBG LLC tem um capital social acima de US$ 9 bilhões, excedendo os requisitos regulatórios em US$ 6 bilhões.

P: Como a IBKR vai agir daqui em diante? Como posso ficar ciente das decisões da IBKR?

R: A IBKR continuará monitorando os desenvolvimentos do mercado e tomará decisões com base nas condições do mercado. Para ter acesso a informações atualizadas, continue acessando nosso site.

Why does my Account Window display a margin requirement when all positions are long and fully paid?

IBKR will calculate and display a margin requirement on the entire portfolio of positions held in an account even if the account holder has paid for the positions in full and is not borrowing any funds to support them. This is necessary in order to compute the Available Funds (Equity with Loan Value - Initial Margin Requirement) on hand to support any subsequent trade activity.

IBKR Australia Margin Accounts

Interactive Brokers Australia Pty Ltd (“IBKR Australia”), which holds an Australian Financial Services License (“AFSL” No. 453554), has been established. IBKR Australia is headquartered in Sydney and has been set up to provide services to our Australian clients. IBKR Australia clients, products and services have some unique characteristics when compared to the Interactive Brokers (“IBKR”) global account and product suite. The purpose of this document is to outline IBKR Australia margin lending offering.

Margin Accounts

IBKR Australia offers two types of margin accounts that will provide all clients excluding SMSF clients with the ability to create portfolios to the maximum degree of risk taking/leverage allowed by IBKR Australia. The two account types are:

• Leveraged Trading account

o Available for both natural persons and non-natural persons, regardless of their regulatory status. However, there are some important differences between the margin accounts available for retail clients and wholesale clients, as outlined below.

• Professional account

o Available primarily for non-natural persons that are confirmed as a professional investor.

Refer to this link for information regarding Australian regulatory status under IBKR Australia.

Important characteristics of IBKR Australia margin accounts are as follows:

• All eligible margin accounts employ a risk-based model to calculate margin requirements. Please click [here] for more details.

• Interest rates on financing may vary depending on the type of client obtaining margin. Please click [here] for more details.

• For all natural person clients (e.g. individuals), only cash or marketable securities may serve as collateral for the margin lending facility, and the collateral deposited must be unborrowed & otherwise free of any mortgage or lien or other encumbrance.

• For all natural person clients, you may only withdraw funds from the margin facility for the limited purpose of repaying another margin lending facility which was used to acquire financial products.

o However, if you are classified as retail you will be not permitted to withdraw from the margin facility if you are already borrowing funds via that facility, i.e. if you are already negative cash, or otherwise if the withdrawal would place your account into cash deficit.

• All retail natural person clients must meet specific financial thresholds in order to be granted a margin account, specifically income must be greater than AUD $40,000 or Liquid net worth must be greater than AUD $100,000. In addition, IBKR Australia is obliged to verify that the information concerning the client’s financial situation that was collected during the application is accurate and complete. If the verified information concerning the client’s financial situation does not meet the thresholds stated above and/or are not comparable to the financials declared by the client during the application, the client will not be granted margin. However, if the client has a valid and recent Statement of Advice (“SOA”) from their registered financial advisor or financial planner that recommends that the client can be issued a margin lending facility and that SOA is made available to IBKR Australia, this additional verification of the client’s personal financial position will not be required.

• In addition retail natural person clients will not be granted a margin account if their occupation is either retired or unemployed or student.

• For all retail clients (both natural person and non-natural person clients), margin loans will be capped at a specific amount (currently set at AUD $50,000, subject to change in IBKR Australia’s sole discretion). However, how much a client can borrow depends on a number of factors, including: the value of the money or assets contributed by the client as security; which financial products the client chooses to invest in, as we lend different amounts for different products under our risk-based model; and the maintenance margin requirement for the client’s portfolio. Once a client reaches their borrowing limit they will be prevented from opening any new margin increasing position. Closing or margin-reducing trades will be allowed. Please click [here] for more details.

• For the non-natural person clients that are NOT categorized as retail clients, IBKR Australia is permitted to utilize for financing purposes a portion of the loan value of the stock these customers hold with IBKR Australia. In simple terms, IBKR Australia borrows money from a third party (such as a bank or broker-dealer), using the customer's margin stock as collateral, and it lends those funds to the customer to finance the customer's margin purchases.

• Please take particular note of how we determine natural person v non-natural person for IBKR Australia trust accounts, as detailed above. It is imperative that if you hold a trust account with IBKR Australia and there exists individuals (natural persons) that are labelled as trustees in your account, then even if you have a corporate trustee, that trust would be considered a natural person trust. The difference between a natural person and non-natural person margin account can be significant as shown above. As a result, please contact customer service if you need to modify trustees.

