IBIS Statements

All IBIS subscribers, whether brokerage clients or not, receive a monthly statement detailing the subscriptions elected and their fees. In the case of brokerage clients, this information is included within the activity statements with billing taking place generally within the first week following the month in which service was received. In the case of non-brokerage clients, this information is provided on a monthly billing statement.

Regardless of client type, all statements (current and historic) are accessible via log in to Account Management.

Free Trial Considerations

IB currently offers a free 30 trial of each of the IBIS Basic Platform (regularly $69 per month), Research Bundle (regularly $39 per month) and various premium newswire and analyst report subscriptions (priced ala carte from $10 - $325 per month). This free trial is made available to both brokerage and non-brokerage clients, although brokerage clients receive the Basic Platform at no cost.

While there is no charge for subscriptions during the free trial period, if you do not cancel your subscription prior to the trial end you will automatically receive and be billed for the subscriptions originally selected each month thereafter. If you do not wish to be billed for these subscriptions, you would need to log into your account at any time prior to the end of the free trial and cancel the subscription.

Should you require any assistance logging into your account or managing your subscriptions, please contact your local Customer Service Center or the IBIS hotline at 1-203-618-7709.

Terminating Service (non-brokerage clients)

IBIS subscriptions renew monthly on a continuous basis until terminated either by client election or for non-payment. Clients may cancel the service by logging into Account Management and selecting the 'Cancel' menu option. As long as service is canceled prior to the billing date, no service fees will be incurred for the following month. If service is canceled on or after the billing date, no refund or proration of fees is provided. Regardless of whether cancellation takes place before or after the billing date, access to billed services will continue until the end of the month for which they have been paid.

Service will also be terminated if the billing charge is not honored by the credit card issuer due to invalid instructions, insufficient credit limit or an expired card. In each of these situations, IB will attempt to send an email notification of the matter prior to the initiation of the upcoming service period in an attempt to ensure continuity of service.

IBIS Billing Considerations

IBIS subscribers who are brokerage customers will have any monthly IBIS fees deducted directly from their account in a manner similar to and simultaneous with the fees assessed for any other (non-IBIS) market data subscriptions. For these accounts, subscriptions are offered on a monthly calendar basis, will billings performed in arrears and generally within the first week of the month following that in which the services were provided. In addition, fees for any IBIS subscriptions initiated mid-month will be prorated based upon the actual term of service provided.

IBIS subscribers who are not brokerage customers are billed on a monthly basis in advance of the month in which services are provided. Payment is made via the credit card provided at the point of registration or as updated via Account Management thereafter with the subscription cycle beginning on the same day each month as that at which service was initiated. Accepted credit cards include: Visa, Master Card, Discover & JCB

Market Data Exchange Access Fees

As a vendor of market data, IBKR is subject to various exchange agreements that specify and control the manner in which such data may be disseminated. In addition, some exchanges impose a monthly fee (also known as an Exchange Access Fee) on the vendor when real-time or delayed data is distributed.

The term Exchange Access Fee is generally used to describe an arrangement where the clients of an organization, such as a broker, obtain market data through our vendor agreement rather than through a direct agreement between the organization and exchange.

When an Exchange Access Fee exists, we allow an organization to opt out of the fee by restricting the ability of the organization's clients to subscribe to the exchange market data. However, the organization may enable client access to the market data subscriptions for a fee.

The table below illustrates existing Exchange Access Fees levied by Nasdaq, CBOE Global Markets and Deutsche Borse. Please note that the Exchange Access Fee for Deutsche Borse has been waived from February 1, 2021 until further notice. Exchange Access Fees for Nasdaq and CBOE Global Markets has been in effect since December 1, 2016.

|

Exchange Access Product

|

Exchange Access Fee

|

Client Enabled Subscription

|

|

BATS EU Exchange Access Fee

|

GBP 950

|

· European (BATS/Chi-X) Equities (P, L2)

· European (BATS/Chi-X) Equities (NP, L2)

|

|

Nasdaq MFDS Exchange Access Fee

|

USD 150

|

· US Mutual Funds (P,L1)

· US Mutual Funds (NP, L1)

|

|

Nasdaq GIDS Exchange Access Fee

|

USD 800

|

· Nasdaq Global Index Data Service (P)

· Nasdaq Global Index Data Service (NP)

|

|

Nordic Equity Exchange Access Fee for Nonprofessional

|

EUR 800

|

· Nordic Equities (NP, L1)

