Afetação de fundos excedentes (cash sweep)

Essas regulamentações exigem que todas as transações de valores mobiliários sejam realizadas e recebam margem no segmento de valores mobiliários da conta universal, enquanto as transações de commodities devem ser realizadas no segmento de commodities.1 Enquanto as regulamentações permitem que a custódia das posições de valores mobiliários pagos integralmente no segmento de commodities seja considerada garantia de margem, a IB não permite essa configuração, limitando a constituição de garantia às regras mais restritivas da SEC. Tendo em vista as regulamentações e as políticas que regem a decisão de manter posições em um determinado segmento, o valor disponível em dinheiro permanece sendo o único ativo que pode ser transferido entre as duas contas e para o qual a discricionariedade do cliente é oferecida.

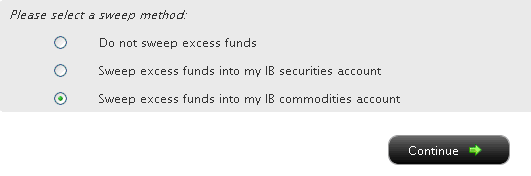

Veja a seguir uma descrição das opções oferecidas de afetação de fundos excedentes (cash sweep), o processo para selecionar uma opção, além das considerações de seleção.

Selecione a opção de sua preferência e clique no botão Continue (Continuar). Sua opção entrará em vigor no próximo dia útil e permanecerá ativada até que uma opção diferente seja selecionada. Observe que, de acordo com as configurações de permissão de negociações indicadas acima, não há restrições sobre quando ou com que frequência é possível alterar seu método de afetação de fundos excedentes.

Comparação de modelos de segregação dos EUA

How To Transfer an Existing IRA from Interactive Brokers

If the other broker participates in the Automated Customer Account Transfer Service (ACATS) program, then contact your other broker to submit the transfer out electronically.

If the other broker is not ACAT eligible, they must provide outgoing trustee to trustee transfer paperwork or outgoing Direct Rollover paperwork. They can give you the completed documents which can be uploaded online. Please note this is only for cash transfers, and information submitted is only instructions, not the actual withdrawal. After paperwork is reviewed and approved, you’ll be advised when to submit the withdrawal of funds.

To submit a withdrawal request:

- Log into Client Portal

- Select Transfer & Pay followed by Transfer Funds

- Click Make a Withdrawal

- Select Use a new withdrawal method and next to Bank Wire, click Use this Method

- Select Financial Institution when asked “Where will funds be deposited?”

- Answer the prompts that follow, then click in the box when asked if you’ll be sending a trustee-to-trustee transfer or Direct Rollover to this destination

- Confirm in the pop up box you have the signed custodian transfer paperwork

- Complete remaining banking prompts and click Save Bank Information

- Confirm the instructions on the next page and click Continue

- Click on Upload your form

- Click Reply to upload the document and add a comment.

- Click Submit and close the window

You will be provided updates of your transfer request through the Message Center.

If a wire transfer is not accepted by your new custodian, you may submit a check withdrawal request. Please note check requests require review by Compliance and will take longer to process if approved.

- Log into Client Portal

- Select Transfer & Pay followed by Transfer Funds

- Click Make a Withdrawal

- Select Use a new withdrawal method and next to Check, click Use this Method

- Select “Send to another person/entity” from the first drop down box

- Answer the prompts that follow and click Save Destination

- Complete remaining banking prompts and click Save Bank Information

- Confirm the information and click Continue

- Read the instructions and click Finish

- Finally, click on Help on the top right and select Secure Message Center to create a new ticket

- Click Compose and then New Ticket>Funds & Banking>Cash Withdrawals

- Complete the prompts and upload the completed paperwork from your broker/custodian

You will be provided updates via this ticket.

Contra firms and Custodians (only) may forward paperwork to the following:

Interactive Brokers LLC

Attn: IRA Services, Transfers

209 South LaSalle Street, 10th Floor

Chicago, IL 60604

- Email — iraservices@ibkr.com

- Fax — 312-542-7345

Additional Information

- IRA Transfer Methods in the Client Portal Users' Guide

Notification Regarding Third-Party Wire Withdrawals

Certain Interactive Brokers (“IBKR”) accounts are eligible to request withdrawal of funds to third parties by bank wire. These requests are subject to review and approval at IBKR’s sole discretion. This program is described on the IBKR website here.

After a due diligence review, IBKR may allow withdrawals to a third party for purposes like:

• Withdrawal for purchase of a home or mortgage payoff

• Withdrawal to a spouse, parent, sibling, or child of source account holder

• Withdrawal to an account held by one of the accountholders of a joint account or vice versa.

• Withdrawal from trust account to a beneficiary

• Payment of certain account expenses

• Tax payments

• IRA qualified charitable distributions

IBKR will generally not approve the following types of third-party withdrawals:

• Private investments

• Repayment of loans

• Withdrawals to companies owned by the accountholder

• Payment for purchase of goods or services

• Withdrawals to individuals other than spouse, parent, sibling or child of account holder

Withdrawing Funds from a Closed Account

Introduction

Clients who elect to close their account must first ensure that all balances (e.g., cash and positions) have been withdrawn or transferred before the account can be closed. Once closed, the account is then restricted from further transactions, however, there are situations where assets may be credited to the account despite it being closed. As disclosed at the point of account closing, cash balances credited to an account after it has been closed are automatically converted to the base currency, regardless of amount, since the trading platform is no longer available to facilitate conversions.

The following article provides background as to how such situations may occur and the steps clients can take to withdraw the assets.

Post-Closure Balances

While it is uncommon for credits to be applied to an account once closed, the events which cause this to happen generally arise from the following:

- The account was closed via disbursement issued in in the form of a check which the client does not present for payment for 90 days and is therefore cancelled by IBKR; or, where the client requests a stop payment due to loss, theft or non-delivery of the check.

- The account was closed via an electronic disbursement (e.g., wire, ACH, EFT) later returned to IBKR by the receiving bank. This can occur if the receiving bank decides to reject and return the funds because the client’s bank account is closed or if the title of the account at IBKR differs from the bank account to which it is being deposited (i.e., a 3rd party transfer).

- A credit adjustment is applied to the account after it has closed to correct an over-withholding of taxes on a prior period dividend.

- An applicant deposited funds prior to the account being opened and the application was never approved by IBKR or was abandoned by the applicant.

- The account was closed via transfer to another broker who later returns the assets after the account has closed.

Withdrawing Assets

To withdraw cash, log into the Client Portal, select the Transfer & Pay and then Transfer Funds menu options and you will be presented with the option to make a withdrawal and a list of available banking instructions which you created while the account was open. Select an instruction that is active and applicable to the denomination of the currency to be withdrawn.

If your account has positions, please contact the broker who returned the positions to request that they be transferred back. Note that you will not be able to submit orders to close positions in a closed account.

FAQs

Q. What do I do if I don't recall my login credentials and am unable to log into the Client Portal?

A. If you require assistance logging into your account, you will need to contact your local Client Service Center via telephone. Such requests require verbal verification of your identity as a protection from unauthorized users. Contact information is available on our website.

Q. How do I determine the credit balance in my account?

A. The account balance and its composition can be found in your activity statement. Daily, monthly and annual statements are available online via the Client Portal through the Reports/Tax Reports menu option.

Q. Am I able to reopen an account that has been closed?

A. Accounts that have been closed for an extended period or are attempting to reopen solely for the purpose of withdrawing assets are generally not eligible to be reopened. If you intend to reopen the account to establish an ongoing brokerage relationship, please contact your local Client Service Center for assistance.

Q. What happens if I want to withdraw the funds via check and my address has changed?

A. If your account is eligible to withdraw funds via check (only available for US currency withdrawals by customers with a US mailing address) and your mailing address on record is no longer accurate, you will not be able to change your address online. In this instance, please contact Client Services to inform us of your new address and receive instructions on how to upload a copy of a driver's license or other acceptable document.

Q. What happens if I want to withdraw the funds electronically and my account does not already have a valid banking instruction on file?

A. If you currently do not have an active banking instruction on file, please log into the Client Portal and add a new instruction using the Transfer & Pay menu option. Note that IBKR reserves the right to verify new instructions via verbal confirmation and/or submission of qualifying documentation. This verification step is intended to protect against unauthorized transfers to a 3rd party.

Q. The entity which owned the account no longer has a bank account or is no longer in existence. How can the funds be withdrawn?

