怎么看我的开户申请状态?

请前往IBKR.com/app-status登录查看申请状态。

要加快审核,请参考以下推荐办法。

- 注资可获得优先审核。如果出于任何原因,您的申请没能获批,资金会即刻退还给您。

- 登录确定是否已按要求提交了所有文件,缺文件是导致延迟的最常见原因。

- 请检查您在申请表上填写的电子邮箱,看看是否有我们合规部门发送给您的邮件。在线申请提交后如果还需要您提供其它文件和/或说明,合规部门会通过电子邮件联系您。

- 所有文件提交并被接受后,还会需要一点时间完成尽职调查检查和申请审核。

我的账户属于哪个IBKR实体?

账户持有人可以通过账户报表顶部的信息确认其账户所属的IBKR实体。

- Interactive Brokers LLC (IB LLC)

- Interactive Brokers Canada Inc (IBC)

- Interactive Brokers (U.K.) Limited (IBUK)

- Interactive Brokers Ireland Limited (IBIE)

- Interactive Brokers Central Europe Zrt. (IBCE)

- Interactive Brokers Luxembourg SARL (IBLUX)

- Interactive Brokers Australia Pty. Ltd. (IBA)

- Interactive Brokers Hong Kong Limited (IBHK)

- Interactive Brokers (India) Pvt. Ltd. (IBI)

- Interactive Brokers Securities Japan, Inc. (IBSJ)

- Interactive Brokers Singapore Pte. Ltd. (IBSG)

为什么需要披露我与金融机构的雇佣关系?

根据美国金融业监管局(FINRA)规则3210要求,与成员公司(雇主成员)关联的申请者在IBKR(执行成员)开户前必须先获得雇主成员的书面同意。该规则还要求开户人士告知IBKR其与雇主成员的关联关系。对IBKR来说,可能还存在其它类似的非美国法规要求。

受雇于其它经纪商或金融机构或与其它经纪商或金融机构关联的申请者需要提交一份包含其雇佣单位联系信息的文件,以便IBKR根据要求向其雇佣单位提供相关交易数据。如果申请者受雇于金融机构,但又不提交相应文件,则IBKR会联系申请者确认其是否是不适用于FINRA规则3210。

如何用手机向IBKR发送文件

即使您一时无法扫描文件,盈透证券也支持您给我们发送文件副本。您可以用手机将所需文件拍下来。

下方介绍了在不同手机操作系统下如何拍照并将照片通过电子邮件发送给盈透证券的详细步骤:

