The Hungarian Social Contribution Tax

The Hungarian Government passed a new bylaw, Government Decree 205/2023 (V.31) on 31 May, 2023, that requires Hungarian financial providers to withhold a Social Contribution Tax on certain capital gains and interest payments and remit these amounts directly to the government.

You will find the answers to the main questions below:

What type of interest is subject to the Hungarian Social Contribution Tax (TAX)?

Interest coupon payments on Bonds, ETFs, closed-end ETFs and mutual funds purchased after July 1, 2023 are subject to the TAX.

Bonds – on both the coupon payment and the capital gains.

ETFs, Closed End Funds and Mutual Funds – The dividend payment is considered as interest and therefore subject to this tax.

ETFs, Closed End Funds and Mutual Funds that are traded in non-EEA or other countries that do not have a tax treaty with Hungary are subject to the Capital Gain Tax.

What is the standard TAX Rate?

The standard TAX rate is 13%.

If I earn interest through Bond Coupons, am I required to pay the TAX?

Yes.

When is the 13% TAX rate applied to my account?

The 13% TAX rate is applied to your account on the date when the interest coupon or the proceeds on the sale of certain types of ETFs and mutual funds (see above) are credited to your account. You will find the withheld TAX amount as a separate line item in your Activity Statement.

What currency is used for the TAX?

The TAX is withheld in the same currency in which the interest coupon or proceeds have been credited.

I am not a Hungarian resident. Do I have to pay the TAX?

Non-Hungarian residents are not affected by the TAX. The TAX is withheld based on the declaration provided by you on your tax residency.

Does the TAX apply to clients who are companies?

No.

Does the TAX apply to interest I earn through the Cash Yield Enhancement Program?

No.

Does the TAX apply to interest I earn through the Stock Yield Enhancement Program?

Under the existing rules, the TAX may apply to your interest earned through the Stock Yield Enhancement Program.

Why is trading of tax-impacted instruments limited?

Due to the duration between the announcement of the bylaw and its effective date, IB is unable to deploy the required tax withholding properly across its full global product set. To ensure correct adherence to the regulation, we must temporarily limit the ability to open new positions in affected products. Closing transactions in pre-existing positions will not be impacted. We will inform you as soon as the trading restrictions for the tax-impacted instruments have been removed.

Irish Tax Withholding Reclaim Process

Interactive Brokers Ireland Limited (IBIE) must apply Irish withholding tax of 20% on credit interest paid to certain clients, including natural persons. However, you may be able to reclaim some or all of the tax withheld, if you are resident in a country with a Double Taxation Treaty (DTT) with Ireland, which includes all EEA countries.

To reclaim withholding tax, you must complete Form IC7. This article explains how to do this. You can find the form at this link:

https://www.revenue.ie/en/self-assessment-and-self-employment/documents/form-ic7.pdf

You may also be interested in our explanation on how to apply for an exemption from or reduction in the rate of withholding tax applicable to your future credit interest payments, which you can find here.

How to Reclaim Withholding Tax

Step 1: Complete the following information:

1. Under section entitled Name of claimant – please fill in full Capital Letters.

Full Name,

Foreign Tax Ref. No.

Revenue File Ref. No. (If known.)

Address:

Tel No.:

E-mail:

2. Under section entitled Agent – only complete this section if you would like enquiries to be sent to your Agent.

Name:

Address:

Tel No.:

E-mail:

Step 2: Answer and complete questions numbered 1-6,

|

|

QUESTION |

ANSWER |

|

1 |

Please state the name, address and Irish tax reference number of the Irish entity making the payments. |

Interactive Brokers Ireland Limited North Dock One, 91/92 North Wall Quay, Dublin 1 D01 H7V7, Ireland TRN: 3674050HH |

|

2 |

State the relationship, if any, between you and the Irish entity making the payments. |

Client |

|

3 |

Please confirm that the payments are made on ‘an arms length Basis’ |

Confirmed: All credit interest payments made by IBIE to clients are on an arm’s length basis |

|

4 |

Please state the rate of the payments |

Variable |

|

5 |

Please state the date of the first payment |

Please refer to the annual statement to determine date of first payment (available on client portal). |

|

6 |

Please state the term of the Agreement. |

Indefinite |

|

7 |

Is the payment in question arising from a Permanent Establishment (P.E.) or fixed base maintained by you in Ireland |

Please complete |

Step 3: Complete the declaration with your country of residence in both blank sections.

Step 4: Sign and date the Form underneath the declaration.

Step 5: Insert the amount you are claiming following “Amount Claimed”.

You can find the amount claimed on Form R185, which is available in IBIE’s client portal in the Tax Forms (see the section marked Tax Deducted).

“Amount Claimed in €________: if claiming a refund of Irish tax on payments already made”

Step 6: Complete the section on payment details in the next box, include details of the account to which you wish to receive the payment from Revenue.

Step 7: Ensure the last section is completed and stamped by the tax authority in your country of residence.

Note: If your tax authority will not stamp the form, Irish Revenue may accept a certificate of tax residence, which can be attached instead of having that section completed.

Step 8:

Post or email the following to International Claims Section, Office of the Revenue Commissioners, Nenagh, Co Tipperary, E45 T611, Ireland or intclaims@revenue.ie:

i) Form IC7,

ii) Form R185 (which is available in IBIE’s client portal in the Tax Forms section),

iii) The IBIE Customer Agreement found at this link or alternatively you can just send the link to the customer agreement (in the email or in a cover letter via post), https://www.interactivebrokers.ie/en/accounts/forms-and-disclosures-client-agreements.php, and

iv) Your certificate of tax residence (if required):

How to Contact Irish Revenue

If you have any questions regarding the form, please contact Irish Revenue (Tel No.: +353 1 7383634 E-email: intclaims@revenue.ie).

Удержания с публичных акционерных товариществ (PTP), взимаемые с января 2023 г.

В связи с постановлением Налоговой службы США, с 1 января 2023 г. для лиц, не являющихся налоговыми резидентами США, выручка с продажи определенных ценных бумаг публичных акционерных товариществ – Publicly Traded Partnerships, сокращенно PTP – будет облагаться удержанием. Поскольку удержания Налоговой службы являются существенными, Interactive Brokers ограничила доступ к данным продуктам для инвесторов, которые могут не знать о рисках инвестирования в публичные акционерные товарищества.

Инструкции о том, как получить доступ к продуктам PTP, приведены ниже.

Что вам необходимо знать:

Сумма удержания: 10% от выручки от продажи или дохода по ценной бумаге. То есть 10% от суммы, полученной в результате любой транзакции или выплаты по ценной бумаге, а не только от суммы расчетной прибыли.

Пример удержания:

Инвестор покупает 200 акций по 50.

Стоимость транзакции = 10 000 $

Инвестор продает 200 акций по 51.

Стоимость транзакции = 10 200 $

Прибыль = 200 $.

Удержание = 1020 $

При отсутствии налогового возврата потеря стоимости для инвестора составит 820 $.

Каких инструментов это касается: полный список инструментов приведен в конце статьи. Список ведется по мере возможности и может не всегда отражать последние обновления. Перечисленные ценные бумаги подпадают под действие нового постановления. Правило об удержании не распространяется на опционы и другие деривативные инструменты, основанные на ценных бумагах PTP. Однако в случае конвертации опциона или дериватива в долю PTP, последующая продажа таких бумаг PTP будет облагаться удержанием.

Особые случаи: новое постановление предусматривает возможность для эмитентов получить освобождение от удержания с PTP. Это освобождение действительно в течение 92 дней, и его можно продлить, получив соответствующее разрешение от Налоговой службы. По мере возможности IBKR будет публиковать список инструментов, освобожденных от удержания, однако при выборе того или иного инструмента инвесторы должны убедиться, что понимают, какие требования для него действуют. Документ, который дает эмитенту право на освобождение от удержания, называется "Qualified Notice".

Каких инвесторов это касается: данное постановление касается всех инвесторов, не являющихся налоговыми резидентами США, т.е. инвесторов, которые не платят налоги и не подают налоговые отчеты в США (и таким образом не подают налоговую форму W-9).

Отчетность: информация об удержаниях включается в форму 1042-S о доходах иностранных лиц в США (Foreign Person's U.S. Source Income Subject to Withholding), подаваемую в конце года.

Как получить доступ к продуктам PTP, если Вы не налоговый резидент США: зайдите на "Портал клиентов" и создайте тикет в "Центре сообщений". В теме письма напишите "Access to PTP Products" ("доступ к продуктам PTP"), а в теле запросите разрешение на торговлю продуктами PTP.

Дополнительная информация: узнать больше о новом постановлении можно на странице сайта Налоговой службы США, посвященной разделу 1446(f): http://www.irs.gov/individuals/international-taxpayers/partnership-withholding

Инструменты PTP

В списке перечислены ценные бумаги PTP, которые могут подлежать налоговому удержанию согласно указанному выше постановлению Налоговой службы США. Бумаги разделены на 2 группы: в отношении которых подано Qualified Notice – т.е.освобожденные от удержания – и подлежащие удержанию. Списки приводятся для удобства клиентов и по мере возможности. IBKR не гарантирует точность и актуальность данной информации, и инвесторы должны самостоятельно ознакомиться с требованиями к продуктам, которые они собираются купить, во избежание штрафов. Также владельцы инструментов должны следить за сроком действия освобождения от удержаний.

Ценные бумаги PTP, освобожденные от удержаний

| ISIN | Символ | Название |

| US74347W3530 | AGQ | PROSHARES ULTRA SILVER |

| BMG162341090 | BBU | BROOKFIELD BUSINESS PT-UNIT |

| G16234109 | BBU.UN | BROOKFIELD BUSINESS PT-UNIT |

| US26923H2004 | BDRY | BREAKWAVE DRY BULK SHIPPING |

| G16258108 | BEP | BROOKFIELD RENEWABLE PARTNER |

| G16258231 | BEP PRA | BROOKFIELD RENEWABLE PAR |

| BMG162581083 | BEP.UN | BROOKFIELD RENEWABLE PARTNER |

| BMG162521014 | BIP | BROOKFIELD INFRASTRUCTURE PA |

| G16252267 | BIP PRA | BROOKFIELD INFRASTRUCTURE PARTNERS LP |

| G16252275 | BIP PRB | BROOKFIELD INFRASTRUCTUR |

| BMG162521014 | BIP.UN | BROOKFIELD INFRASTRUCTURE PA |

| US0917491013 | BITW | BITWISE 10 CRYPTO INDEX FUND |

| US0917491013 | BITW | BITWISE 10 CRYPTO INDEX FUND |

| US91167Q1004 | BNO | UNITED STATES BRENT OIL FUND |

| US74347Y8701 | BOIL | PROSHARES ULTRA BLOOMBERG NA |

| BMG1624R1079 | BPYP.PR.A | NEW LP PREFERRED UNITS CAD |

| G1624R107 | BPYPM | NEW LP PREFERRED UNITS CAD |

| G16249164 | BPYPN | BROOKFIELD PROPERTY PART |

| G16249156 | BPYPO | BROOKFIELD PROPERTY PART |

| G16249149 | BPYPP | BROOKFIELD PROPERTY PART |

| US88166A4094 | CANE | TEUCRIUM SUGAR FUND |

| US88166A1025 | CORN | TEUCRIUM CORN FUND |

| US9117181043 | CPER | UNITED STATES COPPER INDEX |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| US46140H1068 | DBA | INVESCO DB AGRICULTURE FUND |

| US46140H7008 | DBB | INVESCO DB BASE METALS FUND |

| US46138B1035 | DBC | INVESCO DB COMMODITY INDEX T |

| US46140H3049 | DBE | INVESCO DB ENERGY FUND |

| US46140H4039 | DBO | INVESCO DB OIL FUND |

| US46140H5028 | DBP | INVESCO DB PRECIOUS METALS F |

| US46140H2058 | DBS | INVESCO DB SILVER FUND |

| US46139B1026 | DBV | INVESCO DB G10 CURRENCY HARV |

| SGXC50067435 | DCRU | DIGITAL CORE REIT MANAGEMENT |

| US88166A8053 | DEFI | HASHDEX BITCOIN FUTURES ETF |

| US46140H6018 | DGL | INVESCO DB GOLD FUND |

| US74347W8828 | EUO | PROSHARES ULTRASHORT EURO |

| US37959R1032 | GBLI | GLOBAL INDEMNITY GROUP LLC-A |

| US74347W3951 | GLL | PROSHARES ULTRASHORT GOLD |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| US46428R1077 | GSG | ISHARES S&P GSCI COMMODITY I |

