Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

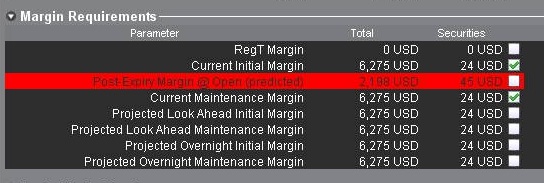

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

Equity & Index Option Position Limits

Equity option exchanges define position limits for designated equity options classes. These limits define position quantity limitations in terms of the equivalent number of underlying shares (described below) which cannot be exceeded at any time on either the bullish or bearish side of the market. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

Position limits are defined on regulatory websites and may change periodically. Some contracts also have near-term limit requirements (near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued). Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. The following information defines how position limits are calculated;

Option position limits are determined as follows:

- Bullish market direction -- long call & short put positions are aggregated and quantified in terms of equivalent shares of stock.

- Bearish market direction -- long put & short call positions are aggregated and quantified in terms of equivalent shares of stock.

The following examples, using the 25,000 option contract limit, illustrate the operation of position limits:

- Customer A, who is long 25,000 XYZ calls, may at the same time be short 25,000 XYZ calls, since long and short positions in the same class of options (i.e., in calls only or in puts only) are on opposite sides of the market and are not aggregated

- Customer B, who is long 25,000 XYZ calls, may at the same time be long 25,000 XYZ puts. Rule 4.11 does not require the aggregation of long call and long put (or short call and short put) positions, since they are on opposite sides of the market.

- Customer C, who is long 20,000 XYZ calls, may not at the same time be short more than 5,000 XYZ puts, since the 25,000 contract limit applies to the aggregate position of long calls and short puts in options covering the same underlying security. Similarly, if Customer C is also short 20,000 XYZ calls, he may not at the same time have a long position of more than 5,000 XYZ puts, since the 25,000 contract limit applies separately to the aggregation of short call and long put positions in options covering the same underlying security.

Notifications and restrictions:

IB will send notifications to customers regarding the option position limits at the following times:

- When a client exceeds 85% of the allowed limit IB will send a notification indicating this threshold has been exceeded

- When a client exceeds 95% of the allowed limit IB will place the account in closing only. This state will be maintained until the account falls below 85% of the allowed limit. New orders placed that would increase the position will be rejected.

Notes:

Position limits are set on the long and short side of the market separately (and not netted out).

Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side (index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge).

Position information is aggregated across related accounts and accounts under common control.

Definition of related accounts:

IB considers related accounts to be any account in which an individual may be viewed as having influence over trading decisions. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account (and accounts under common control), joint accounts with individual accounts for the joint parties and organization accounts (where an individual is listed as an officer or trader) with other accounts for that individual.

Position limit exceptions:

Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. In general the hedges permitted by the US regulators that are recognized in the IB system include outright stock position hedges, conversions, reverse conversions and box spreads. Currently collar and reverse collar strategies are not supported hedges in the IB system. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

OCC posts position limits defined by the option exchanges. They can be found here.

http://www.optionsclearing.com/webapps/position-limits

Do liquidation trades executed by IBKR count as day trades?

Yes, if a position that is opened is subsequently closed in the same trading session (day), it is defined as a Pattern Day Trade. If an IBKR liquidation results in the closing of a position that was opened in that same session/day, it would be counted towards the Pattern Day Trade total. This could also result in the account being flagged as a Pattern Day Trade account.

Will IBKR delay liquidation while I deposit funds in my account?

IBKR's margin compliance policy does not allow for transfers or other deposits if there is a margin violation/deficit in the account. In the case of a margin violation/deficit, the account in deficit is immediately subject to liquidation. Automated liquidations are accomplished with market orders, and any/all positions in the account can be liquidated. There are cases where, due to specific market conditions, a deficit is better addressed via a manual liquidation.

Funds deposited or wired into the account are not taken into consideration from a risk standpoint until those funds have cleared all the appropriate funds and banking channels and are officially in the account. The liquidation system is automated and programmed to act immediately if there is a margin violation/deficit.

Note for Prime Clients: Executing away is not a means to resolve real time deficits as away trades will not be taken into consideration for beneficial margin purposes until 9 pm ET on Trade Date or when the trades have been reported and matched with external confirms, whichever is later. Trading away for expiring options, on expiration day, is also discouraged due to the potential for late or inaccurate reporting which can lead to erroneous margin calculations or incorrect exercise and assignment activity. Clients who wish to trade expiring options on expiration day and away from IB, must load their FTP file no later than 2:50 pm ET, and do so at their own risk.

I want my liquidated position to be reinstated.

IBKR employs a proprietary algorithm which identifies positions for liquidation. This is a complicated formula which seeks always to make the best possible liquidation. There are numerous factors involved in the liquidation algorithm which are taken into account prior to the creation of a liquidation trade.

Your liquidated securities, if part of a valid liquidation, will not be taken back, or reinstated. Going forward, I want to point you towards a feature that might be of help. In the Account Window, under Portfolio, you will have your positions listed. You can highlight a position that you would prefer not be liquidated prior to others in the account in the event of a liquidation, by left-clicking it. Once this position is highlighted, right-click on the line. In the box which appears choose “Set Liquidate Last”. This feature allows you to mark those positions which you would prefer to hold over others. IBKR will try to honor those requests, but this is merely a request and we cannot guarantee that the chosen position won’t be liquidated.

Options Assignment Prior to Expiration

An American-Style option seller (writer) may be assigned an exercise at any time until the option expires. This means that the option writer is subject to being assigned at any time after he or she has written the option until the option expires or until the option contract writer closes out his or her position by buying it back to close. Early exercise happens when the owner of a call or put invokes his or her rights before expiration. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Generally, assignment risk becomes greater closer to expiration, however even with that being said, assignment can still happen at any time when trading American-Style Options.

Short Put

When selling a put, the seller has the obligation to buy the underlying stock or asset at a given price (Strike Price) within a specified window of time (Expiration date). If the strike price of the option is below the current market price of the stock, the option holder does not gain value putting the stock to the seller because the market value is greater than the strike price. Conversely, If the strike price of the option is above the current market price of the stock, the option seller will be at assignment risk.

Short Call

Selling a call gives the right to the call owner to buy or “call” stock away from the seller within a given time frame. If the market price of the stock is below the strike price of the option, the call holder has no advantage to call stock away at higher than market value. If the market value of the stock is greater than the strike price, the option holder can call away the stock at a lower than market value price. Short calls are at assignment risk when they are in the money or if there is a dividend coming up and the extrinsic value of the short call is less than the dividend.

What happens to these options?

If a short call is assigned, the short call holder will be assigned short shares of stock. For example, if the stock of ABC company is trading at $55 and a short call at the $50 strike is assigned, the short call would be converted to short shares of stock at $50. The account holder could then decide to close the short position by purchasing the stock back at the market price of $55. The net loss would be $500 for the 100 shares, less credit received from selling the call initially.

If a short put is assigned, the short put holder would now be long shares of stock at the put strike price. For example, with the stock of XYZ trading at $90, the short put seller is assigned shares of stock at the strike of $96. The put seller is responsible for buying shares of stock above the market price at their strike of $96. Assuming, the account holder closes the long stock position at $90, the net loss would be $600 for 100 shares, less credit received from selling the put originally.

Margin Deficit from the option assignment

If the assignment takes place prior to expiration and the stock position results in a margin deficit, then consistent with our margin policy accounts are subject to automated liquidation in order to bring the account into margin compliance. Liquidations are not confined to only shares that resulted from the option position.

Additionally, for accounts that are assigned on the short leg of an option spread, IBKR will NOT act to exercise a long option held in the account. IBKR cannot presume the intentions of the long option holder, and the exercise of the long option prior to expiration will forfeit the time value of the option, which could be realized via the sale of the option.

Post Expiration Exposure, Corporate Action and Ex-Dividend Events

Interactive Brokers has proactive steps to mitigate risk, based upon certain expiration or corporate action related events. For more information about our expiration policy, please review the Knowledge Base Article "Expiration & Corporate Action Related Liquidations".

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at the OCC's web site.

What happens to the USD equity option that I am long at expiration?

There are two scenarios which could occur if a long option is taken to expiration. If the option is out-of-the-money at expiration and you do not choose to exercise it, the option will expire worthless, and your losses will consist of the premium that was paid to acquire the option. If the option is in-the-money at expiration by 0.01 or more, it will be automatically exercised on your behalf (unless you previously chose to lapse the option) by the Options Clearing Corporation (OCC). The OCC processes monthly expiration options on the third Saturday of the month, or the day after Friday expiration. The resulting long or short position will be put into the account, effective on the Friday trade date. If the account has sufficient margin to satisfy the requirement on the resulting position, it will then be up to the account holder to decide what they want to do with the position. If the resulting position causes a margin deficit, the account will be subject to liquidation at a time which is defined by the holdings within the account. Please be aware that any positions could be liquidated as a result of the account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. For example, if the account holds currency, futures, future options positions or and non-USD product, the account may begin to liquidate to meet the margin deficit as soon as a corresponding market opens.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.

Why did IBKR force liquidate positions in my cash account?

Position liquidations within a cash account generally result from one of the following two situations:

1. The account incurs a negative, or debit, cash balance due to the assessment of fees for items such as market data subscriptions or monthly minimums. As a cash account, by definition, is precluded from holding a negative cash balances in any currency, the existence of a negative balance will result in IB force liquidating positions. Note that our system is designed to liquidate positions in a minimum of 100 share increments.

2. A long equity call or put option was automatically exercised by the clearinghouse. In the case of US security options, the Options Clearing Corporation (OCC) will automatically exercise all equity options at expiration which are in-the-money by $0.01 or more (see OCC Rule 1804). If this is a long put exercise and you do not have an existing long stock position in your account, the short position delivered upon exercise will be closed out as cash accounts cannot maintain a short stock position

If this is a long call exercise (not offset by the simultaneous assignment of a short call which is part of a spread) and your account does not maintain sufficient settled cash to cover the cost of the stock plus commissions, a forced liquidation will take place typically upon the market open of the next business day. Again, this is due to the fact that a cash account may not hold a negative cash balances in any currency.