A. In the event the funds are unable to be withdrawn and distributed in the name of account holder at the point of account closure, IBKR will seek to distribute the funds to the entity owners based on their pro rata share of ownership. Note that this will generally require submission of documentation evidencing the owners and their ownership interests as well as a warranty and indemnification letter executed by the owners that the information they provide is accurate and there aren’t any other owners or creditors to whom the funds are owned. IBKR also reserves the right to request an independent opinion of counsel verifying the accuracy of the information provided.

Q. What happens if I do not act to withdraw assets in a closed account?

A. IBKR will attempt to notify closed accounts of a credit balance using the email address of record. Account holders who do not act to withdraw balances within 30 days after notice has been sent are subject to a monthly closed account fee of $20. Also note that IBKR is subject to statutes which require that assets in accounts deemed "abandoned" be turned over to the state in which the client resides (or Connecticut if the client resides outside the U.S.). The period of inactivity by which an account is considered "inactive" varies by state, but can be as low as 3 years. See Knowledge Base Article 2599 for details regarding retrieving unclaimed property from the state.

Funds Transfer Restrictions

INTRODUCTION

As part of its anti-money laundering efforts, IBKR implements restrictions on certain client deposits and withdrawals. These restrictions apply to transfers associated with countries considered to have elevated AML risk and consider factors such as the client’s residency, the withdrawal destination and the denomination of the currency being transferred.1 An outline of these restrictions is provided below.

OVERVIEW OF RESTRICTIONS

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not withdraw funds to an account located in another country that has elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not deposit funds from an account located in another country having elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may only withdraw funds to an account from which that client received a first-party deposit.

- Clients may only withdraw funds in their base currency, their home country’s currency or common currencies (e.g. USD, EUR, HKD, AUD, GBP, CHF, CAD, JPY and SGD).

- IBSG clients may only withdraw in SGD, USD, CNH, EUR, GBP and HKD.

- IBKR may restrict the number of banks that a client may send money to, regardless of the domicile of the client or the bank.

- A change to your base currency requires a minimum of 5 days before withdrawal instructions can be entered and a withdrawal request can be processed.

Note that clients who attempt to create an online banking instruction or initiate a deposit or withdrawal which is restricted will be blocked from creating that instruction or initiating that transaction and will be presented with an online error message.

1In determining whether a country is associated with elevated AML risk, consideration is given to information provided by the Financial Action Task Force (FATF), an intergovernmental organization which promotes measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system and other public AML indices.

South African Rand (ZAR) - Onshore/Offshore

Explanation of Onshore/Offshore South African Rand (ZAR)

Background

The South African Reserve Bank (SARB) has currency exchange control rules in place for South African residents. A South African resident is a person (i.e. a natural person, body corporate, foundation, trust or partnership) whether of South African or any other nationality who has taken up residence, is domiciled or registered in the Republic of South Africa (RSA). A resident account is also the account of persons resident, domiciled or registered in the Common Monetary Area (CMA). The CMA comprises of the Republic of South Africa, Lesotho, Namibia and Swaziland. There are no exchange control restrictions between the members of the CMA and they form a single exchange control territory.

The rules stipulate that there is a yearly limit placed on the amount of ZAR that can be taken out of the country by South African residents – i.e. taken "Offshore". ZAR that remain in South Africa are deemed “Onshore”.

Each resident can take the following amounts offshore per calendar year:

- ZAR 1 million can be taken offshore as a “Single Discretionary Allowance”

- ZAR 10 million can be taken offshore as an “Foreign Capital Allowance”

Only institutions licensed as “Authorised Dealers” (AD) are able to send ZAR outside of South Africa and so offshore. An AD is responsible for reporting the offshoring of any ZAR to the SARB. As a result, residents sending ZAR offshore must accurately state the purpose for which the ZAR is being sent. Residents must receive approval from an AD before they are able to send any ZAR offshore. Prior to taking ZAR offshore as part of the Foreign Capital Allowance, residents must also have additional clearance from the SA tax authorities.

The full exchange control rulebook from the SARB can be found here: https://www.resbank.co.za/RegulationAndSupervision/FinancialSurveillanceAndExchangeControl/EXCMan/Pages/default.aspx

Current Situation

Our cashiering account is a non-resident account. Therefore, we are permitted to:

- Receive deposits in ZAR from other non-resident accounts.

- Disburse ZAR from our cashiering account to non-resident accounts.

