外汇(FX)入门

IB提供的交易场所和交易平台既适用于专注外汇交易的交易者也适用于因多币种股票和/或衍生品交易需要偶尔进行外汇交易的交易者。下方文章概述了在TWS平台上下达外汇定单的基本要点以及报价管理和头寸报告相关信息。

外汇(FX)交易涉及同时买入一种货币并卖出另一种货币,两种货币组合在一起通常被称为交叉货币对。在下方例子中,EUR.USD交叉货币对中的前一种货币(EUR)为交易者想买入或卖出的交易货币,后一种货币(USD)则为结算货币。

跳转至指定主题;

外汇报价

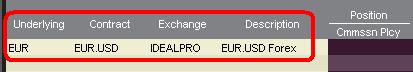

货币对即外汇市场上一种货币单位相对于另一种货币单位的相对价值的报价。用以作为参考的货币被称为报价货币,而参考该货币给出报价的货币则被称为基础货币。在TWS中,每个货币对有一个交易代码。您可以使用外汇交易者(FXTrader)调换报价方向。交易者买入或卖出基础货币的同时在卖出或买入报价货币。例如,EUR/USD货币对的代码为:

EUR.USD

其中:

- EUR为基础货币

- USD为报价货币

上方货币对的价格表示需要多少单位的USD(报价货币)能交易一个单位的EUR(基础货币)。也就是说,1 EUR是在按USD报价。

EUR.USD的买单表示买入EUR并卖出同等金额的USD,具体取决于交易价格。

创建报价行

在TWS添加外汇报价行具体步骤如下:

1. 输入交易货币(如EUR),然后按回车键(enter)。

2. 选择产品类型——外汇

3. 选择结算货币(如USD),然后选择外汇交易场所。

.jpg)

注:

IDEALFX对于超过其最低数量要求(通常为25,000美元)的定单可直接接入银行间外汇报价。传递到IDEALFX但未达到其最低数量要求的定单基本会被自动传递到小额定单交易场所进行外汇转换。点击此处了解IDEALFX的最低数量要求和最高数量限制相关信息。

外汇交易商会按特定方向对外汇货币对进行报价。因此,交易者需通过调整输入的货币代码来查找想要的货币对。例如,如果输入货币代码CAD,交易者会发现合约选择窗口中没有结算货币USD。这是因为,该货币对是按USD.CAD报价的,只能先输入底层代码USD,然后再选择货币对。

下单

具体取决于显示的栏标头,货币对将显示如下:

合约(Contract)和描述(Description)栏将按交易货币.结算货币的形式显示货币对(如EUR.USD)。底层代码(Underlying)栏则只显示交易货币。

点击此处了解如何更改更改显示的数据栏标头。

1. 要输入定单,左键点击买价(下卖单)或卖价(下买单).

2. 指定想要买入或卖出的交易货币的数量。定单的数量按基础货币(即货币对中的前一种货币)显示。

盈透证券在外汇交易上没有代表固定金额基础货币的合约的概念,您的交易尺寸便是所需交易的基础货币金额。

例如,100,000单位EUR.USD的买单会买入100,000单位EUR,并根据显示的汇率卖出等值USD。

3. 指定想使用的定单类型、汇率(价格),然后传递定单。

注:下达的定单必须是完整的货币单位,除上述交易场所最低数量要求外,没有最低合约或手数要求。

点值

点(pip)是货币对变化的衡量单位,对于大多数货币对来说其代表最小变化,但有时也允许存在非整点的变化。

例如,在EUR.USD中,1个点是0.0001,而在USD.JPY中,1个点事0.01。

要计算报价货币1个点的点值,可采用以下公式:

(名义金额) x (1个点)

例如:

- 代码 = EUR.USD

- 金额 = 100,000 EUR

- 1个点 = 0.0001

1个点点值 = 100’000 x 0.0001= 10 USD

- 代码 = USD.JPY

- 金额 = 100’000 USD

- 1个点 = 0.01

1个点点值 = 100’000 x (0.01)= JPY 1000

要计算基础货币1个点的点值,可采用以下公式:

(名义金额) x (1个点/汇率)

例如:

- 代码 = EUR.USD

- 金额 = 100’000 EUR

- 1个点 = 0.0001

- 汇率 = 1.3884

1个点点值 = 100’000 x (0.0001/1.3884)= 7.20 EUR

- 代码 = USD.JPY

- 金额 = 100’000 USD

- 1个点 = 0.01

- 汇率 = 101.63

1个点点值 = 100’000 x (0.01/101.63)= 9.84 USD

头寸(交易后)报告

外汇头寸信息是在IB进行交易的一个重要方面,在真实账户中开始交易之前需对其进行充分了解。IB的交易软件在两个不同的地方反映了外汇头寸,二者均可在账户窗口查看。

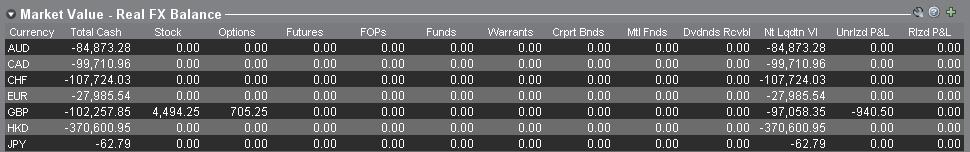

1. 市场价值

账户窗口的市场价值部分反映的是实时货币头寸,按货币(而非货币对)显示。

账户窗口的市场价值部分是唯一一个可供交易者查看实时外汇头寸信息的地方。持有多种货币头寸的交易者不一定要使用开仓时用的货币对来平仓。例如,买了EUR.USD(买EUR卖USD)还买了USD.JPY(买USD卖JPY)的交易者也可以通过交易EUR.JPY(卖EUR买JPY)来平仓头寸。

注:

市场价值部分可展开/收起。交易者应点击净清算价值栏上方的符号确保显示出绿色“减号”。如果是绿色“加号“,某些头寸可能被隐藏。

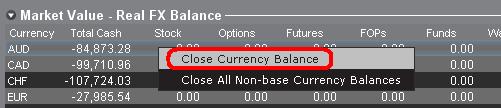

交易者可以从市场价值部分发起平仓交易:右键点击想要平仓的货币,选择”平仓货币余额“或”平仓所有非基础货币余额“。

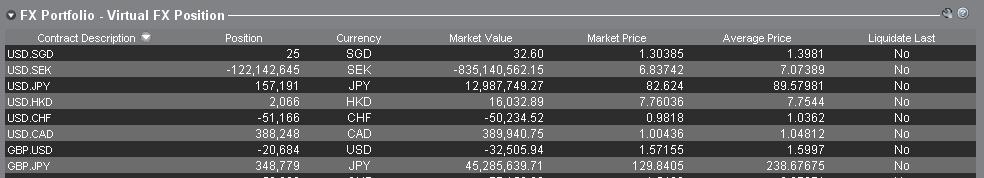

2. 外汇投资组合

账户窗口的外汇投资组合部分展示的是虚拟头寸,以货币对的形式显示头寸信息,这与市场价值部分按货币显示不同。这种特定的显示形式是为了考虑机构外汇交易者的常用惯例,零售或非频繁外汇交易者基本上可以无视该部分信息。外汇投资组合的头寸数量并不反映所有外汇活动,但是,交易者可以对此部分显示的头寸数量和平均成本进行修改。这一无需执行交易便可随意调整头寸和平均成本信息的功能对于除交易非基础货币产品外还参与其它货币交易的交易者可能会有帮助。其可让交易者手动将自动货币转换(交易非基础货币产品时会自动发生)与单纯的外汇交易活动分隔开来。

外汇投资组合部分的外汇头寸和盈亏信息均来自所有其它交易窗口显示的信息。这在确定真实的实时头寸信息时可能会造成一定困惑。为减少或消除此类困惑,交易者可以选择以下操作:

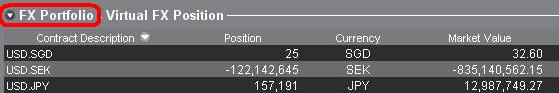

a. 收起外汇投资组合部分

点击外汇投资组合(FX Portfolio)文字左边的箭头可收起外汇投资组合部分。收起该部分后,虚拟头寸信息便不再在各交易页面显示。(注:这并不会让市场价值信息显示出来,其只会阻止外汇投资组合信息显示。)

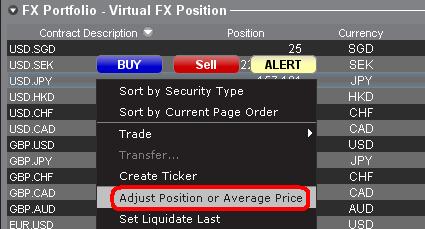

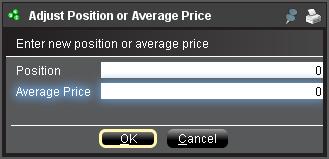

b. 调整头寸或平均价格

右键点击账户窗口的外汇投资组合部分,交易者可以选择调整头寸或平均价格。交易者平仓掉所有非基础货币头寸并确定市场价值部分反映了被平仓的所有非基础货币头寸后,便可将头寸和平均价格区域重置为0。此操作会重置外汇投资组合部分的头寸数量,可让交易者在交易界面看到更加准确的头寸和盈亏信息。(注:这是手动操作,每次货币头寸平仓后都需进行一次)。交易者应随时对市场价值部分的头寸信息进行确认,确保传递的定单达到开仓或平仓头寸想要的结果)

我们鼓励交易者在真实账户中开始交易前,先在模拟交易或演示账户中熟悉一下外汇交易。如关于以上信息仍有任何疑问,请联系IB。

其它常见问题:

How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

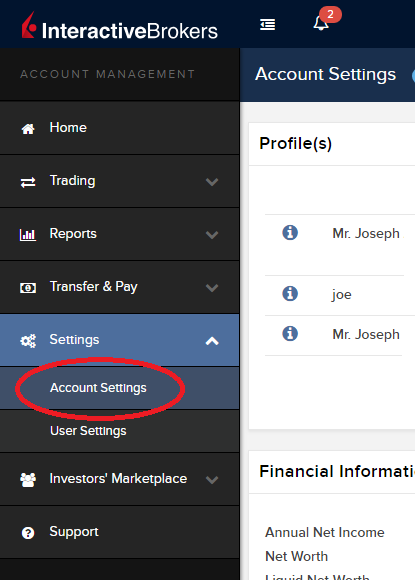

1) To submit this information change request, first login to Account Management

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

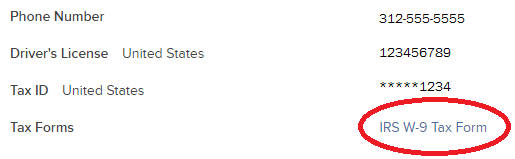

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

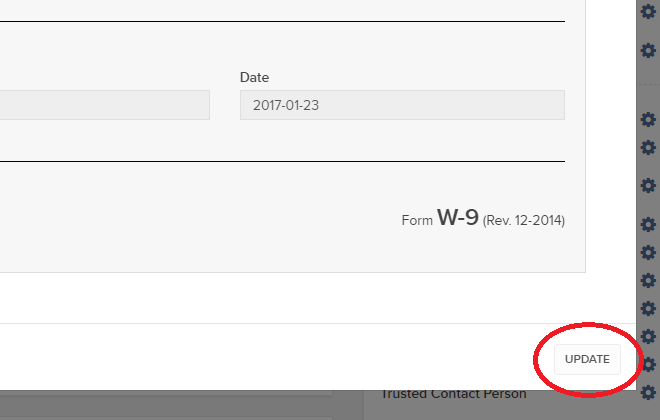

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

IRA: Required Minimum Distributions

IRA owners may be required to to withdraw funds beginning at age 73, and every year thereafter. Determining your Required Minimum Distribution (RMD) is significant while retaining an IRA, considering both your life expectancy and the IRA's fair market value.

The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Interactive Brokers LLC provides several information resources to understand and calculate your RMD, including access to the online FINRA RMD Calculator.

Requesting Your RMD Withdrawal

The Internal Revenue Service (IRS) requires the IRA plan custodian to notify IRA owners about the RMD requirements by January 31 each year. If you turn 73 this year, you are required to begin taking RMDs before April 1 of the following year.

Eligible IRA owners must begin receiving withdrawals by December 31 of the year they reach age 73. The first RMD withdrawal, however, may be delayed until April 1 of the following year.

If you elect to delay the withdrawal, then please observe the following considerations:

(1) Two RMD withdrawals will be required the following year, the undistributed initial RMD and the new RMD.

(2) The new RMD will be slightly larger due to the December 31 market value's inclusion of the undistributed initial RMD.

Subsequent RMD withdrawals from your IRA must be distributed by December 31 to avoid a penalty tax.

Note: Roth IRAs are exempt from the RMD rules during the IRA owner's lifetime.

Requesting Your RMD Withdrawal

You may request a withdrawal of funds through the Transfer & Pay and then Transfer Funds menu options within Client Portal. The IRS deadline for taking RMDs is December 31 each year. Keep in mind that the year end withdrawal cut off for processing withdrawals from your Interactive Brokers account may occur before December 31.

Please note that you can elect to transfer your funds to your bank account or to an Interactive Brokers non-IRA account. To transfer funds to an Interactive Brokers non-IRA account, log into Client Portal, select Transfer & Pay, Transfer Funds then select Transfer Funds Between Accounts.

Your RMD is determined by dividing the account balance on December 31 of last year by your life expectancy factor. Your life expectancy factor is taken from the Life Expectancy Tables contained in IRS Publication 590. Your IRA beneficiary election may play an important role in determining your RMD, as well.

You must calculate your RMD separately for each qualifying IRA custodied at Interactive Brokers and any other financial institution. The RMD, however, may be satisfied from any single one or combination of your IRAs. The IRA Required Minimum Distribution Worksheets may provide additional assistance with the calculation of your RMD.

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

IRA: Rollover Rules & Conditions

This information is for general educational purposes only. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations.

Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The contribution to the second retirement plan is called a rollover contribution.

This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. Select from list below for details:

Eligible Rollover Transactions

Rules & Conditions

Prior to completing an IRA Rollover transaction, we recommend that you review the rules and conditions surrounding eligibility. Interactive Brokers can accept as a tax-free transaction an eligible rollover distribution as defined under the Internal Revenue Code. Included in this article is information about eligible transactions, as well as the Interactive Brokers IRA Rollover Certification form.

IRA Rollover Certification

Before accepting an IRA rollover transaction into an Interactive Brokers LLC IRA, we require that you review your eligibility for the rollover and certify your understanding of the rollover rules and conditions. The IRA Rollover Form includes the IRA Rollover Certification.

The Transfer Funds page within the Client Portal lets you notify IB of an IRA Rollover deposit of funds into your account. From the Transfer & Pay menu select Transfer Funds and then Make a Deposit. Select one of the saved deposit instructions and follow the prompts on the screen or create a new deposit instruction by selecting the Currency of the deposit from the drop-down menu. Click Connect or Get Instructions for the method you will use to transfer funds. And finally follow the remaining instructions provided to initiate the transfer with your bank.

Rollover Transactions

Two types of IRA rollover transactions exist with different guidelines and delivery methods:

- Direct Rollover - a transfer of assets from an employer-sponsored retirement plan directly to an eligible IRA. If you choose to receive the distribution first, then you may roll over the funds to the IRA within 60 days.

- Indirect Rollover - a distribution from an IRA paid to you, followed by a rollover into another IRA within 60 days. The IRS allows an indirect rollover of each IRA's funds once during a twelve-month period.

(Note: A distributions directly from one IRA trustee to another IRA trustee is a Trustee-to-Trustee transfer. It is not affected by the twelve-month waiting period.)

For additional information about rollovers, visit Understanding Rollovers. See also IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) for more specific guidelines on moving retirement plan assets.

Eligible Rollover Transactions

Almost any distribution from a qualified plan can be rolled over to an IRA. Your retirement account may be eligible for one of the following eligible rollover transactions.

Traditional IRA or SIMPLE IRA to Traditional IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

- Required Minimum Distribution satisfied (if over 73)

- For SIMPLE IRAs, after two years from the first contribution

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

Rollover or Direct Rollover from Qualified Plan into a Traditional IRA

- Eligible participant (participant, spouse beneficiary, or former spouse due to divorce)

- Funds or property deposited less than 60 days of receipt by the participant from the previous plan

- Funds received from an eligible qualified retirement plan

- Required Minimum Distribution satisfied (if over 73)

- Consists of funds, property, or proceeds from the sale of property distributed from the qualified plan

- All of the funds are eligible to be rolled over

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- Required Minimum Distribution satisfied (if over 73)

Ineligible Rollover Transactions

Some funds distributed from a retirement plan are not eligible for rollover into an IRA. The following transactions are not eligible rollover transactions.

- Any portion of a distribution from a retirement plan not rolled over

- Required Minimum Distributions

- Distribution of excess contributions and related earnings

- Retirement plan loan treated as a distribution

- Hardship distributions

- Distributions part of substantially equal payments (73-t)

- Dividends on employer securities

- Non-spousal death benefit distributions

- The cost of life insurance coverage

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Charitable Donations from IRAs

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

How to determine if a charity can receive the QCD

Where can an IRA owner find additional information on QCDs?

Withdrawal Processing

When can I submit my withdrawal?

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

Where are the funds disbursed?

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

Are the QCDs allowed from other IRA and retirement plans not held at IBKR?

QCD Tax Reporting

How is the QCD reported to the IRS?

Can any taxes be withheld from the distribution?

Do federal taxes have to be paid on the distribution?

Does a state or municipal tax have to be paid on the distribution?

Charitable Distributions

What is a Qualified Charitable Distribution (QCD)?

An otherwise taxable distribution from an eligible IRA owned by an individual 72 or older paid to an IRS qualified charity.

How to determine if a charity can receive the QCD?

The IRS Exempt Organizations Select Check allows users to "Search for Charities" among a list of organizations eligible to receive tax-deductible charitable contributions.

Where can an IRA owner find additional information on QCDs?

Visit Charitable Donations for IRAs for additional information on qualified charitable distributions. See also IRS Publication 590-b.

Withdrawal Processing

Can IBKR customers submit a QCD withdrawal online?

What amount may be withdrawn? Why?

IBKR will process the withdrawal for any amount, as long as the account has sufficient available funds. Why? Although the QCD donations to the charity must not exceed $100,000 per year to retain QCD status, charitable gifts may exceed this limit.

Where are the funds disbursed?

Funds are made payable to the IRS qualified charity and mailed direct to the charity. Only funds disbursed to the charity can be designated from your IRA as a QCD.

Does the distribution count towards the Required Minimum Distribution (RMD) amount?

Yes

Eligible IRA Accounts

Is the Charitable Distribution allowed from all IRAs held at IBKR?

No, see the list below. IRA owners should contact a qualified tax advisor about how to preserve QCD tax benefits. Not all distributions are created equal. A tax advisor will be able to assess an IRA owner’s best choice.

Traditional IRA > YES

Rollover IRA > YES

Roth IRA > YES

Inherited IRA > YES, if the beneficiary is at least age 70 1/2

SEP IRA > NO

Education IRA > NO

Are the Charitable Distributions allowed from other IRA and retirement plans not held at IBKR?

No, not directly. Retirement plans, employer sponsored SEP IRAs, and Simple IRAs (account classifications not held at IBKR) are not eligible for a QCD election. IRA owners may be eligible to rollover assets from these plans into a traditional, rollover, or Roth IRA to request a charitable distribution. IRA owners should contact a qualified tax advisor or their retirement plan administrator.

QCD Tax Reporting

How is the QCD reported to the IRS?

IBKR will report the charitable distributions on Form 1099-R when issued. See Reports and Dates for 1099 availability dates.

Can any taxes be withheld from the distribution?

No.

Do federal taxes have to be paid on the distribution?

Generally, federal taxes are not paid with QCDs. But distributions in excess of the IRS limit may be subject to income tax. IBKR recommends that customers contact a qualified tax advisor.

Does a state or municipal tax have to be paid on the distribution?

Contact your tax advisor or local tax authority on state and municipal requirements for the distributed amount.

Disclaimer: IBKR does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax advisor or refer to the U.S. Internal Revenue Service.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

Year End Statement & Report Comparison

The Interactive Brokers Year End Reports provide an activity review for US persons and US entities. The various account statements provide the transaction details as the basis for each report. Each of the standard reports spans the time period from January 1 through December 31.

Some reports, such as the Gain/Loss Summary Worksheet, may consolidate transactions and calculations. For the sake of conserving volume, trade activity may be combined. The account statements include all activity. For your convenience and to assist with your reconcilation, customized statements permit activity displays suitable for your personal needs (see the tab "Customized Templates" for details).

All US tax reports include the total figures as required under the US tax laws.

Non-US Persons and Entities

Income paid from US sources to non-US persons and entities may find this comparison helpful. IB is required to withhold US taxes at a rate of 30% on payments of US source stock dividends and substitute payments in lieu. Both the withholding and the income is reported on the US tax Form 1042-S.

For additional information about how IB handles non-US persons and entities, select this Tax Information and Reporting link and choose the tab Non-US Persons and Entities.

Year End Reports (For Trading) Comparison shown below identifies the most common transaction types which appear on the year end reports. Not all activity is included on each report.

Comparison of trades shown on the year end reports| Year End Reports | Stock | Bond | Equity & Index Option | Single Stock Futures | Futures | Forex |

| Form 1099 | Sell | Sell | - | - | Gain/Loss | - |

| Form 1042-S | - | - | - | - | - | - |

| Annual Statement | Buy/Sell Gain/Loss | Buy/Sell Gain/Loss | Buy/Sell Gain/Loss |

Buy/Sell Gain/Loss |

Buy/Sell Gain/Loss |

Buy/Sell Gain/Loss |

| Gain/Loss Worksheet |

Cost/Sell Gain/Loss | Cost/Sell Gain/Loss | Cost/Sell1 Gain/Loss1 | Cost/Sell Gain/Loss | - | - |

| 1256 Worksheet |

- | - | Gain/Loss5 | - | Gain/Loss | - |

NOTES: (1) Only cash settled; (2) Gain/Loss Worksheet was first published by IB with tax year 2007. Worksheets for prior years are not available. IB did provide gain and loss data on the Annual Statements; (3) The 1256 Worksheet was first published by IB with tax year 2008; (4) Option transactions are not 1099 or 1042-S reportable transactions. In accordance with the IRS guidelines, IB excludes the activity from the tax reports; (5) Only broad-sed index options appear on the 1256 Worksheet

Year End Reports (For Income) Comparison shown below identifies the most common types of income which appear on the year end reports. Not all income is reportable on a 1099 or Dividend Summary.

Comparison of income shown on the year end reports| Year End Reports | Dividends | Credit Interest | Debit Interest | Accruals | Pay In Lieu Credit | Pay In Lieu Debits | Fees |

| Form 1099 | Yes | Yes | No | No | Yes | No | No |

| Form 1042-S | Yes | Yes | No | No | Yes | No | No |

| Annual Statement | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Dividend Summary | Yes | No | No | No | Yes | Yes | No |

| Gain/Loss Worksheet | No | No | No | No | No | No | No |

| 1256 Worksheet | No | No | No | No | No | No | No |

NOTES: (1) US Tax Form 1042-S is provided to non-US persons/entities, along with the Dividend Summary. The Tax Form reports interest, dividends, substitute payments in lieu, and US tax withholding from US securities; (2) For US persons/entities, the Dividend Summary may list dividends as potentially eligible for treatment as “Qualified” based on the holding period. IB does not report this on the 1099-DIV or to the Internal Revenue Service; (3) Debit transactions are not 1099 or 1042-S reportable transactions. In accordance with the IRS guidelines, IB excludes the activity from the tax reports; (4) Exchange, market data, and activity fees

Tax Reporting: When to expect Forms 1099-R and 5498

Forms 1099-R and 5498 are available by January 31 and May 31, respectively.

IRS Circular 230 Notice: The information contained in this FAQ is provided for information purposes only, is not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations and does not resolve any tax issues in your favor. Refer to IRS Publication 590, Individual Retirement Accounts for additional information on IRAs in general and consult your tax advisor about your individual tax situation.

Can I contribute to an IRA if I already have a retirement plan through my employer?

Yes. You can contribute to a Roth IRA or Traditional IRA regardless of whether or not you have an employer-sponsored plan. While participation in a retirement plan does not change how much you can contribute to an IRA, it can affect whether or not you are eligible to deduct your Traditional IRA contributions on your tax return.

IRS Circular 230 Notice: The information contained in this FAQ is provided for information purposes only, is not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations and does not resolve any tax issues in your favor. Refer to IRS Publication 590, Individual Retirement Accounts for additional information on IRAs in general and consult your tax advisor about your individual tax situation.