如果您已经知道如何拍照并通过电子邮件发送图片,请点击此处——电子邮件应该发送到哪里以及邮件主题应该写什么。

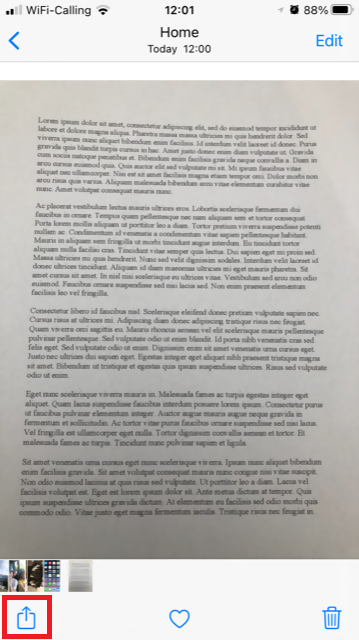

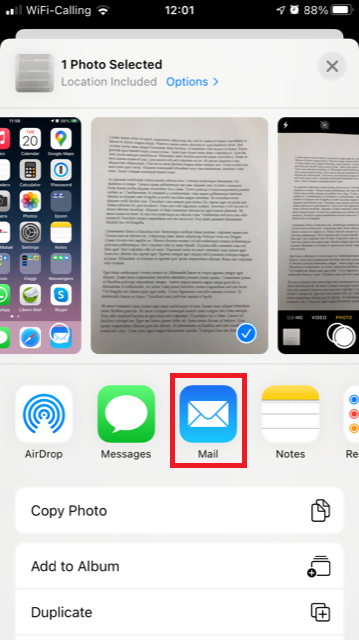

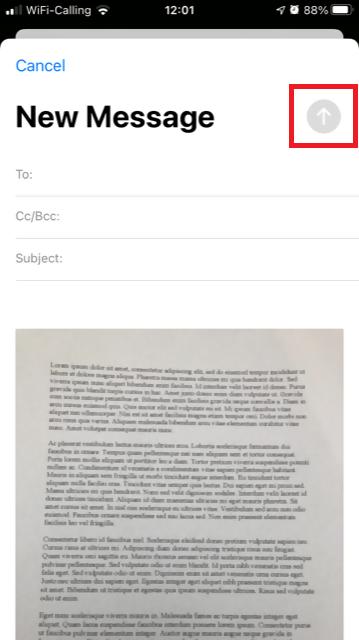

iOS

1. 从手机屏幕的底部向上滑,然后点击相机图标。

如果没找到相机图标,您可以从iPhone主屏幕点击相机应用程序图标。

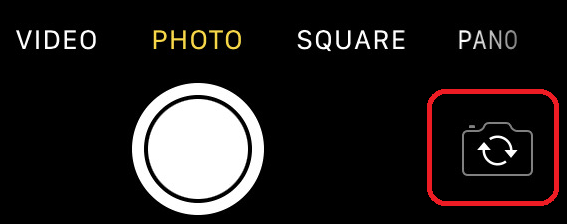

通常情况下打开的应该是后置摄像头。如果打开的是前置摄像头,请点击摄像头切换按钮。

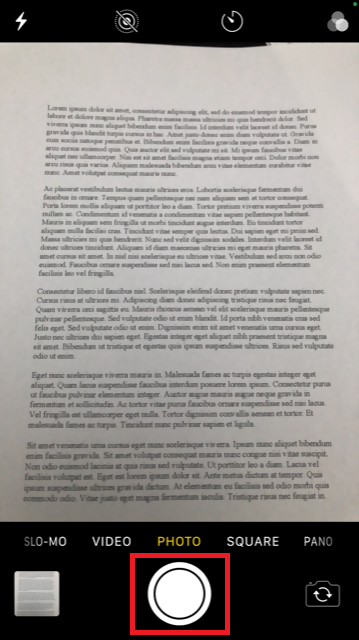

2. 将手机移到文件上方,镜头对准需要的位置或页面。

3. 确保光线均匀、充足,避免因为拿手机的姿势在文件上投下任何阴影。手机拿稳,防止抖动。点击拍照按钮拍照。

4. 点击左下角的缩略图查看您刚刚拍的照片。

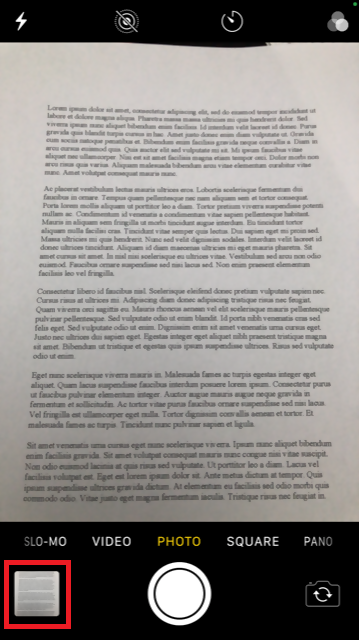

5. 确保照片清晰,文件字迹清楚。您可以用两个手指在图片上划开来放大图片查看细节。

如果图片质量或亮度不好,请重复上述步骤重新拍照。

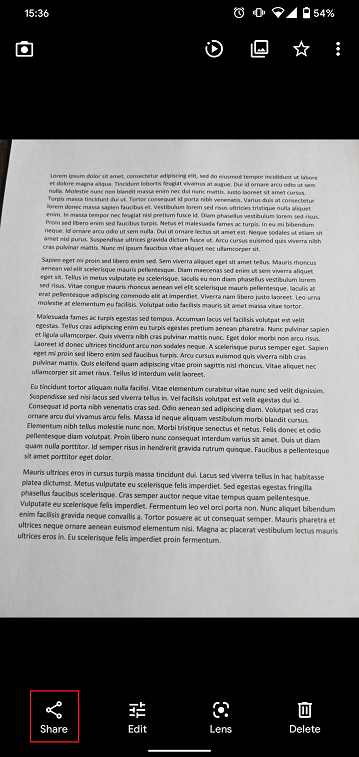

6. 点击屏幕左下角的分享图标。

7. 点击电子邮件图标。