- Receive deposits from accounts of South African residents.

- Disburse ZAR to accounts of South African residents.

Margin Considerations for IB LLC Commodities Accounts

Introduction

As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. To satisfy commodity regulatory requirements and manage economic exposure in a pragmatic fashion, two margin computations are performed at the market close, both which must be met to remain fully margin compliant. An overview of these computations is outlined below.

Overview

All orders are subject to an initial margin check prior to execution and continuous maintenance margin checks thereafter. As certain products may be offered intraday margin at rates less than the exchange minimum and to ensure end of day margin compliance overall, IB will generally liquidate positions prior to the close rather than issue a margin call. If, however, an account remains non-compliant at the close, our practice is to issue a margin call, restrict the account to margin reducing transactions and liquidate positions by the close of the 3rd business day if the initial requirement has not then been satisfied.

In determining whether a margin call is required, IB performs both a real-time and regulatory computation, which in certain circumstances, can generate different results:

Real-Time: under this method, initial margin is computed using positions and prices collected at a common point in time, regardless of a product’s listing exchange and official closing time; an approach we believe appropriate given the near continuous trading offered by most exchanges.

Regulatory: under this method, initial margin is computed using positions and prices collected at the official close of regular trading hours for each individual exchange. So, for example, a client trading futures listed on each of the Hong Kong, EUREX and CME exchanges would have a requirement calculated based upon information collected at the close of each respective exchange.

Impact

Clients trading futures listed within a single country and session are not expected to be impacted. Clients trading both the daytime and after hours sessions of a given exchange or on exchanges located in different countries where the closing times don’t align are more likely to be impacted. For example, a client opening a futures contract during the Hong Kong daytime session and closing it during U.S. hours, would have only the opening position considered for purposes of determining the margin requirement. This implies a different margin requirement and a possible margin call under the revised computation that may not have existed under the current. An example of this is provided in the chart below.

Example

This example attempts to demonstrate how a client trading futures in both the Asia and U.S. timezones would be impacted were that client to trade in an extended hours trading session (i.e., outside of the regular trading hours after which the day's official close had been determined). Here, the client opens a position during the Hong Kong regular hours trading session, closes it during the extended hours session, thereby freeing up equity to open a position in the U.S. regular hours session. For purposes of illustration, a $1,000 trading loss is assumed. This example illustrates that the regulatory end of day computation may not recognize margin reducing trades conducted after the official close, thereby generating an initial margin call.

| Day | Time (ET) | Event |

Start Position |

End Position | IB Margin | Regulatory Margin | |||

| Equity With Loan | Maintenance | Initial | Overnight | Margin Call | |||||

| 1 | 22:00 | Buy 1 HHI.HK | None | Long 1 HHI.HK | $10,000 | $3,594 | $4,493 | N/A | N/A |

| 2 | 04:30 | Official HK Close | Long 1 HHI.HK | Long 1 HHI.HK | $10,000 | $7,942 | $9,927 | $4,493 | N/A |

| 2 | 08:00 | Sell 1 HHI.HK | Long 1 HHI.HK | None | $9,000 | $0 | $0 | $0 | N/A |

| 2 | 10:00 | Buy 1 ES | None | Long 1 ES | $9,000 | $2,942 | $3,677 | N/A | N/A |

| 2 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $9,993 | Yes |

| 3 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $5,500 | No |

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Overview of Dodd-Frank

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd-Frank, is a U.S. law enacted in July of 2010, the purpose of which is to prevent the recurrence of events which lead to the 2008 financial crisis. Its principal goals are to:

- Promote U.S. financial stability by improving accountability and transparency within the financial system;

- Protect taxpayers from future bailouts of institutions deemed “too big to fail”; and

- Protect consumers from financial services practices considered abusive.

For additional information, please review the following sections:

- Dodd-Frank reforms

- Dodd-Frank and your IB Account

Dodd-Frank Reforms

To accomplish its goals, Dodd-Frank proposed the following reforms:

- Enhanced oversight and supervision of financial institutions through the creation of Financial Stability Oversight Council

- Creation of a new agency responsible for implementing and enforcing compliance with consumer financial laws (Bureau of Consumer Financial Protection)

- Implementation of more stringent regulatory capital requirements

- Changes in the regulation of over the counter derivatives including restrictions upon access to Federal credit by swaps entities, establishment of regulatory oversight and mandatory trading and clearing requirements

- Enhanced regulation of credit rating agencies intended to eliminate exemptions from liability, enhance rating agency disclosure, establish prohibited activities and impose standards for independent Board governance

- Changes to corporate governance and executive compensation practices

- Incorporation of the Volcker Rule which imposes restrictions upon the speculative proprietary trading activities of banking entities

- Mandating studies intended to reform investor protection rules

- Changes to the securitization market including requirements that mortgage bankers retain a % of risky loans.

