Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

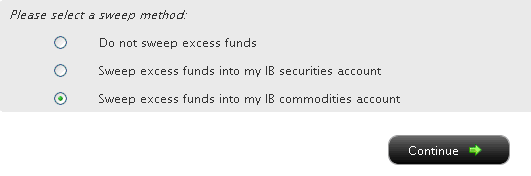

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Depositing Canadian Dollars via Bill Payment

First you will want to set up IBKR as a payee through your bank. To do this, you will need your account number at IBKR and indicate the name of our institution, “Interactive Brokers Inc.”. Depending upon your particular financial institution and whether IBKR is recognized as one of their program participants, your institution will likely indicate an expected delivery date of 1-2 business days for transfers. Once funds are sent via bill payment, please ensure that a bill payment notification is also submitted through Client Portal. For more details on how to submit a deposit notification, please see our Users' Guide.

Please note, Canadian bill payment is only offered for clients of IB Canada.

Find more information on Canadian Bill Payment on the IBKR website.

Cost Basis Reporting

1099 Reporting

Statement and Year End Reporting for US persons and entities comprises the following:

1. Cost Basis: While the required reporting schedule was staggered, the primary cost basis that will be reported to the IRS includes equities bought and sold after December 31, 2010. This includes the adjusted cost basis resulting from wash sales and corporate actions.

The future phase-in period for broker reporting includes the assets sold on or after the following dates:

--- Mutual Funds and ETFS - 1/1/2012

--- Simple debt instruments (i.e. treasuries, fixed-rate bonds & municipal bonds) and options, - 1/1/2014

--- Other debt instruments - 1/1/2016

2. Tax Basis Method: Brokers are required to use the method first in, first out (FIFO), unless given other instructions by an investor. Changes to your tax basis method may be submitted through the Tax Optimizer. The Tax Optimizer is launched from within Account Management and is available for stock, option, bond, warrant and single-stock future trades.

IB offers multiple tax basis methods, including three basic options:

● First In, First Out (FIFO) - This is the default option. FIFO assumes that the oldest security in inventory is matched to the most recently sold security.

● Last In, First Out (LIFO) - LIFO assumes that the newest security acquired is sold first.

● Specific Lot - Lets you see all of your tax lots and closing trades, then manually match lots to trades. Specific Lot is not available as the Account Default Match Method.

Tax Optimizer also lets you select the following additional derivatives of the specific identification method.

● Highest Cost (HC), Maximize Long-Term Gain (MLTG), Maximize Long-Term Loss (MLTG), Maximize Short-Term Gain (MSTG), and Maximize Short-Term Loss(MSTL).

For complete instructions on using the Tax Optimizer and details on the lot-matching algorithms for each method, see the Tax Optimizer Users Guide.

Note: Changing your tax basis is effective immediately. The basis selected will be applied to all subsequent trades on the account statements and tax reports. Updates will not affect previously closed trades nor the TWS profit and loss data displayed.

3. Gain & Loss Categories: An additional requirement to the cost basis reporting is the capital gain or loss category. The gain or loss category of equities is determined by the length of time in which the security was held, known as the "holding period."

● Short-Term - Holding periods of one year or less are categorized as "short-term."

● Long-Term - Holding periods over one year are categorized as "long-term."

Year End Reports

The following statements and reports display cost basis information that will be reported on Form 1099-B for eligible accounts.

- Monthly Account Statements

- Annual Account Statements

- Worksheet for Form 8949

For a complete review of the tax information and year end reporting available, click here.

Note: Unlike the Account Statements, the Gain & Loss Worksheet for Form 8949 may consolidate sell trades. The cost basis will be adjusted, as required for 1099-B reporting.

Asset Transfers

U.S. legislation from 2008 included new guidelines for tax reporting by U.S. financial institutions. Effective January 2011, U.S. Brokers are required to report cost basis on sold assets, whether or not a gain/loss is short-term (held one year or less) or long-term (held more than one year). U.S. brokerage firms, Interactive Brokers LLC (IB) included, implemented changes to comply with the legislation.

For more information on cost basis with asset transfers, see Cost Basis & Asset Transfers.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

Am I required to fund my account prior to application approval?

While applicants are required to provide IBKR with notification as to the amount they intend to fund their account with and the manner in which they fund the account in order to have the application considered for approval, there is no requirement that the funding actually take place prior to approval.

Applicants may nevertheless elect to remit funds via wire, check or electronic funds transfer (e.g., ACH, EFT) prior to receiving confirmation of account approval in an effort to accelerate commencement of any credit hold period. It should be noted, however, that deposits received prior to account approval are held in suspense and are not credited to the account nor eligible to accrue interest until the application has been approved. In the case where the applicant has authorized IBKR to fund the account via asset transfer (e.g., ACATS, ATON) from another broker, IBKR will not initiate the transfer until the application has been approved.

How to Deposit Funds Via a Full ACATS/ATON Transfer

How to deposit funds to your Interactive Brokers account via a full ACATS/ATON Transfer

For information on how to initiate a partial ACATS/ATON transfer/ please click here

For Interactive Brokers tradeable products please visit the Contract Search Engine

For a detailed description of the Full ACATS/ATON process flow please click here

For a list of the most common causes for ACATS/ATON rejects, please click here

How to Deposit Funds Via a Check

How to deposit funds to your Interactive Brokers account via a Check

How to Deposit Funds Via an ACH Initiated by Interactive Brokers

How to transfer funds from your bank account to your Interactive Brokers account via an ACH deposit initiated by IB

Enter KB567 into the search engine for additional information regarding ACH deposits

How to Transfer Funds Via an ACH Initiated by Your Bank

How to transfer funds between your bank account and your Interactive Brokers account via an ACH initiated at your bank.

Enter KB567 into the search engine for additional information regarding ACH deposits.

How to Deposit Funds Via a Wire Transfer

How to deposit funds via a wire transfer

Enter KB834 in the Knowledge Base search engine for additional information on how to deposit funds via a bank wire transfer