The Hungarian Social Contribution Tax

The Hungarian Government passed a new bylaw, Government Decree 205/2023 (V.31) on 31 May, 2023, that requires Hungarian financial providers to withhold a Social Contribution Tax on certain capital gains and interest payments and remit these amounts directly to the government.

You will find the answers to the main questions below:

What type of interest is subject to the Hungarian Social Contribution Tax (TAX)?

Interest coupon payments on Bonds, ETFs, closed-end ETFs and mutual funds purchased after July 1, 2023 are subject to the TAX.

Bonds – on both the coupon payment and the capital gains.

ETFs, Closed End Funds and Mutual Funds – The dividend payment is considered as interest and therefore subject to this tax.

ETFs, Closed End Funds and Mutual Funds that are traded in non-EEA or other countries that do not have a tax treaty with Hungary are subject to the Capital Gain Tax.

What is the standard TAX Rate?

The standard TAX rate is 13%.

If I earn interest through Bond Coupons, am I required to pay the TAX?

Yes.

When is the 13% TAX rate applied to my account?

The 13% TAX rate is applied to your account on the date when the interest coupon or the proceeds on the sale of certain types of ETFs and mutual funds (see above) are credited to your account. You will find the withheld TAX amount as a separate line item in your Activity Statement.

What currency is used for the TAX?

The TAX is withheld in the same currency in which the interest coupon or proceeds have been credited.

I am not a Hungarian resident. Do I have to pay the TAX?

Non-Hungarian residents are not affected by the TAX. The TAX is withheld based on the declaration provided by you on your tax residency.

Does the TAX apply to clients who are companies?

No.

Does the TAX apply to interest I earn through the Cash Yield Enhancement Program?

No.

Does the TAX apply to interest I earn through the Stock Yield Enhancement Program?

Under the existing rules, the TAX may apply to your interest earned through the Stock Yield Enhancement Program.

Why is trading of tax-impacted instruments limited?

Due to the duration between the announcement of the bylaw and its effective date, IB is unable to deploy the required tax withholding properly across its full global product set. To ensure correct adherence to the regulation, we must temporarily limit the ability to open new positions in affected products. Closing transactions in pre-existing positions will not be impacted. We will inform you as soon as the trading restrictions for the tax-impacted instruments have been removed.

Irish Tax Withholding Reclaim Process

Interactive Brokers Ireland Limited (IBIE) must apply Irish withholding tax of 20% on credit interest paid to certain clients, including natural persons. However, you may be able to reclaim some or all of the tax withheld, if you are resident in a country with a Double Taxation Treaty (DTT) with Ireland, which includes all EEA countries.

To reclaim withholding tax, you must complete Form IC7. This article explains how to do this. You can find the form at this link:

https://www.revenue.ie/en/self-assessment-and-self-employment/documents/form-ic7.pdf

You may also be interested in our explanation on how to apply for an exemption from or reduction in the rate of withholding tax applicable to your future credit interest payments, which you can find here.

How to Reclaim Withholding Tax

Step 1: Complete the following information:

1. Under section entitled Name of claimant – please fill in full Capital Letters.

Full Name,

Foreign Tax Ref. No.

Revenue File Ref. No. (If known.)

Address:

Tel No.:

E-mail:

2. Under section entitled Agent – only complete this section if you would like enquiries to be sent to your Agent.

Name:

Address:

Tel No.:

E-mail:

Step 2: Answer and complete questions numbered 1-6,

|

|

QUESTION |

ANSWER |

|

1 |

Please state the name, address and Irish tax reference number of the Irish entity making the payments. |

Interactive Brokers Ireland Limited North Dock One, 91/92 North Wall Quay, Dublin 1 D01 H7V7, Ireland TRN: 3674050HH |

|

2 |

State the relationship, if any, between you and the Irish entity making the payments. |

Client |

|

3 |

Please confirm that the payments are made on ‘an arms length Basis’ |

Confirmed: All credit interest payments made by IBIE to clients are on an arm’s length basis |

|

4 |

Please state the rate of the payments |

Variable |

|

5 |

Please state the date of the first payment |

Please refer to the annual statement to determine date of first payment (available on client portal). |

|

6 |

Please state the term of the Agreement. |

Indefinite |

|

7 |

Is the payment in question arising from a Permanent Establishment (P.E.) or fixed base maintained by you in Ireland |

Please complete |

Step 3: Complete the declaration with your country of residence in both blank sections.

Step 4: Sign and date the Form underneath the declaration.

Step 5: Insert the amount you are claiming following “Amount Claimed”.

You can find the amount claimed on Form R185, which is available in IBIE’s client portal in the Tax Forms (see the section marked Tax Deducted).

“Amount Claimed in €________: if claiming a refund of Irish tax on payments already made”

Step 6: Complete the section on payment details in the next box, include details of the account to which you wish to receive the payment from Revenue.

Step 7: Ensure the last section is completed and stamped by the tax authority in your country of residence.

Note: If your tax authority will not stamp the form, Irish Revenue may accept a certificate of tax residence, which can be attached instead of having that section completed.

Step 8:

Post or email the following to International Claims Section, Office of the Revenue Commissioners, Nenagh, Co Tipperary, E45 T611, Ireland or intclaims@revenue.ie:

i) Form IC7,

ii) Form R185 (which is available in IBIE’s client portal in the Tax Forms section),

iii) The IBIE Customer Agreement found at this link or alternatively you can just send the link to the customer agreement (in the email or in a cover letter via post), https://www.interactivebrokers.ie/en/accounts/forms-and-disclosures-client-agreements.php, and

iv) Your certificate of tax residence (if required):

How to Contact Irish Revenue

If you have any questions regarding the form, please contact Irish Revenue (Tel No.: +353 1 7383634 E-email: intclaims@revenue.ie).

2023年1月より実施となる上場パートナーシップ(「PTP」)にかかる源泉徴収

2023年1月1日より施行される米国内国歳入庁規則により、米国の納税者でない投資家が保有する特定の上場パートナーシップ(「PTP」)の売上収入に対し、新たな源泉徴収が適用されることになりました。IRSによる源泉徴収は相当な金額になるため、インタラクティブ・ブローカーズでは、これらPTP商品への投資リスクをご存じでない可能性のある投資家のお客様が、該当商品にアクセスすることを制限する措置を講じています。

こちらのページでは、PTP商品へのアクセス方法の手順をご説明します。

知っておくべき情報:

源泉徴収額: 売却または分配金の10%です。計算される利益に対する10%だけでなく、取引や分配の結果として決済される資金額の10%を指します。

PTP源泉徴収の例:

1株あたり50で200株を購入する。

取引価値 = $10,000

1株あたり51で200株を売却する。

取引価値 = $10,200

収益 = $200。

源泉徴収額 = $1020 USD

税金還付リクエストはないものと過程すると、投資家にとっても損失は$820になります。

対象銘柄:ページの最後にあるリストをご参照ください。リストはベストエフォート型の管理となるため、タイミングによっては正確でないことがあります。リストに記載される引渡し可能な有価証券は、新しい規制の対象となります。原資産証券がPTPとなるオプションやその他のデリバティブ商品は、源泉徴収の対象になりません。ただし、オプションやデリバティブ商品がPTPに変換された場合、その後の当該PTP証券の売却は源泉徴収の対象となります。

特別な場合の免責: IRSの規制は発行者に対し、源泉徴収義務の免責対象となる資格を提供しています。免責の有効期限は92日となり、免責期間の延長にはIRSからの再認証が必要となります。弊社では対象商品のうち、どの銘柄が免責を受けることができるかを公表するよう、ベストエフォート型で努めていますが、投資家のお客様におかれましては、源泉徴収の条件を十分に理解されている商品をご選択いただきますようお願い致します。源泉徴収の免責を受ける発行者の資料は通常、「Qualified Notice」と記載されています。

影響を受ける投資家: 米国の税務上、「居住者」とみなされない全ての投資家、すなわち、米国の課税および税務報告の対象とならない(このためW-9 IRSフォームの提出を行わない)投資家が対象となります。

報告方法: 源泉徴収は、年末のフォーム1042-S、「Foreign Person's U.S. Source Income Subject to Withholding」で報告します。

非米国納税者としてのPTP商品へのアクセス方法: クライアントポータルにログインし、ユーザーメニュー(右上にある人型のアイコン)に続いて設定を選択してください。この後、口座設定から取引の項目に進み、「PTP取引の選択/選択解除」のリンクをクリックしてください。PTP証券の取引権限をこのページからリクエストできます。権限の有効化にはリクエストが送信されてから1時間ほどかかります。

PTP証券の取引を今後ご希望されないお客様は、同じ「PTP取引の選択/選択解除」のリンクから、PTP取引の資格の無効化をリクエストすることができます。

より詳しい情報: 規制に関するより詳しい情報をご希望のお客様は、IRSウェブサイトのIRC(Internal Revenue Code)の項目をご参照ください。1446(f): http://www.irs.gov/individuals/international-taxpayers/partnership-withholding

PTP銘柄

このリストは上記のIRS規制に基づき、源泉徴収の対象となる可能性のある PTP証券を記載しています。商品は、「Qualified Noticet付き」のものと「Qualified Noticeのない」ものの2グループに分類されています。リストは便宜上、ベストエフォート型でご提供するものとなります。弊社では情報の正確性および適時性を保障するものではありません。投資家のお客様におかれましては、ご自身が投資されている、または投資をお考えの商品が懲罰的な源泉徴収となることを避けるために必要な免責措置の対象となっているかどうかをご自身でご確認ください。免責期間もまた、銘柄のポジションを保有されるお客様ご自身でご確認いただきますようお願い致します。

| ISIN | シンボル | 名称 |

| US74347W3530 | AGQ | PROSHARES ULTRA SILVER |

| BMG162341090 | BBU | BROOKFIELD BUSINESS PT-UNIT |

| G16234109 | BBU.UN | BROOKFIELD BUSINESS PT-UNIT |

| US26923H2004 | BDRY | BREAKWAVE DRY BULK SHIPPING |

| G16258108 | BEP | BROOKFIELD RENEWABLE PARTNER |

| G16258231 | BEP PRA | BROOKFIELD RENEWABLE PAR |

| BMG162581083 | BEP.UN | BROOKFIELD RENEWABLE PARTNER |

| BMG162521014 | BIP | BROOKFIELD INFRASTRUCTURE PA |

| G16252267 | BIP PRA | BROOKFIELD INFRASTRUCTURE PARTNERS LP |

| G16252275 | BIP PRB | BROOKFIELD INFRASTRUCTUR |

| BMG162521014 | BIP.UN | BROOKFIELD INFRASTRUCTURE PA |

| US0917491013 | BITW | BITWISE 10 CRYPTO INDEX FUND |

| US0917491013 | BITW | BITWISE 10 CRYPTO INDEX FUND |

| US91167Q1004 | BNO | UNITED STATES BRENT OIL FUND |

| US74347Y8701 | BOIL | PROSHARES ULTRA BLOOMBERG NA |

| BMG1624R1079 | BPYP.PR.A | NEW LP PREFERRED UNITS CAD |

| G1624R107 | BPYPM | NEW LP PREFERRED UNITS CAD |

| G16249164 | BPYPN | BROOKFIELD PROPERTY PART |

| G16249156 | BPYPO | BROOKFIELD PROPERTY PART |

| G16249149 | BPYPP | BROOKFIELD PROPERTY PART |

| US88166A4094 | CANE | TEUCRIUM SUGAR FUND |

| US88166A1025 | CORN | TEUCRIUM CORN FUND |

| US9117181043 | CPER | UNITED STATES COPPER INDEX |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| US46140H1068 | DBA | INVESCO DB AGRICULTURE FUND |

| US46140H7008 | DBB | INVESCO DB BASE METALS FUND |

| US46138B1035 | DBC | INVESCO DB COMMODITY INDEX T |

| US46140H3049 | DBE | INVESCO DB ENERGY FUND |

| US46140H4039 | DBO | INVESCO DB OIL FUND |

| US46140H5028 | DBP | INVESCO DB PRECIOUS METALS F |

| US46140H2058 | DBS | INVESCO DB SILVER FUND |

| US46139B1026 | DBV | INVESCO DB G10 CURRENCY HARV |

| SGXC50067435 | DCRU | DIGITAL CORE REIT MANAGEMENT |

| US88166A8053 | DEFI | HASHDEX BITCOIN FUTURES ETF |

| US46140H6018 | DGL | INVESCO DB GOLD FUND |

| US74347W8828 | EUO | PROSHARES ULTRASHORT EURO |

| US37959R1032 | GBLI | GLOBAL INDEMNITY GROUP LLC-A |

| US74347W3951 | GLL | PROSHARES ULTRASHORT GOLD |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| US46428R1077 | GSG | ISHARES S&P GSCI COMMODITY I |

