期權第一至第四層級

什麽是期權交易許可的層級?

IBKR新推出了兩種更低層級的期權交易許可,即第一和第二層級交易許可,使目前無法獲得“有限”或“完整”期權交易許可的客戶可交易期權。“有限”交易許可目前被稱爲第三層級,而“完整”交易許可則被視爲第四層級。

賬戶可交易的期權策略類型取决于賬戶獲得的交易許可層級。不同的層級如下:

|

層級 |

支持的期權策略 |

|

第一層級 |

允許交易持保看漲期權,即在做空看漲期權的同時持有相等數量的底層證券。 |

|

第二層級 |

允許交易FINRA法規2360定義的持保期權持倉,但有額外的限制,即期權多頭的到期日不得早于價差策略中期權空頭的到期日。 |

|

第三層級 |

允許交易最大損失風險有限的期權策略。 |

|

第四層級 |

允許交易所有期權策略。 |

要瞭解各層級允許交易的期權組合舉例,請見下表:

|

策略 |

層級要求 |

|

持保看漲/持保籃子看漲 |

第一層級 |

|

買股票賣買權(Buy Write) |

第一層級 |

|

做多期權持倉 |

第二層級 |

|

做多看漲 |

第二層級 |

|

做多看跌 |

第二層級 |

|

持保看跌 |

第二層級 |

|

保護性看漲 |

第二層級 |

|

保護性看跌 |

第二層級 |

|

做多跨式 |

第二層級 |

|

做多寬跨式套利 |

第二層級 |

|

轉換 |

第二層級 |

|

做多看漲價差 |

第二層級 |

|

做多看跌價差 |

第二層級 |

|

做多鐵鷹 |

第二層級 |

|

做多盒子價差 |

第二層級 |

|

領口 |

第二層級 |

|

做空領口 |

第二層級 |

|

做空看跌 |

第三層級 |

|

合成 |

第三層級 |

|

逆轉 |

第三層級 |

|

做空看漲價差 |

第三層級 |

|

做空看跌價差 |

第三層級 |

|

做空鐵鷹 |

第三層級 |

|

做多蝶式 |

第三層級 |

|

不平衡蝶式 |

第三層級 |

|

做空蝶式 |

第三層級 |

|

日曆價差 - 借記 |

第三層級 |

|

對角價差 - 做空最先到期的邊 |

第三層級 |

|

做空裸看漲 |

第四層級 |

|

做空跨式 |

第四層級 |

|

做空寬跨式 |

第四層級 |

|

做空合成 |

第四層級 |

|

日曆價差 - 借記 |

第四層級 |

|

對角價差 - 做多最先到期的邊 |

第四層級 |

交易期權須開立何種賬戶類型?

保證金、現金和IRA/退休賬戶可申請期權交易許可。

保證金賬戶可申請任意層級的期權交易許可(第一至第四層級均可)。現金或IRA賬戶只能申請第一至第三層級,且買入所有看漲和看跌期權均要求全額支付。

請注意

- 持有現金或保證金賬戶的客戶必須在賬戶中保有2000美元(或等值的其它貨幣)的淨清算價值方可開倉或加倉已有的未持保期權倉位。

如何申請或更新我的期權交易許可?

要更新您的期權交易許可:

1. 登錄客戶端

2. 依次選擇使用者菜單(右上角的小人圖標)和設置

3. 在 賬戶設置下找到交易板塊

4. 點擊交易許可

5. 找到期權板塊,選擇添加/編輯或請求,然後選擇您想申請的許可層級幷點擊繼續。

6. 閱讀幷簽署披露與協議。

7. 點擊繼續幷根據屏幕上的提示操作。

交易許可請求可能需要24-48小時審核。有關交易許可的更多信息,請見客戶端用戶指南。

請注意

- 當一個國家/地區只有期權交易許可,該許可將包括股票和指數期權。

- 受美國證監會限制,美國法定居民通常不得在美國以外交易證券期權。證券期權指以個股、美國法定股票或任何以現金結算的寬基指數期貨爲底層的期權。

- 某些期權合約額外要求有“複雜或加杠杆的交易所交易産品”許可。

21周歲以下的人士能否交易期權?

所有客戶均可申請第一級的期權交易許可。然而,IBKR要求客戶須年滿21周歲方可申請第二至四級的許可。

申請期權交易許可須滿足哪些要求?

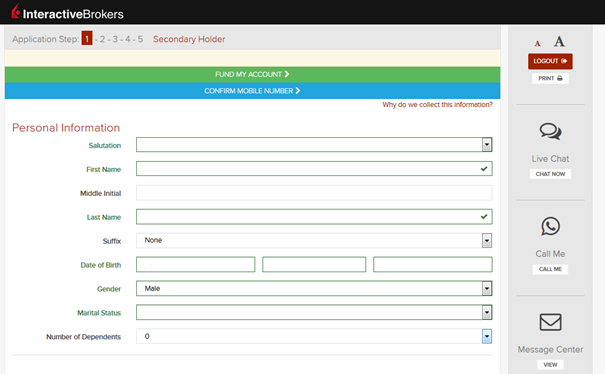

IBKR會向滿足最低年齡、流動淨資産、投資目標、産品知識及投資經驗要求的申請人提供不同層級的交易許可。此類信息是在開戶時收集的,或在開戶後客戶申請提升交易許可時在客戶端內收集。

如您需升級或查看您的財務信息、投資目標或投資經驗,請根據以下說明操作:

1. 登錄客戶端

2. 前往使用者菜單(右上角的小人圖標),然後點設置

3. 在賬戶設置下找到個人信息板塊

4. 點擊財務畫像來修改您的信息幷確認。

怎麼看我的開戶申請狀態?

請前往IBKR.com/app-status登錄查看申請狀態。

要加快審核,請參考以下推薦辦法。

- 注資可獲得優先審核。如果出于任何原因,您的申請沒能獲批,資金會即刻退還給您。

- 登錄確定是否已按要求提交了所有文件,缺文件是導致延遲的最常見原因。

- 請檢查您在申請表上填寫的電子郵箱,看看是否有我們合規部門發送給您的郵件。在綫申請提交後如果還需要您提供其它文件和/或說明,合規部門會通過電子郵件聯繫您。

- 所有文件提交幷被接受後,還會需要一點時間完成盡職調查檢查和申請審核。

我的賬戶屬於哪個IBKR實體?

賬戶持有人可以通過賬戶報表頂部的信息確認其賬戶所屬的IBKR實體。

- Interactive Brokers LLC (IB LLC)

- Interactive Brokers Canada Inc (IBC)

- Interactive Brokers (U.K.) Limited (IBUK)

- Interactive Brokers Ireland Limited (IBIE)

- Interactive Brokers Central Europe Zrt. (IBCE)

- Interactive Brokers Luxembourg SARL (IBLUX)

- Interactive Brokers Australia Pty. Ltd. (IBA)

- Interactive Brokers Hong Kong Limited (IBHK)

- Interactive Brokers (India) Pvt. Ltd. (IBI)

- Interactive Brokers Securities Japan, Inc. (IBSJ)

- Interactive Brokers Singapore Pte. Ltd. (IBSG)

爲什麽需要披露我與金融機構的雇傭關係?

根據美國金融業監管局(FINRA)規則3210要求,與成員公司(雇主成員)關聯的申請者在IBKR(執行成員)開戶前必須先獲得雇主成員的書面同意。該規則還要求開戶人士告知IBKR其與雇主成員的關聯關係。對IBKR來說,可能還存在其它類似的非美國法規要求。

受雇于其它經紀商或金融機構或與其它經紀商或金融機構關聯的申請者需要提交一份包含其雇傭單位聯繫信息的文件,以便IBKR根據要求向其雇傭單位提供相關交易數據。如果申請者受雇于金融機構,但又不提交相應文件,則IBKR會聯繫申請者確認其是否是不適用于FINRA規則3210。

如何用手機向IBKR發送文件

即使您一時無法掃描文件,盈透證券也支持您給我們發送文件副本。您可以用手機將所需文件拍下來。

下方介紹了在不同手機操作系統下如何拍照幷將照片通過電子郵件發送給盈透證券的詳細步驟:

如果您已經知道如何拍照幷通過電子郵件發送圖片,請點擊此處——電子郵件應該發送到哪裏以及郵件主題應該寫什麽。

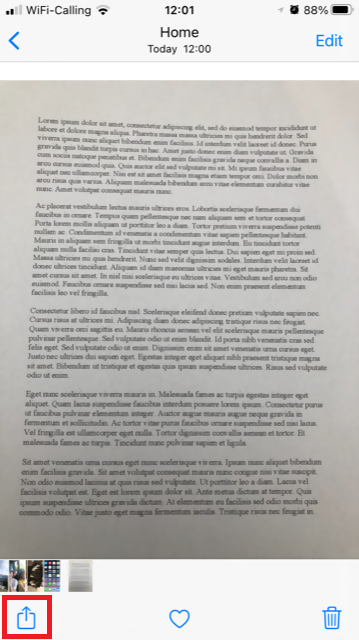

iOS

1. 從手機屏幕的底部向上滑,然後點擊相機圖標。

如果沒找到相機圖標,您可以從iPhone主屏幕點擊相機應用程序圖標。

通常情况下打開的應該是後置攝像頭。如果打開的是前置攝像頭,請點擊攝像頭切換按鈕。

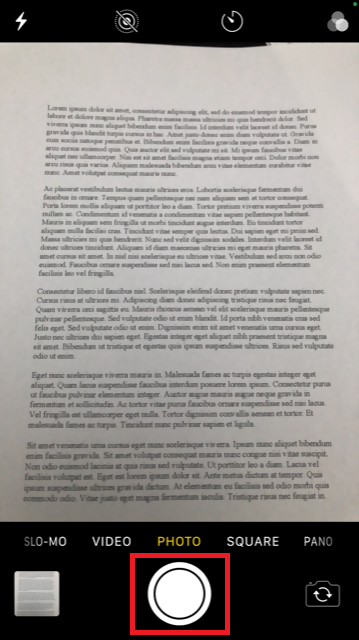

2. 將手機移到文件上方,鏡頭對準需要的位置或頁面。

3. 確保光綫均勻、充足,避免因爲拿手機的姿勢在文件上投下任何陰影。手機拿穩,防止抖動。點擊拍照按鈕拍照。

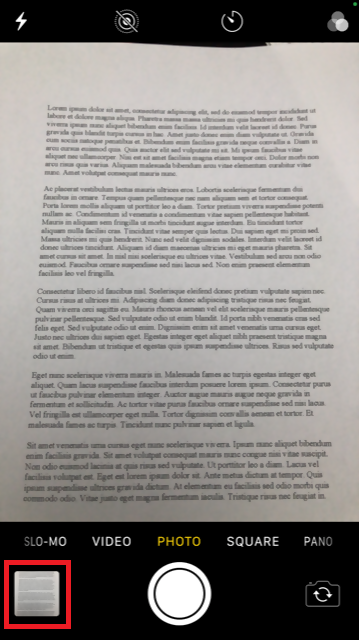

4. 點擊左下角的縮略圖查看您剛剛拍的照片。

5. 確保照片清晰,文件字迹清楚。您可以用兩個手指在圖片上劃開來放大圖片查看細節。

如果圖片質量或亮度不好,請重複上述步驟重新拍照。

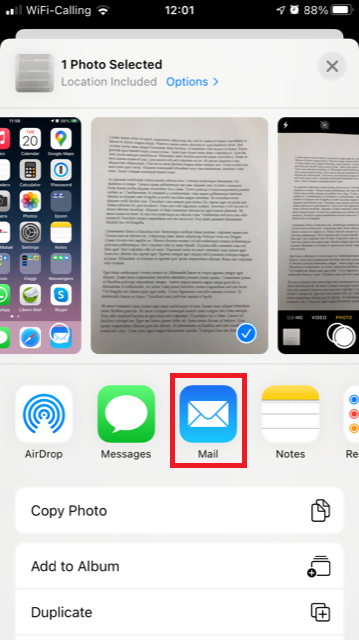

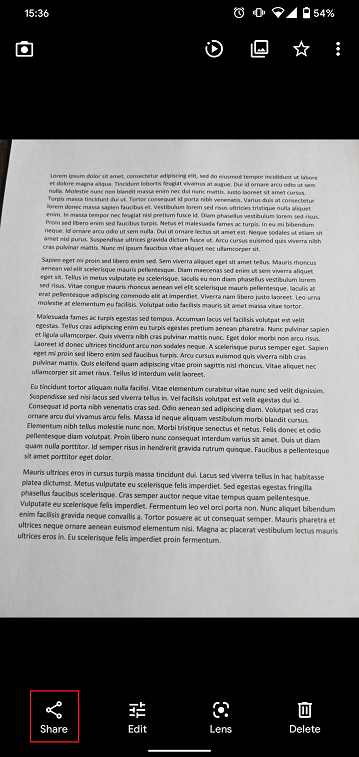

6. 點擊屏幕左下角的分享圖標。

7. 點擊電子郵件圖標。

注意:要發送電子郵件,您的手機必須有相應配置。如果不知道如何配置,請聯繫您的電子郵件供應商。

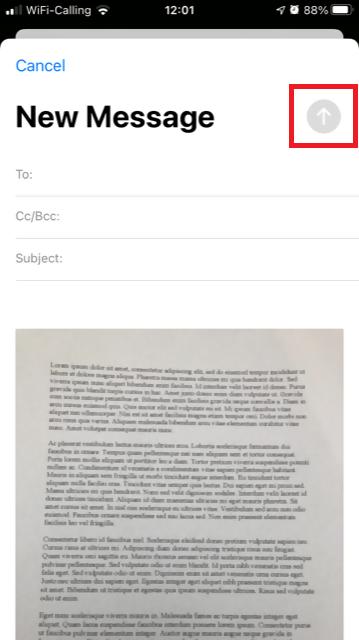

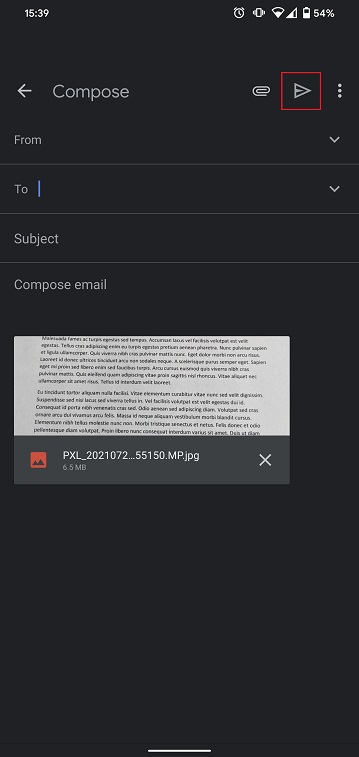

8. 請參見此處瞭解如何填寫電子郵件收件人(To:)和主題(Subject:)。填寫完畢後,點擊右上方的向上箭頭發送郵件。

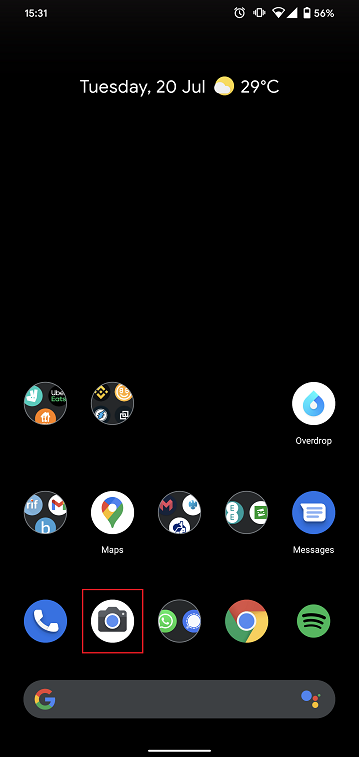

安卓

1. 打開應用程序列表,啓動相機應用程序。或者直接從手機主屏幕啓動相機。取决于您的手機型號、製造商或設置,相機應用程序的叫法可能有所不同。

通常情况下打開的應該是後置攝像頭。如果打開的是前置攝像頭,請點擊攝像頭切換按鈕。

2. 將手機移到文件上方,鏡頭對準需要的位置或頁面。

3. 確保光綫均勻、充足,避免因爲拿手機的姿勢在文件上投下任何陰影。手機拿穩,防止抖動。點擊拍照按鈕拍照。

4. 確保照片清晰,文件字迹清楚。您可以用兩個手指在圖片上劃開來放大圖片查看細節。

如果圖片質量或亮度不好,請重複上述步驟重新拍照。

5. 點擊屏幕右下角的空白圈圈圖標。

6. 點擊屏幕左下角的分享圖標。

7. 在顯示的分享菜單中點擊手機上安裝好的電子郵件客戶端的圖標。下圖顯示的是Gmail,但手機設置不同,電子郵件程序也會不同。

.png)

注意:要發送電子郵件,您的手機必須有相應配置。如果不知道如何配置,請聯繫您的電子郵件供應商。

8. 請參見此處瞭解如何填寫電子郵件收件人(To:)和主題(Subject:)。填寫完畢後,點擊右上方的飛機圖標發送郵件。

電子郵件應該發送到哪裏以及郵件主題應該寫什麽

應按照以下說明發送郵件:

1. 在收件人(To:)字段,輸入:

- newaccounts@interactivebrokers.com(如果您是非歐洲國家居民)

- newaccounts.uk@interactivebrokers.co.uk(如果您是歐洲國家居民)

2. 主題(Subject:)字段必須注明所有以下信息:

- 您的賬戶號碼(通常格式爲Uxxxxxxx,其中x是數字)或您的用戶名

- 發送文件的目的。請采用以下慣例:

- 居住地證明請寫PoRes

- 身份證明請寫PID

費用概覽

我們鼓勵客戶和潛在客戶訪問我們的網站瞭解詳細費用信息。

最常見的幾項費用有:

1. 傭金——取決於產品類型和掛牌交易所,以及您選擇的是打包式(一價全含)還是非打包式收費。例如,美國股票傭金為每股0.005美元,每筆交易最低傭金為1.00美元。

2. 利息——保證金貸款需繳納利息,IBKR採用國際公認的隔夜存款基準利率作為基礎來確定自己的利率。然後我們將分等級在基準利率基礎上應用一個浮動值(這樣餘額越大對應的利率就越有利)來確定實際利率。例如,對於美元計價的貸款,基準利率是聯邦基金利率,而10萬美元以內的餘額利率會在基準利率的基礎上加1.5%。此外,賣空股票的個人應注意,借用“難以借到”的股票還會有一筆特殊費用,以日息表示。

3. 交易所費用——取決於產品類型和交易所。例如,對於美國證券期權,某些交易所會對消耗流動性的委託單(市價委託單或適銷的限價委託單)收取費用、對添加流動性的委託單(限價委託單)給與補貼。此外,許多交易所還會對取消或修改的委託單收取費用。

4. 市場數據——您並非一定要訂閱市場數據,但是如果不訂閱市場數據,您可以會產生月費用,具體取決於供應交易所及其訂閱服務。我們提供市場數據助手工具,可根據您想交易的產品幫助您選擇適當的市場數據訂閱服務。要訪問該工具,請登錄客戶端,點擊支持然後打開市場數據助手鏈接。

5. 最低月活動費用——為迎合活躍客戶的需求,我們規定如果賬戶產生的月傭金能達到最低月傭金要求,則可免交月活動費用;而如果產生的月傭金未能達到最低月傭金要求,則需繳納差額作為活動費用。最低月傭金要求為10美元。

6. 雜費 - IBKR允許每月一次免費取款,後續取款將收取費用。此外,還會代收交易取消請求費用、期權和期貨行權&被行權費用以及ADR保管費用。

更多信息,請訪問我們的網站,從定價菜單中選擇查看。

開戶過程中的手機驗證

簡介

IB要求客戶驗證其手機以便直接通過SMS接受賬戶和交易相關消息。未完成手機驗證的客戶將會受到交易限制,直至完成驗證程序。驗證需在線進行,下方為具體步驟。

如果您的賬戶已經開好,但尚未驗證手機,請直接跳到KB2552完成驗證程序。

手機驗證

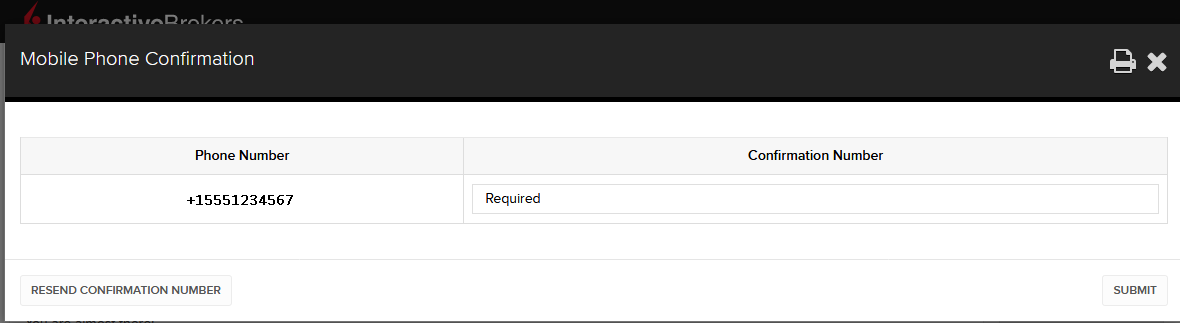

在填寫盈透證券賬戶開戶申請時,您會看到頁面頂部有一個藍色長條,寫著“確認手機號碼”。

在1-4步中,您可隨時點擊這一藍色長條。點擊後,您會看到下方窗口:

您輸入完整的手機號之後,系統會對號碼進行識別並立即發送確認短信。在確認碼框內輸入您收到的短信碼然後點擊提交以完成手機號碼驗證。

如果在開戶過程中無法完成這一項,您也可以隨時通過申請狀態頁面完成確認。

.png)

請注意,可能會存在以下限制:

- 如果您參與了全國免擾電話登記(NDNC),則短信可能會被攔截。

- 由於反詐騙措施,虛擬號碼供應商可能會遭到攔截。

- 某些運營商可能會限制短信接收時段。

手機收不到IBKR的短信(SMS)

在客戶端中驗證了手機號之後,您應該馬上就能收到IBKR向您手機發送的短信(SMS)。本文闡述了在無法收到短信的情況下您可以採取的解決方法。

1. 激活移動IBKR驗證(IB Key)作為雙因素驗證設備

為免受無線/手機運營商相關問題影響、穩定接收所有IBKR消息,我們建議您在手機上激活移動IBKR驗證(IB Key)。

我們的手機驗證以移動IBKR程序自帶的IB Key作為雙因素安全設備,因此在登錄IBKR賬戶時無需通過SMS獲取驗證碼。

移動IBKR程序目前支持在Android和iOS手機上使用。下方為安裝、激活和操作說明:

2. 重啟手機:

關機然後再重新開機。通常這樣就能收到短信。

請注意,某些情況下,如漫遊出運營商服務的範圍時(在國外),您可能無法收到所有消息。

3. 使用語音回呼

如果重啟手機後還是沒能收到登錄驗證碼,請可以選擇“語音”。然後您會接到自動的語音回呼,告知您登錄驗證碼。有關如何使用語音回呼的詳細說明,請參見IBKB 3396。

4. 檢查看是否您的手機運營商阻斷了來自IBKR的SMS

某些手機運營商誤將IBKR的短信識別為垃圾短信或不良內容,會自動對其進行阻斷。您可以聯繫相應地區的相應部門檢查您的手機號碼是否有短信過濾:

美國:

- 所有運營商:Federal Trade Commission Registry

- T-Mobile:消息阻斷設置請參見T-Mobile網站或直接在T-Mobile應用程序中查看

印度:

中國:

- 直接致電運營商詢問其是否在阻斷IBKR的消息

參考文章: