如何向盈透證券提出投訴?

如需向盈透證券提出投訴,請通過客戶端提交故障諮詢單:

- 登錄客戶端

- 點擊幫助

- 選擇安全消息中心

- 選擇撰寫,然後新諮詢單

- 在類別選擇賬戶服務,而主題為投訴

- 在簡短描述中寫上“投訴”,然後提交

- 選擇賬戶,然後在空白欄位鍵入您的詳細信息

- 提交諮詢單

在諮詢單正文中,IBKR要求您提供投訴的詳細描述。如果您的投訴涉及交易,IBKR要求您提供交易詳情,其中可能包括但不限於委託單的提交日期和時間、證券描述、執行日期和時間、執行價格,以及提供計算過程的要求補償金額。請注意,所有與交易相關的爭議必須及時提交。具體而言,交易取消請求必須在IBKR和/或交易所的時間參數範圍內。

收到您的投訴後,IBKR將通過客戶端確認和回覆您的投訴,並創建一張以“與諮詢單#<諮詢單號碼>相關的投訴通信”為名的新諮詢單。此後,請在通信諮詢單中進行與投訴相關的所有通信往來。

通常,投訴將在三到五天內得到答覆;但是,某些複雜的問題可能需要更長的時間來評估。在這段時間,IBKR要求您管理賬戶中的所有委託單、交易和持倉,以確保在調查期間您的賬戶不會受到不必要的風險或波動的影響。

雖然所有提交的索賠也會得到公平和公正的考慮,但提出索賠並不保證能夠獲得部分或全額支付所要求的金額。我們鼓勵索賠人查看客戶協議,因為有關投訴是基於本協議中的條文進行評估。如果客戶協議與IBKR網站不同,則客戶協議將取代網站版本。關於與交易相關的投訴,請注意客戶協議中的以下條款:(i)客戶對使用客戶用戶名 / 密碼鍵入的所有交易負責;(ii)取消請求並不保證;(iii)IBKR不對任何交易所、市場、交易商、清算所或監管機構的任何行動或決定負責,(iv)如果與客戶的委託單一致,客戶受委託單執行的約束,以及(v)客戶有責任瞭解所交易產品的條款和條件以及相應的市場。客戶有責任隨時在賬戶內保持足夠的淨值,以滿足保證金要求。如果客戶賬戶的淨值不足,IBKR有權(但非必需)隨時以任何方式清算客戶的全部或部分持倉,而不會事前通知客戶。請注意,IBKR在任何時候都不會就技術問題或機會損失對客戶進行賠償。

要查看完整的IBKR客戶協議,請在IBKR主頁底部選擇表格和披露,然後選擇適用的客戶協議。

關於使用止損單的更多信息

美股市場偶爾會發生極端波動和價格混亂。 有時這類情況持續時間很長,有時又很短。止損單可能會對價格施加下行壓力、加劇市場波動,且可能使委託單在大幅偏離觸發價格的位置上成交。.

我向賬戶存入資金的同時IBKR會延遲平倉清算嗎?

IBKR的保證金政策規定,如果一個賬戶違反保證金要求/保證金不足,則該賬戶將不能進行轉帳或其它存款。 如果違反保證金要求/保證金不足,賬戶將立即面臨平倉清算。自動平倉清算會以市價委托單的方式完成,賬戶中的任何/所有倉位都可能會被清算。某些情况下,由于特定市場行情,保證金不足最好是通過手動平倉清算解决。

從風險角度而言,存入或匯入賬戶的資金在完成相應的資金與銀行結算幷正式記入賬戶之前是不納入考慮的。平倉清算系統是完全自動的,其程序在賬戶違反保證金/保證不足時會立即執行。

主經紀客戶請注意:外部執行幷不能解决實時保證金不足問題,因爲外部交易在交易發生當天美東時間晚上9點或交易報入賬戶幷經外部確認完成匹配(取較晚發生者)之前是不納入考慮的。我們也不建議在到期日當天在外部交易期權,因爲有可能會出現晚報或誤報,從而導致保證金計算出錯或行權和被行權活動出錯。想要在到期日在IB外部的機構交易到期期權的客戶必須在美東時間下午2:50之前上傳其FTP文件,幷且應自擔風險。

