现金划转

该等法规还要求所有证券交易和相关保证金交易均在全能账户的证券账户段进行,而商品交易则在商品账户段进行。1 虽然法规允许将全额支付的证券持仓以保证金抵押品的形成存放在商品账户段进行托管,但IB并不允许这种操作,从而对抵押权应用了更为严格的SEC限制性规则。鉴于相关法规和政策已对持仓应归于哪个账户段作出了规定,现金是唯一可由客户自行决定在两个账户段之间来回转账的资产。

下方为现金划转选项、选择步骤和注意事项相关的说明。

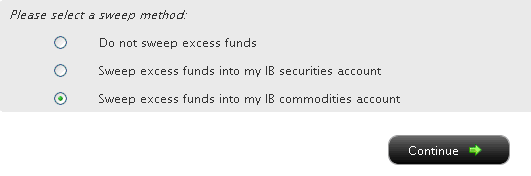

然后,您可点击您想要的划转方式对应的单选按钮,然后选择〝继续〞按钮。您的选择将从下一个工作日起生效,并将一直有效,直到选择其它选项为止。请注意,只要满足上文中提到的交易许可设置,您可随时更改划转方式,没有次数限制。

“信用限制期”内的存款是否可以获得利息?

答案取决于存款方式。 对于通过ACH进行的存款,利息从存款到达当日起便开始计算,资金记入账户前为期四个工作日的信用限制期都会持续计息。对于银行支票以外的支票存款,在信用限制期内不产生利息。银行支票和电汇会在收到后立即记入账户,因此不受任何信用限制期的影响。

您收到的利息因市况而异。 有关当前向贷方余额支付利息的信息,请参阅 www.interactivebrokers.com/interest

活动报表上的应计利息转回项目代表什么?

IBKR每日都会在活动报表的应计利息部分,对报表期间预期或应计赚取或将支付的利息进行计算和报告。 大约在每个月的第一周,上个月的应计利息会被〝返还〞或转回,而当月的实际利息会在现金报告板块发布。应计利息的转回操作每月进行一次,调整后应接近实际利息,但它们可能并不总是完全相同,因为应计额是对实际利息的预测。

账户持有人还应注意,报告期内的应计利息需超过1美元(正数或负数)才会显示出来。低于1美元的余额会作保存,当加上未来应计利息后金额超过1美元时将予显示。

卖空股票收入的贷方利息

如何确定与股票借入仓位相关的贷方利息或费用

账户持有人卖空股票时,IBKR会代账户持有人借入相应数量的股票,以履行向买方交付股票的义务。根据借入股票的股票借贷协议,IBKR需向股票出借方提供现金抵押品。现金抵押品的金额基于股票价值的行业标准计算,称为抵押品标记。

股票出借方就现金抵押品向IBKR提供利息,利率通常会低于现金抵押存款的现行市场利率(通常与美元计价现金存款的联邦基金有效利率挂钩),其中的差额即作为出借方提供此服务收取的费用。对于难以借入的股票,出借方所收取的费用会相应提高,可能会导致净利率变为负,IBKR反而被倒扣费用。

许多经纪商只会向机构客户提供部分利息返还,但所有IBKR客户其卖空股票收入超出10万美元或等值其它货币的部分都可以获得利息。当某证券可供借用的供应量高于借用需求时,账户持有人可就其卖空股票余额获得的利息利率相当于基准利率(例如,美元余额采用联邦基金有效隔夜利率)减去一个利差(目前介于1.25%(10万美元档的余额)至0.25%(300万美元以上的余额)之间)。利率可能会在无事先通知的情况下发生变化。

当某特定证券的供求不平衡导致其难以借入时,借出方提供的利息返还将会减少,甚至可能导致向账户倒扣费用。该等利息返还或倒扣费用会以更高的借券费用的形式转嫁给账户持有人,这可能会超过卖空收入所得的利息,导致账户最终算下来还付出了费用。由于利率因证券和日期而异,IBKR建议客户通过客户端/账户管理中的支持部分,访问〝可供卖空股票〞工具,查看卖空的指示性利率。请注意,该等工具中反映的指示性利率对应的是IBKR向第三等级余额支付的卖空收入利息,即卖空收入为300万美元或以上。对于较低的余额,其利率将根据余额等级和交易货币对应的基准利率进行调整。可使用“对卖空收益现金余额向您支付的利息”计算器计算适用的利率。

请参阅证券融资(融券)页面的更多范例和计算机。

重要提示

“可供卖空股票”工具和TWS中关于可供借用股票和指示性利率的信息,是在尽最大努力的基础上提供,不保证其准确性或有效性。 “可供卖空股票”包括来自第三方的信息,不会实时更新。利率信息仅为指示性质。在当前交易时段执行的交易通常在2个工作日内结算,实际供应和借入成本在结算日确定。交易者应注意,在交易和结算日之间,利率和供应可能会发生重大变化,尤其是交易稀少的股票、小盘股和即将发生公司行动(包括股息)的股票。详情请参阅卖空的操作风险(Operational Risks of Short Selling。

有关向净现金余额为正的账户收取利息的说明

在以下情况下,尽管账户保持整体净多头或贷方现金余额,但仍需支付利息:

1. 该账户持有特定币种的空头或借方余额。

例如,某账户有相当于5,000美元的净现金贷方余额,这其中包括8,000美元的多头余额和相当于3,000美元的欧元空头余额,需要对欧元空头余额支付利息。 由于账户所持有的多头美元余额低于10,000美元的第一阶梯水平,不会获得利息,因此无法冲抵要支付的利息。

账户持有人应注意,如其买入的证券是以账户未持有的货币计价,则IBKR会创建相应币种的贷款,以便与清算所结算交易。如希望避免此类贷款和相关利息费用,客户需在进行交易前存入以该特定货币计价的资金,或通过Ideal Pro(余额25,000美元或以上)或散股(余额低于25,000美元)交易场所兑换现有的现金余额。

2. 贷方余额主要来自于卖空证券所得。

例如,某账户的净现金余额为12,000美元,其中包括证券子账户中的6,000美元借方余额(减去空头股票持仓的市场价值)和18,000美元的股票空仓价值。账户需就第一阶梯借记余额6,000美元支付利息,同时,由于空头股票贷记低于100,000美元的第一阶梯水平,不会从空头股票贷记中获得利息。

3. 贷方余额包含未结算的资金。

IBKR仅根据已结算资金决定要收取和支付利息。正如账户持有人在买入交易结算之前,无需对用来买入证券的借款支付利息一样,在卖出交易结算之前(而清算所已向IBKR存入资金),账户持有人也不会就卖出证券所得资金获得利息或借方余额冲抵。

FAQs – Irish Income Withholding Tax

As an Irish company, Interactive Brokers Ireland Limited (IBIE) is generally required to collect withholding tax (WHT) at a rate of 20% on interest paid to certain clients.

This requirement is set out in section 246 of the Irish Taxes Consolidation Act 1997 and generally applies to interest paid to clients that are:

(i) natural persons resident in Ireland,

(ii) natural persons resident outside Ireland unless the client has successfully applied for an exemption or a reduction in the WHT rate under a Double Tax Treaty (DTT) between Ireland and the person’s country of residence.

(iii) Irish companies

(iv) Companies established in countries with which Ireland has NOT concluded a DTT.

The purpose of this document is to set out our responses to some frequently asked questions (FAQs) on the WHT.

This document is for information purposes only and does not constitute tax, regulatory or any other kind of advice. If you are unsure of your tax obligations please consult the Irish Revenue Commissioners, your local tax authority or an appropriate tax professional.

FAQs

What type of interest does Irish WHT apply to?

Does Irish WHT apply to interest I earn through the Stock Yield Enhancement Program?

If I earn interest through Bond Coupons, am I required to pay Irish WHT?

I do not trade Irish stocks, do I still have to pay Irish WHT?

What is the standard Irish WHT Rate?

When is the 20% WHT applied to my account?

What currency is used for Irish WHT?

I am resident in Ireland. Do I have to pay Irish WHT?

I am not resident in Ireland. Does Irish WHT apply to me?

Does WHT apply to clients who are companies?

How do I apply for an exemption from WHT or a reduced WHT rate?

What do joint account holders need to submit to obtain a WHT exemption/reduction?

Where should I send my completed Form 8-3-6?

How do I submit Form 8-3-6 and supporting documentation to IBIE?

Do I need to apply for an exemption from WHT or a reduction in the WHT rate by a certain deadline?

How do I apply to reclaim WHT applied to my account?

How long does a completed Form 8-3-6 remain valid for?

Do I have to complete a Form 8-3-6? Can I still trade if I don’t complete it?

Where can I see information relating to Irish WHT on my account statement?

How do I know what WHT rate has been agreed between my country of residence and Ireland?

WHT is a set amount of income tax that is withheld at the time income is paid to a person.

Under Irish law, interest payments are considered income. This means that IBIE is legally required to deduct WHT from credit interests on uninvested cash balances in our clients’ securities accounts.

What type of interest does Irish WHT apply to?

Irish WHT applies to credit interest paid to long settled uninvested cash balances as well as short credit interest where you have borrowed stock from IBIE.

Does Irish WHT apply to interest I earn through the Stock Yield Enhancement Program?

No. The interest you earn under the Stock Yield Enhancement Program is not within scope for Irish WHT obligations. Irish WHT only applies to credit interest paid on uninvested cash balances in your account.

If I earn interest through Bond Coupons, am I required to pay Irish WHT?

No. Interest that you earn on Bond Coupons is not within scope for Irish WHT obligations. Irish WHT applies only to credit interest paid on uninvested cash balances in your account.

I do not trade Irish stocks, do I still have to pay Irish WHT?

Yes. If your account is held by IBIE, your account is in scope for Irish WHT on credit interest payments. It is irrelevant whether or not you trade in Irish stocks.

What is the standard Irish WHT Rate?

The standard rate of WHT is 20%. You can find further information on credit interest rates on our webpage.

When is the 20% WHT applied to my account?

If IBIE is required to apply WHT to your interest payments, we will do so at the same time any credit interest is paid to your account.

IBIE pays interest due on the uninvested cash balance in your account on the third business day of the month following the month in which the interest accrued. For example, interest accrued in January will be paid on the third business day in February.

What currency is used for Irish WHT?

Irish WHT is charged in the same currency as the credit interest paid on the uninvested cash balances in your account.

I am resident in Ireland. Do I have to pay Irish WHT?

Yes. Under Irish tax law, all Irish resident individuals and partnerships are subject to 20% WHT on credit interest payments. Irish companies are also subject to WHT, although some limited exemptions may apply.

I am not resident in Ireland. Does Irish WHT apply to me?

Yes, generally Irish WHT applies to natural persons whether or not they reside in Ireland.

However, if Ireland has entered a Double Taxation Treaty (DTT) with your country of residence, that DTA may allow you to apply for an exemption from or reduction in WHT, depending on its terms. Please see further below.

You can find information about Ireland’s DTTs on the Irish Revenue website https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

Does WHT apply to clients who are companies?

WHT does not apply to companies resident in countries that have a DTT with Ireland.

In general, WHT applies to Irish resident companies with a few exceptions, including;

(a) an investment undertaking within the meaning of section 739B of the Taxes Consolidation Act 1997,

(b) interest paid in the State to a qualifying company (within the meaning of section 110).

For a full list of exemptions, please refer to Section 246(3) of the Taxes Consolidation Act.

There is no standard exemption form for corporate clients. In order to avail of these exemptions, clients will have to provide proof of their corporate status requested by IBIE.

How do I apply for an exemption from WHT or a reduced WHT rate?

If you wish to apply for a WHT exemption or reduction under the terms of a DTT, you should complete Form 8-3-6, and return that Form to IBIE.

The following is a summary of the information you must provide when completing Form 8-3-6:

1. Your name (please ensure this matches the name on your IBKR account)

2. Your address

3. Your tax reference number in country of residence

4. The country in which you are tax resident

5. The WHT rate agreed between your country of tax residence and Ireland (see FAQ on this topic).

6. Signature.

7. Date.

You must request your local Tax Authority to sign and stamp Form 8-3-6 before returning it to us.

For more detailed information on how to complete Form 8-3-6, please refer to the Irish Revenue Commissioners’ website here https://www.revenue.ie/en/companies-and-charities/financial-services/withholding-tax-interest-payments/index.aspx

If you have asked your local tax authority to sign Form 8-3-6 and they have refused, you can instead submit a Tax Residency Certificate (TRC) from your local Tax Authority, with a completed Form 8-3-6 that has not been signed and stamped by your local tax authority. Revenue introduced this possibility in January 2023, after being informed by IBIE of the difficulties clients were experiencing in completing the Form.

To be acceptable, the TRC must explicitly state that you are tax resident in your country of residence in accordance with the relevant provision of the double taxation treaty between Ireland and your country of residence.

Please note that a TRC will only be accepted where you have first requested your local tax authority to sign and stamp Form 8-3-6 and it has refused to do so or has failed to do so within a reasonable time.

Form 8-3-6 and information about completing the Form 8-3-6 is available on the website of the Irish Revenue Commissioners.

To assist you, IBIE has also prepared a number of versions of Form 8-3-6 with certain information pre-filled, depending on your jurisdiction of tax residency. You can select the most appropriate form from the list below.

Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch*

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

What do joint account holders need to submit to obtain a WHT exemption/reduction?

Each account holder in a joint account needs to complete their own documentation. This means that a separate Form 8-3-6 must be completed by each account holder and (if relevant) a separate TRC must be provided by each account holder.

Where should I send my completed Form 8-3-6?

You should send your completed Form to IBIE. You should NOT send the Form to Irish Revenue.

How do I submit Form 8-3-6 and supporting documentation to IBIE?

You should email a PDF or JPEG copy of the signed form to tax-withholding@interactivebrokers.com. If you have not been able to obtain a stamp from your local tax authority, please ensure that you also email your Tax Residency Certificate (TRC) to this same email address.

Alternatively, you can upload your signed Form 8-3-6 to your Client Portal through the ‘Document Submission Task’ tab. However, if you are submitting a TRC with your Form you will still need to send this separately to the above email address.

Please put your IBIE account number in the email subject line in all email correspondence. A failure to do so may delay or prevent the processing of your application,

If your submitted documentation is in order, IBIE will send you a confirmation email stating that your Form has been received and processed.

If your submitted documentation is not in order, we will send you an email setting out the additional information or documentation we require to process your application.

Please follow up with IBIE if you have not heard from us within four weeks.

Do I need to apply for an exemption from WHT or a reduction in the WHT rate by a certain deadline?

There is no deadline. However, for applications made in 2023, a WHT exemption or rate reduction will only apply to interest payments made after IBIE has received a complete application.

If we have not processed your Form 8-3-6 by the time the next interest payment is made to your account we will refund any WHT deducted after the date we received your application. Refunds will be visible in the Withholding Tax section of a statement.

Yes, if you are not subject to WHT, or are subject to a reduced WHT rate by virtue of a Double Taxation Treaty between Ireland and your country of residence, you will be entitled to reclaim WHT paid in excess of the WHT rate set out in the DTT.

How do I apply to reclaim WHT applied to my account?

Generally, the application process (i) to apply for an exemption from WHT or a reduction in the WHT rate going forward and (ii) to reclaim WHT already charged, are two separate processes. IBIE is awaiting full details from the Irish Revenue Authority on how clients can make reclaims on WHT and will make these details available once provided.

However, for 2022, Revenue has agreed to allow a completed Form 8-3-6 (signed and stamped by the relevant Tax Authority) received by IBIE before 31 December 2022, to be used to reclaim WHT applied in 2022. This means that if IBIE received a completed form from you on or before 31 December 2022 and WHT was applied to your account from January – December 2022, IBIE will refund all or part of that WHT, depending on Ireland’s arrangements with your tax jurisdiction.

If you did not provide a Form 8-3-6 before 31 December 2022 or, if you provided a Form 8-3-6 but it was incomplete (for example by not being stamped by your local tax authority), you must separately apply for a full or partial reclaim of WHT paid in 2022 and 2023. Further details on the reclaim process may be found in an article titled Irish Tax Withholding Reclaim Process. For your convenience, the full article may be viewed here.

How long does a completed Form 8-3-6 remain valid for?

A fully completed Form 8-3-6 remains valid for 5 years unless there is a material change in your facts and circumstances. This also applies if you have provided IBIE with a TRC in lieu of having your Form 8-3-6 stamped by your local tax authority. If there is a material change to your circumstances from a tax perspective, you must advise IBIE immediately and provide an updated Form 8-3-6 where appropriate. For example, if you move tax residency from one country to another, you should advise IBIE and provide IBIE with a Form 8-3-6, signed and stamped by your local tax authority from your new country of residence.

Do I have to complete a Form 8-3-6? Can I still trade if I don’t complete it?

You do not have to complete Form 8-3-6 and you will still be able to trade if you do not complete the form.

However, if you do not complete Form 8-3-6 IBIE must continue to deduct WHT at a rate of 20% from the credit interest earned on cash balances in your account.

Where can I see information relating to Irish WHT on my account statement?

You can review information relating to Irish WHT in the ‘Withholding Tax’ section of your monthly account activity statement.

You can also view this information in your daily statement on the 3rd business day of the month (when credit interest is paid).

Please see the IBIE website here for more information: https://www.interactivebrokers.ie/en/index.php?f=46788

How do I know what WHT rate has been agreed between my country of residence and Ireland?

This information is available from the Irish Revenue Commissioners and/or your own local tax authority. However, in order to assist you, IBIE has also prepared a list of Irish WHT information by jurisdiction below.

By clicking on the country below, it will bring you to the relevant Form 8-3-6.

*Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch*

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

为什么难以借到的股票其“价格”与收盘价不一致?

在确定借用股票头寸所需存入的现金抵押金额时,通用的行业惯例是用股票前一个交易日**的收盘价乘以102%,向上取整到最近的美元,然后再乘以所借股数。由于借股费用根据现金抵押金额确定,这一惯例直接影响到维持空头头寸的成本,尤其是对那些股价不高但难以借到的股票。注意,不是以美元计价的股票,计算会有所不同。下表为各个币种对应的行业惯例:

| 币种 | 计算方法 |

| USD | 102%;向上取整到最近的元 |

| CAD | 102%;向上取整到最近的元 |

| EUR | 105%;向上取整到最近的分 |

| CHF | 105%;向上取整到最近的生丁 |

| GBP | 105%;向上取整到最近的便士 |

| HKD | 105%;向上取整到最近的分 |

账户持有人可在每日账户报表的“非直接难以借用股票详情(Non-Direct Hard to Borrow Details)”部分查看借股价格。下方通过举例说明了现金抵押金额的计算及其对借股费用的影响。

例 1

以$1.50美元的价格卖空100,000股ABC

卖空所得 = $150,000.00美元

假设ABC股价跌至$0.25美元,股票借贷费率为50%

卖空股票抵押金额计算

价格 = 0.25 x 102% = 0.255; 向上取整至$1.00美元

总金额 = 100,000股 x $1.00 = $100,000.00美元

借股费用 = $100,000 x 50% / 360天 = $138.89美元/天

假设账户持有人的现金余额中没有任何其它卖空交易所得,由于余额没有超过可以开始计息的最低门槛要求$100,000美元,将不会有任何卖空收益的利息收入可用于冲抵此借股费用。

例 2(以欧元计价的股票)

以1.50欧元的价格卖空100,000股ABC

假设前一个交易日收盘价为1.55欧元,股票借贷费率为50%

卖空股票抵押金额计算

价格 = 1.55欧元 x 105% = 1.6275; 向上取整至1.63欧元

总金额 = 100,000股 x 1.63 = 163,000.00欧元

借股费用 = 163,000欧元 x 50% / 360天 = 226.38欧元/天

** 请注意,周六和周天与周五一样将采用周四的收盘价计算抵押金额。

股票收益提升计划(SYEP)常见问题

股票收益提升计划推出的目的是什么?

股票收益提升计划可供客户通过允许IBKR将其账户内原本闲置的证券头寸(即全额支付和超额保证金证券)出借给第三方来赚取额外收益。参与此计划的客户会收到用以确保股票在借贷终止时顺利归还的抵押(美国国债或现金)。

什么是全额支付和超额保证金证券?

全额支付证券是客户账户中全款付清的证券。超额保证金证券是虽然没有全款付清但本身市场价值已超过保证金贷款余额的140%的证券。

客户股票收益提升计划的借出交易收益如何计算?

客户借出股票的收益取决于场外证券借贷市场的借贷利率。借出的股票不同,出借的日期不同,都会对借贷利率造成很大差异。通常,IBKR会按自己借出股票所得金额的大约50%向参与计划的客户支付利息。

借贷交易的抵押金额如何确定?

证券借贷的抵押(美国国债或现金)金额采用行业惯例确定,即用股票的收盘价乘以特定百分比(通常为102-105%),然后向上取整到最近的美元/分。每个币种的行业惯例不同。例如,借出100股收盘价为$59.24美元的美元计价股票,现金抵押应为$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表为各个币种的行业惯例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 欧元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英镑 | 105%;向上取整到最近的便士 |

| 港币 | 105%;向上取整到最近的分 |

更多信息,请参见KB1146。

股票收益提升计划下的抵押如何保管以及保管在何处?

对于IBLLC的客户,抵押将采用现金或美国国债的形式,并将转入IBLLC的联营公司IBKR Securities Services LLC (“IBKRSS”)进行保管。您在该计划下借出股票的抵押会由IBKRSS以您为受益人保管在一个账户中,您将享有第一优先级担保权益。如果IBLLC违约,您将可以直接从IBKRSS取得抵押,无需经过IBLLC。请参见 此处的《证券账户控制协议》了解更多信息。对于非IBLLC的客户,抵押将由账户所在实体保管。例如,IBIE的账户其抵押将由IBIE保管。例如,IBIE的账户其抵押将由IBIE保管。

退出IBKR股票收益提升计划或卖出/转账通过此计划借出的股票会对利息造成什么影响?

交易日的下一个工作日(T+1)停止计息。对于转账或退出计划,利息也会在发起转账或退出计划的下一个工作日停止计算。

参加IBKR股票收益提升计划有什么资格要求?

| 可参加股票收益提升计划的实体* |

| 盈透证券有限公司(IB LLC) |

| 盈透证券英国有限公司(IB UK)(SIPP账户除外) |

| 盈透证券爱尔兰有限公司(IB IE) |

| 盈透证券中欧有限公司(IB CE) |

| 盈透证券香港有限公司(IB HK) |

| 盈透证券加拿大有限公司(IB Canada)(RRSP/TFSA账户除外) |

| 盈透证券新加坡有限公司(IB Singapore) |

| 可参加股票收益提升计划的账户类型 |

| 现金账户(申请参加时账户资产超过$50,000美元) |

| 保证金账户 |

| 财务顾问客户账户* |

| 介绍经纪商客户账户:全披露和非披露* |

| 介绍经纪商综合账户 |

| 独立交易限制账户(STL) |

*参加的账户必须是保证金账户或满足上述现金账户最低资产要求的现金账户。

盈透证券日本、盈透证券卢森堡、盈透证券澳大利亚和盈透证券印度公司的客户不能参加此计划。账户开在IB LLC下的日本和印度客户可以参加。

此外,满足上方条件的财务顾问客户账户、全披露介绍经纪商客户和综合经纪商可以参加此计划。如果是财务顾问和全披露介绍经纪商,必须由客户自己签署协议。综合经纪商由经纪商签署协议。

IRA账户可以参加股票收益提升计划吗?

可以。

IRA账户由盈透证券资产管理公司(Interactive Brokers Asset Management)管理的账户分区可以参加股票收益提升计划吗?

不能。

英国SIPP账户可以参加股票收益提升计划吗?

不能。

如果参加计划的现金账户资产跌破最低资产要求$50,000美元会怎么样?

现金账户只有在申请参加计划当时必须满足这一最低资产要求。之后资产跌破此要求并不会对现有借贷造成任何影响,也不影响您继续借出股票。

如何申请参加IBKR股票收益提升计划?

要参加股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。然后,在账户设置内,寻找交易板块并点击股票收益提升计划以申请参加。 您将会看到参加该计划所需填写的表格和披露。阅读并签署表格后,您的申请便会提交处理。可能需要24到48小时才能完成激活。

如何终止股票收益提升计划?

要退出股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。在账户 设置板块内会找到交易,然后点击股票 收益 提升 计划,然后参照所需步骤。您的申请便会提交处理。 中止参加的请求通常会在当日结束时进行处理。

如果一个账户参加了计划然后又退出,那么该账户多久可以重新参加计划?

退出计划后,账户需要等待90天才能重新参加。

哪些证券头寸可以出借?

| 美国市场 | 欧洲市场 | 香港市场 | 加拿大市场 |

| 普通股(交易所挂牌、粉单和OTCBB) | 普通股(交易所挂牌) | 普通股(交易所挂牌) | 普通股(交易所挂牌) |

| ETF | ETF | ETF | ETF |

| 优先股 | 优先股 | 优先股 | 优先股 |

| 公司债券* |

*市政债券不适用。

借出IPO后在二级市场交易的股票有什么限制吗?

没有,只要账户本身没有就相应的证券受到限制就可以。

IBKR如何确定可以借出的股票数量?

第一步是确定IBKR有保证金扣押权从而可以在没有客户参与的情况下通过股票收益提升计划借出的证券的价值(如有)。根据规定,通过保证金贷款借钱给客户购买证券的经纪商可以将该客户的证券借出或用作抵押,金额最高不超过贷款金额的140%。例如,如果客户现金余额为$50,000美元,买入市场价值为$100,000美元的证券,则贷款金额为$50,000美元,那么经纪商对$70,000美元($50,000的140%)的证券享有扣押权。客户持有的证券超出这一金额的部分被称为超额保证金证券(此例子中为$30,000),需要记在隔离账户,除非客户授权IBKR通过股票收益提升计划将其借出。

计算贷款金额首先要将所有非美元计价的现金余额转换成美元,然后减去股票卖空所得(转换成美元)。如果结果为负数,则我们最高可抵押此数目的140%。此外,商品账户段中持有的现金余额和现货金属和差价合约相关现金不纳入考虑范围。 详细说明请参见此处。

例1: 客户在基础货币为美元的账户内持有100,000欧元,欧元兑美元汇率为1.40。客户买入价值$112,000美元(相当于80,000欧元)的美元计价股票。由于转换成美元后现金余额为正数,所有证券被视为全额支付。

| 项目 | 欧元 | 美元 | 基础货币(美元) |

| 现金 | 100,000 | (112,000) | $28,000 |

| 多头股票 | $112,000 | $112,000 | |

| 净清算价值 | $140,000 |

例2: 客户持有80,000美元、多头持有价值$100,000美元的美元计价股票并且做空了价值$100,000美元的美元计价股票。总计$28,000美元的多头证券被视为保证金证券,剩余的$72,000美元为超额保证金证券。计算方法是用现金余额减去卖空所得($80,000 - $100,000),所得贷款金额再乘以140% ($20,000 * 1.4 = $28,000)

| 项目 | 基础货币(美元) |

| 现金 | $80,000 |

| 多头股票 | $100,000 |

| 空头股票 | ($100,000) |

| 净清算价值 | $80,000 |

IBKR会把所有符合条件的股票都借出去吗?

不保证账户内所有符合条件的股票都能通过股票收益提升计划借出去,因为某些证券可能没有利率有利的市场,或者IBKR无法接入有意愿的借用方所在的市场,也有可能IBKR不想借出您的股票。

通过股票收益提升计划借出股票是否都要以100为单位?

不能。只要是整股都可以,但是借给第三方的时候我们只以100为倍数借出。这样,如果有第三方需要借用100股,就可能发生我们从一个客户那里借出75股、从另一个客户那里借出25股的情况。

如果可供借出的股票超过借用需求,如何在多个客户之间分配借出份额?

如果我们股票收益提升计划的参与者可用以借出的股票数量大于借用需求,则借出份额将按比例分配。例如,可供借出XYZ数量为20,000股,而对于XYZ的需求只有10,000股的情况下,每个客户可以借出其所持股数的一半。

股票是只借给其它IBKR客户还是也会借给其它第三方?

股票可以借给IBKR客户和第三方。

股票收益提升计划的参与者可以自行决定哪些股票IBKR可以借出吗?

不能。此计划完全由IBKR管理,IBKR在确定了自己因保证金贷款扣押权可以借出的证券后,可自行决定哪些全额支付或超额保证金证券可以借出,并发起借贷。

通过股票收益提升计划借出去的证券其卖出是否会受到限制?

借出去的股票可随时卖出,没有任何限制。卖出交易的结算并不需要股票及时归还,卖出收益会按正常结算日记入客户的账户。此外,借贷会于证券卖出的下一个工作日开盘终止。

客户就通过股票收益提升计划借出去的股票沽出持保看张期权还能享受持保看涨期权保证金待遇吗?

可以。由于借出去的股票其盈亏风险仍然在借出方身上,借出股票不会对相关保证金要求造成任何影响。

借出去的股票由于看涨期权被行权或看跌期权行权被交付会怎么样?

借贷将于平仓或减仓操作(交易、被行权、行权)的T+1日终止。

借出去的股票被暂停交易会怎么样?

暂停交易对股票借出没有直接影响,只要IBKR能继续借出该等股票,则无论股票是否被暂停交易,借贷都可以继续进行。

借贷股票的抵押可以划至商品账户段冲抵保证金和/或应付行情变化吗?

不能。股票借贷的抵押不会对保证金或融资造成任何影响。

计划参与者发起保证金贷款或提高现有贷款金额会怎么样?

如果客户有全额支付的证券通过股票收益提升计划借出,之后又发起保证金贷款,则不属于超额保证金证券的部分将被终止借贷。同样,如果客户有超额保证金证券通过此计划借出,之后又要增加现有保证金贷款,则不属于超额保证金证券的部分也将被终止借贷。

什么情况下股票借贷会被终止?

发生以下情况(但不限于以下情况),股票借贷将被自动终止:

- 客户选择退出计划

- 转账股票

- 以股票作抵押借款

- 卖出股票

- 看涨期权被行权/看跌期权行权

- 账户关闭

股票收益提升计划的参与者是否会收到被借出股票的股息?

通过股票收益提升计划借出的股票通常会在除息日前召回以获取股息、避免股息替代支付。但是仍然有可能获得股息替代支付。

股票收益提升计划的参与者是否对被借出的股票保有投票权?

不能。如果登记日或投票、给予同意或采取其它行动的截止日期在贷款期内,则证券的借用者有权就证券相关事项进行投票或决断。

股票收益提升计划的参与者是否能就被借出的股票获得权利、权证和分拆股份?

可以。被借出股票分配的任何权利、权证和分拆股份都将属于证券的借出方。

股票借贷在活动报表中如何呈现?

借贷抵押、借出在外的股数、活动和收益在以下6个报表区域中反映:

1. 现金详情 – 详细列出了期初抵押(美国国债或现金)余额、借贷活动导致的净变化(如果发起新的借贷则为正;如果股票归还则为负)和期末现金抵押余额。

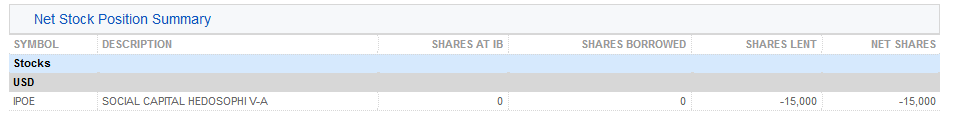

2. 净股票头寸总结 – 按股票详细列出了在IBKR持有的总股数、借入的股数、借出的股数和净股数(=在IBKR持有的总股数 + 借入的股数 - 借出的股数)。

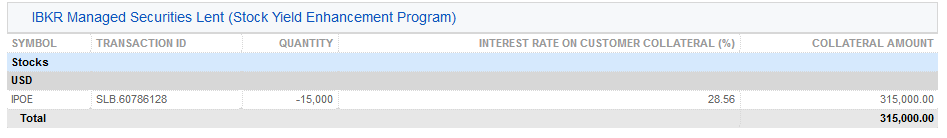

3. 借出的IBKR管理证券(股票收益提升计划) – 对通过股票收益提升计划借出的股票按股票列出了借出的股数以及利率(%)。

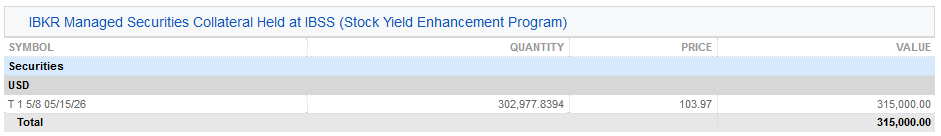

3a. 在IBSS保管的IBKR管理证券的抵押(股票收益提升计划)– IBLLC的客户会看到其报表中多出来一栏,显示作为抵押的美国国债以及抵押的数量、价格和总价值。

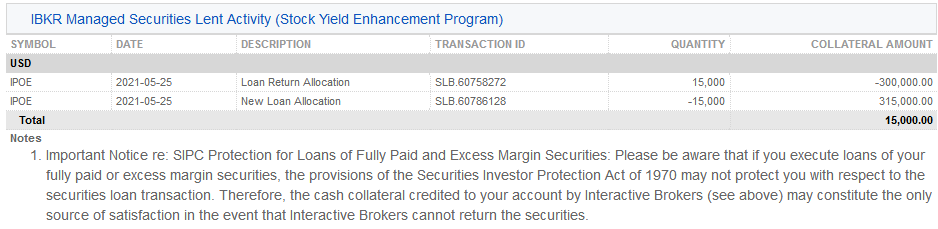

4. IBKR管理证券借出活动 (股票收益提升计划)– 详细列出了各证券的借贷活动,包括归还份额分配(即终止的借贷);新借出份额分配(即新发起的借贷);股数;净利率(%);客户抵押金额及其利率(%)。

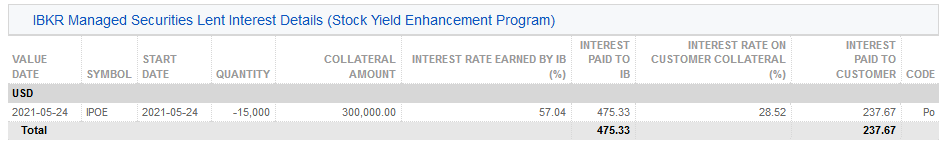

5. IBKR管理的证券借出活动利息详情 (股票收益提升计划)– 按每笔借出活动详细列出了IBKR赚取的利率(%);IBKR赚取的收益(为IBKR从该笔借出活动赚取的总收益,等于{抵押金额 * 利率}/360);客户抵押的利率(为IBKR从该笔借出活动赚取的收益的一半)以及支付给客户的利息(为客户的现金抵押赚取的利息收入)

注:此部分只有在报表期内客户赚取的应计利息超过1美元的情况下才会显示。

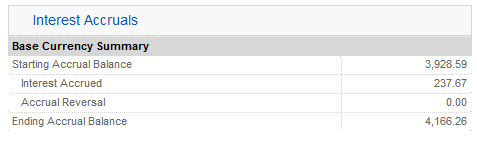

6. 应计利息 – 此处利息收入列为应计利息,与任何其它应计利息一样处理(累积计算,但只有超过$1美元才会显示并按月过账到现金)。年末申报时,该笔利息收入将上报表格1099(美国纳税人)。

确定利率的方法

背景

在确定账户持有人正现金余额可以获得的利息和负现金余额需要支付的利息时,每种货币均有一个IBKR参考基准利率。IBKR参考基准利率根据短期市场利率确定,但会围绕市场普遍使用的外部参考利率或银行存款利率设置偏离的上限。本文解释了IBKR参考基准利率是如何确定的。

参考利率

参考利率分三步确定。其偏离传统外部参考利率的幅度不得超过一定限制。 对于外汇掉期市场定价并不会对我们的利率造成影响的币种和IBKR联营公司,确定最终利率时会省略第一步。

1. 市场隐含利率

对于市场定价,我们参考的是短期外汇掉期市场。由于大部分交易都涉及美元,我们会抽取一个预定义时间段内各货币相对于美元的外汇掉期价格,其中定义的时间段被称为“定价时间窗口”,反映流动交易时间和主要成交量。特定的互换期限及定价窗口视货币而不同。隐含的非美元短期利率将根据多达12家最大的外汇做市银行的最佳买卖价格计算得出(通常为隔夜(T/T+1),Tom Next (T+1/T+2)或Spot Next (T+2/T+3))。定价时间窗口结束后,将这些结果排序,剔除最高及最低的价格,然后对剩余的结果做平均,从而得出市场隐含的参考利率。

2. 传统外部基准参考利率

对于传统基准,我们采用的是已公布的参考利率和银行存款利率。该等利率通常是根据银行调研或实际交易情况确定的。比如香港银行同业拆借利率(HIBOR)就是根据对一组银行的调研得出的,调研会询问银行在每天的某个特定时间能够以什么样的利率从其它银行借到资金。与此相反,美元联邦基金利率则是联邦基金市场上银行间拆借利率的加权平均值。

由20国集团国家于2013年发起并由监管机构以及公共和私营部门工作小组实施推行的利率基准改革(IBOR改革)正在逐渐用由新交易驱动的参考利率取代银行调研利率。

3. IBKR参考基准利率

最后,我们会使用1中的市场隐含利率,然后在2中的传统基准利率的基础上应用一定比例的偏离上限,从而得出最终的IBKR参考基准利率。 对于不受外汇掉期市场定价影响的币种和IBKR联营公司,最终的IBKR参考基准利率采用传统基准或银行存款利率确定,并设置前面提到的偏离上限。上限可在没有事先明示通知的情况下随时更改,并在下方表格中列出。一并列出的还有相关货币和基准参考利率。

举例

a. 假设英镑的市场隐含隔夜利率为0.55%。英镑隔夜银行同业拆借平均利率(SONIA)为0.65%。则实际利率等于0.55%的市场隐含利率,因为该利率仍在SONIA参考利率(0.65%)加减1.00%的范围内。

b. 如果假设离岸人民币的市场隐含利率为4.5%,但同期的隔夜参考利率为1.0%,则实际利率的上限将被设置在参考利率加2%,即3% (1.0%参考利率 + 2.0%偏离上限)。

|

货币

|

基准利率描述

|

向下偏离上限1

|

向上偏离上限1

|

|

USD

|

联邦基金有效利率(隔夜利率)

|

0.00%

|

0.00%

|

|

AUD

|

澳洲联储(RBA)每日目标隔夜拆借利率

|

1.00%

|

1.00%

|

| AED | 阿联酋银行同业拆借利率(EIBOR) | 3.00% | 3.00% |

|

CAD

|

加拿大银行隔夜借贷利率

|

1.00%

|

1.00%

|

|

CHF

|

瑞士平均隔夜利率(SARON)

|

1.00%

|

1.00%

|

|

CNY/CNH

|

离岸人民币固定香港银行同业隔夜拆借利率(TMA)

|

2.00%

|

2.00%

|

|

CZK

|

布拉格Prague ON银行间同业拆借利率

|

1.00%

|

1.00%

|

|

DKK

|

丹麦Tom/Next指数

|

1.00%

|

1.00%

|

|

EUR

|

欧元短期利率(€STR)

|

1.00%

|

1.00%

|

|

GBP

|

英镑隔夜银行同业拆借平均利率(SONIA)

|

1.00%

|

1.00%

|

|

HKD

|

港币香港银行同业拆借利率(隔夜利率)

|

1.00%

|

1.00%

|

|

HUF

|

布达佩斯银行同业拆借利率

|

1.00%

|

1.00%

|

|

ILS

|

特拉维夫银行同业拆借利率

|

1.00%

|

1.00%

|

|

INR

|

印度中央银行基准利率

|

0.00%

|

0.00%

|

|

JPY

|

东京隔夜平均利率(TONAR)

|

1.00%

|

1.00%

|

|

KRW

|

韩元KORIBOR(1周)

|

0.00%

|

0.00%

|

|

MXN

|

墨西哥银行间TIIE利率(28天利率)

|

3.00%

|

3.00%

|

|

NOK

|

挪威隔夜加权平均

|

1.00%

|

1.00%

|

|

NZD

|

新西兰元官方每日现金利率

|

1.00%

|

1.00%

|

|

PLN

|

华沙银行间隔夜拆借利率(WIBOR)

|

1.00%

|

1.00%

|

| SAR | 沙特阿拉伯银行同业拆借利率(SAIBOR) | 3.00% | 3.00% |

|

SEK

|

SEK STIBOR(隔夜利率)

|

1.00%

|

1.00%

|

|

SGD

|

新加坡元SOR(互换隔夜)利率

|

1.00%

|

1.00%

|

|

TRY

|

土耳其里拉隔夜银行同业拆借利率(TRLIBOR)

|

无上限

|

无上限

|

|

ZAR

|

南非存款基准隔夜利率(Sabor)

|

3.00%

|

3.00%

|

Benchmark Interest Calculation – Reference Rate Descriptions

|

Currency

|

Reference rate

|

Description

|

|

USD

|

Fed Funds Effective

|

Volume weighted average of the transactions processed through the Federal Reserve between member banks. It is intended to reflect the best estimate of interbank financing activity for Reserve Bank members and is the reference for many short-term money market transactions in the broader market.

|

| AED | EIBOR | Is the daily reference rate at which the Panel Banks are able and willing to access UAE Dirham funding, just prior to 11:00 local time. The Contributor Banks use a waterfall in order to contribute their Contributions. For Level 1 of the waterfall, volume weighted average prices of all eligible unsecured Saudi Riyal transactions are used. |

|

AUD

|

RBA Daily Cash Target

|

Refers to a 1-day rate set by the Reserve Bank of Australia to influence short term interest rates.

|

| BGN | LEONIA Plus (Lev Overnight Index Average Plus) | Is a weighted reference rate of concluded and effected overnight deposit transactions on the interbank market. |

|

BRL

|

Brazil CETIP DI Interbank Deposit Rate

|

Brazil’s Interbank Deposit Rate is the daily average annualized rate calculated by the number of business days in the month, of the one-day interbank deposit rates.

|

|

CAD

|

Bank of Canada Overnight Lending Rate

|

Refers to a 1-day rate set by Bank of Canada to influence short term interest rates.

|

|

CHF

|

SARON

|

Stands for Swiss Average Rate Overnight and represents the overnight interest rate of the secured funding market for the Swiss Franc. SARON is administered by SIX.

|

|

CNH

|

CNH HIBOR

|

Stands for Hong Kong Interbank Offered Rate and is the offered rate at which deposits in CNH are being quoted to prime banks in the Hong Kong interbank market.

|

|

CZK

|

PRIBOR

|

Average interest rate at which term deposits are offered between prime banks.

|

|

DKK

|

Denmark Tomorrow/Next

|

The interest rate at which a bank is prepared to lend Danish kroner to a prime bank on an uncollateralized basis day to day.

|

|

EUR

|

€STR

|

Stands for Euro Short-Term Rate and is the rate which reflects the wholesale euro unsecured overnight borrowing costs of euro area banks. The rate is published by the ECB and is based on transactions conducted and settled on the previous day and which are deemed to be executed at arm’s length and thereby reflect market rates in an unbiased way.

|

|

GBP

|

SONIA

|

Stands for Sterling Overnight Index Average and is the effective overnight interest rate paid by banks for unsecured transactions in the British sterling market. SONIA is administered by the Bank of England.

|

|

HKD

|

HKD HIBOR

|

Stands for Hong Kong Interbank Offered Rate and is the offered rate at which deposits in HKD are being quoted to prime banks in the Hong Kong interbank market.

|

|

HUF

|

BUBOR

|

Stands for Budapest Interbank Offered Rates and is the average interest rate at which term deposits are offered between prime banks.

|

| HUF | Hungary 3 Month Treasury Bill | Is an annualized yield on Hungarian 3 month Treasury bills. |

|

ILS

|

TELBOR

|

Stands for Tel Aviv Inter-Bank Offered Rate and is based on interest rate quotes by a number of contributors in the inter-bank market.

|

|

INR

|

Indian Rupee Overnight Interest Rate Fixing

|

A rate based on overnight call money trade data from the NDS-Call system within the first hour of trading.

|

|

JPY

|

TONAR

|

Stands for Tokyo Overnight Average Rate and is a measure of the cost of borrowing in the Japanese yen unsecured overnight money market for Japanese Yen. TONAR is administered by the Bank of Japan.

|

|

KRW

|

KORIBOR

|

Average of the leading interest rates for KRW as determined by a group of large Korean banks. The benchmark utilizes the KORIBOR with 1 week maturity.

|

|

MXN

|

TIIE

|

The interbank "equilibrium" rate based on the quotes provided by money center banks as calculated by the Mexican Central Bank. The benchmark TIIE is based on 28-day deposits so is atypical as a measure for short term funds (most currencies have an overnight or similar short-term benchmark).

|

|

NOK

|

Norwegian Overnight Weighted Average

|

The interest rate on unsecured overnight interbank loans between banks that are active in the Norwegian overnight market.

|

|

NZD

|

NZD Daily Cash Target

|

Refers to a 1-day rate set by the Reserve Bank of New Zealand to influence short term interest rates.

|

|

PLN

|

WIBOR

|

Stands for Warsaw Interbank Offered Rates and is a measure of unsecured deposits concluded between market participants.

|

| RON | ROBOR (Romanian Overnight Interbank Offered Rate) | Calculated daily as a trimmed arithmetic average of the quotations by main banks on the interbank market. |

| SAR | SAIBOR | Is a daily benchmark using contributions from a panel of Contributor Banks. The Contributor Banks use a waterfall in order to contribute their Contributions. For Level 1 of the waterfall, volume weighted average prices of all eligible unsecured Saudi Riyal transactions are used. |

|

SEK

|

STIBOR

|

Daily fixing based on a group of large Swedish banks.

|

|

SGD

|

SOR

|

Stands for the SGD Swap Offer Rate and represents the cost of borrowing SGD synthetically by borrowing USD for the same maturity and swapping USD in return for SGD.

|

|

TRY

|

TLREF

|

The Turkish Lira Overnight Rate (TLREF) is calculated as the volume-weighted mean rate, based on the central 70% of the the volume-weighted distribution of overnight repo rate transactions. |

|

ZAR

|

SABOR

|

Stands for South African Benchmark Overnight Rate and is calculated based on interbank funding.

|

|

|

|

|

|

|

|

|

|

|

Overnight

|

(O/N) rate is the most widely used short term benchmark and represents the rate for balances held from today until the next business day.

|

|

|

Spot-Next

|

(S/N) refers to the rate on balances from the next business day to the business day thereafter. Due to time zone and other criteria, Spot-Next rates are sometimes used as the short-term reference.

|

|

|

Day-Count conventions:

|

IBKR conforms to the international standards for day-counting wherein deposits rates for most currencies are expressed in terms of a 360-day year, while for other currencies (ex: GBP) the convention is a 365-day year.

|