Общая информация

Универсальный счет IB состоит из двух отдельных субсчетов или сегментов: один для балансов и позиций с ценными бумагами, которые застрахованы согласно правилам SEC о защите клиентов, и второй для балансов и позиций с биржевыми товарами, застрахованных согласно правилам CFTC. Такая структура счета позволяет сократить административные расходы, которые понес бы клиент, если бы открыл два отдельных счета (например, связанные с переводом средств между счетами, авторизацией и размещением ордеров на разных счетах, созданием отдельных отчетов и т.д.), и в то же время сохранить разделение, установленное законом.

Согласно законодательству, все транзакции с ценными бумагами должны исполняться и обеспечиваться в сегменте ценных бумаг универсального счета, а транзакции с товарами – в сегменте товаров1. Хотя законом разрешено хранение позиций с полностью оплаченными ценными бумагами в сегменте товаров в качестве маржинального залога, IB хранит бумаги и товары в разных сегментах, тем самым ограничивая размер залога согласно более строгим правилам SEC. Поскольку решение о хранении позиций в том или ином сегменте определяется законодательством, единственным активом, который можно перемещать между сегментами с согласия клиента, являются наличные средства.

Ниже описаны варианты использования свободных денежных средств (применения cash sweep), как выбрать подходящий вариант и что при этом следует учесть.

Варианты cash sweep

Клиентам доступно 3 варианта перемещения денежных средств:

1. Не переводить свободные средства (Do not sweep excess funds) – в этом случае избыточные денежные средства перемещаются из одного сегмента в другой, только если необходимо:

A. Устранить или сократить дефицит маржи в другом сегменте;

B. Уменьшить дебетовый наличный остаток и, соответственно, сумму процентов в каком-либо сегменте. Обращаем ваше внимание, что этот вариант выбирается по умолчанию, а также является единственным доступным вариантом для владельцев счетов, имеющих разрешение на торговлю только одним из инструментов (только ценными бумагами или только товарами).

2. Переводить избыточные средства на мой счет ценных бумаг в IB (Sweep excess funds into my IB securities account) – в этом случае в сегменте товаров хранятся только денежные средства, необходимые для удовлетворения текущих маржинальных требований для товаров. Любые средства сверх маржинальных требований, полученные в результате увеличения денежных средств (например, благоприятных колебаний и/или из-за транзакций) или снижения маржинальных требований (например, изменения диапазона риска в расчетах SPAN и/или из-за транзакций), будут автоматически переведены из сегмента товаров в сегмент ценных бумаг. Обратите внимание, что для выбора этого варианта владельцу счета необходимо иметь разрешение на торговлю ценными бумагами.

3. Переводить избыточные средства на мой товарный счет в IB (Sweep excess funds into my IB commodities account) – в этом случае в сегменте ценных бумаг хранятся только денежные средства, которые наряду с другими ценными бумагами с кредитной стоимостью необходимы для удовлетворения текущих маржинальных требований для ценных бумаг. Обратите внимание, что для выбора этого варианта владельцу счета необходимо иметь разрешение на торговлю биржевыми товарами.

Другие важные примечания:

- Поскольку на универсальном счете можно хранить средства в разных валютах, то если на вашем счете есть балансы в разных валютах, порядок использования средств определяется на основании установленной иерархии. Сначала перечисляются средства в базовой валюте, затем в USD, и в последнюю очередь – остальные длинные балансы, начиная с самых больших.

- Чтобы вывод средств не привел к дефициту маржи, на другой сегмент будет переведена не вся сумма избыточных средств: в исходном сегменте останется резерв в 5% от требуемой минимальной маржи. Аналогичным образом, чтобы сократить операционные расходы, связанные с переводом номинальных остатков, средства будут переведены только в том случае, если с учетом маржинального резерва в 5% избыток средств (при его наличии) составляет не меньше 1% капитала на счете или 200 $.

- Перед выполнением сделки проводится кредитная проверка с целью определить, достаточно ли на счете средств для поддержания нового ордера, и избыточные средства в одном сегменте учитываются для сделок в другом сегменте (но перевод средств будет выполнен только после исполнения сделки и в случае, если это будет необходимо для соблюдения маржинальных требований). Если ваш счет имеет статус "системного дневного трейдера" (Pattern Day Trader), то при кредитной проверке учитывается капитал не только за текущий, но и за предыдущий день, поэтому вам следует обратить особое внимание на раздел "Что необходимо учесть при выборе свип-метода" ниже.