注意:要发送电子邮件,您的手机必须有相应配置。如果不知道如何配置,请联系您的电子邮件供应商。

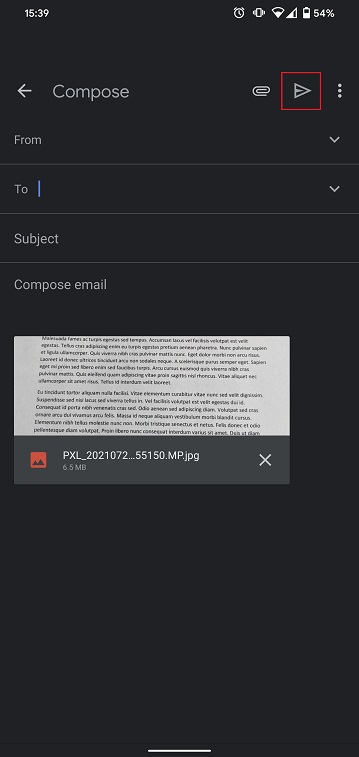

8. 请参见此处了解如何填写电子邮件收件人(To:)和主题(Subject:)。填写完毕后,点击右上方的向上箭头发送邮件。

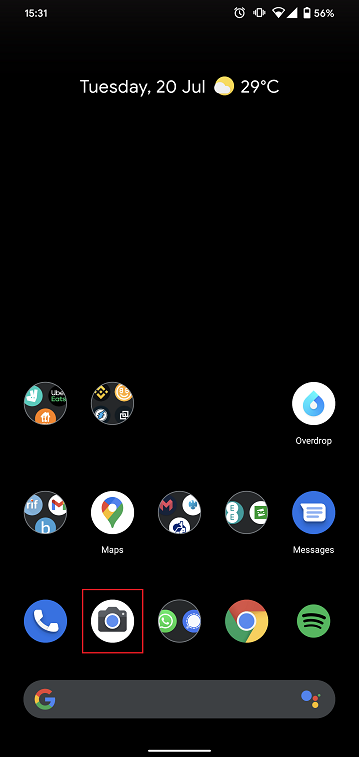

安卓

1. 打开应用程序列表,启动相机应用程序。或者直接从手机主屏幕启动相机。取决于您的手机型号、制造商或设置,相机应用程序的叫法可能有所不同。

通常情况下打开的应该是后置摄像头。如果打开的是前置摄像头,请点击摄像头切换按钮。

2. 将手机移到文件上方,镜头对准需要的位置或页面。

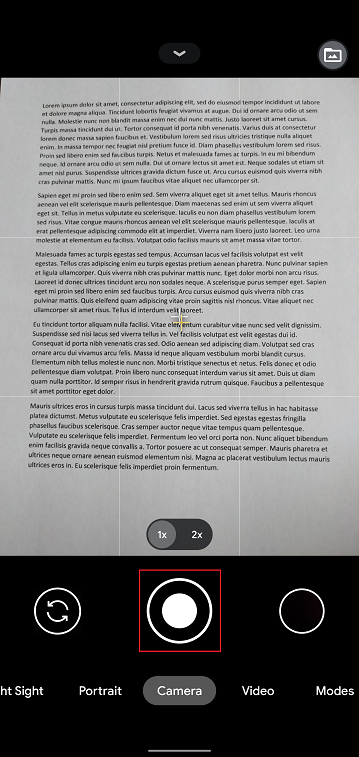

3. 确保光线均匀、充足,避免因为拿手机的姿势在文件上投下任何阴影。手机拿稳,防止抖动。点击拍照按钮拍照。

4. 确保照片清晰,文件字迹清楚。您可以用两个手指在图片上划开来放大图片查看细节。

如果图片质量或亮度不好,请重复上述步骤重新拍照。

5. 点击屏幕右下角的空白圈圈图标。

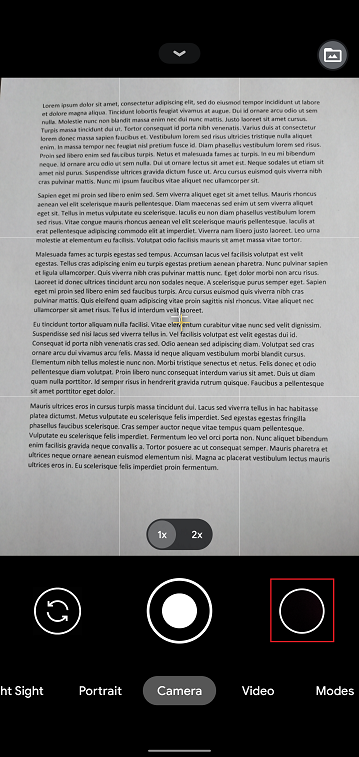

6. 点击屏幕左下角的分享图标。

7. 在显示的分享菜单中点击手机上安装好的电子邮件客户端的图标。下图显示的是Gmail,但手机设置不同,电子邮件程序也会不同。

.png)

