Deposit Funds with IBKR Mobile Check Deposit

US clients using IBKR Mobile with IB Key two-factor authentication can deposit endorsed checks drawn on a US bank into their account from anywhere using Mobile Check Deposit.

Mobile Check Deposit is NOT supported for: IRAs, MMCs, partitioned accounts or Advisor Masters (Advisors cannot deposit into client accounts).

To use Mobile Check Deposit:

- You must be a US client.

- The check must be drawn on a US bank.

- The check must be properly endorsed.

- You must have IBKR Mobile installed on your phone.

- You must have activated IB Key two-factor authentication on the IBKR Mobile app.

- It must not be your first deposit.

To find out more about how to install IBKR Mobile, visit the IBKR Mobile web page.

- Log into IBKR Mobile, and tap the More menu followed by Transfer & Pay.

- From the Transfer & Pay menu tap Deposit Check.

- If prompted, read and accept the disclosure.

- Set up your deposit:

- a. If you hold multiple accounts with IBKR, select the account for the deposit in the Deposit to field.

- b. Enter the amount of the deposit in the Amount field.

- c. Scan the front and back of your check using the camera function on your phone. You may be asked to allow IBKR Mobile to access your camera. Please be sure that you have properly endorsed your check.

- When you are satisfied with your scanned images, tap Deposit Check at the bottom of the screen.

- Validate with IB Key as required.

- Once the deposit has been approved and processed, the funds are deposited into your IBKR account. Funds are generally available to use within six (6) business days after the deposit has been approved.

- Currently available for US clients and for checks drawn on US banks.

- Requires active IB Key protocol for two-factor authentication.

- To find out the daily limit and 30 day limit on check deposits, tap “What is my daily limit?” on the Deposit Check screen.

U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.

South African Rand (ZAR) - Onshore/Offshore

Explanation of Onshore/Offshore South African Rand (ZAR)

Background

The South African Reserve Bank (SARB) has currency exchange control rules in place for South African residents. A South African resident is a person (i.e. a natural person, body corporate, foundation, trust or partnership) whether of South African or any other nationality who has taken up residence, is domiciled or registered in the Republic of South Africa (RSA). A resident account is also the account of persons resident, domiciled or registered in the Common Monetary Area (CMA). The CMA comprises of the Republic of South Africa, Lesotho, Namibia and Swaziland. There are no exchange control restrictions between the members of the CMA and they form a single exchange control territory.

The rules stipulate that there is a yearly limit placed on the amount of ZAR that can be taken out of the country by South African residents – i.e. taken "Offshore". ZAR that remain in South Africa are deemed “Onshore”.

Each resident can take the following amounts offshore per calendar year:

- ZAR 1 million can be taken offshore as a “Single Discretionary Allowance”

- ZAR 10 million can be taken offshore as an “Foreign Capital Allowance”

Only institutions licensed as “Authorised Dealers” (AD) are able to send ZAR outside of South Africa and so offshore. An AD is responsible for reporting the offshoring of any ZAR to the SARB. As a result, residents sending ZAR offshore must accurately state the purpose for which the ZAR is being sent. Residents must receive approval from an AD before they are able to send any ZAR offshore. Prior to taking ZAR offshore as part of the Foreign Capital Allowance, residents must also have additional clearance from the SA tax authorities.

The full exchange control rulebook from the SARB can be found here: https://www.resbank.co.za/RegulationAndSupervision/FinancialSurveillanceAndExchangeControl/EXCMan/Pages/default.aspx

Current Situation

Our cashiering account is a non-resident account. Therefore, we are permitted to:

- Receive deposits in ZAR from other non-resident accounts.

- Disburse ZAR from our cashiering account to non-resident accounts.

- Receive deposits from accounts of South African residents.

- Disburse ZAR to accounts of South African residents.

Depositing Shares Held in the Direct Registration System (DRS)

Overview

The Direct Registration System (DRS) allows shareholders to register their U.S. share holdings on the books and records of the issuer in an electronic rather than paper certificate form through the issuer’s designated transfer agent. Once held in a DRS account, the shares may then be transferred electronically via the Depository Trust Company (DTC) to your IB account where transactions may take place or where the shares may be afforded margin loan value.

