1099-INT Interest Income

Interest Income received from taxable and tax-exempt earnings are reported on this form. This includes domestic and foreign bonds, municipal bonds, mutual funds, as well as other interest payment sources.

Interest income

Box 1 reports interest income, exclusive of U.S. savings bond and U.S. Treasury obligations interest. The transaction level details are provided on other year-end activity statements and reports.

U.S. savings bonds and treasury obligations

Box 3 reports interest from U.S. savings bonds and US Treasury obligations. US savings bond and treasury obligation interest is separated for state tax reporting. Interest on these obligations is generally not subject to state tax.

Federal income tax withheld

If the IRS has notified us that income tax must be withheld (backup withholding) on interest income in your account, the tax withheld amount will be reported in Box 4.

Note: Interest payments details are part of the supplemental information on the Consolidated 1099.

Investment Expenses

Box 5 reports investment expenses from real estate mortgage investment conduits (REMIC) income.

Foreign Taxes

Boxes 6 and 7 pertain to both any foreign tax withheld from interest income and the associated foreign country code.

Tax-exempt interest

Interest payments not subject to federal taxation, such as municipal bonds, are reported under Box 8. Accrued interest paid: Provided in supplemental information on consolidated 1099 – reduce the amount of reported interest by interest paid.

Any amounts reported in Box 8 subject to the Alternative Minimum Tax (AMT) is reported in Box 9.

Market Discount & Bond Premium

The market discount and bond premium for taxable and tax-exempt bonds are reported as separate sub-totals in Boxes 10, 11, and 13.

Note:

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Tax Reporting: When are 1099s and other tax forms issued?

For U.S Persons

Normativa italiana riguardo imposte su capital gains

Tutti i redditi di natura finanziaria percetpiti da investitori residenti in Italia persone fisiche sono soggetti all’applicazione di una singola aliquota del 20% (decreto legge 138/2011 e legge di conversione 148/2011). Tale regola generale non si applica a redditi derivanti da investimenti in titoli pubblici italiani (obbligazioni e altri titoli di cui all’art.31 DPR 601/1973) ed equiparati e derivanti da titoli pubblici di Stati esteri appartenenti alla cosidetta White List. Per questi prodotti continua ad applicarsi l’aliquota del 12,5% (ottenuta applicando l’aliquota del 20% a una base imponibile ridotta al 62,5%).

- Ritenuta del 20% su ETF quotati alla Borsa Italiana (simbolo mercato di IB: BVME.ETF) è trattenuta alla fonte.

L’imposta sui capital gains su azioni è applicata come segue:

- I clienti residenti in Italia (o aventi Italia come Paese di costituzione, in caso di conti in nome di società) che negoziano in azioni sono soggetti ad imposte sui capital gains. Poichè IB applica solamente il Regime Dichiarativo, IB non è tenuta a trattenere alla fonte tali imposte direttamente dai conti dei clienti. I clienti sono responsabili di consultare un commercialista con riferimento ai propri obblighi dichiarativi secondo la legge italiana.

Borse disponibili per il mercato italiano presso IB:

- BVME: disponibile per tutti i clienti IB per azioni italiane.

-

BVME.ETF: ETFs che sono organismi di investimento collettivo del risparmio (OICR) quotati al mercato ETFPlus non sono disponibili per residenti in Italia.

Italian regulations on capital gain taxes

All financial income received by an Italian resident individual investor will be subject to a tax rate of 26% (decreto legge 66/2014 and coordinated conversion law 89/2014). This general rule does not apply to financial income from investments in Italian Government securities (bonds and other securities pursuant to art. 31 DPR 601/1973) and equivalent products resulting from Government securities of foreign states belonging to the White List. These products shall continue to be subject to a reduced tax rate of 12.5%.

Italian tax laws impose the withholding at source on ETFs that are collective investment schemes (UCITS). This designation is applicable to the ETFs currently listed on the Italian Stock Exchange Market ETFPlus.

- Withholding rate of 26% for ETFs listed on the Italian Stock exchange market (IBKR market symbol: BVME.ETF) is taxed at source.