| US74347Y8131 | KOLD | PROSHARES ULTRASHORT BLOOMBE |

| G54050102 | LAZ | LAZARD LTD-CL A |

| CA70214T1012 | PVF.PR.U | PARTNERS VALUE INVEST LP |

| CA70214T1194 | PVF.UN | PARTNERS VALUE INVESTMENTS I |

| CA76090H1038 | QSP.UN | RESTAURANT BRANDS-EXCH UNITS |

| G4196W108 | RSE | RIVERSTONE ENERGY LTD |

| CA76090H1038 | RSTRF | RESTAURANT BRANDS-EXCH UNITS |

| US74347Y7976 | SCO | PROSHARES ULTRASHORT BLOOMBE |

| US88166A6073 | SOYB | TEUCRIUM SOYBEAN FUND |

| US21258A2015 | SPKX | CONVXTY SHS 1X SPIKES FUTUR |

| US21258A1025 | SPKY | CONVXTY SHS DAILY 1.5X SP FU |

| US85814R1077 | SPLP | STEEL PARTNERS HOLDINGS LP |

| US85814R2067 | SPLP PRA | STEEL PARTNERS HOLDINGS LP |

| US92891H1014 | SVIX | -1X SHORT VIX FUTURES ETF |

| US92891H1014 | SVIX | -1X SHORT VIX FUTURES ETF |

| US74347W1302 | SVXY | PROSHARES SHORT VIX ST FUTUR |

| US88166A7063 | TAGS | TEUCRIUM AGRICULTURAL FUND |

| US74347Y8883 | UCO | PROSHARES ULTRA BLOOMBERG CR |

| US46141D1046 | UDN | INVESCO DB US DOLLAR INDEX B |

| US91201T1025 | UGA | UNITED STATES GAS FUND LP |

| US74347W6012 | UGL | PROSHARES ULTRA GOLD |

| US74347W8745 | ULE | PROSHARES ULTRA EURO |

| US9123183009 | UNG | US NATURAL GAS FUND LP |

| US91288X1090 | UNL | UNITED STATES 12 MONTH NATUR |

| US9117171069 | USCI | UNITED STATES COMMODITY INDE |

| US91288V1035 | USL | UNITED STATES 12 MONTH OIL |

| US91232N2071 | USO | UNITED STATES OIL FUND LP |

| US46141D2036 | UUP | INVESCO DB US DOLLAR INDEX B |

| US92891H3093 | UVIX | 2X LONG VIX FUTURES ETF |

| US92891H3093 | UVIX | 2X LONG VIX FUTURES ETF |

| US92891H4083 | UVIX | 2X LONG VIX FUTURES ETF |

| US74347Y8396 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3381 | VIXM | PROSHARES VIX MID-TERM FUT |