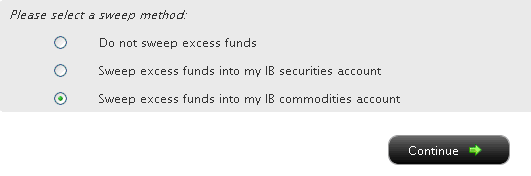

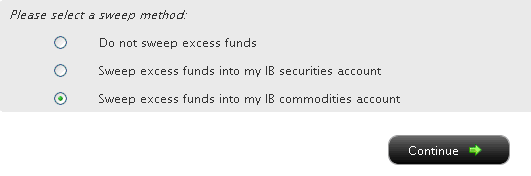

Как выбрать вариант cash sweep

Если в вашем личном кабинете меню отображается слева, выберите "Параметры счета" (Account Administration) и затем "Свип-перевод избытка средств" (Excess Funds Sweep). Если в вашем личном кабинете разделы меню расположены сверху, выберите "Параметры счета" / "Настройки" (Manage Account / Settings) и затем "Настройка счета" / "Свип-перевод избытка средств" (Configure Account / Excess Funds Sweep). Вне зависимости от версии меню далее на экране отобразится следующее окно:

Выберите графу рядом с нужным вариантом и нажмите "Далее" (Continue). Настройки начнут действовать на следующий рабочий день и будут активны до тех пор, пока вы не выберите другой вариант. Обратите внимание, что если у вас есть необходимые торговые разрешения, описанные выше, менять настройки можно в любое время без ограничений.

Что необходимо учесть при выборе свип-метода

Хотя решение о выборе сегмента для хранения избыточных средств может зависеть от субъективных причин и предпочтений (например, клиент хранит крупные и сконцентрированные активы в одном сегменте), ниже приведены некоторые факторы, которые следует учитывать:

1. Капитал для системной дневной торговли – покупательная способность счета со статусом "системный дневной трейдер" (т.е. счета, на котором исполняется 4 или более дневных сделки за 5 рабочих дней) ограничена размером капитала в сегменте ценных бумаг за текущий или предыдущий день на момент закрытия рынка (в зависимости от того, что меньше). Поэтому в случае перевода свободных средств на товарный сегмент они не будут включены в расчет, что может сказаться на возможности размещать новые ордера. Если вы хотите иметь возможность использовать весь доступный капитал при размещении ордеров на ценные бумаги, следует выбрать перемещение избыточных средств в сегмент ценных бумаг. Обращаем внимание, что выбор сегмента ценных бумаг не повлияет на возможность размещать ордера на товары, поскольку правила системной дневной торговли не распространяются на такие счета.

2. Страхование – страхование SIPC распространяется на активы в сегменте ценных бумаг, однако для сегмента товаров не предусмотрено соразмерной программы страхования. Страхование также не распространяется на наличные балансы свыше лимита SIPC в 250 000 $ (или лимита компании Lloyd в 900 000 $, если применимо). Для клиентов IB Canada и IB UK также действуют правила страхования CIPF и FSCS соответственно.

3. Доход в виде процентов – при прочих равных клиент получит более оптимальный процентный доход по длинным денежным балансам, которые не были поделены между сегментами ценных бумаг и товаров, поскольку балансы не объединяются в целях процентных выплат (т.к. они относятся к разным пулам и подчиняются разным правилам реинвестирования). Также при выборе свип-метода следует учитывать, что для выплат требуется поддерживать минимальный баланс, и для более высоких балансов действуют более выгодные ставки2.

Примечания:

1 Поскольку фьючерсы OneChicago на одиночные акции являются гибридным продуктом, который регулирует и SEC, и CFTC, их можно покупать и продавать на любом типе счета. Тем не менее, IB исполняет такие транзакции в сегменте ценных бумаг, т.к. это необходимо для снижения маржинальных требований для фьючерсов на одиночные акции и соответствующих позиций с акциями или опционами.

2 Возьмем, например, счет с длинным балансом в 9000 USD в каждом сегменте (ценных бумаг и товаров). В зависимости от фактической ставки по федеральным фондам счет мог бы получить процентный доход с 8000 $ (18 000 $ - 10 000 $), если бы оба баланса находились в одном сегменте, но поскольку в каждом отдельном сегменте баланс не достигает 10 000 $, то проценты не начисляются, и счет не будет получать проценты без cash sweep. Аналогичным образом, если в результате перевода свободных средств денежный баланс в каком-либо сегменте превысит 100 000 $, то клиент может получить процентный доход по более высокой ставке. Узнать больше о расчете процентов и текущие ставки-ориентиры можно в статье

KB39.