Tax on capital gains for stocks is applied as follows:

- Customers with Italy as their country of residence (or as country of incorporation in case of entity accounts) who are trading in stocks are subject to capital gain tax. As IBKR applies the Regime Dichiarativo only, IBKR is not required to withhold capital gain taxes from customer accounts directly. Customers would be responsible to discuss with their tax advisor on their individual reporting requirements in accordance with Italian laws.

Available IBKR exchanges for Italian markets:

- BVME: Available to all IBKR customers for Italian stocks.

- BVME.ETF: ETFs that are collective investment schemes (UCITS) listed on the ETFPlus market are not available to Italian residents to trade.

Information For IBKR Clients Relating to the Spanish Tax Form 720

Interactive Brokers wishes to supply the following information which may be useful for our Spanish residents when completing the required Form 720 for the Spanish Tax Authorities.

The legal entity that holds the accounts is mentioned in the upper part of the Activity Statements. Accounts of clients resident in Spain are held by:

Interactive Brokers Ireland Limited

10 Earlsfort Terrace

Dublin, D02 T38

Ireland

The tax identification number of Interactive Brokers Ireland Limited is 3674050HH. It is regulated by the Central Bank of Ireland (CBI, reference number C423427), registered with the Companies Registration Office (CRO, registration number 657406), and is a member of the Irish Investor Compensation Scheme (ICS).

Routing instructions for depositing funds are determined based on the denomination of the currency you are depositing and the IBKR entity through which your account is held. Routing instructions are made available after creating a deposit notification via Client Portal under the Transfer & Pay menu followed by Transfer Funds.

Should you require information regarding the average cash balance in your account, you may create a Flex Query through Client Portal by navigating to Reports followed by Activity and Flex Queries.

You may similarly run a Flex Query within Client Portal in order to obtain ISIN information for non-US assets. IBKR does not provide customers with ISIN information for US securities; however CUSIPs may be obtained through a Flex Statement query provided the account has subscribed to the CUSIP Service, available for USD 1.00 per month for non-professional accounts. Customers requiring ISIN data for US securities may obtain such information from company websites or internet searches.

Please be aware that Interactive Brokers does not provide information to the Spanish government directly relating to Form 720. Customers are responsible for all reporting aspects and should consult with their tax advisor for any assistance in completing the required documentation.

Information Regarding the Italian Financial Transaction Tax

This document is designed to provide an overview of how the Italian Financial Transaction Tax (I-FTT) will be handled by Interactive Brokers.

Effective March 1, 2013, a new tax has been implemented on the purchase of certain Italian securities.

Effective September 1, 2013, a new tax will be implemented on the purchase and sale of certain Italian derivatives.

Tax Rate

The tax rate for the year 2013 will be 0.12% for shares transacted on regulated markets and MTFs and 0.22% for those transacted outside of these markets. The tax rates are to decrease in 2014 to 0.10% and 0.20% respectively.

The acquisition of the underlying stock upon exercise or delivery of a derivative instrument will be subject to the higher (0.22% in 2013) rate.

Scope

The I-FTT will be applied to shares provided the issuer is resident in Italy. In addition, the I-FTT will be applied to securities representing shares issued by companies resident in Italy (example American Depository Receipts).

The acquisition of shares whose average market capitalization in November of the previous year was less than EUR 500 million will not be subject to the tax.

While at this time the Italian Tax Authorities have not defined corporate actions for which the acquisition of shares may be subject to the I-FTT, traders should be aware that as information is released, IB will assess taxes as required.

Calculation Method

The tax will be calculated on the net settlement per ISIN per final beneficiary per day. The net long share quantity will be multiplied by the average price of the purchase shares. Securities with identical settlement dates will be netted together for the determination of the tax.

In the event the net settlement includes transaction executed both on and off regulated markets, a blended tax rate will be used. For example

| Location | Purchase Quantity | Sale Quantity | Price | Net Quantity |

| Regulated Market / MTF | 10 | 15 | 50 | (5) |

| Other | 15 | 5 | 51 | 10 |

The final net position of the above transactions is 5

Weighted average purchase price = (10*50 + 15*51) / 25 = 50.60

Tax Base = 5 * 50.60 = 253

Average Tax Rate = (15*0.22% + 10*0.12%) / 25 = 0.18%

Tax Due = 253 * 0.18% = 0.46 EUR

The tax may be due on either the actual settlement date or the contractual settlement date of the transaction. IB intends to calculate the tax based on the contractual settlement date, which on most European venues is T+3 with the exception of the German markets where it is T+2. Please contact IB should you wish to discuss changing this default.