FAQs: Securities subject to Special Requirements

We are seeing unprecedented volatility in GME, AMC, BB, EXPR, KOSS and a small number of other U.S. securities that has forced us reduce the leverage previously offered to these securities and, at times, limit trading to risk reducing transactions. Outlined below are a series of FAQs relating to these actions.

Q: Are there any current restrictions on my ability to trade GME and the other US securities that have been subject to the recent heightened volatility?

A: IBKR is currently not restricting customers from trading shares of AMC, GME, BB, EXPR, KOSS or the other stocks that have been the subject of extreme market volatility. That includes orders to open new positions or close existing ones.

Like many brokers, IBKR placed limits on opening new positions in certain of these securities for a period of time. Those restrictions have since been lifted.

IBKR has not restricted customers’ ability to close existing positions and does not plan to do so.

Q: Can I use margin in trading stocks, options or other derivatives on these products through IBKR?

A: IBKR has increased its margin requirements for securities in GME and the other US securities subject to the recent volatility, including up to 100% margin required for long positions and 300% margin on the short side. You can see these margin requirements in your trading platform prior to submitting an order.

Q: Why did IBKR place these restrictions on my ability to open new positions in certain securities?

A: IBKR took these actions for risk management purposes, to protect the firm and its customers from incurring outsized losses due to wild swings in prices in a volatile and unstable marketplace.

IBKR remains concerned about the effect of this unnatural volatility on the clearinghouses, brokers and market participants.

Q: Does IBKR or its affiliates have positions in these products that it was protecting by placing these restrictions?

A: No. IBKR itself has no proprietary positions in any of the securities.

Q: What allowed IBKR to place those restrictions?

A: Pursuant to its customer agreement, IBKR may decline to accept any customer’s order at IBKR’s discretion.

IBKR also has the right to modify margin requirements for any open or new positions at any time, in its sole discretion. After all, IBKR is the one whose money is being loaned in a margin trade.

Q: Did those restrictions apply to all or just some of IBKR’s customers?

A: All restrictions – all limits on opening new positions and margin increases – applied to all IBKR customers. They were placed based on the security, not based on the customer.

Q: Is my money at IBKR at risk? Has IBKR suffered material losses?

A: IBKR did not incur substantial losses. Through its prudent risk management, IBKR has navigated this market volatility well. In any event, on a consolidated basis, IBG LLC exceeds $9 billion in equity capital, over $6 billion in excess of regulatory requirements.

Q: What will IBKR do going forward? How will I know?

A: IBKR will continue to monitor developments in the market, and will make decisions based on market conditions. For current information, please continue to visit our website.

Risk Based Margin Considerations

| LLC Risk Based (i.e. Portfolio Margin) | Non-LLC Risk Based Margin | |

| $110,000 initial value requirement | Yes | N/A |

| Minimum equity to operate on margin | USD 100,000 | IB-HK: USD 2,000 IB-AU: AUD 2,000 IB-LUX, IB-IE and IB-CE: EUR 2,000 IB-SG: SGD 2,000 |

| Full options trading approval | Yes | N/A |

| PDT | Yes | N/A |

| Stress testing | Yes | Yes |

| Dynamic House Scanning Charges (TOMS) ¹ | Yes | Yes |

| Shifts in option Implied Volatility (IV) | Yes | Yes |

| A $0.375 multiplied by the index per contract minimum is computed (Only applied to Portfolio Margin eligble products) | Yes | Yes |

| Initial margin will be 110% of Maintenance Margin (US securities only) | Yes | Yes |

| Initial margin will be 125% of Maintenance Margin (Non-US securities) | Yes | Yes |

| Extreme Price Scans | Yes | Yes |

| Large Position Charge (A position which is 1% or more of shares outstanding) | Yes | Yes |

| Days to Liquidate (A large position in relation to the average daily trading volume, which may result in higher initial margin requirements) | Yes | Yes |

| Global Concentration Charge (2 riskiest position stressed +/-30% remaining assets +/-5%) | Yes | Yes |

| Singleton Margin Method for Small Cap Stocks (Stress Test which simulates a price change reflective of a $500 million USD in market capitalization)² | Yes | Yes |

| Singleton Margin Method for stocks domiciled in China (Stress Test which simulates a price change reflective of a $1.5 billion USD in market capitalization)² | Yes | Yes |

| Default Singleton Margin Method (Stress Test which simulates a price change +30% and down -25%)² | Yes | Yes |

| Singleton Margin Method for HK Real Estate Stocks (Stress test +/-50%)² | Yes | Yes |

