My bank debited my account for the Fedwire that I sent to IBKR but IBKR has not yet credited the funds to my account. Why?

IBKR's bank typically posts incoming wires to IBKR's bank account within a few minutes. However, delays to the posting may occur if the volume of Fedwire activity is significant at that time.

- the client didn't submit a deposit notification

- the sending bank improperly formatted the wire (and therefore client identifiers do not appear on IBKR's bank reports)

- the sending bank misspelled the client’s name or incorrectly input other client identifiers so an automatic match to the deposit notification cannot occur

- IBKR's bank didn’t display the client identifiers on its bank reporting system (we then ask our bank for additional details on the incoming wire)

What happens if I trade a product denominated in a currency which I do not hold in my account?

The particular currency which is necessary to purchase and settle any given product is determined by the listing exchange, not IBKR. If, for example, you enter into a transaction to purchase a security which is denominated in a currency that you do not hold and assuming that you have a margin account and sufficient margin excess, IBKR will create a loan for those funds. Note that this is necessary as IBKR is obligated to settle that trade with the clearinghouse solely in the designated currency of denomination. If you do not wish to have such a loan created and incur its associated interest costs, you would need to either first deposit funds into your account in the required currency form and amount or convert existing funds in your account using either our IdealPro (for amounts in excess of USD 25,000 or equivalent) or odd lot (for amounts below USD 25,000 or equivalent) venues, both available through the TWS.

Also note that once you close out a security position which is denominated in a given currency, the proceeds will remain in that currency regardless of whether it is the Base Currency you've selected for your account. Accordingly, such proceeds will be subject to exchange rate risk relative to your Base Currency until such time you either perform a currency conversion or use those proceeds for another similarly denominated product.

Why does the Cash Report section of my Activity Statement reflect an internal transfer between securities and commodities?

For regulatory purposes IBKR is required to segregate the securities assets within your account from the commodities assets. Those commodities assets may include the market value of options on futures positions plus any cash required as margin as a result of commodities futures and options on futures positions. Periodically, the margin requirement on your commodities positions will be recomputed and should this requirement decline, cash in excess of that required as commodities margin will be transferred from the commodities side of your account to the securities side. Likewise, should the commodities margin requirement increase, IBKR will transfer any available cash from the securities side to the commodities side. As SIPC insurance is provided to assets on the securities side of your account but not the commodities, this periodic transfer is performed to ensure that your cash balance is afford the greatest protection possible. It should be noted that these cash movements represent journal entries within your account which serve to fully offset each other and therefore have no impact upon the aggregate cash balance within your account (see the Total column within the Cash Report section of the Activity Statement).

How to Initiate ACH Transfers

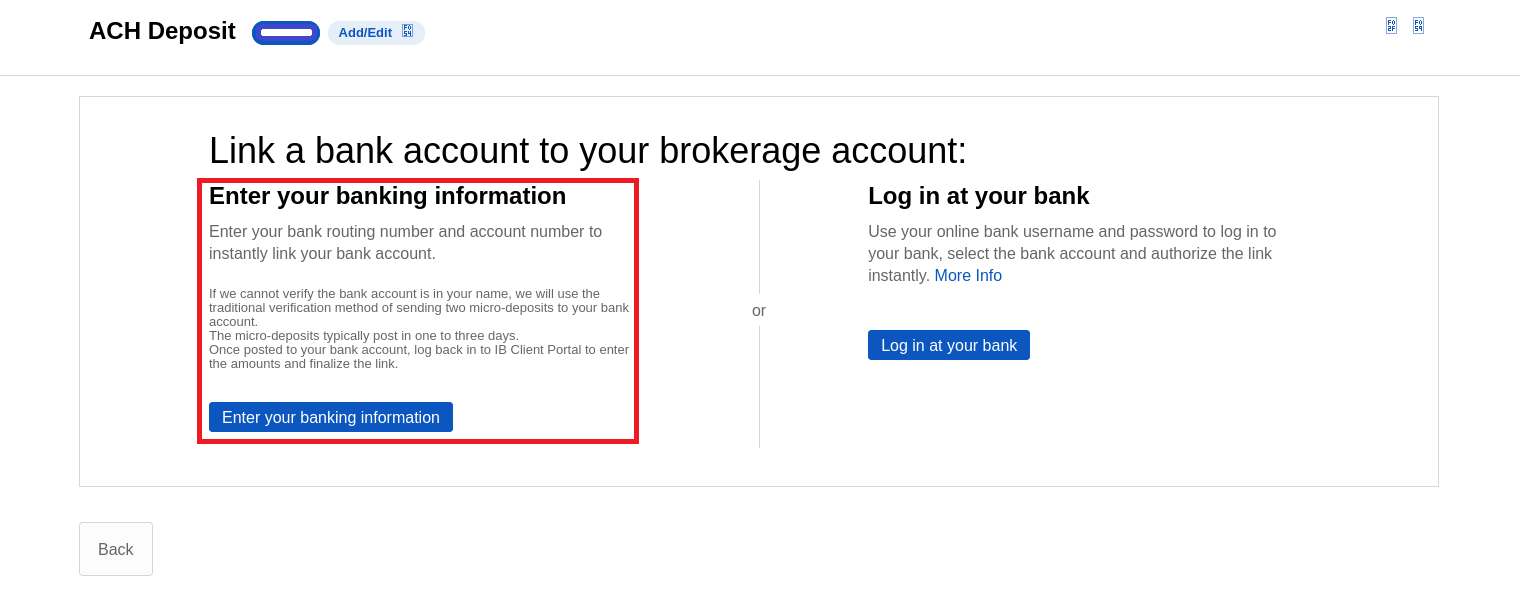

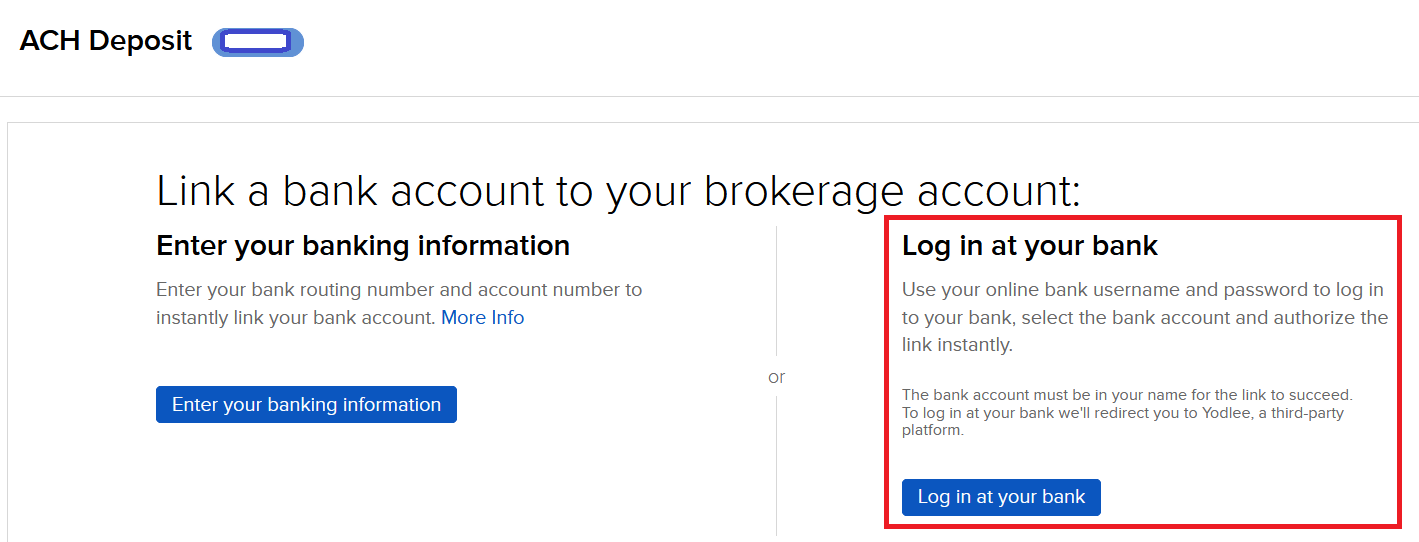

Automated Clearing House (ACH) deposits/withdrawals may be made to your IBKR account from and to your bank. The method referred to as ‘Connect Your Bank’ means your transfer request will be automatically processed through a message sent to your bank by IBKR. Prior to using this method, you will need to create a standing instruction through Transfer and Pay which authorizes IBKR and your bank to electronically transfer funds between the two accounts. You will be asked to verify your bank in one of two ways:

- Enter your banking information: You will be asked to enter your bank account number and routing number for instant verification. If we cannot verify the account is in your name, we will issue test transactions in the form of small debit and credit amounts to your bank account.

- Note: This request does not actually move your funds.

- Log in at your bank: You will be asked to select your bank and enter your username and password to verify your credentials immediately.

- Note: Verification by logging in at your bank uses a third-party service.

Once established, this transfer method can be used for future deposit and withdrawal requests.

Initiating an ACH Transfer:

- On the Transfer & Pay > Transfer Funds menu, after you select the transaction type, currency and the transaction method, you enter and save your bank information just as you would for any other deposit or withdrawal method.

Note: You do not enter an amount.

- For ACH withdrawals, as part of the bank information you enter, you are asked to enter a bank information name and select the Bank Information Usage. This selection tells us if you would like the ability to reuse this bank information for both withdrawals and deposits (Debit & Credit), or only withdrawals (Credit).

- You will be asked to verify your bank in one of two ways:

