口座開設手続きの進捗状況はどうやって確認できますか?

お申込みの進捗状況は、IBKR.com/app-statusからログインしてご確認いただくことができます。

審査手続きを速めるため、以下の推奨事項をご活用下さい。

- 資金がご入金されているお申込みは優先的に審査が行われます。なんらかの理由でお申込みが承認されない場合、ご資金は速やかに返却されます。

- ログインして必要書類がすべて提出されているかをご確認下さい。書類の抜け漏れが最も多い遅延理由となっています。

- お申込書に記載されるメールアドレスのコンプライアンスチームからのメールが届いていないか、定期的に確認して下さい。オンラインでのお申込完了後、追加書類や説明が必要な場合には、コンプライアンスよりメールにてご連絡致します。

- すべての書類が提出され受理された後、デューデリジェンスと審査が完了するまでお待ち下さい。

どのIBKR事業体が私の口座管理していますか?

口座を保有されるお客様は、アクティビティーステートメントの上に表示される情報からお客様のお口座を管理するIBKRの事業体をご確認いただくことができます。

- Interactive Brokers LLC (IB LLC)

- Interactive Brokers Canada Inc (IBC)

- Interactive Brokers (U.K.) Limited (IBUK)

- Interactive Brokers Ireland Limited (IBIE)

- Interactive Brokers Central Europe Zrt. (IBCE)

- Interactive Brokers Luxembourg SARL (IBLUX)

- Interactive Brokers Australia Pty. Ltd. (IBA)

- Interactive Brokers Hong Kong Limited (IBHK)

- Interactive Brokers (India) Pvt. Ltd. (IBI)

- Interactive Brokers Securities Japan, Inc. (IBSJ)

- Interactive Brokers Singapore Pte. Ltd. (IBSG)

なぜ個人の雇用に関する情報を金融機関に開示する必要があるのでしょうか?

FINRAルール3210では、会員企業(雇用者会員)と関連性のある申請者は、IBKR(執行会員)における口座を開設する前に、雇用者会員の書面による同意を得る必要があります。 また、この規則では、雇用者会員との関連性を通知することが必要となります。IBKRもまた、同様の米国以外の規制の対象となります。

他の証券会社や金融機関に雇用されている、または提携している申請者は、IBKRが要求に応じて雇用者企業に取引データを提供するため、雇用者企業の連絡先を記載した書類の提出を求められることがあります。申請者が金融機関に勤務されていて、書類が提出されていない場合には、FINRAルール3210が適用とならないことの確認のために、IBKRより申請者に連絡を取ることがあります。

スマートフォンを利用してIBKRにドキュメントを送信する方法

インタラクティブ・ブローカーズでは、お客様がスキャナを利用できない場合にドキュメントのコピーを受付けています。スマートフォンで必要ドキュメントの写真を撮ってお送りください。

こちらでは、以下のスマートフォンのOSで、写真を撮ってメールで送信する方法をご説明致します:

スマートフォンで写真を撮ってメールで送信する方法をすでにご存知の方は、こちらの「メールの送信先および件名に含める内容」をご覧ください。

iOS

1. スマートフォン画面の下から上にスワイプして、カメラのアイコンをタップしてください。

カメラのアイコンがない場合には、ホーム画面のカメラアプリのアイコンをタップしてください。

通常はこの時点でリアカメラが有効化されています。フロントカメラが有効化されている場合には、切り替えボタンをタップしてください。

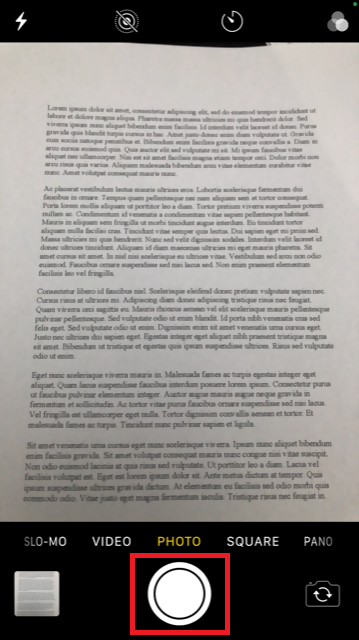

2. ドキュメントにiPhoneをかざし、必要な部分またはページを枠内に入れます。

3. 光が十分に当たっていて、ポジションのせいでドキュメントに影ができないようにしてください。 スマートフォンが震えないように、手でしっかり持ってください。シャッターボタンをタップして写真を撮ります。