期權到期前被行權

美式期權賣方(沽出方)在期權到期前隨時可能會被行權。也就是說,期權賣方在賣出期權後到期權到期或通過買回期權將頭寸平倉這段時間隨時可能會被行權。看漲或看跌期權所有者在期權到期前調用其權利即為提早行權。作為期權賣方,您無法控制期權被行權,也無法知曉其會何時發生。通常,越臨近到期,被行權的風險越大,但即使這樣,美式期權交易仍然隨時會發生被行權。

空頭看跌期權

賣出看跌期權時,賣方有義務在指定時間窗口內(到期日)以約定價格(行使價)買入底層股票或資產。如果期權的行使價低於股票的當前市價,則期權持有者把股票賣給期權賣方並不會獲利,因為市場價格比行使價要高。反過來,如果期權的行使價高於股票的當前市價,則期權賣方就會有被行權的風險。

空頭看漲期權

賣出看漲期權後,看漲期權的所有者有權在給定時間範圍內以約定價格從期權賣方買入股票。如果股票的市價低於期權的行使價,則對看漲期權持有者來說,以高於市價的價格買入股票沒有任何好處。但如果股票的市價高於期權的行使價,則期權持有者可以低於市價的價格買入股票。如果期權處於價內或如果即將派息且空頭看漲期權的內在價值低於股息,則空頭看漲期權會有被行權風險。

期權會發生什麼?

如果空頭看漲期權被行權,則空頭看漲期權持有者將被分配空頭股票。例如,如果ABC公司的股價為$55,行使價為$50的空頭看漲期權被行權,則空頭看漲期權將會轉換成價格為$50的空頭股票。然後賬戶持有人可以決定以$55的價格買回股票平倉空頭頭寸。100股的淨損失會是$500,再減去最開始賣出看漲期權時收到的權利金。

如果空頭看跌期權被行權,則空頭看跌期權持有者相當於是以看跌期權行使價多頭持有股票。例如,XYZ的股價為$90,空頭看跌期權賣方按行使價$96被分配了股票,則看跌期權賣方有責任以$96(高於市價)的價格買入股票。假設賬戶持有人以$90的價格平倉了多頭股票頭寸,那麼100股的淨損失會是$600,再減去最開始賣出看跌期權時收到的權利金。

期權被行權導致保證金不足

如果被行權發生在期權到期之前並且產生的股票頭寸導致保證金不足,則根據我們的保證金政策,賬戶將面臨自動平倉清算以重新滿足保證金要求。平倉清算並不只限於期權被行權產生的股票頭寸。

此外,對於期權價差的空頭邊被行權的賬戶,IBKR不會將其持有的多頭期權行權。IBKR無法推測多頭期權持有者的意圖,並且在到期前行使多頭期權將導致放棄期權的時間價值(時間價值通過賣出期權實現)。

到期後風險敞口、公司行動和除息

盈透證券會根據到期時間或公司行動相關事件採取積極措施降低風險。有關我們到期政策的更多信息,請閱讀知識庫文章“到期&公司行動相關清算”。

賬戶持有人應參閱“標準期權的特徵與風險”披露文件,IBKR在賬戶申請時便向所有有期權交易資格的客戶提供了此文件,其中明確說明了被行權風險。此文件還可在期權清算公司(OCC)網站上查看。

針對大麻類證券的清算所限制

斯圖加特交易所(Boerse Stuttgart)和明訊銀行(Clearstream Banking)宣布其將不再對主營業務與大麻及其它毒品直接或間接相關的證券提供服務。 因此,該等證券將不會再於斯圖加特(SWB)或法蘭克福(FWB)證券交易所交易。自2018年9月19日收槃開始,IBKR將釆取以下行動:

- 對於客戶未釆取行動平倉,但也不能轉至美國掛牌市場的受影響頭寸,進行強制平倉;

- 對於客戶未釆取行動平倉,但能夠轉至美國掛牌市場的受影響頭寸,將股票轉至其美國掛牌市場。

下方表格列出了斯圖加特交易所和明訊銀行截至2018年8月7日公布的受影響證券。該表格還標記了受影響證券是否能夠轉至美國掛牌市場。注意,清算所已聲明該列表可能尚不完整,建議客戶檢查其各自網站了解最新信息。

| ISIN | 名稱 | 交易所 | 是否可轉至美國? | 美國代碼 |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | 是 |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | 是 |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | 是 |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | 是 |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | 是 |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | 是 |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | 是 |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | 是 |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | 是 |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | 是 |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | 是 |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | 是 |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | 是 |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | 否 | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | 否 | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | 否 | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | 否 | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | 否 |