| US74347Y8131 | KOLD | PROSHARES ULTRASHORT BLOOMBE |

| G54050102 | LAZ | LAZARD LTD-CL A |

| CA70214T1012 | PVF.PR.U | PARTNERS VALUE INVEST LP |

| CA70214T1194 | PVF.UN | PARTNERS VALUE INVESTMENTS I |

| CA76090H1038 | QSP.UN | RESTAURANT BRANDS-EXCH UNITS |

| G4196W108 | RSE | RIVERSTONE ENERGY LTD |

| CA76090H1038 | RSTRF | RESTAURANT BRANDS-EXCH UNITS |

| US74347Y7976 | SCO | PROSHARES ULTRASHORT BLOOMBE |

| US88166A6073 | SOYB | TEUCRIUM SOYBEAN FUND |

| US21258A2015 | SPKX | CONVXTY SHS 1X SPIKES FUTUR |

| US21258A1025 | SPKY | CONVXTY SHS DAILY 1.5X SP FU |

| US85814R1077 | SPLP | STEEL PARTNERS HOLDINGS LP |

| US85814R2067 | SPLP PRA | STEEL PARTNERS HOLDINGS LP |

| US92891H1014 | SVIX | -1X SHORT VIX FUTURES ETF |

| US92891H1014 | SVIX | -1X SHORT VIX FUTURES ETF |

| US74347W1302 | SVXY | PROSHARES SHORT VIX ST FUTUR |

| US88166A7063 | TAGS | TEUCRIUM AGRICULTURAL FUND |

| US74347Y8883 | UCO | PROSHARES ULTRA BLOOMBERG CR |

| US46141D1046 | UDN | INVESCO DB US DOLLAR INDEX B |

| US91201T1025 | UGA | UNITED STATES GAS FUND LP |

| US74347W6012 | UGL | PROSHARES ULTRA GOLD |

| US74347W8745 | ULE | PROSHARES ULTRA EURO |

| US9123183009 | UNG | US NATURAL GAS FUND LP |

| US91288X1090 | UNL | UNITED STATES 12 MONTH NATUR |

| US9117171069 | USCI | UNITED STATES COMMODITY INDE |

| US91288V1035 | USL | UNITED STATES 12 MONTH OIL |

| US91232N2071 | USO | UNITED STATES OIL FUND LP |

| US46141D2036 | UUP | INVESCO DB US DOLLAR INDEX B |

| US92891H3093 | UVIX | 2X LONG VIX FUTURES ETF |

| US92891H3093 | UVIX | 2X LONG VIX FUTURES ETF |

| US92891H4083 | UVIX | 2X LONG VIX FUTURES ETF |

| US74347Y8396 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3381 | VIXM | PROSHARES VIX MID-TERM FUT |