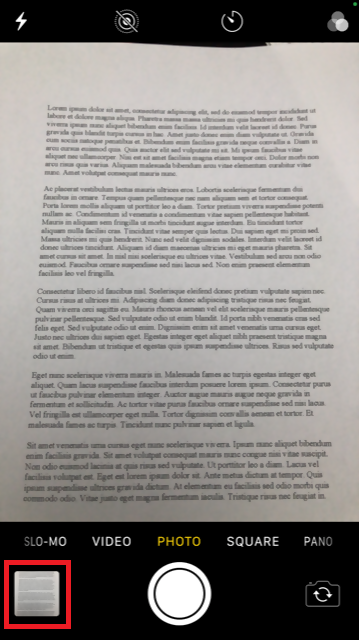

4. 左下のサムネイルイメージをタップして、写真にアクセスしてください。

5. 写真がはっきりしていて、ドキュメントが読めることを確認してください。詳細を見る場合には、2本の指で写真を拡大して確認してください。

良く見えない場合や、光が十分でない場合には、前の手順を繰り返して、はっきりとした写真を撮ってください。

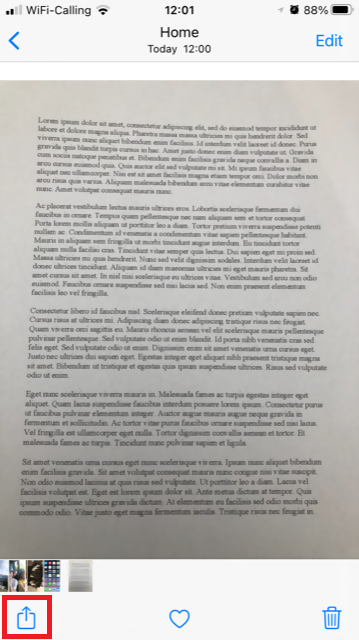

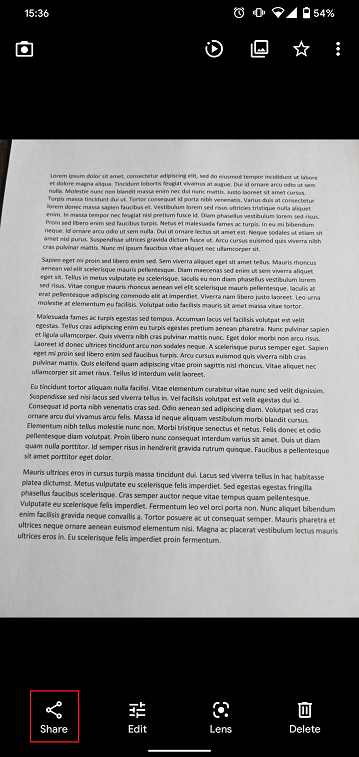

6. 画面の左下にある共有アイコンをタップしてください。

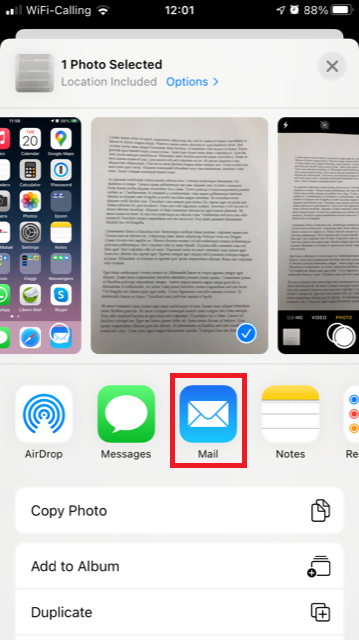

7. メールアイコンをタップしてください。

注意事項: メールの送信にはこの機能が設定されている必要があります。この手順を使い慣れていない場合には、メールプロバイダーにお問合せください。

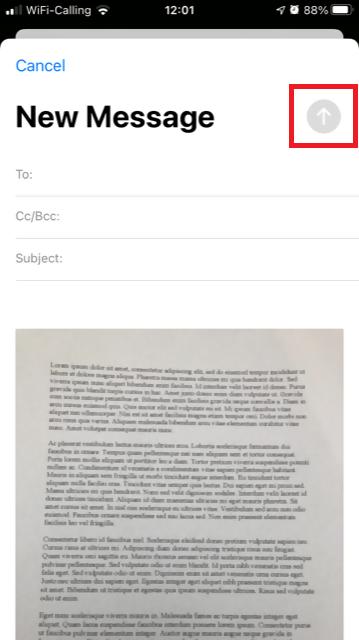

