U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

満期に関わる強制決済

リアルタイムの証拠金不足にあたってクライアントのポジションを強制決済するポリシーに加え、IBでは過度のリスクや運用上の懸念につながるイベントに関連する満期やコーポレートアクションに基づいてポジションの強制決済を行います。 下記はその例になります。

オプション権利行使

権利行使や割当てによって口座に証拠金不足が発生する場合、IBでは株式オプションの権利行使および/またはショートオプションのクローズを禁止する権利を有します。ポジションは全額の支払いとなるため通常オプションの購入に証拠金は必要ありませんが、権利行使され次第、その後のロング株式ポジションを全額支払うか(キャッシュ口座内のコールが権利行使される、または株式の証拠金が100%になる場合)、ロング/ショート株式ポジションの融資(マージン口座内のコール/プットが権利行使される場合)が義務となります。 権利行使前に十分な資産のない口座は、引渡しによって原資産の価格が不利に変化した場合、過度なリスクにつながります。無担保の場合のリスクは特に顕著であり、クリアリングハウスが株あたり$0.01のイン・ザ・マネーレベルでオプションを自動的に権利行使する際の満期の際には特にロングオプションが保有していた可能性のあるイン・ザ・マネーの価値を大幅に超える可能性があります。

ここでは原資産が$51のコントラクトを満期に1枚当たり$1でクローズした仮想の株式XYZを例にとります。1日目における口座資産は権利行使価格が$50のコールオプションがロングで20のみです。シナリオ1ではオプションがすべて自動で権利行使され、2日目に$51で開始すると仮定します。シナリオ2ではオプションがすべて自動で権利行使され、2日目に$48で開始すると仮定します。

| 口座残高 | 満期前 | シナリオ 1 - XYZが$51で開始 | シナリオ 2 - XYZが$48で開始 |

|---|---|---|---|

| キャッシュ | $0.00 | ($100,000.00) | ($100,000.00) |

| ロング株式 | $0.00 | $102,000.00 | $96,000.00 |

|

ロングオプション* |

$2,000.00 | $0.00 | $0.00 |

| 流動性総資産/(不足) | $2,000.00 | $2,000.00 | ($4,000.00) |

| 必要証拠金 | $0.00 | $25,500.00 | $25,500.00 |

| 証拠金超過分/(不足) | $0.00 | ($23,500.00) | ($29,500.00) |

*ロングオプションには貸出価値がありません。

満期を迎えた時点でこのような状況を回避するため、IBでは妥当な原資産価格シナリオの想定と、株式引き渡しの前提で各口座のエクスポージャーの査定を行うことによって、満期による営業をシミュレーションします。エクスポージャーが過度であると判断された場合、IBは以下のいずれかを行う権利を有します: 1) 権利行使前にオプションを強制決済する、2) オプションを失効させる、および/または 3) 原資産の引渡しと共生決済をいつでもできるように許可する。 さらにエクスポージャーの増加を避けるため、新しいポジションのオープンに対する規制が口座にかけられることがあります。IBでは満期日の取引終了後間もなくIB /自動権利行使によって失効することになるコントラクトの枚数を割り出します。その日の取引時間後に行われた取引の影響はエクスポージャーの計算に入らないことがあります。

弊社ではこういった作業を行う権利を有していますが、口座内のポジションに関連する権利行使/割当てリスクの管理は口座を保有される方の責任になります。IBではこのようなリスクを管理する義務を負いません。

弊社ではまた決済が証拠金不足につながるとシステムが予想した場合、決済前の午後にポジションの強制決済を行う権利を有します。満期を迎えた時点でこのような状況を回避するため、IBでは妥当な原資産価格シナリオの想定と、決済後の各口座のエクスポージャーの査定を行うことによって、満期による営業をシミュレーションします。 例:決済の結果ポジションが口座から削除されると考えられる場合(ポジションがアウト・オブ・ザ・マネーで満期になる場合や、現金決済されたオプションがイン・ザ・マネーで満期になる場合)、IBのシステムが該当する決済の証拠金に対する影響を査定します。

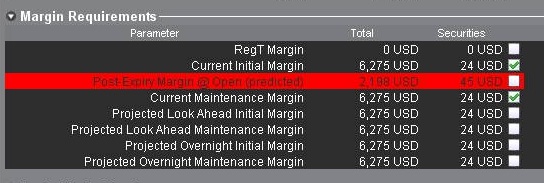

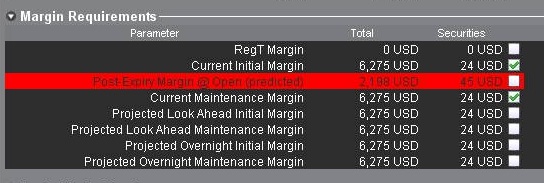

エクスポージャーが過度であると考えられる場合、弊社では予想される証拠金付属を解消するために口座内のポジションを強制決済することがあります。 満期に関連する証拠金のエクスポージャーは、TWS内の口座ウィンドウより確認することができます。予想される証拠金不足は「満期後証拠金」(下記をご覧ください)の行に表示されます。値がマイナスかつ赤でハイライトされる場合には口座のポジションが強制決済される可能性を意味します。エクスポージャーの計算は次の満期の3日前に計算され、15分ごとにアップデートされます。 体系が段階的になっている口座の場合(セパレート・トレーディング・リミット口座など)、これは計算が集約されるマスター口座レベルのみに表示されます。

弊社では通常、終了時2時間前に満期関連の強制決済を始めますが、状況が確実である場合には2時間前の前後に強制決済を開始する権利を有します。強制決済はさらに流動性総資産価値や満期後に予想される不足額、ならびにオプション権利行使価格と原資産の関係などを含める口座特有の基準に基づいて優先順位がつけられます。

権利落ち日前のコール・スプレッド

権利落ち日前に原資産にコールスプレッド(同じ原資産のロングとショートコール)を保有されていて、かつスプレッドの強制決済をされていない、またはロングコールの権利行使をされていない場合、弊社では以下を行う権利を有します:i)ロングコールを部分的またはすべて権利行使する、および/またはii)以下が予想される場合にはIBの裁量によりスプレッドを部分的またはすべて強制決済(クローズ処理を意味します)する: a)ショートコールが割り当てられる可能性がある、およびb)配当金を支払う義務を満たすに足る資産が口座にないか、一般的に必要証拠金を満たしていない。 このシナリオでIBがロングコールを権利行使し、お客様にショートコールを割当てられてない場合、損失がお客様に発生する可能性があります。同様にお客様のポジションをIBが部分的またはすべて強制決済する場合、お客様に損失が発生する、または当初の目的と異なる投資結果となる可能性があります。

このシナリオを避けるため、原資産の権利落ち日前にオプションのポジションと口座資産を注意深くご確認いただき、またこれに基づいてリスクと口座管理を行ってください。

実際に引渡しされる先物

原資産に通貨を含む特定の先物コントラクト以外、IBでは実際に決済された先物や先物オプションコントラクトの原資産の引渡しを許可していません。満期になるコントラクトの引渡しを避けるため、コントラクトをロールオーバーするか、コントラクトに指定される最終取引期限前(ウェブサイトにリストがあります)にポジションのクローズを行う必要があります。

最終取引期限および実際に引渡しされるコントラクトで指定されている時間内に最終取引されないものをIBが事前通知なく強制決済する可能性を認識しておいていただくことはお客様の責任となります。

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

FAQs - U.S. Securities Option Expiration

The following page has been created in attempt to assist traders by providing answers to frequently asked questions related to US security option expiration, exercise, and assignment. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer.

Click on a question in the table of contents to jump to the question in this document.

Table Of Contents:

How do I provide exercise instructions?

Do I have to notify IBKR if I want my long option exercised?

What if I have a long option which I do not want exercised?

What can I do to prevent the assignment of a short option?

Is it possible for a short option which is in-the-money not to be assigned?

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Am I charged a commission for exercise or assignments?

Q&A:

How do I provide exercise instructions?

Instructions are to be entered through the TWS Option Exercise window. Procedures for exercising an option using the IBKR Trader Workstation can be found in the TWS User's Guide.

![]() Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Do I have to notify IBKR if I want my long option exercised?

In the case of exchange listed U.S. securities options, the clearinghouse (OCC) will automatically exercise all cash and physically settled options which are in-the-money by at least $0.01 at expiration (e.g., a call option having a strike price of $25.00 will be automatically exercised if the stock price is $25.01 or more and a put option having a strike price of $25.00 will be automatically exercised if the stock price is $24.99 or less). In accordance with this process, referred to as exercise by exception, account holders are not required to provide IBKR with instructions to exercise any long options which are in-the-money by at least $0.01 at expiration.

![]() Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

What if I have a long option which I do not want exercised?

If a long option is not in-the-money by at least $0.01 at expiration it will not be automatically exercised by OCC. If it is in-the-money by at least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to let the option lapse. These instructions would need to be entered through the TWS Option Exercise window prior to the deadline as stated on the IBKR website.

What can I do to prevent the assignment of a short option?

The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day (for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes). When you sell an option, you provided the purchaser with the right to exercise which they generally will do if the option is in-the-money at expiration.

Is it possible for a short option which is in-the-money not to be assigned?

While is unlikely that holders of in-the-money long options will elect to let the option lapse without exercising them, certain holders may do so due to transaction costs or risk considerations. In conjunction with its expiration processing, OCC will assign option exercises to short position holders via a random lottery process which, in turn, is applied by brokers to their customer accounts. It is possible through these random processes that short positions in your account be part of those which were not assigned.

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Spread positions can have unique expiration risks associated with them. For example, an expiring spread where the long option is in-the-money by less than $0.01 and the short leg is in-the-money more than $0.01 may expire unhedged. Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money.

Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned?

No. There is no provision for issuing conditional exercise instructions to OCC. OCC determines the assignment of options based upon a random process which is initiated only after the deadline for submitting all exercise instructions has ended. In order to avoid the delivery of a long or short underlying stock position when only the short leg of an option spread is in-the-money at expiration, the account holder would need to either close out that short position or consider exercising an at-the-money long option.

What happens to my long stock position if a short option which is part of a covered write is assigned?

If the short call leg of a covered write position is assigned, the long stock position will be applied to satisfy the stock delivery obligation on the short call. The price at which that long stock position will be closed out is equal to the short call option strike price.

Am I charged a commission for exercise or assignments?

There is no commissions charged as the result of the delivery of a long or short position resulting from option exercise or assignment of a U.S. security option (note that this is not always the case for non-U.S. options).

What happens if I am unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment?

You should review your positions prior to expiration to determine whether you have adequate equity in your account to exercise your options. You should also determine whether you have adequate equity in the account if an in-the-money short option position is assigned to your account. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money.

If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account to meet the anticipated post-delivery margin requirement.

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either:

- Liquidate options prior to expiration. Please note: While IBKR retains the right to liquidate at any time in such situations, liquidations involving US security positions will typically begin at approximately 9:40 AM ET as of the business day following expiration;

- Allow the options to lapse; and/or

- Allow delivery and liquidate the underlying at any time.

In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

For more information, please see Expiration & Corporate Action Related Liquidations