Worksheet for Form 8949 - TurboTax FAQs

Which IB tax reports may be imported into TurboTax?

The only tax report for which IB supports import to TurboTax is the Worksheet for Form 8949. This IRS form is used by U.S. persons to report the sales of securities. It also serves to reconcile balances reported on Form 1099-B and provides summary computations for Schedule D.

How does file import work?

File import begins by logging into Account Management, selecting and downloading the file to your desktop and then importing from within TurboTax application. detailed steps for completing this process may be found within KB2030.

Do all versions of TurboTax support this file import feature?

No. While IB produces a file in a TurboTax Tax Exchange Format (.TXF), not all TurboTax applications accommodate this file import feature. As a general guideline, the CD/download versions support this feature and the online versions do not. Note, however, that this is only a guideline and the actual functionality may vary depending the specific CD/download software package your are using (e.g., Basic, Deluxe, Premier, Home & Business, Business) and whether you are using a mobile or tablet version. Please refer to www.turbotax.intuit.com for additional details.

Is the .TXF file compatible with both the Windows and Mac operating systems?

Yes, subject to the guidelines and considerations noted above.

Is the .TXF file provided for all IB account types?

Yes, subject to the following:

1, The account is question has qualifying transactions required to be reported on the Worksheet for Form 8949; and

2. Those transactions do not include IRS required codes which TurboTax does not support. If this is the case you will receive an error message when attempting to download the TXF file (i.e., “Your import file contains IRS required information, the import of which is not supported by TurboTax”). Here, TurboTax offers an alternative method which allows one to enter summary numbers from the worksheets into the electronic version of Form 8949, file electronically and mail in a schedules of trades thereafter. Detailed instructions for this method may be found within KB2026.

Does IB support the export of the Worksheet for Form 8949 in any other format?

Yes. In addition to the TurboTax .TXF format, IB supports the download of this worksheet in a Comma-Separated Values, or .CSV file format. Files in this format can be opened in applications such as Microsoft Excel, Open Office Calc or Google Docs. The .CSV file format is not supported for purposes of import to TurboTax

Is there a transaction limit for TXF import?

While there is no transaction limit enforced by IB, TurboTax restricts the import to files containing no more than between 2,000 to 2,500 transactions for system performance purposes. Note that the precise limit depends upon the volume of data in each transaction, which explains why TurboTax cannot provide an exact number. In the event the import of a file containing transactions above the threshold is attempted, an error message will appear (e.g., “The selected file contains no importable tax information. Please select a different file”). IB is not aware of any workaround for this restriction and suggest that you contact TurboTax Support for assistance.

Are there any dollar amount limits associated with the TXF file?

Yes. Again, while IB imposes no limits, TurboTax has a 9-digit limit in data entry fields; when exceeding that limit, you'll receive a message similar to “The value is too large for this field”

Steps for Importing Worksheet for Form 8949 to TurboTax

As a matter of operational convenience and to assist with the preparation of IRS Form 8949 (Sales and Other Dispositions of Capital Assets) IB Prepares a Form 8949 worksheet in each of a PDF, CSV and TXF format on an annual basis. The TXF format allows you to import the information into Turbo Tax Standalone(CD/Download Version) but not the online version. Please click here for to visit our Turbo Tax FAQ's.

How to Import Form 8949 into TurboTax

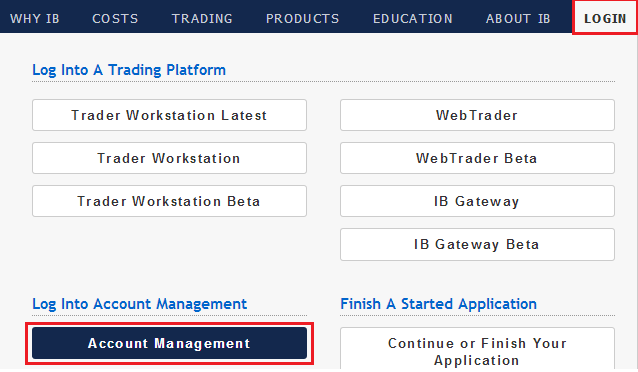

1. Log into Account Management by going to https://www.interactivebrokers.com and select Login and then Account Management from the upper right hand section and enter username/password to log in.

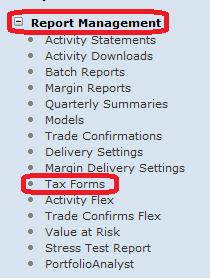

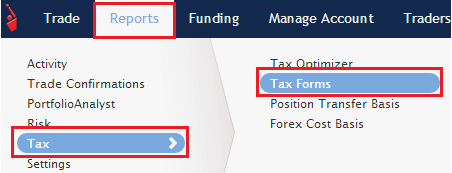

2. Navigate to Reports, Tax and then select Tax Forms

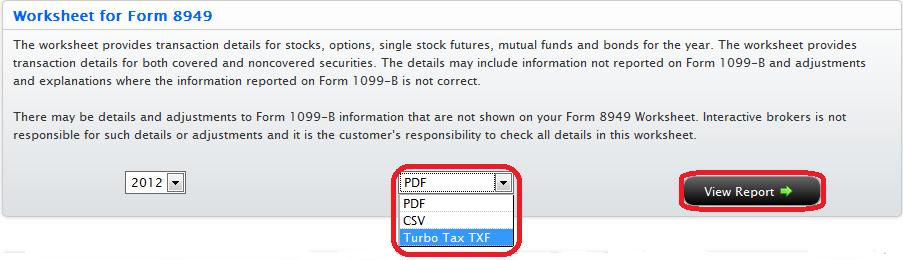

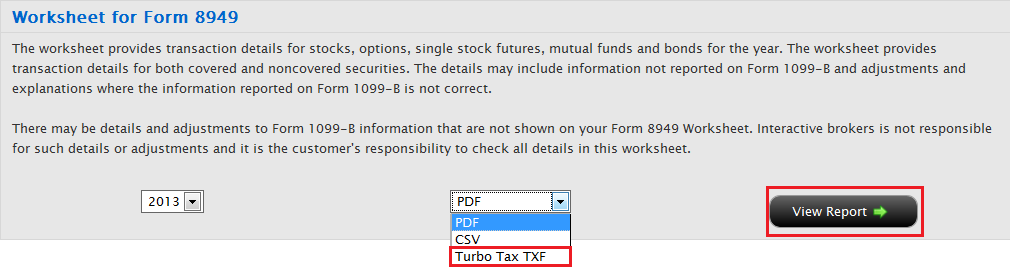

3. Under Worksheet for Form 8949 section, select TurboTax TXF from the drop down menu and select View Report

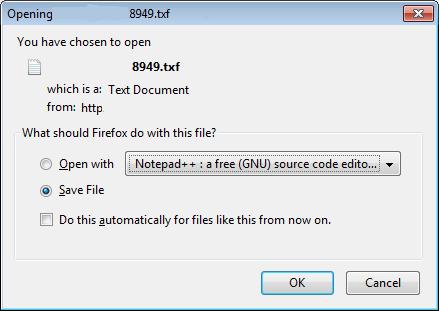

4. A save dialog box will appear. Please select Save File and then OK.

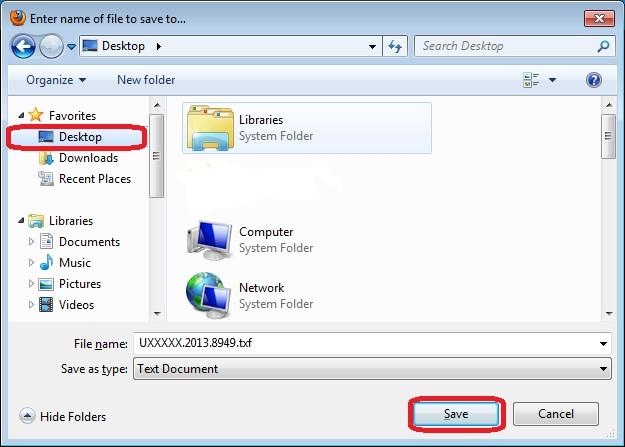

5. Another dialog box will appear. Please select Desktop on the left and then Save. This will save your downloaded file to your desktop

6. Now that the file is downloaded please follow the directions below in Section C to import into TurboTax

Section B (Vertical menu on the left)

1. Log into Account Management by going to www.interactivebrokers.com and select Login and then Account Management from the upper right hand section and enter username/password to log in.

.jpg)

2. On the left please select Report Management and then Tax Forms

3. On the right under Worksheet for Form 8949 section, select TurboTax TXF from the drop down menu and select View Report

4. A save dialog box will appear. Please select Save File and then OK

5. Another dialog box will appear. Please select Desktop on the left and then Save. This will save your download file to your desktop

6. Now that the file is downloaded please follow the directions below in Section C to import TurboTax

Section C (Importing downloaded file into TurboTax)

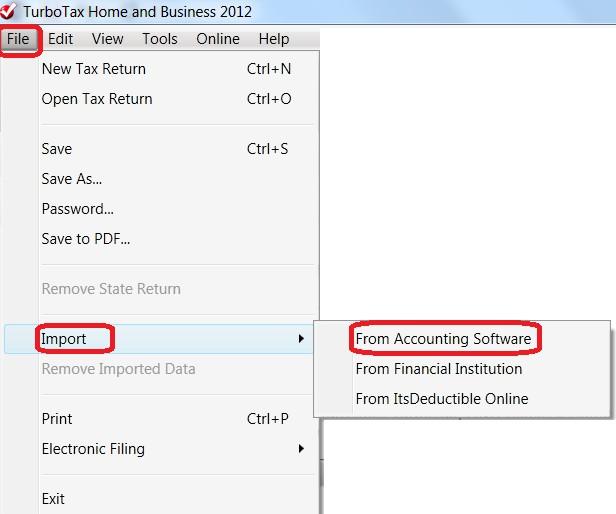