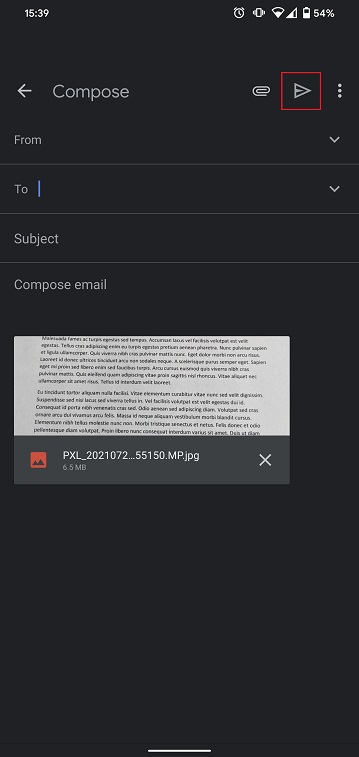

8. メールの送信先:と件名:欄の表示の仕方は、こちらをご参照ください。メールが完了したら、右上の上向きの矢印をタップして送信してください。

アンドロイド

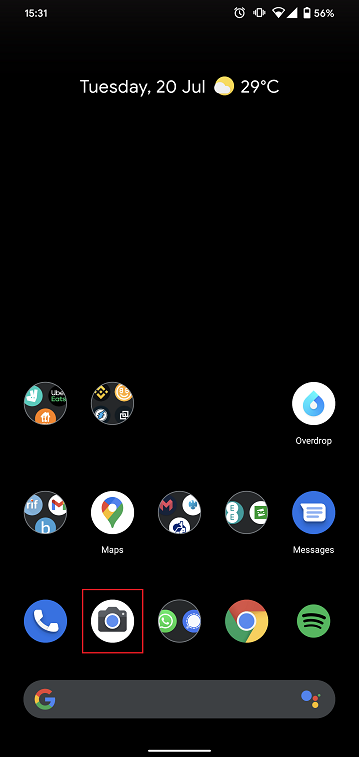

1. アプリのリストを開いて、カメラアプリを起動するか、ホーム画面から起動してください。スマートフォンのモデル、ブランド、または設定によってアプリの名前が異なることがあります。

通常はこの時点でリアカメラが有効化されています。フロントカメラが有効化されている場合には、切り替えボタンをタップしてください。

2. ドキュメントにスマートフォンをかざし、必要な部分またはページを枠内に入れます。

3. 光が十分に当たっていて、ポジションのせいでドキュメントに影ができないようにしてください。 スマートフォンが震えないように、手でしっかり持ってください。シャッターボタンをタップして写真を撮ります。

4. 写真がはっきりしていて、ドキュメントが読めることを確認してください。詳細を見る場合には、2本の指で写真を拡大して確認してください。

良く見えない場合や、光が十分でない場合には、前の手順を繰り返して、はっきりとした写真を撮ってください。

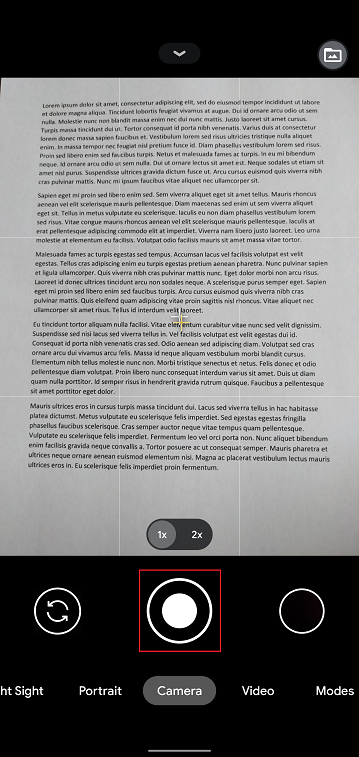

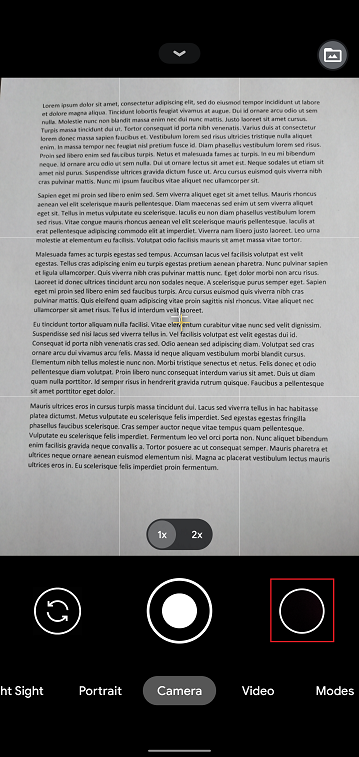

5. 画面の右下にある、黒丸のアイコンをタップしてください。

6. 画面の左下にある共有アイコンをタップしてください。

7. ここで表示される共有メニューから、スマートフォンに設定されているメールクライアントのアイコンをタップしてください。下記の例ではGmailですが、お客様の設定により別の名前のことがあります。

.png)

注意事項: メールの送信にはこの機能が設定されている必要があります。この手順を使い慣れていない場合には、メールプロバイダーにお問合せください。

8. メールの送信先と件名欄の表示の仕方は、こちらをご参照ください。メールが完了したら、右上の飛行機の矢印をタップして送信してください。

メールの送信先および件名に含める内容

メールの作成にあたっては、下記のインストラクションをご参照ください:

1. 送信先:の欄に以下を入力してください:

- ヨーロッパ以外の国に居住される方は、newaccounts@interactivebrokers.comをご利用ください。

- ヨーロッパに居住される方は、newaccounts.uk@interactivebrokers.co.ukをご利用ください。

2. 件名:の欄には、下記をすべて入力してください:

- お客様の口座番号(通常はxが数字で、Uxxxxxxxのフォーマットになります)またはユーザー名。

- ドキュメントの送信目的。以下の名前付け規則を使用してください:

- PoRes:居住地住所を証明する書類

- PID:本人確認書類

携帯電話でIBKRからのテキストメッセージ(SMS)を受信することができません

携帯電話の番号がクライアント・ポータルで認証され次第、IBKRより直接お客様の携帯電話にテキストメッセージ(SMS)が送信されるようになります。こちらのページではメッセージの受信に問題がある場合の基本的な解決策をご説明します。

1. 二段階認証プロセス用にIBKRモバイル認証(IB Key) を有効化する

無線/通信会社の問題に左右されずに、IBKRより送信されるすべてのメッセージを安定して受信するために、スマートフォンでIBKRモバイル認証(IB Key)を有効化することをお勧めします。

IBKRモバイルアプリで利用可能な携帯電話でのIB Key認証は二段階認証プロセスとして機能します。このためIBKR口座にログインする際に、SMSで認証コードを受信する必要がなくなります。

現在、IBKRモバイルアプリは、アンドロイドまたはiOS のOSを搭載したスマートフォンに対応しています。インストール、有効化および管理に関する手順は以下のリンクよりご確認ください:

2. 携帯電話の再起動:

デバイスのスイッチを完全に切ってから再起動してください。通常はこの作業でテキストメッセージを受信できるようになります。

通信会社のカバー圏外(外国)でローミングが必要な場合などは、すべてのメッセージを受信できないことがあります。

3. ボイスコールバック機能の使用

スマートフォンを再起動してもログイン認証コードが配信されない場合には、代わりに「ボイス」機能を選択することもできます。この機能を選択すると自動音声によるコールバックでログイン認証コードを受信することができます。ボイスコールバック機能の使用方法は、IBKB 3396をご参照ください。