Dodd-Frank and Your IB Account

Perhaps most visible to IB account holders of all the Dodd-Frank regulations are those relating to money transfers. Here, Section 1073 of the Act introduces consumer protections designed to increase transparency with respect to the costs, timing and the right to repudiate cross-border transactions.

For purpose of Section 1073, a cross-border transaction is defined as an electronic transfer of money from a consumer in the United States to a person or business in a foreign country. As IB LLC is a U.S. based broker, all its account holders regardless of whether they are domiciled in the U.S. or not, benefit from this protection and it covers withdrawals denominated in a currency other than the U.S. dollar as well as USD denominated withdrawals sent to a non-U.S. bank. Account holders submitting a withdrawal which is covered by this regulation will be provided with a disclosure after confirming the request within Account Management. This disclosure will include the following information:

- The name and address of the sender and recipient

- The amount to be deducted from the sender’s IB account

- The amount projected to be credited to the recipient’s bank account including an estimate of fees which the receiving bank's correspondent bank(s) may charge. Note that these correspondent bank fees are not set by nor is any part of them earned by IB.

- A disclaimer that additional fees and foreign taxes may apply.

- Notice of the sender’s right to cancel the transfer request for a full refund within 30 minutes of it being authorized.

- Regulatory contact information in the event of questions or complaints.

When estimating correspondent bank transfer fees, IB takes into consideration information collected from past customer transactions in addition to data made available by our agent banks. We encourage our customers to review and consider this information when making decisions regarding cross-border transactions.

IRA: Required Minimum Distributions

IRA owners may be required to to withdraw funds beginning at age 73, and every year thereafter. Determining your Required Minimum Distribution (RMD) is significant while retaining an IRA, considering both your life expectancy and the IRA's fair market value.

The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Interactive Brokers LLC provides several information resources to understand and calculate your RMD, including access to the online FINRA RMD Calculator.

Requesting Your RMD Withdrawal

The Internal Revenue Service (IRS) requires the IRA plan custodian to notify IRA owners about the RMD requirements by January 31 each year. If you turn 73 this year, you are required to begin taking RMDs before April 1 of the following year.

Eligible IRA owners must begin receiving withdrawals by December 31 of the year they reach age 73. The first RMD withdrawal, however, may be delayed until April 1 of the following year.

If you elect to delay the withdrawal, then please observe the following considerations:

(1) Two RMD withdrawals will be required the following year, the undistributed initial RMD and the new RMD.

(2) The new RMD will be slightly larger due to the December 31 market value's inclusion of the undistributed initial RMD.

Subsequent RMD withdrawals from your IRA must be distributed by December 31 to avoid a penalty tax.

Note: Roth IRAs are exempt from the RMD rules during the IRA owner's lifetime.

Requesting Your RMD Withdrawal

You may request a withdrawal of funds through the Transfer & Pay and then Transfer Funds menu options within Client Portal. The IRS deadline for taking RMDs is December 31 each year. Keep in mind that the year end withdrawal cut off for processing withdrawals from your Interactive Brokers account may occur before December 31.

Please note that you can elect to transfer your funds to your bank account or to an Interactive Brokers non-IRA account. To transfer funds to an Interactive Brokers non-IRA account, log into Client Portal, select Transfer & Pay, Transfer Funds then select Transfer Funds Between Accounts.

Your RMD is determined by dividing the account balance on December 31 of last year by your life expectancy factor. Your life expectancy factor is taken from the Life Expectancy Tables contained in IRS Publication 590. Your IRA beneficiary election may play an important role in determining your RMD, as well.

You must calculate your RMD separately for each qualifying IRA custodied at Interactive Brokers and any other financial institution. The RMD, however, may be satisfied from any single one or combination of your IRAs. The IRA Required Minimum Distribution Worksheets may provide additional assistance with the calculation of your RMD.

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.