Ex-Ante Costs and Charges Disclosures

What is this Disclosure?

MIFID II rules require that Interactive Brokers in Europe and the UK provide its retail clients with a reasonable estimate of the costs and charges related to products and services offered.

Retail clients of Interactive Brokers in Europe can view a per-transaction costs and charges disclosure at the time of the order entry (‘ex-ante’). The disclosure is personalized and corresponds to the conditions applicable to the client account.

While clients have the option to view the disclosure, it is not a mandatory step before the order submission.

The disclosure content and format are largely prescribed by the rules to enable retail clients to compare costs and charges across providers. This article aims to clarify the meaning of these standardized terms.

In addition to Interactive Brokers costs and charges, the disclosure must show implicit costs and costs embedded in the product price itself (and not charged by Interactive Brokers separately).

A per transaction costs and charges disclosure is required for:

- All futures and options globally, including futures options

- ETFs of all types

- Funds, including closed-end funds

- CFDs

- Warrants and structured products

A disclosure is not required for other products such as vanilla stocks and bonds.

Where to Find the Per-transaction Costs and Charges Disclosure?

Access to the disclosure is via a link embedded in the primary order-entry dialog.

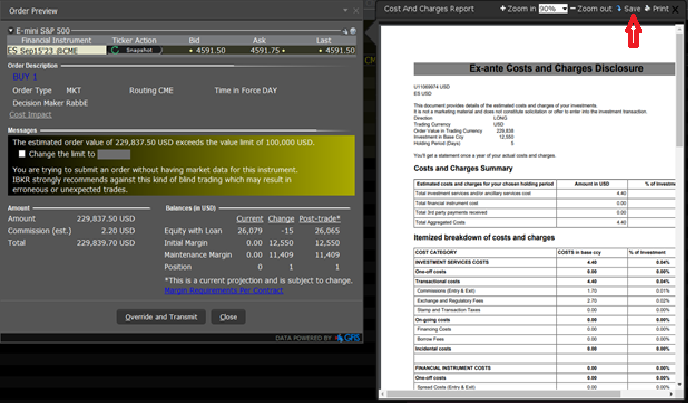

TWS Classic:

.png)

The presence of the link does not interrupt the standard order entry workflow if a client chooses not to click it. A client can click the transmit button in the usual way and skip viewing the disclosure.

Clicking the “Cost Impact” link brings up a pop-up with the ex-ante per transaction costs and charges disclosure, with the option to download it as a PDF:

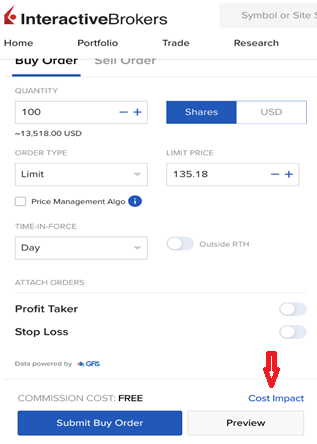

Other Trading Applications:

The other order entry interfaces such as Mosaic, Client Portal and Mobile likewise include a link to the costs and charges disclosure, again without interrupting the standard workflow unless a client expressly wants to see the disclosure.

Below is an example of the order ticket in the Client Portal. Order tickets in TWS Mosaic and Mobile are similar.

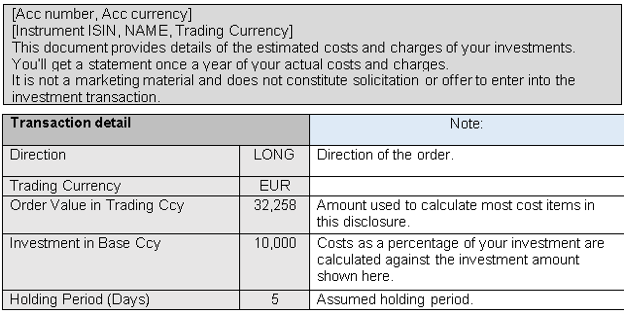

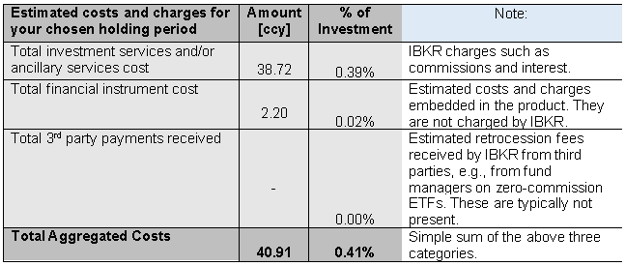

The Disclosure Content and Structure

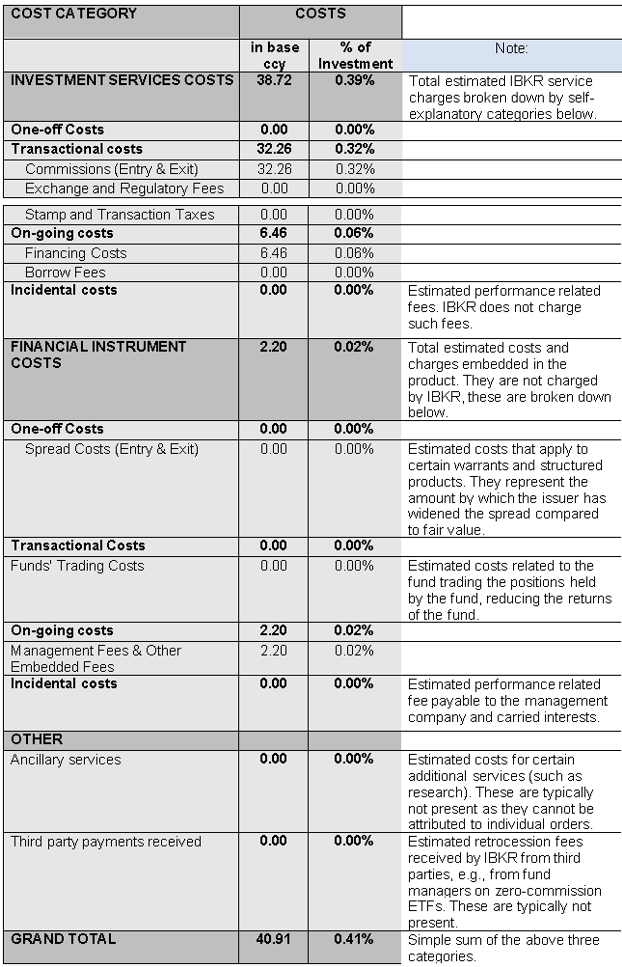

The per transaction costs and charges disclosure includes a summary-section followed by an itemized costs and charges breakdown. The various cost items are presented using headings and terms that are mandated by the regulation to make the disclosures comparable across investment service providers. The example below illustrates the statement structure and contains explanatory notes.

Ex-ante Costs and Charges Disclosure - Illustrative Example

(1) Account detail

(2) Costs and Charges Summary

Please note that the “Financial Instrument Cost” is embedded in the product, and not a cost charged by Interactive Brokers. We are required to source or estimate such costs so you could better understand all of the costs that are associated with some of your securities.

(3) Itemized Breakdown of Costs and Charges

卖空股票收入的贷方利息

如何确定与股票借入仓位相关的贷方利息或费用

账户持有人卖空股票时,IBKR会代账户持有人借入相应数量的股票,以履行向买方交付股票的义务。根据借入股票的股票借贷协议,IBKR需向股票出借方提供现金抵押品。现金抵押品的金额基于股票价值的行业标准计算,称为抵押品标记。

股票出借方就现金抵押品向IBKR提供利息,利率通常会低于现金抵押存款的现行市场利率(通常与美元计价现金存款的联邦基金有效利率挂钩),其中的差额即作为出借方提供此服务收取的费用。对于难以借入的股票,出借方所收取的费用会相应提高,可能会导致净利率变为负,IBKR反而被倒扣费用。

许多经纪商只会向机构客户提供部分利息返还,但所有IBKR客户其卖空股票收入超出10万美元或等值其它货币的部分都可以获得利息。当某证券可供借用的供应量高于借用需求时,账户持有人可就其卖空股票余额获得的利息利率相当于基准利率(例如,美元余额采用联邦基金有效隔夜利率)减去一个利差(目前介于1.25%(10万美元档的余额)至0.25%(300万美元以上的余额)之间)。利率可能会在无事先通知的情况下发生变化。

当某特定证券的供求不平衡导致其难以借入时,借出方提供的利息返还将会减少,甚至可能导致向账户倒扣费用。该等利息返还或倒扣费用会以更高的借券费用的形式转嫁给账户持有人,这可能会超过卖空收入所得的利息,导致账户最终算下来还付出了费用。由于利率因证券和日期而异,IBKR建议客户通过客户端/账户管理中的支持部分,访问〝可供卖空股票〞工具,查看卖空的指示性利率。请注意,该等工具中反映的指示性利率对应的是IBKR向第三等级余额支付的卖空收入利息,即卖空收入为300万美元或以上。对于较低的余额,其利率将根据余额等级和交易货币对应的基准利率进行调整。可使用“对卖空收益现金余额向您支付的利息”计算器计算适用的利率。

请参阅证券融资(融券)页面的更多范例和计算机。

重要提示

“可供卖空股票”工具和TWS中关于可供借用股票和指示性利率的信息,是在尽最大努力的基础上提供,不保证其准确性或有效性。 “可供卖空股票”包括来自第三方的信息,不会实时更新。利率信息仅为指示性质。在当前交易时段执行的交易通常在2个工作日内结算,实际供应和借入成本在结算日确定。交易者应注意,在交易和结算日之间,利率和供应可能会发生重大变化,尤其是交易稀少的股票、小盘股和即将发生公司行动(包括股息)的股票。详情请参阅卖空的操作风险(Operational Risks of Short Selling。

Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

FAQs for February 23, 2022 messages regarding CME exchange fee credits

Why did I receive this message?

