IBSJ Multi Currency

Can I trade foreign products in supported currencies at Interactive Brokers Securities Japan (IBSJ)?

Yes, clients can trade in any currency that has a product listed in.

For example: Client with a cash account wants to buy a US stock. Our system will check if the client has sufficient available funds in USD or other supported currencies to cover 100% of the trade and, if so, the order will be sent to the exchange.

- If client has enough balance in USD, it will be used for execution of the order.

- If not, IBSJ will automatically convert an equivalent amount of USD from other supported currencies with a positive balance.

- If the same client wishes to sell his USD denominated security at a later date, IBSJ will NOT convert the proceeds back to one of the supported currencies.

- Client can use proceeds in USD for purchasing US stocks or withdraw them.

- Conversion to other currencies not connected to withdrawing funds is not allowed.

- Client can withdraw funds in supported cashiering currencies (JPY, USD, EUR, GBP). If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBSJ will automatically convert positive balances in the supported currencies to the requested one.

Please Note

- IBSJ does NOT charge a commission to clients for automatic currency conversion.

- Commissions for currency conversion used for closing a non-JPY cash balance are presented on our website.

- Supported cashiering currency is a currency in which client can make deposits and withdrawals.

Can I trade Forex and convert currencies at Interactive Brokers Securities Japan (IBSJ)?

Currency conversion at IBSJ must be connected to an investment service transaction (purchasing a stock, for instance) and its resulting cash flows. To comply with this regulation, clients can make a currency conversion in a trading platform only to close the negative balance from borrowing. In other cases, IBSJ makes a conversion automatically.

- The client CANNOT open long positions that create cash debits (loans). Nevertheless, client can open long positions in any foreign product regardless of the currency in which it is denominated. IBSJ will auto convert the value of the transaction from the positive balance in supported currencies held in the account.

- Any positive cash that is generated as the result of a trade or cash flows from a position you hold (e.g. dividends, coupon, interest) will NOT be auto-converted.

- The client can withdraw funds in JPY, EUR, USD, GBP. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBSJ will automatically convert positive balances in the supported currencies to the requested one.

- The client can use the option “Withdraw All Available Cash”, which allows to withdraw all available funds in one currency: supported currencies or base currency. IBSJ will automatically convert positive balances to the requested one without leaving residuals.

For further information please see the IBSJ Multi-Currency Account Foreign Exchange Restrictions Disclosure.

Please Note

- IBSJ does NOT charge clients commissions for automatic currency conversion.

- Commissions for currency conversion used for closing a non-JPY cash balance are presented on our website.

- Supported cashiering currency is a currency in which client can make deposits and withdrawals.

- Base currency: JPY.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

What currencies are available for deposits and withdrawals at Interactive Brokers Securities Japan (IBSJ)?

IBSJ clients can make deposits in four Supported Cashiering Currencies.

Withdrawals are allowed in base currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBSJ will automatically convert positive balances in the supported currencies to the requested one.

Client can use the option “Withdraw All Available Cash”, which allows to withdraw all available funds in one currency: supported currencies or base currency. IBSJ will automatically convert positive balances to the requested one without leaving residuals.

For further information please see the IBSJ Multi-Currency Account Foreign Exchange Restrictions Disclosure.

Please Note

- IBSJ does NOT charge clients commissions for automatic currency conversion.

- Commissions for currency conversion used for closing a non-JPY cash balance are presented on our website.

- Supported cashiering currency is a currency in which client can make deposits and withdrawals.

- Base currency: JPY.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

“EMIR”:交易报告库报告义务和盈透证券的委托报告服务

Multi-Currency Trading at IBKR Central Europe

- If client has enough balance in USD, it will be used for execution of the order.

- If not, IBCE will automatically convert an equivalent amount of USD from other supported currencies with a positive balance.

- If the same client wishes to sell his USD denominated security at a later date, IBCE will NOT convert the proceeds back to one of the supported currencies.

- Client can use proceeds in USD for purchasing US stocks or withdraw them.

- Conversion to other currencies not connected to withdrawing funds is not allowed.

- Client can withdraw funds in Major Currencies, Home currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBCE will automatically convert positive balances in the supported currencies to the requested one.

- If client borrows EUR, he can decide what to do with the negative EUR balance. This negative balance can be closed by converting from any other supported currency or remain in the account.

- If the same client wishes to sell his EUR denominated security at a later date, IBCE will NOT convert the proceeds back to one of the supported currencies.

- Client can use proceeds in EUR for purchasing EU stocks or withdraw them.

- Conversion to other currencies not connected to withdrawing funds is not allowed.

- Client can withdraw funds in Major Currencies, Home currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBCE will automatically convert positive balances in the supported currencies to the requested one.

- IBCE does NOT charge clients for automatic currency conversion.

- Commissions for currency conversion used for closing a negative balance are presented on our website.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- Major currencies: USD and EUR.

- Home currency: Currency of client’s country of legal residence.

- If the same client wishes to sell his CAD denominated security at a later date, IBCE will auto convert the proceeds back to the base currency.

- The same process occurs when cash flows are generated from positions (e.g. dividends, interest). Conversion takes place when the cash is credited to or debited from the account, not when it is accrued.

- Client can decide what to do with the negative CAD balance. This negative balance can be closed by converting from any other supported currency or remain in the account.

- If the same client wishes to sell his CAD stock at a later date, IBCE will automatically convert the proceeds to the base currency as CAD is not a supported currency.

- IBCE does NOT charge clients for automatic currency conversion.

- Commissions for currency conversion used for closing a negative balance are presented on our website.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- For Margin accounts, the client can open long positions that create cash debits (loans) in any currency. IBCE will not auto-convert your transaction but will create an investment loan in the currency of the trade. It will be the client’s discretion when to initiate a currency conversion to close the negative balance in part or in full.

- For Cash accounts, the client CANNOT open long positions that create cash debits (loans). Nevertheless, client can open long positions in any foreign product regardless of the currency in which it is denominated. IBCE will auto convert the value of the transaction from the positive balance in supported currencies held in the account.

- For both Margin and Cash accounts, any positive cash that is generated as the result of a trade or cash flows from a position you hold (e.g. dividends, coupon, interest) will NOT be auto-converted if it is the supported currency (EUR, USD, CHF, GBP, HUF, CZK, PLN, DKK, SEK and NOK).

- For both Margin and Cash accounts, any positive cash that is generated as the result of a trade or cash flows from a position you hold (e.g. dividends, coupon, interest) will be auto-converted if it is NOT the supported currency.

- For both Margin and Cash accounts, the client can withdraw funds in Major Currencies, Home currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBCE will automatically convert positive balances in the supported currencies to the requested one.

- For both Margin and Cash accounts, the client can use the option “Withdraw All Available Cash”, which allows to withdraw all available funds in one currency: Major Currencies or Home currency. IBCE will automatically convert positive balances in the supported currencies to the requested one without leaving residuals.

- IBCE does NOT charge clients for automatic currency conversion.

- Commissions for currency conversion used for closing a negative balance are presented on our website.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- Major currencies: USD and EUR.

- Home currency: Currency of client’s country of legal residence.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

- Interactive Brokers Central Europe accounts are not allowed to withdraw funds on margin due to regulatory reasons.

- The same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFDs risk warnings before trading these instruments.

- IBCE does NOT charge clients for automatic currency conversion.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- Major currencies: USD and EUR.

- Home currency: Currency of client’s country of legal residence.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

- Interactive Brokers Central Europe accounts are not allowed to withdraw funds on margin due to regulatory reasons.

- The changes mentioned above are effective since October 17, 2022.

有关俄罗斯卢布(RUB)的重要信息

跟许多金融机构一样,IBKR已降低对俄罗斯卢布(RUB)的风险敞口,并已停止俄罗斯卢布的所有资金服务,包括所有取款和货币兑换。

具体而言:

卢布存款:IBKR不再接受卢布存款。任何卢布存款均会被拒绝。

IBKR会根据您账户所属IBKR实体定期将卢布余额兑换成美元或欧元。

|

IBKR实体 |

目标货币 |

|

IBLLC |

USD |

|

IBCE |

EUR |

|

IBUK |

EUR |

|

IBIE |

EUR |

|

所有其它实体 |

USD |

卢布取款:IBKR现在无法支持卢布取款。

基础货币:目前IBKR不允许客户将卢布作为基础货币。 如果您账户的基础货币是卢布,我们会根据您账户所在的IBKR实体将其更改为美元或欧元(见上表)。

IBKR完全遵守所有适用的制裁法律。感谢您的理解与配合。

IMPORTANT NOTICE REGARDING THE RUSSIAN RUBLE (RUB)

In line with many financial institutions, IBKR has reduced exposure to the Russian Ruble, (“RUB”) and has discontinued all cashiering services for Russian Rubles, including all withdrawals and currency conversions.