It should be noted that not all shares are DRS eligible. In general, most U.S. exchange traded securities are, but many OTC shares, as well as shares subject to a restriction and therefore held in certificate form, are not.

Transfer Process

To deposit shares held in your DRS account to your IB account you will need to log into Account Management and create transfer instructions. These instructions require that you provide IB with certain information regarding your DRS account (e.g., account number and taxpayer ID) which you will need to obtain from and/or confirm with your transfer agent. It’s important that you provide IB with information which matches that of your DRS account, otherwise your transfer agent will reject the request and you will be charged a rejection fee. Information regarding fees for rejected as well as settled transactions are posted on the website.

Once the DRS account information has been confirmed, log into Account Management and proceed as follows:

1. Select the Funding and then Position Transfers menu options;

2. From the Position Transfer screen, select a transfer method of DRS-Direct Registration System and transfer type of Deposit via the drop-down menus;

3. You’ll be directed to the DRS Transfer screen where the taxpayer ID you’ve provided to IB is displayed. If this does not match that which you maintain for your DRS account, you will first need to reconcile and correct the information so it matches prior to proceeding with the transfer request. Requests submitted with a mismatched taxpayer ID will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;

4. Enter your DRS account number and click the Continue button. Note that requests submitted with an account number that doesn't match that of your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;

5. Enter the symbol of the security you intend to transfer as well as the share quantity. Note that requests submitted with a symbol not held within or a share quantity which exceeds that held in your DRS account will result in the transfer being rejected by your transfer agent and your account being subject to a rejection processing fee;

6. Enter your electronic signature and click the “Continue” button to confirm your transfer request.

IB will then notify DTC who will match the security to its associated transfer agent and send them notification of your request. Assuming the DRS account and share information you’ve provided is correct, the transfer agent will post the shares for delivery to IB. Note that while transfer requests typically settle within 2 -5 business days, the transfer agent may take longer to respond to the notification and, if no response is received within 30 days, the request will be canceled.

IMPORTANT NOTE

If you are transferring shares from a joint account or are a non-US person, special consideration needs to be provided to the taxpayer ID you provide to IB for matching to your DRS account. In the case of a joint account, the ID will generally be one of the SSNs of the joint account holders or a default value of 999999999. In the case of a non-US person, where no US taxpayer ID exists, a default value of 111111111 is often used. In either case, you will need to verify with the transfer agent the identifier they will recognize for matching purposes. If the transfer agent requests an identifier which doesn’t match one of the elections provided within Account Management, please contact Customer Service for transfer assistance.

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Mailing Address For Check Deposits to Interactive Brokers

For paper and mail based deposit of funds

Before sending your check deposit, you should write your account number on the check. We highly encourage you to create a deposit notification, which allows us to efficiently identify your incoming funds for proper credit to your account.

The specific mailing instructions, including the printing of the deposit form, and addresses will be displayed during the deposit notification process. The IBKR address for sending your check will be printed on the deposit form.

Upon receipt of this deposit the notice should update to provide the availability date of the deposit.

- To ensure proper handling and to avoid unnecessary delays, please instruct your financial institution not to mail checks directly to our bank.

- Please take note that Interactive Brokers Canada customers cannot fund their accounts with cheques or bank drafts.

- Deposit notifications do NOT move any funds; you must contact your bank to move the funds into your IBKR account.

In order to create a Check deposit notification, you will need to visit our secure website: www.interactivebrokers.com. Be prepared to provide your username, password and any additional secure log-in information when submitting your notice.

1. Log into Client Portal

2. Select Transfer & Pay

3. Click on Transfer Funds

4. Your Transaction Type: Deposit

5. The Currency: USD

6. Choose the Method: Check

and follow the prompts.

Next, mail your check with the Confirmation Page to one of the addresses listed below.

(If you are sending your check via overnight delivery service (FedEx, DHL, UPS, etc))

Interactive Brokers LLC

2 Pickwick Plaza

Attn: IBCD

Greenwich, Connecticut 06830

United States

(If you are sending your check via regular mail or US Postal Service (USPS) EXPRESS MAIL)

Interactive Brokers LLC

P.O. Box 7579

Attn: IBCD

Greenwich, Connecticut 06836-7579

United States

Please Note:

- The person who signs the check must be the account holder.

- Your name must be printed on the check.

- You must sign and date your check.

- Payee Name must be Interactive Brokers LLC

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

IRA: Rollover Rules & Conditions

This information is for general educational purposes only. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations.

Generally, an IRA rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The contribution to the second retirement plan is called a rollover contribution.

This article outlines the types of IRA rollover transactions, rules and conditions, IB's Rollover Certification form, and rollover transaction details. Select from list below for details:

Eligible Rollover Transactions

Rules & Conditions

Prior to completing an IRA Rollover transaction, we recommend that you review the rules and conditions surrounding eligibility. Interactive Brokers can accept as a tax-free transaction an eligible rollover distribution as defined under the Internal Revenue Code. Included in this article is information about eligible transactions, as well as the Interactive Brokers IRA Rollover Certification form.

IRA Rollover Certification

Before accepting an IRA rollover transaction into an Interactive Brokers LLC IRA, we require that you review your eligibility for the rollover and certify your understanding of the rollover rules and conditions. The IRA Rollover Form includes the IRA Rollover Certification.

The Transfer Funds page within the Client Portal lets you notify IB of an IRA Rollover deposit of funds into your account. From the Transfer & Pay menu select Transfer Funds and then Make a Deposit. Select one of the saved deposit instructions and follow the prompts on the screen or create a new deposit instruction by selecting the Currency of the deposit from the drop-down menu. Click Connect or Get Instructions for the method you will use to transfer funds. And finally follow the remaining instructions provided to initiate the transfer with your bank.

Rollover Transactions

Two types of IRA rollover transactions exist with different guidelines and delivery methods:

- Direct Rollover - a transfer of assets from an employer-sponsored retirement plan directly to an eligible IRA. If you choose to receive the distribution first, then you may roll over the funds to the IRA within 60 days.

- Indirect Rollover - a distribution from an IRA paid to you, followed by a rollover into another IRA within 60 days. The IRS allows an indirect rollover of each IRA's funds once during a twelve-month period.

(Note: A distributions directly from one IRA trustee to another IRA trustee is a Trustee-to-Trustee transfer. It is not affected by the twelve-month waiting period.)

For additional information about rollovers, visit Understanding Rollovers. See also IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) for more specific guidelines on moving retirement plan assets.

Eligible Rollover Transactions

Almost any distribution from a qualified plan can be rolled over to an IRA. Your retirement account may be eligible for one of the following eligible rollover transactions.

Traditional IRA or SIMPLE IRA to Traditional IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

- Required Minimum Distribution satisfied (if over 73)

- For SIMPLE IRAs, after two years from the first contribution

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- During the preceding 12 months, no other distributions from the distributing IRA were rolled over

- The assets involved in the transaction have not been rolled over in the past 12 months

Rollover or Direct Rollover from Qualified Plan into a Traditional IRA

- Eligible participant (participant, spouse beneficiary, or former spouse due to divorce)

- Funds or property deposited less than 60 days of receipt by the participant from the previous plan

- Funds received from an eligible qualified retirement plan

- Required Minimum Distribution satisfied (if over 73)

- Consists of funds, property, or proceeds from the sale of property distributed from the qualified plan

- All of the funds are eligible to be rolled over

Roth IRA to Roth IRA Rollover

- Funds or property deposited less than 60 days of receipt by the IRA owner from the previous IRA

- Required Minimum Distribution satisfied (if over 73)

Ineligible Rollover Transactions

Some funds distributed from a retirement plan are not eligible for rollover into an IRA. The following transactions are not eligible rollover transactions.

- Any portion of a distribution from a retirement plan not rolled over

- Required Minimum Distributions

- Distribution of excess contributions and related earnings

- Retirement plan loan treated as a distribution

- Hardship distributions

- Distributions part of substantially equal payments (73-t)

- Dividends on employer securities

- Non-spousal death benefit distributions

- The cost of life insurance coverage

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

iOS

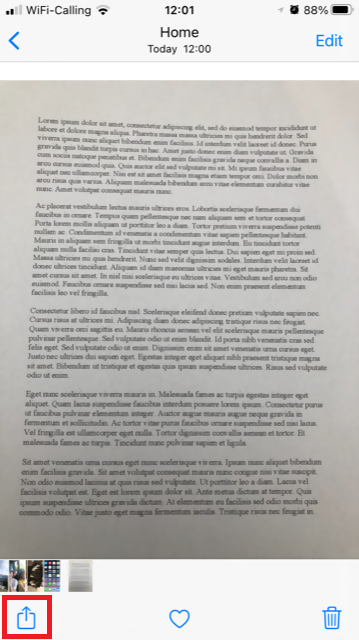

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

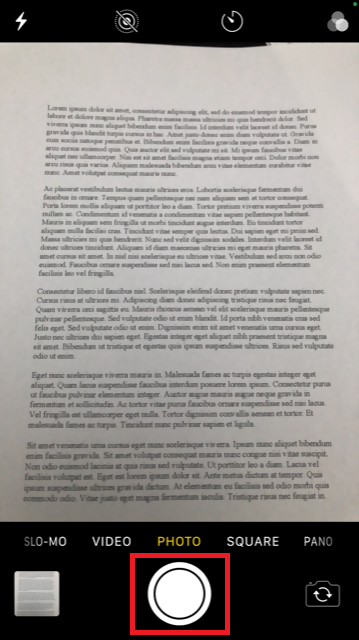

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

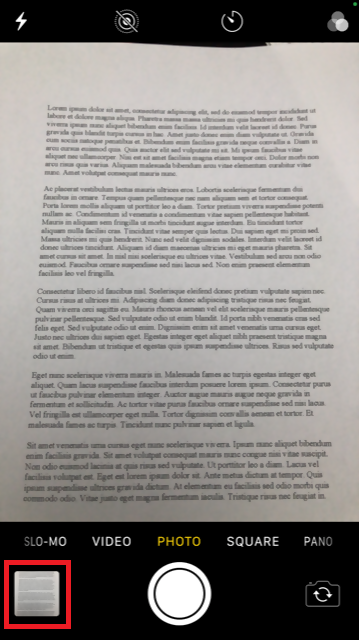

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

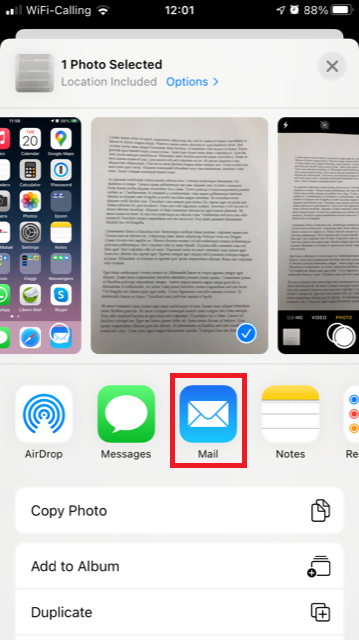