| US74347Y8545 | VIXY | PROSHARES VIX SHORT-TERM FUT |

| US88166A5083 | WEAT | TEUCRIUM WHEAT FUND |

| US26800L1008 | WEIX | DYNAMIC SHORT SHORT |

| US74347W2706 | YCL | PROSHARES ULTRA YEN |

| US74347W5691 | YCS | PROSHARES ULTRASHORT YEN |

| US74347Y8479 | ZSL | PROSHARES ULTRASHORT SILVER |

Ценные бумаги PTP, не освобожденные от удержаний

| ISIN | Символ | Название |

| US28252B3096 | - | 1847 HOLDINGS LLC |

| US28252B8046 | EFSH | 1847 HOLDINGS LLC |

| US00434L1098 | - | ACCESS MIDSTREAM PARTNERS LP |

| US0093661058 | AIRL | AIRLEASE LTD |

| US01855A1016 | AC | ALLIANCE CAP MGMT LP |

| US01861G1004 | AHGP | ALLIANCE HOLDINGS GP LP |

| US01877R1086 | ARLP | ALLIANCE RESOURCE PARTNERS |

| US01881G1067 | AB | ALLIANCEBERNSTEIN HOLDING LP |

| US02052T1097 | ALDW | ALON USA PARTNERS LP |

| US02364V1070 | - | AMERICA FIRST MULTIFAMILY IN |

| US02364V2060 | ATAX | AMERICA FIRST MULTIFAMILY IN |

| US02364Y1010 | AFREZ | AMERICA FIRST REAL ESTATE INVESTMENT PARTNERS |

| US02520N1063 | APO | AMERICAN COMMUNITY PROPERTIE |

| CA0266951064 | HOT.UN | AMERICAN HOTEL INCOME PROPER |

| US0268621028 | AIA | AMERICAN INSD MTG INVS |

| US02752P1003 | - | AMERICAN MIDSTREAM PARTNERS |

| US0291692087 | ACP PR | AMERICAN REAL ESTATE PRTNRS: ACP PR |

| US0291691097 | ACP | AMERICAN REAL ESTATE PTNR-LP |

| US0293162055 | - | AMERICAN RESTAURANT PRTNR LP |

| US0309751065 | APU | AMERIGAS PARTNERS-LP |

| US02686F1030 | AIJ | AMERN INSD MTG INVS L P 86 |

| US02686G1013 | AIK | AMERN INSD MTG INVS L P 88 |

| US0293161065 | XXMUT | AMERN RESTAURANT PARTNERS |

| US03350F1066 | ANDX | ANDEAVOR LOGISTICS LP |

| US03673L1035 | - | ANTERO MIDSTREAM PARTNERS LP |

| GB00B15Y0C52 | AAAA | AP ALTERNATIVE ASSETS LP |

| US0376123065 | - | APOLLO GLOBAL MANAGEMENT - A |

| US0376124055 | APO PRA.O | APOLLO MANAGEMENT LLC |

| US0376125045 | APO PRB.O | APOLLO MANAGEMENT LLC |

| US03879N1019 | ARCX | ARC LOGISTICS PARTNERS LP |

| US30225N1054 | EXLP | ARCHROCK PARTNERS LP |

| US03957U1007 | APLP | ARCHROCK PARTNERS LP |

| US04014Y1010 | - | ARES MANAGEMENT LP |

| US04014Y2000 | ARES PRA. | ARES MGMT LP PFD UNIT SER A |

| US04929Q1022 | - | ATLAS ENERGY GROUP LLC |

| US04939R1086 | - | ATLAS ENERGY LP |

| US04930A1043 | ATLS | ATLAS ENERGY LP |

| US0493031001 | ATN | ATLAS ENERGY RESOURCES LLC |

| US0493921037 | APL | ATLAS PIPELINE PARTNERS LP |

| US0493923017 | APL PRECL | ATLAS PIPELINE PARTNERS, L.P. CUMV |

| US04941A4085 | ARPPQ | ATLAS RESOURCE PARTNERS |

| US04941A1016 | ARPJQ | ATLAS RESOURCE PARTNERS LP |

| US04941A5074 | ARNPQ | ATLAS RESOURCE PARTNERS |

| US0548071028 | AZLCZ | AZTEC LAND & CATTLE LTD |

| US05501X1000 | AZURQ | AZURE MIDSTREAM PARTNERS LP |

| US0806941029 | OZ | BELPOINTE PREP LLC |

| US09225M1018 | BSM | BLACK STONE MINERALS LP |

| US0925ESC094 | BHL.ESC | BLACKROCK DEFINED OPPORTUNIT - ESCROW |

| US09253U1088 | - | BLACKSTONE GROUP LP/THE |

| US09625U2087 | BKEPP | BLUEKNIGHT ENERGY PARTNERS - SERIES A PREF UNIT |

| US09625U1097 | BKEP | BLUEKNIGHT ENERGY PARTNERS L |

| US0966271043 | BWP | BOARDWALK PIPELINE PARTNERS |

| US0556EL1098 | BPMP | BP MIDSTREAM PARTNERS LP |

| US1067761072 | BBEPQ | BREITBURN ENERGY PARTNERS LP |

| US1067761155 | BBPPQ | BREITBURN ENG PARTNERS LP CUM REDEE |

| BMG162491077 | BPY | BROOKFIELD PROPERTY PARTNERS |

| US1181671058 | BGH | BUCKEYE GP HOLDINGS LP |

| US1182301010 | BPL | BUCKEYE PARTNERS LP |

| US1272072075 | CSD PRA | CADBURY SCHWEPPES DEL L P |

| US1314761032 | CLMT | CALUMET SPECIALTY PRODUCTS |

| TC0001464281 | ACE PRB | CAPITAL RE LLC: 7.65% CUM "MIPS" |

| US14309L1026 | - | CARLYLE GROUP INC/THE |

| US1501851067 | FUN | CEDAR FAIR -LP |

| US15188T1088 | - | CENTERLINE HOLDING CO |

| US1534231089 | ENGY | CENTRAL ENERGY PARTNERS LP |

| US14309L2016 | TCGP | CG 5 7/8 PERP PFD |

| US1609081096 | CHC | CHARTERMAC |

| US16411Q1013 | CQP | CHENIERE ENERGY PARTNERS LP |

| US1651851099 | CHKR | CHESAPEAKE GRANITE WASH TRUS |

| US16524K1088 | - | CHESAPEAKE MIDSTREAM PARTNER |

| US12547R1059 | CIFC | CIFC LLC |

| US18383H1014 | - | CLAYMORE MACROSHARES OIL DOW |

| US18383R1095 | - | CLAYMORE MACROSHARES OIL UP |

| US12592V1008 | - | CNX COAL RESOURCES LP |

| US12654A1016 | CNXM | CNX MIDSTREAM PARTNERS LP |

| US1982811077 | CPPL | COLUMBIA PIPELINE PARTNERS L |

| US20467A1016 | GSJK | COMPRESSCO PARTNERS LP |

| US20588V3078 | CAG PRB | CONAGRA CAP L C: CAG PRB |

| US2068121092 | - | CONE MIDSTREAM PARTNERS LP |

| US20855T1007 | CCR | CONSOL COAL RESOURCES LP |

| US21038E1010 | - | CONSTELLATION ENERGY PARTNER |

| GG00B1WR8K11 | CCAP | CONVERSUS CAPITAL |

| US2128491030 | CWPS | CONWEST PARTNERSHIP LP-UNITS |

| US2172021006 | CPNO | COPANO ENERGY LLC-UNITS |

| US2189161043 | CNPP | CORNERSTONE PROPANE PARTNERS |

| US2263443077 | CEQP PR | CRESTWOOD EQUITY PARTNER |

| US2263441097 | - | CRESTWOOD EQUITY PARTNERS LP |

| US2263442087 | CEQP | CRESTWOOD EQUITY PARTNERS LP |

| US2263721001 | - | CRESTWOOD MIDSTREAM PARTNERS |

| US2263781070 | CMLP | CRESTWOOD MIDSTREAM PARTNERS |

| US22676R1150 | KWH.UN | CRIUS ENERGY TRUST |

| US22758A1051 | CAPL | CROSSAMERICA PARTNERS LP |

| US22765U1025 | - | CROSSTEX ENERGY LP |

| US2284391057 | CRPPE | CROWN PAC PARTNERS L P |

| US12637A1034 | CCLP | CSI COMPRESSCO LP |

| US1266331065 | - | CVR PARTNERS LP |

| US1266332055 | UAN | CVR PARTNERS LP |

| US12663P1075 | CVRR | CVR REFINING LP |

| US2327511075 | - | CYPRESS ENVIRONMENTAL PARTNE |

| US23311P3082 | DCP PRC | DCP 7.95 PERP PFD - DCP MIDSTREAM LP |

| US23311P1003 | DCP | DCP MIDSTREAM L.P. |

| US23311P2092 | DCP PRB | DCP MIDSTREAM LP |

| US24664T1034 | DKL | DELEK LOGISTICS PARTNERS LP |

| US25490F2092 | BARS | DIREXION DAILY GOLD BEAR 3X |

| US25490F1003 | BAR | DIREXION DAILY GOLD BULL 3X |

| US2574541080 | - | DOMINION ENERGY MIDSTREAM PA |

| US25820R1059 | DMLP | DORCHESTER MINERALS LP |

| US2650261041 | DEP | DUNCAN ENERGY PARTNERS LP |

| US2662242039 | DQ PRA | DUQUESNE CAP L P |

| SGXC28500103 | LIW | EAGLE HOSPITALITY TRUST |

| US26985R1041 | EROC | EAGLE ROCK ENERGY PARTNERS |

| US26827L1098 | ECTM | ECA MARCELLUS TRUST I |

| US2837021086 | EPB | EL PASO PIPELINE PARTNERS LP |

| US29102H1086 | EMESQ | EMERGE ENERGY SERVICES LP |

| US2921021000 | ESBA | EMPIRE STATE REALTY OP LP-ES |

| US2921023089 | FISK | EMPIRE STATE REALTY OP -S250 |

| US2921022099 | OGCP | EMPIRE STATE REALTY OP-S60 |

| US2924801002 | ENBL | ENABLE MIDSTREAM PARTNERS LP |

| US29250R1068 | EEP | ENBRIDGE ENERGY PARTNERS LP |

| US29257A1060 | ENP | ENCORE ENERGY PARTNERS-LP |

| US29273V1008 | ET | ENERGY TRANSFER LP |

| US29273V6056 | ET PRE | ENERGY TRANSFER LP 7.6% PERP PFD U |

| US29273V5066 | ET PRD | ENERGY TRANSFER LP 7.625% PERP PFD |

| US29273V4077 | ET PRC | ENERGY TRANSFER LP |

| US29278N1037 | ETP | ENERGY TRANSFER OPERATING LP |

| US29278N5095 | ETP PRE | ENERGY TRANSFER OPERATNG |

| US29278N3017 | ETP PRC | ENERGY TRANSFER PARTNERS |

| US29273R1095 | - | ENERGY TRANSFER PARTNERS LP |

| US29278N4007 | ETP PRD | ENERGY TRANSFER PARTNERS |

| US29336U1079 | ENLK | ENLINK MIDSTREAM PARTNERS LP |

| TC0001373946 | ECTPQ | ENRON CAP LLC |

| US29357D2080 | ECSPQ | ENRON CAPITAL RESOURCES 9% CUM RED PFD |

| US2937161063 | EPE | ENTERPRISE GP HOLDINGS LP |

| US2937921078 | EPD | ENTERPRISE PRODUCTS PARTNERS |

| US29414J1079 | - | ENVIVA PARTNERS LP |

| US26885J1034 | EQGP | EQGP HOLDINGS LP |

| US26885B1008 | EQM | EQM MIDSTREAM PARTNERS LP |

| US092ESC0377 | BGIO.ESC | ESC BGIO LIQUIDATION TRUST |

| US26926V1070 | EVEPQ | EV ENERGY PARTNERS LP |

| US30053M1045 | SNMP | EVOLVE TRANSITION INFRASTRUC |

| US30304T1060 | FSG | FACTORSHARES 2X: GOLD-S&P500 |

| US30304P1049 | FOL | FACTORSHARES 2X: OIL-S&P500 |

| US3030461061 | FSE | FACTORSHARES 2X: S&P500-TBD |

| US3030481028 | FSU | FACTORSHARES 2X: S&P500-USD |

| US3030471045 | FSA | FACTORSHARES 2X: TBD-S&P500 |

| US3152933087 | FGPRB | FERRELLGAS PARTNERS LP-B |

| US3152931008 | FGPRQ | FERRELLGAS PARTNERS-LP |

| US3152932097 | FGPR | FERRELLGAS PARTNERS-LP |

| US30242M1062 | XXFPL | FFP PARTNERS -LP-CL A |

| US34552U1043 | FELPQ | FORESIGHT ENERGY LP |

| US34958B1061 | - | FORTRESS INVESTMENT GRP-CL A |

| US34960P2002 | FTAIP | FORTRESS TRANS & INFRAST |

| US34960P3091 | FTAIO | FORTRESS TRANS & INFRAST |

| US34960P4081 | FTAIN | FORTRESS TRANS & INFRAST |

| US34960P1012 | FTAI | FORTRESS TRANSPORTATION-CL A |

| US36761Q1058 | GWYGU | GATEWAY GARAGE PARTNERS LLC |

| US3719271047 | GEL | GENESIS ENERGY L.P. |

| US37946R1095 | GLP | GLOBAL PARTNERS LP |

| US37946R2085 | GLP PRA | GLOBAL PARTNERS LP |

| US37946R3075 | GLP PRB | GLOBAL PARTNERS LP |

| US38349K1051 | GDVTZ | GOULD INVESTORS LP |

| US3860872098 | GRM PRA | GRAND MET DEL L P |

| US3932211069 | GPP | GREEN PLAINS PARTNERS LP |

| US39525T1007 | - | GREENHAVEN COAL FUND |

| US3952581060 | - | GREENHAVEN CONTINUOUS CMDTY |

| US40274U1088 | GTM | GULFTERRA ENERGY PARTNERS LP |

| US4038291047 | GYRO | GYRODYNE LLC |

| US40636T2033 | HRY | HALLWOOD RLTY PARTNERS L P |

| BMG4285W1001 | HRBGF | HARBOR GLOBAL COMPANY LTD |

| US41988L2025 | NNUTU | HAWAIIAN MACADAMIA NUT ORCHA |

| US4223571039 | HTLLQ | HEARTLAND PARTNERS LP-A |

| US4269181081 | HPG | HERITAGE PROPANE PRTNRS LP |

| US4281041032 | - | HESS MIDSTREAM PARTNERS LP |

| US4283371098 | HCRSQ | HI-CRUSH INC |

| US43129M1071 | HPGP | HILAND HOLDINGS GP LP |

| US4312911039 | HLND | HILAND PARTNERS LP |

| US4357631070 | HEP | HOLLY ENERGY PARTNERS LP |

| US4511001012 | IEP | ICAHN ENTERPRISES LP |

| US4511002002 | IEP PRCL | ICAHN ENTERPRISES LP |

| US4511001194 | IEPRR | ICAHN ENTERPRISES LP-RIGHT |

| US45661Q1076 | NRGP | INERGY HOLDINGS LP |

| US4566151035 | - | INERGY LP |

| US45671U1060 | - | INERGY MIDSTREAM LP |

| US4608852053 | IGLPA | INTERSTATE GEN L P |

| US4642941078 | ALT | ISHARE DIVERSIFIED ALT TRUST |

| US45032K1025 | CMDT | ISHARES COMMODITY OPTIMIZED |

| US46643C1099 | JPEP | JP ENERGY PARTNERS LP |

| US4841691078 | KPP | KANEB PIPE LINE PARTNERS L P |

| US4841731098 | KSL | KANEB SERVICES LLC |

| US4945501066 | KMP | KINDER MORGAN ENERGY PRTNRS |

| GB00B13BNQ35 | KKR | KKR & CO (GUERNSEY) LP |

| US48248M2017 | KKR PRA.O | KKR & CO LP |

| US48248M3007 | KKR PRB.O | KKR 6 1/2 12/31/49 PFD |

| US48248A3068 | KFN | KKR FINANCIAL HOLDINGS LLC |

| US48248A6038 | KFN PRCL | KKR FINANCIAL HOLDINGS |

| US48268Y1010 | KSP | K-SEA TRANSPORTATION PARTNER |

| US5053461068 | LAACZ | LAACO LTD-UNITS OF LTD PRTNS |

| US51508J2078 | LMRKP | LANDMARK INFRASTRUCTURE |

| US51508J1088 | LMRK | LANDMARK INFRASTRUCTURE PART |

| US51508J4058 | LMRKN | LANDMARK INFRASTRUCTURE PARTNERS LP |

| US51508J3068 | LMRKO | LANDMARK INFRASTRUCTURE |

| US5248141005 | - | LEHIGH GAS PARTNERS LP |

| US5327711025 | - | LIN MEDIA LLC - A |

| US5357631069 | LNKE | LINK ENERGY LLC |

| US5360201009 | LINEQ | LINN ENERGY LLC-UNITS |

| US50214A1043 | LRE | LRR ENERGY LP |

| US55608B1052 | MIC.USD | MACQUARIE INFRASTRUCTURE HOL |

| US55610T1025 | - | MACROSHARES $100 OIL DOWN |

| US55610W1053 | - | MACROSHARES $100 OIL UP |

| US55610X1037 | DMM | MACROSHARES MAJ MET HOU DOWN |

| US55610R1068 | UMM | MACROSHARES MAJ MET HOU UP |

| US55610N1054 | DCR | MACROSHARES OIL DOWN TRADEABLE |

| US55610L1098 | UCR | MACROSHARES OIL UP TRADEABLE T |

| US55610T2015 | DOY | MACROSHARES USD 100 OIL DOWN |

| US55610W2044 | UOY | MACROSHARES USD 100 OIL UP |

| US55907R1086 | MGG | MAGELLAN MIDSTREAM HOLDINGS |

| US5590801065 | MMP | MAGELLAN MIDSTREAM PARTNERS |

| US5707591005 | MWE | MARKWEST ENERGY PARTNERS LP |

| US57118V1008 | - | MARLIN MIDSTREAM PARTNERS LP |

| US5733311055 | MMLP | MARTIN MIDSTREAM PARTNERS LP |

| US5860481002 | MEMPQ | MEMORIAL PRODUCTION PARTNERS |

