“信用限制期”内的存款是否可以获得利息?

答案取决于存款方式。 对于通过ACH进行的存款,利息从存款到达当日起便开始计算,资金记入账户前为期四个工作日的信用限制期都会持续计息。对于银行支票以外的支票存款,在信用限制期内不产生利息。银行支票和电汇会在收到后立即记入账户,因此不受任何信用限制期的影响。

您收到的利息因市况而异。 有关当前向贷方余额支付利息的信息,请参阅 www.interactivebrokers.com/interest

盈透证券欢迎您

现在您的账户已完成入金并获批,您可以开始交易了。以下信息可以帮助您入门。

- 您的资金

- 设置您的账户以进行交易

- 如何交易

- 在全球范围进行交易

- 拓展您IB经验的五个要点

1. 您的资金

存款&取款基本信息。所有转账都通过您的账户管理进行管理

存款

首先,通过您的账户管理 > 资金 > 资金转账 > 转账类型:“存款”创建一个存款通知(如何创建存款通知)。 第二步,通知您的银行进行电汇转账,在存款通知中提供详细银行信息。

取款

通过您的账户管理 > 资金 > 资金转账 > 转账类型:“取款”创建一个取款指令(如何创建取款指令)

如果您通知要进行超出取款限额的取款,则会被视为异常取款,我们因此将需要匹配银行账户持有人和IB账户。如果目的地银行账户已被用作存款,那么取款将会被处理;否则,您必须联系客户服务并提供所需文件。

错误排查

存款:我的银行发出了资金,但我没有看到资金记入我的IB账户。可能的原因:

a) 资金转账需要1至4个工作日。

b) 存款通知缺失。您必须通过账户管理创建存款通知并向客户服务发送一条咨询单。

c) 修改详情缺失。转账详情中缺失您的姓名或IB账户号码。您必须联系您的银行索取完整的修改详情。

d) IB发起的ACH存款7个工作日内限额为10万美元。如果您开立的是初始要求为11万美元的投资组合保证金账户,最好选择电汇存款以减少您第一笔交易的等待时间。如果选择ACH,会需要等待近2周时间,或者可以选择临时升级至RegT。

取款:我已经请求了取款,但我没有看到资金记入我的银行账户。可能的原因:

a) 资金转账需要1至4个工作日。

b) 被拒。超出最大取款限额。请检查您账户的现金余额。注意,出于监管要求,存入资金时会有三天置存期,之后才可以被取出。

c) 您的银行退回了资金。可能是因为接收银行账户与汇款银行账户名称不匹配。

2. 设置您的账户以进行交易

现金与保证金账户的区别:如果您选择快速申请,默认您的账户类型为配备美国股票许可的现金账户。如果您想使用杠杆并以保证金交易,参见此处如何升级为RegT保证金账户

交易许可

为了能够交易特定国家的某一特定资产类别,您需要通过账户管理获得该资产类别的交易许可。请注意,交易许可是免费的。但您可能需要签署当地监管部门所要求的风险披露。如何请求交易许可

市场数据

如果想获取某一特定产品/交易所的实时市场数据,您需要订阅交易所收费的市场数据包。如何订阅市场数据

市场数据助手会帮助您选择正确的数据包。请观看该视频,其解释了市场数据助手是如何工作的。

客户可以通过从未订阅的代码行点击免费延时数据按钮选择接收免费的延时市场数据。

顾问账户

请阅读用户指南顾问入门指南。在这里,您可以看到如何向您的顾问账户创建其他使用者以及如何授予其访问权限等等。

3. 如何交易

如果想学习如何使用我们的交易平台,您可以访问交易者大学。在这里您可以找到我们以10种语言提供的实时与录制网研会以及有关交易平台的课程与文档。

交易者工作站(TWS)

要求更高级交易工具的交易者可以使用我们做市商设计的交易者工作站(TWS)。TWS有着便于操作的电子表格式界面,可优化您的交易速度和效率,支持60多种定单类型,配备可适应任何交易风格的特定任务交易工具,并可实时监控账户余额与活动。试试两种不同模式:

魔方TWS:直观可用性,简便的交易准入,定单管理,自选列表与图表全部在一个窗口呈现。

标准模式TWS:为需要更高级工具与算法的交易者提供高级定单管理。

基本描述与信息 / 快速入门指南 / 用户指南

互动课程:TWS基础 / TWS设置 / 魔方TWS

如何下单交易:标准模式TWS视频 / 魔方TWS视频

交易工具:基本描述与信息 / 用户指南

要求:如何安装适用于Windows的Java / 如何安装适用于MAC的Java / 需打开端口4000和4001

登录TWS / 下载TWS

网络交易者(WebTrader)

偏好干净简洁界面的交易者可以使用我们基于HTML的网络交易者。网络交易者便于查看市场数据、提交定单以及监控您的账户与执行。从各浏览器使用最新版本网络交易者

快速入门指南 / 网络交易者用户指南

简介:网络交易者视频

如何下单交易:网络交易者视频

登录网络交易者

移动交易者(MobileTrader)

我们的移动解决方案可供您随时随地用您的IB账户进行交易。IB TWS iOS版和IB TWS BlackBerry版是为这些型号定制设计的,而通用的移动交易者支持大多数其他智能手机。

基本描述与信息

定单类型 可用定单类型与描述 / 视频 / 课程 / 用户指南

模拟交易 基本描述与信息 / 如何获得模拟交易账户

一旦您的模拟交易账户创建成功,您便可用模拟交易账户分享您真实账户的市场数据:账户管理 > 管理账户 > 设置 > 模拟交易

4. 在全球范围进行交易

IB账户为多币种账户。您的账户可以同时持有不同的货币,可供您从一个账户交易全球范围内的多种产品。

基础货币

您的基础货币决定了您报表的转换货币以及用于确定保证金要求的货币。基础货币在您开立账户时决定。客户随时可通过账户管理改变其基础货币。

我们不会自动将货币转换为您的基础货币

货币转换必须由客户手动完成。在该视频中,您可以学习如何进行货币转换。

要开仓以您账户所不持有之货币计价的头寸,您可以有以下两种选择:

A) 货币转换。

B) IB保证金贷款。(对现金账户不可用)

请查看该课程,其解释了外汇交易方法。

5. 拓展您IB经验的五个要点

1. 合约搜索

在这里,您会找到我们的所有产品、代码与说明。

2. IB知识库

IB知识库包含了一系列术语、指导性文章、错误排查技巧以及指南,旨在帮助IB客户管理其IB账户。只需在搜索按钮输入您想要了解的内容,您便会得到答案。

3. 账户管理

我们的交易平台可供您访问市场,账户管理则可供您访问自己的IB账户。使用账户管理可管理账户相关任务,如存入或取出资金、查看您的报表、修改市场数据与新闻订阅、更改交易许可并验证或更改您的个人信息。

登录账户管理 / 账户管理快速入门指南 / 账户管理用户指南

4. 安全登录系统

为向您提供最高级别的在线安全,盈透证券推出了安全登录系统(SLS),通过安全登录系统访问账户需要进行双因素验证。双因素验证旨在于登录时采用两项安全因素确认您的身份:1)您的用户名与密码组合;和2)生成随机、一次性安全代码的安全设备。因为登录账户需要既知晓您的用户名/密码又持有实物安全设备,所以参加安全登录系统基本上可以杜绝除您之外的其他任何人访问您账户的可能性。

如何激活您的安全设备 / 如何获取安全代码卡 / 如何退还安全设备

如果忘记密码或丢失安全代码卡,请联系我们获取即时帮助。

5. 报表与报告

我们的报表与报告方便查看和进行自定义,覆盖了您盈透账户的方方面面。如何查看活动报表

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Depositing Canadian Dollars via Bill Payment

First you will want to set up IBKR as a payee through your bank. To do this, you will need your account number at IBKR and indicate the name of our institution, “Interactive Brokers Inc.”. Depending upon your particular financial institution and whether IBKR is recognized as one of their program participants, your institution will likely indicate an expected delivery date of 1-2 business days for transfers. Once funds are sent via bill payment, please ensure that a bill payment notification is also submitted through Client Portal. For more details on how to submit a deposit notification, please see our Users' Guide.

Please note, Canadian bill payment is only offered for clients of IB Canada.

Find more information on Canadian Bill Payment on the IBKR website.

How to Deposit Funds Via a Full ACATS/ATON Transfer

How to deposit funds to your Interactive Brokers account via a full ACATS/ATON Transfer

For information on how to initiate a partial ACATS/ATON transfer/ please click here

For Interactive Brokers tradeable products please visit the Contract Search Engine

For a detailed description of the Full ACATS/ATON process flow please click here

For a list of the most common causes for ACATS/ATON rejects, please click here

How to Deposit Funds Via a Check

How to deposit funds to your Interactive Brokers account via a Check

Withdrawal restrictions applicable to assets transferred via ACATS

Assets transferred to IBKR via ACATS are subject to a withdrawal hold period of up to 30 days, the count of which begins the day after the transfer has settled and ends at midnight of the 30th day thereafter. Note that assets are often credited to an account holder’s equity and made available for trade prior to transfer settlement. The date at which a given ACATS deposit is eligible for withdrawal may be determined through the Transaction History function within Client Portal.

How can I check the status of funding transactions?

IBKR provides account holders with a tool that provides real-time updates and current status of all deposit and withdrawal transactions relating to both cash and positions which have taken place over the prior 45 calendar day period. This tool is made available through the secure Account Management application and may be accessed via the Transfer & Pay and then Transaction History menu options.

Display

By default, the Transaction History page shows all of your funding transactions for the past ten days. You can adjust that up to the past 90 days by adjusting the time slider. Click and drag the slider right or left to change the time. The page updates to display all of your funding transactions for the selected period.

By default, transactions are displayed by date in descending order. Change the sort order by clicking any column heading. To change the sort order from descending to ascending, click the column heading again. For example, if you want to view all deposits listed together, click the Type column heading.

Click the Configure (gear) icon to configure the transaction history to display additional information, including Account ID, Account Title and Method.

To view transaction details, click anywhere on a transaction row. Details for the transaction appear in a popup window. From the transaction detail popup window, you can perform any of the following operations:

- Cancel any transaction that has a status of Pending by clicking Cancel. Click Yes to confirm the cancellation.

- Print the transaction details by clicking Print.

- Stop payment on a check withdrawal.

- Close the popup window by clicking the X icon in the upper corner.

- Note: DO NOT CLICK THE CANCEL BUTTON UNLESS YOU WANT TO CANCEL THE TRANSACTION.

Search and Filter

Search for a specific transaction by Account ID, Account Title, Transaction Type (deposit, withdrawal, etc.), Transaction Method (check, wire, etc.), or Status by typing the search criteria in the Search field, and then clicking the Search (magnifying glass) icon. Search words are not case-sensitive.

Filter the transaction history by Transaction Type, Method or Status.

Print and Export

To print the transaction history as currently displayed, click the Print icon located in the upper right corner of the screen.

To export your transaction history to an XLS file (Microsoft Excel-compatible), click the Export icon located in the upper right corner of the page. You are prompted to save or download the .XLS page to your computer (depending on your web browser). Once saved, you can open that file in Microsoft Excel.

How to Initiate ACH Transfers

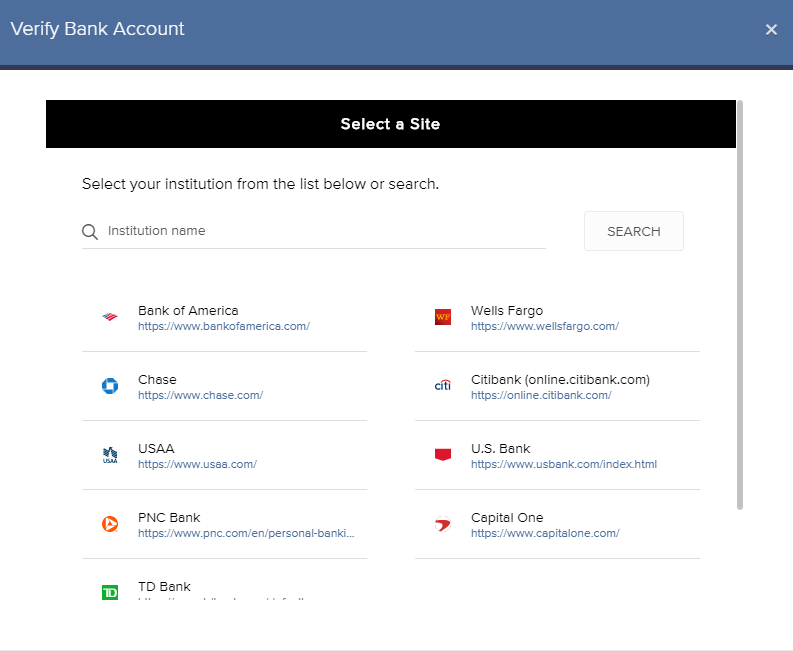

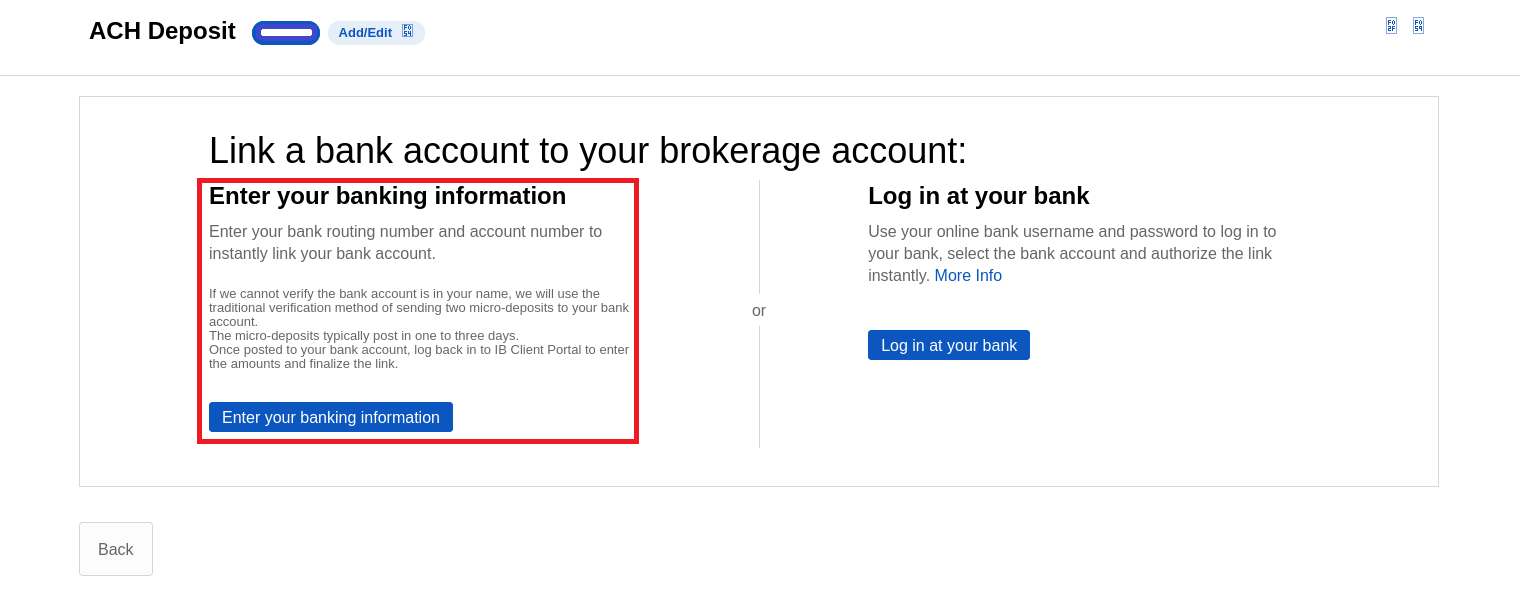

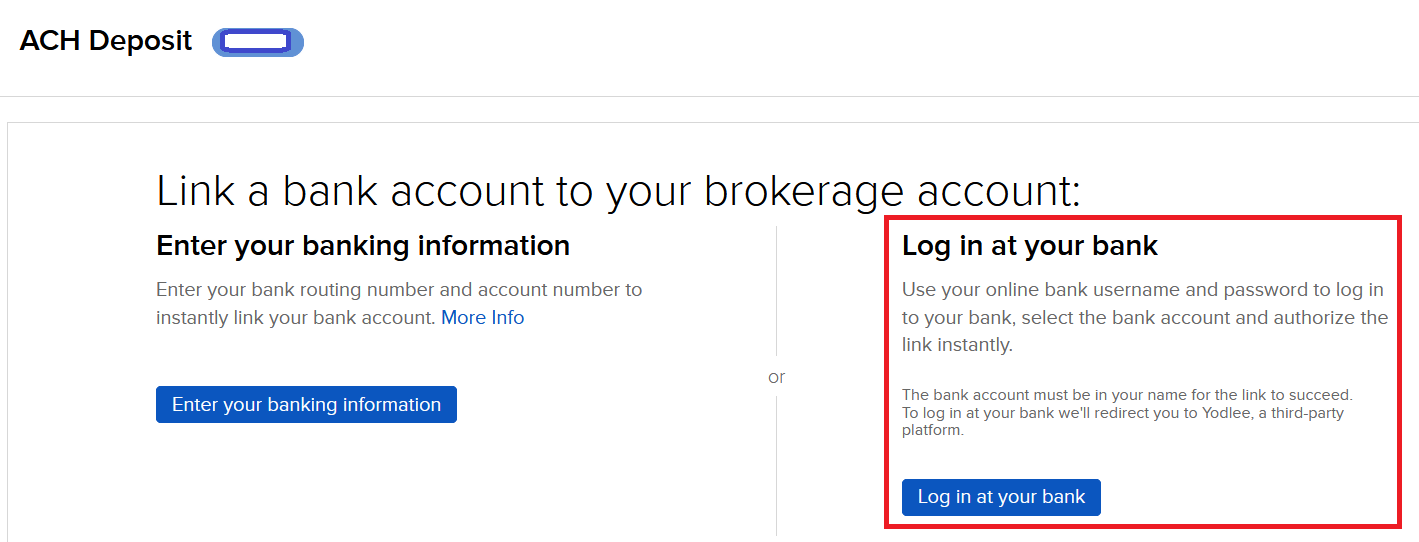

Automated Clearing House (ACH) deposits/withdrawals may be made to your IBKR account from and to your bank. The method referred to as ‘Connect Your Bank’ means your transfer request will be automatically processed through a message sent to your bank by IBKR. Prior to using this method, you will need to create a standing instruction through Transfer and Pay which authorizes IBKR and your bank to electronically transfer funds between the two accounts. You will be asked to verify your bank in one of two ways:

- Enter your banking information: You will be asked to enter your bank account number and routing number for instant verification. If we cannot verify the account is in your name, we will issue test transactions in the form of small debit and credit amounts to your bank account.

- Note: This request does not actually move your funds.

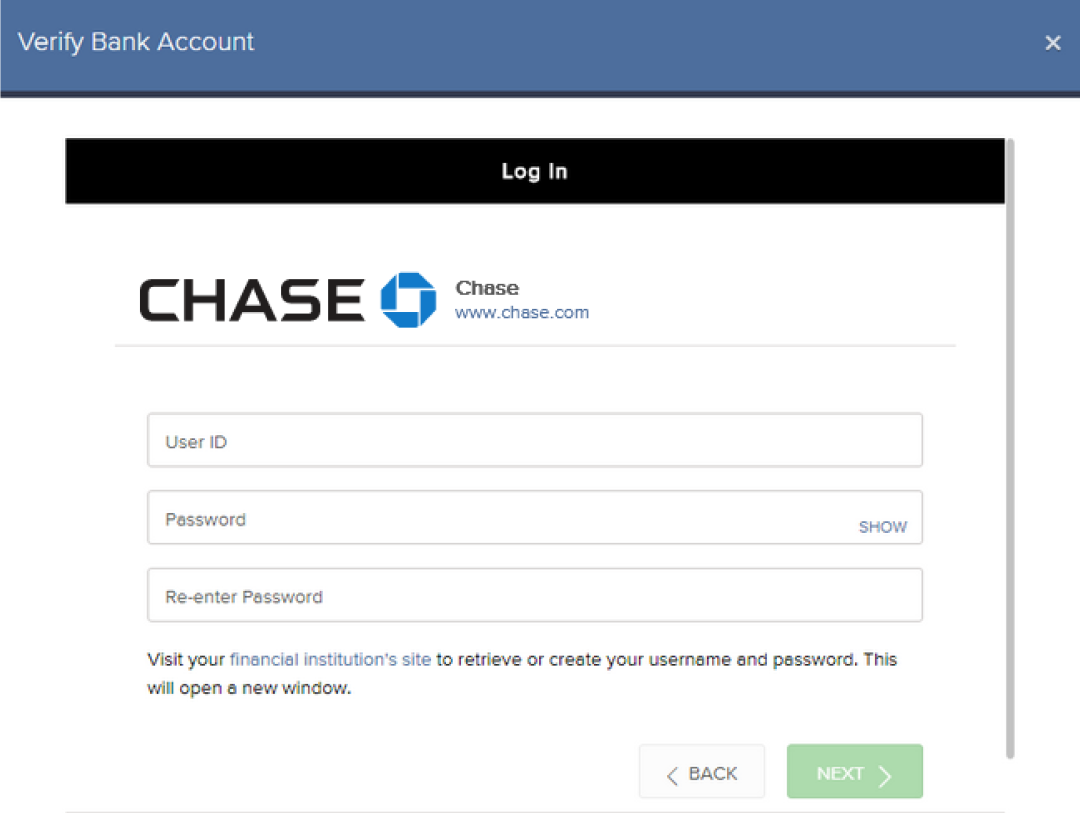

- Log in at your bank: You will be asked to select your bank and enter your username and password to verify your credentials immediately.

- Note: Verification by logging in at your bank uses a third-party service.

Once established, this transfer method can be used for future deposit and withdrawal requests.

Initiating an ACH Transfer:

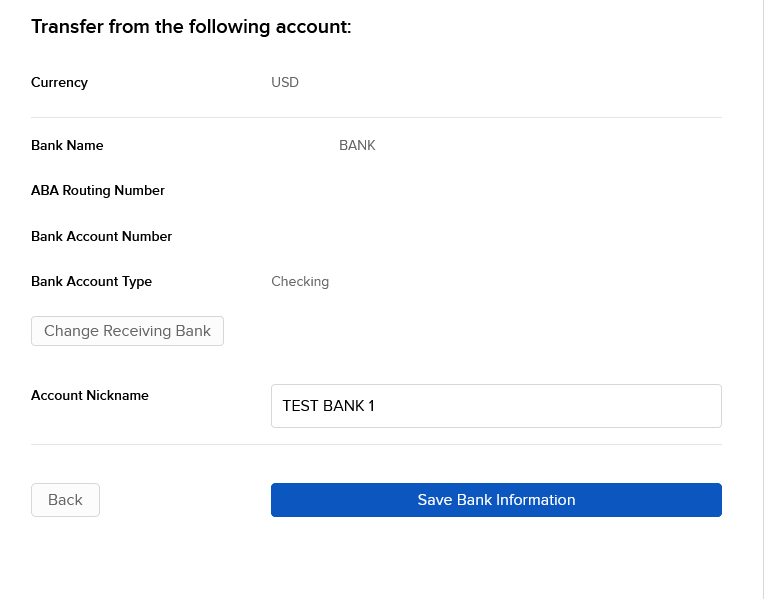

- On the Transfer & Pay > Transfer Funds menu, after you select the transaction type, currency and the transaction method, you enter and save your bank information just as you would for any other deposit or withdrawal method.

Note: You do not enter an amount.

- For ACH withdrawals, as part of the bank information you enter, you are asked to enter a bank information name and select the Bank Information Usage. This selection tells us if you would like the ability to reuse this bank information for both withdrawals and deposits (Debit & Credit), or only withdrawals (Credit).

- You will be asked to verify your bank in one of two ways:

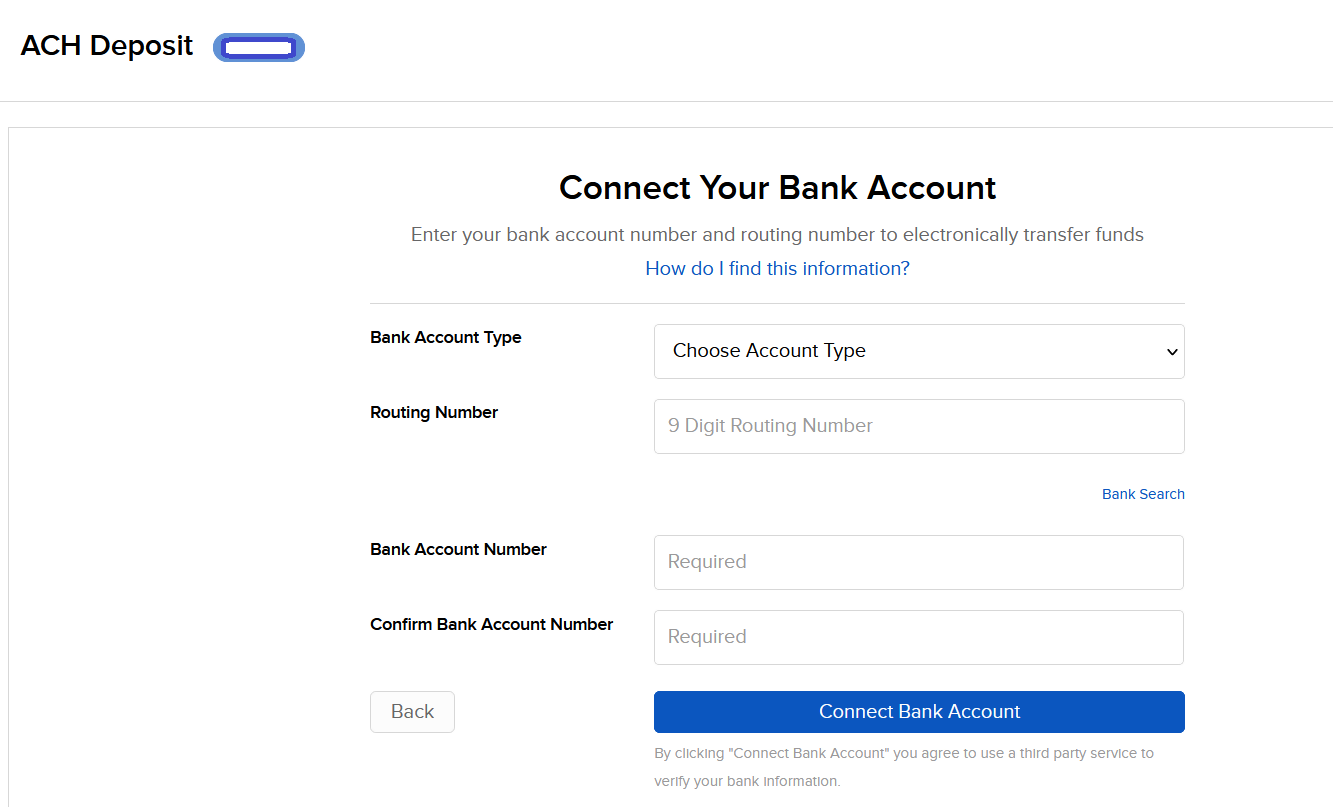

Enter your banking information

- Select: Enter your banking information

- Select the Bank Account Type

- Enter the Routing Number, Bank Account Number and Confirm the Bank Account Number below

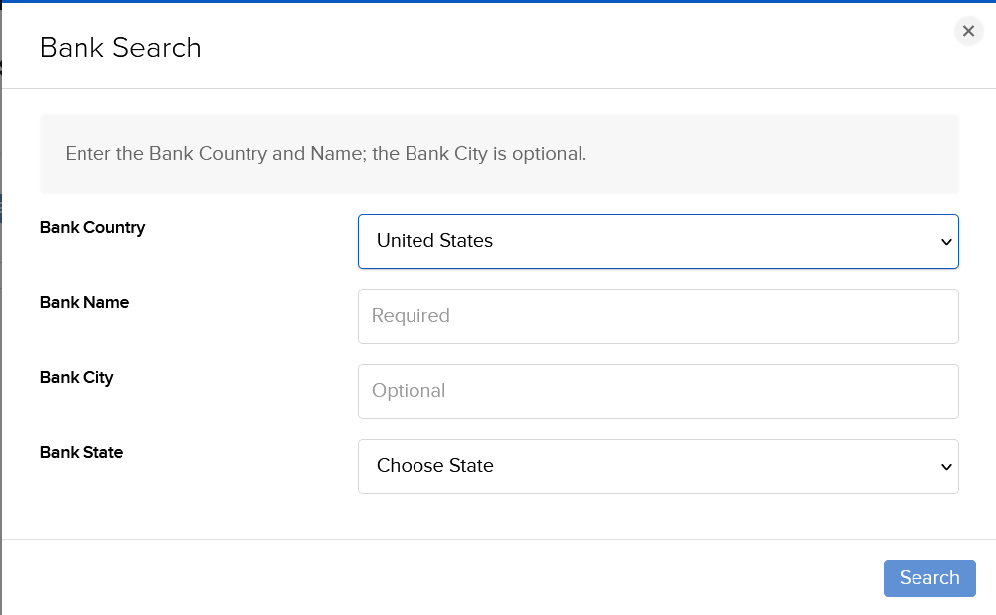

- Or use the Bank Search to find the Receiving Bank

- You will be asked to confirm your request via electronic signature and security token authentication which authorizes both IBKR and your bank to act upon any transfer requests you provide through IBKR;

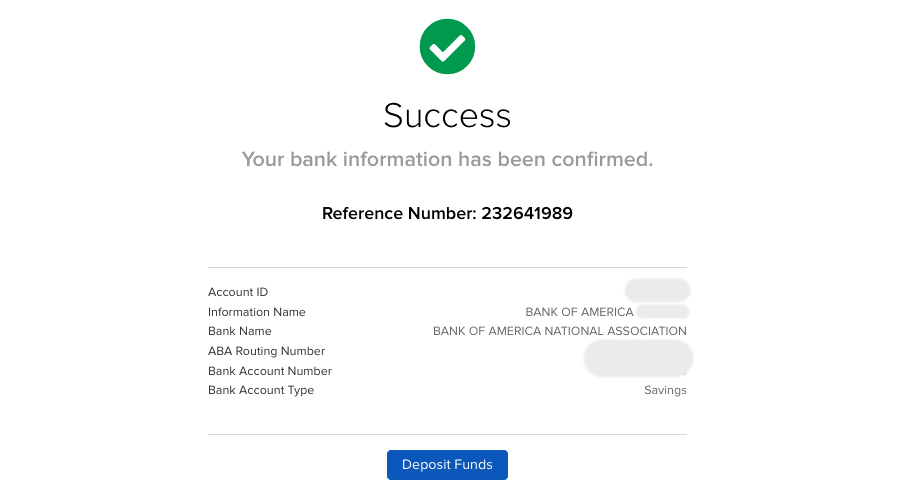

- If your bank account is in your name then your account will instantly link to your bank account. Then you can set up your deposit or withdrawal transfers.

- If we cannot verify the bank account is in your name, we will use the traditional verification method of sending two micro-deposits to your bank account.

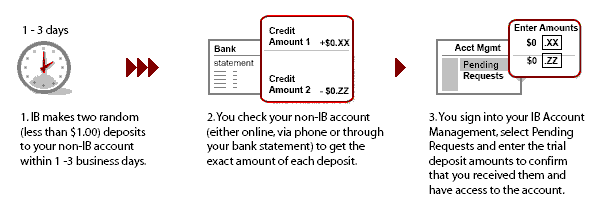

- Within 1-3 business days, two random credits (micro-deposits) each less than one dollar and a corresponding debit (withdrawal) will be issued to your bank account.

- You will need to monitor your bank account for these transactions as they will be needed to confirm this funding instruction.

- Note: These transactions may take place on different days.

- Once you have these amounts, log back in to Client Portal and from the Pending Items menu option select the Confirm Amount link adjacent to your instruction enter the credit amounts.

- After you have entered the correct amounts, you may use the ACH instruction for deposit and withdrawal transfers.

Log in at your bank

- Select: Log in at your bank

- Enter a Nickname

- Click the Verify Bank Account button

- Select your bank from the pop-up window

- Enter the login credentials for your online banking account, and click Next

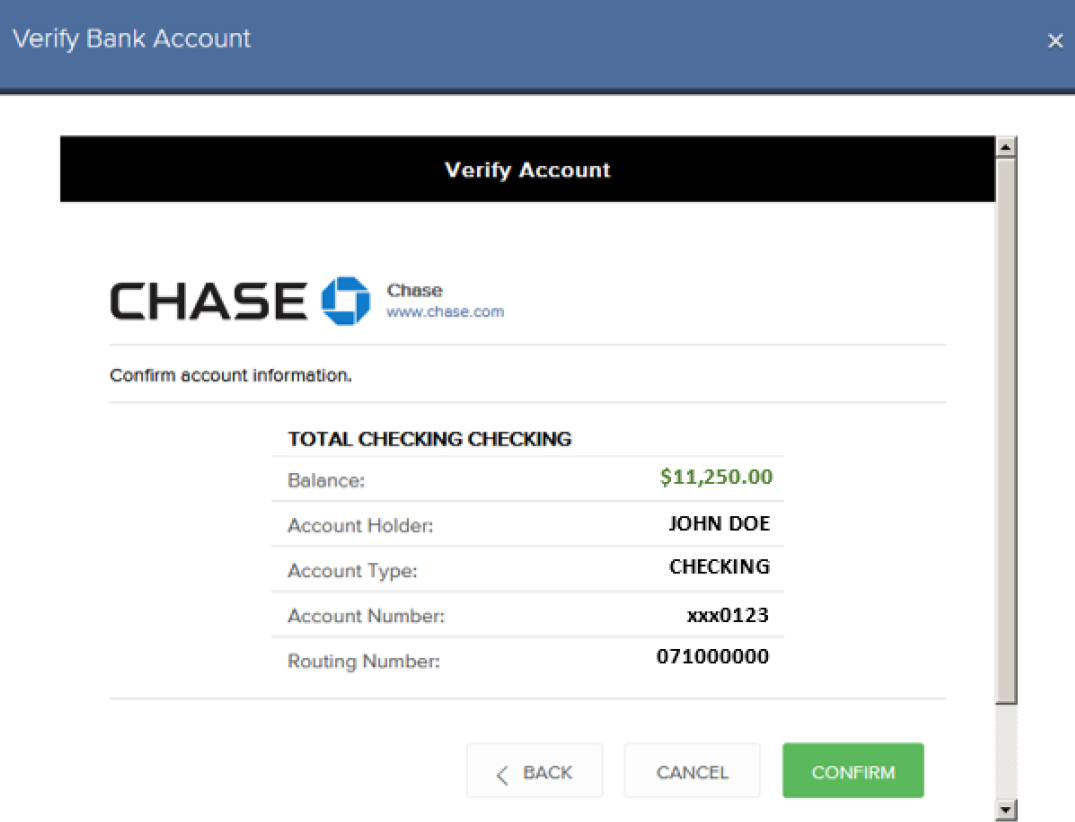

- On the next screen, select the account you wish to use.

- The Verify Account screen will present the details of the account you selected. Click Confirm.

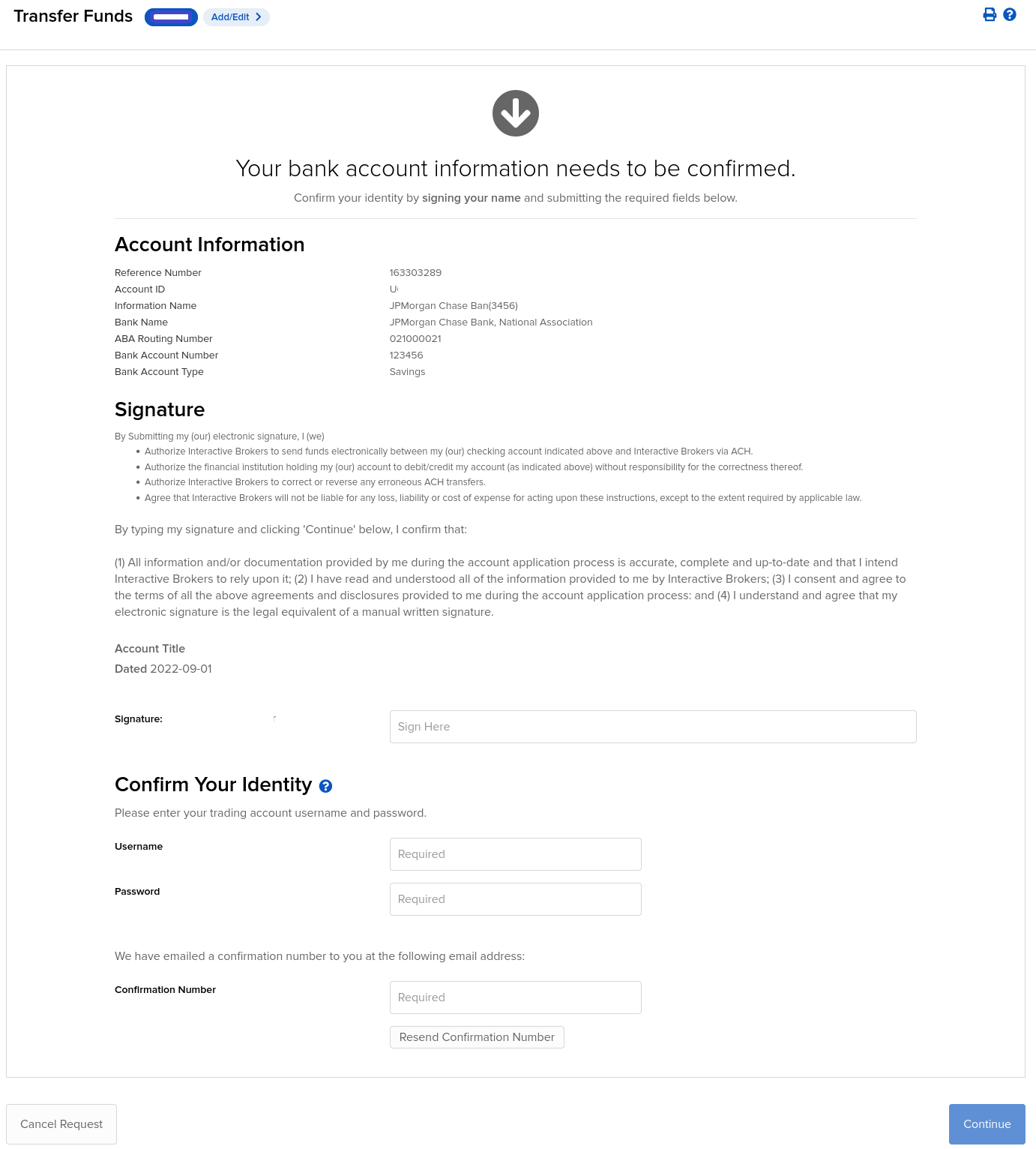

- Verify banking information and click Continue.

- Confirm and Sign on the next screen. Scroll down to enter your:

- Electronic Signature

- IBKR Username

- IBKR Password

Click Continue when complete. (OR, click Cancel Request if you do not wish to proceed.)

9. What appears next will be based on your Security Device:

If using Security Code Card:

a) The Card Values field will appear.

b) Follow the onscreen instructions and use your card to obtain values.

c) Enter values into Card Values.

If using either the Digital Security Card or IB Key App:

a) The Challenge Code and Passcode fields will appear.

b) Enter the Challenge Code into the Digital Security Card and press OK, OR on your smartphone, launch the IB Key App, enter the Challenge Code, and click Generate.

c) Enter the Response String returned into the Passcode field.

10. Click Continue.

Success! You may use this transfer method for future deposit and withdrawal transfers.

Be Careful…

For steps 4 and 6 above, the following points are important to keep in mind:

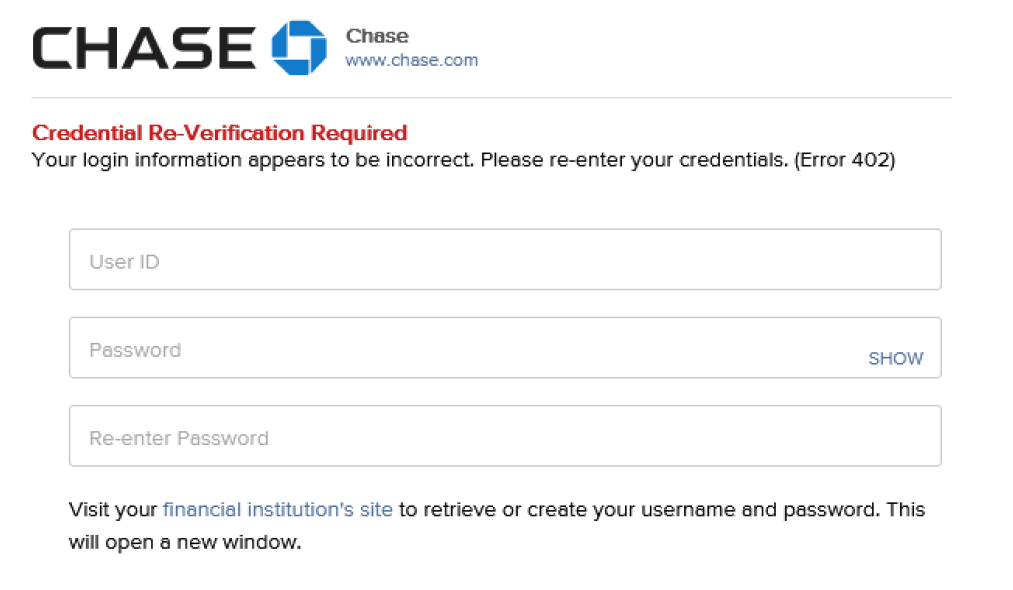

Step 4- When logging into your online banking site, be sure the username and password is entered properly. For example, case sensitivity, middle initials, etc. may be a part of your username and password. An error message will appear if there is an issue.

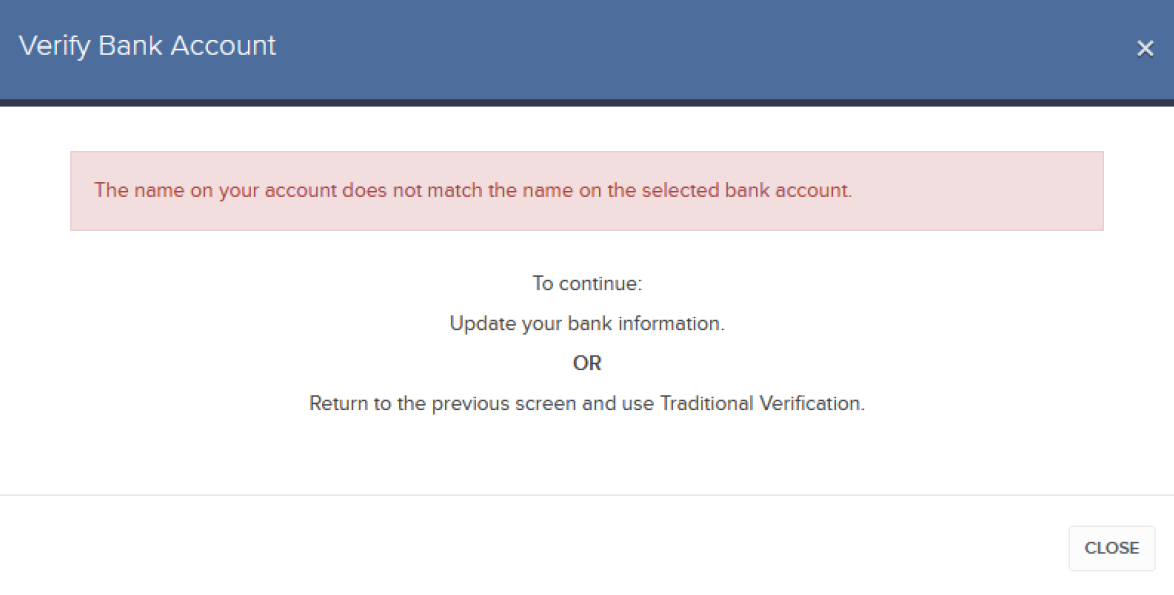

Step 6- For security reasons, the name of the bank Account Holder must match the name on the IBKR account. If the names do not match, the following message will appear.

Note:

- IBKR does not charge any fee for ACH deposits and accounts are afforded one free withdrawal request per month.

- ACH deposits are subject to a possible 4 business day credit hold after arrival prior to being credited to your account.

- If funds are withdrawn to a bank other than the originating bank, a 44-business-day withdrawal hold period will be applied.

Why does IBKR place a hold on the funds deposited via check when my bank has already debited the funds from my account?

IBKR, like any bank client, is subject to the hold periods that banks by regulation are allowed to place upon check deposits. While these regulations generally provide for full availability to be provided within 2 to 5 business days, banks in certain instances may not make the funds available until the 11th business day, and a key factor in determining the availability timeframe is whether the check is drawn upon an institution whose Federal Reserve check processing office is local relevant to IBKR’s bank (which is determined based upon the routing transit number or ABA bank code listed on the check). As it is not operationally feasible to distinguish and track the clearance of individual checks given a large and geographically diverse client base, IBKR has opted to use a uniform hold period of 6 business days for check deposits (with funds made available on the 7th business day). This timeframe had been selected based upon a review of historical data which suggests that the risk of non-payment of funds to be sufficiently minimal after that period.

To minimize any delays associated with the receipt and crediting of deposits, IBKR strongly recommends that clients deposit funds via wire transfer as this process introduces few of the credit risks or operational overhead typically associated with checks. In addition, funds deposited in this manner are immediately credited to your account upon arrival and are not subject to any processing fee by IBKR.