1 Dynamic House Scanning Charges are available only on select exchanges (Asian Exchanges and MEXDER)

2 IBKR will calculate the potential loss for each stock and its derivates by subjecting them to a stress test. The requirement for the stock (and its derivatives) which projects the greatest loss in the above scenario will be compared to what would otherwise be the aggregate portfolio margin requirement, and the greater of the two will be the margin requirement for the portfolio

U.S. 2020 Election Margin Increase

In light of the potential market volatility associated with the upcoming United States presidential election, Interactive Brokers will implement an increase in the margin requirement for all U.S. traded equity index futures and derivatives and Dow Jones Futures listed on the OSE.JPN exchange.

Clients holding a position in a U.S. equity index future and their derivatives and/or Down Jones Futures listed on the OSE.JPN exchange should expect the margin requirement to increase by approximately 35% above the normal margin requirement. The increase is scheduled to be implemented gradually over a 20-calendar day period with the maintenance margin increase starting on October 5, 2020 through October 30, 2020.

The table below provides examples of the margin increases projected for some of the more widely held products

| Future Symbol |

Description | Listing Exchange | Trading Class | Current Rate (Price scan range)* | Projected Rate (Price scan range) |

| ES | E-mini S&P 500 | CME | ES | 7.13 | 9.63 |

| YM | MINI DJIA | CBOT | YM | 6.14 | 8.29 |

| RTY | Russell 2000 | CME | RTY | 6.79 | 9.17 |

| NQ | NASDAQ E-MINI | CME | NQ | 6.57 | 8.87 |

| DJIA | OSE Dow Jones Industrial Average | OSE.JPN | DJIA | 5.14 | 6.94 |

*As of 10/2/20 open.

NOTE: IBKR's Risk Navigator can help you determine the impact the new maintenance margin requirements will have on your current portfolio or any other portfolio you would like to construct or test. For more information about the Alternative Margin Calculator feature, please see KB Article 2957: Risk Navigator: Alternative Margin Calculator and from the margin mode setting in Risk Navigator, select " US Election Margin".

Overview of Central Bank of Ireland CFD Rules Implementation for Retail Clients at IBIE

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The Central Bank of Ireland (CBI) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2019. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR has implemented the CBI Decision.

1 Leverage Limits

1.1 Margins

Leverage limits were set by CBI at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for:

- Non-major currency pairs are any combination that includes a currency not listed above, e.g., USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- Gold

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the CBI Margins, IBKR establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by CBI .

Details of applicable IB and CBI margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD and/or Stock positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement for the combined Stock and CFD positions. Note that the concentration charge is the only instance where CFD and Stock positions are margined together.

1.3 Funding of Initial Margin Requirements

You can only use cash to post initial margin to open a CFD position.

Initially all cash used to fund the account is available for CFD trading. Any initial margin requirements for other instruments and cash used to purchase cash stock reduce the available cash. If your cash stock purchases have created a margin loan, no funds are available for CFD trades even if your account has significant equity. We cannot increase a margin loan to fund CFD margin under the CBI rules.

Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

The CBI requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes CFD cash and unrealized CFD P&L (positive and negative). Note that CFD cash excludes cash supporting margin requirements for other instruments.

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your account and no open positions. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

|

|

Cash |

Equity* |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Pre Trade |

2000 |

2000 |

|

|

|

|

|

|

2000 |

|

|

Post Trade 1 |

2000 |

2000 |

50 |

100 |

5000 |

0 |

1000 |

500 |

1000 |

No |

|

Post Trade 2 |

2000 |

2000 |

100 |

100 |

10000 |

0 |

2000 |

1000 |

0 |

No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the CBI rules IM and MM remain unchanged:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

3000 |

100 |

110 |

11000 |

1000 |

2000 |

1000 |

0 |

No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

1500 |

100 |

95 |

9500 |

(500) |

2000 |

1000 |

0 |

No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

|

|

Cash |

Equity |

Position |

Price |

Value |

Unrealized P&L |

IM |

MM |

Available Cash |

MM Violation |

|

Change |

2000 |

500 |

100 |

85 |

8500 |

(1500) |

2000 |

1000 |

0 |

Yes |

3 Negative Equity Protection

The CBI Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g., shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore, non-CFD assets are not part of your capital at risk for CFD trading.

Should you lose more than the cash dedicated to CFD trading, IB must write off the loss.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.