| US74347Y8545 | VIXY | PROSHARES VIX SHORT-TERM FUT |

| US88166A5083 | WEAT | TEUCRIUM WHEAT FUND |

| US26800L1008 | WEIX | DYNAMIC SHORT SHORT |

| US74347W2706 | YCL | PROSHARES ULTRA YEN |

| US74347W5691 | YCS | PROSHARES ULTRASHORT YEN |

| US74347Y8479 | ZSL | PROSHARES ULTRASHORT SILVER |

| ISIN | シンボル | 名称 |

| US28252B3096 | - | 1847 HOLDINGS LLC |

| US28252B8046 | EFSH | 1847 HOLDINGS LLC |

| US00434L1098 | - | ACCESS MIDSTREAM PARTNERS LP |

| US0093661058 | AIRL | AIRLEASE LTD |

| US01855A1016 | AC | ALLIANCE CAP MGMT LP |

| US01861G1004 | AHGP | ALLIANCE HOLDINGS GP LP |

| US01877R1086 | ARLP | ALLIANCE RESOURCE PARTNERS |

| US01881G1067 | AB | ALLIANCEBERNSTEIN HOLDING LP |

| US02052T1097 | ALDW | ALON USA PARTNERS LP |

| US02364V1070 | - | AMERICA FIRST MULTIFAMILY IN |

| US02364V2060 | ATAX | AMERICA FIRST MULTIFAMILY IN |

| US02364Y1010 | AFREZ | AMERICA FIRST REAL ESTATE INVESTMENT PARTNERS |

| US02520N1063 | APO | AMERICAN COMMUNITY PROPERTIE |

| CA0266951064 | HOT.UN | AMERICAN HOTEL INCOME PROPER |

| US0268621028 | AIA | AMERICAN INSD MTG INVS |

| US02752P1003 | - | AMERICAN MIDSTREAM PARTNERS |

| US0291692087 | ACP PR | AMERICAN REAL ESTATE PRTNRS: ACP PR |

| US0291691097 | ACP | AMERICAN REAL ESTATE PTNR-LP |

| US0293162055 | - | AMERICAN RESTAURANT PRTNR LP |

| US0309751065 | APU | AMERIGAS PARTNERS-LP |

| US02686F1030 | AIJ | AMERN INSD MTG INVS L P 86 |

| US02686G1013 | AIK | AMERN INSD MTG INVS L P 88 |

| US0293161065 | XXMUT | AMERN RESTAURANT PARTNERS |

| US03350F1066 | ANDX | ANDEAVOR LOGISTICS LP |

| US03673L1035 | - | ANTERO MIDSTREAM PARTNERS LP |

| GB00B15Y0C52 | AAAA | AP ALTERNATIVE ASSETS LP |

| US0376123065 | - | APOLLO GLOBAL MANAGEMENT - A |

| US0376124055 | APO PRA.O | APOLLO MANAGEMENT LLC |

| US0376125045 | APO PRB.O | APOLLO MANAGEMENT LLC |

| US03879N1019 | ARCX | ARC LOGISTICS PARTNERS LP |

| US30225N1054 | EXLP | ARCHROCK PARTNERS LP |

| US03957U1007 | APLP | ARCHROCK PARTNERS LP |

| US04014Y1010 | - | ARES MANAGEMENT LP |

| US04014Y2000 | ARES PRA. | ARES MGMT LP PFD UNIT SER A |

| US04929Q1022 | - | ATLAS ENERGY GROUP LLC |

| US04939R1086 | - | ATLAS ENERGY LP |

| US04930A1043 | ATLS | ATLAS ENERGY LP |

| US0493031001 | ATN | ATLAS ENERGY RESOURCES LLC |

| US0493921037 | APL | ATLAS PIPELINE PARTNERS LP |

| US0493923017 | APL PRECL | ATLAS PIPELINE PARTNERS, L.P. CUMV |

| US04941A4085 | ARPPQ | ATLAS RESOURCE PARTNERS |

| US04941A1016 | ARPJQ | ATLAS RESOURCE PARTNERS LP |

| US04941A5074 | ARNPQ | ATLAS RESOURCE PARTNERS |

| US0548071028 | AZLCZ | AZTEC LAND & CATTLE LTD |

| US05501X1000 | AZURQ | AZURE MIDSTREAM PARTNERS LP |

| US0806941029 | OZ | BELPOINTE PREP LLC |

| US09225M1018 | BSM | BLACK STONE MINERALS LP |

| US0925ESC094 | BHL.ESC | BLACKROCK DEFINED OPPORTUNIT - ESCROW |

| US09253U1088 | - | BLACKSTONE GROUP LP/THE |

| US09625U2087 | BKEPP | BLUEKNIGHT ENERGY PARTNERS - SERIES A PREF UNIT |

| US09625U1097 | BKEP | BLUEKNIGHT ENERGY PARTNERS L |

| US0966271043 | BWP | BOARDWALK PIPELINE PARTNERS |

| US0556EL1098 | BPMP | BP MIDSTREAM PARTNERS LP |

| US1067761072 | BBEPQ | BREITBURN ENERGY PARTNERS LP |

| US1067761155 | BBPPQ | BREITBURN ENG PARTNERS LP CUM REDEE |

| BMG162491077 | BPY | BROOKFIELD PROPERTY PARTNERS |

| US1181671058 | BGH | BUCKEYE GP HOLDINGS LP |

| US1182301010 | BPL | BUCKEYE PARTNERS LP |

| US1272072075 | CSD PRA | CADBURY SCHWEPPES DEL L P |

| US1314761032 | CLMT | CALUMET SPECIALTY PRODUCTS |

| TC0001464281 | ACE PRB | CAPITAL RE LLC: 7.65% CUM "MIPS" |

| US14309L1026 | - | CARLYLE GROUP INC/THE |

| US1501851067 | FUN | CEDAR FAIR -LP |

| US15188T1088 | - | CENTERLINE HOLDING CO |

| US1534231089 | ENGY | CENTRAL ENERGY PARTNERS LP |

| US14309L2016 | TCGP | CG 5 7/8 PERP PFD |

| US1609081096 | CHC | CHARTERMAC |

| US16411Q1013 | CQP | CHENIERE ENERGY PARTNERS LP |

| US1651851099 | CHKR | CHESAPEAKE GRANITE WASH TRUS |

| US16524K1088 | - | CHESAPEAKE MIDSTREAM PARTNER |

| US12547R1059 | CIFC | CIFC LLC |

| US18383H1014 | - | CLAYMORE MACROSHARES OIL DOW |

| US18383R1095 | - | CLAYMORE MACROSHARES OIL UP |

| US12592V1008 | - | CNX COAL RESOURCES LP |

| US12654A1016 | CNXM | CNX MIDSTREAM PARTNERS LP |

| US1982811077 | CPPL | COLUMBIA PIPELINE PARTNERS L |

| US20467A1016 | GSJK | COMPRESSCO PARTNERS LP |

| US20588V3078 | CAG PRB | CONAGRA CAP L C: CAG PRB |

| US2068121092 | - | CONE MIDSTREAM PARTNERS LP |

| US20855T1007 | CCR | CONSOL COAL RESOURCES LP |

| US21038E1010 | - | CONSTELLATION ENERGY PARTNER |

| GG00B1WR8K11 | CCAP | CONVERSUS CAPITAL |

| US2128491030 | CWPS | CONWEST PARTNERSHIP LP-UNITS |

| US2172021006 | CPNO | COPANO ENERGY LLC-UNITS |

| US2189161043 | CNPP | CORNERSTONE PROPANE PARTNERS |

| US2263443077 | CEQP PR | CRESTWOOD EQUITY PARTNER |

| US2263441097 | - | CRESTWOOD EQUITY PARTNERS LP |

| US2263442087 | CEQP | CRESTWOOD EQUITY PARTNERS LP |

| US2263721001 | - | CRESTWOOD MIDSTREAM PARTNERS |

| US2263781070 | CMLP | CRESTWOOD MIDSTREAM PARTNERS |

| US22676R1150 | KWH.UN | CRIUS ENERGY TRUST |

| US22758A1051 | CAPL | CROSSAMERICA PARTNERS LP |

| US22765U1025 | - | CROSSTEX ENERGY LP |

| US2284391057 | CRPPE | CROWN PAC PARTNERS L P |

| US12637A1034 | CCLP | CSI COMPRESSCO LP |

| US1266331065 | - | CVR PARTNERS LP |

| US1266332055 | UAN | CVR PARTNERS LP |

| US12663P1075 | CVRR | CVR REFINING LP |

| US2327511075 | - | CYPRESS ENVIRONMENTAL PARTNE |

| US23311P3082 | DCP PRC | DCP 7.95 PERP PFD - DCP MIDSTREAM LP |

| US23311P1003 | DCP | DCP MIDSTREAM L.P. |

| US23311P2092 | DCP PRB | DCP MIDSTREAM LP |

| US24664T1034 | DKL | DELEK LOGISTICS PARTNERS LP |

| US25490F2092 | BARS | DIREXION DAILY GOLD BEAR 3X |

| US25490F1003 | BAR | DIREXION DAILY GOLD BULL 3X |

| US2574541080 | - | DOMINION ENERGY MIDSTREAM PA |

| US25820R1059 | DMLP | DORCHESTER MINERALS LP |

| US2650261041 | DEP | DUNCAN ENERGY PARTNERS LP |

| US2662242039 | DQ PRA | DUQUESNE CAP L P |

| SGXC28500103 | LIW | EAGLE HOSPITALITY TRUST |

| US26985R1041 | EROC | EAGLE ROCK ENERGY PARTNERS |

| US26827L1098 | ECTM | ECA MARCELLUS TRUST I |

| US2837021086 | EPB | EL PASO PIPELINE PARTNERS LP |

| US29102H1086 | EMESQ | EMERGE ENERGY SERVICES LP |

| US2921021000 | ESBA | EMPIRE STATE REALTY OP LP-ES |

| US2921023089 | FISK | EMPIRE STATE REALTY OP -S250 |

| US2921022099 | OGCP | EMPIRE STATE REALTY OP-S60 |

| US2924801002 | ENBL | ENABLE MIDSTREAM PARTNERS LP |

| US29250R1068 | EEP | ENBRIDGE ENERGY PARTNERS LP |

| US29257A1060 | ENP | ENCORE ENERGY PARTNERS-LP |

| US29273V1008 | ET | ENERGY TRANSFER LP |

| US29273V6056 | ET PRE | ENERGY TRANSFER LP 7.6% PERP PFD U |

| US29273V5066 | ET PRD | ENERGY TRANSFER LP 7.625% PERP PFD |

| US29273V4077 | ET PRC | ENERGY TRANSFER LP |

| US29278N1037 | ETP | ENERGY TRANSFER OPERATING LP |

| US29278N5095 | ETP PRE | ENERGY TRANSFER OPERATNG |

| US29278N3017 | ETP PRC | ENERGY TRANSFER PARTNERS |

| US29273R1095 | - | ENERGY TRANSFER PARTNERS LP |

| US29278N4007 | ETP PRD | ENERGY TRANSFER PARTNERS |

| US29336U1079 | ENLK | ENLINK MIDSTREAM PARTNERS LP |

| TC0001373946 | ECTPQ | ENRON CAP LLC |

| US29357D2080 | ECSPQ | ENRON CAPITAL RESOURCES 9% CUM RED PFD |

| US2937161063 | EPE | ENTERPRISE GP HOLDINGS LP |

| US2937921078 | EPD | ENTERPRISE PRODUCTS PARTNERS |

| US29414J1079 | - | ENVIVA PARTNERS LP |

| US26885J1034 | EQGP | EQGP HOLDINGS LP |

| US26885B1008 | EQM | EQM MIDSTREAM PARTNERS LP |

| US092ESC0377 | BGIO.ESC | ESC BGIO LIQUIDATION TRUST |

| US26926V1070 | EVEPQ | EV ENERGY PARTNERS LP |

| US30053M1045 | SNMP | EVOLVE TRANSITION INFRASTRUC |

| US30304T1060 | FSG | FACTORSHARES 2X: GOLD-S&P500 |

| US30304P1049 | FOL | FACTORSHARES 2X: OIL-S&P500 |

| US3030461061 | FSE | FACTORSHARES 2X: S&P500-TBD |

| US3030481028 | FSU | FACTORSHARES 2X: S&P500-USD |

| US3030471045 | FSA | FACTORSHARES 2X: TBD-S&P500 |

| US3152933087 | FGPRB | FERRELLGAS PARTNERS LP-B |

| US3152931008 | FGPRQ | FERRELLGAS PARTNERS-LP |

| US3152932097 | FGPR | FERRELLGAS PARTNERS-LP |

| US30242M1062 | XXFPL | FFP PARTNERS -LP-CL A |

| US34552U1043 | FELPQ | FORESIGHT ENERGY LP |

| US34958B1061 | - | FORTRESS INVESTMENT GRP-CL A |

| US34960P2002 | FTAIP | FORTRESS TRANS & INFRAST |

| US34960P3091 | FTAIO | FORTRESS TRANS & INFRAST |

| US34960P4081 | FTAIN | FORTRESS TRANS & INFRAST |

| US34960P1012 | FTAI | FORTRESS TRANSPORTATION-CL A |

| US36761Q1058 | GWYGU | GATEWAY GARAGE PARTNERS LLC |

| US3719271047 | GEL | GENESIS ENERGY L.P. |

| US37946R1095 | GLP | GLOBAL PARTNERS LP |

| US37946R2085 | GLP PRA | GLOBAL PARTNERS LP |

| US37946R3075 | GLP PRB | GLOBAL PARTNERS LP |

| US38349K1051 | GDVTZ | GOULD INVESTORS LP |

| US3860872098 | GRM PRA | GRAND MET DEL L P |

| US3932211069 | GPP | GREEN PLAINS PARTNERS LP |

| US39525T1007 | - | GREENHAVEN COAL FUND |

| US3952581060 | - | GREENHAVEN CONTINUOUS CMDTY |

| US40274U1088 | GTM | GULFTERRA ENERGY PARTNERS LP |

| US4038291047 | GYRO | GYRODYNE LLC |

| US40636T2033 | HRY | HALLWOOD RLTY PARTNERS L P |

| BMG4285W1001 | HRBGF | HARBOR GLOBAL COMPANY LTD |

| US41988L2025 | NNUTU | HAWAIIAN MACADAMIA NUT ORCHA |

| US4223571039 | HTLLQ | HEARTLAND PARTNERS LP-A |

| US4269181081 | HPG | HERITAGE PROPANE PRTNRS LP |

| US4281041032 | - | HESS MIDSTREAM PARTNERS LP |

| US4283371098 | HCRSQ | HI-CRUSH INC |

| US43129M1071 | HPGP | HILAND HOLDINGS GP LP |

| US4312911039 | HLND | HILAND PARTNERS LP |

| US4357631070 | HEP | HOLLY ENERGY PARTNERS LP |

| US4511001012 | IEP | ICAHN ENTERPRISES LP |

| US4511002002 | IEP PRCL | ICAHN ENTERPRISES LP |

| US4511001194 | IEPRR | ICAHN ENTERPRISES LP-RIGHT |

| US45661Q1076 | NRGP | INERGY HOLDINGS LP |

| US4566151035 | - | INERGY LP |

| US45671U1060 | - | INERGY MIDSTREAM LP |

| US4608852053 | IGLPA | INTERSTATE GEN L P |

| US4642941078 | ALT | ISHARE DIVERSIFIED ALT TRUST |

| US45032K1025 | CMDT | ISHARES COMMODITY OPTIMIZED |

| US46643C1099 | JPEP | JP ENERGY PARTNERS LP |

| US4841691078 | KPP | KANEB PIPE LINE PARTNERS L P |

| US4841731098 | KSL | KANEB SERVICES LLC |

| US4945501066 | KMP | KINDER MORGAN ENERGY PRTNRS |

| GB00B13BNQ35 | KKR | KKR & CO (GUERNSEY) LP |

| US48248M2017 | KKR PRA.O | KKR & CO LP |

| US48248M3007 | KKR PRB.O | KKR 6 1/2 12/31/49 PFD |

| US48248A3068 | KFN | KKR FINANCIAL HOLDINGS LLC |

| US48248A6038 | KFN PRCL | KKR FINANCIAL HOLDINGS |

| US48268Y1010 | KSP | K-SEA TRANSPORTATION PARTNER |

| US5053461068 | LAACZ | LAACO LTD-UNITS OF LTD PRTNS |

| US51508J2078 | LMRKP | LANDMARK INFRASTRUCTURE |

| US51508J1088 | LMRK | LANDMARK INFRASTRUCTURE PART |

| US51508J4058 | LMRKN | LANDMARK INFRASTRUCTURE PARTNERS LP |

| US51508J3068 | LMRKO | LANDMARK INFRASTRUCTURE |

| US5248141005 | - | LEHIGH GAS PARTNERS LP |

| US5327711025 | - | LIN MEDIA LLC - A |

| US5357631069 | LNKE | LINK ENERGY LLC |

| US5360201009 | LINEQ | LINN ENERGY LLC-UNITS |

| US50214A1043 | LRE | LRR ENERGY LP |

| US55608B1052 | MIC.USD | MACQUARIE INFRASTRUCTURE HOL |

| US55610T1025 | - | MACROSHARES $100 OIL DOWN |

| US55610W1053 | - | MACROSHARES $100 OIL UP |

| US55610X1037 | DMM | MACROSHARES MAJ MET HOU DOWN |

| US55610R1068 | UMM | MACROSHARES MAJ MET HOU UP |

| US55610N1054 | DCR | MACROSHARES OIL DOWN TRADEABLE |

| US55610L1098 | UCR | MACROSHARES OIL UP TRADEABLE T |

| US55610T2015 | DOY | MACROSHARES USD 100 OIL DOWN |

| US55610W2044 | UOY | MACROSHARES USD 100 OIL UP |

| US55907R1086 | MGG | MAGELLAN MIDSTREAM HOLDINGS |

| US5590801065 | MMP | MAGELLAN MIDSTREAM PARTNERS |

| US5707591005 | MWE | MARKWEST ENERGY PARTNERS LP |

| US57118V1008 | - | MARLIN MIDSTREAM PARTNERS LP |

| US5733311055 | MMLP | MARTIN MIDSTREAM PARTNERS LP |

| US5860481002 | MEMPQ | MEMORIAL PRODUCTION PARTNERS |

| US55271M2061 | MUK PRA | MEPC INTL CAP L P |

| US59140L1008 | IDIV | METAURUS US EQUITY CUMULATIV |

| US59140L2097 | - | METAURUS US EQUITY EX DIVIDE |

| US59564N1037 | MEP | MIDCOAST ENERGY PARTNERS LP |

| US59560V1098 | - | MID-CON ENERGY PARTNERS LP |

| US59560V2088 | MCEP | MID-CON ENERGY PARTNERS LP |

| US6050342061 | ME PRA | MISSION CAP L P |

| US6050343051 | ME PRB | MISSION CAP L P: ME PRB |

| US55307U1079 | - | ML MACADAMIA ORCHARDS LP-UT |

| US55336V1008 | MPLX | MPLX LP |

| US62624B1017 | - | MUNICIPAL MORTGAGE & EQUITY |

| US55406N1037 | MYTH | MYT HLDG LLC BE+ |

| US63900P1030 | - | NATURAL RESOURCE PARTNERS LP |

| US63900P4000 | NSP | NATURAL RESOURCE PARTNERS LP -PARTNERSHIP UNITS |

| US63900P6088 | NRP | NATURAL RESOURCE PARTNERS LP |

| US63900P5098 | NSP | NATURAL RESOURCE PARTNERS LP |

| US6442061049 | NEN | NEW ENGLAND REALTY ASSOC-LP |

| US64881E1091 | NSLPQ | NEW SOURCE ENERGY PARTNERS L |

| US64881E3071 | NUSPQ | NEW SOURCE ENG PARTNERS LP 11%SR A |

| US64ESC19977 | NYRT.ESC | NEW YORK REIT INC - ESCROW |

| US6514261089 | NHL | NEWHALL LAND & FARMING CO |

| US62913M2061 | NGL PRB | NGL 9 PERP PFD |

| US62913M1071 | NGL | NGL ENERGY PARTNERS LP |

| US62913M3051 | NGL PRC | NGL ENERGY PARTNERS LP |

| US6546781013 | NKA | NISKA GAS STORAGE PARTNERS-U |

| US65506L1052 | NBLX | NOBLE MIDSTREAM PARTNERS LP |

| US6658261036 | NTI | NORTHERN TIER ENERGY LP |

| US67058H3003 | NS PRB | NSUS 7 5/8 PERP PFD |

| US67058H2013 | NS PRA | NSUS 8 1/2 12/31/49 |

| US6294221063 | NLP | NTS REALTY HOLDINGS LP |

| US67058H1023 | NS | NUSTAR ENERGY LP |

| US67058H4092 | NS PRC | NUSTAR ENERGY LP |

| US67059L1026 | - | NUSTAR GP HOLDINGS LLC |

| US67074P1049 | CFD | NUVEEN DIVERSIFIED COMMODITY |

| US6707311089 | CTF | NUVEEN LONG/SHORT COMMODITY |

| US6740011027 | OKCMZ | OAKTREE CAP GROUP-UTS CL A |

| US6740012017 | OAK | OAKTREE CAPITAL GROUP LLC |

| US6740013007 | OAK PRA | OAKTREE CAPITAL GRP LLC |

| US6740014096 | OAK PRB | OAKTREE CAPITAL GRP LLC |

| US67420T2069 | OMP | OASIS MIDSTREAM PARTNERS LP |

| US67551U1051 | - | OCH-ZIFF CAPITAL MANAGEMEN-A |

| US67091N1081 | OCIP | OCI PARTNERS LP |

| US67081B1061 | - | OCI RESOURCES LP |

| US6780491071 | OILT | OILTANKING PARTNERS LP |

| US68268N1037 | OKS | ONEOK PARTNERS LP |

| US6710281089 | OSP | OSG AMERICA LP |

| US6918071019 | OXF | OXFORD RESOURCE PARTNERS LP |

| US6931391071 | PNG | PAA NATURAL GAS STORAGE LP |

| US69422R1059 | PPX | PACIFIC ENERGY PARTNERS LP |

| US69318Q1040 | PBFX | PBF LOGISTICS LP |

| CA7069025095 | - | PENGROWTH ENERGY TRUST-A |

| US70788P1057 | - | PENN VIRGINIA GP HOLDINGS LP |

| US7078841027 | - | PENN VIRGINIA RESOURCE PARTN |

| US7093111042 | PTXP | PENNTEX MIDSTREAM PARTNERS L |

| US71672U1016 | PDH | PETROLOGISTICS LP |

| US55406N2027 | PFDM | PFD MYT HLDG CO BE+ |

| US7185492078 | PSXP | PHILLIPS 66 PARTNERS LP |

| US7192171012 | PLP | PHOSPHATE RESOURCE PRTNRS L.P. |

| US72388B1061 | PSE | PIONEER SOUTHWEST ENERGY PAR |

| US7265031051 | PAA | PLAINS ALL AMER PIPELINE LP |

| US69341H1059 | GFWQZ | PLM EQUIPMENT GROWTH FD III |

| US7328571077 | POPE | POPE RESOURCES |

| US73936B4086 | - | POWERSHARES DB AGRICULTURE F |

| US73936B7055 | - | POWERSHARES DB BASE METALS F |

| US73935S1050 | - | POWERSHARES DB COMMODITY IND |

| US73936B1017 | - | POWERSHARES DB ENERGY FUND |

| US73935Y1029 | - | POWERSHARES DB G10 CURR HARV |

| US73936B6065 | - | POWERSHARES DB GOLD FUND |

| US73936B5075 | - | POWERSHARES DB OIL FUND |

| US73936B2007 | - | POWERSHARES DB PREC METALS F |

| US73936B3096 | - | POWERSHARES DB SILVER FUND |

| US73936D2062 | - | POWERSHARES DB US DOL IND BE |

| US73936D1072 | - | POWERSHARES DB US DOL IND BU |

| SGXC75818630 | OXMU | PRIME US REIT |

| US74347W5360 | FUTS | PROSHARES MANAGED FUTURES ST |

| US74347W7424 | - | PROSHARES SHORT EURO ETF |

| US74347W6277 | - | PROSHARES SHORT VIX ST FUTUR |

| US74347W4942 | GDAY | PROSHARES ULT AUSTRALIAN DOL |

| US74347W7754 | - | PROSHARES ULT DJ-UBS NAT GAS |

| US74347W1062 | - | PROSHARES ULTRA BLOOMBERG CO |

| US74347W2888 | UCD | PROSHARES ULTRA BLOOMBERG CO |

| US74347W6509 | - | PROSHARES ULTRA BLOOMBERG CR |

| US74347W2474 | - | PROSHARES ULTRA BLOOMBERG CR |

| US74347W3209 | - | PROSHARES ULTRA BLOOMBERG CR |

| US74347W1229 | - | PROSHARES ULTRA BLOOMBERG NA |

| US74347Y7067 | - | PROSHARES ULTRA BLOOMBERG NA |

| US74347W2961 | - | PROSHARES ULTRA BLOOMBERG NA |

| US74347W5022 | - | PROSHARES ULTRA DJ-UBS CRUDE OIL |

| US74347W8414 | - | PROSHARES ULTRA SILVER |

| US74347W6350 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W4116 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3464 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W2540 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W1633 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W5444 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3795 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3126 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W2391 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W1484 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W8661 | - | PROSHARES ULTRA YEN |

