FATCA Procedures - Grantor Trust Tax Information Submission

Overview:

Interactive Brokers is required to collect certain documentation from clients to comply with U.S. Foreign Account Tax Compliance Act (“FATCA”) and other international exchange of information agreements.

This guide contains instructions for a Trust to complete the online tax information and to electronically submit a W-9 or W-8BEN.

U.S. Tax Classification

Your U.S. income tax classification determines the tax form(s) required to document the account.

You must login to Account Management with the trust's primary username to access the Tax Form Collection page.

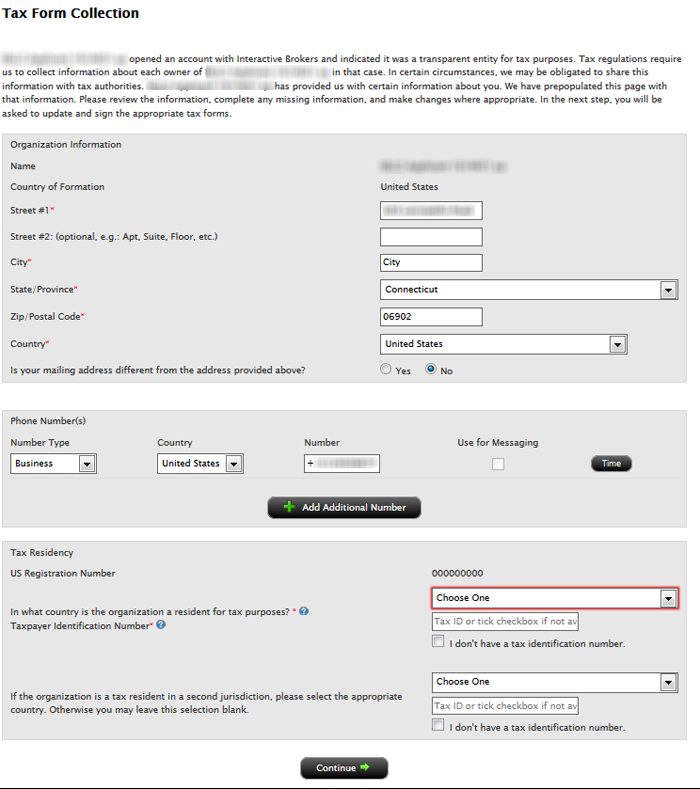

1. Tax Form Collection

The Tax Form Collection page lets account holders review and update important tax-related information and lets account holders electronically fill out an IRS Form W-9 (U.S. taxpayers) and IRS Form W-8 (non-U.S. taxpayers).

Accessing the Tax Form Collection Page

a. Click Manage Account > Account Information > Tax Information > Tax Forms.

b. Click the Update Tax Forms button to access the Collection page.

The Tax Form Collection page opens, displaying a form with tax-related information that should already be completed. (Advisors and brokers can check the status of client updates to this page on the Dashboard Pending Items tab.

c. Review the Trust’s information and update as required.

Confirm the primary tax residency of the trust beside the Tax Residency question, "In what country is the trust a resident for tax purposes?" Select the appropriate country in the drop down menu.

Select in the Tax Residency drop down menu the applicable country.

d. Click Continue.

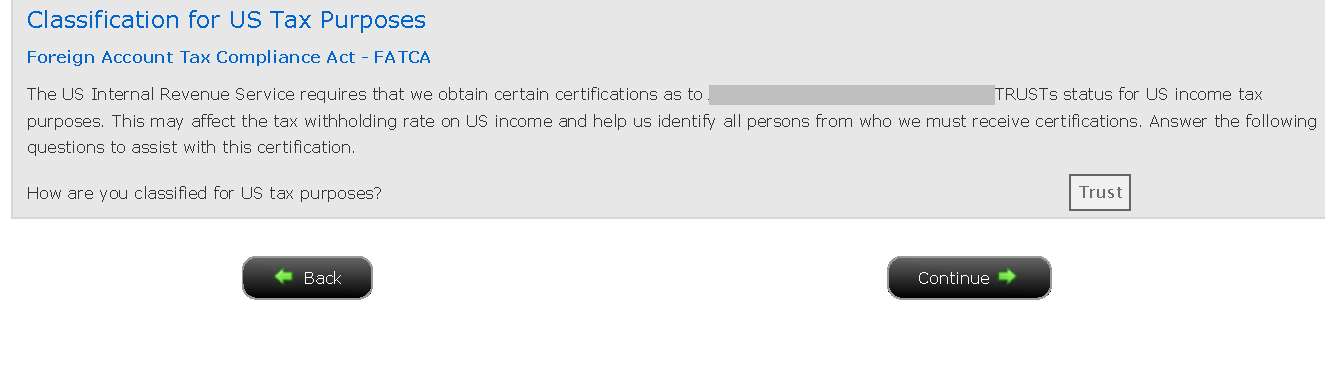

2. Classification for US Tax Purposes

Confirming the Trust’s classification for U.S. purposes

a. Review the Trust’s status by confirming the question, “How are you classified for US tax purposes?” The answer is pre-filled based upon your information completed during the account application process.

b. Click the Continue button to confirm the trust classification and complete the Form W-8 or W-9 for the entity.

c. Click the Continue button to identify each Grantor.

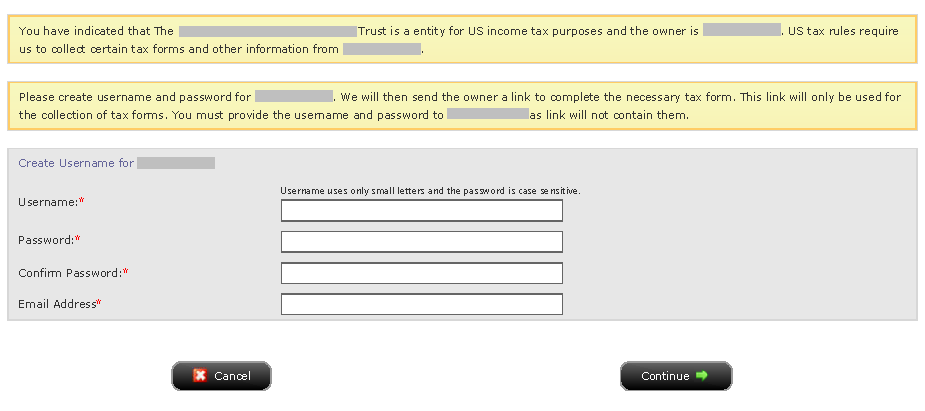

3. Identify Grantors

a. Click Manage Account > Account Information > Tax Information > Tax Forms.

b. Click the Create button beside each grantor to send each user the applicable tax questionnaire and to submit the tax certification form (W-8 or W-9).

Also, update the "Percentage of Ownership" to add up to 100%, if necessary.

.png)

c. Enter the required fields for the username and password for specified grantor and click the Continue button to complete the email delivery of the link.

We will then send the owner a link to complete the necessary tax form. This link will only be used for the collection of tax forms. You must provide the username and password to the Grantor as link will not contain them.

Each Grantor must login with the username/password created and complete the pending tasks by going to Manage Account > Account Information > Tax Information > Tax Forms > Update Tax Forms.

d. Click the Continue button upon creating and sending usernames to each Grantor.

Disclaimer

This guide does not constitute tax or legal advice and Interactive Brokers cannot advise you on how to complete an IRS Forms W-8 or W-9. Instructions are for information purposes only and do not address all possible scenarios. Please consult your tax professional if you are unsure how to complete.