修改待完成ACAT或ATON轉帳的賬戶號碼

爲了讓您的ACAT或ATON轉帳順利完成,您的經紀商必須對申請上提供的賬戶號碼進行驗證。如果賬戶號碼無效,則經紀商會拒絕您的申請。爲避免您的申請被拒,如果您提供的賬戶號碼與所選經紀商賬戶號碼的字母數字模式不一致,則IBKR可能會推遲傳遞您的ACATS/ATON申請。IBKR會向您發送通知,讓您檢查幷更正自己的賬戶號碼。

有關如何更新賬戶號碼的詳細說明請見下方:

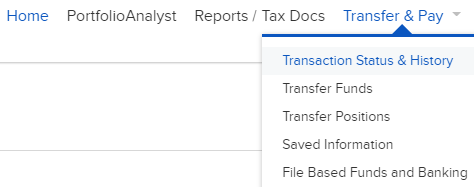

- 在客戶端中,依次打開“轉帳與支付”>“轉帳狀態與歷史”。

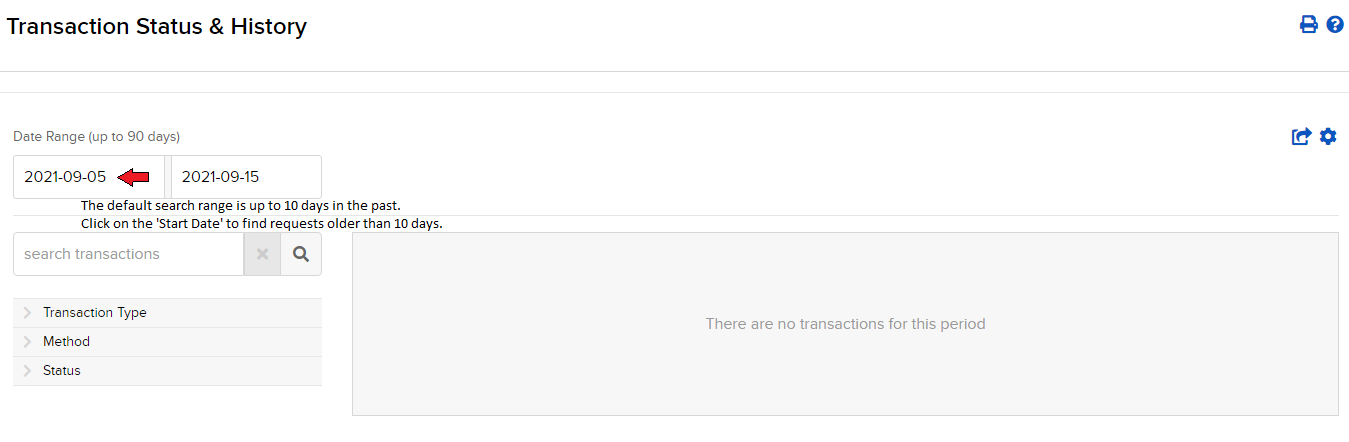

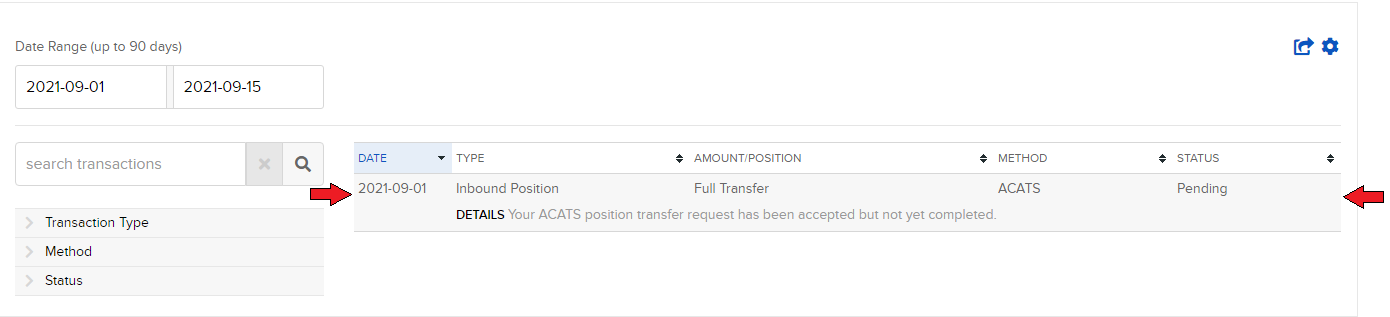

- 找到狀態爲“待定”的轉帳申請幷點擊。默認的搜索範圍爲過去10天;您可根據需要調整開始日期。

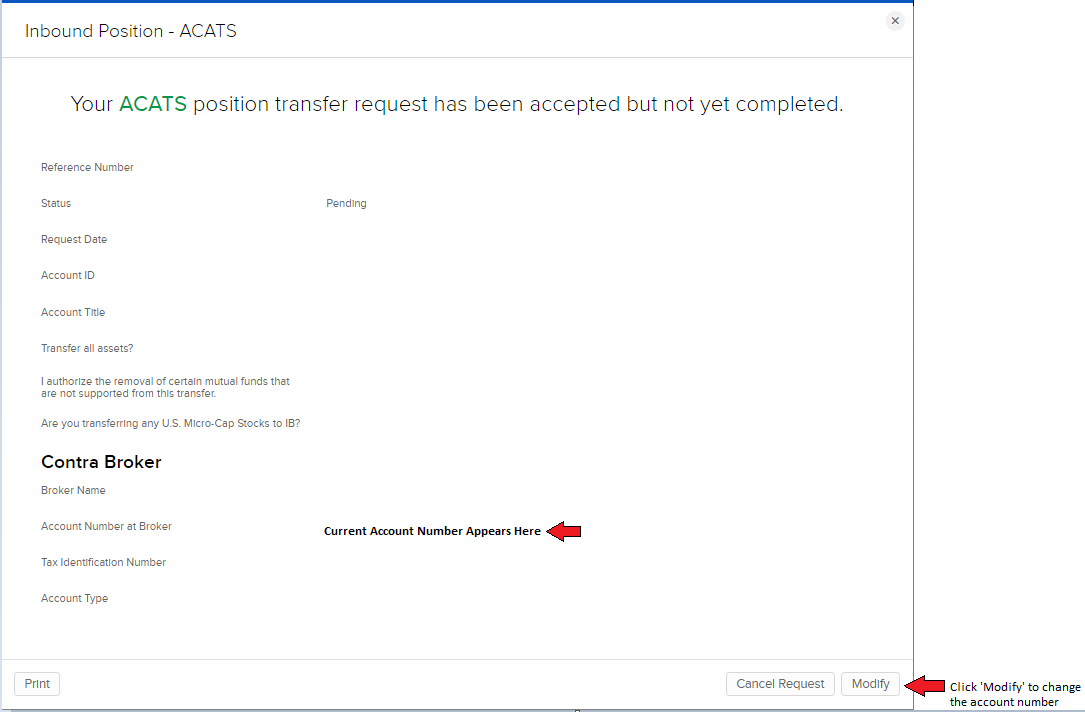

- 界面將會出現一個彈窗顯示待完成申請的詳細信息。在彈窗的右下方,點擊“修改”按鈕。

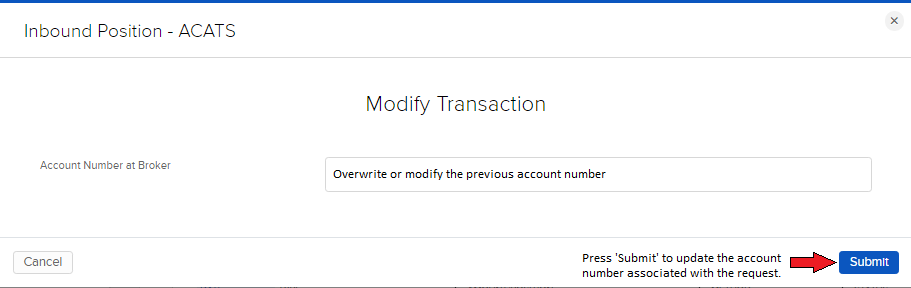

- 界面將出現一個新的彈窗,顯示當前申請關聯的賬戶號碼。請根據需要對賬戶號碼進行修改。

- 完成後,點擊“提交”。

- 界面會再次彈窗顯示申請詳情,您將會看到更新後的“在經紀商處的賬戶號碼”。

- 您可點擊右上角的“X”關閉該窗口。

更新爲有效的賬戶號碼會促使您的申請被傳遞到發出方經紀商。如果更新後的賬戶號碼仍然無效,則申請不會傳遞,幷且第二天您會收到一封新的郵件提醒您更新賬戶號碼。

如果您認爲申請攔截有誤,請創建一個諮詢單讓盈透證券進行進一步審核。

查找ACATS轉帳的賬戶號碼

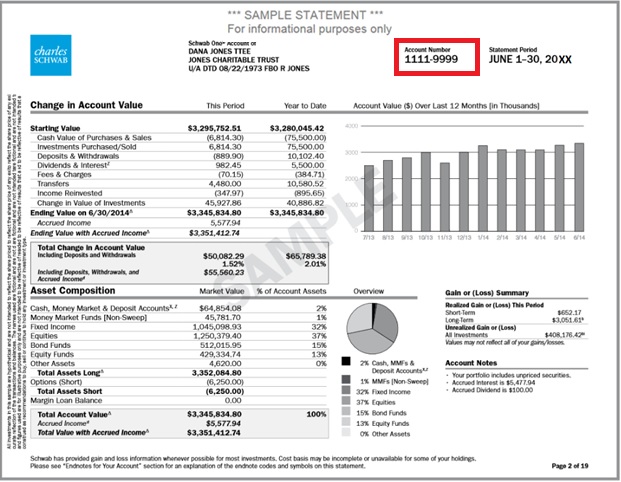

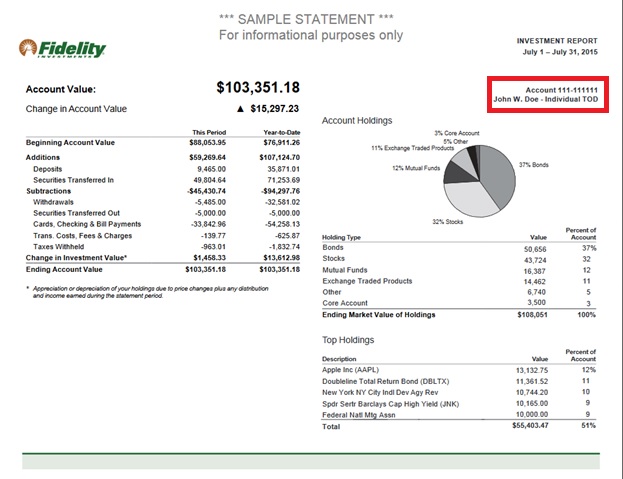

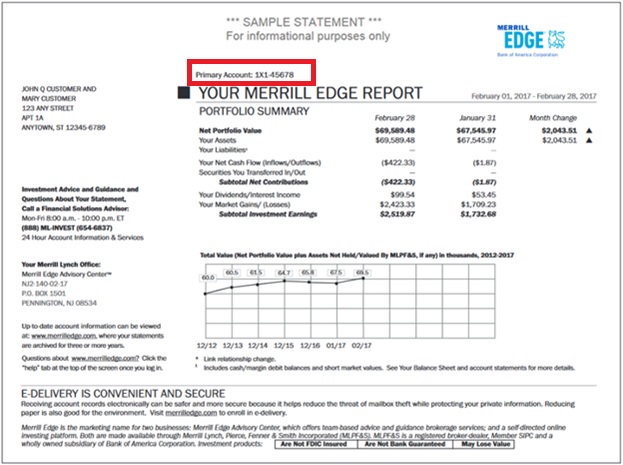

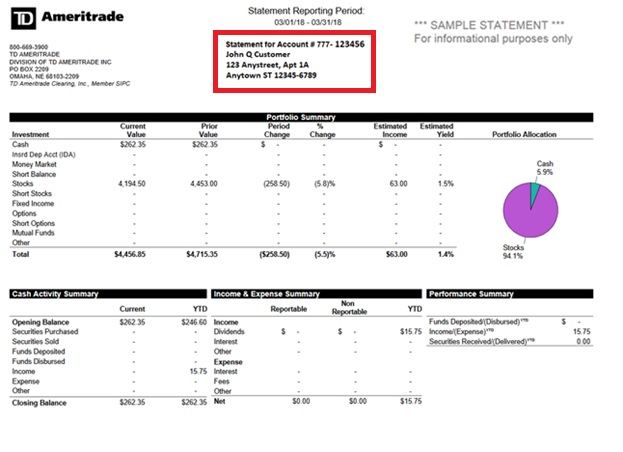

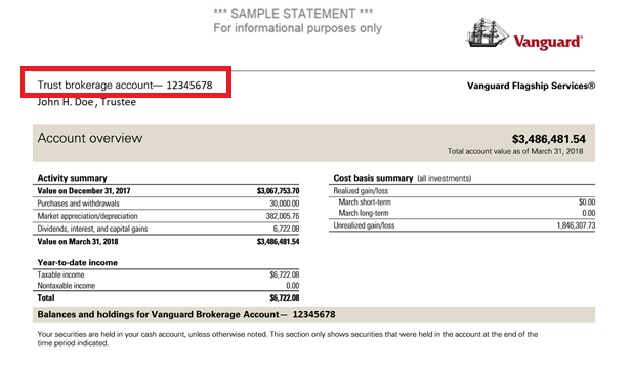

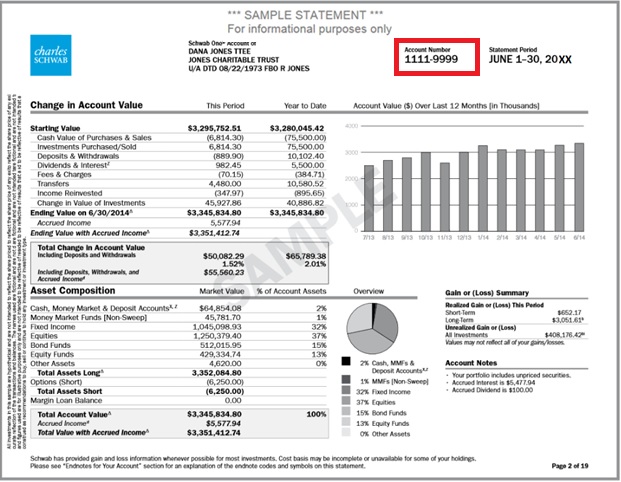

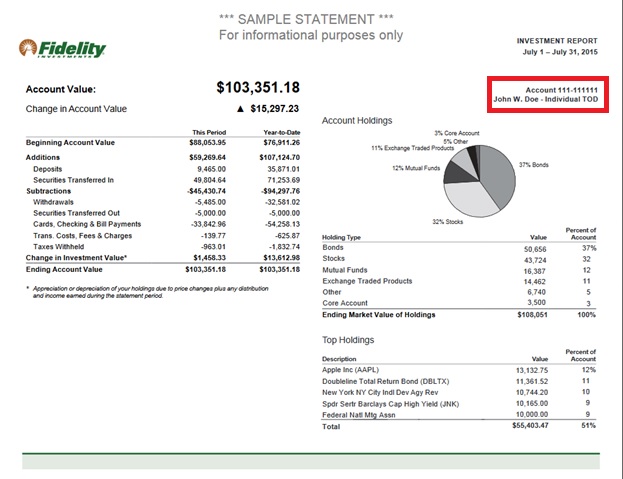

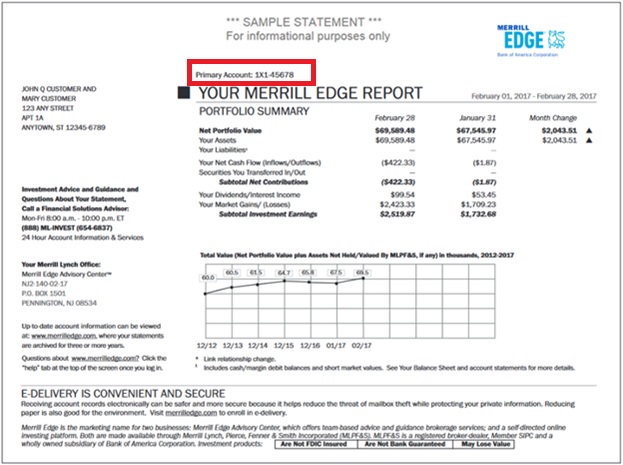

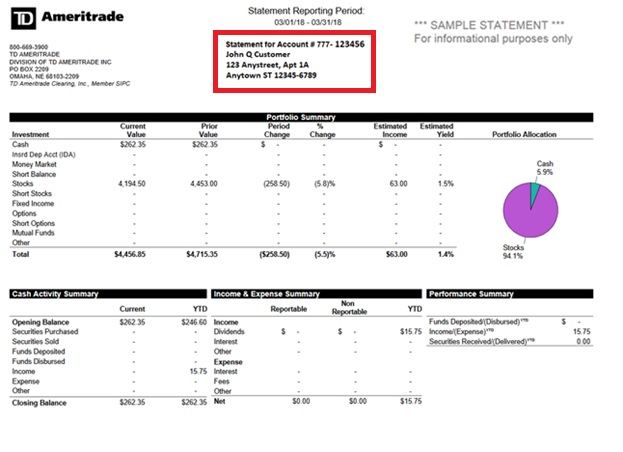

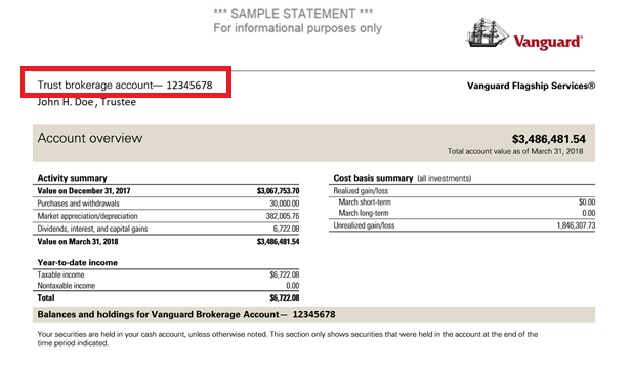

爲了讓您的ACAT或ATON轉帳順利完成,您的經紀商必須對申請上提供的賬戶號碼進行驗證。如果賬戶號碼無效,則經紀商會拒絕您的申請。IBKR建議客戶看一下自己的經紀報表確認賬戶號碼,下方爲比較常見的幾家經紀商的報表樣本,紅色方框標出的地方就有賬戶號碼信息。

Charles Schwab - 經紀商#0164。賬戶號碼采用8位字符,全部爲數字。

Fidelity Investments - 通過National Financial Services(經紀商#0226)提供。賬戶號碼采用9位字符,前3位爲字母數字,後6位爲數字。

Merrill Edge - 經紀商#0671。賬戶號碼采用8位字符,爲字母數字組合。

TD Ameritrade - 經紀商#0188。賬戶號碼采用9位字符,全部爲數字。

Vanguard- 經紀商#0062。賬戶號碼采用8位字符,全部爲數字。

注:本文所有經紀商報表樣本圖片僅出于解釋說明的目的列出,其中包含的商標屬于各自經紀商的財産。

美國微型市值股票限制

簡介

爲遵守非注册證券賣出相關法規、最小化非公開報價證券交易過程中的人工處理,IBKR對美國微型市值股票實施了一定限制。下方列出了該等限制以及與此話題相關的其它常見問題。

微型市值股票限制

- IBKR將只接受來自符合條件之客戶的美國微型市值股票轉帳。符合條件的客戶包括:(1) 資産(轉帳前或轉帳後)不低于500萬美元的賬戶,或資産規模不低于2000萬美元的財務顧問的客戶;幷且(2) 美國微型市值股票投資占比不到其賬戶資産的一半。

- IBKR將只接受符合條件的客戶能够確認股票系從公開市場買入或已在美國證監會(SEC)進行過注册的美國微型市值股票的大宗轉帳1;

- IBKR不接受客戶被OTC標記爲“買者自負”或“灰色市場”的美國微型市值股票轉帳1或開倉委托單。持有該等股票倉位的客戶可以進行平倉;

- IBKR不接受爲了回補在IBKR的空頭倉位而進行的美國微型市值股票轉帳;

- 僅執行客戶(即只通過IBKR執行交易,但在別處清算)不能在其IBKR賬戶中交易美國微型市值股票。(IBKR可對在美國注册的經紀商例外對待);

微型市值股票常見問題

什麽是美國微型市值股票?

“微型市值股票”是指市值介于5000萬美元到3億美元之間幷且價格低于5美元一股的(1) 場外交易股票或(2) Nasdaq和NYSE American挂牌股票。就該政策而言,微型市值股票包括市值等于或低于5000萬美元的美國上市公司股票,這種股票有時也被稱爲納級股或者是在與微型市值股票相關的市場上交易。

爲避免股價短期小幅波動導致股票被反復重新分類,所有被分類爲美國微型市值股的股票只有在其市值和股價連續30天均分別超過5億美元和5美元的情况下才會重新分類。

微型市值股票通常股價很低,常常被稱爲仙股。IBKR也可設置例外,包括對股價低但近期市值上漲的股票。此外,IBKR不會將非美國公司的ADR視作微型市值股票。

微型市值股票在哪裏交易?

微型市值股票通常在OTC市場而非全國性證券交易所交易。其通常由做市商在OTC系統(如OTCBB)和OTC Markets Group管理的市場(如OTCQX、OTCQB和Pink)以電子方式報價。該類別下還包含非公開報價的股票和被指定爲“買者自負”、其它OTC或“灰色市場”的股票。

此外,美國監管部門也將在Nasdaq和NYSE American挂牌、價格等于或低于5美元一股且市值等于或低于3億美元的股票視爲微型市值股票。

如果IBKR收到來自符合條件之客戶的轉倉,其中一個或多個倉位是微型市值股票,會怎麽樣?

如果IBKR收到包含微型市值股票的轉倉,IBKR有權限制其中任何微型市值股票倉位的賣出,除非符合條件的客戶能够提供適當的文件證明該等股票系在公開市場買入(即通過其它經紀商在交易所買入)或者該等股票已經根據S-1或類似股票注册聲明表在美國證監會進行過注册。

符合條件的客戶可以通過提供經紀商給出的能够反映股票買入交易的經紀報表或交易確認來證明股票確實是在公開市場上買入。符合條件的客戶也可以通過提供其股票在美國證監會(Edgar系統)進行注册的備案號(以及任何可證明股票就是注册聲明上所列股票的文件)來證明股票已經過注册。

注意:所有客戶隨時都可轉出我們對其實施了限制的股票。

IBKR對主經紀賬戶有什麽限制?

活動包含主經紀服務的客戶只在IBKR同意接受的來自其執行經紀商的交易方面被視爲符合條件的客戶。然而,儘管主經紀賬戶可以在IBKR清算美國微型市值股票,但在IBKR確認股票根據上述程序可以賣出之前,相關股票將受到限制。

要爲在公開市場上買入的股票移除限制,請讓執行經紀商提供有公司抬頭的簽字函件或正式賬戶報表,證明股票系從公開市場買入。提供的函件或報表必須包含以下信息。如果股票是通過發行取得,則函件必須提供相關注册聲明文件或鏈接幷說明該等股票是發行股票的一部分。

經紀商函件必須包含的信息:

1) IBKR賬戶號碼

2) IBKR賬戶名稱

3) 交易日期

4) 結算日期

5) 代碼

6) 買賣方向

7) 價格

8) 數量

9) 執行時間

10) 交易所

11) 必須有簽字

12) 必須有公司正式抬頭

簡而言之:如果多頭倉位不再受到限制則可以接受賣出多頭交易。賣出空頭交易可以接受。買入多頭交易可以接受,但倉位將被限制,直到向合規部門提供足够資料將限制移除。不接受買入補倉交易和日內軋平交易。

如果您買入的股票被重新分類爲“灰色市場”或“買者自負”股票怎麽辦?

如果您在IBKR賬戶中買入的股票之後被分類爲“買者自負”或“灰色市場”股票,您將可以繼續持有倉位、平倉或轉倉,但無法增加持倉。

我賬戶中微型市值股票交易受到限制的原因是什麽?

您被限制交易微型市值股票的主要原因有兩個:

- 與發行方存在潜在關聯:美國證監會規則144對發行人的關聯方交易股票(包括微型市值股票)有一定限制。如果IBKR發現微型市值股票交易活動或持倉接近規則144規定的交易量閾值(“規則144閾值”),則IBKR會限制客戶交易該微型市值股票,直到完成合規審查。

- 微型市值股票轉倉:如果客戶近期將微型市值股票轉入其IBKR賬戶,IBKR會限制客戶交易該證券,直到完成合規審查。

如果符合其中一種情况,相關證券交易會受到限制,客戶會在賬戶管理的消息中心下收到相應通知。該通知將說明限制的原因以及客戶爲了解除限制必須采取的措施。

爲什麽IBKR將我視爲微型市值股票發行方的潜在關聯方?

“關聯方”是與發行方存在控制關係的人士,如執行官、董事或大股東。

規則144適用于包括微型市值股票在內的所有證券。但是,鑒于交易微型市值股票涉及高風險,如果客戶的微型市值股交易和/或持倉接近規則144閾值,IBKR將限制客戶交易該微型市值股票。 該等限制在合規對客戶的潜在關聯方身份進行審核幷作出决定之前將保持生效。

對于潜在關聯方審核,爲什麽我需要要求每兩周進行一次新的審核?

客戶的關聯方身份可能會在IBKR完成上述潜在關聯方審核後很快發生變化。因此,IBKR認爲如果客戶的的微型市值股交易和/或持倉仍然接近規則144閾值,每兩周刷新一下潜在關聯方審核較爲合適。

哪裏可以查看IBKR指定爲美國微型市值股的股票列表?

請打開以下鏈接:www.ibkr.com/download/us_microcaps.csv

請注意,此列表每日更新。

哪裏可以瞭解更多有關微型市值股票的信息?

有關微型市值股票的更多信息,包括其相關風險,請參見美國證監會網站:https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1包括任何方式的轉帳(如ACATS、DWAC、FOP)、通過“南向(Southbound)”轉帳將加拿大挂牌股票轉成美國股票的轉換、爲回補空頭倉位進行的轉帳、在其它經紀商執行但在IBKR清算的IB主經紀服務客戶等。

Modifying the account number for a pending ACAT or ATON transfer

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. To avoid such rejects, IBKR may delay the transmission of your ACATS/ATON request if the account number you have provided does not match the alpha-numeric pattern used by the selected broker. IBKR will send a notification for you to review and correct your account number.

Details for updating the account number are below.

- In Client Portal under the ‘Transfer & Pay’ menu, select “Transaction Status & History”.

- Locate the transfer request with a status of Pending and click on it. The default search range starts 10 days in the past; update the start date as necessary.

- A pop-up will appear with the summary details of the pending request. On the bottom right of the pop-up window, select the “Modify” button.

- A new pop-up will be presented that displays the current account number associated with the request. Modify the account number as appropriate.

- When done, select ‘Submit’.

- The summary detail pop-up will be re-displayed and you will now see the updated ‘Account Number at Broker’ value.

- You may close this will by clicking the ‘x’ at the top right.

An update to a valid account number will prompt the transmission of your request to the delivering broker. An update to an invalid account will not be transmitted and you will receive a new email alert the following day requesting additional account number updates.

If you determine the request is being held up for review incorrectly, please create a web ticket for further review by Interactive Brokers.

HK Stock Physical Certificate Deposit FAQ

HK Stock Physical Certificate Deposit FAQ

⦁ Does IBKR support HK stock physical certificate deposit?

Yes, we support stock physical certificate deposits for stocks trading on HKEX and available to trade at Interactive Brokers. We do not support physical withdrawals and reserve the right to reject any deposit.

⦁ Does Interactive Brokers Hong Kong charge any fees?

| Certificate Size | Processing Fee |

| HKD 500,000 or above (Full Service) | Free |

| Less than HKD 500,000 (Full Service) |

HKD 300.00/first stock certificate per day HKD 100.00/each additional certificate per day |

| Less than HKD 500,000 (Self Service) |

HKD 200.00/first stock certificate per day HKD 20.00/each additional certificate per day |

*A rejection fee of HKD 1,000 will be charged for any transaction rejected by the share registry. Additional fees may be imposed for submitting large volumes that are time consuming to process. Please contact Client Services via a web ticket for more information.

In addition to the above, there is also a fee of HKD 5 stamp tax per transfer form. Cash cannot be accepted. Please prepare a cheque for HKD 5 per transfer form payable to “The Stock Exchange of Hong Kong Limited”.

If a total of five certificates are to be deposited for stock A and stock B, a breakdown of the fees would be illustrated by the below examples:

Scenario (Full Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 300 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 100 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 100 HKD

Scenario (Self Service)

Stock A (Certificate 1 - Stock Value above 500K HKD) - Free

Stock A (Certificate 2 - Stock Value less than 500K HKD) - 200 HKD

Stock A (Certificate 3 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 4 - Stock Value less than 500K HKD) - 20 HKD

Stock B (Certificate 5 - Stock Value less than 500K HKD) - 20 HKD

⦁ How do I initiate a request?

Please compose a web ticket from the Client Portal under the category Funds & Banking > Position Transfer with all of the following information to avoid delays:

- Full Service or Self Service

- Company name/ stock ticker symbol

- Approximate value

- Number of certificates

Full Service

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ You will receive a receipt from IBKR within one business day.

Self Service

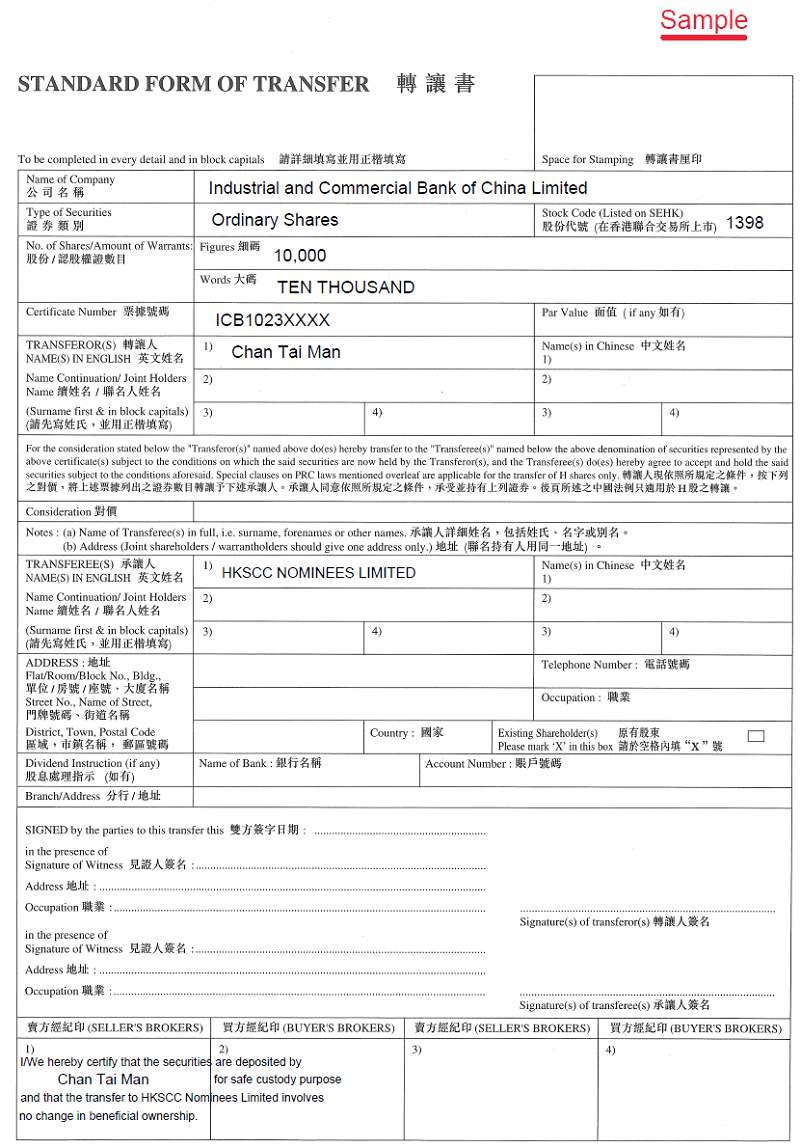

⦁ Our Client Service team will contact you by email and provide a “Standard Form of Transfer”;

⦁ Complete the “Standard Form of Transfer” by following below guidance.

⦁ Make an appointment and deliver your physical certificate(s) to our office as follows:

Admiralty - Suite 1512, Two Pacific Place, 88 Queensway, Admiralty, Hong Kong SAR

Kwun Tong - Suite 3204-05, AIA Kowloon Tower, Landmark East, 100 How Ming Street, Kwun Tong, Hong Kong SAR (Additional courier fees, to be quoted, will be passed on to client)

⦁ IBKR will counter sign the form and return to you for the delivery of all of the below documents to HKSCC. Address – 1/F, One & Two Exchange Square, Central, Hong Kong SAR.

⦁ The countersigned Standard Form of Transfer

⦁ CCASS Stock Deposit Form (Prepared by IBKR)

⦁ The physical certificate(s)

⦁ A cheque for HKD 5 payable to “The Stock Exchange of Hong Kong Limited” for each transfer

⦁ Provide a scanned copy of the receipt to IBKR.

⦁ When will the shares be credited to my IBKR account?

Typically, the shares will be reflected on your IBKR account within 3-4 business days. However, as the share registry has the right to reject deposits, IBKR will apply a 12 business day hold on the shares during which time you will not be able to sell nor withdraw the shares deposited.

⦁ Instruction and Sample – Standard Form of Transfer

.png)

How to Submit an Inbound or Outbound Position Transfer via DWAC

You can initiate a DWAC transfer request in Client Portal:

- DWAC fees are USD 100.00 per DWAC. The account must also ensure enough funds are available to absorb the fees prior to setting up a DWAC request.

- The IBKR cutoff time for transmitting a DWAC transfer is 3:15 PM EST

FAQS: IBIE Account Transfer

This is an important document regarding the proposed transfer of your account from IBUK and IBLLC to IBIE that requires your attention. Please read the entirety of this document ahead of taking any action referred to in the Covering Letter sent to you via email.

Please take time to read these FAQs, which summarise some of the key changes to the regulatory framework which will be brought about by the Proposed Transfer (as described below) and provide answers to some of the more general questions that you may have. The FAQs should be read in conjunction with the Covering Letter. If you require any further information, please get in touch with us using the contact details provided in the Covering Letter.

Discussion:

The FAQs are split into three parts.

- Part A sets out key information in relation to the Proposed Transfer (as described below).

- Part B covers key legal and regulatory topics that arise as a result of the Proposed Transfer (as described below).

- Part C aims to answer any other questions that you may have and provides some further and more practical information in relation to what will and will not be changing following the Proposed Transfer (as described below).

PART A – THE PROPOSED TRANSFER

1. What is the situation currently?

As you will be aware, at present, your relationship with Interactive Brokers is led by our entity based in the United Kingdom, specifically Interactive Brokers (U.K.) Limited (“IBUK”) and the services provided to you are provided by IBUK and, depending on the products you do business in, our US affiliate Interactive Brokers LLC (“IBLLC”).

2. What is Interactive Brokers requesting?

We are inviting all clients domiciled in the European Economic Area (“EEA”) to transfer their accounts to one of our brokers based in Europe.

We propose to transfer the relationship that you currently have with IBUK and IBLLC to Interactive Brokers Ireland Limited (“IBIE”), an Interactive Brokers investment firm located in Ireland. It is our intention that all of your accounts, investments and services currently provided to you by IBUK and IBLLC will instead be singularly provided by IBIE (for convenience we will refer to this as the “Proposed Transfer”).

3. Who is IBIE? What sort of a firm is it?

IBIE is an investment firm regulated by the Central Bank of Ireland and authorised pursuant to the second Markets in Financial Instruments Directive (Directive 2014/65/EU). IBIE is an affiliate of IBUK and IBLLC.

4. What are IBIE’s legal details?

Interactive Brokers Ireland Limited is registered as a private company limited by shares (registration number 657406) and is listed in the Register of Companies maintained by the Irish Companies Registration Office. Its registered address is 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. IBIE can be contracted by telephone at 00800-42-276537 or electronically through the IBIE website at www.interactivebrokers.ie.

5. Who regulates IBIE and what are their contact details?

As set out above the Central Bank of Ireland is the competent regulator for IBIE (in the same way that the Financial Conduct Authority is the competent regulator for IBUK). IBIE is included in the Central Bank of Ireland’s register of authorised firms under number 423427. The Central Bank of Ireland’s contact details are set out below:

Location

The Central Bank of Ireland

New Wapping Street

North Wall Quay

Dublin 1

D01 F7X3

Contact Numbers

Phone: +353 (0)1 224 6000

Fax: +353 (0)1 224 5550

Postal Address

Central Bank of Ireland

P.O. Box 559

Dublin 1

Public Helpline

E-mail: enquiries@centralbank.ie

Lo-Call: 1890 777 777

Phone: +353 (0)1 224 5800

6. Where does IBIE fit with respect to the broader Interactive Brokers group?

IBIE is a wholly-owned subsidiary that sits within the broader Interactive Brokers Group.

7. What does the Proposed Transfer mean for me? Will there be any material impacts?

We do not anticipate any material impacts for you as a result of the Proposed Transfer. Nonetheless, it is very important that you read these FAQs carefully and in full and make sure that you understand what the changes are for you.

8. What do I have to do if I want to continue doing business with Interactive Brokers?

If you would like to continue to do business with Interactive Brokers, we require your cooperation and action.

Specifically, we need you to consent and agree to the Customer Agreement and other Documents available under the Important Information section of the Proposed Transfer process and to the regulatory matters outlined in the Covering Letter, the Important Information and Consent sections of the Proposed Transfer process. You can do this by following the instructions in the Covering Letter.

To be clear, you do not have to consent to the Proposed Transfer if you feel that you may be adversely affected by it. You have the option of transferring your positions to another broker or closing your positions and transferring any cash balance to another account.

If you do not take action by December 7, 2022, your account will be restricted from opening new transactions or transferring in new assets. You always have the ability to transfer your account to another broker. If you wish to decline, please follow the instructions in the Covering Letter.

In either case, we ask that you read the entirety of this FAQs and the Covering Letter before deciding to consent to or decline the Proposed Transfer.

9. What happens next?

If you consent to the transfer, please complete all actions detailed in the Covering Letter and we will prepare your account to be transferred to IBIE. Once your account is transferred, IBIE will write to you with further information about your new relationship with them.

PART B – LEGAL AND REGULATORY CHANGES THAT YOU SHOULD BE AWARE OF

1. What terms and conditions will govern my relationship with IBIE following the Proposed Transfer? Are these different to the ones that currently apply?

Trades that you conduct after the Proposed Transfer will be governed by the new Customer Agreement between you and IBIE. A copy of the IBIE Customer Agreement is available in the Important Information section of the Proposed Transfer process.

2. What conduct of business rules (including best execution) will apply to my relationship with IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

There are some changes to be aware of, which we explain below.

If you do business with IBUK on a “carried” basis (in other words, you trade index options, futures and futures options and IBUK carries your account and custodies your assets) then the Financial Conduct Authority’s conduct of business rules currently apply to you. These rules are based heavily on the recast Markets in Financial Instruments Directive, the Markets in Financial Regulation and various delegated directives and regulations (collectively, “MiFID”). In relation to best execution, where it applies, IBUK must take all sufficient steps to achieve the best possible result for you when we execute your order.

If you currently do business with IBUK on an “introduced” basis (in other words, you trade products outside of those mentioned in the previous paragraph and you have a relationship with both IBUK and its US affiliate, IBLLC) a mix of conduct of business rules will currently apply to you. For instance, with respect to the introduction of your business to IBLLC, the Financial Conduct Authority’s conduct of business rules will apply (see above in relation to these). Once introduced to IBLLC, the relevant U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission rules and regulations (among others) will apply to IBLLC’s role (including its obligations in relation to best execution and custody).

Please note that it is of course possible that your business is split across these two scenarios (in other words some of your business is conducted on a “carried” basis while some of it is conducted on an “introduced” basis).

Going forward, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish conduct of business rules will exclusively apply to your relationship with IBIE. Similar to the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID and IBIE’s obligations in relation to best execution will largely mirror those that currently apply to IBUK.

In our view, while the rules that apply to our relationship will change, we do not consider such changes to be material or to result in a lesser degree of protection being afforded to you.

3. How will my investments that I custody with IBIE be held from a legal/regulatory perspective? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

The rules that currently apply depends on the sort of business that you presently have with IBUK (please see the response to Question B2 above). Where you conduct “carried” business with IBUK, the Financial Conduct Authority’s client asset (or “CASS”) rules will apply. These rules are based heavily on MiFID. Where you conduct “introduced” business with IBUK and IBLLC, the US custody rules will apply to your custody assets.

Going forward, as set out above, the distinction between “carried” and “introduced” business will no longer apply and in each case set out above, Irish custody rules will exclusively apply to your relationship with IBIE. Like the UK Financial Conduct Authority’s rules, the Irish conduct of business rules are based on MiFID. Please consult the Client Assets Key Information Document provided in the Important Information section in relation to the Irish custody regime.

4. How am I protected against loss? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK?

Currently, your eligible assets are protected from loss either under the US Securities Investor Protection Corporation at an amount of up to USD 500,000 (subject to a cash sublimit of USD 250,000) or the UK Financial Services Compensation Scheme at an amount up to GBP 50,000 (which regime applies depends on the relevant segment of your IBUK account, as explained in the response to Question B2 above). After the Proposed Transfer, the Irish Investor Compensation Scheme, which is administered by The Investor Compensation Company DAC, may protect your assets from loss should IBIE default and be unable to meet its obligations to you.

Ireland’s compensation scheme is similar to the compensation scheme you have access to in the UK, albeit with a lower limit. The purpose of the Irish Investor Compensation Scheme is to pay compensation to you (subject to certain limits) if you have invested money or investment instruments in either of the following cases:

- A firm goes out of business and cannot return your investments or money; and

- A Central Bank of Ireland determination or a court ruling has been made under the Investor Compensation Act 1998.

The Investor Compensation Company DAC (ICCL) administers the scheme. IBIE will be a member of the scheme.

The scheme covers investment products including:

- Public and private company shares

- Units in collective investment schemes

- Life insurance policies (including unit-linked funds)

- Non-life insurance policies

- Tracker bonds

- Futures and options

Usually, you can only make a claim after a firm goes out of business and its assets have been liquidated and distributed to those who are owed money. Please check the details of the schemes for any limits that apply – not all losses will be covered as there are maximum levels of compensation. The ICCL will pay you compensation for 90% of the amount you have lost, up to a maximum of €20,000.

5. How do I make a complaint to IBIE? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK? What if my complaint relates to something that happened while I was a customer of IBUK?

The new Customer Agreement sets out how to lodge a complaint with IBIE. The complaints handling procedures are materially similar to those that apply to your existing relationship with IBUK. If the substance of your complaint relates to something that happened prior to the Proposed Transfer, then you should address your complaint to IBUK. Its current contact information will stay the same and can be found at interactivebrokers.co.uk should you need to contact IBUK.

6. After the Proposed Transfer, will I still have access to the Financial Ombudsman Service?

In case of complaint, investors should follow the complaints procedure as referred to in the Customer Agreement. Once your account is transferred to IBIE, the UK Financial Ombudsman Service will cease to have jurisdiction over any complaints that you may have in respect of IBUK. However, please be aware that Ireland has a dispute resolution scheme in the form of the Financial Services and Pensions Ombudsman (“FSPO”). The FSPO is a free and independent statutory dispute resolution scheme for financial services. You may be eligible to make a complaint to the FSPO if you are an “eligible complainant”. Details of who are “eligible complainants” can be found on www.fspo.ie. The FSPO can be contacted at:

Postal Address

Financial Services and Pensions Ombudsman

Lincoln House,

Lincoln Place

Dublin 2

D02 VH29

Telephone

+353 (0)1 567 7000

Email

Info@fspo.ie

7. How will my personal data be processed and protected? Are there any material differences that will apply to my relationship with IBIE compared to those that apply to my existing relationship with IBUK in this context?

Your data will be processed and protected in accordance with the Interactive Brokers Group Privacy Policy which can be found at: https://www.interactivebrokers.com/en/index.php?f=305. There will be no material change.

PART C – OTHER PRACTICAL QUESTIONS AND NEXT STEPS

1. Who should I contact before the Proposed Transfer takes place and after the Proposed Transfer if I have any questions in the ordinary course?

Generally speaking, you should contact IBUK with any questions that you may have prior to the Proposed Transfer, and you should contact IBIE with any questions that you may have following the Proposed Transfer taking place. Regardless of who you contact at Interactive Brokers, we will ensure your query is promptly dealt with and we will help you to connect with the right person or department.

2. Will the range of products offered be the same?

Our current expectation is that the same range of products will be offered by IBIE as are offered by IBUK.

There might be a restriction on Foreign Exchange transactions that would create a negative balance or would increase a preexisting negative balance in either component currency. However, the same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFD risk warnings before trading these instruments following the transfer of your account.

Please note that IBIE offers financing for securities and commodities trades but cannot support withdrawals of borrowed funds. You will be free to withdraw any free cash not needed to support your open positions. If you would like to withdraw additional funds, you can sell positions and withdraw the proceeds.

In limited instances where clients hold restricted products, clients may transfer and maintain or close such positions but won’t be allowed to increase the position.

3. I currently trade OTC derivatives with IBUK – what will happen to my open positions?

Your open positions will be transferred to IBIE and you will face IBIE rather than IBUK. You will no longer have any legal relationship with IBUK in relation to those positions. We will separately provide you with an updated Key Investor Information Document (please follow the link to the PRIIPs KID landing page in the Covering Letter).

4. What happens to any security I have granted to IBUK/IBLLC as part of a margin loan?

If you have granted security or collateral to IBUK/IBLLC this will transfer to IBIE upon the Proposed Transfer taking place.

We do not anticipate you needing to take any steps to reflect the change in beneficiary, although we may need to take some administrative steps of our own to update security registers with the change in details. This should, however, not affect our priority or otherwise affect the date from which the security is valid.

5. Will I have access to the same trading platform or be subject to any software changes following the transfer of my account?

The transfer of your account will have no impact upon the software you use to trade or administer your account. The technology will remain the same as it is today.

6. Will all account balances be transferred at the same time?

All balances, with the exception of accruals (e.g., interest, dividends) will be transferred at the same time. Once accruals have been posted to cash, they will automatically be swept to the transferred account.

7. What will happen to my current account following the transfer of my account?

Once all accruals have been swept, your current account will be closed and inaccessible for trading purposes. You will still be able to access this closed account via the Client Portal for purposes of viewing and printing archived activity and tax statements.

8. Will IBKR’s commissions and fees change when my account is transferred?

No. IBKR commissions and fees do not vary by the broker your account is maintained with.

9. Will my trading permissions change when my account is transferred?

No. Your trading permissions will not change when your account is transferred.

10. Will open orders (e.g., Good-til-Canceled) be carried over when my account is transferred?

Open orders will not be carried over to the new account, and we recommend that clients review their orders immediately following the transfer of their account to ensure that the open orders are consistent with their trading intentions.

11. Will I be subject to the U.S. Pattern Day Trading Rule if my account is transferred?

Accounts maintained with IBUK are subject to the U.S. Pattern Day Trading (PDT) rule as the accounts are introduced to and carried by IBLLC, a U.S. broker. The PDT rules restricts accounts with equity below USD 25,000 to no more than 3 Day Trades within any 5-business day period.

As accounts transferred to IBIE will not be introduced to IBLLC, they will not be subject to the PDT rule.

12. Will I receive a single, combined annual activity statement at year end?

No. You will receive an annual statement of your existing account which will cover the period starting 1 January 2022 through the date your account was transferred and a second annual statement for your new account which will cover the period starting from the transfer date through the end of the year.

13. Will the current cost basis of positions be carried over when my account is transferred?

Yes, the transfer of your account will have no impact upon the cost basis of your positions.

14. Will the transferred account retain the same configuration as the current account?

The configuration of the account following transfer will match that of the current account to the extent permissible by regulation. This includes attributes such as margin capability, market data, additional users, and alerts.

15. Will my login credentials change?

No. Your username, password, and any 2-factor authentication process in place for your existing account will remain active following transfer. You will, however, be assigned a new account ID for your transferred account.

針對大麻類證券的清算所限制

斯圖加特交易所(Boerse Stuttgart)和明訊銀行(Clearstream Banking)宣布其將不再對主營業務與大麻及其它毒品直接或間接相關的證券提供服務。 因此,該等證券將不會再於斯圖加特(SWB)或法蘭克福(FWB)證券交易所交易。自2018年9月19日收槃開始,IBKR將釆取以下行動:

- 對於客戶未釆取行動平倉,但也不能轉至美國掛牌市場的受影響頭寸,進行強制平倉;

- 對於客戶未釆取行動平倉,但能夠轉至美國掛牌市場的受影響頭寸,將股票轉至其美國掛牌市場。

下方表格列出了斯圖加特交易所和明訊銀行截至2018年8月7日公布的受影響證券。該表格還標記了受影響證券是否能夠轉至美國掛牌市場。注意,清算所已聲明該列表可能尚不完整,建議客戶檢查其各自網站了解最新信息。

| ISIN | 名稱 | 交易所 | 是否可轉至美國? | 美國代碼 |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | 是 |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | 是 |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | 是 |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | 是 |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | 是 |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | 是 |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | 是 |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | 是 |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | 是 |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | 是 |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | 是 |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | 是 |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | 是 |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | 否 | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | 否 | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | 否 | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | 否 | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | 否 |

重要注意事項:

- 請注意,美國掛牌證券通常為場外交易(PINK),且以美元(而非歐元)計價, 因此,除市場風險外,您還將面對匯率風險。

- 持有粉單(PINK Sheet)證券的賬戶持有人需要有美國(仙股) 交易許可才能下達開倉定單。

- 擁有美國(仙股) 交易許可之賬戶的所有使用者均須使用雙因素驗證登錄賬戶。

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

Locating your account number for ACATS transfers

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. IBKR recommends that clients review a copy of their brokerage statement to confirm their account number and has provided statement samples below from some of the more common brokers highlighting where this information can be found.

Charles Schwab - Broker #0164. Account Number convention is 8 characters, all numeric.

Fidelity Investments - Delivers through National Financial Services, Broker #0226. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric.

Merrill Edge - Broker #0671. Account Number convention is 8 characters, combination of alpha and numeric.

TD Ameritrade - Broker #0188. Account Number convention is 9 characters, all numeric.

Vanguard- Broker #0062. Account Number convention is 8 characters, all numeric.

Note: This article contains images of sample broker statements which are for illustrative purposes only and which may contain logos that remain the property of each of those brokers.