Specifically:

Deposits in RUB: IBKR is no longer accepting deposits of RUB. Any deposit in RUB will be rejected.

IBKR will periodically convert RUB balances to USD or EUR, depending on the IBKR entity with which you have an account.

|

IBKR Entity |

Target Currency |

|

IBLLC |

USD |

|

IBCE |

EUR |

|

IBUK |

EUR |

|

IBIE |

EUR |

|

All Others |

USD |

Withdrawals in RUB: IBKR is not able to accommodate RUB withdrawals at this time.

Base Currency: IBKR does not currently allow clients to maintain RUB as their base currency. If you previously used RUB as your base currency, we converted it to USD or EUR depending on which IBKR entity your account is with (see chart above).

IBKR is fully committed to complying with all applicable sanctions laws. We appreciate your cooperation and your business.

如果我交易的产品是以我账户中没有的币种计价的会怎么样?

买卖给定的产品所需的特定币种是交易所决定的,不是IBKR决定的。例如,当您下单买入某种以您的账户中没有的币种计价的证券,假设您使用的是保证金账户且在满足了保证金要求后有多余的资产,则IBKR会借入该币种的资金。请注意,IBKR有义务以指定的计价币种和清算所结算该交易。如您不希望我们借入资金进而产生利息成本,则您需先向您的账户存入所需的币种及金额的资金,或通过IdealPro或各种零数(odd lot)交易场所将账户中的资金兑换为所需的币种及金额——对于超过25,000美元或等值的金额,通过IdealPro兑换;对于小于25,000美元或等值的金额,通过零数交易场所兑换,这两种渠道都可在TWS中找到。

需注意的还有,当您平仓了以特定币种计价的证券,所获资金将始终以该币种保留在您的账户中,不论该币种是否是您为账户选择的基础货币。相应地,这部分资金相对于您的基础货币将存在汇率风险,直至您完成换汇或用这些资金交易其它以该币种计价的产品。

关于使用止损单的更多信息

美股市场偶尔会发生极端波动和价格混乱。 有时这类情况持续时间很长,有时又很短。止损单可能会对价格施加下行压力、加剧市场波动,且可能使委托单在大幅偏离触发价格的位置上成交。

每日活动报表中的现金外汇转换盈亏表示什么?如何计算?

为了对账户资产进行全面概览、生成报表,账户中所有以非基础货币计价的多头或空头现金余额都将按现行汇率进行转换。由于汇率随时会变,这一转换过程就可能导致现金外汇转换余额呈正(即盈利)或呈负(即亏损)。请注意,这些盈亏只是市场计算的一种标记(即假设所有非基础货余额都以日末汇率平仓),实际的盈亏(如有)直到非基础货币余额平仓之后才能确定。

要计算非基础货币的现金外汇转换盈亏,首先要计算当前的基础货币汇率和前一个每日报表周期基础货币汇率之间的差额(汇率C – 汇率P,汇率可,参见每份报表的基础货币汇率部分)。然后用这个差额(或正或负)乘以当前报表周期的期初现金余额,所得结果就是现金外汇转换盈利(如果是正数)或亏损(如果是负数)。由于所有其它非基础货币项目(如净卖出和买入、佣金、利息等)均在日末记账,其本质上就没有转换盈亏。

IBKR Metals CFDs – Facts and Q&A

The following article is intended to provide a general introduction to London Gold and Silver Contracts for Differences (CFDs) issued by IBKR.

Please follow these links for information on IBKR Share CFDs, Index CFDs and Forex CFDs.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the

high risk of losing your money.

ESMA Rules for CFDs (Retail Clients only)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August

2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per

account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

Introduction

A London Gold CFD enables you to have exposure to price movements of physical Gold without actually owning it. A London Gold CFD is an agreement between you and IBKR to exchange the difference in price of the underlying over a period of time. The difference to be exchanged is determined by the change in the reference price of the underlying. Thus, if the price of physical Gold traded on the London bullion market rises and you are long the CFD, you receive cash from IBKR and vice versa. A London Gold CFD can be bought long or sold short to suit your view of market direction in the future.

Contract Specifications

| Contract | IBKR Symbol | Per Trade Fee | Minimum per Order | Multiplier |

| London Gold | XAUUSD | 0.015% | USD 2.00 | 1 |

| London Silver | XAGUSD | 0.03% | USD 2.00 | 1 |

Price Determination

The IBKR London Gold and Silver CFDs reference physical Gold and Silver traded on the London bullion market. The London bullion market is a wholesale over-the-counter market for the trading of precious metals. Trading is conducted among members of the London Bullion Market Association (LBMA). Most of the members are major international banks.

IBKR receives quote streams from approximately 10 such major banks, in much the same way it does for cash forex. IBKR Smart routes between the banks, and the best available price at any given time becomes the reference price for the CFDs. IBKR does not add a spread to the banks’ quotes.

Low Commissions and Financing Rates: Unlike other CFD providers IBKR charges a transparent

commission, rather than widening the spread. Commission rates are only 0.015% for London Gold and 0.03% for London Silver. Overnight financing rates are just benchmark +/- 1.5% (an additional 1% surcharge is added for retail accounts).

Transparent Quotes: Because IBKR does not widen the spread, the Metals CFD quotes accurately

represent the spreads and price movements of the related cash metal, as described above.

Margin Efficiency: IBKR establishes house-margin requirements based on historic volatility of the

underlying and other factors. Retail clients are subject to regulatory minimum initial margins of 5% for

London Gold or 10% for London Silver.

Trading Permissions: Same as for Share and Index CFDs.

Market Data Permissions: Metals CFD market data is free, but a permission is required for system

reasons.

Worked Trade Example (Professional Clients):

You purchase 100 XAUUSD CFDs at $1,942.5 for USD 194,250 which you then hold for 5 days.

![]()

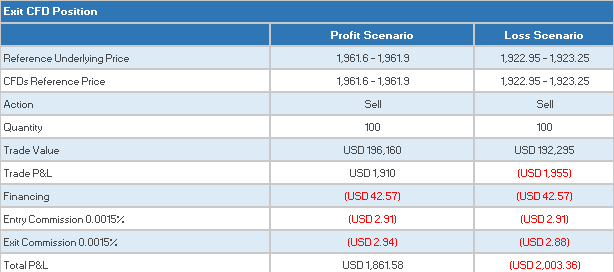

Closing the Position

CFD Resources

Below are some useful links with more detailed information on IB’s CFD offering:

Frequently asked Questions

Are short Metals CFDs subject to forced buy-in?

No.

Can I take delivery of the underlying metal?

No, IBKR does not support physical delivery for Metals CFDs.

Are there any market data requirements?

The market data for Metal CFDs is free, and is included the market data for Index CFDs. However, you need to subscribe to the permission for system reasons. To do this, log into Account Management, and click through the following tabs: Settings/User Settings/Trading Platform/Market Data Subscriptions. Alternatively you can set up an Index or Metals CFD in your TWS quote monitor and click the “Market Data Subscription Manager” button that appears on the quote line.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Account Management.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

In what type of IB accounts can I trade CFDs e.g., Individual, Friends and Family,

Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening

orders.

Can anyone trade IB CFDs?

All clients can trade IB CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and

Israel. There are no exemptions based on investor type to the residency-based exclusions.

外汇(FX)入门

IB提供的交易场所和交易平台既适用于专注外汇交易的交易者也适用于因多币种股票和/或衍生品交易需要偶尔进行外汇交易的交易者。下方文章概述了在TWS平台上下达外汇定单的基本要点以及报价管理和头寸报告相关信息。

外汇(FX)交易涉及同时买入一种货币并卖出另一种货币,两种货币组合在一起通常被称为交叉货币对。在下方例子中,EUR.USD交叉货币对中的前一种货币(EUR)为交易者想买入或卖出的交易货币,后一种货币(USD)则为结算货币。

跳转至指定主题;

外汇报价

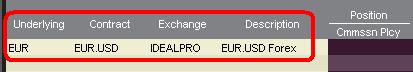

货币对即外汇市场上一种货币单位相对于另一种货币单位的相对价值的报价。用以作为参考的货币被称为报价货币,而参考该货币给出报价的货币则被称为基础货币。在TWS中,每个货币对有一个交易代码。您可以使用外汇交易者(FXTrader)调换报价方向。交易者买入或卖出基础货币的同时在卖出或买入报价货币。例如,EUR/USD货币对的代码为:

