Non-Guaranteed Combination Orders

A combination order is a special type of order that is constructed of multiple separate positions, or ‘legs’, but executed as a single transaction. The legs of the combination may be comprised of the same position type (e.g. stock vs. stock, option vs. option or SSF vs. SSF) or different position types (e.g. stock vs. option, SSF vs. option or EFP). It’s important to note that many combination order types, while submitted via the IB trading platform as a combination, are not native to (i.e., supported by) the exchanges and therefore may not be guaranteed by IB. Accordingly, IB’s policy is to guarantee only Smart-Routed U.S. stock vs. option and option vs. option combination orders.

As combination orders which are not guaranteed are exposed to the risk of partial execution, both in terms of the quantity of legs and their balance, IB requires account holders to acknowledge the 'Non-Guaranteed' attribute at the point of order entry. There are two methods for setting this attribute:

- Method 1 - Users can select the Non-Guaranteed attribute in the Misc. section on the Order Ticket for a particular order

- Method 2 - Users can add the Non-Guaranteed column to the Order Management section of the TWS

Notes:

- Non-Guaranteed combination orders are not available for Financial Advisor allocation orders

The risk of such 'Non-Guaranteed' orders is illustrated through the example below:

Example

Assume the following quotes for a Stock vs. Stock combination order to purchase shares of Microsoft (MSFT) and sell shares of Appl (AAPL).

Current markets

MSFT - 26.30 bid, 26.31 offer

AAPL - 250.25 bid, 250.30 offer

A generic combination is created to buy 1 share AAPL and sell 1 share MSFT, the implied quote would be 223.94 bid, 224 offer.

The following order is entered:

Buy 200 AAPL, Sell 200 MSFT

Pay 224

Based on the current markets, the order would appear to be executable.

- A buy of 200 shares of AAPL are routed with a 250.30 limit. Only 100 execute.

- A sell of 200 shares of MSFT are routed with a 26.30 limit. No execution is received as the market moves to 26.29 bid.

With a Non-Guaranteed combination, the 100 shares of AAPL would be placed in the client account, even though no MSFT shares were executed. The remainder of the combination order will continue to work until executed in its entirety or until it is canceled.

Information Regarding Multi-Account Voluntary CA Elections

A tool is provided for accounts maintaining a master account/sub-account structure which accommodates bulk election decisions for voluntary corporate actions initiated by the master account on behalf of its sub-accounts. The account types provided with this tool include Financial Advisor, Non-Professional Advisor, Introducing Broker (undisclosed) and Separate Trading Limit. The following article provides step by step instructions for use of the tool along with a list of common FAQs.

Note

With respect to a Stock Purchase Plan (SPP) offer, the corporate action election tool will require the submission of a VALUE of stock to purchase in the offer. As such, the corporate action election tool will reflect the maximum allowable stock value to purchase rather than an eligible share quantity.

1. Accessing the Tool

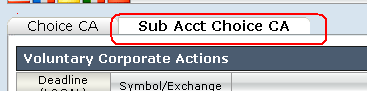

To access the Voluntary Corporate Action Election Tool, log into the Portal and click on the Tools icon located in the upper left hand corner of the screen. From the list of available tools, select Corp Actions. Then select the tab titled Sub Account Choice CA as depicted in the exhibit below.

2. Selecting an Event

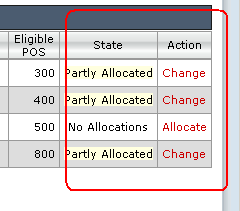

An event list window will appear detailing, by row, those voluntary corporate actions associated with positions maintained in a sub-account where the deadline for provided election instructions has not yet expired. Each event will reflect the deadline, eligible position and the state of election actions, if any, taken to-date (i.e., No Allocations, Partly Allocated, Allocated). To change an existing election action or to provide allocation instructions to an event not previously acted upon, click on the Change or Allocate link located in the Action column as displayed below

3. Submitting Instructions

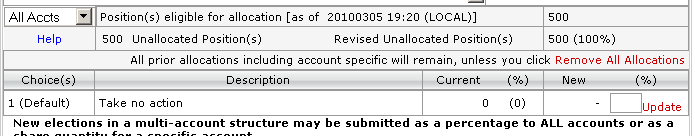

Once an action has been specified the election screen will appear, providing summary information regarding the nature of the event, the method for submitting elections and detail as to the effective date and deadline. Located below the event information is the position detail aggregated across all sub-accounts, including the following:

- Total position eligible for allocation

- Current unallocated position

- Revised unallocated position

The Voluntary Corporate Action Election Tool offers two methods for submitting election instructions:

- Submit a quantity of shares per specified account

- Submit a percentage of shares to allocate across all accounts

Examples for each of these methods are provided below:

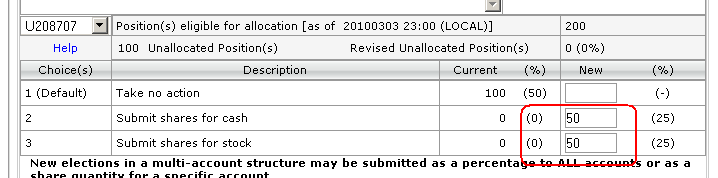

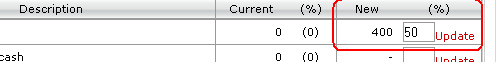

A. To submit shares or value for a specific account

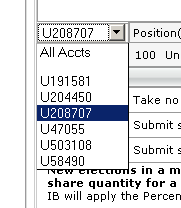

Select the account from the drop-down selector located to the left of the Total eligible position detail

Under the column titled New, submit the specific number of shares you wish to submit to the given election for the selected account.

Submit Save

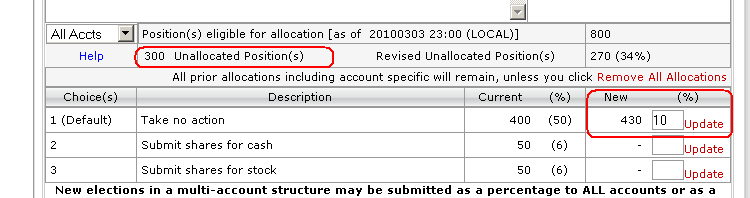

B. To submit a percentage of shares to allocate across all accounts

Select ALL from the drop-down selector located to the left of the Total eligible position detail

Under the column titled %, submit the percentage of shares you wish to submit to the given election

All new percentage allocations will be applied to the Revised Unallocated portion of the shares and will be added to any previous allocation.

Submit Save

IMPORTANT NOTE: If one submits shares using a combination of share quantity and then percentage, any accounts designated for allocation on a per share quantity will also then have their unallocated shares submitted on the same percentage basis as the remaining accounts. If this is not your intent you will need to revisit those accounts and adjust their share allocations accordingly.

To reduce a previously submitted percentage allocation

- Select "Remove All Allocations"

- Enter a new % allocation for All accounts

Note: If elections have been made on a per-account basis, selecting "Remove All Allocations" will remove all account-specific allocations as well.

Frequently Asked Questions

How do I know if the election has been accepted?

After an election has been submitted and the user selects "SAVE" from the election screen, the user will be given a confirmation screen for review. In the event the election is incorrect, a user may re-enter the election screen (prior to the deadline) in order to update the elections.

How is the percentage allocation processed?

Each account will have the entered allocation applied to the eligible, unallocated shares.

Assume there are 4 sub-accounts with the following holdings:

| Account | Eligible Shares | Unallocated Shares |

| A | 200 | 200 |

| B | 100 | 100 |

| C | 100 | 100 |

| D | 50 | 50 |

An election for 50% of the shares is submitted to tender shares to an offer. The allocation will be applied as follows:

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 200 | 100 | 100 |

| B | 100 | 50 | 50 |

| C | 100 | 50 | 50 |

| D | 50 | 25 | 25 |

Can both methods be used on the same voluntary offer?

Yes. Both allocation methods may be used on the same offer. This will allow a user to easily allocate a percentage of all shares plus all eligible shares for a specific account.

If I submit an account specific election and a percentage allocation for all accounts, how will the election be made?

Percentage allocations are posted only to the eligible, unallocated share quantities. Therefore both the specific and percentage allocations will be allocated.

Assume there are four sub-accounts with the following holdings:

| Account | Eligible Shares | Unallocated Shares |

| A | 200 | 200 |

| B | 100 | 100 |

| C | 100 | 100 |

| D | 50 | 50 |

If an election is made to tender 50 shares in Account A the elections will be as follows:

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 200 | 150 | 50 |

| B | 100 | 100 | 100 |

| C | 100 | 100 | 100 |

| D | 50 | 50 | 50 |

If an election is then made to allocate 50% of ALL remaining shares, the elections will be as follows:

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 200 | 75 | 125 (50 + 75) |

| B | 100 | 50 | 50 |

| C | 100 | 50 | 50 |

| D | 50 | 25 | 25 |

How will fractional shares be treated as a result of using a percentage allocation?

If the election quantity is a fractional share as a result of the percentage allocation, then the fractional share will be truncated and submitted to the default allocation.

Assume there are 3 sub-accounts with the following holdings

| Account | Eligible Shares | Unallocated Shares |

| A | 100 | 100 |

| B | 100 | 100 |

| C | 75 | 75 |

If an election of 50% is submitted, each account will have 50% of the eligible, unallocated shares elected on.

| Account | Eligible Shares | Unallocated Shares | Allocated Shares |

| A | 100 | 50 | 50 |

| B | 100 | 50 | 50 |

| C | 75 | 38 | 37 (37.5 truncated to 37) |

Does it matter the order in which I allocate to the accounts?

If a user first allocates positions as a percentage using the All Accounts function and then selects an individual account, the user may override the percentage allocation for the individual account. In this manner, a user may elect 50% of all unallocated eligible shares to be allocated and subsequently reduce the election in Account A to fewer than 50% by making a change in the account specific allocation.

Understanding the 2009 Gain/Loss Summary Worksheet

IMPORTANT NOTE: This article has been customized for use by individual US taxpayers investing in securities for information purposes only. Persons are encouraged to consult a qualified tax professional with the preparation of tax returns. IB does not provide tax advice. Traders or dealers in securities, for whom other tax treatment applies, may find the worksheet helpful. The methodology used to determine the yearly gain or loss, however, differs. Traders electing the mark-to-market accounting method may consult IRS Instructions for Form 4797, page 2.

The 2009 Gain/Loss Summary Worksheet calculates the gain or loss for your securities bought and sold from January 1 through December 31 utilizing the Internal Revenue Service (IRS) guidelines. Every sell trade executed appears, including short sells, on a trade-date basis. Not all securities, however, are eligible for inclusion. For additional information, see the following article categories.

Below we have categorized information about this year's "Worksheet" within the IB Knowledge Base. Each article provides more details to assist with your understanding of this tool.

- Select What's New for the 2009 Gain/Loss Summary Worksheet for a brief overview of new additions.

- Select 2009 Gain/Loss Summary Worksheet, General Explanation, for details on the columns and fields of the “Worksheet.”

- Select 2009 Gain/Loss Summary Worksheet, Considerations, for details about limitations and adjustments on the “Worksheet.”

- Select Tax Information and Reporting page, then click the Reports and Dates tab for the year-end tax form and worksheet calendar.

- Select IRS Publication 550 for a comprehensive explanation of the IRS guidelines for determining your gain/loss.

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Tax Treaty Benefits

Income payments (dividends and payment in lieu) from U.S. sources into your IB account may have U.S. tax withheld. Generally, a 30% rate is applied to non-U.S. accounts. Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the U.S. Complete the applicable Form W-8 to find out your status.

Tax Treaties*

U.S. tax treaties with some countries have different benefits. Legal tax residents of the following countries may be eligible for the treaty benefits. Below is a list of the tax treaty countries. Benefits vary by country.

| Australia | Czech Republic | India | Lithuania | Sweden |

| Austria | Denmark | Indonesia | Poland | Switzerland |

| Bangladesh | Egypt | Ireland | Portugal | Thailand |

| Barbados | Estonia | Israel | Romania | Trinidad & Tobago |

| Belgium | Finland | Italy | Russia | Tunisia |

| Bulgaria | France | Jamaica | Slovak Republic | Turkey |

| Canada | Germany | Japan | Slovenia | Ukraine |

| China, People's Rep. Of | Greece | Kazakhstan | South Africa | United Kingdom |

| Commonwealth of Ind. States | Hungary | Korea, Rep. of | Spain | Venezuela |

| Cyprus | Iceland | Latvia | Sri Lanka |

*Country list as of April 2009

Refer to IRS Publication 901 for details on withholding rates for your tax residence country and your eligible benefits.

Which Tax Form Should I Select?

3 simple questions can help you choose a tax certification form. Read the questions and select the form. For more detailed help, see Tax Information & Reporting.

Question # 1: Are you a U.S. Person or a U.S. Entity?

| • U.S. Citizen | • U.S. Business or Organization |

| • U.S. Green Card Holder | • U.S. Domestic Trust |

| • U.S. Legal Resident | |

If the answer is YES, complete Form W-9

If the answer is NO, go to # 2.

Question # 2: Do you have a U.S. Visa?

| • H-1B Visa Holder | • TN Visa Holder |

| • O-1 Visa Holder | |

If the answer is YES, find your status by the "substantial presence test." See More U.S. Legal Resident Info

If the answer is NO, go to # 3.

Question # 3: Are you a Legal Resident or Entity of another country?

*Question does Not apply to U.S. Citizens/Entities or Green Card Holders

| • Permanent Home Outside of U.S | • Entity Formed Outside of U.S. |

| •Business or Organization formed outside of U.S. | |

If the answer is YES, complete Form W-8 (U.S. Citizens, Green Card Holders, and Entities still complete the W-9.)

NOT SURE because you work, live, or study in the U.S. then, see More U.S. Legal Resident Info

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

Certify Your Tax Status

Filling out a tax certification form is required to open an IB account. The forms confirm your tax status in relation to the United States. Information provided by you may lower or exempt the U.S. tax withholding on your account.

This article will help you to:

►Choose the correct certification form ►Find your tax treaty benefits

►Fill out and submit your form online ►Answer tax certification questions

Which Form Do You Pick? |

Tax Treaty Benefits |

|

Management of account activity differs for each account type. IB is a U.S. broker and must follow U.S. guidelines. 3 simple questions help you choose the right form |

Some countries have a tax treaty with the U.S. Find out if you benefit from a lower tax-withholding rate. Tax Treaty Benefit Info |

Filling Out The Form |

Tax Certification – FAQ’s |

| The certification form is direct. Supply basic account information on the true owner of the assets or entity. Select W-9 Instructions or W-8 Instructions for help. | Seek professional advice for tax questions. These common questions and answers may help you make an informed decision. Tax Certification - Frequently Asked Questions |

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax advisor or refer to the U.S. Internal Revenue Service.

How and When to Use a Direct Rollover

This information is for general educational purposes only. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations.

Generally, an investor changing jobs or leaving the workforce may utilize either a Direct Rollover election to continue their retirement savings outside of their employer-sponsored retirement plan. Assets distributed directly to your IRA from the retirement plan may qualify as a Direct Rollover.

What is a Direct Rollover?

The Direct Rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan, including an IRA. The contribution to the IRA is called a rollover contribution. The Direct Rollover method transfers the assets directly from the retirement plan (and not to the IRA owner) into the investor's IRA, avoiding the 20% mandatory IRS withholding. This option to transfer retirement assets has no age limitations.

Eligible retirement plans include:

- Employer's qualified pension, profit -sharing, or stock bonus plan

- Annuity plan

- Tax sheltered annuity plan (section 403(b) plan)

- Governmental deferred compensation plan (section 457 plan)

Who do you contact first?

Contact your retirement plan administrator or the human resources office for eligibility and requirements. The plan administrator is required to provide a reasonable direct method of asset transfer. Completion of an IRA Rollover Form provided by the administrator may be required, in some cases. In other cases, the plan accepts an IRA Rollover Form supplied by your IRA's broker. Therefore, it is important to check with the plan administrator.

Initiating your Direct Rollover through IB

For those transfers that require a broker-supplied IRA Rollover Form, Interactive Brokers provides a convenient IRA Rollover Form. Interactive Brokers will forward the request to the plan administrator or broker for processing. Funds may be transferred by either wire transfer or check directly to Interactive Brokers.

Before accepting an IRA rollover transaction into an IRA, we require that you review your eligibility for the rollover and certify your understanding of the rollover rules and conditions. The IRA Rollover Form includes the Rollover Form and an IRA Rollover Certification Form.

The Fund Transfers page within the Account Management lets you notify IB of an IRA Rollover deposit of funds into your account. Select the Funding tab in the header link and choose Deposit Funds in the Transaction list. In the Method list, select Direct Rollover. Complete, sign, and return both forms to the Interactive Brokers address on the form.

Contact Customer Service with any additional questions.

In compliance with Treasury Department Circular 230, unless stated to the contrary, any information contained in this article was not intended or written to be used and cannot be used for the purpose of avoiding tax penalties that may be imposed on any taxpayer.

How do I add a second user to my Friends and Family master account?

While technically, Friends and Family accounts can have more than one user, there cannot be more than one trader. The second user can access all other functions.

The second user on a Friends and Family master account is designed to accommodate an API connection.

Will the consolidated statement reflect the tax basis choices of client accounts?

Clients have the ability to select one of three tax basis methods, First in First Out (FIFO), Last in First Out (LIFO) and Max Losses. The method selected will affect the P&L values which are posted on the statements.

In an advisor structure, where the advisor has the ability to create a consolidated statement, those P&L values posted will properly reflect the tax basis choice as these calculations are done independent of how a statement may be viewed.

Does IB offer managed accounts?

IB, itself, does not provide advisory services to customers, but we do clear for a rather large number of Financial Advisors who do carry and clear their customer accounts with IB. As we are not in a position to provide personal recommendations as to Financial Advisors, you would need to research for an advisor on your own and if they are not already affiliated with IB, request that they open an account on your behalf with IB.

You may also wish to review the website of a US industry regulator such as FINRA (www.finra.org) which provides information regarding selecting investment professionals along with a tool referred to as FINRA BrokerCheck which allows investors to check the professional background of individual brokers.