| US55271M2061 | MUK PRA | MEPC INTL CAP L P |

| US59140L1008 | IDIV | METAURUS US EQUITY CUMULATIV |

| US59140L2097 | - | METAURUS US EQUITY EX DIVIDE |

| US59564N1037 | MEP | MIDCOAST ENERGY PARTNERS LP |

| US59560V1098 | - | MID-CON ENERGY PARTNERS LP |

| US59560V2088 | MCEP | MID-CON ENERGY PARTNERS LP |

| US6050342061 | ME PRA | MISSION CAP L P |

| US6050343051 | ME PRB | MISSION CAP L P: ME PRB |

| US55307U1079 | - | ML MACADAMIA ORCHARDS LP-UT |

| US55336V1008 | MPLX | MPLX LP |

| US62624B1017 | - | MUNICIPAL MORTGAGE & EQUITY |

| US55406N1037 | MYTH | MYT HLDG LLC BE+ |

| US63900P1030 | - | NATURAL RESOURCE PARTNERS LP |

| US63900P4000 | NSP | NATURAL RESOURCE PARTNERS LP -PARTNERSHIP UNITS |

| US63900P6088 | NRP | NATURAL RESOURCE PARTNERS LP |

| US63900P5098 | NSP | NATURAL RESOURCE PARTNERS LP |

| US6442061049 | NEN | NEW ENGLAND REALTY ASSOC-LP |

| US64881E1091 | NSLPQ | NEW SOURCE ENERGY PARTNERS L |

| US64881E3071 | NUSPQ | NEW SOURCE ENG PARTNERS LP 11%SR A |

| US64ESC19977 | NYRT.ESC | NEW YORK REIT INC - ESCROW |

| US6514261089 | NHL | NEWHALL LAND & FARMING CO |

| US62913M2061 | NGL PRB | NGL 9 PERP PFD |

| US62913M1071 | NGL | NGL ENERGY PARTNERS LP |

| US62913M3051 | NGL PRC | NGL ENERGY PARTNERS LP |

| US6546781013 | NKA | NISKA GAS STORAGE PARTNERS-U |

| US65506L1052 | NBLX | NOBLE MIDSTREAM PARTNERS LP |

| US6658261036 | NTI | NORTHERN TIER ENERGY LP |

| US67058H3003 | NS PRB | NSUS 7 5/8 PERP PFD |

| US67058H2013 | NS PRA | NSUS 8 1/2 12/31/49 |

| US6294221063 | NLP | NTS REALTY HOLDINGS LP |

| US67058H1023 | NS | NUSTAR ENERGY LP |

| US67058H4092 | NS PRC | NUSTAR ENERGY LP |

| US67059L1026 | - | NUSTAR GP HOLDINGS LLC |

| US67074P1049 | CFD | NUVEEN DIVERSIFIED COMMODITY |

| US6707311089 | CTF | NUVEEN LONG/SHORT COMMODITY |

| US6740011027 | OKCMZ | OAKTREE CAP GROUP-UTS CL A |

| US6740012017 | OAK | OAKTREE CAPITAL GROUP LLC |

| US6740013007 | OAK PRA | OAKTREE CAPITAL GRP LLC |

| US6740014096 | OAK PRB | OAKTREE CAPITAL GRP LLC |

| US67420T2069 | OMP | OASIS MIDSTREAM PARTNERS LP |

| US67551U1051 | - | OCH-ZIFF CAPITAL MANAGEMEN-A |

| US67091N1081 | OCIP | OCI PARTNERS LP |

| US67081B1061 | - | OCI RESOURCES LP |

| US6780491071 | OILT | OILTANKING PARTNERS LP |

| US68268N1037 | OKS | ONEOK PARTNERS LP |

| US6710281089 | OSP | OSG AMERICA LP |

| US6918071019 | OXF | OXFORD RESOURCE PARTNERS LP |

| US6931391071 | PNG | PAA NATURAL GAS STORAGE LP |

| US69422R1059 | PPX | PACIFIC ENERGY PARTNERS LP |

| US69318Q1040 | PBFX | PBF LOGISTICS LP |

| CA7069025095 | - | PENGROWTH ENERGY TRUST-A |

| US70788P1057 | - | PENN VIRGINIA GP HOLDINGS LP |

| US7078841027 | - | PENN VIRGINIA RESOURCE PARTN |

| US7093111042 | PTXP | PENNTEX MIDSTREAM PARTNERS L |

| US71672U1016 | PDH | PETROLOGISTICS LP |

| US55406N2027 | PFDM | PFD MYT HLDG CO BE+ |

| US7185492078 | PSXP | PHILLIPS 66 PARTNERS LP |

| US7192171012 | PLP | PHOSPHATE RESOURCE PRTNRS L.P. |

| US72388B1061 | PSE | PIONEER SOUTHWEST ENERGY PAR |

| US7265031051 | PAA | PLAINS ALL AMER PIPELINE LP |

| US69341H1059 | GFWQZ | PLM EQUIPMENT GROWTH FD III |

| US7328571077 | POPE | POPE RESOURCES |

| US73936B4086 | - | POWERSHARES DB AGRICULTURE F |

| US73936B7055 | - | POWERSHARES DB BASE METALS F |

| US73935S1050 | - | POWERSHARES DB COMMODITY IND |

| US73936B1017 | - | POWERSHARES DB ENERGY FUND |

| US73935Y1029 | - | POWERSHARES DB G10 CURR HARV |

| US73936B6065 | - | POWERSHARES DB GOLD FUND |

| US73936B5075 | - | POWERSHARES DB OIL FUND |

| US73936B2007 | - | POWERSHARES DB PREC METALS F |

| US73936B3096 | - | POWERSHARES DB SILVER FUND |

| US73936D2062 | - | POWERSHARES DB US DOL IND BE |

| US73936D1072 | - | POWERSHARES DB US DOL IND BU |

| SGXC75818630 | OXMU | PRIME US REIT |

| US74347W5360 | FUTS | PROSHARES MANAGED FUTURES ST |

| US74347W7424 | - | PROSHARES SHORT EURO ETF |

| US74347W6277 | - | PROSHARES SHORT VIX ST FUTUR |

| US74347W4942 | GDAY | PROSHARES ULT AUSTRALIAN DOL |

| US74347W7754 | - | PROSHARES ULT DJ-UBS NAT GAS |

| US74347W1062 | - | PROSHARES ULTRA BLOOMBERG CO |

| US74347W2888 | UCD | PROSHARES ULTRA BLOOMBERG CO |

| US74347W6509 | - | PROSHARES ULTRA BLOOMBERG CR |

| US74347W2474 | - | PROSHARES ULTRA BLOOMBERG CR |

| US74347W3209 | - | PROSHARES ULTRA BLOOMBERG CR |

| US74347W1229 | - | PROSHARES ULTRA BLOOMBERG NA |

| US74347Y7067 | - | PROSHARES ULTRA BLOOMBERG NA |

| US74347W2961 | - | PROSHARES ULTRA BLOOMBERG NA |

| US74347W5022 | - | PROSHARES ULTRA DJ-UBS CRUDE OIL |

| US74347W8414 | - | PROSHARES ULTRA SILVER |

| US74347W6350 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W4116 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3464 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W2540 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W1633 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W5444 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3795 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W3126 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W2391 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W1484 | - | PROSHARES ULTRA VIX ST FUTUR |

| US74347W8661 | - | PROSHARES ULTRA YEN |

| US74347W2219 | - | PROSHARES ULTRAPRO 3X CRUDE |

| US74347W2136 | - | PROSHARES ULTRAPRO 3X SHORT |

| US74347Y8057 | - | PROSHARES ULTRAPRO 3X SHORT |

| US74347W4603 | CROC | PROSHARES ULTRASHORT AUD |

| US74347Y8214 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347W6681 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347W3878 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347Y8628 | - | PROSHARES ULTRASHORT BLOOMBE |

| US74347W6764 | CMD | PROSHARES ULTRASHORT BLOOMBE |

| US74347W7002 | - | PROSHARES ULTRASHORT GOLD |

| US74347W7184 | - | PROSHARES ULTRASHORT GOLD |

| US74347W8331 | - | PROSHARES ULTRASHORT SILVER |

| US74347W6434 | - | PROSHARES ULTRASHORT SILVER |

| US74347W7267 | - | PROSHARES ULTRASHORT SILVER |

| US74347W1146 | - | PROSHARES ULTRASHORT SILVER |

| US74347W8588 | - | PROSHARES ULTRASHORT YEN |

| US74347W7671 | - | PROSHARES ULTSHRT DJ-UBS NAT |

| US74347W6848 | - | PROSHARES VIX MID-TERM FUT |

| US74347W3613 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W6921 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W2623 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W1716 | - | PROSHARES VIX SHORT-TERM FUT |

| US74347W2052 | - | PROSHRE U/S DJ-AIG COMMODITY |

| US74347W8091 | - | PROSHRE U/S DJ-AIG CRUDE OIL |

| CA74624AUSD4 | RUF.U | PURE MULTI-FAMILY REIT LP |

| CA74624A1084 | RUF.UN | PURE MULTI-FAMILY REIT LP |

| US6936651016 | PVR | PVR PARTNERS LP |

| US74735R1150 | QEPM | QEP MIDSTREAM PARTNERS LP |

| US74734R1086 | QRE | QR ENERGY LP |

| US74836B2097 | - | QUEST ENERGY PARTNERS LP |

| US74839G1067 | - | QUICKSILVER GAS SERVICES LP |

| US75885Y1073 | RGP | REGENCY ENERGY PARTNERS LP |

| US7601131003 | RNF | RENTECH NITROGEN PARTNERS LP |

| US76090H1032 | QSP.U | RESTAURANT BRANDS EXCHANGE UNITS |

| US76218Y1038 | - | RHINO RESOURCE PARTNERS LP |

| US76218Y2028 | - | RHINO RESOURCE PARTNERS LP |

| US7628191006 | RMP | RICE MIDSTREAM PARTNERS LP |

| US7672711097 | - | RIO VISTA ENERGY PARTNERS LP |

| US7771491054 | RRMS | ROSE ROCK MIDSTREAM LP |

| US78028T1007 | - | ROYAL HAWAIIAN ORCHARDS LP |

| GG00BKTRRM22 | RTW | RTW VENTURE FUND LTD |

| US79971C2017 | - | SANCHEZ MIDSTREAM PARTNERS L |

| US79971A1060 | - | SANCHEZ PRODUCTION PARTNERS |

| US79971C1027 | - | SANCHEZ PRODUCTION PARTNERS |

| US80007T1016 | SDTTU | SANDRIDGE MISSISSIPPIAN TRUS |

| US80007V1061 | SDRMU | SANDRIDGE MISSISSIPPIAN TRUS |

| US80007A1025 | - | SANDRIDGE PERMIAN TRUST |

| MHY737602026 | SRG U | SEANERGY MARITIME CORP-UNITS |

| MHY737601036 | - | SEANERGY MARTIME HOLDINGS CORP |

| US81662W1080 | - | SEMGROUP ENERGY PARTNERS LP |

| US8226341019 | SHLX | SHELL MIDSTREAM PARTNERS LP |

| US1724641097 | SIRE | SISECAM RESOURCES LP |

| US26923H1014 | RISE | SIT RISING RATE ETF |

| US84130C1009 | SXEEQ | SOUTHCROSS ENERGY PARTNERS L |

| US84756N1090 | SEP | SPECTRA ENERGY PARTNERS LP |

| US8493431089 | SRLP | SPRAGUE RESOURCES LP |

| US85512C2044 | SGH | STAR GAS PTNRS,LP SR SB UTS |

| US85814R3057 | SPLP PRT | STEEL PARTNERS HLDS LP |

| US86183Q1004 | - | STONEMOR PARTNERS LP |

| US86324B1035 | BNPC | STREAM S&P DYN GLOBAL COMM |

| US8644821048 | SPH | SUBURBAN PROPANE PARTNERS LP |

| US8661421029 | - | SUMMIT MIDSTREAM PARTNERS LP |

| US8661424098 | SMLP | SUMMIT MIDSTREAM PARTNERS LP |

| US86722Y1010 | SXCP | SUNCOKE ENERGY PARTNERS LP |

| US86764L1089 | - | SUNOCO LOGISTICS PARTNERS L.P |

| US86765K1097 | SUN | SUNOCO LP |

| US8692391035 | - | SUSSER PETROLEUM PARTNERS LP |

| US8746971055 | TEP | TALLGRASS ENERGY PARTNERS LP |

| US87611X2045 | NGLS PRA | TARGA RESOURCES PARTNERS |

| US87611X1054 | NGLS | TARGA RESOURCES PARTNERS LP |

| US87233Q1085 | TCP | TC PIPELINES LP |

| US8723841024 | TPP | TEPPCO PARTNERS LP |

| US8810052014 | TNH | TERRA NITROGEN COMPANY LP |

| US88160T1079 | - | TESORO LOGISTICS LP |

| US88166A3005 | CRUD | TEUCRIUM CRUDE OIL FUND |

| US88166A2015 | NAGS | TEUCRIUM NATURAL GAS FUND |

| US89376V1008 | TLP | TRANSMONTAIGNE PARTNERS LP |

| SGXC39411175 | ODBU | UNITED HAMPSHIRE US REIT |

| US91733T3077 | USOU | UNITED STATES 3X OIL FUND |

| US91733T4067 | - | UNITED STATES 3X SHORT OIL F |

| US91733T5056 | USOD | UNITED STATES 3X SHORT OIL F |

| US9117182033 | USAG | UNITED STATES AGRICULTURE IN |

| US9117831084 | UHN | UNITED STATES DIESEL-HEATING |

| US91204P1075 | - | UNITED STATES HEATING OIL LP |

| US9117183023 | USMI | UNITED STATES METALS INDEX F |

| US91232N1081 | - | UNITED STATES OIL FUND LP |

| US9126132052 | DNO | UNITED STATES SHORT OIL FUND |

| US9134301046 | UCLP | UNIVERSAL COMPRESSION PARTNE |

| US9123181029 | - | US NATURAL GAS FUND LP |

| US9123182019 | - | US NATURAL GAS FUND LP |

| US9123181102 | - | US NATURAL GAS FUND LP |

| US9034171036 | USSPQ | US SHIPPING PARTNERS LP |

| US90290N1090 | USAC | USA COMPRESSION PARTNERS LP |

| US9033181036 | USDP | USD PARTNERS LP |

| US91914J1025 | VLP | VALERO ENERGY PARTNERS LP |

| US91914G1085 | VEH | VALERO GP HOLDINGS LLC |

| US91913W1045 | VLI | VALERO LP |

| US92205F2056 | VNRAQ | VANGUARD NATURAL RESOU |

| US92205F4037 | VNRCQ | VANGUARD NATURAL RESOU |

| US92205F1066 | VNRSQ | VANGUARD NATURAL RESOURCES |

| US92205F3047 | VNGBQ | VANGUARD NATURAL RESOURCES LLC RED |

| KYG9325C1050 | VTDRF | VANTAGE DRILLING INTERNATION |

| US93964X1063 | WPG | WASHINGTON PG INC UNRESTRICTED SHARES |

| US95825R1032 | - | WESTERN GAS EQUITY PARTNERS |

| US9582541044 | - | WESTERN GAS PARTNERS LP |

| US9586691035 | WES | WESTERN MIDSTREAM PARTNERS L |

| US95931Q2057 | WNRL | WESTERN REFINING LOGISTICS L |

| US9604171036 | WLKP | WESTLAKE CHEMICAL PARTNERS L |

| US96108P1030 | WMLPQ | WESTMORELAND RESOURCE PARTNE |

| US96949L1052 | WPZ | WILLIAMS PARTNERS LP |

| US96950F1049 | WPZ.USD | WILLIAMS PARTNERS LP |

| US96950K1034 | WMZ | WILLIAMS PIPELINE PARTNERS L |

| US976ESC3018 | FUR.ESC | WINTHROP REALTY TRUST - ESCROW |

| US97718T1051 | TONS | WISDOMTREE COAL FUND |

| US97718W1080 | GCC.USD | WISDOMTREE CONTINUOUS COMMOD |

| US98159G1076 | WPT | WORLD POINT TERMINALS LP |

| US92930Y1073 | - | WP CAREY & CO LLC |

Withholding on Publicly Traded Partnerships (“PTPs”) Effective Jan 2023

As a result of U.S. Internal Revenue Regulations taking effect 1 January 2023, new withholding charges will be applied to sales proceeds from certain Publicly Traded Partnerships ("PTPs”) held by investors who are not U.S. taxpayers. The IRS withholding charges are substantial, therefore, Interactive Brokers has taken steps to limit access to these products for investors who might be unaware of the risks of investing in these PTP products.

Instructions on How to Access PTP Products are available below in this document.

What you need to know:

Amount of Withholding: 10% of sale or distribution proceeds. This means 10% of the amount of funds that would settle resulting from any transaction or distribution, not just 10% on any calculated profit.

Example of PTP withholding:

Buy 200 shares @ 50.

Transaction value = $10,000

Sell 200 shares @ 51.

Transaction value = $10,200

Profit = $200.

Withholding = $1020 USD

Assuming no tax reclaim requests, the loss in value to the investor would be $820

Affected Instruments: Please see the list at the end of this article. The list is maintained on a best efforts basis and there may be some timing issues as information is refreshed. Listed deliverable securities are in scope of the new regulation. Options and other derivative instruments with a PTP as the underlying security are not subject to withholding. However, if the option or derivative is converted into a PTP interest, a subsequent sale of such PTP security would be subject to withholding.

Special Exemptions: The IRS regulation provides issuers the ability to get an exemption from the PTP withholding requirement. The exemption is valid for 92 days, and issuers are required to re-certify with the IRS to extend the duration of the exemption. IBKR will try, on a best-efforts basis, to publish which of the affected instruments have an operating exemption, but investors should ensure they are choosing products whose withholding conditions they fully understand. The issuer document that provides for a withholding exemption is generally referred to as a "Qualified Notice"

What Investors are affected: All investors who are not considered ‘resident’ for U.S. tax purposes, i.e. investors who are not subject to U.S. taxation and tax reporting (and therefore doesn't file a W-9 IRS tax form).

Reporting: Withholding will be reported on the year-end Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding.

How to Access PTP Products as a Non-US Taxpayer: Please login to Client Portal and select the User menu (head and shoulders icon in the top right corner) followed by Settings. Then under Account Settings find the Trading section and click on the “PTP Trading Opt In/Out” link. The webpage allows you to request the ability to trade PTP securities. Once the request is submitted, it may take up to one hour for the ability to be activated.

Note that clients who no longer desire to trade PTP securities may request to deactivate the PTP trading ability via the same “PTP Trading Opt In/Out” link.

Additional Resources: For those interested in understanding additional information about the new regulation, please see the IRS website for IRC Sec. 1446(f): http://www.irs.gov/individuals/international-taxpayers/partnership-withholding

PTP Instruments

This list identifies PTP securities which may be subject to withholding under the IRS Regulation referenced above. The products are presented in 2 groups: those with a "Qualified Notice” exemption, and those "without Qualified Notice". The lists are shown on a best-efforts basis for convenience only. IBKR does not guarantee the accuracy or timeliness of the information, and investors should independently verify that products in which they are invested in, or intend to invest, have the necessary exemptions to avoid punitive withholding outcomes. Duration of the exemptions should also be monitored by position holders in the instruments.

PTP Securities with known Qualified Notice

Last updated 22-01-2024

| ISIN | Symbol | Description |

| US3152931008 | FGPRQ | FERRELLGAS PARTNERS-LP |

| US7328571077 | POPE | POPE RESOURCES |

| US7265031051 | PAA | PLAINS ALL AMER PIPELINE LP |

| US87233Q1085 | TCP | TC PIPELINES LP |

| BMG540501027 | LAZ.OLD | LAZARD LTD-CL A |

| US89376V1008 | TLP | TRANSMONTAIGNE PARTNERS LP |

| US01861G1004 | AHGP | ALLIANCE HOLDINGS GP LP |

| US46428R1077 | GSG | ISHARES S&P GSCI COMMODITY I |

| US16411Q1013 | CQP | CHENIERE ENERGY PARTNERS LP |

| US4511001012 | IEP | ICAHN ENTERPRISES LP |

| BMG162521014 | BIP | BROOKFIELD INFRASTRUCTURE PA |

| US74347W8828 | EUO | PROSHARES ULTRASHORT EURO |

| US74347W6012 | UGL | PROSHARES ULTRA GOLD |

| US161239AC25 | IBCID66377068 | 161239AC2 11/30/50 |

| US161239AE80 | IBCID66377074 | 161239AE8 6.8 11/30/50 |

| US161239AN89 | IBCID66419451 | 161239AN8 12/31/45 |

| US161239AB42 | IBCID67286679 | 161239AB4 06/30/49 |

| US161239AM07 | IBCID67287230 | 161239AM0 6.3 12/31/45 |

| USU3595KAA52 | MIZUHO | MIZUHO 9.87 PERP |

| US9126132052 | DNO | UNITED STATES SHORT OIL FUND |

| US91288X1090 | UNL | UNITED STATES 12 MONTH NATUR |

| US26827L1098 | ECTM | ECA MARCELLUS TRUST I |

| US9117171069 | USCI | UNITED STATES COMMODITY INDE |

| US38349K1051 | GDVTZ | GOULD INVESTORS LP |

| US88166A6073 | SOYB | TEUCRIUM SOYBEAN FUND |

| US88166A5083 | WEAT | TEUCRIUM WHEAT FUND |

| US9117181043 | CPER | UNITED STATES COPPER INDEX |

| BMG162581083 | BEP.UN | BROOKFIELD RENEWABLE PARTNER |

| US88166A7063 | TAGS | TEUCRIUM AGRICULTURAL FUND |

| US9117831084 | UHN | UNITED STATES DIESEL-HEATING |

| US74347W3951 | GLL | PROSHARES ULTRASHORT GOLD |

| BMG162581083 | BEP | BROOKFIELD RENEWABLE PARTNER |

| US84130C1009 | SXEEQ | SOUTHCROSS ENERGY PARTNERS L |

| US24664T1034 | DKL | DELEK LOGISTICS PARTNERS LP |

| CA3874371147 | GRT.UN | GRANITE REAL ESTATE INVESTME |

| CA3874371147 | GRP U | GRANITE REAL ESTATE INVESTME |

| CA16141A1030 | CSH.UN | CHARTWELL RETIREMENT RESIDEN |

| US86722Y1010 | SXCP | SUNCOKE ENERGY PARTNERS LP |

| US48248A6038 | KFN PRCL | KKR FINANCIAL HOLDINGS |

| JP3047550003 | 3283 | NIPPON PROLOGIS REIT INC |

| BMG162491077 | BPY | BROOKFIELD PROPERTY PARTNERS |

| US03879N1019 | ARCX | ARC LOGISTICS PARTNERS LP |

| US29336U1079 | ENLK | ENLINK MIDSTREAM PARTNERS LP |

| US2574541080 | DM.OLD | DOMINION ENERGY MIDSTREAM PA |

| MXCFFI170008 | FIBRAPL14 | PROLOGIS PROPERTY MEXICO SA |

| US7628191006 | RMP | RICE MIDSTREAM PARTNERS LP |

| CA76090H1038 | RSTRF | RESTAURANT BRANDS-EXCH UNITS |

| BMG162521279 | BIP.PR.A | BROOKFIELD INFRASTRUCTUR |

| US09225M1018 | BSM | BLACK STONE MINERALS LP |

| US74347W2888 | UCD | PROSHARES ULTRA BLOOMBERG CO |

| US91831H1068 | VPRB | VPR BRANDS LP |

| GG00BYV2ZQ34 | RGL | REGIONAL REIT LTD |

| BMG162581323 | BEP.PR.G | BROOKFIELD RENEWABLE POW |

| BMG162521436 | BIP.PR.B | BROOKFIELD INFRASTRUCTUR |

| BMG162341090 | BBU | BROOKFIELD BUSINESS PT-UNIT |

| SG1CI1000004 | BTOU | MANULIFE US REAL ESTATE INV |

| CA70214T1194 | PVF.UN.OL | PARTNERS VALUE INVESTMENTS I |

| BMG162521683 | BIP.PR.C | BROOKFIELD INFRASTRUCTUR |

| US85814R2067 | SPLP PRA | STEEL PARTNERS HOLDINGS LP |

| US74347W2219 | OILU.OLD | PROSHARES ULTRAPRO 3X CRUDE |

| US29278N1037 | ETP | ENERGY TRANSFER OPERATING LP |

| US67420T2069 | OMP | OASIS MIDSTREAM PARTNERS LP |

| US85814R3057 | SPLP PRT | STEEL PARTNERS HLDS LP |

| US0556EL1098 | BPMP | BP MIDSTREAM PARTNERS LP |

| US20855T1007 | CCR | CONSOL COAL RESOURCES LP |

| SG1EA1000007 | CMOU | KEPPEL PACIFIC OAK US REIT |

| US29278NAB91 | ETP | ETP 6 5/8 PERP |

| US9123183009 | UNG.OLD | US NATURAL GAS FUND LP |

| BMG162584053 | BEP.PR.M | BROOKFIELD RENEWABLE PAR |

| US74347Y8057 | OILD.OLD1 | PROSHARES ULTRAPRO 3X SHORT |

| US46140H2058 | DBS | INVESCO DB SILVER FUND |

| US46140H6018 | DGL | INVESCO DB GOLD FUND |

| US46140H5028 | DBP | INVESCO DB PRECIOUS METALS F |

| US46139B1026 | DBV | INVESCO DB G10 CURRENCY HARV |

| US46140H4039 | DBO | INVESCO DB OIL FUND |

| US46141D2036 | UUP | INVESCO DB US DOLLAR INDEX B |

| US46141D1046 | UDN | INVESCO DB US DOLLAR INDEX B |

| US6740014096 | OAK PRB | OAKTREE CAPITAL GRP LLC |

| US19237JAB98 | IBCID352663531 | 19237JAB9 0 08/01/54 |

| BMG162582156 | BEP.PR.O | BROOKFIELD RENEWABLE PAR |

| BMG162522269 | BIP.PR.F | BROOKFIELD INFRASTRUCTUR |

| SGXC28500103 | LIW | EAGLE HOSPITALITY TRUST |

| SGXC75818630 | OXMU | PRIME US REIT |

| BMG162491564 | BPYPO | BROOKFIELD PROPERTY PART |

| KYG9325C1050 | VTDRF | VANTAGE DRILLING INTERNATION |

| BMG162581083 | BXE.EUR | BROOKFIELD RENEWABLE PARTNER |

| US29278NAS27 | ETP | ETP 6 3/4 PERP |

| US29278NAT00 | ETP | ETP 7 1/8 PERP |

| BMG162491648 | BPYPN | BROOKFIELD PROPERTY PART |

| BMG162582313 | BEP PRA | BROOKFIELD RENEWABLE PAR |

| US74347Y8883 | UCO | PROSHARES ULTRA BLOOMBERG CR |

| US91232N2071 | USO | UNITED STATES OIL FUND LP |

| US55406N1037 | MYTH | MYT HLDG LLC BE+ |

| BMG162522756 | BIP PRB | BROOKFIELD INFRASTRUCTUR |

| US36761Q1058 | GWYGU | GATEWAY GARAGE PARTNERS LLC |

| CA85554C1041 | SCPT.A | STRLIGHT US MLTI-FAM 2 CORE |

| US29273VAL45 | ET | ET 6 3/4 PERP |

| US29273VAM28 | ET | ET 7 1/8 PERP |

| US29273VAJ98 | ET | ET 6 5/8 PERP |

| US29273VAH33 | ET | ET Float PERP |

| US29273VAN01 | ET | ET 6 1/42 PERP |

| US74347Y8396 | UVXY.OLD | PROSHARES ULTRA VIX ST FUTUR |

| BMG1624R1079 | BPYPM | NEW LP PREFERRED UNITS CAD |

| BMG1624R1079 | BPYP.PR.A | NEW LP PREFERRED UNITS CAD |

| US86943V2097 | AGO | AGO Float PERP |

| US86943X2053 | AGO | AGO Float PERP |

| US86943W2070 | AGO | AGO Float PERP |

| US93964X1063 | WPG. | WASHINGTON PG INC UNRESTRICTED SHARES |

| SGXC50067435 | DCRU | DIGITAL CORE REIT MANAGEMENT |

| US74347Y7976 | SCO | PROSHARES ULTRASHORT BLOOMBE |

| BMG162582644 | BEP.PR.R | BROOKFIELD RENEWABLE PAR |

| US88166A8053 | DEFI.OLD | HASHDEX BITCOIN FUTURES ETF |

| US74347Y7638 | BOIL | PROSHARES ULTRA BLOOMBERG NA |

| US74347Y7893 | VIXY | PROSHARES VIX SHORT-TERM FUT |

| US74347Y7711 | UVXY | PROSHARES ULTRA VIX ST FUTUR |

| BMG6936M1001 | PVF.UN | PARTNERS VALUE INVESTMENTS L |

| US88634V1008 | DEFI | HASHDEX BITCOIN FUTURES ETF |

PTP Securities without Qualified Notices

Last updated 22-01-2024

| ISIN | Symbol | Description |

| US1182301010 | BPL | BUCKEYE PARTNERS LP |

| US3152931008 | FGPRQ | FERRELLGAS PARTNERS-LP |

| US1501851067 | FUN | CEDAR FAIR -LP |

| US29250R1068 | EEP | ENBRIDGE ENERGY PARTNERS LP |

| US0309751065 | APU | AMERIGAS PARTNERS-LP |

| US40636T2033 | HRY | HALLWOOD RLTY PARTNERS L P |

| US8644821048 | SPH | SUBURBAN PROPANE PARTNERS LP |

| US3719271047 | GEL | GENESIS ENERGY L.P. |

| US8810052014 | TNH | TERRA NITROGEN COMPANY LP |

| US6442061049 | NEN | NEW ENGLAND REALTY ASSOC-LP |

| US7328571077 | POPE | POPE RESOURCES |

| US2937921078 | EPD | ENTERPRISE PRODUCTS PARTNERS |

| US7265031051 | PAA | PLAINS ALL AMER PIPELINE LP |

| US87233Q1085 | TCP | TC PIPELINES LP |

| US01877R1086 | ARLP | ALLIANCE RESOURCE PARTNERS |

| US5733311055 | MMLP | MARTIN MIDSTREAM PARTNERS LP |

| US25820R1059 | DMLP | DORCHESTER MINERALS LP |

| US29273R1095 | ETP.OLD | ENERGY TRANSFER PARTNERS LP |

| US4357631070 | HEP | HOLLY ENERGY PARTNERS LP |

| US89376V1008 | TLP | TRANSMONTAIGNE PARTNERS LP |

| US37946R1095 | GLP | GLOBAL PARTNERS LP |

| US0966271043 | BWP | BOARDWALK PIPELINE PARTNERS |

| US23311P1003 | DCP | DCP MIDSTREAM L.P. |

| US1314761032 | CLMT | CALUMET SPECIALTY PRODUCTS |

| US29273V1008 | ET | ENERGY TRANSFER LP |

| US01881G1067 | AB | ALLIANCEBERNSTEIN HOLDING LP |

| US01861G1004 | AHGP | ALLIANCE HOLDINGS GP LP |

| US68268N1037 | OKS | ONEOK PARTNERS LP |

| US26926V1070 | EVEPQ | EV ENERGY PARTNERS LP |

| US1067761072 | BBEPQ | BREITBURN ENERGY PARTNERS LP |

| US34958B1061 | FIG.OLD | FORTRESS INVESTMENT GRP-CL A |

| US16411Q1013 | CQP | CHENIERE ENERGY PARTNERS LP |

| US67058H1023 | NS | NUSTAR ENERGY LP |

| US67059L1026 | NSH.OLD | NUSTAR GP HOLDINGS LLC |

| US84756N1090 | SEP | SPECTRA ENERGY PARTNERS LP |

| US55608B1052 | MIC.USD | MACQUARIE INFRASTRUCTURE HOL |

| US4511001012 | IEP | ICAHN ENTERPRISES LP |

| US92205F1066 | VNRSQ | VANGUARD NATURAL RESOURCES |

| US9582541044 | WES.OLD | WESTERN GAS PARTNERS LP |

| US30242M1062 | XXFPL | FFP PARTNERS -LP-CL A |

| US9126132052 | DNO | UNITED STATES SHORT OIL FUND |

| US09625U1097 | BKEP | BLUEKNIGHT ENERGY PARTNERS L |

| US6546781013 | NKA | NISKA GAS STORAGE PARTNERS-U |

| US2128491030 | CWPS | CONWEST PARTNERSHIP LP-UNITS |

| US0548071028 | AZLCZ | AZTEC LAND & CATTLE LTD |

| US26827L1098 | ECTM | ECA MARCELLUS TRUST I |

| US38349K1051 | GDVTZ | GOULD INVESTORS LP |

| US5053461068 | LAACZ | LAACO LTD-UNITS OF LTD PRTNS |

| US1534231089 | ENGY | CENTRAL ENERGY PARTNERS LP |

| US80007T1016 | SDTTU | SANDRIDGE MISSISSIPPIAN TRUS |

| US62913M1071 | NGL | NGL ENERGY PARTNERS LP |

| US12547R1059 | CIFC | CIFC LLC |

| US02752P1003 | AMID.OLD | AMERICAN MIDSTREAM PARTNERS |

| US09625U2087 | BKEPP | BLUEKNIGHT ENERGY PARTNERS - SERIES A PREF UNIT |

| US1651851099 | CHKR | CHESAPEAKE GRANITE WASH TRUS |

| US5860481002 | MEMPQ | MEMORIAL PRODUCTION PARTNERS |

| US0293162055 | ICTPU.OLD | AMERICAN RESTAURANT PRTNR LP |

| US04941A1016 | ARPJQ | ATLAS RESOURCE PARTNERS LP |

| US6740012017 | OAK | OAKTREE CAPITAL GROUP LLC |

| US26885B1008 | EQM | EQM MIDSTREAM PARTNERS LP |

| US74347W7424 | EUFX.OLD | PROSHARES SHORT EURO ETF |

| US74347W4603 | CROC | PROSHARES ULTRASHORT AUD |

| US6658261036 | NTI | NORTHERN TIER ENERGY LP |

| US9117831084 | UHN | UNITED STATES DIESEL-HEATING |

| US4283371098 | HCRSQ | HI-CRUSH INC |

| US55336V1008 | MPLX | MPLX LP |

| US84130C1009 | SXEEQ | SOUTHCROSS ENERGY PARTNERS L |

| US24664T1034 | DKL | DELEK LOGISTICS PARTNERS LP |

| US02052T1097 | ALDW | ALON USA PARTNERS LP |

| US90290N1090 | USAC | USA COMPRESSION PARTNERS LP |

| US86722Y1010 | SXCP | SUNCOKE ENERGY PARTNERS LP |

| US12663P1075 | CVRR | CVR REFINING LP |

| US48248A6038 | KFN PRCL | KKR FINANCIAL HOLDINGS |

| US64881E1091 | NSLPQ | NEW SOURCE ENERGY PARTNERS L |

| BMG162491077 | BPY | BROOKFIELD PROPERTY PARTNERS |

| US8746971055 | TEP | TALLGRASS ENERGY PARTNERS LP |

| US92205F2056 | VNRAQ | VANGUARD NATURAL RESOU |

| US5327711025 | LIN.OLD1 | LIN MEDIA LLC - A |

| US7185492078 | PSXP | PHILLIPS 66 PARTNERS LP |

| US98159G1076 | WPT | WORLD POINT TERMINALS LP |

| US2921022099 | OGCP | EMPIRE STATE REALTY OP-S60 |

| US2921023089 | FISK | EMPIRE STATE REALTY OP -S250 |

| US2921021000 | ESBA | EMPIRE STATE REALTY OP LP-ES |

| US8493431089 | SRLP | SPRAGUE RESOURCES LP |

| US03879N1019 | ARCX | ARC LOGISTICS PARTNERS LP |

| US59564N1037 | MEP | MIDCOAST ENERGY PARTNERS LP |

| US91914J1025 | VLP | VALERO ENERGY PARTNERS LP |

| US29336U1079 | ENLK | ENLINK MIDSTREAM PARTNERS LP |

| US92205F3047 | VNGBQ | VANGUARD NATURAL RESOURCES LLC RED |

| US2924801002 | ENBL | ENABLE MIDSTREAM PARTNERS LP |

| US69318Q1040 | PBFX | PBF LOGISTICS LP |

| US9604171036 | WLKP | WESTLAKE CHEMICAL PARTNERS L |

| US92205F4037 | VNRCQ | VANGUARD NATURAL RESOU |

| US22758A1051 | CAPL | CROSSAMERICA PARTNERS LP |

| US9033181036 | USDP | USD PARTNERS LP |

| US2574541080 | DM.OLD | DOMINION ENERGY MIDSTREAM PA |

| US86765K1097 | SUN | SUNOCO LP |

| US8226341019 | SHLX | SHELL MIDSTREAM PARTNERS LP |

| US12637A1034 | CCLP | CSI COMPRESSCO LP |

| US7628191006 | RMP | RICE MIDSTREAM PARTNERS LP |

| US96108P1030 | WMLPQ | WESTMORELAND RESOURCE PARTNE |

| US96949L1052 | WPZ | WILLIAMS PARTNERS LP |

| US04929Q1022 | ATLS.OLD | ATLAS ENERGY GROUP LLC |

| US26923H1014 | RISE | SIT RISING RATE ETF |

| US09225M1018 | BSM | BLACK STONE MINERALS LP |

| US74347W2888 | UCD | PROSHARES ULTRA BLOOMBERG CO |

| US64881E3071 | NUSPQ | NEW SOURCE ENG PARTNERS LP 11%SR A |

| US3932211069 | GPP | GREEN PLAINS PARTNERS LP |

| US4038291047 | GYRO | GYRODYNE LLC |

| US91831H1068 | VPRB | VPR BRANDS LP |

| US87611X2045 | NGLS PRA | TARGA RESOURCES PARTNERS |

| US1724641097 | SIRE | SISECAM RESOURCES LP |

| US03957U1007 | APLP | ARCHROCK PARTNERS LP |

| US2263442087 | CEQP | CRESTWOOD EQUITY PARTNERS LP |

| US97718W1080 | GCC.USD | WISDOMTREE CONTINUOUS COMMOD |

| US63900P6088 | NRP | NATURAL RESOURCE PARTNERS LP |

| US51508J2078 | LMRKP | LANDMARK INFRASTRUCTURE |

| CA70214T1194 | PVF.UN.OL | PARTNERS VALUE INVESTMENTS I |

| BMG162521683 | BIP.PR.C | BROOKFIELD INFRASTRUCTUR |

| US976ESC3018 | FUR.ESC | WINTHROP REALTY TRUST - ESCROW |

| US65506L1052 | NBLX | NOBLE MIDSTREAM PARTNERS LP |

| US67058H2013 | NS PRA | NSUS 8 1/2 12/31/49 |

| BMG162521840 | BIP.PR.D | BROOKFIELD INFRASTRUCTUR |

| US74347W2219 | OILU.OLD | PROSHARES ULTRAPRO 3X CRUDE |

| US67058H3003 | NS PRB | NSUS 7 5/8 PERP PFD |

| US29278N1037 | ETP | ENERGY TRANSFER OPERATING LP |

| US62913M2061 | NGL PRB | NGL 9 PERP PFD |

| US67420T2069 | OMP | OASIS MIDSTREAM PARTNERS LP |

| US85814R3057 | SPLP PRT | STEEL PARTNERS HLDS L |

| US0556EL1098 | BPMP | BP MIDSTREAM PARTNERS LP |

| US20855T1007 | CCR | CONSOL COAL RESOURCES LP |

| US67058H4092 | NS PRC | NUSTAR ENERGY LP |

| US12654A1016 | CNXM | CNX MIDSTREAM PARTNERS LP |

| US59140L1008 | IDIV | METAURUS US EQUITY CUMULATIV |

| US59140L2097 | XDIV.OLD | METAURUS US EQUITY EX DIVIDE |

| US74347Y8057 | OILD.OLD1 | PROSHARES ULTRAPRO 3X SHORT |

| US26923H2004 | BDRY | BREAKWAVE DRY BULK SHIPPING |

| US29278N3017 | ETP PRC | ENERGY TRANSFER PARTNERS |

| US23311P2092 | DCP PRB | DCP MIDSTREAM LP |

| US46140H2058 | DBS | INVESCO DB SILVER FUND |

| US46140H6018 | DGL | INVESCO DB GOLD FUND |

| US46139B1026 | DBV | INVESCO DB G10 CURRENCY HARV |

| US29278N4007 | ETP PRD | ENERGY TRANSFER PARTNERS |

| US37946R2085 | GLP PRA | GLOBAL PARTNERS LP |

| US23311P3082 | DCP PRC | DCP 7.95 PERP PFD - DCP MIDSTREAM LP |

| US64ESC19977 | NYRT.ESC | NEW YORK REIT INC - ESCROW |

| US9586691035 | WES | WESTERN MIDSTREAM PARTNERS L |

| US62913M3051 | NGL PRC | NGL ENERGY PARTNERS LP |

| US29278N5095 | ETP PRE | ENERGY TRANSFER OPERATNG |

| SGXC28500103 | LIW | EAGLE HOSPITALITY TRUST |

| US2263443077 | CEQP PR | CRESTWOOD EQUITY PARTNER |

| KYG9325C1050 | VTDRF | VANTAGE DRILLING INTERNATION |

| US59560V2088 | MCEP | MID-CON ENERGY PARTNERS LP |

| US55406N2027 | PFDM | PFD MYT HLDG CO BE+ |

| US55406N1037 | MYTH | MYT HLDG LLC BE+ |

| US8661424098 | SMLP | SUMMIT MIDSTREAM PARTNERS LP |

| US1266332055 | UAN | CVR PARTNERS LP |

| US36761Q1058 | GWYGU | GATEWAY GARAGE PARTNERS LLC |

| US37946R3075 | GLP PRB | GLOBAL PARTNERS LP |

| US29273V6056 | ET PRE | ENERGY TRANSFER LP 7.6% PERP PFD U |

| US29273V5066 | ET PRD | ENERGY TRANSFER LP 7.625% PERP PFD |

| US29273V4077 | ET PRC | ENERGY TRANSFER LP |

| US3152932097 | FGPR | FERRELLGAS PARTNERS-LP |

| US3152933087 | FGPRB | FERRELLGAS PARTNERS LP-B |

| US74347Y8396 | UVXY.OLD | PROSHARES ULTRA VIX ST FUTUR |

| US0806941029 | OZ | BELPOINTE PREP LLC |

| US93964X1063 | WPG. | WASHINGTON PG INC UNRESTRICTED SHARES |

| CA70214T2002 | PVI.II | PARTNERS VALUE INVESTMENTS LP |

| CA70214T3091 | PVI.III | PARTNERS VALUE INVESTMENTS LP SERIES 3 |

| CA70214T4081 | PVI.IIII | PARTNERS VALUE INVESTMENTS LP SERIES 4 |

| US092ESC0377 | BGIO.ESC | ESC BGIO LIQUIDATION TRUST |

| US90205J1025 | TESLU | 286 LENOX PARTNERS LLC |

| US02364V2060 | GHI | GREYSTONE HOUSING IMPACT INV |

| US21258A2015 | SPKX | CONVXTY SHS 1X SPIKES FUTUR |

| US21258A1025 | SPKY | CONVXTY SHS DAILY 1.5X SP FU |

| US41988L2025 | NNUTU | HAWAIIAN MACADAMIA NUT ORCHA |

| US87313P1030 | TXO | TXO PARTNERS LP |

| US26923H3093 | BWET | BREAKWAVE TANKER SHIP ETF |

| US30053M2035 | SNMP | EVOLVE TRANSITION INFRASTRUC |

| US28252B8871 | EFSH.OLD | 1847 HOLDINGS LLC |

| US55285N1090 | MDBH | MDB CAPITAL HOLDINGS LLC |

| US55445L1008 | MNR | MACH NATURAL RESOURCES LP |

| US29273V7047 | ET PRI | ENERGY TRANSFER LP |

| BMG6936M1001 | PVF.UN | PARTNERS VALUE INVESTMENTS L |

| BMG6936M1183 | PVF.PR.U | PARTNERS VALUE INVEST LP |

| BMG6936M1266 | PVI.II.SP | PARTNERS VALUE INVESTMENTS LP - PREF UNIT LTD PRTNS SR 2 CL |

| BMG6936M1423 | PVIIII.P | PARTNERS VALUE INVESTMENTS LP - PREF UNIT LTD PRTNS SR 4 CL |

| BMG6936M1340 | PVIIII.P | PARTNERS VALUE INVESTMENTS LP - PREF UNIT LTD PNTRS SR 3 CL |

| US28252B8798 | EFSH | 1847 HOLDINGS LLC |

| US88634V1008 | DEFI | HASHDEX BITCOIN FUTURES ETF |

Information on Irish Interest Withholding

The Irish Tax Authority requires IBKR to collect withholding tax on interest earned in Ireland. This withholding is at a rate of 20% and must be deducted from interest payments to your account.

Please note withholding tax applies to all clients who are resident in Ireland, whether individuals (including partnerships) or companies.

Withholding tax does not apply to clients who are companies in countries that are members of the European Union (excluding Ireland) or companies in countries that have a Double Tax Agreement (DTA) with Ireland.

For other clients in the EU (excluding Ireland) or if you are a non-resident of Ireland but tax resident in a country with a Double Tax Agreement (DTA) with Ireland, you may complete Form 8-3-6, that will reduce or eliminate your withholding tax. In addition to providing your information, you will need to have the form completed by the tax authority in the country where you are a tax resident.

You will require the following information in order to complete Form 8-3-6.

1. Client name (please ensure this matches the name on your IBKR account).

2. Client address.

3. Tax reference number in country of residence.

4. The country in which the client is resident for tax.

5. The rate of withholding tax between the country of tax residence and Ireland (see below).

6. Signature.

7. Date.

On completion of the form, you should submit it to the local tax authority in the country of your residence. The local tax authority must sign and stamp the form. As per below, Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch.

Once you receive the completed form from your local tax authority, please email a PDF or JPEG copy of the fully signed form to tax-withholding@interactivebrokers.com.

Please note, the withholding tax rate depends on the DTA between Ireland and your country of tax residence which can be found on the Irish Revenue website https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

For your convenience, we have prepared the forms to include items 3 to 5 above for all countries in the European Economic Area (“EEA”). Clients will need to complete the other items in 1 to 7 above.

For clients outside the EEA please use this form when the withholding tax rate is 0% and this form in all other cases.

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

|

|

|

|

Классификация нефинансовых организаций согласно FATCA

Введение

Компания Interactive Brokers ("IB", "мы") обязана собирать определенные данные клиентов в целях соблюдения Закона США о налогообложении иностранных счетов (Foreign Account Tax Compliance Act, сокр. FATCA) и других соглашений о международном обмене информацией.

Данная статья содержит схемы и примечания, которые описывают положения Налоговой службы США в отношении:

1. Налоговой классификации в целях определения того, какую налоговую форму должно заполнить юр.лицо – W-8 или W-9; и

2. Классификации юр.лиц, предоставляющих форму W-8 (часть I, раздел 5), согласно регламенту FATCA.

![]() Примечание. Приведенные схемы и примечания не охватывают все возможные ситуации, и в Вашем случае может лучше подходить вариант, который не содержится в этой статье. Если после прочтения данной статьи Вы не уверены, к какой категории Вы относитесь в рамках классификации согласно законодательству США и/или FATCA, рекомендуем проконсультироваться с налоговым специалистом.

Примечание. Приведенные схемы и примечания не охватывают все возможные ситуации, и в Вашем случае может лучше подходить вариант, который не содержится в этой статье. Если после прочтения данной статьи Вы не уверены, к какой категории Вы относитесь в рамках классификации согласно законодательству США и/или FATCA, рекомендуем проконсультироваться с налоговым специалистом.

Что НЕ рассматривается в данной статье:

Данная памятка предназначена для иностранных юр.лиц, которые (1) являются бенефициарными владельцами платежей, вносимых на счет, и (2) не являются финансовыми учреждениями. Данная статья не распространяется на:

• Частных лиц (используйте форму W-9 или W-8BEN);

• Юридических лиц США (используйте форму W-9);

• Юридических лиц, выступающих в роли посредника (например, номинальных владельцев, брокеров, депозитариев, инвестиционных консультантов) в интересах другого лица (используйте форму W-8IMY);

• Иностранные организации, освобожденные от уплаты налогов, и частные фонды;

• Финансовые учреждения.

![]() Примечание. США заключили двусторонние "межправительственные соглашения" (МПС) со многими странами в целях исполнения FATCA. В некоторых случаях положения МПС могут устанавливать другой регламент, чем описанный в этой памятке. Если на юр.лицо распространяется действие МПС, то для определения его обязательств рекомендуется обратиться к положениям данного соглашения и/или налоговому консультанту.

Примечание. США заключили двусторонние "межправительственные соглашения" (МПС) со многими странами в целях исполнения FATCA. В некоторых случаях положения МПС могут устанавливать другой регламент, чем описанный в этой памятке. Если на юр.лицо распространяется действие МПС, то для определения его обязательств рекомендуется обратиться к положениям данного соглашения и/или налоговому консультанту.

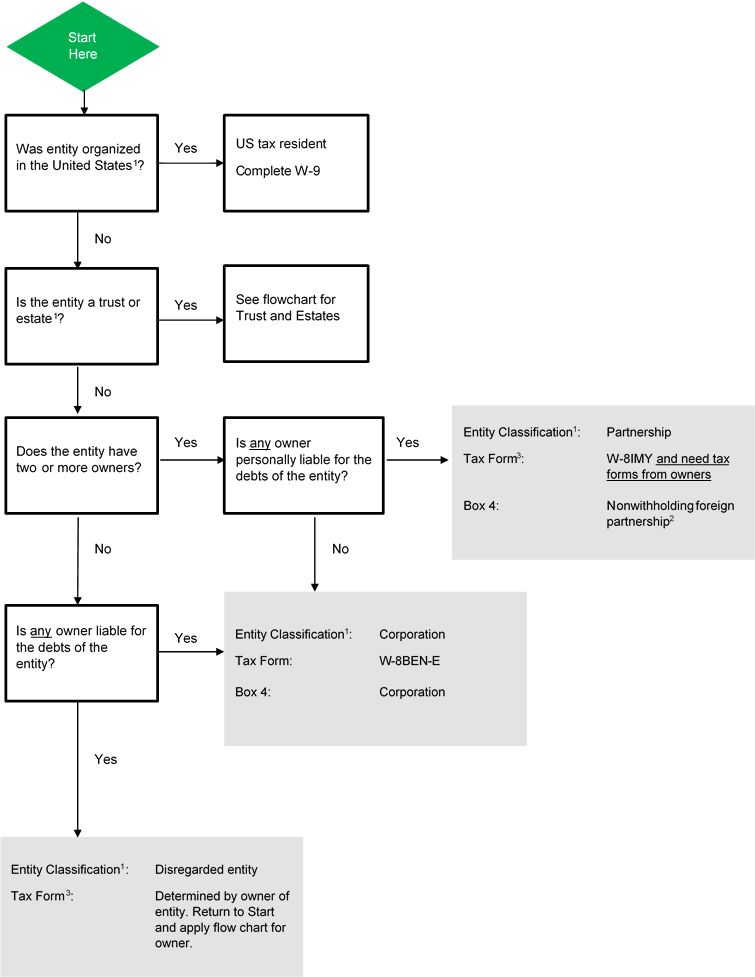

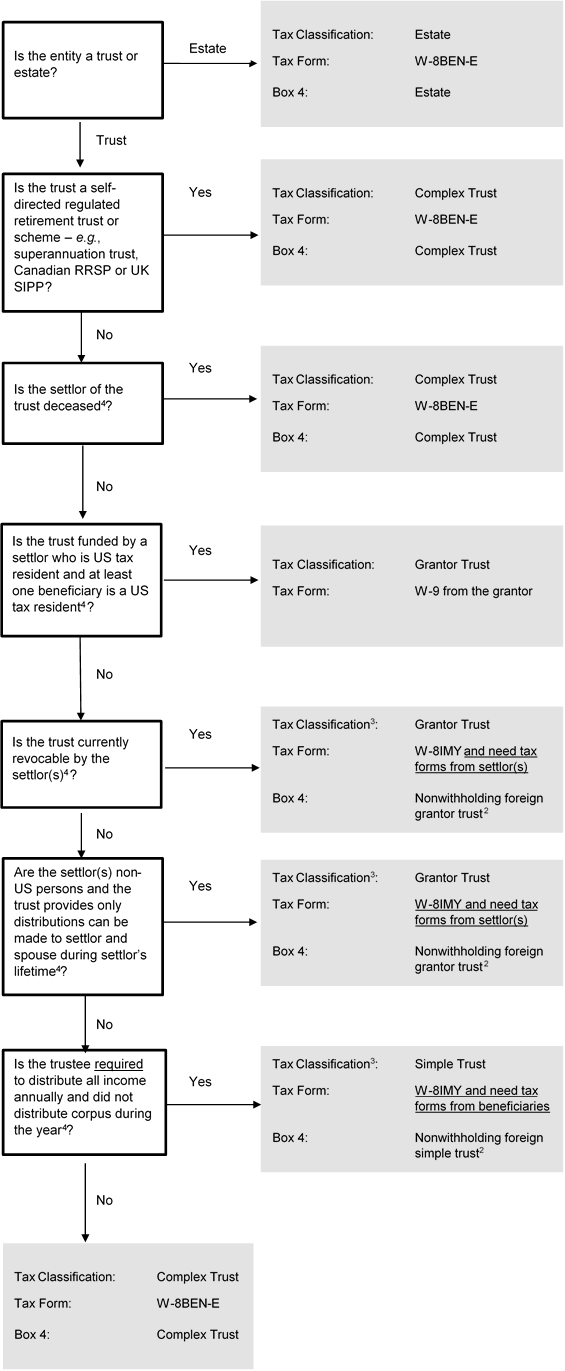

1. Классификация по налоговому законодательству США

От Вашей категории по доходу в рамках налогового законодательства США зависит, какие формы Вам необходимо заполнить. Схема ниже поможет определить, к какой категории Вы относитесь, а также какие налоговые формы Вам нужно предоставить.

Внимание! По законам США, налогом облагаются все доходы резидентов США вне зависимости от того, в какой стране они получены. Однако, нерезиденты обязаны уплатить налоги только с некоторых видов дохода от инвестиций, полученного в США (например, с дивидендов от компаний США и т.д.) Предоставление налоговой формы серии W-8 подтверждает, что Ваши доходы НЕ облагаются налогом как доходы резидента США. Форму W-8 также можно использовать, чтобы получить льготную налоговую ставку по договору об избежании двойного налогообложения с США.

Схема для определения налоговой категории и необходимых налоговых форм (для юр.лиц, кроме трастов)

Схема для определения налоговой категории и необходимых налоговых форм (для трастов)

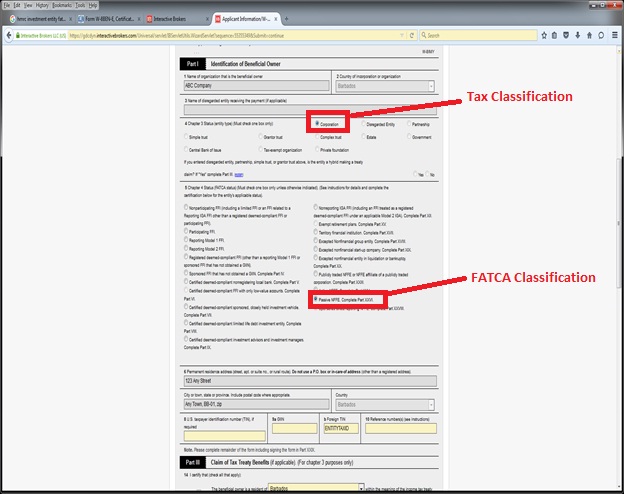

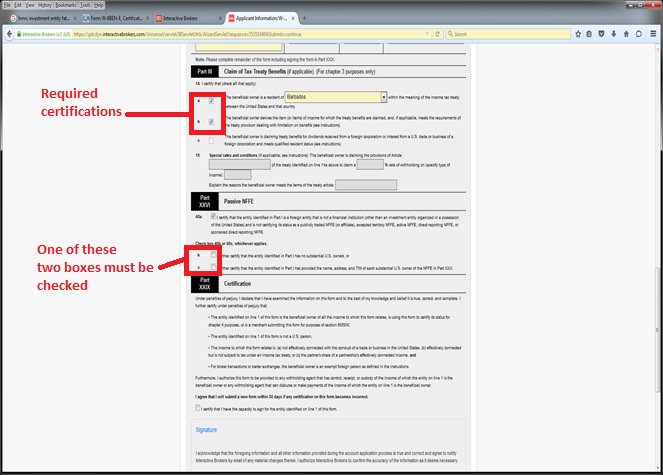

2. Классификация согласно FATCA

Формы W8 также используются для передачи данных о налоговой категории в рамках FATCA. Многие страны заключили межправительственные соглашения (МПС) с США, которые обязывают финансовые учреждения определять категорию своих клиентов согласно FATCA. Регламент МПС по определению налоговой категории может не совпадать с правилами, установленными Налоговой службой США (IRS). Некоторые учреждения договорились с Налоговой службой США о том, чтобы соблюдать положения FATCA и определять категории своих клиентов согласно FATCA по правилам IRS. Мы обязаны собирать эти данные. Схема ниже описывает регламент IRS по выбору категории FATCA по умолчанию и носит общий характер. Схема сопровождается скриншотами формы W-8BEN-E для распространенного типа счета: иностранной корпорации, которая в рамках FATCA относится к категории пассивных нефинансовых иностранных организаций (Non-Financial Foreign Entity, сокр. NFFE) и имеет право на льготную налоговую ставку.

![]() Примечание. Важно учитывать, что многие организации соответствуют параметрам нескольких налоговых категорий FATCA, и в таком случае Вы должны выбрать наиболее подходящую категорию. Ваша ситуация может не подпадать под общие правила. Рекомендуется самостоятельно обратиться за консультацией, поскольку мы не можем учесть все частные случаи и правила классификации включают множество факторов.

Примечание. Важно учитывать, что многие организации соответствуют параметрам нескольких налоговых категорий FATCA, и в таком случае Вы должны выбрать наиболее подходящую категорию. Ваша ситуация может не подпадать под общие правила. Рекомендуется самостоятельно обратиться за консультацией, поскольку мы не можем учесть все частные случаи и правила классификации включают множество факторов.

Схема для определения категории согласно FATCA

.png)

Пример: корпорация с обычной юридической формой владения с двумя или более владельцами, которые не несут личную ответственность за долговые обязательства организации. Как видно из схемы выше, данная корпорация должна предоставить форму W-8BEN-E. Если корпорация не относится к категории Foreign Financial Entity, или иностранной финансовой организации (т.е. не является банком, брокером, инвестиционным менеджером, хедж-фондом, взаимным фондом, страховой компанией), как указано в примечании 5 ниже, то по классификации FATCA она относится к пассивным NFFE. Скриншоты формы W-8BEN-E для этой организации приведены ниже.

Образец W-8BEN-E для пассивных NFFE

Примечания

1. Налоговая служба США установила правила для определения налоговой категории юр.лиц, учрежденных за пределами США. Эти правила применяются вне зависимости от того, к какой категории относятся эти юр.лица в стране учреждения.

Как правило, юридические лица рассматриваются как бенефициарные владельцы счета и должны заполнить форму W-8BEN-E, отметив графе "корпорация", если нет других факторов, описанных ниже.

Правила IRS устанавливают для каждого типа компании категорию по умолчанию. Чтобы изменить категорию, выбранную по умолчанию, необходимо подать документы в IRS и получить идентификационный номер работодателя (EIN). Некоторые компании не могут изменить свою категорию и всегда считаются корпорациями (например, юр.лица с такими формами, как Sociedad Anonima, Public Limited Company и Aktiengesellschaft). Полный список можно найти в разделе 301.7701-2(b)(8) Свода федеральных законов Министерства финансов США.

Категория по умолчанию обычно определяется на основе (1) числа владельцев и (2) несут ли владельцы личную ответственность за долговые обязательства компании согласно уставу организации (т.е. банковские соглашения и другие соглашения, заключенные владельцами, не учитываются). В следующей таблице описаны правила для определения категории по умолчанию:

|

|

Число владельцев

|

Ответственность владельцев ограничена?

|

|

|||

|

|

Да

|

Нет

|

|

|||

|

|

1 владелец

|

Корпорация

|

Организация, не являющаяся юр. лицом (Disregarded Entity)

|

|

||

|

|

2 и более владельцев

|

Корпорация

|

Товарищество

|

|

||

|

|

|

|

||||

Примечание. Поскольку в случае с организацией, не являющейся юр. лицом, налоговую категорию определяет ее владелец, данная схема может быть полезна для такой организации в США, если ее владельцем является иностранное лицо.

Если фискально-прозрачная организация (например, товарищество, простой траст или траст доверителя) использует форму W-8IMY IRS, то она должна предоставить налоговые формы IRS для всех ее бенефициарных владельцев (партнеров товарищества, бенефициаров простого траста или учредителей траста доверителя) в целях регистрации счета в налоговой системе США.

Некоторые паевые инвестиционные фонды (Unit Investment Trusts) не считаются трастами в налоговой системе США, например, трасты, где есть возможность менять инвестиции. Данные инвестиционные фонды рассматриваются как обычные коммерческие организации по правилам, описанным выше (т.е. как корпорация, товарищество или организация, не являющаяся юр. лицом).

Наконец, в целях налогообложения в США траст (кроме паевых инвестиционных фондов, считающихся коммерческими организациями) считается иностранным трастом, если (1) суд за пределами США может осуществлять первичный контроль над руководством траста и (2) какое-либо иностранное физическое лицо может контролировать (или запрещать) любое "важное решение" траста.

Схема представляет собой классификацию по умолчанию и не учитывает юр.лиц, которые заведомо являются корпорациями.

2. Товарищество, простой траст и траст доверителя могут заключить с Налоговой службой США соглашение о налоговых удержаниях, по которому данные организации соглашаются удерживать со счета налоги США. Схема приведена без учета наличия соглашения о налоговых удержаний.

3. Как правило, налоговые льготы, предусмотренные соглашением с США, предоставляются бенефициарному владельцу дохода, определяемого согласно принципам налогообложения США. Для фискально-прозрачных организаций (например, товарищество, простой траст, траст доверителя, организация, не являющаяся юр. лицом) это означает, что льготы по налоговому соглашению действуют для владельцев, А НЕ САМОЙ ОРГАНИЗАЦИИ. Бенефициарный владелец сообщает о праве на льготы в налоговой форме W8. Однако в редких случаях юр.лицо может считаться фискально-прозрачным в рамках налогообложения США, но не иметь такой статус в стране, с которой США заключили налоговое соглашение. В таком случае юр.лицо является "гибридным образованием". В некоторых случаях гибридное образование – а не его владельцы – может претендовать на налоговые льготы по соглашению с США, если оно отвечает критериям резидентства в рамках соответствующего налогового соглашения. Гибридное образование, отвечающее необходимым критериям, сообщает о своих правах на льготы с помощью формы W-8BEN-E, а также формы, указанной в схеме. Обращаем внимание, что гибридный статус не отменяет необходимость в регистрации всех бенефициарных владельцев. Следует отметить, что обычно гибридные образования не претендуют на налоговые льготы. Чаще льготы запрашивают бенефициарные владельцы в своих налоговых формах.

4. Правила для определения категории траста учитывают множество факторов. В схеме приведены только общие принципы. На выбор категории влияют многие условия, не указанные в схеме. Например, бенефициарами простого траста не могут быть благотворительные фонды.

5. Что считается иностранным финансовым учреждением в рамках FATCA?

Все категории FATCA можно разделить на две группы: иностранные финансовые учреждения – Foreign Financial Institutions (FFI) – и нефинансовые иностранные организации – Non-Financial Foreign Entities (NFFE). В целом к финансовым учреждениям относятся:

• Банковские организации (Depository Institution)

• Депозитарные организации (Custodial Institution)

• Инвестиционные компании (Investment Entity)

• Страховые компании (Insurance Company), выпускающие определенные договоры страхования с накоплением средств или аннуитеты.

Как правило, FFI должно быть зарегистрировано в IRS, получить глобальный идентификационный номер посредника – Global Intermediary Identification Number (GIIN) – и предоставлять отчеты о своих клиентах/владельцах в соответствующие надзорные органы. Если организация не соответствует критериям финансового учреждения, то она считается NFFE и описывается в этой статье.

Согласно положениям Налоговой службы США и межправительственных соглашений:

• Банковская организация – это учреждение, которое принимает вклады в ходе обычной банковской или сходной деятельности. Включает банки и кредитные союзы.