Warrant Tutorial

Introduction

A warrant confers the right to buy (call-warrant) or sell (put-warrant) a specific quantity of a specific underlying instrument at a specific price over a specific period of time.

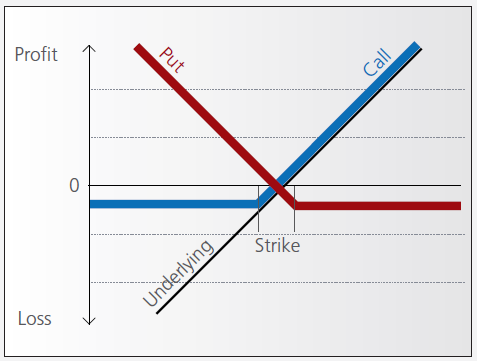

Pay-out Profile

With some warrants, the option right can only be exercised on the expiration date. These are referred to as “European-style” warrants. With “American-style” warrants, the option right can be exercised at any time prior to expiration. The vast majority of listed warrants are cash-exercised, meaning that you cannot exercise the warrant to obtain the underlying physical share. The exception to this rule is Switzerland, where physically settled warrants are widely available.

Factors that influence pricing

Not only do changes in the price of the underlying instrument influence the value of a warrant, a number of other factors are also involved. Of particular importance to investors in this regard are changes in volatility, i.e. the degree to which the price of the underlying instrument fluctuates. In addition, changes in interest rates and the anticipated dividend payments on the underlying instrument also play a role.

However, changes in implied volatility - as well as interest rates and dividends - only affect the time value of a warrant. The primary driver - intrinsic value - is solely determined by the difference between the price of the underlying instrument and the specified exercise price.

Historical and implied volatility

In addressing this topic, a differentiation has to be made between historical and implied volatility. Implied volatility reflects the volatility market participants expect to see in the financial instrument in the days and months ahead. If implied volatility for the underlying instrument increases, so does the price of the warrant.

This is because the probability of profiting from a warrant during a particular time-frame increases if the price of the underlying instrument is highly volatile. The warrant is therefore more valuable.

Conversely, if implied volatility decreases, that leads to a decline in the value of warrants and hence occasionally to nasty surprises for warrant investors who aren’t familiar with the concept and influence of volatility.

Interest rates and dividends

Issuers hedge themselves against price changes in the warrant through purchases and sales of the underlying instrument. Due to the leverage afforded by warrants, the issuer needs considerably more capital to hedge its exposure than you require to buy the warrants. The issuer’s interest expense associated with that capital is included in the price of the warrant. The amount of embedded interest reduces over time and at expiration is zero.

In the case of puts, the situation is exactly the opposite. Here, the issuer sells the underlying instrument

short to establish the necessary hedge, and in so doing receives capital that can earn interest. Thus interest reduces the price of the warrant by an amount that decreases over time.

As the issuer owns shares as a part of its hedging operations, it is entitled to receive the related dividend

payments. That additional income reduces the price of call warrants and increases the price for puts. But if the dividend expectations change, that will have an influence on the price of the warrants. Unanticipated special dividends on the underlying instrument can lead to a price decline in the related warrants.

Key valuation factors

Let’s assume the following warrant:

Warrant Type: Call

Term to expiration: 2 years

Underlying : ABC Share

Share price: EUR 30.00

Strike: EUR 30.00

Exercise ratio: 0.1

Warrant’s price: EUR 0.30

Intrinsic value

Intrinsic value represents the amount you could receive if you exercised the warrant immediately and then bought (in the case of a call) or sold (put) the underlying instrument in the open market.

It’s very easy to calculate the intrinsic value of a warrant. In our example the intrinsic value is EUR 00.00

and is calculated as follows:

(price of underlying instrument – strike price) x exercise ratio

= (EUR 30.00 – EUR 30.00) x 0.1

= EUR 00.00

If the price of the ABC share increases by EUR 1, the intrinsic value becomes

= (EUR 31.00 – EUR 30.00) x 0.1

= EUR 00.10

The intrinsic value of a put warrant is calculated with this formula:

(strike price – price of underlying instrument) x exercise ratio

It’s important to note that the intrinsic value of a warrant can never be negative. By way of explanation:

if the price of the underlying instrument is at or below the exercise price, the intrinsic value of a call equals zero. In this instance, the price of the warrant consists only of “time value”. On the flipside, the intrinsic value of a put is equal to zero if the price of the underlying instrument is at or above the exercise price.