1. Open TurboTax and navigate to File and select “From Accounting Software” under the Import option.

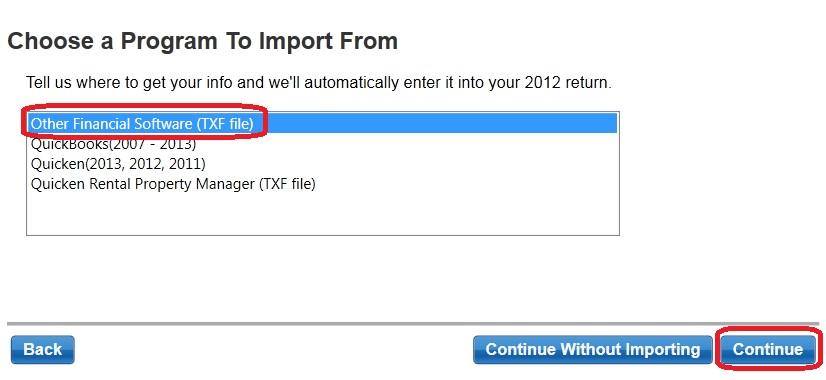

2. A new window will appear with a few options. Please select Other Financial Software (TXF file) and then Continue

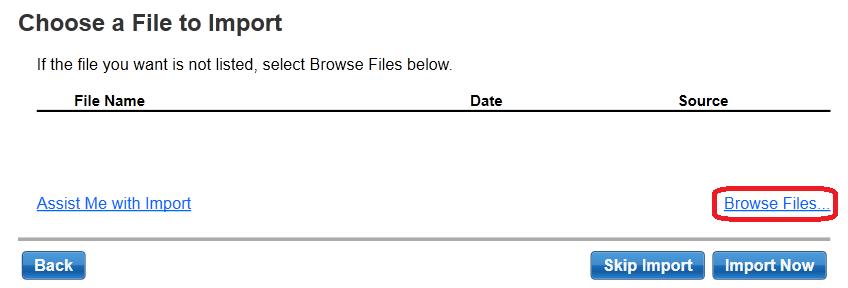

3. On the next screen select Browse Files

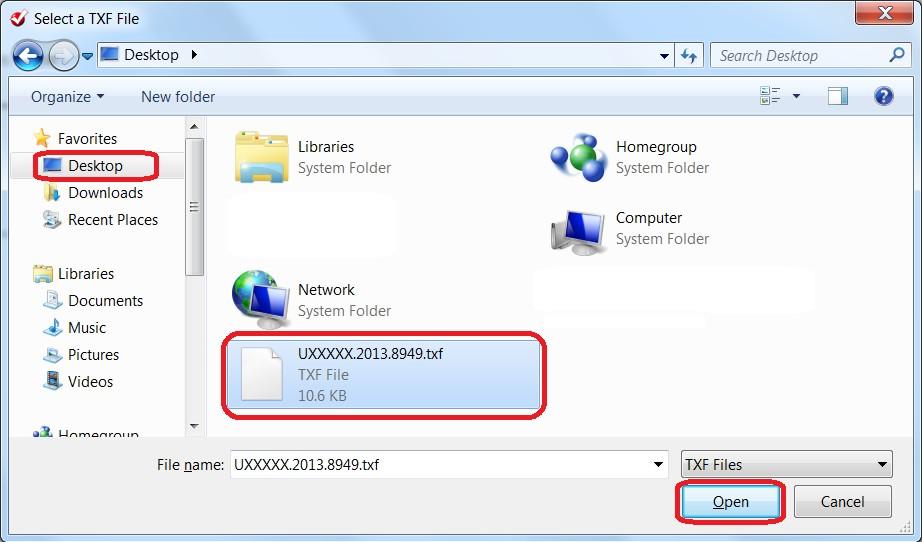

4. A new window will appear. Please select Desktop on the left and then select the file you just saved on your desktop and then select Open.

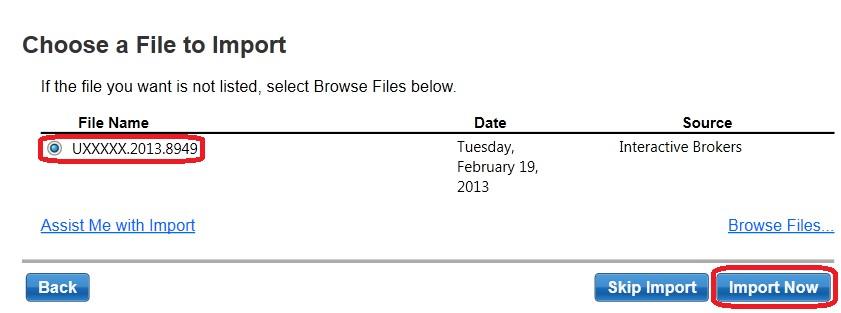

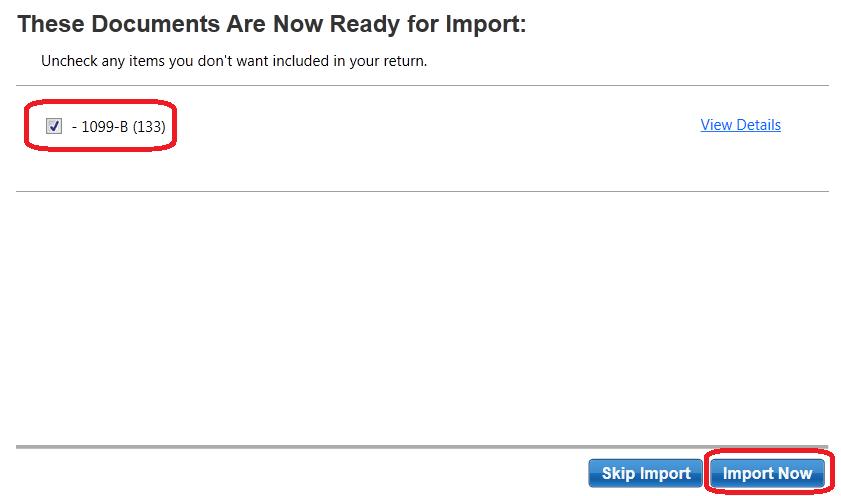

5. A new window will appear with the name of the file. Select Import Now

6. On the next page you will see 1099-B (133). Make sure the box next to it is checked and then select Import Now

7. On the last page select Done and all your transactions will now be imported into TurboTax. If you need any additional help navigating TurboTax please contact them directly at http://turbotax.intuit.com/