EUR.USD

其中:

- EUR为基础货币

- USD为报价货币

上方货币对的价格表示需要多少单位的USD(报价货币)能交易一个单位的EUR(基础货币)。也就是说,1 EUR是在按USD报价。

EUR.USD的买单表示买入EUR并卖出同等金额的USD,具体取决于交易价格。

创建报价行

在TWS添加外汇报价行具体步骤如下:

1. 输入交易货币(如EUR),然后按回车键(enter)。

2. 选择产品类型——外汇

3. 选择结算货币(如USD),然后选择外汇交易场所。

.jpg)

注:

IDEALFX对于超过其最低数量要求(通常为25,000美元)的定单可直接接入银行间外汇报价。传递到IDEALFX但未达到其最低数量要求的定单基本会被自动传递到小额定单交易场所进行外汇转换。点击此处了解IDEALFX的最低数量要求和最高数量限制相关信息。

外汇交易商会按特定方向对外汇货币对进行报价。因此,交易者需通过调整输入的货币代码来查找想要的货币对。例如,如果输入货币代码CAD,交易者会发现合约选择窗口中没有结算货币USD。这是因为,该货币对是按USD.CAD报价的,只能先输入底层代码USD,然后再选择货币对。

下单

具体取决于显示的栏标头,货币对将显示如下:

合约(Contract)和描述(Description)栏将按交易货币.结算货币的形式显示货币对(如EUR.USD)。底层代码(Underlying)栏则只显示交易货币。

点击此处了解如何更改更改显示的数据栏标头。

1. 要输入定单,左键点击买价(下卖单)或卖价(下买单).

2. 指定想要买入或卖出的交易货币的数量。定单的数量按基础货币(即货币对中的前一种货币)显示。

盈透证券在外汇交易上没有代表固定金额基础货币的合约的概念,您的交易尺寸便是所需交易的基础货币金额。

例如,100,000单位EUR.USD的买单会买入100,000单位EUR,并根据显示的汇率卖出等值USD。

3. 指定想使用的定单类型、汇率(价格),然后传递定单。

注:下达的定单必须是完整的货币单位,除上述交易场所最低数量要求外,没有最低合约或手数要求。

点值

点(pip)是货币对变化的衡量单位,对于大多数货币对来说其代表最小变化,但有时也允许存在非整点的变化。

例如,在EUR.USD中,1个点是0.0001,而在USD.JPY中,1个点事0.01。

要计算报价货币1个点的点值,可采用以下公式:

(名义金额) x (1个点)

例如:

- 代码 = EUR.USD

- 金额 = 100,000 EUR

- 1个点 = 0.0001

1个点点值 = 100’000 x 0.0001= 10 USD

- 代码 = USD.JPY

- 金额 = 100’000 USD

- 1个点 = 0.01

1个点点值 = 100’000 x (0.01)= JPY 1000

要计算基础货币1个点的点值,可采用以下公式:

(名义金额) x (1个点/汇率)

例如:

- 代码 = EUR.USD

- 金额 = 100’000 EUR

- 1个点 = 0.0001

- 汇率 = 1.3884

1个点点值 = 100’000 x (0.0001/1.3884)= 7.20 EUR

- 代码 = USD.JPY

- 金额 = 100’000 USD

- 1个点 = 0.01

- 汇率 = 101.63

1个点点值 = 100’000 x (0.01/101.63)= 9.84 USD

头寸(交易后)报告

外汇头寸信息是在IB进行交易的一个重要方面,在真实账户中开始交易之前需对其进行充分了解。IB的交易软件在两个不同的地方反映了外汇头寸,二者均可在账户窗口查看。

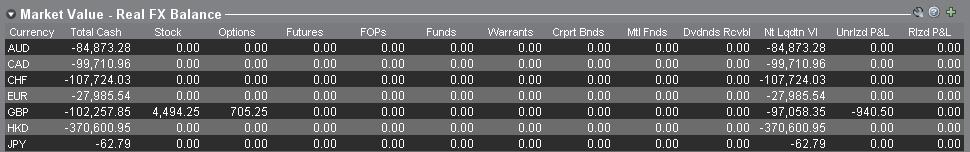

1. 市场价值

账户窗口的市场价值部分反映的是实时货币头寸,按货币(而非货币对)显示。

账户窗口的市场价值部分是唯一一个可供交易者查看实时外汇头寸信息的地方。持有多种货币头寸的交易者不一定要使用开仓时用的货币对来平仓。例如,买了EUR.USD(买EUR卖USD)还买了USD.JPY(买USD卖JPY)的交易者也可以通过交易EUR.JPY(卖EUR买JPY)来平仓头寸。

注:

市场价值部分可展开/收起。交易者应点击净清算价值栏上方的符号确保显示出绿色“减号”。如果是绿色“加号“,某些头寸可能被隐藏。

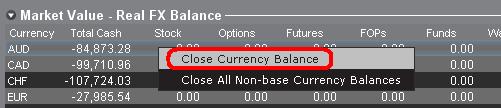

交易者可以从市场价值部分发起平仓交易:右键点击想要平仓的货币,选择”平仓货币余额“或”平仓所有非基础货币余额“。

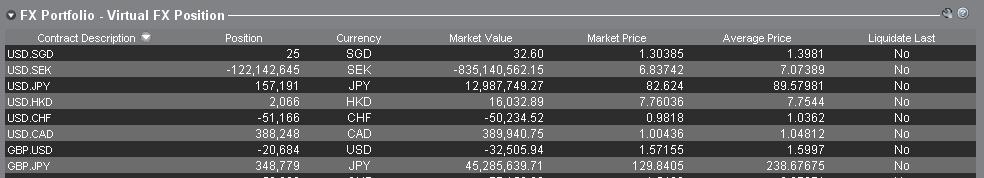

2. 外汇投资组合

账户窗口的外汇投资组合部分展示的是虚拟头寸,以货币对的形式显示头寸信息,这与市场价值部分按货币显示不同。这种特定的显示形式是为了考虑机构外汇交易者的常用惯例,零售或非频繁外汇交易者基本上可以无视该部分信息。外汇投资组合的头寸数量并不反映所有外汇活动,但是,交易者可以对此部分显示的头寸数量和平均成本进行修改。这一无需执行交易便可随意调整头寸和平均成本信息的功能对于除交易非基础货币产品外还参与其它货币交易的交易者可能会有帮助。其可让交易者手动将自动货币转换(交易非基础货币产品时会自动发生)与单纯的外汇交易活动分隔开来。

外汇投资组合部分的外汇头寸和盈亏信息均来自所有其它交易窗口显示的信息。这在确定真实的实时头寸信息时可能会造成一定困惑。为减少或消除此类困惑,交易者可以选择以下操作:

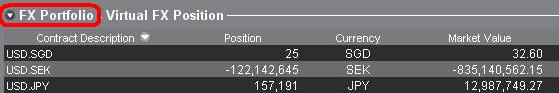

a. 收起外汇投资组合部分

点击外汇投资组合(FX Portfolio)文字左边的箭头可收起外汇投资组合部分。收起该部分后,虚拟头寸信息便不再在各交易页面显示。(注:这并不会让市场价值信息显示出来,其只会阻止外汇投资组合信息显示。)

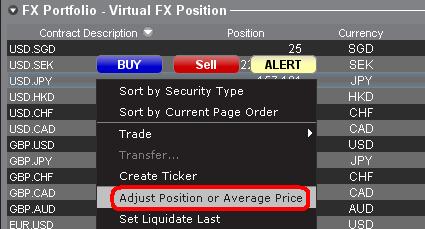

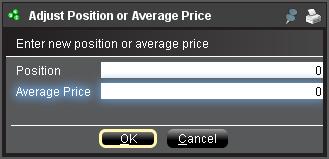

b. 调整头寸或平均价格

右键点击账户窗口的外汇投资组合部分,交易者可以选择调整头寸或平均价格。交易者平仓掉所有非基础货币头寸并确定市场价值部分反映了被平仓的所有非基础货币头寸后,便可将头寸和平均价格区域重置为0。此操作会重置外汇投资组合部分的头寸数量,可让交易者在交易界面看到更加准确的头寸和盈亏信息。(注:这是手动操作,每次货币头寸平仓后都需进行一次)。交易者应随时对市场价值部分的头寸信息进行确认,确保传递的定单达到开仓或平仓头寸想要的结果)

我们鼓励交易者在真实账户中开始交易前,先在模拟交易或演示账户中熟悉一下外汇交易。如关于以上信息仍有任何疑问,请联系IB。

其它常见问题: