Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

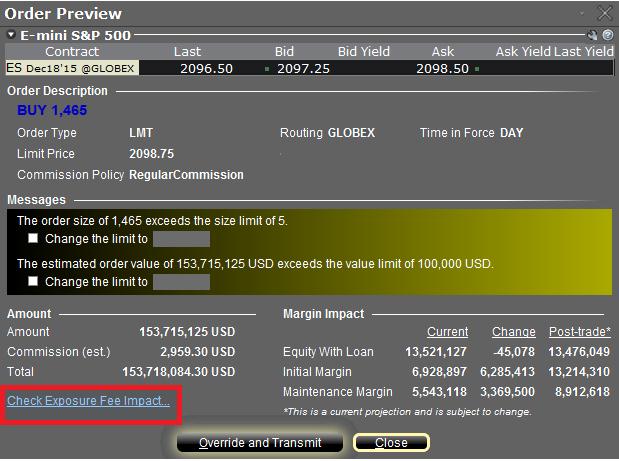

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

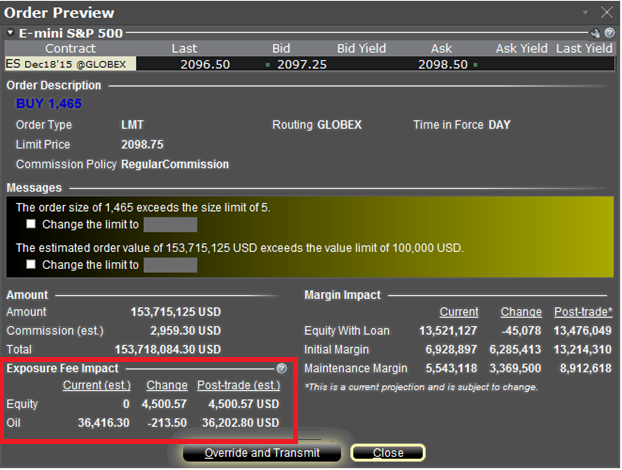

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days

Using Risk Navigator to Project Exposure Fees

IB's Risk Navigator provides a custom scenario feature which allows one to determine what effect, if any, changes to their portfolio will have to the Exposure fee. Outlined below are the steps for creating a “what-if” portfolio through assumed changes to an existing portfolio or through an entirely new proposed portfolio along with determining the resultant fee. Note that this feature is available through TWS build 971.0i and above.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please see KB2344 for information on monitoring the Exposure fee through the Account Window and KB2276 for verifying exposure fee through the Order Preview screen.

Important Note

1. The on-demand Exposure Fee check represents a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

Overview of Margin Methodologies

Introduction

Where to Learn More

Tools provided to monitor and manage margin

How to determine if you are borrowing funds from IBKR

Why does IBKR calculate and report a margin requirement when I am not borrowing funds?

Margin Requirement on Leveraged ETF Products

Leveraged Exchange Traded Funds (ETFs) are a subset of general ETFs and are intended to generate performance in multiples of that of the underlying index or benchmark (e.g. 200%, 300% or greater). In addition, some of these ETFs seek to generate performance which is not only a multiple of, but also the inverse of the underlying index or benchmark (e.g., a short ETF). To accomplish this, these leveraged funds typically include among their holdings derivative instruments such as options, futures or swaps which are intended to provide the desired leverage and/or inverse performance.

Exchange margin rules seek to recognize the additional leverage and risk associated with these instruments by establishing a margin rate which is commensurate with that level of leverage (but not to exceed 100% of the ETF value). Thus, for example, whereas the base strategy-based maintenance margin requirement for a non-leveraged long ETF is set at 25% and a short non-leveraged ETF at 30%, examples of the maintenance margin change for leveraged ETFs are as follows:

1. Long an ETF having a 200% leverage factor: 50% (= 2 x 25%)

2. Short an ETF having a 300% leverage factor: 90% (= 3 x 30%)

A similar scaling in margin is also in effect for options. For example, the Reg. T maintenance margin requirement for a non-leveraged, short broad based ETF index option is 100% of the option premium plus 15% of the ETF market value, less any out-of-the-money amount (to a minimum of 10% of ETF market value in the case of calls and 10% of the option strike price in the case of puts). In the case where the option underlying is a leveraged ETF, however, the 15% rate is increased by the leverage factor of the ETF.

In the case of portfolio margin accounts, the effect is similar, with the scan ranges by which the leveraged ETF positions are stress tested increasing by the ETF leverage factor. See NASD Rule 2520 and NYSE Rule 431 for further details.

What happens if the net liquidating equity in my Portfolio Margining account falls below USD 100,000?

Portfolio Margining accounts reporting net liquidating equity below USD 100,000 are limited to entering trades which serve solely to reduce the margin requirement until such time as either: 1) the equity increases to above 100,000 or 2) the account holder requests a downgrade to Reg T style margining through Client Portal (select the Settings, Account Settings, Configure and Account Type menu options).

If a Portfolio Margining eligible account reporting net liquidating equity below USD 100,000 enters an order which, if executed, would serve to increase the margin requirement, the following TWS message will be displayed: "Your order is not accepted, margin requirement increase not allowed. Equity with loan value is less than 100,000.00 USD."

IMPORTANT NOTICE

Please note that requests to downgrade to Reg. T will become effective the following business day if submitted prior to 4:00 ET. Also note that as the Reg. T margining methodology generally affords less leverage than does Portfolio Margining, requesting a downgrade may lead to the automatic liquidation of positions in your account in order to comply with Reg. T. You will receive a warning message if that is the case at the time you request the downgrade.

-->

What positions are eligible for Portfolio Margining?

Portfolio Margining is eligible for US securities positions including stocks, ETFs, stock and index options and single stock futures. It does not apply to US futures or futures options positions or non-US stocks, which may already be margined using an exchange approved risk based margining methodology.

Are there any qualification requirements in order to receive Portfolio Margining treatment on US securities positions and how does one request this form of margin?

In order to enabled for portfolio margining an account must be approved for option trading and must have at least USD 110,000 in net liquidating equity (USD 100,000 to maintain, once enabled). Account holders will also be required to acknowledge and sign the Portfolio Margin Risk Disclosure document and be bound by its terms.

Portfolio margining may be requested through the on-line application phase (in the Account Configuration step) or after the account has been approved. To apply once the account has already been approved, log into Client Portal and select the Settings and Account Settings menu options. In the Configuration section, click the gear icon next to the words "Account Type". There you may choose the portfolio margin treatment which will initiate the approval process. Please note that requests are subject to review (generally a 1-2 day process) and may be declined for various reasons including a projected increase in margin upon upgrade from Reg T to Portfolio Margining.