Form 8949 Worksheet – TurboTax Import Considerations

In order to complete the Form 8948 in an IRS compliant manner, adjustments to the gain or loss of a particular transaction may be required in order to reconcile the totals on this form with the corresponding fields on Form 1099-B. When an adjustment is required, entry of a IRS specific code is also required in order to explain the adjustment. Example of codes are as follows:

W: The customer has a nondeductible loss from a wash sale. This applies where the transaction being reported is a wash sale

B: The basis reported on box 3 of Form 1099-B requires clarification. Take, for example, a wash sale where the original security was purchased prior to January 1, 2011 (i.e., classified as "non-covered"), sold at a loss and the replacement purchased within 30 days but after January 1, 2011 (i.e., classified as "covered"). In this case, the basis reported on Form 1099-B for the "covered security" does not include the disallowed loss from the wash sale and an adjustment on the 8949 worksheet is required.

T: The type of gain or loss (short-term or long-term) shown in box 1c of Form 1099-B requires clarification. Take, for example, a wash sale not reported on the Form 1099-B because the original purchase involved a "non-covered" security and where the replacement security is later sold. The holding period for the original purchase must be included in that of the later transaction and any adjustment from short- to long-term reflected on the 8949 worksheet.

E: The transaction is reported on Form 1099-B and there are selling expenses or option premiums that are not reflected on the form or statement to either the proceeds or basis shown. (this applies to options purchased or sold prior to 2011.)

O: There is an adjustment that we have failed to identify.

Currently, TurboTax only supports adjustments associated with code “W” and transactions which are subject to an adjustment requiring a different code cannot be imported to TurboTax through the TXF file.

If your worksheet contains unsupported codes, you will be notified of this through an error message provided when attempting to download the TXF file through Account Management (i.e., “Your import file contains IRS required information, the import of which is not supported by TurboTax”). If this is the case, TurboTax offers an alternative method which allows one to enter summary numbers from the worksheets into the electronic version of Form 8949, file electronically and mail in a schedules of trades thereafter. Detailed instructions for this method are outlined below.

STEPS FOR ENTERING 8949 WORKSHEET SUMMARIES INTO TURBOTAX

TurboTax software download does not support all of the possible adjustment codes on Form 8949 – Sales and Other Dispositions of Capital Assets. Please follow the following instruction to add your securities transactions to your Turbo Tax prepared return.

Step 1: Print your Form 8949 Worksheet from Account Management through the Reports and then Tax Forms menu options. Please review the worksheet for any errors or omissions and verify that it is correct.

Step 2: In TurboTax, open your return and select Personal and then select Personal Income menu options.

Step 3: Scroll down until you reach the Investment Income Section and select

Stock, Mutual Funds, Bonds, Other and go to Start.

Step 4: Select EasyGuide

Step 5: Scroll down to the Other section and select from the following:

For Form 8949 worksheet Parts 1 and 2 Box A: Attach a statement – Broker-reported sales with basis reported to IRS

For Form 8949 worksheet Parts 1 and 2 Box B: Attach a statement – Broker – reported sales – no cost reported to IRS

For Form 8949 worksheet Parts 1 and 2 Box C: Attach a statement –

Sales without a broker statement

Note: Transactions reported on Form 8949 worksheet by IB include option transactions which as of the 2012 tax year are not required to be reported by brokers to the IRS on Form 1099-B.

Step 6: Select Short- or Long-Term as follows:

For Form 8949 worksheet Part 1 Box A : Short–Term

For Form 8949 worksheet Part 1 Box B: Short–Term

For Form 8949 worksheet Part 1 Box C : Short–Term

For Form 8949 worksheet Part 1 Box A: Long-Term

For Form 8949 worksheet Part 2 Box B: Long-Term

For Form 8949 worksheet Part 3 Box C: Long-Term

Select Continue

Step 7: On the new window, change the Date Sold box to Various and enter the totals from the part of the Form 8949 worksheet you are working from in the net proceeds box and codes.

Step 8: Check the box titled “My statement includes adjustment codes as described in Form 8949 instructions".

Step 9: Enter the adjustment column total from the Form 8949 worksheet you are working from and adjustment code M

Select Continue, verify results and, if correct, then Continue.

To add another set of worksheet totals begin again at step 5. If your Form 8949

Worksheet has information in all six sections you will need to repeat this process 5 additional times.

When this is complete, select Done and if you have completed this section, done with investment sales.

Upon e-filing your return a Form 8453 will be created. This form must be printed an mailed to the IRS along with copies of your Form 8949 worksheets within 3 business days after you have received acknowledgment from TurboTax that the IRS has accepted your electronically filed tax return.

Foreign Acount Tax Compliance Act (FATCA)

What is FATCA?

The Foreign Account Tax Compliance Act (FATCA) represents the United States efforts to combat tax evasion and abuse by US persons holding investments outside of the United States. The Act establishes a new set of tax information reporting and withholding procedures. While not expressly aimed at non-US persons, the regulations do impose withholding taxes on certain non-US entities that decline to disclose their US investors or account holders.

Under FATCA, US persons must report to the US tax authority, Internal Revenue Service (IRS), their assets held in offshore accounts. In addition, the regulations seek to require non-US financial institutions to report to the US tax authority certain information about financial accounts of US or US-owned investors and account holders.

How does this impact US Brokers, including Interactive Brokers?

As a broker based in the United States, Interactive Brokers is required to report information and make payment of withholding taxes to the IRS, for all of our customers. FATCA simply creates additional practices and withholdings to the current requirements for all US brokers.

Interactive Brokers will comply with the new rules. This may require additional disclosures by investors during the account application process, as well as expanded tax reporting. For all US institutions, FATCA becomes effective January 1, 2013. Any FATCA tax withholding requirements begin on January 1, 2014.

Additional aspects of the regulations will be phased-in over the next few years, including an expansion of US brokers reporting on US source income to non-US accounts through Form 1042-S.

What action is required for US persons?

No additional action is required for US persons holding Interactive Brokers accounts. US persons, who include US citizens, Green Card holders and other legal residents, need only to complete Form W-9 during the account application process to certify their tax status.

Does FATCA affect non-US accounts?

Yes. FATCA requires foreign financial institutions (FFIs) to furnish certain data directly to the IRS about any of their US taxpayer accounts or foreign entity accounts in which US taxpayers hold a certain level of ownership. FFI compliance with the new regulations becomes effective July 1, 2013 with the submission of electronic FFI applications to the IRS. The application forms are scheduled to be available through the IRS in January 2013.

All non-US persons and entities applying for and maintaining Interactive Broker accounts will continue to be required to fully disclose and indentify the identity of their account's beneficial owner(s). Through the IRS Form W-8, our account holders certify the beneficial owner's country of tax residence. If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply.

Some entities not ordinarily considered to be financial institutions may be categorized under FATCA as an FFI. Therefore, it is important to review the details outlined by the IRS.

Is there a summary of FFI requirements?

While the regulations and compliance are far more complex than a brief FAQ can describe, the following offers a short summary of actions required by those defined foreign financial institutions.

- Identify US taxpayers. If US taxpayers refuse to waive your non-US country's privacy or secrecy rules, then the US taxpayer account must be closed.

- Report to the IRS on the related US taxpayer activity within defined financial accounts.

- Withhold 30% US tax on US source income against any US taxpayer or foreign entity failing to disclose information or comply with the FATCA regulations.

Additional Information & Resources

The IRS remains the most comprehensive and up-to-date resource about FATCA compliance, implementation, and document filing. The IRS continues to issue news releases and forms. Please feel free to visit the IRS FATCA Website for details.

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.