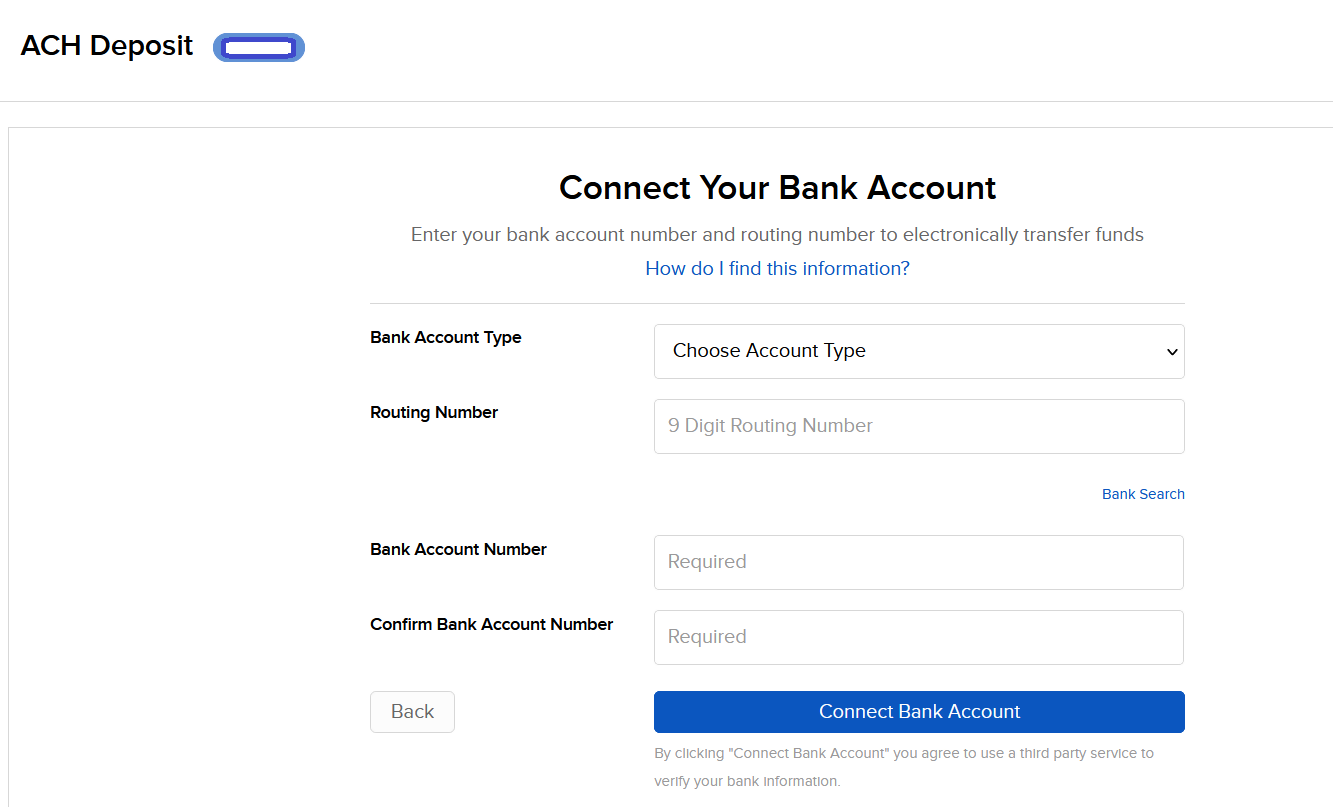

Enter your banking information

- Select: Enter your banking information

- Select the Bank Account Type

- Enter the Routing Number, Bank Account Number and Confirm the Bank Account Number below

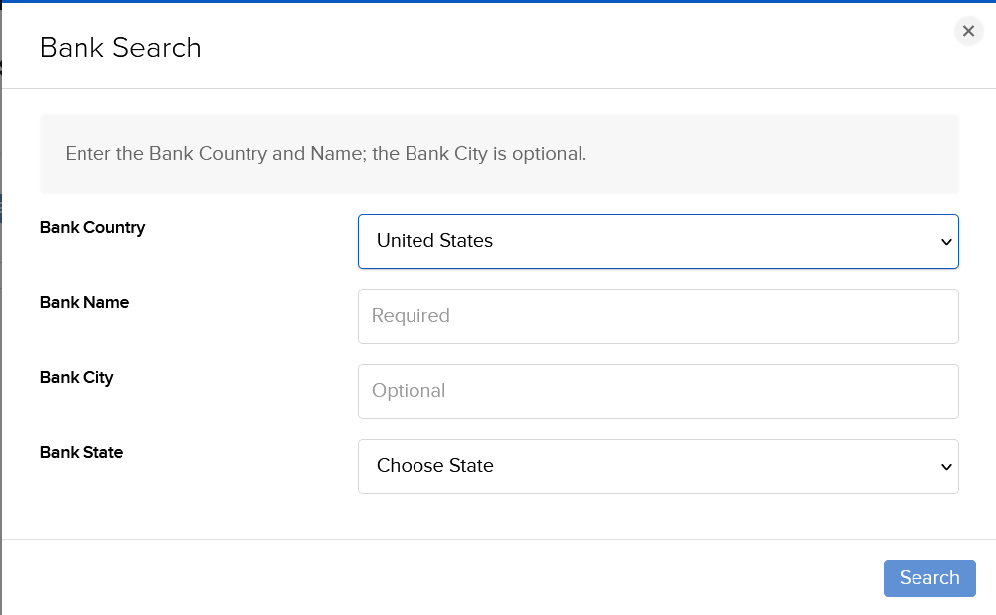

- Or use the Bank Search to find the Receiving Bank

- You will be asked to confirm your request via electronic signature and security token authentication which authorizes both IBKR and your bank to act upon any transfer requests you provide through IBKR;

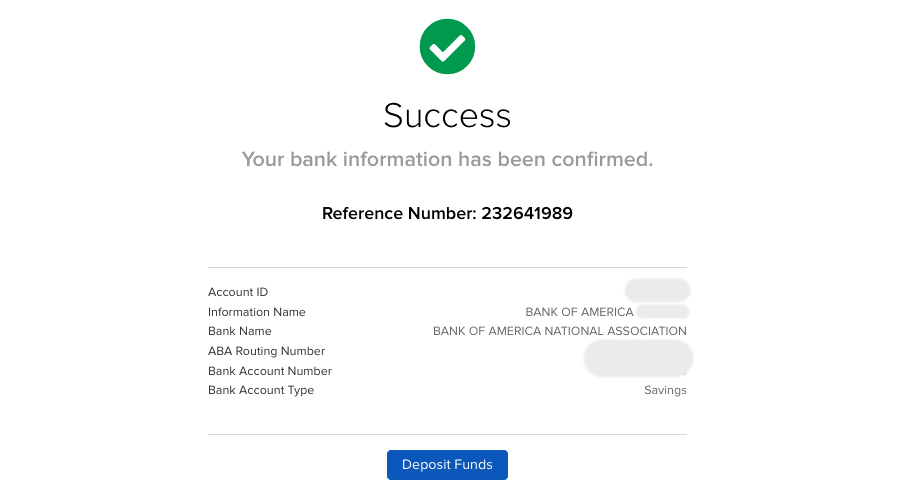

- If your bank account is in your name then your account will instantly link to your bank account. Then you can set up your deposit or withdrawal transfers.

- If we cannot verify the bank account is in your name, we will use the traditional verification method of sending two micro-deposits to your bank account.

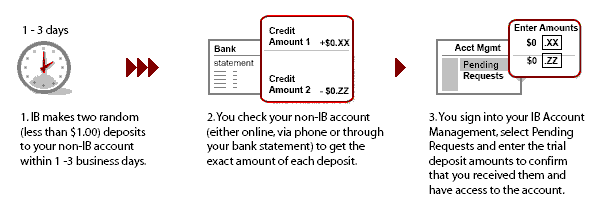

- Within 1-3 business days, two random credits (micro-deposits) each less than one dollar and a corresponding debit (withdrawal) will be issued to your bank account.

- You will need to monitor your bank account for these transactions as they will be needed to confirm this funding instruction.

- Note: These transactions may take place on different days.

- Once you have these amounts, log back in to Client Portal and from the Pending Items menu option select the Confirm Amount link adjacent to your instruction enter the credit amounts.

- After you have entered the correct amounts, you may use the ACH instruction for deposit and withdrawal transfers.

Log in at your bank

- Select: Log in at your bank

- Enter a Nickname

- Click the Verify Bank Account button

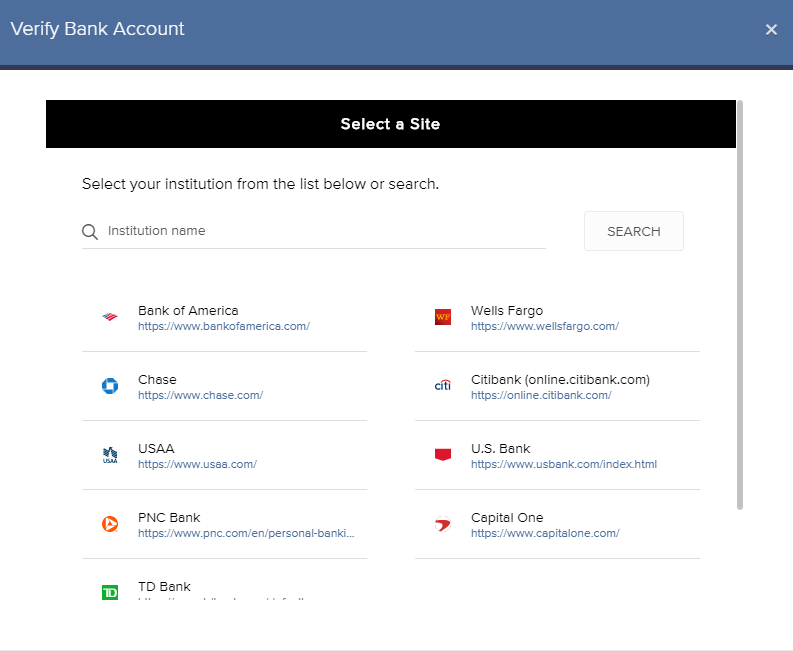

- Select your bank from the pop-up window

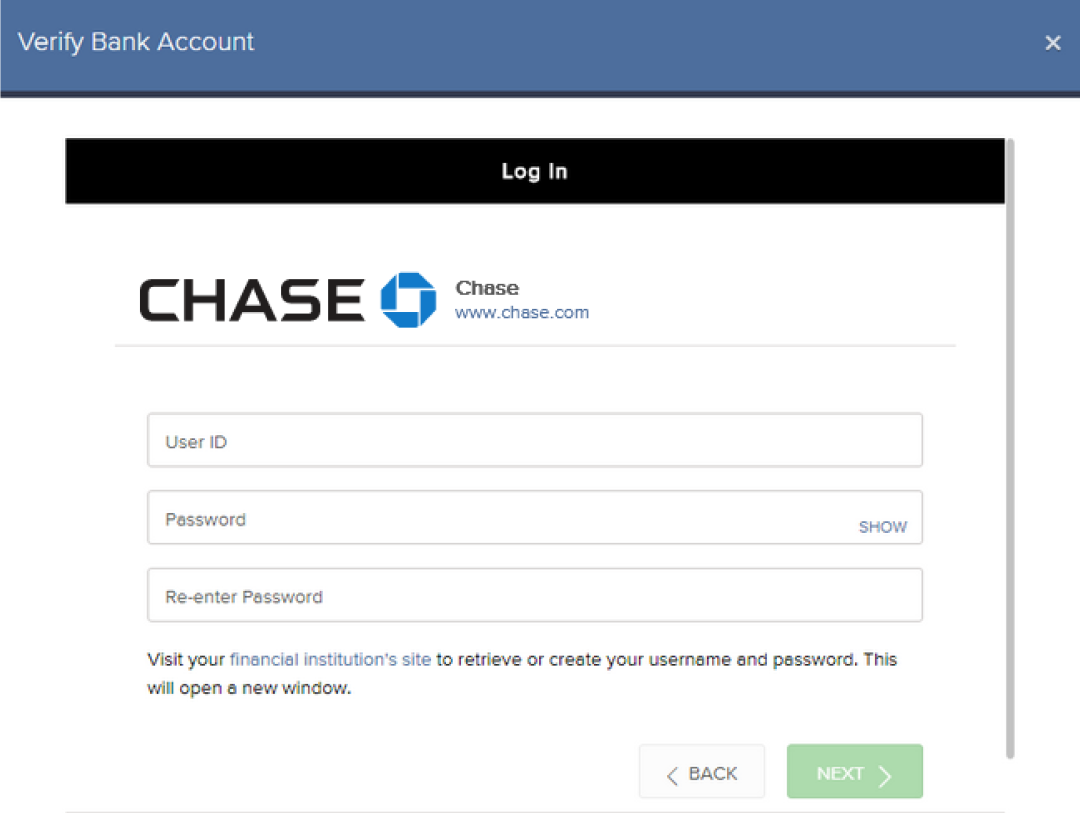

- Enter the login credentials for your online banking account, and click Next

- On the next screen, select the account you wish to use.

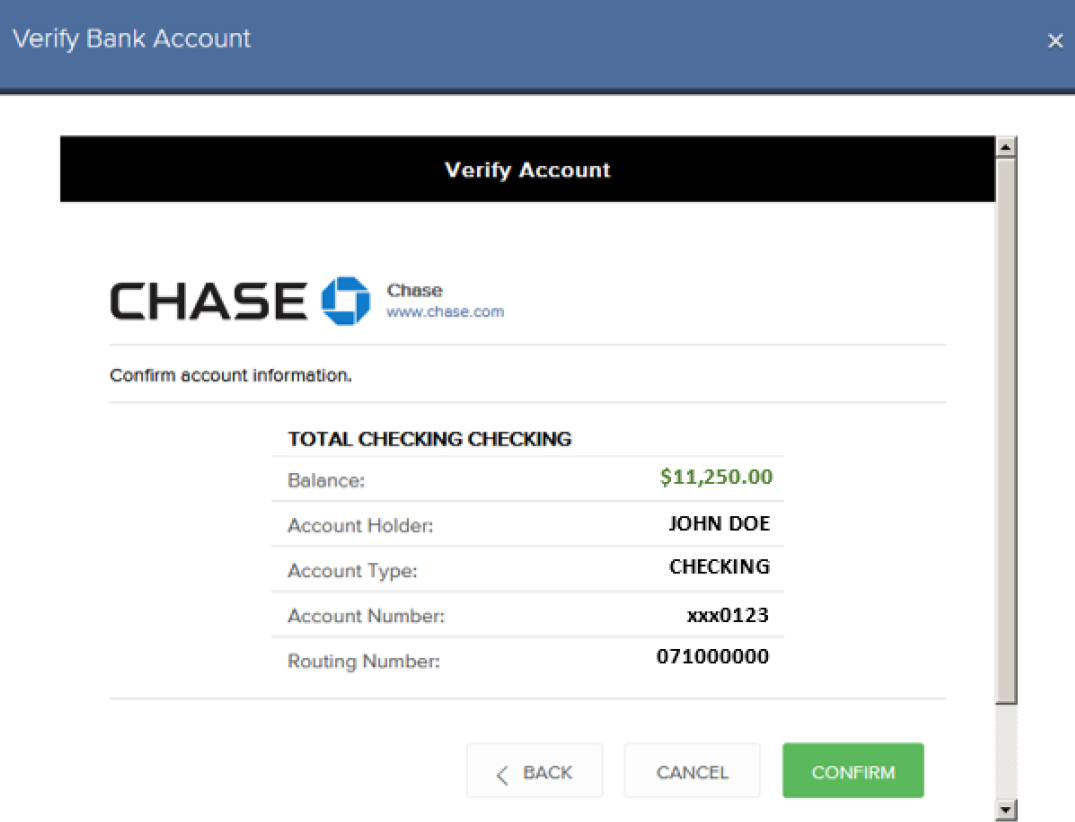

- The Verify Account screen will present the details of the account you selected. Click Confirm.

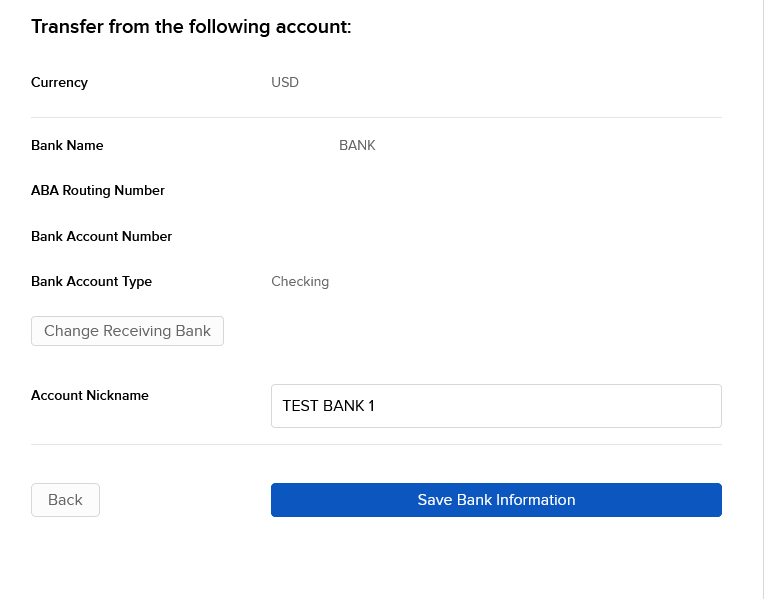

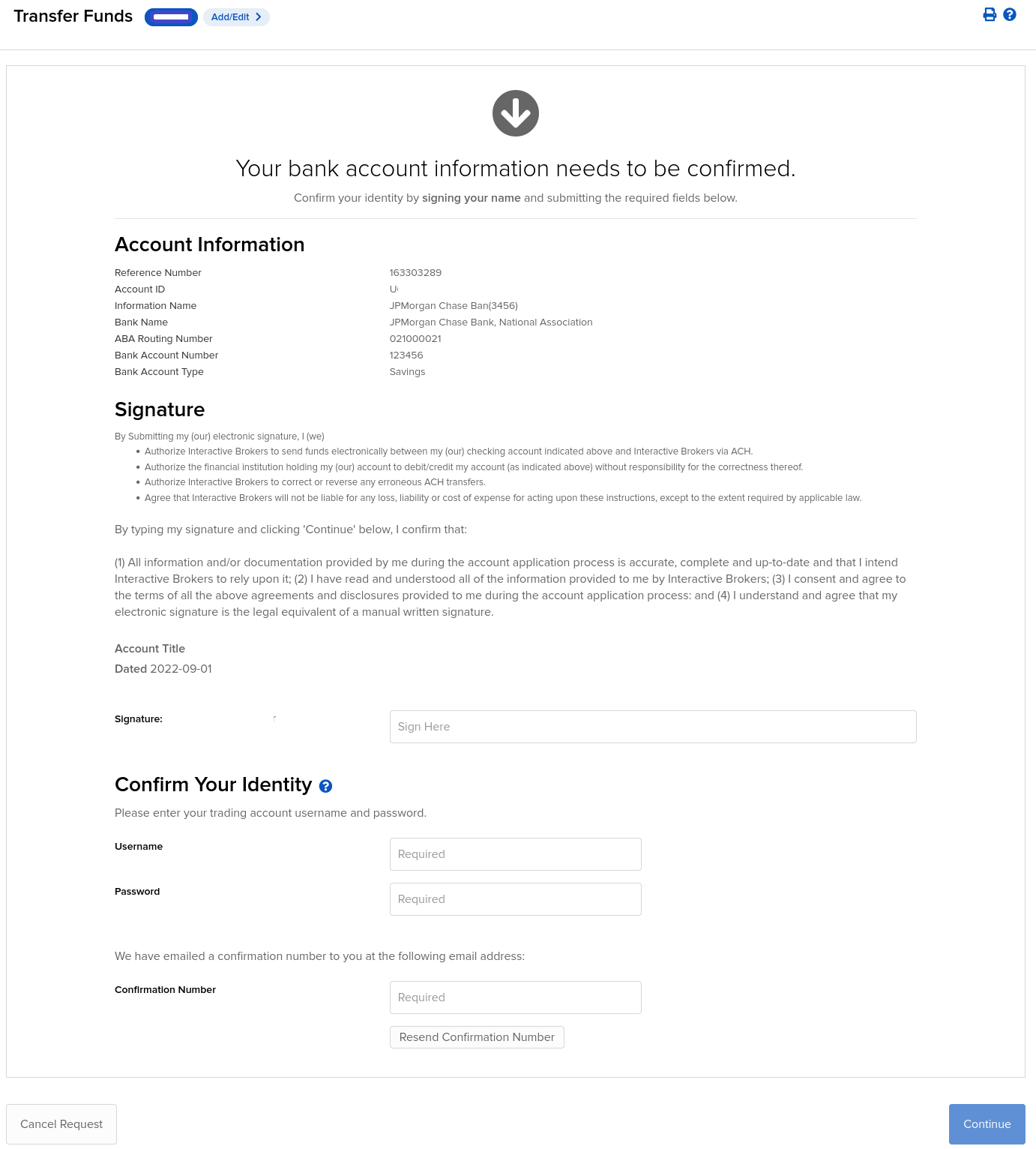

- Verify banking information and click Continue.

- Confirm and Sign on the next screen. Scroll down to enter your:

- Electronic Signature

- IBKR Username

- IBKR Password

Click Continue when complete. (OR, click Cancel Request if you do not wish to proceed.)

9. What appears next will be based on your Security Device:

If using Security Code Card:

a) The Card Values field will appear.

b) Follow the onscreen instructions and use your card to obtain values.

c) Enter values into Card Values.

If using either the Digital Security Card or IB Key App:

a) The Challenge Code and Passcode fields will appear.

b) Enter the Challenge Code into the Digital Security Card and press OK, OR on your smartphone, launch the IB Key App, enter the Challenge Code, and click Generate.

c) Enter the Response String returned into the Passcode field.

10. Click Continue.

Success! You may use this transfer method for future deposit and withdrawal transfers.

Be Careful…

For steps 4 and 6 above, the following points are important to keep in mind:

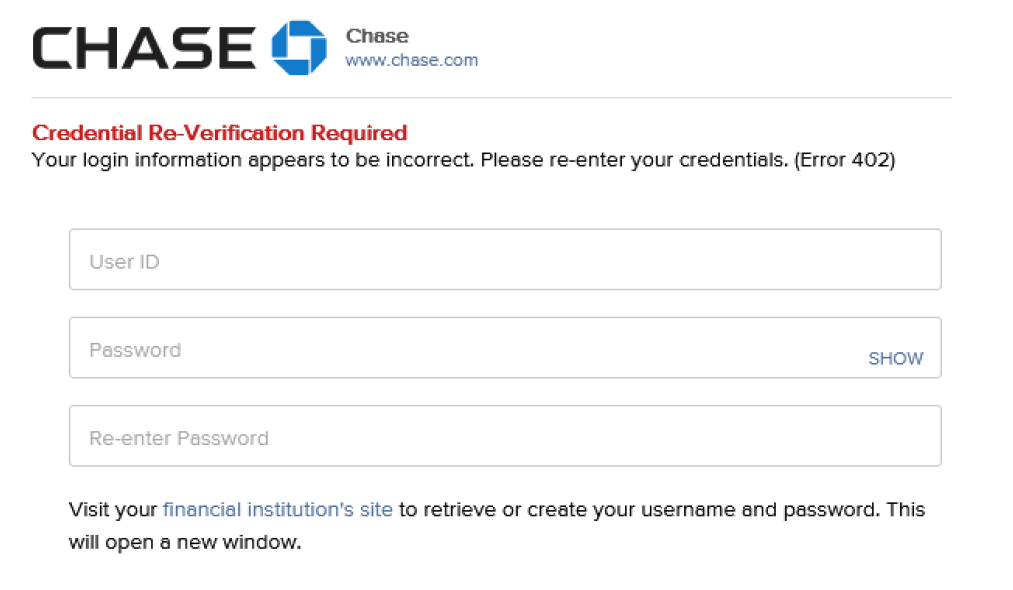

Step 4- When logging into your online banking site, be sure the username and password is entered properly. For example, case sensitivity, middle initials, etc. may be a part of your username and password. An error message will appear if there is an issue.

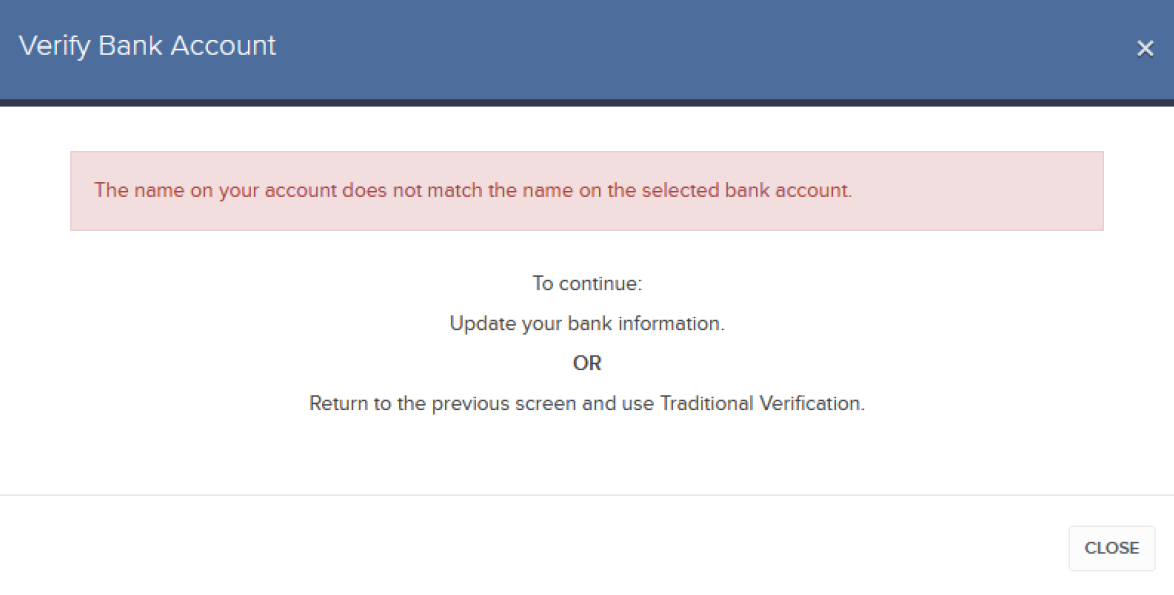

Step 6- For security reasons, the name of the bank Account Holder must match the name on the IBKR account. If the names do not match, the following message will appear.

Note:

- IBKR does not charge any fee for ACH deposits and accounts are afforded one free withdrawal request per month.

- ACH deposits are subject to a possible 4 business day credit hold after arrival prior to being credited to your account.

- If funds are withdrawn to a bank other than the originating bank, a 44-business-day withdrawal hold period will be applied.

Can I open a paper trading account for practice purposes before opening a live account?

IB does offer a paper trading account which allows one to use the full range of IB trading facilities in a simulated environment using real market conditions. This account, however, is made available only after the regular trading account has been approved and funded. Until that time, we recommend that you try the online demos made available to prospective customers through our website to get an overview of system functionality. A demo of both the TraderWorkstation or WebTrader trading platforms may be found by visiting our website at www.interactivebrokers.com and selecting the Individuals page. There you will be presented with a series of links including one titled 'Demos'.

I'm trying to transfer assets from my account at Fidelity via ACATS but can't find that broker on your dropdown list.

Fidelity Investments uses its National Financial Services affiliate for certain clearing, custody and brokerage services including ACATS transfers. To initiate a full or partial ACATS transfer from a Fidelity account, select National Financial Services (DTCC No 0226) from the drop-down broker list.

Are the funds I deposited today considered for buying power calculations?

The answer is yes. To calculate buying power IB compares Current Equity with Loan Value to Previous Day Equity with Loan Value. Whichever figure is lesser is used. From the lesser of these two figures, the Initial Margin Requirement on the positions you currently hold in the account is subtracted. The difference is then multiplied by the current leverage amount (at present 4:1), which results in your intraday buying power. Funds deposited today are now considered as part of Previous Day ELV.

Please understand that funds deposited today will not be considered until they have cleared all appropriate funds and banking channels and are officially in the account.

Also note that this calculation of buying power applies to Regulation T margin type accounts and not to Portfolio Margin type accounts.

The Previous Day ELV check is done once an account is labeled as a "Pattern Day Trader" account. This occurs when the account has completed 4 day trades in a 5 day period. If the account is not labeled as a PDT, then the Previous Day ELV check doesn't apply.

The equation used is:

((Lesser of: Equity With Loan Value or Previous Day Equity With Loan Value) - Initial Margin)*4 for accounts labeled as PDT accounts.

(Equity With Loan Value - Initial Margin)*4 for accounts not labeled as PDT accounts.

IRA: Understanding Rollovers

Interactive Brokers offers three IRA account types for US persons: Traditional IRA, Roth IRA, and Simplified Employee Pension plan IRA (a.k.a. SEP-IRA). Rollover transaction options may be available into or out of each account type.

The term IRA Rollover refers to several different movements of funds between US retirement accounts. Select from the list below for a brief description of each rollover type available, as well as the their guidelines.

IRA to Employer Sponsored Retirement Plan Rollover

Rollover Types

Funds withdrawn from an IRA and re-deposited into an IRA within 60 days may be eligible for treatment as a 60-day rollover contribution. If eligible, this movement of funds may qualify as an IRA withdrawal of funds without any penalty or taxes.

Tax Reporting - IBKR will report the withdrawal of funds as an IRA distribution and the re-deposit of funds as an IRA rollover contribution to the IRS. The IRS receives Form 5498 (IRA Contributions) and Form 1099-R (IRA Distributions). US investors do not include the Form 5498 with their tax filing, but do include the 1099-R. Click IRA Tax Reporting for details.

Funds received or withdrawn from an employer-sponsored retirement plan and deposited directly into an IRA. The 20% tax withholding of funds by the plan sponsor is waived when funds are rolled directly into an IRA.

Tax Reporting - IBKR will report the deposit of funds from an employer-sponsored retirement plan as an IRA rollover contribution to the IRS. The IRS receives Form 5498 (IRA Contributions). US investors do not include the Form 5498 with their tax filing. Click IRA Tax Reporting for details.

3. IRA to Employer Sponsored Retirement Plan Rollover

Funds moved directly from an IRA into an employer's retirement plan are deemed rollover contributions. Not all retirement plans accept rollovers from IRAs. Investors should consult the plan sponsor to determine eligibility.

Limitations & Guidelines

Distributed funds from an IRA may be rolled into another IRA only once every 12-month period. The rule applies to funds withdrawn from each separate IRA. The 12-month period begins the date funds are received, not on the date funds are deposited into another IRA. (See IRS Publication 590 for limited exceptions to the rule.)

Distributions from an IRA or Employer Sponsored Retirement plan may remain eligible for the tax-free rollover treatment only when contributed to another qualified plan within 60 days of receipt. Generally, funds re-deposited outside of 60 days are not tax-free. The withdrawal of funds is taxable. The deposit into another IRA is treated as a regular contribution. (See IRS Publication 590 for limited exceptions to the rule.)

Click here to return to the Retirement Account Resource page.

Disclaimer: IBKR does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax advisor or refer to the US Internal Revenue Service.

Will IBKR delay liquidation while I deposit funds in my account?

IBKR's margin compliance policy does not allow for transfers or other deposits if there is a margin violation/deficit in the account. In the case of a margin violation/deficit, the account in deficit is immediately subject to liquidation. Automated liquidations are accomplished with market orders, and any/all positions in the account can be liquidated. There are cases where, due to specific market conditions, a deficit is better addressed via a manual liquidation.

Funds deposited or wired into the account are not taken into consideration from a risk standpoint until those funds have cleared all the appropriate funds and banking channels and are officially in the account. The liquidation system is automated and programmed to act immediately if there is a margin violation/deficit.

Note for Prime Clients: Executing away is not a means to resolve real time deficits as away trades will not be taken into consideration for beneficial margin purposes until 9 pm ET on Trade Date or when the trades have been reported and matched with external confirms, whichever is later. Trading away for expiring options, on expiration day, is also discouraged due to the potential for late or inaccurate reporting which can lead to erroneous margin calculations or incorrect exercise and assignment activity. Clients who wish to trade expiring options on expiration day and away from IB, must load their FTP file no later than 2:50 pm ET, and do so at their own risk.

Why does the system not recognize my SWIFT code?

S.W.I.F.T stands for Society for Worldwide Interbank Financial Telecommunication. It is a non-profit organization comprised of member financial institutions.

Only SWIFT codes which are part of the SWIFT network are recognized as SWIFT codes.