| US74347W2219 | - | PROSHARES ULTRAPRO 3X CRUDE |

| US74347W2136 | - | PROSHARES ULTRAPRO 3X SHORT |

| US74347Y8057 | - | PROSHARES ULTRAPRO 3X SHORT |

| US74347W4603 | CROC | PROSHARES ULTRASHORT AUD |

| US74347Y8214 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347W6681 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347W3878 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347Y8628 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347W6764 | CMD | PROSHARES ULTRASHORT BLOOMBE |

| US74347W7002 | - | PROSHARES ULTRASHORT GOLD |

| US74347W7184 | - | PROSHARES ULTRASHORT GOLD |

| US74347W8331 | - | PROSHARES ULTRASHORT SILVER |

| US74347W6434 | - | PROSHARES ULTRASHORT SILVER |

| US74347W7267 | - | PROSHARES ULTRASHORT SILVER |

| US74347W1146 | - | PROSHARES ULTRASHORT SILVER |

| US74347W8588 | - | PROSHARES ULTRASHORT YEN |

| US74347W7671 | - | PROSHARES ULTSHRT DJ-UBS NAT |

| US74347W6848 | - | PROSHARES VIX MID-TERM FUT |

| US74347W3613 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W6921 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W2623 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W1716 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W2052 | - | PROSHRE U/S DJ-AIG COMMODITY |

| US74347W8091 | - | PROSHRE U/S DJ-AIG CRUDE OIL |

| CA74624AUSD4 | RUF.U | PURE MULTI-FAMILY REIT LP |

| CA74624A1084 | RUF.UN | PURE MULTI-FAMILY REIT LP |

| US6936651016 | PVR | PVR PARTNERS LP |

| US74735R1150 | QEPM | QEP MIDSTREAM PARTNERS LP |

| US74734R1086 | QRE | QR ENERGY LP |

| US74836B2097 | - | QUEST ENERGY PARTNERS LP |

| US74839G1067 | - | QUICKSILVER GAS SERVICES LP |

| US75885Y1073 | RGP | REGENCY ENERGY PARTNERS LP |

| US7601131003 | RNF | RENTECH NITROGEN PARTNERS LP |

| US76090H1032 | QSP.U | RESTAURANT BRANDS EXCHANGE UNITS |

| US76218Y1038 | - | RHINO RESOURCE PARTNERS LP |

| US76218Y2028 | - | RHINO RESOURCE PARTNERS LP |

| US7628191006 | RMP | RICE MIDSTREAM PARTNERS LP |

| US7672711097 | - | RIO VISTA ENERGY PARTNERS LP |

| US7771491054 | RRMS | ROSE ROCK MIDSTREAM LP |

| US78028T1007 | - | ROYAL HAWAIIAN ORCHARDS LP |

| GG00BKTRRM22 | RTW | RTW VENTURE FUND LTD |

| US79971C2017 | - | SANCHEZ MIDSTREAM PARTNERS L |

| US79971A1060 | - | SANCHEZ PRODUCTION PARTNERS |

| US79971C1027 | - | SANCHEZ PRODUCTION PARTNERS |

| US80007T1016 | SDTTU | SANDRIDGE MISSISSIPPIAN TRUS |

| US80007V1061 | SDRMU | SANDRIDGE MISSISSIPPIAN TRUS |

| US80007A1025 | - | SANDRIDGE PERMIAN TRUST |

| MHY737602026 | SRG U | SEANERGY MARITIME CORP-UNITS |

| MHY737601036 | - | SEANERGY MARTIME HOLDINGS CORP |

| US81662W1080 | - | SEMGROUP ENERGY PARTNERS LP |

| US8226341019 | SHLX | SHELL MIDSTREAM PARTNERS LP |

| US1724641097 | SIRE | SISECAM RESOURCES LP |

| US26923H1014 | RISE | SIT RISING RATE ETF |

| US84130C1009 | SXEEQ | SOUTHCROSS ENERGY PARTNERS L |

| US84756N1090 | SEP | SPECTRA ENERGY PARTNERS LP |

| US8493431089 | SRLP | SPRAGUE RESOURCES LP |

| US85512C2044 | SGH | STAR GAS PTNRS,LP SR SB UTS |

| US85814R3057 | SPLP PRT | STEEL PARTNERS HLDS LP |

| US86183Q1004 | - | STONEMOR PARTNERS LP |

| US86324B1035 | BNPC | STREAM S&P DYN GLOBAL COMM |

| US8644821048 | SPH | SUBURBAN PROPANE PARTNERS LP |

| US8661421029 | - | SUMMIT MIDSTREAM PARTNERS LP |

| US8661424098 | SMLP | SUMMIT MIDSTREAM PARTNERS LP |

| US86722Y1010 | SXCP | SUNCOKE ENERGY PARTNERS LP |

| US86764L1089 | - | SUNOCO LOGISTICS PARTNERS L.P |

| US86765K1097 | SUN | SUNOCO LP |

| US8692391035 | - | SUSSER PETROLEUM PARTNERS LP |

| US8746971055 | TEP | TALLGRASS ENERGY PARTNERS LP |

| US87611X2045 | NGLS PRA | TARGA RESOURCES PARTNERS |

| US87611X1054 | NGLS | TARGA RESOURCES PARTNERS LP |

| US87233Q1085 | TCP | TC PIPELINES LP |

| US8723841024 | TPP | TEPPCO PARTNERS LP |

| US8810052014 | TNH | TERRA NITROGEN COMPANY LP |

| US88160T1079 | - | TESORO LOGISTICS LP |

| US88166A3005 | CRUD | TEUCRIUM CRUDE OIL FUND |

| US88166A2015 | NAGS | TEUCRIUM NATURAL GAS FUND |

| US89376V1008 | TLP | TRANSMONTAIGNE PARTNERS LP |

| SGXC39411175 | ODBU | UNITED HAMPSHIRE US REIT |

| US91733T3077 | USOU | UNITED STATES 3X OIL FUND |

| US91733T4067 | - | UNITED STATES 3X SHORT OIL F |

| US91733T5056 | USOD | UNITED STATES 3X SHORT OIL F |

| US9117182033 | USAG | UNITED STATES AGRICULTURE IN |

| US9117831084 | UHN | UNITED STATES DIESEL-HEATING |

| US91204P1075 | - | UNITED STATES HEATING OIL LP |

| US9117183023 | USMI | UNITED STATES METALS INDEX F |

| US91232N1081 | - | UNITED STATES OIL FUND LP |

| US9126132052 | DNO | UNITED STATES SHORT OIL FUND |

| US9134301046 | UCLP | UNIVERSAL COMPRESSION PARTNE |

| US9123181029 | - | US NATURAL GAS FUND LP |

| US9123182019 | - | US NATURAL GAS FUND LP |

| US9123181102 | - | US NATURAL GAS FUND LP |

| US9034171036 | USSPQ | US SHIPPING PARTNERS LP |

| US90290N1090 | USAC | USA COMPRESSION PARTNERS LP |

| US9033181036 | USDP | USD PARTNERS LP |

| US91914J1025 | VLP | VALERO ENERGY PARTNERS LP |

| US91914G1085 | VEH | VALERO GP HOLDINGS LLC |

| US91913W1045 | VLI | VALERO LP |

| US92205F2056 | VNRAQ | VANGUARD NATURAL RESOU |

| US92205F4037 | VNRCQ | VANGUARD NATURAL RESOU |

| US92205F1066 | VNRSQ | VANGUARD NATURAL RESOURCES |

| US92205F3047 | VNGBQ | VANGUARD NATURAL RESOURCES LLC RED |

| KYG9325C1050 | VTDRF | VANTAGE DRILLING INTERNATION |

| US93964X1063 | WPG | WASHINGTON PG INC UNRESTRICTED SHARES |

| US95825R1032 | - | WESTERN GAS EQUITY PARTNERS |

| US9582541044 | - | WESTERN GAS PARTNERS LP |

| US9586691035 | WES | WESTERN MIDSTREAM PARTNERS L |

| US95931Q2057 | WNRL | WESTERN REFINING LOGISTICS L |

| US9604171036 | WLKP | WESTLAKE CHEMICAL PARTNERS L |

| US96108P1030 | WMLPQ | WESTMORELAND RESOURCE PARTNE |

| US96949L1052 | WPZ | WILLIAMS PARTNERS LP |

| US96950F1049 | WPZ.USD | WILLIAMS PARTNERS LP |

| US96950K1034 | WMZ | WILLIAMS PIPELINE PARTNERS L |

| US976ESC3018 | FUR.ESC | WINTHROP REALTY TRUST - ESCROW |

| US97718T1051 | TONS | WISDOMTREE COAL FUND |

| US97718W1080 | GCC.USD | WISDOMTREE CONTINUOUS COMMOD |

| US98159G1076 | WPT | WORLD POINT TERMINALS LP |

| US92930Y1073 | - | WP CAREY & CO LLC |

Withholding on Publicly Traded Partnerships (“PTPs”) Effective Jan 2023

As a result of U.S. Internal Revenue Regulations taking effect 1 January 2023, new withholding charges will be applied to sales proceeds from certain Publicly Traded Partnerships ("PTPs”) held by investors who are not U.S. taxpayers. The IRS withholding charges are substantial, therefore, Interactive Brokers has taken steps to limit access to these products for investors who might be unaware of the risks of investing in these PTP products.

Instructions on How to Access PTP Products are available below in this document.

What you need to know:

Amount of Withholding: 10% of sale or distribution proceeds. This means 10% of the amount of funds that would settle resulting from any transaction or distribution, not just 10% on any calculated profit.

Example of PTP withholding:

Buy 200 shares @ 50.

Transaction value = $10,000

Sell 200 shares @ 51.

Transaction value = $10,200

Profit = $200.

Withholding = $1020 USD

Assuming no tax reclaim requests, the loss in value to the investor would be $820

Affected Instruments: Please see the list at the end of this article. The list is maintained on a best efforts basis and there may be some timing issues as information is refreshed. Listed deliverable securities are in scope of the new regulation. Options and other derivative instruments with a PTP as the underlying security are not subject to withholding. However, if the option or derivative is converted into a PTP interest, a subsequent sale of such PTP security would be subject to withholding.

Special Exemptions: The IRS regulation provides issuers the ability to get an exemption from the PTP withholding requirement. The exemption is valid for 92 days, and issuers are required to re-certify with the IRS to extend the duration of the exemption. IBKR will try, on a best-efforts basis, to publish which of the affected instruments have an operating exemption, but investors should ensure they are choosing products whose withholding conditions they fully understand. The issuer document that provides for a withholding exemption is generally referred to as a "Qualified Notice"

What Investors are affected: All investors who are not considered ‘resident’ for U.S. tax purposes, i.e. investors who are not subject to U.S. taxation and tax reporting (and therefore doesn't file a W-9 IRS tax form).

Reporting: Withholding will be reported on the year-end Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding.

How to Access PTP Products as a Non-US Taxpayer: Please login to Client Portal and select the User menu (head and shoulders icon in the top right corner) followed by Settings. Then under Account Settings find the Trading section and click on the “PTP Trading Opt In/Out” link. The webpage allows you to request the ability to trade PTP securities. Once the request is submitted, it may take up to one hour for the ability to be activated.

Note that clients who no longer desire to trade PTP securities may request to deactivate the PTP trading ability via the same “PTP Trading Opt In/Out” link.

Additional Resources: For those interested in understanding additional information about the new regulation, please see the IRS website for IRC Sec. 1446(f): http://www.irs.gov/individuals/international-taxpayers/partnership-withholding

PTP Instruments

This list identifies PTP securities which may be subject to withholding under the IRS Regulation referenced above. The products are presented in 2 groups: those with a "Qualified Notice” exemption, and those "without Qualified Notice". The lists are shown on a best-efforts basis for convenience only. IBKR does not guarantee the accuracy or timeliness of the information, and investors should independently verify that products in which they are invested in, or intend to invest, have the necessary exemptions to avoid punitive withholding outcomes. Duration of the exemptions should also be monitored by position holders in the instruments.

PTP Securities with known Qualified Notice

Last updated 22-01-2024

| ISIN | Symbol | Description |

| US3152931008 | FGPRQ | FERRELLGAS PARTNERS-LP |

| US7328571077 | POPE | POPE RESOURCES |

| US7265031051 | PAA | PLAINS ALL AMER PIPELINE LP |

| US87233Q1085 | TCP | TC PIPELINES LP |

| BMG540501027 | LAZ.OLD | LAZARD LTD-CL A |

| US89376V1008 | TLP | TRANSMONTAIGNE PARTNERS LP |

| US01861G1004 | AHGP | ALLIANCE HOLDINGS GP LP |

| US46428R1077 | GSG | ISHARES S&P GSCI COMMODITY I |

| US16411Q1013 | CQP | CHENIERE ENERGY PARTNERS LP |

| US4511001012 | IEP | ICAHN ENTERPRISES LP |

| BMG162521014 | BIP | BROOKFIELD INFRASTRUCTURE PA |

| US74347W8828 | EUO | PROSHARES ULTRASHORT EURO |

| US74347W6012 | UGL | PROSHARES ULTRA GOLD |

| US161239AC25 | IBCID66377068 | 161239AC2 11/30/50 |

| US161239AE80 | IBCID66377074 | 161239AE8 6.8 11/30/50 |

| US161239AN89 | IBCID66419451 | 161239AN8 12/31/45 |

| US161239AB42 | IBCID67286679 | 161239AB4 06/30/49 |

| US161239AM07 | IBCID67287230 | 161239AM0 6.3 12/31/45 |

| USU3595KAA52 | MIZUHO | MIZUHO 9.87 PERP |

| US9126132052 | DNO | UNITED STATES SHORT OIL FUND |

| US91288X1090 | UNL | UNITED STATES 12 MONTH NATUR |

| US26827L1098 | ECTM | ECA MARCELLUS TRUST I |

| US9117171069 | USCI | UNITED STATES COMMODITY INDE |

| US38349K1051 | GDVTZ | GOULD INVESTORS LP |

| US88166A6073 | SOYB | TEUCRIUM SOYBEAN FUND |

| US88166A5083 | WEAT | TEUCRIUM WHEAT FUND |

| US9117181043 | CPER | UNITED STATES COPPER INDEX |

| BMG162581083 | BEP.UN | BROOKFIELD RENEWABLE PARTNER |

| US88166A7063 | TAGS | TEUCRIUM AGRICULTURAL FUND |

| US9117831084 | UHN | UNITED STATES DIESEL-HEATING |

| US74347W3951 | GLL | PROSHARES ULTRASHORT GOLD |

| BMG162581083 | BEP | BROOKFIELD RENEWABLE PARTNER |

| US84130C1009 | SXEEQ | SOUTHCROSS ENERGY PARTNERS L |

| US24664T1034 | DKL | DELEK LOGISTICS PARTNERS LP |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| US86722Y1010 | SXCP | SUNCOKE ENERGY PARTNERS LP |

| US48248A6038 | KFN PRCL | KKR FINANCIAL HOLDINGS |

| JP3047550003 | 3283 | NIPPON PROLOGIS REIT INC |

| BMG162491077 | BPY | BROOKFIELD PROPERTY PARTNERS |

| US03879N1019 | ARCX | ARC LOGISTICS PARTNERS LP |

| US29336U1079 | ENLK | ENLINK MIDSTREAM PARTNERS LP |

| US2574541080 | DM.OLD | DOMINION ENERGY MIDSTREAM PA |

| MXCFFI170008 | FIBRAPL14 | PROLOGIS PROPERTY MEXICO SA |

| US7628191006 | RMP | RICE MIDSTREAM PARTNERS LP |

| CA76090H1038 | RSTRF | RESTAURANT BRANDS-EXCH UNITS |

| BMG162521279 | BIP.PR.A | BROOKFIELD INFRASTRUCTUR |

| US09225M1018 | BSM | BLACK STONE MINERALS LP |

| US74347W2888 | UCD | PROSHARES ULTRA BLOOMBERG CO |

| US91831H1068 | VPRB | VPR BRANDS LP |

| GG00BYV2ZQ34 | RGL | REGIONAL REIT LTD |

| BMG162581323 | BEP.PR.G | BROOKFIELD RENEWABLE POW |

| BMG162521436 | BIP.PR.B | BROOKFIELD INFRASTRUCTUR |

| BMG162341090 | BBU | BROOKFIELD BUSINESS PT-UNIT |

| SG1CI1000004 | BTOU | MANULIFE US REAL ESTATE INV |

| CA70214T1194 | PVF.UN.OL | PARTNERS VALUE INVESTMENTS I |

| BMG162521683 | BIP.PR.C | BROOKFIELD INFRASTRUCTUR |

| US85814R2067 | SPLP PRA | STEEL PARTNERS HOLDINGS LP |

| US74347W2219 | OILU.OLD | PROSHARES ULTRAPRO 3X CRUDE |

| US29278N1037 | ETP | ENERGY TRANSFER OPERATING LP |

| US67420T2069 | OMP | OASIS MIDSTREAM PARTNERS LP |

| US85814R3057 | SPLP PRT | STEEL PARTNERS HLDS LP |

| US0556EL1098 | BPMP | BP MIDSTREAM PARTNERS LP |

| US20855T1007 | CCR | CONSOL COAL RESOURCES LP |

| SG1EA1000007 | CMOU | KEPPEL PACIFIC OAK US REIT |

| US29278NAB91 | ETP | ETP 6 5/8 PERP |

| US9123183009 | UNG.OLD | US NATURAL GAS FUND LP |

| BMG162584053 | BEP.PR.M | BROOKFIELD RENEWABLE PAR |

| US74347Y8057 | OILD.OLD1 | PROSHARES ULTRAPRO 3X SHORT |

| US46140H2058 | DBS | INVESCO DB SILVER FUND |

| US46140H6018 | DGL | INVESCO DB GOLD FUND |

| US46140H5028 | DBP | INVESCO DB PRECIOUS METALS F |

| US46139B1026 | DBV | INVESCO DB G10 CURRENCY HARV |

| US46140H4039 | DBO | INVESCO DB OIL FUND |

| US46141D2036 | UUP | INVESCO DB US DOLLAR INDEX B |

| US46141D1046 | UDN | INVESCO DB US DOLLAR INDEX B |

| US6740014096 | OAK PRB | OAKTREE CAPITAL GRP LLC |

| US19237JAB98 | IBCID352663531 | 19237JAB9 0 08/01/54 |

| BMG162582156 | BEP.PR.O | BROOKFIELD RENEWABLE PAR |

| BMG162522269 | BIP.PR.F | BROOKFIELD INFRASTRUCTUR |

| SGXC28500103 | LIW | EAGLE HOSPITALITY TRUST |

| SGXC75818630 | OXMU | PRIME US REIT |

| BMG162491564 | BPYPO | BROOKFIELD PROPERTY PART |

| KYG9325C1050 | VTDRF | VANTAGE DRILLING INTERNATION |

| BMG162581083 | BXE.EUR | BROOKFIELD RENEWABLE PARTNER |

| US29278NAS27 | ETP | ETP 6 3/4 PERP |

| US29278NAT00 | ETP | ETP 7 1/8 PERP |

| BMG162491648 | BPYPN | BROOKFIELD PROPERTY PART |

| BMG162582313 | BEP PRA | BROOKFIELD RENEWABLE PAR |

| US74347Y8883 | UCO | PROSHARES ULTRA BLOOMBERG CR |

| US91232N2071 | USO | UNITED STATES OIL FUND LP |

| US55406N1037 | MYTH | MYT HLDG LLC BE+ |

| BMG162522756 | BIP PRB | BROOKFIELD INFRASTRUCTUR |

| US36761Q1058 | GWYGU | GATEWAY GARAGE PARTNERS LLC |

| CA85554C1041 | SCPT.A | STRLIGHT US MLTI-FAM 2 CORE |

| US29273VAL45 | ET | ET 6 3/4 PERP |

| US29273VAM28 | ET | ET 7 1/8 PERP |

| US29273VAJ98 | ET | ET 6 5/8 PERP |

| US29273VAH33 | ET | ET Float PERP |

| US29273VAN01 | ET | ET 6 1/42 PERP |

| US74347Y8396 | UVXY.OLD | PROSHARES ULTRA VIX ST FUTUR |

| BMG1624R1079 | BPYPM | NEW LP PREFERRED UNITS CAD |

| BMG1624R1079 | BPYP.PR.A | NEW LP PREFERRED UNITS CAD |

| US86943V2097 | AGO | AGO Float PERP |

| US86943X2053 | AGO | AGO Float PERP |

| US86943W2070 | AGO | AGO Float PERP |

| US93964X1063 | WPG. | WASHINGTON PG INC UNRESTRICTED SHARES |

| SGXC50067435 | DCRU | DIGITAL CORE REIT MANAGEMENT |

| US74347Y7976 | SCO | PROSHARES ULTRASHORT BLOOMBE |

| BMG162582644 | BEP.PR.R | BROOKFIELD RENEWABLE PAR |

| US88166A8053 | DEFI.OLD | HASHDEX BITCOIN FUTURES ETF |

| US74347Y7638 | BOIL | PROSHARES ULTRA BLOOMBERG NA |

| US74347Y7893 | VIXY | PROSHARES VIX SHORT-TERM FUT |

| US74347Y7711 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| BMG6936M1001 | PVF.UN | PARTNERS VALUE INVESTMENTS L |

| US88634V1008 | DEFI | HASHDEX BITCOIN FUTURES ETF |

PTP Securities without Qualified Notices

Last updated 22-01-2024

| ISIN | Symbol | Description |

| US1182301010 | BPL | BUCKEYE PARTNERS LP |

| US3152931008 | FGPRQ | FERRELLGAS PARTNERS-LP |

| US1501851067 | FUN | CEDAR FAIR -LP |

| US29250R1068 | EEP | ENBRIDGE ENERGY PARTNERS LP |

| US0309751065 | APU | AMERIGAS PARTNERS-LP |

| US40636T2033 | HRY | HALLWOOD RLTY PARTNERS L P |

| US8644821048 | SPH | SUBURBAN PROPANE PARTNERS LP |

| US3719271047 | GEL | GENESIS ENERGY L.P. |

| US8810052014 | TNH | TERRA NITROGEN COMPANY LP |

| US6442061049 | NEN | NEW ENGLAND REALTY ASSOC-LP |

| US7328571077 | POPE | POPE RESOURCES |

| US2937921078 | EPD | ENTERPRISE PRODUCTS PARTNERS |

| US7265031051 | PAA | PLAINS ALL AMER PIPELINE LP |

| US87233Q1085 | TCP | TC PIPELINES LP |

| US01877R1086 | ARLP | ALLIANCE RESOURCE PARTNERS |

| US5733311055 | MMLP | MARTIN MIDSTREAM PARTNERS LP |

| US25820R1059 | DMLP | DORCHESTER MINERALS LP |

| US29273R1095 | ETP.OLD | ENERGY TRANSFER PARTNERS LP |

| US4357631070 | HEP | HOLLY ENERGY PARTNERS LP |

| US89376V1008 | TLP | TRANSMONTAIGNE PARTNERS LP |

| US37946R1095 | GLP | GLOBAL PARTNERS LP |

| US0966271043 | BWP | BOARDWALK PIPELINE PARTNERS |

| US23311P1003 | DCP | DCP MIDSTREAM L.P. |

| US1314761032 | CLMT | CALUMET SPECIALTY PRODUCTS |

| US29273V1008 | ET | ENERGY TRANSFER LP |

| US01881G1067 | AB | ALLIANCEBERNSTEIN HOLDING LP |

| US01861G1004 | AHGP | ALLIANCE HOLDINGS GP LP |

| US68268N1037 | OKS | ONEOK PARTNERS LP |

| US26926V1070 | EVEPQ | EV ENERGY PARTNERS LP |

| US1067761072 | BBEPQ | BREITBURN ENERGY PARTNERS LP |

| US34958B1061 | FIG.OLD | FORTRESS INVESTMENT GRP-CL A |

| US16411Q1013 | CQP | CHENIERE ENERGY PARTNERS LP |

| US67058H1023 | NS | NUSTAR ENERGY LP |

| US67059L1026 | NSH.OLD | NUSTAR GP HOLDINGS LLC |

| US84756N1090 | SEP | SPECTRA ENERGY PARTNERS LP |

| US55608B1052 | MIC.USD | MACQUARIE INFRASTRUCTURE HOL |

| US4511001012 | IEP | ICAHN ENTERPRISES LP |

| US92205F1066 | VNRSQ | VANGUARD NATURAL RESOURCES |

| US9582541044 | WES.OLD | WESTERN GAS PARTNERS LP |

| US30242M1062 | XXFPL | FFP PARTNERS -LP-CL A |

| US9126132052 | DNO | UNITED STATES SHORT OIL FUND |

| US09625U1097 | BKEP | BLUEKNIGHT ENERGY PARTNERS L |

| US6546781013 | NKA | NISKA GAS STORAGE PARTNERS-U |

| US2128491030 | CWPS | CONWEST PARTNERSHIP LP-UNITS |

| US0548071028 | AZLCZ | AZTEC LAND & CATTLE LTD |

| US26827L1098 | ECTM | ECA MARCELLUS TRUST I |

| US38349K1051 | GDVTZ | GOULD INVESTORS LP |

| US5053461068 | LAACZ | LAACO LTD-UNITS OF LTD PRTNS |

| US1534231089 | ENGY | CENTRAL ENERGY PARTNERS LP |

| US80007T1016 | SDTTU | SANDRIDGE MISSISSIPPIAN TRUS |

| US62913M1071 | NGL | NGL ENERGY PARTNERS LP |

| US12547R1059 | CIFC | CIFC LLC |

| US02752P1003 | AMID.OLD | AMERICAN MIDSTREAM PARTNERS |

| US09625U2087 | BKEPP | BLUEKNIGHT ENERGY PARTNERS - SERIES A PREF UNIT |

| US1651851099 | CHKR | CHESAPEAKE GRANITE WASH TRUS |

| US5860481002 | MEMPQ | MEMORIAL PRODUCTION PARTNERS |

| US0293162055 | ICTPU.OLD | AMERICAN RESTAURANT PRTNR LP |

| US04941A1016 | ARPJQ | ATLAS RESOURCE PARTNERS LP |

| US6740012017 | OAK | OAKTREE CAPITAL GROUP LLC |

| US26885B1008 | EQM | EQM MIDSTREAM PARTNERS LP |

| US74347W7424 | EUFX.OLD | PROSHARES SHORT EURO ETF |

| US74347W4603 | CROC | PROSHARES ULTRASHORT AUD |

| US6658261036 | NTI | NORTHERN TIER ENERGY LP |

| US9117831084 | UHN | UNITED STATES DIESEL-HEATING |

| US4283371098 | HCRSQ | HI-CRUSH INC |

| US55336V1008 | MPLX | MPLX LP |

| US84130C1009 | SXEEQ | SOUTHCROSS ENERGY PARTNERS L |

| US24664T1034 | DKL | DELEK LOGISTICS PARTNERS LP |

| US02052T1097 | ALDW | ALON USA PARTNERS LP |

| US90290N1090 | USAC | USA COMPRESSION PARTNERS LP |

| US86722Y1010 | SXCP | SUNCOKE ENERGY PARTNERS LP |

| US12663P1075 | CVRR | CVR REFINING LP |

| US48248A6038 | KFN PRCL | KKR FINANCIAL HOLDINGS |

| US64881E1091 | NSLPQ | NEW SOURCE ENERGY PARTNERS L |

| BMG162491077 | BPY | BROOKFIELD PROPERTY PARTNERS |

| US8746971055 | TEP | TALLGRASS ENERGY PARTNERS LP |

| US92205F2056 | VNRAQ | VANGUARD NATURAL RESOU |

| US5327711025 | LIN.OLD1 | LIN MEDIA LLC - A |

| US7185492078 | PSXP | PHILLIPS 66 PARTNERS LP |

| US98159G1076 | WPT | WORLD POINT TERMINALS LP |

| US2921022099 | OGCP | EMPIRE STATE REALTY OP-S60 |

| US2921023089 | FISK | EMPIRE STATE REALTY OP -S250 |

| US2921021000 | ESBA | EMPIRE STATE REALTY OP LP-ES |

| US8493431089 | SRLP | SPRAGUE RESOURCES LP |

| US03879N1019 | ARCX | ARC LOGISTICS PARTNERS LP |

| US59564N1037 | MEP | MIDCOAST ENERGY PARTNERS LP |

| US91914J1025 | VLP | VALERO ENERGY PARTNERS LP |

| US29336U1079 | ENLK | ENLINK MIDSTREAM PARTNERS LP |

| US92205F3047 | VNGBQ | VANGUARD NATURAL RESOURCES LLC RED |

| US2924801002 | ENBL | ENABLE MIDSTREAM PARTNERS LP |

| US69318Q1040 | PBFX | PBF LOGISTICS LP |

| US9604171036 | WLKP | WESTLAKE CHEMICAL PARTNERS L |

| US92205F4037 | VNRCQ | VANGUARD NATURAL RESOU |

| US22758A1051 | CAPL | CROSSAMERICA PARTNERS LP |

| US9033181036 | USDP | USD PARTNERS LP |

| US2574541080 | DM.OLD | DOMINION ENERGY MIDSTREAM PA |

| US86765K1097 | SUN | SUNOCO LP |

| US8226341019 | SHLX | SHELL MIDSTREAM PARTNERS LP |

| US12637A1034 | CCLP | CSI COMPRESSCO LP |

| US7628191006 | RMP | RICE MIDSTREAM PARTNERS LP |

| US96108P1030 | WMLPQ | WESTMORELAND RESOURCE PARTNE |

| US96949L1052 | WPZ | WILLIAMS PARTNERS LP |

| US04929Q1022 | ATLS.OLD | ATLAS ENERGY GROUP LLC |

| US26923H1014 | RISE | SIT RISING RATE ETF |

| US09225M1018 | BSM | BLACK STONE MINERALS LP |

| US74347W2888 | UCD | PROSHARES ULTRA BLOOMBERG CO |

| US64881E3071 | NUSPQ | NEW SOURCE ENG PARTNERS LP 11%SR A |

| US3932211069 | GPP | GREEN PLAINS PARTNERS LP |

| US4038291047 | GYRO | GYRODYNE LLC |

| US91831H1068 | VPRB | VPR BRANDS LP |

| US87611X2045 | NGLS PRA | TARGA RESOURCES PARTNERS |

| US1724641097 | SIRE | SISECAM RESOURCES LP |

| US03957U1007 | APLP | ARCHROCK PARTNERS LP |

| US2263442087 | CEQP | CRESTWOOD EQUITY PARTNERS LP |

| US97718W1080 | GCC.USD | WISDOMTREE CONTINUOUS COMMOD |

| US63900P6088 | NRP | NATURAL RESOURCE PARTNERS LP |

| US51508J2078 | LMRKP | LANDMARK INFRASTRUCTURE |

| CA70214T1194 | PVF.UN.OL | PARTNERS VALUE INVESTMENTS I |

| BMG162521683 | BIP.PR.C | BROOKFIELD INFRASTRUCTUR |

| US976ESC3018 | FUR.ESC | WINTHROP REALTY TRUST - ESCROW |

| US65506L1052 | NBLX | NOBLE MIDSTREAM PARTNERS LP |

| US67058H2013 | NS PRA | NSUS 8 1/2 12/31/49 |

| BMG162521840 | BIP.PR.D | BROOKFIELD INFRASTRUCTUR |

| US74347W2219 | OILU.OLD | PROSHARES ULTRAPRO 3X CRUDE |

| US67058H3003 | NS PRB | NSUS 7 5/8 PERP PFD |

| US29278N1037 | ETP | ENERGY TRANSFER OPERATING LP |

| US62913M2061 | NGL PRB | NGL 9 PERP PFD |

| US67420T2069 | OMP | OASIS MIDSTREAM PARTNERS LP |

| US85814R3057 | SPLP PRT | STEEL PARTNERS HLDS L |

| US0556EL1098 | BPMP | BP MIDSTREAM PARTNERS LP |

| US20855T1007 | CCR | CONSOL COAL RESOURCES LP |

| US67058H4092 | NS PRC | NUSTAR ENERGY LP |

| US12654A1016 | CNXM | CNX MIDSTREAM PARTNERS LP |

| US59140L1008 | IDIV | METAURUS US EQUITY CUMULATIV |

| US59140L2097 | XDIV.OLD | METAURUS US EQUITY EX DIVIDE |

| US74347Y8057 | OILD.OLD1 | PROSHARES ULTRAPRO 3X SHORT |

| US26923H2004 | BDRY | BREAKWAVE DRY BULK SHIPPING |

| US29278N3017 | ETP PRC | ENERGY TRANSFER PARTNERS |

| US23311P2092 | DCP PRB | DCP MIDSTREAM LP |

| US46140H2058 | DBS | INVESCO DB SILVER FUND |

| US46140H6018 | DGL | INVESCO DB GOLD FUND |

| US46139B1026 | DBV | INVESCO DB G10 CURRENCY HARV |

| US29278N4007 | ETP PRD | ENERGY TRANSFER PARTNERS |

| US37946R2085 | GLP PRA | GLOBAL PARTNERS LP |

| US23311P3082 | DCP PRC | DCP 7.95 PERP PFD - DCP MIDSTREAM LP |

| US64ESC19977 | NYRT.ESC | NEW YORK REIT INC - ESCROW |

| US9586691035 | WES | WESTERN MIDSTREAM PARTNERS L |

| US62913M3051 | NGL PRC | NGL ENERGY PARTNERS LP |

| US29278N5095 | ETP PRE | ENERGY TRANSFER OPERATNG |

| SGXC28500103 | LIW | EAGLE HOSPITALITY TRUST |

| US2263443077 | CEQP PR | CRESTWOOD EQUITY PARTNER |

| KYG9325C1050 | VTDRF | VANTAGE DRILLING INTERNATION |

| US59560V2088 | MCEP | MID-CON ENERGY PARTNERS LP |

| US55406N2027 | PFDM | PFD MYT HLDG CO BE+ |

| US55406N1037 | MYTH | MYT HLDG LLC BE+ |

| US8661424098 | SMLP | SUMMIT MIDSTREAM PARTNERS LP |

| US1266332055 | UAN | CVR PARTNERS LP |

| US36761Q1058 | GWYGU | GATEWAY GARAGE PARTNERS LLC |

| US37946R3075 | GLP PRB | GLOBAL PARTNERS LP |

| US29273V6056 | ET PRE | ENERGY TRANSFER LP 7.6% PERP PFD U |

| US29273V5066 | ET PRD | ENERGY TRANSFER LP 7.625% PERP PFD |

| US29273V4077 | ET PRC | ENERGY TRANSFER LP |

| US3152932097 | FGPR | FERRELLGAS PARTNERS-LP |

| US3152933087 | FGPRB | FERRELLGAS PARTNERS LP-B |

| US74347Y8396 | UVXY.OLD | PROSHARES ULTRA VIX ST FUTUR |

| US0806941029 | OZ | BELPOINTE PREP LLC |

| US93964X1063 | WPG. | WASHINGTON PG INC UNRESTRICTED SHARES |

| CA70214T2002 | PVI.II | PARTNERS VALUE INVESTMENTS LP |

| CA70214T3091 | PVI.III | PARTNERS VALUE INVESTMENTS LP SERIES 3 |

| CA70214T4081 | PVI.IIII | PARTNERS VALUE INVESTMENTS LP SERIES 4 |

| US092ESC0377 | BGIO.ESC | ESC BGIO LIQUIDATION TRUST |

| US90205J1025 | TESLU | 286 LENOX PARTNERS LLC |

| US02364V2060 | GHI | GREYSTONE HOUSING IMPACT INV |

| US21258A2015 | SPKX | CONVXTY SHS 1X SPIKES FUTUR |

| US21258A1025 | SPKY | CONVXTY SHS DAILY 1.5X SP FU |

| US41988L2025 | NNUTU | HAWAIIAN MACADAMIA NUT ORCHA |

| US87313P1030 | TXO | TXO PARTNERS LP |

| US26923H3093 | BWET | BREAKWAVE TANKER SHIP ETF |

| US30053M2035 | SNMP | EVOLVE TRANSITION INFRASTRUC |

| US28252B8871 | EFSH.OLD | 1847 HOLDINGS LLC |

| US55285N1090 | MDBH | MDB CAPITAL HOLDINGS LLC |

| US55445L1008 | MNR | MACH NATURAL RESOURCES LP |

| US29273V7047 | ET PRI | ENERGY TRANSFER LP |

| BMG6936M1001 | PVF.UN | PARTNERS VALUE INVESTMENTS L |

| BMG6936M1183 | PVF.PR.U | PARTNERS VALUE INVEST LP |

| BMG6936M1266 | PVI.II.SP | PARTNERS VALUE INVESTMENTS LP - PREF UNIT LTD PRTNS SR 2 CL |

| BMG6936M1423 | PVIIII.P | PARTNERS VALUE INVESTMENTS LP - PREF UNIT LTD PRTNS SR 4 CL |

| BMG6936M1340 | PVIIII.P | PARTNERS VALUE INVESTMENTS LP - PREF UNIT LTD PNTRS SR 3 CL |

| US28252B8798 | EFSH | 1847 HOLDINGS LLC |

| US88634V1008 | DEFI | HASHDEX BITCOIN FUTURES ETF |

Information on Irish Interest Withholding

The Irish Tax Authority requires IBKR to collect withholding tax on interest earned in Ireland. This withholding is at a rate of 20% and must be deducted from interest payments to your account.

Please note withholding tax applies to all clients who are resident in Ireland, whether individuals (including partnerships) or companies.

Withholding tax does not apply to clients who are companies in countries that are members of the European Union (excluding Ireland) or companies in countries that have a Double Tax Agreement (DTA) with Ireland.

For other clients in the EU (excluding Ireland) or if you are a non-resident of Ireland but tax resident in a country with a Double Tax Agreement (DTA) with Ireland, you may complete Form 8-3-6, that will reduce or eliminate your withholding tax. In addition to providing your information, you will need to have the form completed by the tax authority in the country where you are a tax resident.

You will require the following information in order to complete Form 8-3-6.

1. Client name (please ensure this matches the name on your IBKR account).

2. Client address.

3. Tax reference number in country of residence.

4. The country in which the client is resident for tax.

5. The rate of withholding tax between the country of tax residence and Ireland (see below).

6. Signature.

7. Date.

On completion of the form, you should submit it to the local tax authority in the country of your residence. The local tax authority must sign and stamp the form. As per below, Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch.

Once you receive the completed form from your local tax authority, please email a PDF or JPEG copy of the fully signed form to tax-withholding@interactivebrokers.com.

Please note, the withholding tax rate depends on the DTA between Ireland and your country of tax residence which can be found on the Irish Revenue website https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

For your convenience, we have prepared the forms to include items 3 to 5 above for all countries in the European Economic Area (“EEA”). Clients will need to complete the other items in 1 to 7 above.

For clients outside the EEA please use this form when the withholding tax rate is 0% and this form in all other cases.

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

|

|

|

|

非金融機関のための事業体およびFATCA区分

イントロダクション

インタラクティブ・ブローカーズ(「IB」または「弊社」)では、米国外国口座税務コンプライアンス法(「FATCA」)およびその他の国際的な情報交換協定を遵守するため、お客様(「お客様」)より特定の書類を収集することを義務付けられています。

このガイドには一連のフローチャートと、以下に関連するIRSルールをまとめた付属の注意事項が含まれます:

1. W-8またはW-9の納税申告書のどちらを事業体が使用するべきかを決定するための税区分、および

2. W-8を使用する事業体に必要となるFATCA区分(パートI、セクション5)。

![]() 注意事項: このフローチャートとその他の記載事項は、すべての可能なシナリオをカバーしているわけではなく、ここで紹介されていないシナリオも存在し、よりお客様の状況に近い可能性もあります。こちらのガイドをお読みいただいた後、米国におけるご自身の事業体およびFATCA区分が明確でない場合には、専門の税理士にご相談下さい。

注意事項: このフローチャートとその他の記載事項は、すべての可能なシナリオをカバーしているわけではなく、ここで紹介されていないシナリオも存在し、よりお客様の状況に近い可能性もあります。こちらのガイドをお読みいただいた後、米国におけるご自身の事業体およびFATCA区分が明確でない場合には、専門の税理士にご相談下さい。

このガイドに含まれないもの

このガイドは米国外の法人で、 (i) 口座への支払の受益者であり、 (ii) 金融機関ではない事業体を対象としています。このガイドは以下には適用されません:

• 個人(W-9またはW-8BENを使用)

• 米国の事業体(W-9を使用)

• 別の個人の代理で仲介人としての役割を担う事業体(受取人、ブローカー、証券保管機関、投資アドバイザーなど)(W-8IMYを使用)。

• 米国外の非課税となる組織および私立財団

• 金融機関

![]() 注意事項: 米国はFATCAの実施に関し、多くの国と政府間協定(IGA)と呼ばれる二国間協定を締結しています。適用となるIGAの既定により、場合によっては本ガイドに記載される内容が変更されることがあります。 IGAの対象となる事業体はIGAをご参照いただく、および/または専門の税理士にご相談の上、申告の必要性をご確認下さい。

注意事項: 米国はFATCAの実施に関し、多くの国と政府間協定(IGA)と呼ばれる二国間協定を締結しています。適用となるIGAの既定により、場合によっては本ガイドに記載される内容が変更されることがあります。 IGAの対象となる事業体はIGAをご参照いただく、および/または専門の税理士にご相談の上、申告の必要性をご確認下さい。

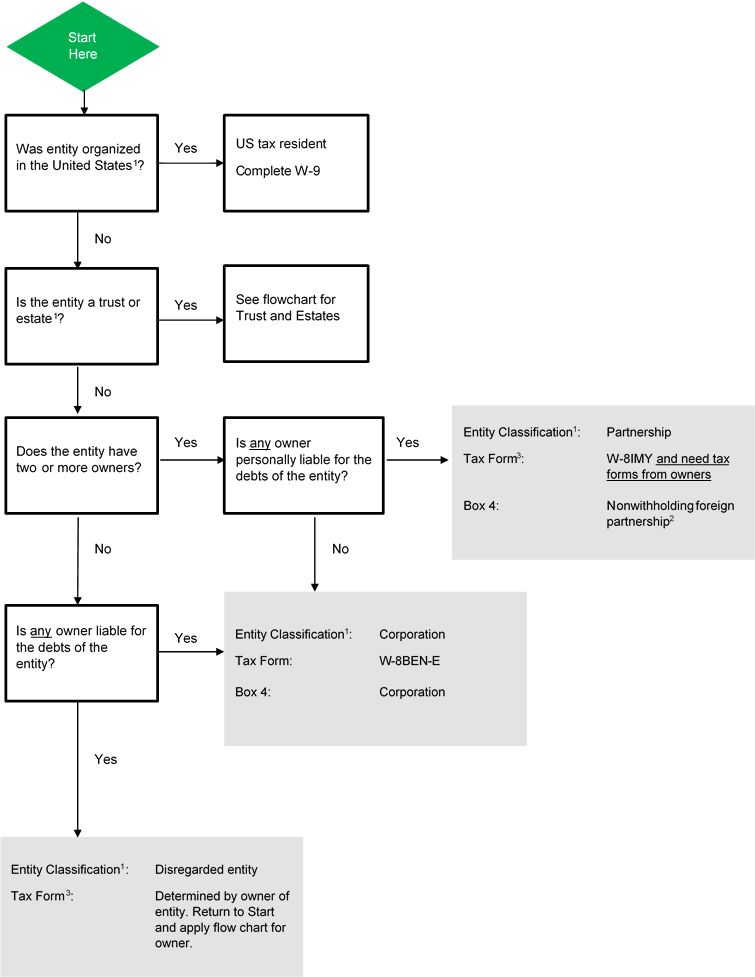

1. 米国における税区分

お客様の米国における税区分によって口座の記録に必要となる納税申告書が決定されます。 税区分および納税申告書のご確認に、以下のフローチャートをお役立て下さい。

重要事項: 米国ではその居住者の世界所得に対して所得税を課しています。一方、非居住者は特定の限られた種類の米国源泉投資所得(米国法人からの配当金など)に限って源泉徴収の対象になります。W-8関連の納税申告書の使用は、米国居住者として課税されないことを証明するものです。W-8フォームは、米国租税条約に基づく源泉徴収税の軽減税率申請の際にも使用することができます。

税区分および適用となる納税申告書を決定するためのフローチャート(信託以外の事業体)

税区分および適用となる納税申告書を決定するためのフローチャート(信託)

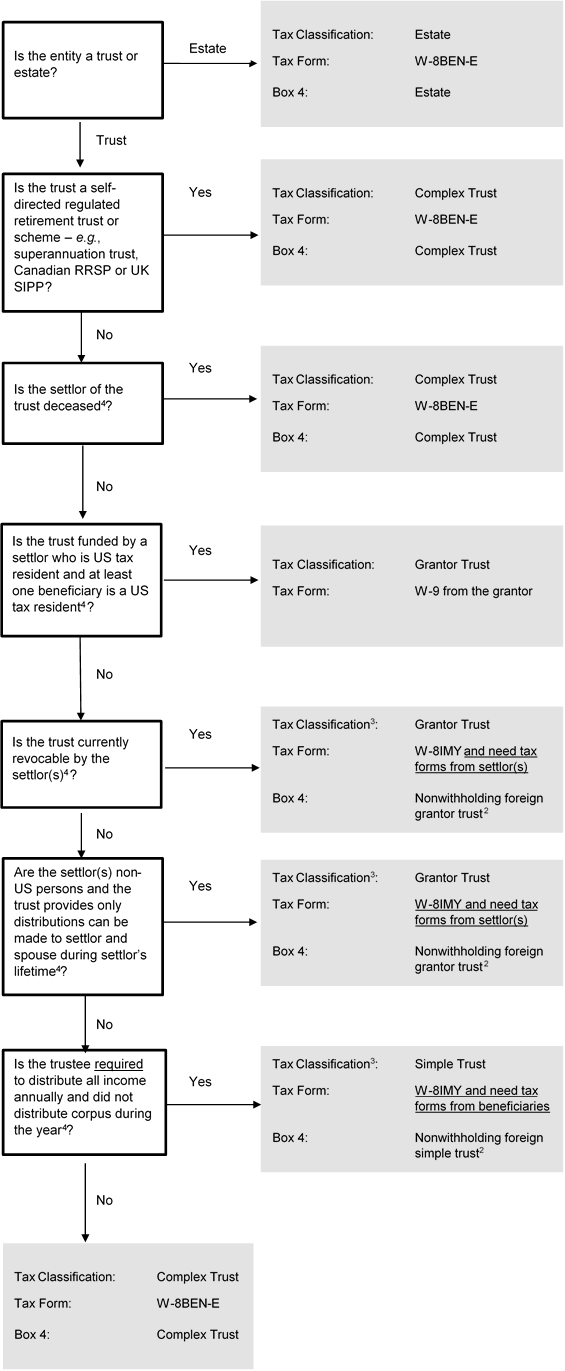

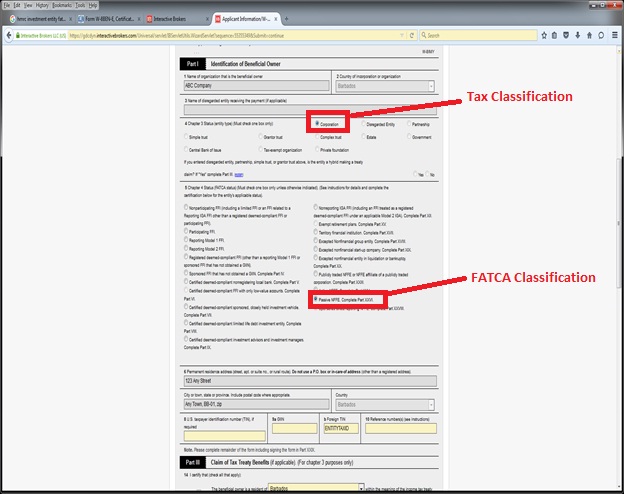

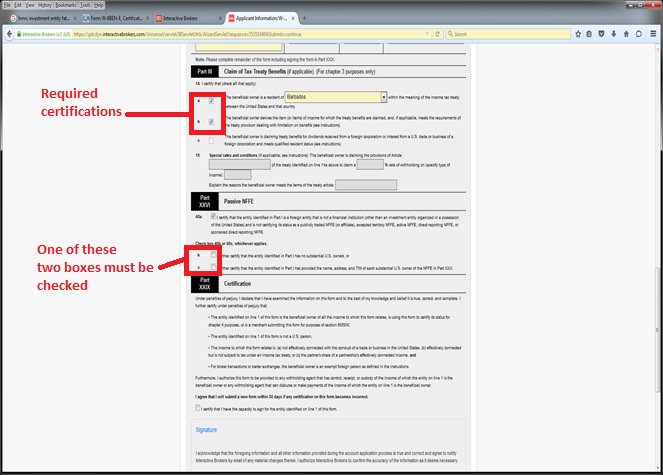

2. FATCA区分

W8納税報告書はFATCA区分の収集にも使用されます。多くの国では米国との「政府間協定」(IGA)を締結し、FATCAのために自国の金融機関に顧客を区分するよう求めています。IGAに基づく区分ルールは、IRSによる区分ルールと完全に一致しないことがあります。他金融機関ではFATCAの準拠をIRSと合意の上、IRSのルールに基づいて顧客のFATCA区分を行っています。弊社ではこの情報の収集を義務付けられています。以下のフローチャートはIRSの既定するFATCA区分用のルールを適用しており、一般的なものとなります。 このフローチャートには、一般的な口座体系であるFATCAにおいて受動的非金融外国企業(NFFE)として区分され、条約による源泉徴収率の適用を受ける非米国法人のためのW-8BEN-Eのサンプルスクリーンショットが添付されています。

![]() 注意事項: 多くの事業体が複数のタイプのFATCAに該当するため、最も適切な区分の選択が必要です。お客様の個人的な状況は一般的なガイダンスに当てはまらないことがあります。弊社ではお客様に代わってこの判断を行う立場にはなく、また規則が複雑であるため、お客様ご自身で専門化のアドバイスを求めることをお勧め致します。