6. Tap the share icon in the lower left-hand corner of the screen.

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

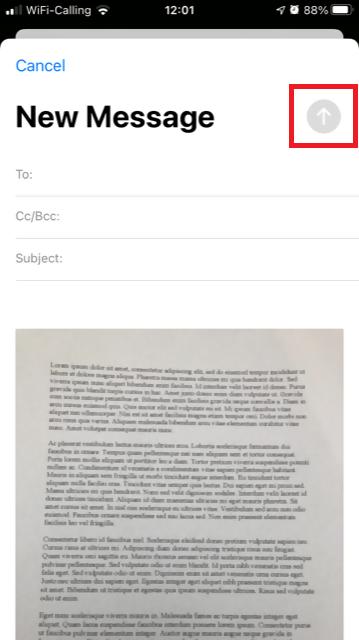

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

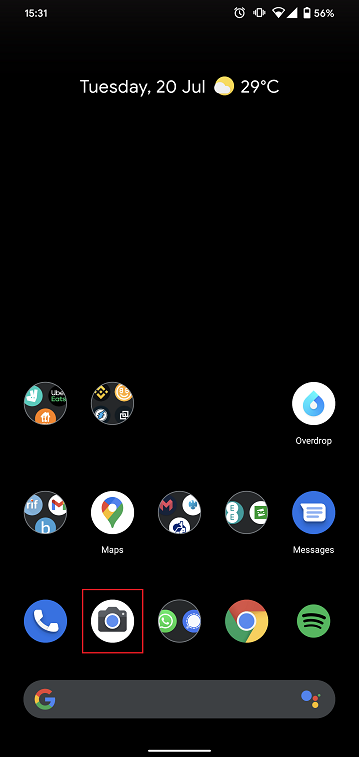

Android

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

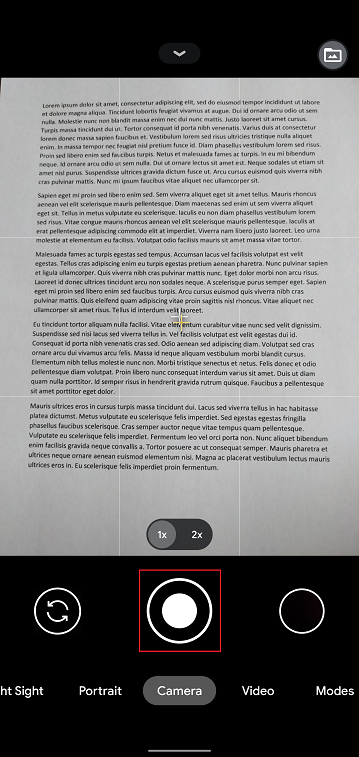

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

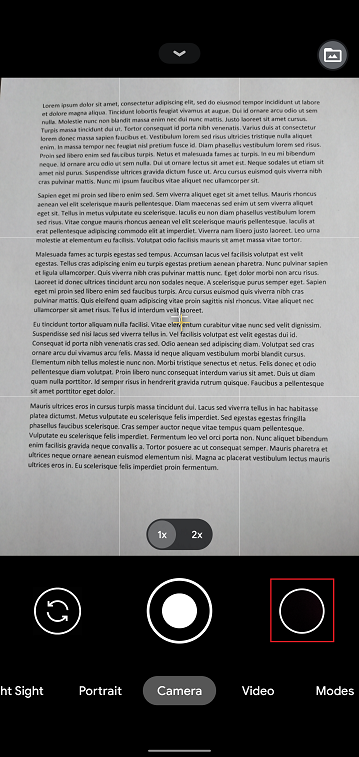

5. Tap the empty circle icon in the lower right-hand corner of the screen.

6. Tap the share icon in the lower left-hand corner of the screen.

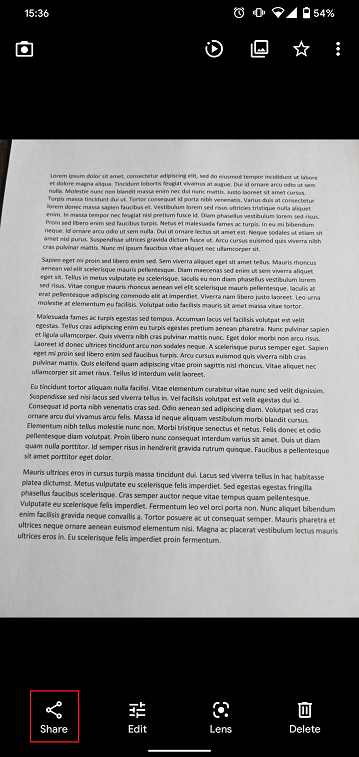

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

Cash Sweeps

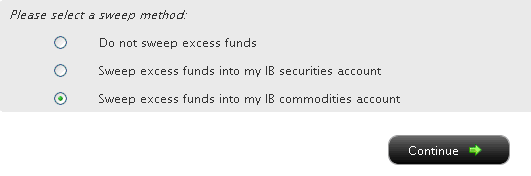

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models