注意:要发送电子邮件,您的手机必须有相应配置。如果不知道如何配置,请联系您的电子邮件供应商。

8. 请参见此处了解如何填写电子邮件收件人(To:)和主题(Subject:)。填写完毕后,点击右上方的飞机图标发送邮件。

电子邮件应该发送到哪里以及邮件主题应该写什么

应按照以下说明发送邮件:

1. 在收件人(To:)字段,输入:

- newaccounts@interactivebrokers.com(如果您是非欧洲国家居民)

- newaccounts.uk@interactivebrokers.co.uk(如果您是欧洲国家居民)

2. 主题(Subject:)字段必须注明所有以下信息:

- 您的账户号码(通常格式为Uxxxxxxx,其中x是数字)或您的用户名

- 发送文件的目的。请采用以下惯例:

- 居住地证明请写PoRes

- 身份证明请写PID

费用概览

我们鼓励客户和潜在客户访问我们的网站了解详细费用信息。

最常见的几项费用有:

1. 佣金——取决于产品类型和挂牌交易所,以及您选择的是打包式(一价全含)还是非打包式收费。例如,美国股票佣金为每股0.005美元,每笔交易最低佣金为1.00美元。

2. 利息——保证金贷款需缴纳利息,IBKR采用国际公认的隔夜存款基准利率作为基础来确定自己的利率。然后我们将分等级在基准利率基础上应用一个浮动值(这样余额越大对应的利率就越有利)来确定实际利率。例如,对于美元计价的贷款,基准利率是联邦基金利率,而10万美元以内的余额利率会在基准利率的基础上加1.5%。此外,卖空股票的个人应注意,借用“难以借到”的股票还会有一笔特殊费用,以日息表示。

3. 交易所费用——取决于产品类型和交易所。例如,对于美国证券期权,某些交易所会对消耗流动性的委托单(市价委托单或适销的限价委托单)收取费用、对添加流动性的委托单(限价委托单)给与补贴。此外,许多交易所还会对取消或修改的委托单收取费用。

4. 市场数据——您并非一定要订阅市场数据,但是如果不订阅市场数据,您可以会产生月费用,具体取决于供应交易所及其订阅服务。我们提供市场数据助手工具,可根据您想交易的产品帮助您选择适当的市场数据订阅服务。要访问该工具,请登录客户端,点击支持然后打开市场数据助手链接。

5. 最低月活动费用——为迎合活跃客户的需求,我们规定如果账户产生的月佣金能达到最低月佣金要求,则可免交月活动费用;而如果产生的月佣金未能达到最低月佣金要求,则需缴纳差额作为活动费用。最低月佣金要求为10美元。