· Nordic Equities (NP, L2)

|

|

Nordic Equity Exchange Access Fee for Professional

|

EUR 2,140

|

· Nordic Equities (P, L1)

· Nordic Equities (P, L2)

|

|

Deutsche Borse Indices and Xetra ETF & Volatility Indices Exchange Access Fee

|

Fee Waived

|

· German ETFs and Indices (P, L1)

· German ETFs and Indices (NP, L1)

|

|

Eurex Core Exchange Access Fee

|

Fee Waived

|

· Eurex Core (P, L2)

· Eurex Retail Europe (NP, L1)

· Eurex Core (NP, L1)

· Eurex Core (NP, L2)

|

|

STOXX Indices Exchange Access Fee

|

Fee Waived

|

· STOXX Index Real-Time Data (P)

· STOXX Index Real-Time Data (NP)

|

|

Xetra Core Exchange Access Fee

|

Fee Waived

|

· Spot Market Germany (Frankfurt/Xetra) (P, L1)

· Spot Market Germany (Frankfurt/Xetra) (P, L2)

· Spot Market Germany (Frankfurt/Xetra) (NP, L1)

· Spot Market Germany (Frankfurt/Xetra) (NP, L2)

|

| Tradegate Exchange Access Fees | Fee Waived | Tradegate (L1) |

The table reads as follows: An organization pays EUR 800 for the Nordic Equity Exchange Access Fee for Non-professional product, which gives the organization’s clients the option to subscribe to Nordic Equities (NP, L1) or Nordic Equities (NP, L2).

Market Data Considerations for the Paper Trading Account

As a licensed distributor of exchange market data, IBKR is obligated to respect constraints imposed by the exchanges which serve to govern the dissemination and/or retransmission of this data.

As a general rule, within a given account, the real user can activate and maintain its own set of market data subscriptions. The paper user, by design, does not have a set of market data subscription on its own but can be configured in one of the following ways:

-

The paper user can be set to share2 the live market data subscriptions of the real user:

In this scenario, if the real and paper trading sessions are running simultaneously, they must reside on the same device in order for the paper to receive live market data. If this is not the case, the real trading session will be still afforded the real-time market data but the paper trading session will not receive any data3 . Please see the section CASE 1 below for details.

-

The paper user can be set NOT to share2 the live market data subscriptions of the real user:

In this scenario, the real and paper trading sessions are independent, in respect of market data flows. Hence, they can run simultaneously on the same or on different devices and the paper user will receive delayed data, as available. Please see the section CASE 1 below for details.

-

In case the account possess multiple real users, the paper user can be set to share2 the live market data subscriptions of a chosen one.

Clients who wish to run real and paper sessions simultaneously and on different devices (e.g., stand-alone PC, smart phone, tablet), may create an additional real user for their account, as explained here: Adding a second user for an individual account holder. While this approach will result in additional fees for any paid market data subscriptions elected, it will allow maintaining different subscription sets. In this scenario, the client will be able to select2 which real user will share his subscriptions with the paper user, allowing the other real user and the paper trading sessions to run simultaneously on different devices. Please see the section CASE 2 below for details.

Example Cases:

| Location of real_user session | Location of paper_user session | Sharing of live market data between real_user and paper_user is active? | Type of market data received by real_user | Type of market data received by paper_user |

| DEVICE1 | DEVICE2 | YES | LIVE | NO DATA3 |

| DEVICE1 | DEVICE1 | YES | LIVE | LIVE |

| DEVICE1 | DEVICE2 | NO | LIVE | DELAYED |

| DEVICE1 | DEVICE1 | NO | LIVE | DELAYED |

| USER NOT LOGGED IN | DEVICE1 | YES | N/A | LIVE |

| USER NOT LOGGED IN | DEVICE1 | NO | N/A | DELAYED |

| Location of real_user1 session | Location of real_user2 session | Location of paper_user session | paper_user is mirroring the subscriptions of | Type of market data received by real_user1 | Type of market data received by real_user2 | Type of market data received by paper_user |

| USER NOT LOGGED IN | DEVICE1 | DEVICE2 | real_user1 | N/A | LIVE | LIVE |

| USER NOT LOGGED IN | DEVICE1 | DEVICE1 | real_user1 | N/A | LIVE | LIVE |

| DEVICE1 | USER NOT LOGGED IN | DEVICE2 | real_user1 | LIVE | N/A | NO DATA3 |

| DEVICE1 | USER NOT LOGGED IN | DEVICE1 | real_user1 | LIVE | N/A | LIVE |

| USER NOT LOGGED IN | DEVICE1 | DEVICE2 | real_user2 | N/A | LIVE | NO DATA3 |

| USER NOT LOGGED IN | DEVICE1 | DEVICE1 | real_user2 | N/A | LIVE | LIVE |

| DEVICE1 | USER NOT LOGGED IN | DEVICE2 | real_user2 | LIVE | N/A | LIVE |

| DEVICE1 | USER NOT LOGGED IN | DEVICE1 | real_user2 | LIVE | N/A | LIVE |

| DEVICE1 | DEVICE1 | DEVICE2 | real_user1 | LIVE | LIVE | NO DATA3 |

| DEVICE1 | DEVICE1 | DEVICE1 | real_user1 | LIVE | LIVE | LIVE |

| DEVICE1 | DEVICE2 | DEVICE2 | real_user2 | LIVE | LIVE | LIVE |

| DEVICE1 | DEVICE1 | DEVICE2 | real_user1 | LIVE | LIVE | NO DATA3 |

| DEVICE1 | DEVICE1 | DEVICE2 | Set NOT to mirror | LIVE | LIVE | DELAYED |

| DEVICE1 | DEVICE1 | DEVICE1 | Set NOT to mirror | LIVE | LIVE | DELAYED |

| DEVICE1 | DEVICE2 | DEVICE1 | Set NOT to mirror | LIVE | LIVE | DELAYED |

| DEVICE1 | DEVICE2 | DEVICE2 | Set NOT to mirror | LIVE | LIVE | DELAYED |

Notes

-

Trader Workstation (TWS)

-

IBKR Mobile

-

Web Trader

-

Client Portal

3. No Data: On the paper session, the trading platform will display a warning message containing: “...production username associated with this paper-trading username is also running on...”

Change Your Billable Account

If you have additional linked, duplicate or consolidated accounts, the Billable Account section appears on the Market Data Subscriptions screen. Use the Billable Accounts panel to change the account that is currently being billed for market data.

To change your billable account

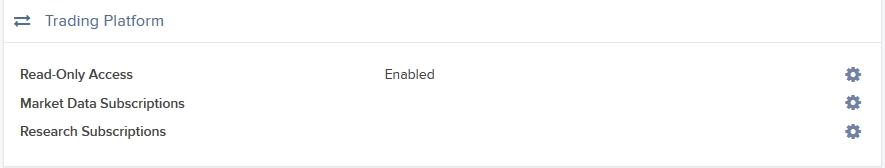

1. Click Settings > User Settings

2. In the Trading Platform panel, click the Configure (gear) icon for Market Data Subscriptions.

The Market Data Subscription screen opens.

3. Click the Configure (gear) icon in the Billable Account panel.

4. Select the account you want to be billed for market data, then click Save.

Beginning with the next billing cycle, your market data subscriptions will be billed to the account you selected.

Market Data Price Changes Effective January 1, 2011

Effective January 1, 2011, the monthly fees for the below noted market data subscriptions will be increased in accordance with exchange billing practices.

This serves as a reminder to the market data price change notification sent December 17, 2010, as well as to inform clients who may have subscribed to the affected feeds since then.

If you no longer wish to subscribe to any of the below noted data feeds at the new monthly tariffs, you must unsubscribe through Account Management / Trading Access / Market Data Subscriptions, prior to January 1, 2011 to avoid being billed at the higher rate.

Should you have any questions regarding these changes, please create an inquiry ticket via the Message System within Account Management, referencing the subscription name and ID number therein.

| SUBSCRIPTION | ID | CURRENT FEE | NEW FEE |

| Eurex - DJ STOXX Indices | 229 | 5 EUR | 8 EUR |

| German Indices & Xetra ETF's | 418 | 4 EUR | 6 EUR |

| Venture Market by Price Level II | 448 | 14 CAD | 16 CAD |

| Toronto Market by Price Level II | 449 | 27 CAD | 30 CAD |

| Euronext.Liffe Commodities Derivatives Level I | 155 / 255 | 15 EUR | 20 EUR |

| Euronext.Liffe Commodities Derivatives Level II | 156 / 256 | 20 EUR | 25 EUR |

| Euronext.Liffe Equity Derivatives and Indices Level I | 265 | 30 EUR | 35 EUR |

| Euronext.Liffe Equity Derivatives and Indices Level II | 266 | 36 EUR | 45 EUR |

| Euronext.Liffe Interest Rate Derivatives Level I | 153 / 253 | 32 EUR | 38 EUR |

| Euronext.Liffe Interest Rate Derivatives Level II | 154 / 254 | 40 EUR | 45 EUR |

Account Linkage FAQs

Q: Which accounts are eligible for linkage?