You received a message from IBKR on February 23, 2022 because your account traded spread trades on CME in (1) one or more of the following products between January 1, 2015 and late September 2021: E-Mini Equity index Futures (including Housing Index Futures); Micro E-Mini Index Futures; Micro E-Mini Index Options; and Nikkei Equity Futures, and/or (2) certain FX futures products between February 1, 2018 and mid-December 2021.

Why did I receive a credit?

As set forth in the message, certain spread trades in those products (see response #1) are subject to discounted CME exchange fees (as compared to outright trades in those products). Your account traded spread trades in one or more of those products between January 1, 2015 and late September 2021 (or FX futures between February 1, 2018 and mid-December 2021) and, as a result of an inadvertent error, overpaid associated CME exchange fees. IBKR has credited your account for the overpaid CME exchange fees.

What do I need to do?

You will need to log into your account and withdrawal the funds.

Am I owed money for other trades?

Not that we have identified.

How long do I have to withdraw the funds?

Please withdraw the funds within 30 days of the date of the message you received (by March 25, 2022).

The message I received says something about owing an outstanding debt to IBKR. What does that mean?

This means that your account owed an outstanding debt to IBKR, and the amount you received in reimbursement was credited against the outstanding debt amount. If the reimbursement amount exceeded the outstanding debt about, you received a credit and may withdraw the difference.

如何确定哪些市场数据订阅适合某一指定证券?

IBKR为账户持有人提供了市场数据助手,可帮助其选择想要交易的证券(股票、期权或权证)所适用的订阅服务。搜索结果会显示产品进行交易的所有交易所、订阅服务及其月费(专业客户和非专业客户)以及每种订阅服务的市场深度数据。

要访问市场数据助手:

- 登录客户端

- 点击“帮助”菜单(右上角的问号图标),然后点击“支持中心”

- 向下滚动,选择“市场数据助手”

- 输入代码或ISIN以及交易所

- 选择筛选条件:专业/非专业订户状态、币种和资产

- 点击“搜索”

- 查看搜索结果并决定哪些订阅最符合自己的需求。

更多信息请参见IBKR网站的市场数据选择页面。

迁移后向IBKR转账资金

如果您的账户是近期迁移到IBKR爱尔兰(IBIE)或IBKR中欧(IBCE),则您在客户端中保存的或是在银行登记的银行指令信息可能已经过期。账户迁移后,向IBKR转账资金时您需要在客户端中输入新的存款通知/银行指令,并更新您在银行登记的IBKR银行信息。

如果在向IBKR转账资金时您不小心使用了过期的银行指令,导致资金转到了别的IBKR实体,为了您的便利,我们会尝试将资金转账到正确的IBKR实体。请注意,这种转账第一次为免费处理。后续每笔转账IBKR将收取50欧元(或等值)的手续费。您也会收到一则消息告知您有该笔转账并建议您更新银行信息。

Sending Funds to IBKR Post Migration

If your account has recently migrated to IBKR Ireland (IBIE) or IBKR Central Europe (IBCE), it is likely that you have outdated bank instructions saved in your Client Portal or with your bank. When transferring funds to IBKR after migration, you will want to enter a new deposit notification/bank instruction within Client Portal and update any saved IBKR bank information that you have with your bank.

Should you inadvertently use outdated bank instructions to send funds to IBKR and they arrive at the incorrect IBKR entity, as a courtesy we will attempt to forward the funds to the correct IBKR entity. Please note that this transfer will be done free of charge for the first instance. For subsequent transfers, IBKR will charge your account a processing fee of EUR 50 (or equivalent). You will also receive a message notifying you of the transfer and advising you to update your bank information.