Time value

Once you’ve calculated the intrinsic value of a warrant, it’s also easy to figure out what the time value of that warrant is. You simply deduct the intrinsic value from the current market price of the warrant. In our example, the time value is equal to EUR 1.30 as you can see from the following calculation:

(warrant price – intrinsic value)

= (EUR 0.30 EUR – EUR 0.00)

= EUR 0.30

Time value gradually erodes during the term of a warrant and ultimately ends up at zero upon expiration. At that point, warrants with no intrinsic value expire worthless. Otherwise you can expect to receive payment of the intrinsic value. Take note, though: a warrant’s loss of time value accelerates during the final months of its term.

Premium

The premium indicates how much more expensive a purchase/sale of the underlying instrument would be via the purchase of a warrant and the immediate exercise of the option right as opposed to simply buying/selling the underlying instrument in the open market.

Hence the premium is a measure of how expensive a warrant actually is. It follows that, when given a choice between warrants with similar features, you should always buy the one with the lowest premium. By calculating the premium as an annualized percentage, warrants with different terms to expiry can be compared with each other.

The percentage premium for the call warrant in our example can be calculated as follows:

(strike price + warrant price / exercise ratio – share price) / share price * 100

= (EUR 30.00 + EUR 0.30 / 0.1 – EUR 30.00) / EUR 30.00 x 100

= 10 percent

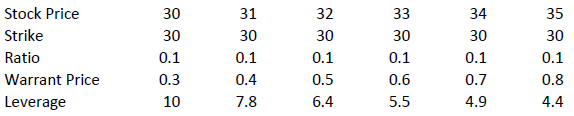

Leverage

The amount of leverage is the price of the share * ratio divided by the price of the warrant. In our example 30.00*0.1/0.3 = 10. So when the price of ABC increases by 1% the value of the warrant increases by 10%.

The amount of leverage is not constant however; it varies as intrinsic and time value changes, and is particularly sensitive to changes in intrinsic value. As a rule of thumb, the higher the intrinsic value of the warrant, the lower the leverage. For example (assuming constant time value):

Knock-out (Turbo) Tutorial

Introduction

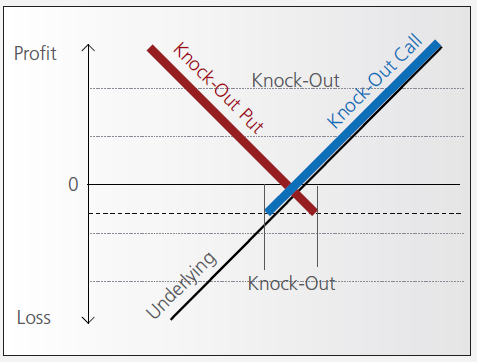

Knock-out warrants (turbos), like vanilla warrants, derive their value from the difference between the price of the underlying and the strike. They differ significantly however from vanilla warrants in many important respects:

- They can expire (knock-out) prematurely if the price of the underlying instrument touches or falls below (in the case of knock-out calls) or exceeds (in the case of knockout puts) a predetermined barrier-level. It expires worthless if the barrier equals the strike, or it may have a residual stop-loss value if the barrier is set higher than the strike (in the case of a call).

- Changes in implied volatility have little or no impact on knock-out products, therefore their pricing is easier for investors to comprehend than that of warrants.

- They have little or no time value (because of the presence of the knock-out barrier), and therefore have a higher degree of leverage than a warrant with the same strike. This is because the absence of time value makes the instrument “cheaper”.

Pay-out Profile

Leverage

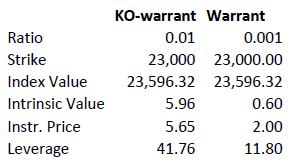

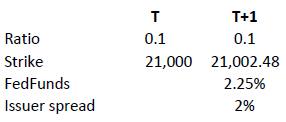

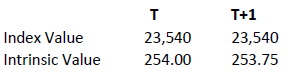

As discussed above, knock-out warrants exhibit high degrees of leverage, particularly as the price of the underlying nears the strike/barrier. Consider the following example of a long turbo on the Dow Jones Index, compared to a vanilla warrant:

Intrinsic value = (index value – strike) x ratio

Leverage = Index Value x Ratio / Instrument Price

A vanilla warrant retains significant time value even as the underlying price approaches the strike, sharply reducing its leverage compared to a knock-out warrant.

Product types

As discussed above, the barrier may either equal the strike, or be set above (calls) or below (puts). In the latter cases a small residual value remains after knock-out, corresponding to the difference between the barrier (the stop-loss level) and the strike.

Moreover, knock-out products may either have an expiration date or may be open-ended. This makes a difference in the way interest is accounted for. If the contract has an expiration date interest is included in the premium, the amount of which reduces over time and is zero on expiration. This is analogous to a standard vanilla warrant.

in relation to an expiration date. The price of the contract therefore corresponds exactly to its intrinsic value. Interest however must be accounted for. This is done by a daily adjustment of the barrier and strike. The following example shows the daily adjustment for a long open-end turbo on the Dow Jones Index:

The adjustment = Strike T x (1+ FedFunds/360 + Issuer Spread/360).

The intrinsic value of the instrument is correspondingly reduced as follows, assuming no change in the value of the DJ Index):

Intrinsic value = (index value – strike) x ratio

Discount Certificates Tutorial

Introduction

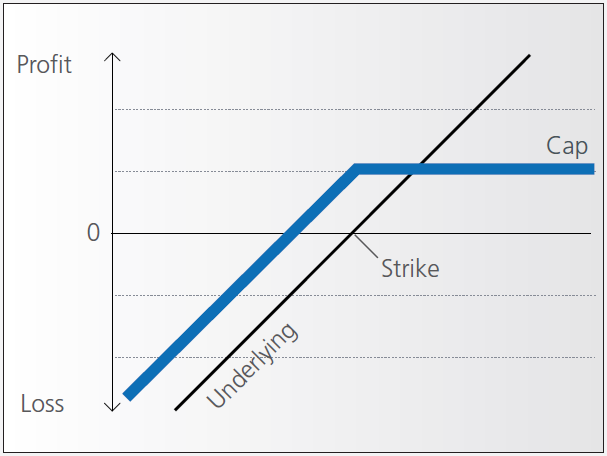

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

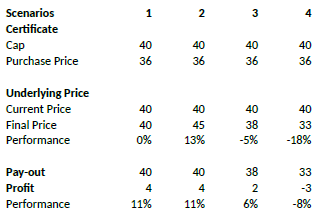

Example

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

Daily Leverage

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

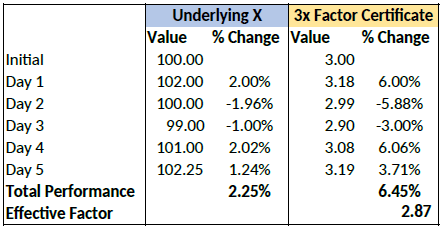

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

Intraday Reset

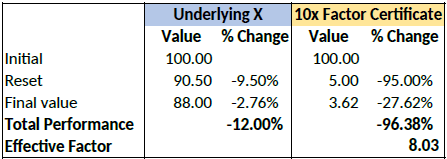

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows:

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

为何美国期权的佣金收费各有不同?

IB的期权佣金费用包含两部分:

1. 归于IB的执行费用。 对于智能传递定单,该费用为每份合约$0.70美元,给定月份超出100,000份合约的定单,每份合约可低至$0.15美元(参见网站了解直接传递定单费用、低价期权优惠费率和最低定单费用);

2. 第三方交易所、监管和/或交易费用。

就第三方费用而言,某些美国的期权交易所会有一个流动性费用/折扣结构,在与IB的执行费用以及其他监管和/或交易费用一起应用时,可能会导致各个定单总的每份合约佣金费用各不相同。 这是由交易所部分的计算所造成的。交易所部分的计算最终结果可能是向客户支付款项而非收取费用,其取决于一些不受IB控制的因素,包括客户的定单属性以及现行买-卖报价。

采用这种流动性费用/折扣模式的交易所会对消耗流动性的定单(即适销定单)收取费用,而对添加流动性的定单(即非适销的限价定单)提供折扣返点。费用会因交易所、客户类型(如公众客户、经纪交易商、公司、做市商和专业交易者)和期权底层证券的不同而不同,公众客户折扣通常介于$0.10 - $0.42之间,而公众客户费用则介于$0.15 - $0.50之间。

IB有义务将适销的期权定单传递至提供最佳执行价格的交易所,且如果出现多个最佳报价,智能传递在决定将定单传往哪个交易所时会考虑流动性消耗费用(即会将定单传递至费用最低或无费用的交易所)。 因此,只有在提供的价格优于市价至少$0.01时,智能传递才会将市价定单传递至收取更高费用的交易所(鉴于标准期权乘数为100,会产生$1.00的价格改善,大于最高流动性消耗费用)。

有关添加/消耗流动性概念的更多信息以及相关举例,请参见KB201。

添加/消耗流动性

本文旨在对交易所费用、添加/消耗流动性费用以及非组合佣金提供正确的理解。

添加或消耗流动性的概念既适用于股票,也适用于股票/指数期权。一个定单是消耗流动性还是添加流动性,取决于定单是适销还是非适销。

适销定单会消耗流动性。

适销定单要么是市价定单,要么是限价等于或高于/低于当前市价的买入/卖出限价定单。

1. 对于适销的买入限价定单,限价等于或高于卖价。

2. 对于适销的卖出限价定单,限价等于或低于买价。

举例:

XYZ股票当前卖价尺寸/价格为400股/46.00。您输入一个买入限价定单,即以46.01的价格买入100股XYZ股票。由于定单马上就能执行,其将被视为适销定单。如果交易所会对消耗流动性收费,则客户将需缴纳该费用。

非适销定单是限价低于/高于当前市价的买入/卖出限价定单。

1. 对于非适销的买入限价定单,限价低于卖价。

2. 对于非适销的卖出限价定单,限价高于买价。

举例:

XYZ股票当前卖价尺寸/价格为400股/46.00。您输入一个买入限价定单,即以45.99的价格买入100股XYZ股票。由于定单将被作为最佳买价发布至市场,而不会立即执行,其将被视为非适销定单。

若有人发送了一个适销的卖出定单,从而使您的买入限价定单得以执行,则如果有添加流动性返点,您会收到一定折扣(返点)。

请注意:

1. 所有交易期权的账户均需就消耗/添加流动性缴纳/享受期权交易所费用或返点。

2. 根据IB网站,消耗/添加流动性费用表下只有负数才是折扣(返点)。

https://www.ibkr.com.cn/cn/index.php?f=2356

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.

专业客户委托单优先级

美国期权交易所已设定规则,把交易行为被视为“专业”(即交易方式更类似于做市商而非普通客户的个人或实体)的一批公众客户(即并非经纪交易商)委托单,与交易行为并非“专业”的公众客户区分开来。 根据该等细则,任何不是经纪交易商的客户,但在每季度的最少1个月内,每日平均下达超过390笔美国上市期权委托单(在其自有受益账户),将被分类为专业。

代专业客户提交的委托单在执行优先级和费用方面与经纪交易商待遇相同。

经纪商需最少每个季度进行一次审查,以确定该季度内的任意月份,哪些客户超过了390笔委托单的临界值,以及哪些客户将在下一个季度被指定为专业。

委托单计算

各地交易所对委托单的定义略有不同,寻求特定期权计算规则的客户(特别是使用算法委托单类型时,在某些情况下,可能导致在市场两边下达委托单)应查看相关交易所的规则手册和指南。然而,为达到计算期权委托单的目的,委托单通常被定义为:

- 单一委托单;

- 8条或以下期权边的复杂委托单;

- 在一个9条或以上期权边的复杂委托单中的每条期权边;或

- 母委托单,即使该委托单被经纪商分割为多笔同边/系列的子委托单,以达到执行或传递目的 (挂钩全国最佳买卖报价(NBBO)的委托单除外,下方会加以说明)。

根据上方的逻辑,由客户发起的取消和取代母委托单(通过任意方式,如分段委托单)会计算为新委托单(如取消/取代一笔单边委托单会计算为一笔新委托单,而取消/取代一笔9条期权边的委托单会计算为9笔新委托单)。

挂钩全国最佳买卖报价(NBBO)/最佳买卖报价(BBO)的委托单

请注意,使用挂钩NBBO或BBO期权委托单的客户(如相对委托单或挂钩波幅委托单,或其它母委托单类型,其设计是跟随NBBO/BBO移动),每笔基于NBBO/BBO改变而取消/取代的子委托单,将构成一笔额外新委托单。 把挂钩委托单存放在IBUSOPT以参与RFQ竞价的客户应留意,每次挂钩委托单在IBKR系统参与RFQ竞价时,将以取消并取代的方式处理(无论该委托单是否成为交易所竞价的发起委托单)。

账户集合

在计算委托单总数时,经纪商必须把客户全部实益拥有账户的期权委托单加起来。 IBKR把个人或实体账户的期权委托单与其相关的联名账户、信托账户和组织账户加起来。

如客户身份由零售客户转变为专业客户,IBKR将向其发出通知。此外,IBKR智能传递在做出传递决定时,会把交易费因素(包括专业和非专业客户费用的差距)考虑在内。

更多额外信息,请查看以下链接: