Converting Currency Balances

Account holders may find themselves holding balances in currencies other than their designated Base Currency as a result of trades in products denominated in a different currency or from profits/losses directly associated with Forex trading. In these cases, IB does not act to automatically convert balances back to the Base Currency as this action would require assumptions as to the account holder's desired currency exposure as well as the trade price at which they would be willing to close the position.1 IB does, however, provide those account holders who are not active Forex traders an expedited 3 step process for converting such positions at an individual or aggregate currency level. These steps are outlined below.

Please note the feature below is specific to Trader Workstation. If you are using WebTrader, you must place an order to convert currency. Please see the following link for more information on WebTrader Order Entry: WebTrader Order Entry

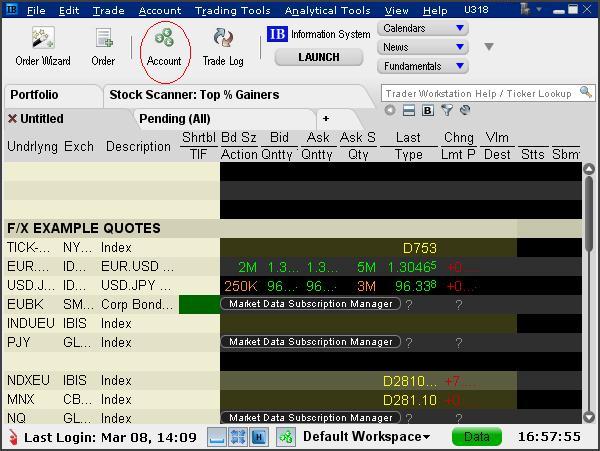

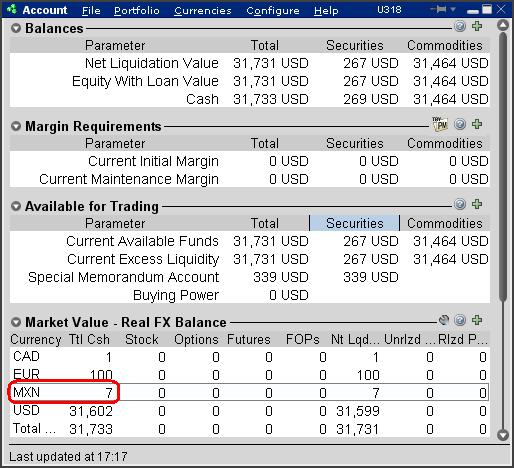

Step 1 – View Currency Balances

Select the Account icon from the TWS header.

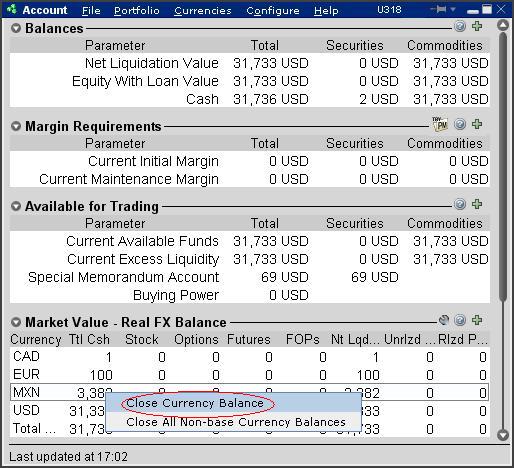

Step 2 - Select the Position(s) to Close

From the Account window, scroll down to the section titled "Market Value - Real FX Balance", place your cursor on a currency you wish to convert and right-click on the mouse to display the Close Currency menu option. You will be provided with two options, Close Currency Balance which will close the single currency you've selected and Close All Non-base Currency Balances which will close all.

Depending upon the currency quantity you are converting and the market rate, a residual balance may remain as conversions can only be performed in whole currency amounts (e.g. no cents). The following message will appear advising of this situation and the automated conversion which will take place thereafter.

.jpg)

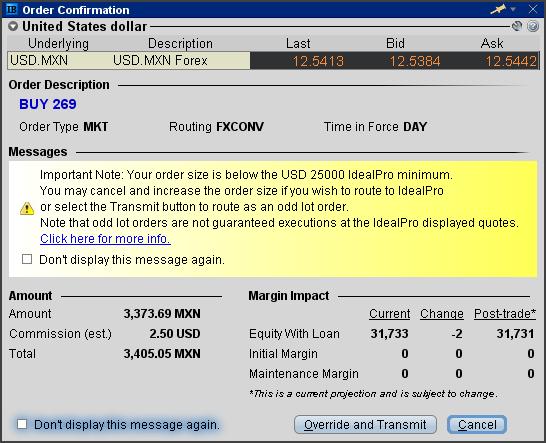

Step 3 - Review & Transmit Order

Next, an order line for the conversion trade will be populated on the TWS. The order will be set up with default conditions of a market order (“MKT”), good for that day and for the current position quantity2. Select "T" to generate the Order Confirmation window using the default conditions or set the price and time conditions as desired.

Note: At times the use of a market order when performing a currency conversion may result in an order rejection due to margin requirements. In order to avoid this, traders may wish to update the order type to a limit order (“LMT”) and set up a limit price. The limit price is the worst price you are willing to trade at; if a better price is available your order will be executed at a better price.

Preview the order from the Order Confirmation window. Note that if your order size is below the IdealPro USD 25,000 equivalent minimum, it will be routed to the odd lot order book. Select the Transmit button when your desired order has been set up.

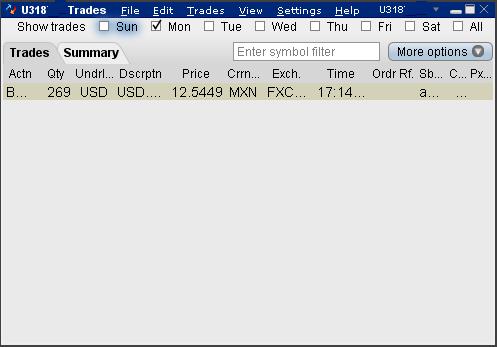

Once your order has been executed, it may be reviewed through the Trade Log icon from the TWS header.

In the event a residual balance remains, it will be displayed within the Account window (e.g. MXN 7 equals approximately USD 0.56) until the following business day at which point it will be automatically converted to the Base Currency.

For additional information on IB Forex, please see: An Introduction to Forex (FX)

1 IB will act to automatically convert non-Base Currency balances only where the balance is nominal (i.e., below USD 5 equivalent and assuming no subsequent trade activity through settlement) and when the customer requests to close the account (where the balances are below USD 1,000 equivalent)

2 Note that the position quantity created by this default will not include balances which are in an accrual state (e.g. interest, dividends).

Compatibility between MetaTrader and Interactive Brokers

Interactive Brokers (IBKR) provides to its account holders a variety of proprietary trading platforms at no cost and therefore does not actively promote or offer the platforms or add-on software of other vendors. Nonetheless, as IBKR's principal trading platform, the TraderWorkstation (TWS), operates with an open API, there are numerous third-party vendors who create order entry, charting and various other analytical programs which operate in conjunction with the TWS for purposes of executing orders through IBKR. As these API specifications are made public, we are not necessarily aware of all vendors who create applications to integrate with the TWS but do offer a program referred to as the Investors Marketplace which operates as a self-service community bringing together third party vendors who have products and services to offer with IBKR customers seeking to fill a specific need.

While MetaQuotes Software is not a participant of IBKR's Investors Marketplace, they offer to Introducing Brokers the oneZero Hub Gateway so that MetaTrader 5 can be used to trade IBKR Accounts[1]. Clients interested would need to contact oneZero directly for additional assistance. Please refer to the Contact section from the following URL.

Note: Besides oneZero Hub Gateway, different vendors such as Trade-Commander, jTWSdata and PrimeXM also offer a software which they represent, acts as a bridge between MetaTrader 4/5 and the TWS. As is the case with other third-party software applications, IBKR is not in a position to provide information or recommendations as to the compatibility or operation of such software.

1: oneZero is not available for Individual Accounts, please click here for more information on Introducing Brokers.

Considerations for Optimizing Order Efficiency

Account holders are encouraged to routinely monitor their order submissions with the objective of optimizing efficiency and minimizing 'wasted' or non-executed orders. As inefficient orders have the potential to consume a disproportionate amount of system resources. IB measures the effectiveness of client orders through the Order Efficiency Ratio (OER). This ratio compares aggregate daily order activity relative to that portion of activity which results in an execution and is determined as follows:

OER = (Order Submissions + Order Revisions + Order Cancellations) / (Executed Orders + 1)

Outlined below is a list of considerations which can assist with optimizing (reducing) one's OER:

1. Cancellation of Day Orders - strategies which use 'Day' as the Time in Force setting and are restricted to Regular Trading Hours should not initiate order cancellations after 16:00 ET, but rather rely upon IB processes which automatically act to cancel such orders. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not.

2. Modification vs. Cancellation - logic which acts to cancel and subsequently replace orders should be substituted with logic which simply modifies the existing orders. This will serve to reduce the process from two order actions to a single order action, thereby improving the OER.

3. Conditional Orders - when utilizing strategies which involve the pricing of one product relative to another, consideration should be given to minimizing unnecessary price and quantity order modifications. As an example, an order modification based upon a price change should only be triggered if the prior price is no longer competitive and the new suggested price is competitive.

4. Meaningful Revisions – logic which serves to modify existing orders without substantially increasing the likelihood of the modified order interacting with the NBBO should be avoided. An example of this would be the modification of a buy order from $30.50 to $30.55 on a stock having a bid-ask of $31.25 - $31.26.

5. RTH Orders – logic which modifies orders set to execute solely during Regular Trading Hours based upon price changes taking place outside those hours should be optimized to only make such modifications during or just prior to the time at which the orders are activated.

6. Order Stacking - Any strategy that incorporates and transmits the stacking of orders on the same side of a particular underlying should minimize transmitting those that are not immediately marketable until the orders which have a greater likelihood of interacting with the NBBO have executed.

7. Use of IB Order Types - as the revision logic embedded within IB-supported order types is not considered an order action for the purposes of the OER, consideration should be given to using IB order types, whenever practical, as opposed to replicating such logic within the client order management logic. Logic which is commonly initiated by clients and whose behavior can be readily replicated by IB order types include: the dynamic management of orders expressed in terms of an options implied volatility (Volatility Orders), orders to set a stop price at a fixed amount relative to the market price (Trailing Stop Orders), and orders designed to automatically maintain a limit price relative to the NBBO (Pegged-to-Market Orders).

The above is not intended to be an exhaustive list of steps for optimizing one's orders but rather those which address the most frequently observed inefficiencies in client order management logic, are relatively simple to implement and which provide the opportunity for substantive and enduring improvements. For further information or questions, please contact the Customer Service Technical Assistance Center.

IdealPro - Large-Size Order Facility

The IdealPro Forex market center provides a Large-Size Order facility specifically intended for accounts which regularly submit orders in quantities greater than standard order maximums and are willing to trade outside the NBBO associated with the standard order minimum/maximum bands in an attempt to obtain faster fills.

Standard orders submitted through IdealPro are subject to minimum and maximum size restrictions which, when expressed in USD equivalents, generally range from $25,000 to $7,000,000 but vary by currency (see Forex Min/Max Order Sizes Chart). These size restrictions serve to provide for the most optimal combination of liquidity and spreads, minimize the impact of erroneous or “fat finger” entries, and are intended to minimize any distortion which the submission of a large-size order may have upon supply or demand.

Orders submitted at a quantity below the standard order minimums are considered odd lot orders and are subject to special handling and price quoting considerations (see Odd Lot FX Transactions). Account holders who wish to submit orders at quantities above the standard order maximum must first request to be qualified for the Large-Size Order facility. Unlike standard orders for which the quote covers any quantity within the stated minimum and maximum size restrictions, the quote associated with a Large-Sized Order is specific to the order quantity entered. In an effort to obtain the best execution possible and also to limit any market impact, Large-Sized Order quotes are

generated based upon an aggregation of quotes provided by interbank dealers along with

and internalized orders of other IB clients.

Outlined below are a series of FAQs addressing the features and considerations of the Large-Size Order

facility.

How do I become eligible to submit Large-Size Orders?

In order to become eligible to submit large-size orders through the Large-Size Order facility, you would need to first submit a request to Customer Service. Requests will be reviewed and considered based upon a number of factors including the applicant's prior trade history and account equity. Please allow up to 7 business days for completion of this review to take place.

What spreads are expected for Large-Size Orders?

In general, spreads for Large-Size Orders on IdealPro are expected to be greater than those for standard orders, however, other factors such as liquidity of the currency pair, time of the day and release of economic numbers or other data can also influence bid ask spreads and should also be taken into consideration.

What is the maximum available order size?

In general sizes up to 50 million of the base currency are available. As with bid-ask spreads, this may vary depending on a number of factors. The Large-Size Order facility will return the lower of the size requested and size available at the time of the request.

What order types are supported?

Account holders are strongly encouraged to use limit order types with the Large Size Order facility as market orders are susceptible to being filled at prices far lower/higher than the current displayed bid/ask particularly under volatile market conditions or where the order involves illiquid products. In addition, to protect from losses associated with significant and rapidly changing prices, IB will simulate client market orders as market with protection orders, establishing an execution cap seven basis points (0.07%) beyond the quoted bid/ask. While this cap is set at a level that is intended to balance the objectives of execution certainty and minimizing price risk, there exists a remote possibility that the execution of a market order will be delayed or may not take place.

How will prices be displayed?

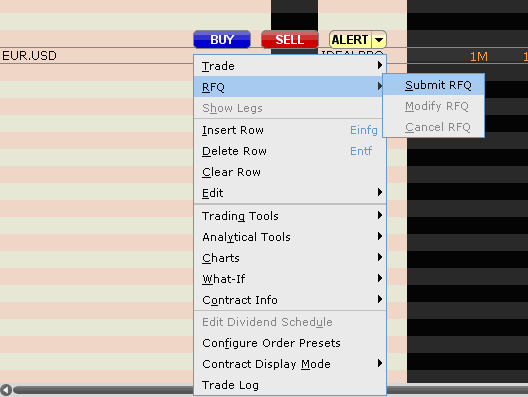

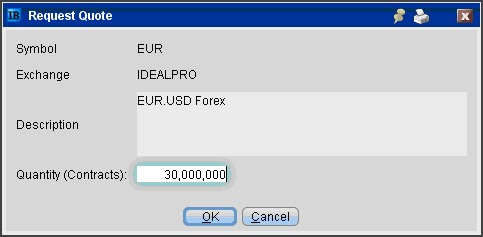

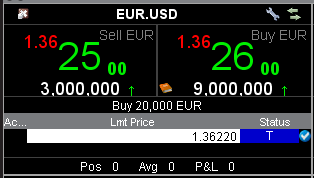

The TWS quote line will display dealable prices for a predefined amount once access to the Large-Size Order facility has been provided. To display prices, right-click on a given currency pair and then select the Choose RFQ and Submit RFQ menu options (Exhibit 1). You will then be prompted to provide the currency amount and then hit enter (Exhibit 2). The prices displayed (Exhibit 3) will time out after a certain time and you would have to repeat the request process to get another price again. We do not publish prices through other channels at the moment. The handling of the orders remains the same, regardless whether sent using the Large-Size Order facility, the quote screen, FX Trader or sent using an API.

Exhibit 1

Exhibit 2

Exhibit 3

.bmp)

Forex Basics

A Forex trade represents an exchange of one asset for another, similar in many respects to a stock trade. However, while in the case of the stock trade the assets being exchanged are cash for stock, in the Forex transaction the assets being exchanged are both cash, one denominated in a given currency and the other a different currency. Similar to the convention in which stocks are quoted, for example, in quantity of USD per share unit, in a currency pair the quote reflects the quantity of one currency unit which is required to buy (or which will be received if selling) another unit.

Take, for example the currency pair of EUR/USD quoted at 1.40. In accordance with industry quoting conventions, the first currency listed, the EUR, is the transaction currency or that which the trader wishes to buy or sell (also referred to as the base currency). The second currency listed, the USD, is the currency in which the transaction will be settled (referred to as either the settlement or quote currency). A trader seeking to buy 1 EUR given this quote would pay 1.40 USD and if seeking to sell 1 EUR would receive 1.40 USD.

Other items of note regarding Forex transactions are as follows:

IdealPro

IB’s venue for executing Forex trades, referred to as IdealPro, operates as an exchange-style order book, assembling quotes from the largest international Forex banks as well as other IB clients and market makers. IB imposes no markup to the quoted spreads but rather charges an explicit commission ranging from 0.2 to 0.10 basis points of the trade value depending upon your monthly trade amount, subject to a per order minimum of USD 2.00.

Quoting Conventions

In Forex markets the USD is generally considered the transaction currency for quoting purposes, that is the quotes are expressed as a unit of USD $1 per the other currency quoted in the pair (e.g., USD.CAD, USD.JPY, USD.CHF). The primary exceptions to this rule are the GBP, the EUR and the AUD which are quoted as GBP.USD, EUR.USD and AUD.USD, respectively. These quoting conventions are industry standard and orders cannot be submitted to IB’s IdealPro venue in an inverted format (e.g. USD.EUR).

These quoting conventions introduce special considerations when one is attempting to close out a specific cash balance denominated in a settlement currency which, based upon the current quote, may not be able to be closed out in its entirety. Please refer to the following article for additional details: Closing FX Positions Denominated in a Settlement Currency

Odd Lots

For purposes of maintaining adequate scale and competitive spreads, a minimum size of USD 25,000, or equivalent, is imposed on all IdealPro orders. Orders below this size are considered odd lots and their limit prices are not disclosed through IdealPro. While odd lot marketable orders are not likely to be executed at the inter-bank spreads afforded to IdealPro orders, they will generally be executed at prices only slightly inferior (1-3 ticks).

Trading Multi-Currency Products

When trading products which are denominated in a currency which you do not hold in your account, special attention must be paid to the Forex implications of such trades. Namely, if you do not hold or acquire the particular currency in the necessary amount and denomination prior to the trade, IB will automatically create a loan for those funds (assuming margin compliance). In addition, once you close out a non-base currency stock, option or futures position you are likely to be left with a residual Forex balance which IB will not automatically convert. Please refer to the following article for additional details: What happens if I trade a product denominated in a currency which I do not hold in my account?

Odd Lot FX Transactions

IB’s venue for executing Forex trades, referred to as IdealPro, operates as an exchange-style order book, assembling quotes from the largest global Forex banks and dealers as well as other IB clients and market makers. For purposes of maintaining competitive bid-ask spreads and optimal liquidity, a minimum size of USD 25,000, or equivalent, is imposed on all IdealPro orders. Orders below this size are considered odd lots and their limit prices are not disclosed through IdealPro even if inside the IdealPro bid-ask spread. As such, odd lot marketable limit orders are not guaranteed execution at the inter-bank spreads afforded to IdealPro orders, and will generally be executed at slightly inferior prices ranging from 1- 2 basis points* outside the IdealPro quote.

*Basis points are a unit of measure that describes the percentage change in value of a financial instrument. One basis point = 0.01% or 0.0001 in decimal form.

Closing FX Positions Denominated in a Settlement Currency

Price quoting for Forex pairs on IdealPro is subject to an industry convention whereby the relationship between the first pair (transaction currency) and second pair (settlement currency) is fixed and cannot be inverted. Considering, for example, pairs involving the USD, the following are examples where the USD is listed as the transaction currency: USD.CAD, USD.JPY and USD.CHF. Similarly, the GBP.USD, EUR.USD and AUD.USD are examples where the USD is listed as the settlement currency (a complete listing of quoting conventions for pairs executable via IdealPro can be found by typing IdealPro into the IB website search engine).

These quoting conventions introduce special considerations when one is attempting to close out a specific cash balance denominated in a settlement currency which, based upon the current quote, may not be able to be closed out in its entirety. To illustrate, assume the following transactions:

Day 1: Account holder maintaining USD 300,000 in a USD base currency account buys 10,000 shares of stock XYZ which is denominated in CAD at a price of 50.00. Also assume that the account holder does not convert USD into CAD prior to the stock purchase and therefore borrows the CAD necessary to settle the trade from IB. The USD.CAD closes at 1.0526 and XYZ at CAD 50.00 (no unrealized gain or loss). The end of day account balance is as follows:

| Position |

Position in Local Currency |

Position Translated into Base Currency |

| Cash - USD | 300,000.00 | $300,000.00 |

| Cash - CAD | (500,000.00) | ($475,014.25) |

| Stock - XYZ | 500,000.00 | $475,014.25 |

| NLV (in Base) | $300,000.00 |

Day 2: Assume no trade activity, the USD.CAD closes that day at 1.0309 and XYZ closes at CAD 52.00. (unrealized gain of USD 19,400.52). The end of day account balance is as follows:

| Position |

Position in Local Currency |

Position Translated into Base Currency |

| Cash - USD | 300,000.00 | $300,000.00 |

| Cash - CAD | (500,000.00) | ($485,013.10) |

| Stock - XYZ | 520,000.00 | $504,413.62 |

| NLV (in Base) | $319,400.52 |

Day 3: Account holder sells the 10,000 shares of XYZ at CAD 53.00 and the USD.CAD closes unchanged at 1.0309 (unrealized gain of USD 29,100.79). The end of day account balance is as follows:

| Position |

Position in Local Currency |

Position Translated into Base Currency |

| Cash - USD | 300,000.00 | $300,000.00 |

| Cash - CAD | 30,000.00 | $29,100.79 |

| Stock - XYZ | 0.00 | $0.00 |

| NLV (in Base) | $329,100.79 |

Day 4: Account holder seeks to close out the CAD 30,000.00 cash balance through the sale of CAD vs. the purchase of USD. Due to the quoting convention of this pair in which the order must be specified in a quantity of USD, the account holder is required to determine the USD equivalent of CAD 30,000.00 at the desired trade price. Assuming the account holder seeks to close the position at the market price of 1.0253 an order to buy 29,259 USD.CAD would be entered which, if executed, will result in a residual long CAD balance of 0.75. The end of day account balance is displayed below:

| Position |

Position in Local Currency |

Position Translated into Base Currency |

| Cash - USD | 329,259.00 | $329,259.00 |

| Cash - CAD | 0.75 | $0.73 |

| Stock - XYZ | 0.00 | $0.00 |

| NLV (in Base) | $329,259.73 |

Note, however, that in accordance with IB's policies regarding nominal Forex balances, residual balances of less than USD 5.00 equivalent will automatically be converted into the account holder's base currency upon settlement assuming no subsequent trade activity in that non-base currency has taken place in the interim. This is intended to minimize the actions required of the account holder to convert nominal non-base currency balances back into the designated base currency and also to convert fractional balances which could otherwise not be converted. IB does not charge a commission for these automated conversions.

Why is there no "Last" price for Forex pairs?

The Last column does not show the most recent trade for currency pairs but either the midpoint of the most recent bid/ask price or if not available then the previous day closing price. This is not a market data error but rather the nature of the Forex market.

The global Forex market is what is referred to as an "OTC" (Over the Counter) market. Unlike the options, futures or listed equity markets, there is no central reporting facility for OTC markets, including Forex. Hence there is no official "tape". The Last Traded Price for Forex depends entirely upon where you look. Bloomberg, Reuters, Yahoo, Google, IB, etc will all have different combinations of pools of liquidity from which they are gleaning this information. Since there is no official "Last Price" for Forex, IB cannot report one on our TWS. The previous day's closing price is the last traded price from the liquidity providers IB does business with. It may not match the last traded price for the previous day from other agencies who might have access to additional--or less--liquidity providers than does IB.

How is an order entered using the FX Trader?

The Trader Workstation (TWS) allows traders to create forex (FX) orders from a page referred to as the FX Trader page.

Although the appearance of the FX Trader screen is different than the Order Management screen, the trading functionality is the same.

The FX Trader screen displays currency pairs in a "cell" like layout which can be accessed from the FX Trader icon at the top of the main TWS screen.

![]()

Similar to the market data line in the Order Management screen, the bid is on the left and the ask on the right. Buy orders are created by clicking on the ask and sales by clicking the bid.

Working Orders and Trades are reflected in the respective tabs in the second section of the FX Trader window.

Note: Orders created in the FX Trader are displayed in the Order Management screens on the TWS, however, orders created on the Order Management screen are not visible in the FX Trader window.

Click HERE to watch a previously recorded webinar regarding the use of FX Trader.

What if a forex order is transmitted to the incorrect venue?

If a trader transmits a forex (FX) order to the incorrect venue (Ideal or IdealPro), IB will automatically re-route that order to the proper venue based upon the order size. The minimum order size for IdealPro is USD 25,000, or equivalent, and all order below that size are eligible for routing to Ideal.

Orders will be routed to the proper market venue should a market venue inconsistent with the order size be selected. This ensures that small orders are not routed to a venue where they cannot be executed and that large orders are availed of the generally tighter spreads afforded by the interbank market.

Example:

If an order to buy 500 EUR.USD is transmitted to the IdealPro venue, IB will recognize that this order is not of sufficient quantity to be sent to that venue and will re-route the order to Ideal.

Similarly, if a trader transmits an order to buy 100,000 EUR.USD to the Ideal venue, IB will recognize that the order is eligible to be routed to IdealPro and will automatically re-route the order.