期权监管费用(ORF)

期权监管费用是期权清算公司(OCC)向其清算会员(包括IBKR)收取的一种交易所费用。 其目的在于抵消因期权市场的监督管理(如日常监控、调查以及政策和规则的制定、解释和执行活动)而产生的交易所开销。该费用CBOE于2009年年中开始收取,BOX、ISE和PHLX于2010年1月开始收取,AMEX和ARCA于2011年5月开始收取,Nasdaq于2012年1月开始收取,C2于2012年8月开始收取,Miami于2013年1月开始收取,ISE GEMINI于2013年8月开始收取,BATS于2015年2月开始收取,Nasdaq BX于2016年2月开始收取,BATS EDGX于2017年2月开始收取,PEARL于2017年2月开始收取,MERCURY和EMERALD于2019年2月开始收取。截至2023年2月1日,客户委托单每张美国交易所挂牌期权合约收取$0.02905美元,每家交易所收费如下:

| 交易所 | 期权监管费用 |

| AMEX | 0.0055 |

| ARCA | 0.0055 |

| BATS | 0.0001 |

| BOX | 0.00295 |

| CBOE | 0.0017 |

| C2 | 0.0003 |

| EDGX | 0.0001 |

| EMERALD | 0.0006 |

| ISE | 0.0014 |

| GEMINI | 0.0013 |

| MERCURY | 0.0004 |

| MIAX | 0.0019 |

| NOM | 0.0016 |

| NASDAQBX | 0.0005 |

| PEARL | 0.0018 |

| PHLX | 0.0034 |

| 总计 | 0.02905 |

注意,期权监管费用 针对所有交易(买单和卖单)收取,独立于IBKR佣金和现有的交易所费用(如消耗流动性)之外,在活动报表中显示为监管费用。

第三方交易费用概览

英国

- 相当于交易金额0.5%的印花税。

- 对于在英国、马恩岛和海峡群岛注册之公司的股票,英国并购委员会(Panel of Takeovers and Mergers)会对所有交易金额超过1万英镑的委托单征收1英镑的税。

爱尔兰

- 相当于交易金额1%的印花税。

瑞士

- 瑞士交易税并不是由盈透证券向个人账户自动收取的。需要缴税的客户应咨询当地税务顾问以履行其纳税义务。

法国

- 法国金融交易税:针对总部位于法国并且市值超过十亿欧元之公司的股票,按交易金额的0.30%收取。

意大利

- 意大利金融交易税:受监管市场和多边交易设施中交易的股票按0.10%收取;这些市场以外其它市场上交易的股票按0.20%收取。

西班牙

- 西班牙金融交易税:针对截至收购之日前一年12月1日市值超过十亿欧元之西班牙公司的股票,按交易金额的0.20%收取。

比利时

- 证券交易所内进行之交易(TST)的比利时税费并不是由盈透证券向个人账户自动收取的。需要缴税的客户应咨询当地税务顾问以履行其纳税义务。

香港

- 对于在香港联交所(SEHK)交易的股票、权证和结构性产品:

- 政府印花税:0.13%,对于联交所股票向上取整到最近的整数1.00,通常只适用于股票。

- 香港证监会(SFC)的交易税费:0.0027%,通常适用于股票,权证和牛熊证。

- 财务汇报局(FRC)的交易征费:0.00015%,通常适用于股票,权证和牛熊证。

- 对于通过沪港通北向通和深港通交易的产品:

- 相当于卖出所得0.1%的印花税

费用概览

我们鼓励客户和潜在客户访问我们的网站了解详细费用信息。

最常见的几项费用有:

1. 佣金——取决于产品类型和挂牌交易所,以及您选择的是打包式(一价全含)还是非打包式收费。例如,美国股票佣金为每股0.005美元,每笔交易最低佣金为1.00美元。

2. 利息——保证金贷款需缴纳利息,IBKR采用国际公认的隔夜存款基准利率作为基础来确定自己的利率。然后我们将分等级在基准利率基础上应用一个浮动值(这样余额越大对应的利率就越有利)来确定实际利率。例如,对于美元计价的贷款,基准利率是联邦基金利率,而10万美元以内的余额利率会在基准利率的基础上加1.5%。此外,卖空股票的个人应注意,借用“难以借到”的股票还会有一笔特殊费用,以日息表示。

3. 交易所费用——取决于产品类型和交易所。例如,对于美国证券期权,某些交易所会对消耗流动性的委托单(市价委托单或适销的限价委托单)收取费用、对添加流动性的委托单(限价委托单)给与补贴。此外,许多交易所还会对取消或修改的委托单收取费用。

4. 市场数据——您并非一定要订阅市场数据,但是如果不订阅市场数据,您可以会产生月费用,具体取决于供应交易所及其订阅服务。我们提供市场数据助手工具,可根据您想交易的产品帮助您选择适当的市场数据订阅服务。要访问该工具,请登录客户端,点击支持然后打开市场数据助手链接。

5. 最低月活动费用——为迎合活跃客户的需求,我们规定如果账户产生的月佣金能达到最低月佣金要求,则可免交月活动费用;而如果产生的月佣金未能达到最低月佣金要求,则需缴纳差额作为活动费用。最低月佣金要求为10美元。

6. 杂费 - IBKR允许每月一次免费取款,后续取款将收取费用。此外,还会代收交易取消请求费用、期权和期货行权&被行权费用以及ADR保管费用。

更多信息,请访问我们的网站,从定价菜单中选择查看。