重要注意事項:

- 請注意,美國掛牌證券通常為場外交易(PINK),且以美元(而非歐元)計價, 因此,除市場風險外,您還將面對匯率風險。

- 持有粉單(PINK Sheet)證券的賬戶持有人需要有美國(仙股) 交易許可才能下達開倉定單。

- 擁有美國(仙股) 交易許可之賬戶的所有使用者均須使用雙因素驗證登錄賬戶。

ESMA差價合約新規推行概述 - 僅限零售客戶

|

差價合約屬于複雜金融産品,其交易存在高風險,由于杠杆的作用,可能會出現迅速虧損。

在通過IBKR交易差價合約時,有63.7%的零售投資者賬戶出現了虧損。

您應考慮自己是否理解差價合約的運作機制以及自己是否能够承受虧損風險。 |

歐洲證券與市場管理局(ESMA)頒布了適用于交易差價合約(CFD)的零售客戶的新法規,自2018年8月1日起生效。專業客戶不受影響。

法規包含:1) 杠杆限制;2) 以單個賬戶爲單位的保證金平倉規則;3) 以單個賬戶爲單位的負餘額保護規則;4) 對交易差價合約激勵措施的限制;以及 5) 標準的風險警告。

大多數客戶(受監管的實體除外)一開始都會被分類爲零售客戶。某些情况下,IBKR可能會同意將零售客戶重新分類爲專業客戶或將專業客戶重新分類爲零售客戶。更多詳細信息,請參見MiFID分類。

以下板塊詳細說明了IBKR(英國)是如何貫徹ESMA規定的。

1 杠杆限制

1.1 ESMA保證金

ESMA針對不同的底層證券設置了不同的杠杆限制:

- 貨幣對爲3.33%;主要貨幣對爲美元、加元、歐元、英鎊、瑞郎、日元間的任意組合

- 非主要貨幣對及主要指數爲5%;

- 非主要貨幣對爲包括上方未列出的貨幣的任意組合,如美元/離岸人民幣

- 主要指數爲IBUS500、IBUS30、IBUST100、IBGB100、IBDE40、IBEU50、IBFR40、IBJP225、IBAU200

- 非主要股票指數爲10%,包括IBES35、IBCH20、IBNL25、IBHK50

- 個股爲20%

1.2應用的保證金 - 標準保證金要求

除ESMA的保證金要求外,IBKR(英國)還基于底層證券的歷史波動率及其它因素實施其自有的保證金要求(IB保證金) 如果IB的保證金率高于ESMA規定的比例,則應用IB的保證金率。

點此可查看適用的IB和ESMA保證金要求詳情。

1.2.1應用的保證金 - 最低集中保證金要求

如果您的投資組合包含一小部分CFD頭寸,或者如果最大的兩種頭寸占據了絕大多數份額,則您的賬戶將應用集中保證金。我們會通過對最大的兩種頭寸假設30%的跌幅、對其餘頭寸假設5%的跌幅來對您的投資組合進行壓力測試。如果總虧損額高于標準要求,則將用總虧損額作爲維持保證金要求。

1.3可用于初始保證金的資金

您只可使用現金作爲初始保證金開立差價合約頭寸。已實現的差價合約盈利將包括在現金中且立即可用;現金無需先結算。然而,未實現的盈利不得用于滿足初始保證金要求。

1.4自動轉移資金以滿足初始保證金要求(賬戶F賬戶段)

IBKR(英國)會自動將您主賬戶中的資金轉移至賬戶的F賬戶段,用于滿足差價合約的初始保證金要求。

然而,需注意的是,系統不會轉移資金用于滿足差價合約維持保證金要求。因此,如符合條件的資産(參照下方定義)不足以滿足保證金要求,則即使您的主賬戶中有足够的資金,賬戶仍會被清算。如您想避免被清算,您必須在賬戶管理中將多餘的資金轉移至賬戶的F賬戶段。

2 保證金平倉規則

2.1維持保證金計算與清算

如果符合條件的資産跌至開倉初始保證金的50%以下,ESMA要求IBKR最後清算差價合約倉位。如果我們的風險觀更爲保守,IBKR可能會更早平倉倉位。符合條件的資産包括F賬戶段下的現金(不包括賬戶任何其它賬戶段下的現金)及未實現的差價合約盈虧(盈利及虧損)。

計算的基礎爲開立差價合約頭寸時存入的初始保證金。 換言之,當差價合約頭寸的價值發生變動時,初始保證金的金額不會變化,這與非差價合約頭寸適用的保證金計算方式不同。

2.1.1舉例

您的差價合約賬戶中有2000歐元現金。您想以100歐元的限價買入100份XYZ的差價合約。首先成交了50份合約,然後再成交其餘的50份。隨著您的交易成交,您的可用現金如下减少:

| 現金 | 淨資産* | 頭寸 | 價格 | 價值 | 未實現盈虧 | 初始保證金 | 維持保證金 | 可用現金 | 維持保證金不足 | |

| 交易前 | 2000 | 2000 | 2000 | |||||||

| 第一次交易後 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | 否 |

| 第二次交易後 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | 否 |

*淨資産等于現金加未實現盈虧

價格上漲至110。您的淨資産現爲3000,但由于您的可用現金仍爲0,且在ESMA規則下初始保證金和維持保證金不變,您不得開立新的頭寸:

| 現金 | 股票 | 頭寸 | 價格 | 價值 | 未實現盈虧 | 初始保證金 | 維持保證金 | 可用現金 | 維持保證金不足 | |

| 變化 | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | 否 |

然後價格下跌至95。您的淨資産跌至1500,但鑒于淨資産仍大于1000,無需追加保證金:

| 現金 | 股票 | 頭寸 | 價格 | 價值 | 未實現盈虧 | 初始保證金 | 維持保證金 | 可用現金 | 維持保證金不足 | |

| 變化 | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | 否 |

價格進一步跌至85,導致保證金不足幷觸發清算:

| 現金 | 股票 | 頭寸 | 價格 | 價值 | 未實現盈虧 | 初始保證金 | 維持保證金 | 可用現金 | 維持保證金不足 | |

| 變化 | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | 是 |

3 負資産保護

ESMA規則規定,您交易差價合約的損失以劃撥的專項資金爲上限。不得清算其它金融産品(如股票或期貨)來填補差價合約的保證金缺口。*

因此,您主賬戶證券和大宗商品賬戶段的資産,以及F賬戶段中持有的非差價合約資産不列入差價合約交易的風險資本。但是,F賬戶段中的所有現金都可用以彌補差價合約交易産生的虧損。

由于負資産保護對IBKR來說意味著要承擔額外風險,對于隔夜持有的差價合約頭寸我們會向零售客戶額外收取1%的融資息差。您可在此處查看詳細的差價合約融資利率。

*我們無法清算非差價合約頭寸來彌補差價合約不足,但可以清算差價合約頭寸來彌補非差價合約不足。

4 交易差價合約的激勵措施

ESMA規定對與差價合約交易相關的金錢及某些非金錢激勵均予以禁止。IBKR不對交易差價合約提供任何獎金或其它激勵。

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

Overview of ESMA CFD Rules Implementation at IBKR (UK) - Retail Investors Only

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

The European Securities and Markets Authority (ESMA) enacted new rules applicable to retail clients trading CFDs, effective 1st August 2018. Professional clients are unaffected.

The rules consist of: 1) leverage limits; 2) a margin close out rule on a per account basis; 3) negative balance protection on a per account basis; 4) a restriction on the incentives offered to trade CFDs; and 5) a standardized risk warning.

Most clients (excepting regulated entities) are initially categorised as Retail Clients. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. Please see MiFID Categorisation for further detail.

The following sections detail how IBKR (UK) has implemented the ESMA Decision.

1 Leverage Limits

1.1 ESMA Margins

Leverage limits were set by ESMA at different levels depending on the underlying:

- 3.33% for major currency pairs; Major currency pairs are any combination of USD; CAD; EUR; GBP; CHF; JPY

- 5% for non-major currency pairs and major indices;

- Non-major currency pairs are any combination that includes a currency not listed above, e.g. USD.CNH

- Major indices are IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- 10% for non-major equity indices; IBES35; IBCH20; IBNL25; IBHK50

- 20% for individual equities

1.2 Applied Margins - Standard Requirement

In addition to the ESMA Margins, IBKR (UK) establishes its own margin requirements (IB Margins) based on the historical volatility of the underlying, and other factors. We will apply the IB Margins if they are higher than those prescribed by ESMA.

Details of applicable IB and ESMA margins can be found here.

1.2.1 Applied Margins - Concentration Minimum

A concentration charge is applied if your portfolio consists of a small number of CFD positions, or if the three largest positions have a dominant weight. We stress the portfolio by applying a 30% adverse move on the three largest positions and a 5% adverse move on the remaining positions. The total loss is applied as the maintenance margin requirement if it is greater than the standard requirement.

1.3 Funds Available for Initial Margin

You can only use cash to post initial margin to open a CFD position. Realized CFD profits are included in cash and are available immediately; the cash does not have to settle first. Unrealized profits however cannot be used to meet initial margin requirements.

1.4 Automatic Funding of Initial Margin Requirements (F-segments)

IBKR (UK) automatically transfers funds from your main account to the F-segment of your account to fund initial margin requirements for CFDs.

Note however that no transfers are made to satisfy CFD maintenance margin requirements. Therefore if qualifying equity (defined below) becomes insufficient to meet margin requirements, a liquidation will occur even if you have ample funds in your main account. If you wish to avoid a liquidation you must transfer additional funds to the F-segment in Account Management.

2 Margin Close Out Rule

2.1 Maintenance Margin Calculations & Liquidations

ESMA requires IBKR to liquidate CFD positions latest when qualifying equity falls below 50% of the initial margin posted to open the positions. IBKR may close out positions sooner if our risk view is more conservative. Qualifying equity for this purpose includes cash in the F-segment (excluding cash in any other account segment) and unrealized CFD P&L (positive and negative).

The basis for the calculation is the initial margin posted at the time of opening a CFD position. In other words, and unlike margin calculations applicable to non-CFD positions, the initial margin amount does not change when the value of the open position changes.

2.1.1 Example

You have EUR 2000 cash in your CFD account. You want to buy 100 CFDs of XYZ at a limit price of EUR 100. You are first filled 50 CFDs and then the remaining 50. Your available cash reduces as your trades are filled:

| Cash | Equity* | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Pre Trade | 2000 | 2000 | 2000 | |||||||

| Post Trade 1 | 2000 | 2000 | 50 | 100 | 5000 | 0 | 1000 | 500 | 1000 | No |

| Post Trade 2 | 2000 | 2000 | 100 | 100 | 10000 | 0 | 2000 | 1000 | 0 | No |

*Equity equals Cash plus Unrealized P&L

The price increases to 110. Your equity is now 3000, but you cannot open additional positions because your available cash is still 0, and under the ESMA rules IM and MM remain unchanged:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 3000 | 100 | 110 | 11000 | 1000 | 2000 | 1000 | 0 | No |

The price then drops to 95. Your equity declines to 1500 but there is no margin violation since it is still greater than the 1000 requirement:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 1500 | 100 | 95 | 9500 | (500) | 2000 | 1000 | 0 | No |

The price falls further to 85, causing a margin violation and triggering a liquidation:

| Cash | Equity | Position | Price | Value | Unrealized P&L | IM | MM | Available Cash | MM Violation | |

| Change | 2000 | 500 | 100 | 85 | 8500 | (1500) | 2000 | 1000 | 0 | Yes |

3 Negative Equity Protection

The ESMA Decision limits your CFD-related liability to the funds dedicated to CFD-trading. Other financial instruments (e.g. shares or futures) cannot be liquidated to satisfy a CFD margin-deficit.*

Therefore assets in the security and commodity segments of your main account, and non-CFD assets held in the F-segment, are not part of your capital at risk for CFD trading. However, all cash in the F-segment can be used to cover losses arising from CFD trading.

As Negative Equity Protection represents additional risk to IBKR, we will charge retail investors an additional financing spread of 1% for CFD positions held overnight. You can find detailed CFD financing rates here.

*Although we cannot liquidate non-CFD positions to cover a CFD deficit, we can liquidate CFD positions to cover a non-CFD deficit.

4 Incentives Offered to trade CFDs

The ESMA Decision imposes a ban on monetary and certain types of non-monetary benefits related to CFD trading. IBKR does not offer any bonus or other incentives to trade CFDs.

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

到期相關清算

除了在實時保證金不足時強行清算客戶頭寸的政策外,IB還會根據某些到期相關事件(會導致不應有的風險和/或操作問題)清算頭寸。下方列出了此類事件範例。

期權行權

如果行權/轉讓會導致帳戶保證金不足,IB保留禁止股票期權行權并/或平倉空頭期權的權利。由於頭寸已全額支付,因此購買期權通常不需要保證金,一旦行權,帳戶持有人便有義務全額支付後續多頭股票頭寸(現金帳戶看漲期權行權或100%保證金股票)或支付多頭/空頭股票頭寸(保證金帳戶看漲/看跌期權行權)。如果在交割時,底層證券價格出現重大不利變化,行權之前不具備充足權益的帳戶會面臨不應有的風險。這種無擔保風險尤為明顯,並且可能會超出多頭期權所持有的任何價內價值,尤其是在到期時清算所以每股低達$0.01美元的價格自動行使期權的時候。

例如,第一天,帳戶權益只包括20張行使價為$50美元的XYZ多頭看漲期權,這些合約在底層證券價格為$51美元時以每份$1美元的價格平倉。假設情境1中,期權自動行權,並且XYZ在第二天的開盤價達到$51美元。假設情境2中,期權自動行權,並且XYZ在第二天的開盤價為$48美元。

| 帳戶餘額 | 到期前 |

情境1 - XYZ開盤價 @ $51 |

情境 2 - XYZ 開盤價 @ $48 |

| 現金 |

$0.00 | ($100,000.00) | ($100,000.00) |

| 多頭股票 |

$0.00 | $102,000.00 | $96,000.00 |

|

多頭期權* |

$2,000.00 | $0.00 | $0.00 |

| 凈清算權益/(不足) | $2,000.00 | $2,000.00 | ($4,000.00) |

| 保證金要求 |

$0.00 | $25,500.00 | $25,500.00 |

| 多餘保證金/(不足) | $0.00 | ($23,500.00) | ($29,500.00) |

*多頭期權無貸款價值。

為在到期日臨近時防止發生這些情景,IB將假設接近實際的底層證券價格情境并評估股票交割帳戶風險來模擬到期影響。如果風險過高,IB保留一下權利:1) 到期前清算期權;2)允許期權失效;及/或3) 允許交割并立即清算底層證券。此外,帳戶不能開立新的頭寸以防增加風險。

如果IB系統預測結算會導致保證金不足,那麼IB也會保留在結算前的下午清算頭寸的權利。為在到期日臨近時防止發生這些情景,IB將假設接近實際的底層證券價格情境并評估結算后帳戶風險來模擬到期影響。例如,如果IB預測結算將導致頭寸從帳戶中移除(如期權將在價外到期或現金結算期權在價內到期),那麼IB系統將評估結算的保證金影響。

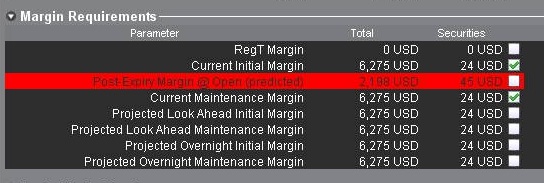

如果IB認為風險過高,那麼IB可能會清算帳戶中的頭寸以解決預測的保證金不足問題。帳戶持有人可通過TWS中的帳戶窗口監控與保證金風險相關的到期期權。預測超額保證金將顯示在“到期后保證金”(見下方)一行,如果其為負數并紅色顯示,則表明您的帳戶可能強制頭寸清算。風險計算在下一個到期日的前面三天進行,並且每15分鐘更新一次。請注意,某些分層結構帳戶類型(如獨立交易限制帳戶)的這一信息只會在主帳戶層級顯示并計算。

請注意,IB通常在收盤前兩小時發起到期相關清算,但保留條件允許的情況下提前或推遲此類清算程序。此外,清算會更具特定的帳戶條件(包括凈清算價值、預測到期后保證金不足以及期權行使價格與底層證券價格之間關係)進行優先排序。

實物交割期貨

除了將貨幣作為其底層證券的某些期貨合約外,IB通常不允許客戶發起或接收實物結算期貨或期貨期權合約的底層交割。為避免交割即將到期的合約,客戶必須延期合約或在合約指定的結算截止日期(我們網站中列有)前平倉頭寸。

請注意,客戶有義務瞭解結算截止日期,并知曉未在指定時間段內結算的實物交割合約可能會在無事先通知的情況下被IB清算。