A: Eligible accounts include Independent individual and IRA accounts which have matching country and state of legal residence and account title.

Q: What are the benefits of linkage?

A: The principal benefits of linkage are ease of access and potential savings in market data subscription fees. Following linkage, all accounts will be accessed via a single User Name, password and SLS device. After login to the trading platform or Client Portal Management you will be provided with a drop-down window for selecting the account you wish to trade or perform administrative tasks thereby eliminating the need to memorize multiple login information or maintain additional security devices.

In addition, as market data subscriptions are billed at a session level (i.e., User Name) and only a single TWS session can be viewed for any one user at a given time, account holders previously maintaining duplicate market data subscriptions for multiple accounts have the opportunity to consolidate those following linkage.

Q: If I link two accounts enrolled in SLS, are there any restrictions with respect to the security device which will remain following linkage?

A: Yes. In the case of a linkage request where the two accounts are SLS enrolled but maintain different devices, IBKR requires that the account holder retain the device having the highest protection rating as noted at the time of your request.

Q: What do I do with security devices which no longer are operable following linkage?

A: In the case of Security Code Cards, you may discard of the device once the linkage has been processed. For all other devices, you will need to return the device to IBKR to ensure that your account is not assessed a lost device fee. Click here for additional information regarding returning your device.

Q: Can I maintain multiple groups of linked accounts?

A: No. Once an account linkage has been requested and processed, all subsequent requests must be linked to that original grouping

Q: Can I unlink accounts which have already been linked?

A: No. Once a link has been established it is permanent and cannot be undone.

Q: Why has the linkage request which I submitted not been processed?

A: Linkage requests are automatically processed as of the close of business on the day submitted when accounts are SLS enrolled and the individual information on record identical (e.g. mailing address, telephone numbers, email address, etc.). If any of these conditions are not met, the linkage request will not be processed until SLS enrollment is complete and/or Compliance review of the information changes and any supporting documentation necessary to evidence the change has been received.

Q: Once linked, from which account will market data subscription fees be deducted?

A: Account holders are allowed to designate a billing account from which all market data fees may be deducted. We recommend that you select the account which generates the greatest level of commission activity if your subscription provides for fee waiver should your monthly commissions reach a minimum threshold (e.g., U.S. Securities & Commodities Market Data Bundle). IBKR will only look to the activity conducted in the billing account to determine waiver eligibility rather than aggregating the commission activity across all linked accounts. In selecting the billing account, consideration should also be given to selecting an account having the greatest level of equity as well as cash. This will minimize situations where the account has insufficient cash and the billing serves to increase the margin debit balance or where the account does not have margin permissions or maintains insufficient equity with loan value which, in both cases, will result in the liquidation of positions to cover the fees. IBKR will not act to automatically transfer cash across linked accounts to meet subscription obligations.

Q: If I link two accounts, will I have any restrictions on short sales?

A: Accounts owned by the same beneficial owner are considered in a consolidated manner when determining the ability to sell a stock short. If account A is long 100 shares and account B is short 100 shares, a new order to sell shares in either account A or account B will be considered a short sale, as overall the accounts hold a 0 position. The new sell order would be subject to any applicable locate requirements.

Why is there no "Last" price for Forex pairs?

The Last column does not show the most recent trade for currency pairs but either the midpoint of the most recent bid/ask price or if not available then the previous day closing price. This is not a market data error but rather the nature of the Forex market.

The global Forex market is what is referred to as an "OTC" (Over the Counter) market. Unlike the options, futures or listed equity markets, there is no central reporting facility for OTC markets, including Forex. Hence there is no official "tape". The Last Traded Price for Forex depends entirely upon where you look. Bloomberg, Reuters, Yahoo, Google, IB, etc will all have different combinations of pools of liquidity from which they are gleaning this information. Since there is no official "Last Price" for Forex, IB cannot report one on our TWS. The previous day's closing price is the last traded price from the liquidity providers IB does business with. It may not match the last traded price for the previous day from other agencies who might have access to additional--or less--liquidity providers than does IB.