4. 通信会社がIBKRからのSMSをブロックしているかの確認

通信会社によってはIBKRからのテキストメッセージをスパムなどと認識し、自動的にブロックすることがあります。お住まいの地域に応じて、お使いの電話番号にSMSフィルターが適用されているかどうかの確認に、以下のサービスにお問合せください:

米国内:

- すべての通信会社: Federal Trade Commission Registry

- T-Mobile: メッセージブックの設定は、T-Mobileウェブサイトまたは、T-Mobileアプリで直接行うことができます

インド内:

- すべての通信会社: Telecom Regulatory Authority of India

中国内:

- 通信会社に直接電話して、IBKRからのメッセージをブロックしているかどうか確認してください

参考文献:

口座開設中の携帯電話番号の認証

イントロダクション

口座や取引に関する連絡をSMSで直接受信するには、お客様の携帯電話番号の認証が必要になります。 携帯電話番号を認証されていないお客様は、この作業が完了するまで取引制限の対象となります。下記の手順に従って、オンラインで認証作業を完了させてください。

お口座の開設がすでに完了していて携帯電話番号の認証がお済でないお客様は、KB2552に直接進んで認証手続きを完了させてください。

携帯電話番号の認証

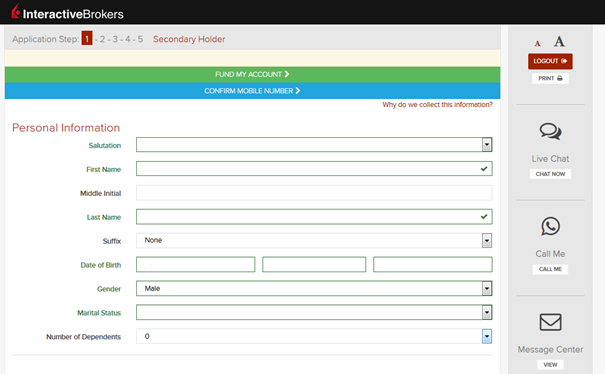

インタラクティブ・ブローカーズ口座のお申込み手続きが完了すると、ページの上部に「携帯番号の確認」という青いバーが表示されます。

このバーは手順1-4の間、いつでもクリックすることができます。クリックすると次の画面が表示されます:

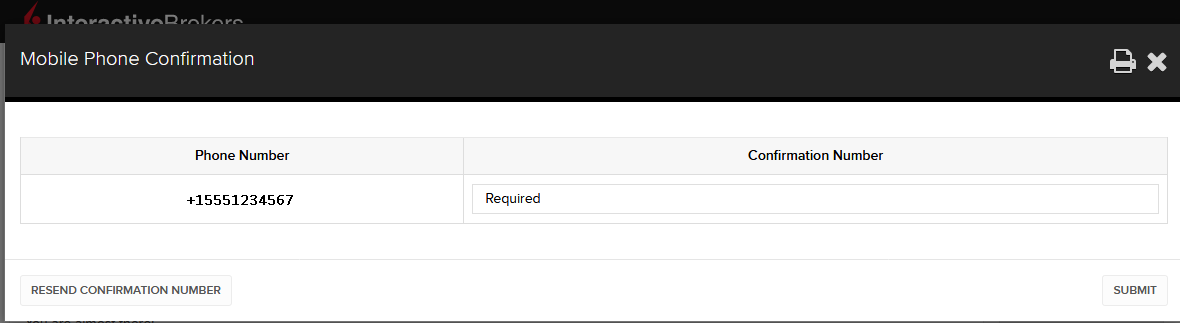

番号を完全に入力するとシステムが認識し、確認メッセージがすぐに送信されます。確認コードで受信したSMSコードを入力して、送信をクリックしてください。

お申込み手続き中に認証作業ができない場合には、「お申し込みの進捗状況」からいつでもできます。

.png)

規制が適用されることもありますので、下記にお気をつけください:

- お住まいの国のNDNC(National Do Not Call)サービスをご利用の場合にはSMSメッセージがブロックされる可能性があります。

- 詐欺防止対策のため、仮想番号プロバイダーはブロックされる可能性があります。

- 通信会社によっては、SMSメッセージの配信時間に制限がある場合があります。

諸費用に関する概要

お客様および将来的に弊社のご利用をお考えの方は、料金の詳細が記載されている、弊社のウェブサイトをご覧いただくことをお勧め致します。

最も共通的な手数料や諸費用の概要は以下のようになります:

1. 手数料 - 商品の種類や上場取引所、またセットプラン(すべて一括)や別プランかなどの選択によって異なります。例えば米国株の場合、取引あたり$1.00を最低限として、1株あたり$0.005を手数料として設定しています。

2. 金利 - 証拠金によるマイナス残高には金利がかかりますが、弊社では国際的に認められたオーバーナイトのベンチマークを使用して金利を決定しています。さらに、ベンチマーク金利(「BM」)にスプレッドを適用し、残高が大きいほど金利が高くなるように設定して、実効レートを決定しています。 例えば、米ドル建てのローンの場合、ベンチマーク率はフェドファンドの実行レートで残高が10万ドル以下の場合には、ベンチマーク1.5%のスプレッドが追加されます。 また株式の空売りの際には、これをカバーするために借りた株式が「借入困難な銘柄」とみなされる場合、日次で表示される特別な手数料が適用されます。

3. 取引所手数料 - これもまた商品の種類や上場取引所によって異なります。例えば、米国の証券オプションの取引所では、流動性が失われると(成行注文または約定のつく指値注文)支払い手数料が発生し、また流動性が追加されると(指値注文)受取り手数料が発生することがあります。また、多くの取引所では注文のキャンセルや変更に手数料を設けています。

4. マーケットデータ - マーケットデータのご購読は必要ありませんが、購読する場合には、ベンダーの取引所と購読サービスによっては月額料金が発生することがあります。弊社では、お客様が取引を希望される商品に応じて、適切なマーケットデータ購読サービスを選択するための、マーケットデータ・アシスタントツールをご提供しています。ポータルにログインしてサポートの項目をクリックし、マーケットデータ・アシスタントのリンクを選択してください。

5. 月間最低アクティビティ手数料 - 弊社ではアクティブなトレーダーのお客様を対象としているため、毎月最低額の手数料が発生しない場合には、差額をアクティビティ手数料としてお支払いいただきます。最低額は月あたり$10です。

6. その他の諸費用 - IBKRでは月に1回の出金は無料になっていますが、それ以降の出金には手数料が設定されています。また、取引のバスト・リクエストやオプションや先物の権利行使や割当て、ADRカストディアン手数料など、お客様にパススルーされる手数料があります。

さらに詳しい情報は、弊社ウェブサイトの「諸費用・海外口座手数料」のメニューより該当するオプションを選択してご確認ください。

FaceKomによるビデオインタビューに必要となる動作環境

Interactive Brokers Central Europe ZRt(「IBCE」)では規制により、口座開設にお申込みいただくお客様のビデオインタビューでのご本人様確認を義務付けられております。インタビューは規制に則り、FaceKomを利用してリモートでのお客様確認となります。以下はIBCEのビデオインタビューに必要な動作環境です:

- PC、ノートPC、またはモバイルデバイス: Android OS 4+ およびChrome、またはChromeビルトインのAndroid 5+ 、iOS Safari 11+。

- PC / ノートPCにご利用可能なブラウザー: Google Chrome v44以上、Mozilla Firefox v39以上、2018年以降のOpera、Microsoft Edge 15+、Safari 11。

- ハードウェア要件: Intel Core i3、i5、i7(AMDまたはこれと同等のもの)、RAM: 最低2GB。カメラ: HD(720p)を推奨。

System requirements for FaceKom interviews

Interactive Brokers Central Europe ZRt ("IBCE") is required, by regulation, to confirm applicant's identity via video interview. Interviews are conducted using a regulatory compliant remote client identification system offered by FaceKom. The minimum system requirements necessary to participate in the IBCE video interview are as follows:

- PC, laptop or mobile devices: Android OS 4+ and Chrome or Android 5+ with built-in Chrome, iOS Safari 11+.

- Supported browsers from PC / laptop: Google Chrome v44 or later, Mozilla Firefox v39 or later, Opera (since 2018), Microsoft Edge 15+ Safari 11.

- Hardware requirements: Intel Core i3, i5, or i7 (AMD or equivalent), RAM: minimum 2GB. Camera: HD (720p) is recommended.