注意事項: 多くの事業体が複数のタイプのFATCAに該当するため、最も適切な区分の選択が必要です。お客様の個人的な状況は一般的なガイダンスに当てはまらないことがあります。弊社ではお客様に代わってこの判断を行う立場にはなく、また規則が複雑であるため、お客様ご自身で専門化のアドバイスを求めることをお勧め致します。

FATCA区分を決定するためのフローチャート

.png)

例: 株式会社は、2人以上の所有者が関与し、事業体の債務に対する個人的な責任を持つ人物がいない、一般的な所有形態の事業体です。 上記の税区分フローチャートにまとめられるように、このタイプの事業体はW-8BEN-Eの記入が必要になります。企業が外国金融機関(例、銀行、ブローカー、投資マネージャー、ヘッジファンド、投資信託、保険会社など)に区分されない場合には、以下の脚注5に記載されるよう、FATCA区分は受動的NFFEになります。 こちらのサンプル事業体用のスクリーンショットは以下のようになります。

スクリーンショットのサンプル - W-8BEN-E(受動的NFFE)

脚注

1 米国国税庁(IRS)は、米国外で設立された事業体の課税区分を決定するための規則を制定しています。この既定は、事業体が設立または所在する国での区分に関係なく適用されます。

一般的に法人は口座の受益者として扱われるため、別途選択しない限り(以下を参照)、W-8BEN-Eの記入しと「法人」の選択が必要です。

IRSの規制では各タイプの事業体にデフォルトの区分を割り当てています。デフォルトの区分は、IRSに報告して米国雇用者番号を取得することによって上書きされることがあります。事業体の中には区分の変更ができず、状況に関係なく法人として扱われる場合があります(例:公開有限責任会社、Sociedad Anonima、Aktiengesellschaftなど)。完全なリストは米国財務省規則、301.7701-2(b)(8)をご参照下さい。

IRSによるデフォルトの区分は通常、 (i) 所有者の数、および (ii) 所有者が組織法(銀行保証や所有者によるその他の契約の同意は関係なく)に基づいて事業体の債務に対し個人的に責任を負うかどうかによります。以下の表はデフォルトのルールをまとめたものになります:

|

|

所有者数

|

所有者には有限責任がありますか?

|

|

|||

|

|

ある

|

ない

|

|

|||

|

|

所有者1人

|

法人

|

法人格を持たない事業体

|

|

||

|

|

所有者2人以上

|

法人

|

パートナーシップ

|

|

||

|

|

|

|

||||

注意事項: 法人格のない事業体の税区分はその所有者によって決定されます。米国の法人格のない事業体で所有者が非米国の企業のお客様はフローチャートをご参考下さい。

IRS Form W-8IMYを使用する財務的に透明な企業(パートナーシップ、単純信託またはグランター・トラスト)は米国における税法上、口座を文書化するため、その受益者全員のIRS納税申告書を提供する必要があります。

特定のユニット型投資信託(一般的に投資先を変更できる場合)は、米国の税法上トラストとみなされません。これらの投資信託は、上記の規則により、従来の事業体と同様に扱われます(法人、パートナーシップ、または法人格のない事業体)。

(1) 米国外の裁判所が信託の管理について第一次監督を行うことができ、かつ (2) 米国外の人物が信託の重要な決定を支配する(または拒否する)ことができる場合、米国の税法上、そういった信託は最終的に非米国信託とみなされます。

フローチャートはデフォルトの事業体区分が適用され、事業体が当然(per se)法人ではないものとみなします。

2 パートナーシップ、単純信託またはグランター・トラストは、IRSと源泉徴収に関する契約を結ぶことにより、口座からの米国源泉徴収に同意することができます。フローチャートでは源泉徴収の契約がないことを前提としています。

3 一般的に、米国の租税条約による特典は、米国の税法に基づいて決定された所得の受益者に付与されます。これは財務的に透明な企業(パートナーシップ、単純信託、グランター・トラスト、または法人格のない事業体)にとって事業体自体ではなく、事業体の所有者が米国の租税条約による特典を受けることを意味します。これらの特典は、受益者のW8納税申告書で要求されますが、特定の限られた場合において、企業は米国の税法上は財務的に透明であるものの、米国と租税条約を結ぶ国においては財務的に透明でないとみなされることがあります。このタイプの事業体は「ハイブリッド事業体」を呼ばれます。特定の場合において、ハイブリッド事業体が適用される租税条約のいわゆる適格居住者テストを達成する場合には、所有者ではなくハイブリッド事業体が、米国租税条約の特典を受けることができます。適格とされる「ハイブリッド事業体」は、フローチャートに記載されるフォームと併せてForm W-8BEN-Eを提出することにより、米国租税条約の特典を要求することができます。ハイブリッドステータスの選択によって、すべての受益権所有者の文書化が必要なくなるわけではありませんのでご注意下さい。ハイブリッド事業体が租税条約の特典を要求することは稀であり、受益権者が租税条約の特典を要求する方がより一般的です。

4 信託を区分するルールは複雑です。フローチャートは一般的なルールのみを適用しており、信託の区分にあたって考慮される様々な点が、フローチャートには記載されていません。例えば、単純信託は慈善団体を受益者にすることはできません。

5 FATCAにおける外国金融機関とは何ですか?

FATCA区分はいろいろありますが、大きく2つのカテゴリーに分けることができます: 外国金融機関(FFI)および 非金融外国企業(NFFE)。ごく一般的に、金融機関とは以下に該当する事業体を指します:

• 預託金取扱い金融機関

• 保管機関

• 投資事業体

• 特定の貯蓄型保険または年金契約を発行する保険会社。

FFIは通常IRSに登録の上、グローバル仲介者認識番号 (GIIN)を取得し、その顧客/所有者について適切な税務当局に報告する必要があります。事業体が金融機関の定義に当てはまらない場合これはNFFEとみなされ、このガイドブックのカバーの対象になります。

IRSの規則および政府間協定の合意により変更されることがあります:

• 預貯金取扱金融機関とは、銀行業務またはこれに似た業務の通常の仮定で預金を受け入れる機関です。これには銀行と信用金庫が含まれます。

• 保管機関とは、その業務の実質的な位置づけとして、他人の金融資産を保管する機関です。これにはブローカー、管理銀行、信託会社、クリアリング機関などが含まれます。

• 投資事業体とは、以下のいずれかの事業体を指します

(i) 総収入の50%以上を次から得ている事業体:(i) 金融商品、外貨、有価証券、金利、先物などの取引、(ii) ポートフォリオ管理、または (iii) 他人(通常はブローカーディーラーや投資マネージャーなど)の代行として資金または金融資産の投資、管理または運用を行っている、

または、

(ii) 事業体の総収入の50%以上が金融資産への投資、再投資、または取引に起因し、かつ金融機関(投資信託、ヘッジファンド、の他のグループ投資機能など)により管理されている、

または、

(iii) 金融資産(投資信託、ヘッジファンド、の他のグループ投資機能など)への投資、再投資、または取引を行うために設立された企業であることを自称している。

個人はFFIにはなれません。このため、専門の個人投資アドバイザーに管理される組織(組織の従業員とは違い)は金融機関による管理ではないため、上記の(ii)の下 、投資事業体とはみなされません。

信託、家族投資信託、ファンドは、金融機関によって専門的に運用されている場合、つまり金融機関が事業体の日常業務を処理しているかファンドに対する裁量権を有している場合には、投資事業体の定義に該当する可能性があります。

例: 個人が非米国信託Aを設立し、非米国の金融機関であるXを受託者として任命します。Xは受託者として、信託Aの管理と運営に対する責任を負います。信託Aは外国金融機関によって管理されているために投資事業体であり、外国金融機関になります。

例: 個人が非米国信託Aを設立し、個人の専門マネージャーであるYを受託者として任命します。Yは受託者として、信託Aの管理と運営に対する責任を負います。信託Aは外国金融機関によって管理されていないために投資事業体でも外国金融機関でもありません。個人は金融機関にはなれません。

6 IRSには、その管轄地域におけるFATCAの実施を承認する政府間協定(IGA)を締結している国のリストがあります。IGAのリストはこちらをご参照下さい:https://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA-Archive.aspx.

7 金融機関の定義は4番をご参照下さい。金融機関とみなされない組織は、非金融外国企業(NFFE)とみなされます。NFFEには、適用除外、能動的、受動的の3つのタイプがあります。能動的NFFEとは、(i) 総所得の50%以下が受動的所得とみなされ、かつ (ii) 平均資産が受動的所得の生産のために保有されている事業体を指します。適用除外または能動的ではないNFFEはすべて受動的NFFEとなり、受動的NFFEは通常10%以上の直接または間接的な所有権となる実質的米国人所有者の証明書を弊社にご提出いただく必要があります。IGAの中には実質的な米国人所有者の定義を変更し、実質的支配者と呼んでいるものもあります。

8 その他の選択肢としては、非金融グループ企業、適用除外の非金融系新企業、清算または倒産した適用除外の非金融系企業、上場NFFE、またはスポンサー付きNFFEなどがあります。詳細はW-8のインストラクションをご覧下さい。

ディスクレーマー

このガイドは税金や法的なアドバイスを行うものではなく、インタラクティブ・ブローカーズではIRS Forms W-8の記入に関するアドバイスを提供しておりません。このガイドに含まれる例は説明を目的とするものであり、すべての可能なシナリオを取り上げていません。Forms W-8の記入方法が不明な場合には、専門の税理士にご確認いただきますようお願い致します。

非米国居住者は源泉徴収の対象になりますか?

納税義務に関する情報は、お客様の居住国の税務当局に義務として報告され、また取引商品が現地で源泉徴収の対象となる場合には、その他の国にも報告されます。 IBKRでは税務当局からの特別な指示がない限り、有価証券の売却に対する源泉徴収は行いません。米国の税法により、例えば米国の法人が外国人に支払う配当金に対しては、30%の源泉徴収を義務付けられています。税率は米国とお客様の国の間で租税条約が結ばれている場合には、これより低いことがあります。また、投資の利子による収益は米国源泉徴収の対象になりません。米国外の個人および法人の源泉徴収はすべて、各年度末にForm 1042-Sで報告されます。詳細は、「IRS publication 901」をご参照いただくか、専門の税理士にお問合せ下さい。

納税者ステータスの実証 - 米国に住所を持つ非米国人

米国内国歳入庁は通常、米国と特定の関連性を持つ個人を米国納税者とみなし、この場合にはIRS Form W-9のご記入と、弊社への米国の社会保障番号のご提出が必要になります。

米国との関連性とみなされる一般的な基準には、米国における居住地住所および郵便物送付先住所があることが挙げられます。 これらの住所を持つ個人は米国納税者とみなされ、米国との関連性として認められている条件のいずれかに当てはまらない限り、Form W-9の提出が求められます。 条件には下記が含まれます:

(A) 米国財務省の既定301.7701(b)-1(c) に記載される米国の納税上居住者としての「実質滞在テスト」(substantial presence test)を満たしておらず、 米国における住所が

(B) 米国財務省の既定§ 301.7701(b)-2に記載される密接な関連性の例外に該当し、 米国における住所が

(C) 米国の機関における学生、教師、または研修生として米国に居住する場合。米国の移民・関税執行局の発行するビザ、F、J、MまたはQのコピーの提出が必要になります。

(D) 外交官として米国に居住する場合。米国の移民・関税執行局の発行するビザ、AまたはG(A-3またはG-3以外)のコピーの提出が必要になります。

(E) 米国に滞在しており、上記(C)または(D)に記載される人物の配偶者、または21歳未満の未婚の子供である場合。ビザのコピーの提出が必要になります。

注意事項: 上記の例は、米国との関連性として認められる唯一の状況ではありません。どの例にも当てはまらないものの非納税者であると思われる場合には、非米国ステータスを裏付ける説明の提出が必要になります。

税金: 非米国人および非米国企業: Form 1042-S

Form 1042-Sは、課税年度中に非米国人であるお客様の口座に支払われた、米国源泉の金利、配当金、これの代わりとなる所得および諸費用を含め、米国源泉税対象となる所得に関する報告です。 異なる種類の所得報告のために、複数の1042-Sフォームをお受取りいただく可能性があります。

この情報はIRSにも報告されます。所得はそれぞれボックス1のコードを記入の上、個別のフォームで報告されます。共通コードは以下のようになります:

Circular 230に関する通知: これらのステートメントは情報提供目的のみであり、税務助言や連邦税、州税、その他の地域の税制罰則や規制罰則体側のために提供されたものではありません。

Connecticut Sales and Use Tax

The state of Connecticut imposes a sales and use tax which is applicable to online access to information including all data and access fees.

The tax rate as of 2017 is 1% and is applicable to clients with the state of legal residency of Connecticut or a Connecticut permanent/resident address.

The sales and use tax will be applied to all research and market data subscriptions as well as special connections such as VPN, IB Gateway, Extranet and Dedicated Leased Lines.

The sales and use tax will be passed through to client accounts at the time of the subscription billing. The tax is only applicable if a monthly fee is charged, therefore should an account receive a waiver the sales and use tax will similarly be waived.