6. 杂费 - IBKR允许每月一次免费取款,后续取款将收取费用。此外,还会代收交易取消请求费用、期权和期货行权&被行权费用以及ADR保管费用。

更多信息,请访问我们的网站,从定价菜单中选择查看。

开户过程中的手机验证

简介

IB要求客户验证其手机以便直接通过SMS接受账户和交易相关消息。未完成手机验证的客户将会受到交易限制,直至完成验证程序。验证需在线进行,下方为具体步骤。

如果您的账户已经开好,但尚未验证手机,请直接跳到KB2552完成验证程序。

手机验证

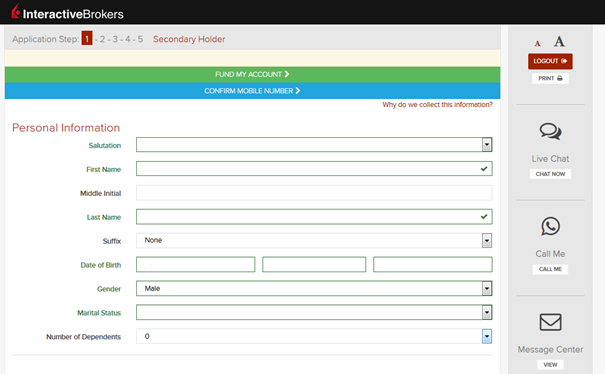

在填写盈透证券账户开户申请时,您会看到页面顶部有一个蓝色长条,写着“确认手机号码”。

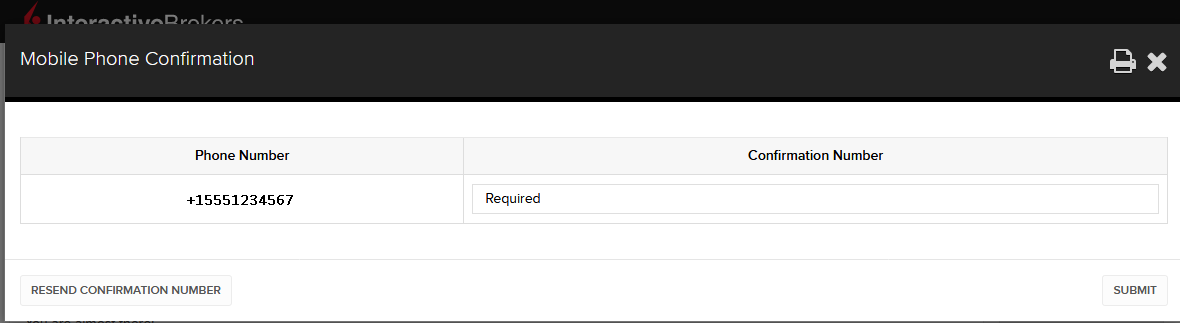

在1-4步中,您可随时点击这一蓝色长条。点击后,您会看到下方窗口:

您输入完整的手机号之后,系统会对号码进行识别并立即发送确认短信。在确认码框内输入您收到的短信码然后点击提交以完成手机号码验证。

如果在开户过程中无法完成这一项,您也可以随时通过申请状态页面完成确认。

.png)

请注意,可能会存在以下限制:

- 如果您参与了全国免扰电话登记(NDNC),则短信可能会被拦截。

- 由于反诈骗措施,虚拟号码供应商可能会遭到拦截。

- 某些运营商可能会限制短信接收时段。

手机收不到IBKR的短信(SMS)

在客户端中验证了手机号之后,您应该马上就能收到IBKR向您手机发送的短信(SMS)。本文阐述了在无法收到短信的情况下您可以采取的解决方法。

1. 激活移动IBKR验证(IB Key)作为双因素验证设备

为免受无线/手机运营商相关问题影响、稳定接收所有IBKR消息,我们建议您在手机上激活移动IBKR验证(IB Key)。

我们的手机验证以移动IBKR程序自带的IB Key作为双因素安全设备,因此在登录IBKR账户时无需通过SMS获取验证码。

移动IBKR程序目前支持在Android和iOS手机上使用。下方为安装、激活和操作说明:

2. 重启手机:

关机然后再重新开机。通常这样就能收到短信。

请注意,某些情况下,如漫游出运营商服务的范围时(在国外),您可能无法收到所有消息。

3. 使用语音回呼

如果重启手机后还是没能收到登录验证码,请可以选择“语音”。然后您会接到自动的语音回呼,告知您登录验证码。有关如何使用语音回呼的详细说明,请参见IBKB 3396。

4. 检查看是否您的手机运营商阻断了来自IBKR的SMS

某些手机运营商误将IBKR的短信识别为垃圾短信或不良内容,会自动对其进行阻断。您可以联系相应地区的相应部门检查您的手机号码是否有短信过滤:

美国:

- 所有运营商:Federal Trade Commission Registry

- T-Mobile:消息阻断设置请参见T-Mobile网站或直接在T-Mobile应用程序中查看

印度:

中国:

- 直接致电运营商询问其是否在阻断IBKR的消息

参考文章:

FaceKom面谈的系统要求

根据法规要求,盈透证券中欧有限公司(“IBCE”)须通过视频面谈的方式确认账户申请人的身份。面谈将通过监管当局认可的远程客户身份识别系统进行,该系统由FaceKom提供。以下是参加IBCE视频面谈的最低系统要求:

- 台式电脑、手提电脑或移动设备:安卓OS 4+ 及Chrome,或安卓5+内置Chrome,iOS Safari 11。

- 台式电脑/手提电脑支持的浏览器: Google Chrome v44或更新的版本,Mozilla Firefox v39或更新的版本,Opera(2018年以后),Microsoft Edge 15+ Safari 11。

- 硬件要求:Intel Core i3, i5或i7(AMD或同等配置),RAM:最小2GB。摄像头:推荐使用HD (720p)。