外汇(FX)入门

IB提供的交易场所和交易平台既适用于专注外汇交易的交易者也适用于因多币种股票和/或衍生品交易需要偶尔进行外汇交易的交易者。下方文章概述了在TWS平台上下达外汇定单的基本要点以及报价管理和头寸报告相关信息。

外汇(FX)交易涉及同时买入一种货币并卖出另一种货币,两种货币组合在一起通常被称为交叉货币对。在下方例子中,EUR.USD交叉货币对中的前一种货币(EUR)为交易者想买入或卖出的交易货币,后一种货币(USD)则为结算货币。

跳转至指定主题;

外汇报价

货币对即外汇市场上一种货币单位相对于另一种货币单位的相对价值的报价。用以作为参考的货币被称为报价货币,而参考该货币给出报价的货币则被称为基础货币。在TWS中,每个货币对有一个交易代码。您可以使用外汇交易者(FXTrader)调换报价方向。交易者买入或卖出基础货币的同时在卖出或买入报价货币。例如,EUR/USD货币对的代码为:

EUR.USD

其中:

- EUR为基础货币

- USD为报价货币

上方货币对的价格表示需要多少单位的USD(报价货币)能交易一个单位的EUR(基础货币)。也就是说,1 EUR是在按USD报价。

EUR.USD的买单表示买入EUR并卖出同等金额的USD,具体取决于交易价格。

创建报价行

在TWS添加外汇报价行具体步骤如下:

1. 输入交易货币(如EUR),然后按回车键(enter)。

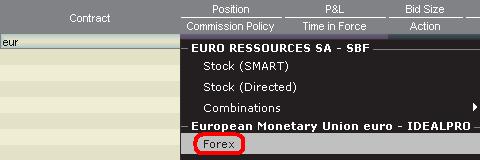

2. 选择产品类型——外汇

3. 选择结算货币(如USD),然后选择外汇交易场所。

.jpg)

注:

IDEALFX对于超过其最低数量要求(通常为25,000美元)的定单可直接接入银行间外汇报价。传递到IDEALFX但未达到其最低数量要求的定单基本会被自动传递到小额定单交易场所进行外汇转换。点击此处了解IDEALFX的最低数量要求和最高数量限制相关信息。

外汇交易商会按特定方向对外汇货币对进行报价。因此,交易者需通过调整输入的货币代码来查找想要的货币对。例如,如果输入货币代码CAD,交易者会发现合约选择窗口中没有结算货币USD。这是因为,该货币对是按USD.CAD报价的,只能先输入底层代码USD,然后再选择货币对。

下单

具体取决于显示的栏标头,货币对将显示如下:

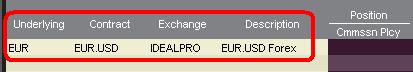

合约(Contract)和描述(Description)栏将按交易货币.结算货币的形式显示货币对(如EUR.USD)。底层代码(Underlying)栏则只显示交易货币。

点击此处了解如何更改更改显示的数据栏标头。

1. 要输入定单,左键点击买价(下卖单)或卖价(下买单).

2. 指定想要买入或卖出的交易货币的数量。定单的数量按基础货币(即货币对中的前一种货币)显示。

盈透证券在外汇交易上没有代表固定金额基础货币的合约的概念,您的交易尺寸便是所需交易的基础货币金额。

例如,100,000单位EUR.USD的买单会买入100,000单位EUR,并根据显示的汇率卖出等值USD。

3. 指定想使用的定单类型、汇率(价格),然后传递定单。

注:下达的定单必须是完整的货币单位,除上述交易场所最低数量要求外,没有最低合约或手数要求。

点值

点(pip)是货币对变化的衡量单位,对于大多数货币对来说其代表最小变化,但有时也允许存在非整点的变化。

例如,在EUR.USD中,1个点是0.0001,而在USD.JPY中,1个点事0.01。

要计算报价货币1个点的点值,可采用以下公式:

(名义金额) x (1个点)

例如:

- 代码 = EUR.USD

- 金额 = 100,000 EUR

- 1个点 = 0.0001

1个点点值 = 100’000 x 0.0001= 10 USD

- 代码 = USD.JPY

- 金额 = 100’000 USD

- 1个点 = 0.01

1个点点值 = 100’000 x (0.01)= JPY 1000

要计算基础货币1个点的点值,可采用以下公式:

(名义金额) x (1个点/汇率)

例如:

- 代码 = EUR.USD

- 金额 = 100’000 EUR

- 1个点 = 0.0001

- 汇率 = 1.3884

1个点点值 = 100’000 x (0.0001/1.3884)= 7.20 EUR

- 代码 = USD.JPY

- 金额 = 100’000 USD

- 1个点 = 0.01

- 汇率 = 101.63

1个点点值 = 100’000 x (0.01/101.63)= 9.84 USD

头寸(交易后)报告

外汇头寸信息是在IB进行交易的一个重要方面,在真实账户中开始交易之前需对其进行充分了解。IB的交易软件在两个不同的地方反映了外汇头寸,二者均可在账户窗口查看。

1. 市场价值

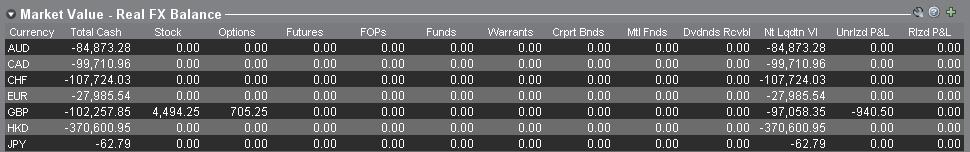

账户窗口的市场价值部分反映的是实时货币头寸,按货币(而非货币对)显示。

账户窗口的市场价值部分是唯一一个可供交易者查看实时外汇头寸信息的地方。持有多种货币头寸的交易者不一定要使用开仓时用的货币对来平仓。例如,买了EUR.USD(买EUR卖USD)还买了USD.JPY(买USD卖JPY)的交易者也可以通过交易EUR.JPY(卖EUR买JPY)来平仓头寸。

注:

市场价值部分可展开/收起。交易者应点击净清算价值栏上方的符号确保显示出绿色“减号”。如果是绿色“加号“,某些头寸可能被隐藏。

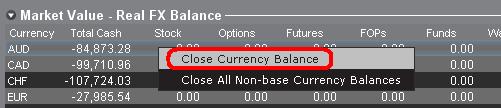

交易者可以从市场价值部分发起平仓交易:右键点击想要平仓的货币,选择”平仓货币余额“或”平仓所有非基础货币余额“。

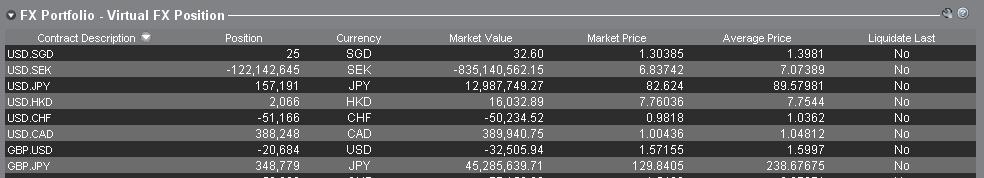

2. 外汇投资组合

账户窗口的外汇投资组合部分展示的是虚拟头寸,以货币对的形式显示头寸信息,这与市场价值部分按货币显示不同。这种特定的显示形式是为了考虑机构外汇交易者的常用惯例,零售或非频繁外汇交易者基本上可以无视该部分信息。外汇投资组合的头寸数量并不反映所有外汇活动,但是,交易者可以对此部分显示的头寸数量和平均成本进行修改。这一无需执行交易便可随意调整头寸和平均成本信息的功能对于除交易非基础货币产品外还参与其它货币交易的交易者可能会有帮助。其可让交易者手动将自动货币转换(交易非基础货币产品时会自动发生)与单纯的外汇交易活动分隔开来。

外汇投资组合部分的外汇头寸和盈亏信息均来自所有其它交易窗口显示的信息。这在确定真实的实时头寸信息时可能会造成一定困惑。为减少或消除此类困惑,交易者可以选择以下操作:

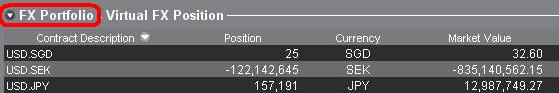

a. 收起外汇投资组合部分

点击外汇投资组合(FX Portfolio)文字左边的箭头可收起外汇投资组合部分。收起该部分后,虚拟头寸信息便不再在各交易页面显示。(注:这并不会让市场价值信息显示出来,其只会阻止外汇投资组合信息显示。)

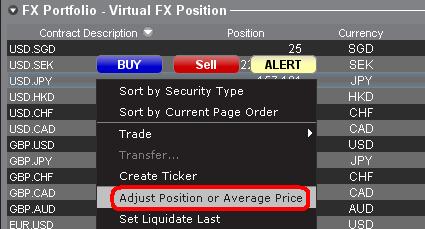

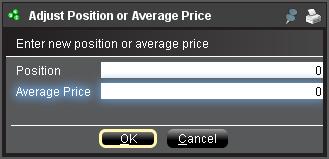

b. 调整头寸或平均价格

右键点击账户窗口的外汇投资组合部分,交易者可以选择调整头寸或平均价格。交易者平仓掉所有非基础货币头寸并确定市场价值部分反映了被平仓的所有非基础货币头寸后,便可将头寸和平均价格区域重置为0。此操作会重置外汇投资组合部分的头寸数量,可让交易者在交易界面看到更加准确的头寸和盈亏信息。(注:这是手动操作,每次货币头寸平仓后都需进行一次)。交易者应随时对市场价值部分的头寸信息进行确认,确保传递的定单达到开仓或平仓头寸想要的结果)

我们鼓励交易者在真实账户中开始交易前,先在模拟交易或演示账户中熟悉一下外汇交易。如关于以上信息仍有任何疑问,请联系IB。

其它常见问题:

An Introduction to Forex (FX)

IB offers market venues and trading platforms which are directed towards both forex-centric traders as well as traders whose occasional forex activity originates from multi-currency stock and/or derivative transactions. The following article outlines the basics of forex order entry on the TWS platform and considerations relating to quoting conventions and position (post-trade) reporting.

A forex (FX) trade involves a simultaneous purchase of one currency and the sale of another, the combination of which is commonly referred to as a cross pair. In the examples below the EUR.USD cross pair will be considered whereby the the first currency in the pair (EUR) is known as the transaction currency that one wishes to buy or sell and the second currency (USD) the settlement currency.

Jump to a specific topic in this article;

- Forex Price Quotes

- Creating a quote line

- Creating an order

- Pip Value

- Position (Post-Trade) Reporting

Forex Price Quotes

A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is used as reference is called quote currency, while the currency that is quoted in relation is called base currency. In TWS we offer one ticker symbol per each currency pair. You could use FXTrader to reverse the quoting. Traders buy or sell the base currency and sell or buy the quote currency. For ex. the EUR/USD currency pair’s ticker symbol is:

EUR.USD

where:

- EUR is the base currency

- USD is the quote currency

The price of the currency pair above represents how many units of USD (quote currency) are required to trade one unit of EUR (base currency). Said in other words, the price of 1 EUR quoted in USD.

A buy order on EUR.USD will buy EUR and sell an equivalent amount of USD, based on the trade price.

Creating a quote line

The steps for adding a currency quote line on the TWS are as follows:

1. Enter the transaction currency (example: EUR) and press enter.

2. Choose the product type forex

3. Select the settlement currency (example: USD) and choose the forex trading venue.

.jpg)

Notes:

The IDEALFX venue provides direct access to interbank forex quotes for orders that exceed the IDEALFX minimum quantity requirement (generally 25,000 USD). Orders directed to IDEALFX that do not meet the minimum size requirement will be automatically rerouted to a small order venue principally for forex conversions. Click HERE for information regarding IDEALFX minimum and maximum quantities.

Currency dealers quote the FX pairs in a specific direction. As a result, traders may have to adjust the currency symbol being entered in order to find the desired currency pair. For example, if the currency symbol CAD is used, traders will see that the settlement currency USD cannot be found in the contract selection window. This is because this pair is quoted as USD.CAD and can only be accessed by entering the underlying symbol as USD and then choosing Forex.

Creating an order

Depending on the headers that are shown, the currency pair will be displayed as follows;

The Contract and Description columns will display the pair in the format Transaction Currency.Settlement Currency (example: EUR.USD). The Underlying column will display only the Transaction Currency.

Click HERE for information regarding how to change the shown column headers.

1. To enter an order, left click on the bid (to sell) or the ask (to buy).

2. Specify the quantity of the trading currency you wish to buy or sell. The quantity of the order is expressed in base currency, that is the first currency of the pair in TWS.

Interactive Brokers does not know the concept of contracts that represent a fixed amount of base currency in Foreign exchange, rather your trade size is the required amount in base currency.

For example, an order to buy 100,000 EUR.USD will serve to buy 100,000 EUR and sell the equivalent number of USD based on the displayed exchange rate.

3. Specify the desired order type, exchange rate (price) and transmit the order.

Note: Orders may be placed in terms of any whole currency unit and there are no minimum contract or lot sizes to consider aside from the market venue minimums as specified above.

Common Question: How is an order entered using the FX Trader?

Pip Value

A pip is measure of change in a currency pair, which for most pairs represents the smallest change, although for others changes in fractional pips are allowed.

For ex. in EUR.USD 1 pip is 0.0001, while in USD.JPY 1 pip is 0.01.

To calculate 1 pip value in units of quote currency the following formula can be applied:

(notional amount) x (1 pip)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100,000 EUR

- 1 pip = 0.0001

1 pip value = 100’000 x 0.0001= 10 USD

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

1 pip value = 100’000 x (0.01)= JPY 1000

To calculate 1 pip value in units of base currency the following formula can be applied:

(notional amount) x (1 pip/exchange rate)

Examples:

- Ticker symbol = EUR.USD

- Amount = 100’000 EUR

- 1 pip = 0.0001

- Exchange rate = 1.3884

1 pip value = 100’000 x (0.0001/1.3884)= 7.20 EUR

- Ticker symbol = USD.JPY

- Amount = 100’000 USD

- 1 pip = 0.01

- Exchange rate = 101.63

1 pip value = 100’000 x (0.01/101.63)= 9.84 USD

Position (Post-Trade) Reporting

FX position information is an important aspect of trading with IB that should be understood prior to executing transactions in a live account. IB's trading software reflects FX positions in two different places both of which can be seen in the account window.

1. Market Value

The Market Value section of the Account Window reflects currency positions in real time stated in terms of each individual currency (not as a currency pair).

The Market Value section of the Account view is the only place that traders can see FX position information reflected in real time. Traders holding multiple currency positions are not required to close them using the same pair used to open the position. For example, a trader that bought EUR.USD (buying EUR and selling USD) and also bought USD.JPY (buying USD and selling JPY) may close the resulting position by trading EUR.JPY (selling EUR and buying JPY).

Notes:

The Market Value section is expandable/collapsible. Traders should check the symbol that appears just above the Net Liquidation Value Column to ensure that a green minus sign is shown. If there is a green plus symbol, some active positions may be concealed.

Traders can initiate closing transactions from the Market Value section by right clicking on the currency that they wish to close and choosing "close currency balance" or "close all non-base currency balances".

2. FX Portfolio

The FX Portfolio section of the account window provides an indication of Virtual Positions and displays position information in terms of currency pairs instead of individual currencies as the Market Value section does. This particular display format is intended to accommodate a convention which is common to institutional forex traders and can generally be disregarded by the retail or occasional forex trader. FX Portfolio position quantities do not reflect all FX activity, however, traders have the ability to modify the position quantities and average costs that appear in this section. The ability to manipulate position and average cost information without executing a transaction may be useful for traders involved in currency trading in addition to trading non-base currency products. This will allow traders to manually segregate automated conversions (which occur automatically when trading non base currency products) from outright FX trading activity.

The FX portfolio section drives the FX position & profit and loss information displayed on all other trading windows. This has a tendency to cause some confusion with respect to determining actual, real time position information. In order to reduce or eliminate this confusion, traders may do one of the following;

a. Collapse the FX Portfolio section

By clicking the arrow to the left of the word FX Portfolio, traders can collapse the FX Portfolio section. Collapsing this section will eliminate the Virtual Position information from being displayed on all of the trading pages. (Note: this will not cause the Market Value information to be displayed it will only prevent FX Portfolio information from being shown.)

b. Adjust Position or Average Price

By right clicking in the FX portfolio section of the account window, traders have the option to Adjust Position or Average Price. Once traders have closed all non base currency positions and confirmed that the market value section reflects all non base currency positions as closed, traders can reset the Position and Average Price fields to 0. This will reset the position quantity reflected in the FX portfolio section and should allow traders to see a more accurate position and profit and loss information on the trading screens. (Note: this is a manual process and would have to be done each time currency positions are closed out. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving the desired result of opening or closing a position.

We encourage traders to become familiar with FX trading in a paper trade or DEMO account prior to executing transactions in their live account. Please feel free to Contact IB for additional clarification on the above information.

Other common questions:

How can I see details of orders that I've entered in the TWS?

Account holders are able to see the details of orders they've submitted in TWS through audit trails.

In the TWS go to the Account menu and select Audit Trail beneath Information. A small window will appear titled View Audit Trail. Here you have the option of choosing Condensed or Expanded. You can also select the day you wish to view. This function will default to the current day. You can try both Condensed and Expanded to decide which you prefer. Clicking the OK button will take you to a screen where you can see details of orders that you've entered, for the day you select.

My open order doesn't appear to be working, why not?

In the case of orders that have been placed, but do not appear to be acknowledged, you must contact IBKR via telephone immediately. We will need to contact the exchange in these cases. Communication through web tickets is not real time, and can not be used for issues of an urgent nature. Requests for trade cancellations/fills must be made within the time limits set by the relevant exchange. Many equity exchanges have a notification period of 30 minutes or less. Derivative exchanges have notification periods as short as 5 minutes. Requests for trade cancellations should be made by telephone or the Bust Request tool (no email or other non real-time method) to IBKR within 15 minutes of the erroneous transaction. IBKR requires sufficient time to prepare the necessary information required by the exchanges and this time is included in the exchange-specified reporting period. Requests for cancellation are always handled on a best-efforts basis and IBKR cannot guarantee the reporting time requirements. In addition, exchanges have bust request fees that account holders must agree to before IBKR can proceed with the request. The fees vary by exchange, and you will be informed of what that fee is for the exchange in question prior to the bust request filing.